Ormonde Mining Plc - Final Results

November 19 1998 - 11:00AM

UK Regulatory

RNS No 8916d

ORMONDE MINING PLC

19th November 1998

Shares on Issue: 36,327,841

Fully Diluted: 36,327,841

Irish Stock Exchange Share Price: 7.5p

Vancouver Stock Exchange (OMP) Market Cap: IR#2.7M, C$6.37

PRELIMINARY STATEMENT OF RESULTS FOR THE YEAR ENDED 30 JUNE, 1998

Ormonde Mining Plc (OMP) has today released its financial results and Annual

Report for the year ended 30th June 1998. The Company continues to develop its

position in Tanzania and plans immediate drilling on the Mgusu and Bukoli gold

projects.

Mgusu

Ormonde recently announced a joint venture agreement with Pangea whereby

Ormonde can earn a 50% interest in the Mgusu licences for exploration and

evaluation expenditure of US$2.6 million over a three year period. Ormonde

will act as manager of exploration and operations during this period. Pangea

has carried out a preliminary mapping, geophysical and geochemical exploration

programme on the Mgusu licences and identified six target areas for follow-up.

Following a preliminary wide-spaced reverse circulation (RC) and diamond

drilling programme on one of these targets in 1997, Mgusu I, Pangea published

an inferred resource estimate of 1.83 million tonnes at 4.6 grams per tonne

gold or 271,000 ounces in 1998.

Ormonde's objective at Mgusu is to first establish, by drilling, a resource of

at least 500,000 ounces of gold and then to proceed into feasibility study.

The approach will be to immediately carry out rotary-air-blast (RAB) drilling

traverses over three of the untested target areas at Mgusu to look for repeats

of Mgusu I. Follow-up RC and diamond drilling on these target areas is

planned, in conjunction with infill drilling at Mgusu I, in 1999.

Exploration Projects

Ormonde's work on its Bukoli, Ikoka and Karumwa licences yielded very

encouraging results. Bukoli, the most prospective of these three licences and

the most advanced in terms of exploration activity, is of particular interest.

Three extensive, semi-continuous, and high-tenor soil anomalies have been

defined over a 3.3 kilometre long zone on this licence. Shallow surface

workings exist over one of these soil anomalies and chip sampling of these

workings has yielded results of up to 3.5grams per tonne gold over a vertical

interval of 8m. It is clear from our exploration work that there is a

relatively extensive area of gold mineralisation in the Bukoli area and

Ormonde sees these three zones as most prospective, high-priority targets. It

is proposed to carry out first-pass RAB or RC drilling over these three zones

in 1998 in conjunction with the Mgusu drilling programme.

Work continues on the Mrangi and Chunya licences and is financed by Joint

Venture partners.

Financial Results

The company has posted a loss of #172,370 (Canadian $398,174.7) before tax.

Profit and Loss Statement for the year ended 30th June 1998 is appended.

Desmond J. Burke

Managing Director

ORMONDE MINING PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEARS ENDED 30 JUNE 1998 AND 1997

1998 1997

IR# IR#

Administrative expenses (33,427) (30,016)

Write-down of exploration costs (147,885) (450,864)

Exceptional item - (103,587)

-----------------------

OPERATING LOSS (181,312) (584,467)

Other income 8,942 17,818

-----------------------

LOSS ON ORDINARY ACTIVITIES BEFORE TAXATION (172,370) (566,649)

Taxation - -

-----------------------

LOSS ON ORDINARY ACTIVITIES AFTER TAXATION (172,370) (566,649)

Profit and loss account brought forward - (deficit) (4,350,947) (3,784,298)

-----------------------

Profit and loss account carried forward - (deficit) (4,523,317) (4,350,947)

=======================

Loss per share (0.53p) (2.18p)

=======================

The group has no recognised gains or losses other than those reflected in the

profit and loss accounts above.

The financial statements were approved by the Board of Directors on 21 October

1998 and signed on its behalf by:

For further information contact:

Desmond J. Burke Esq

2 St. Canice's Court

Dean Street

Kilkenny City

Kilkenny

Ireland

Tel: 353-56-52411

Fax: 353-56-52433

END

FR AKSVKWKKAAAA

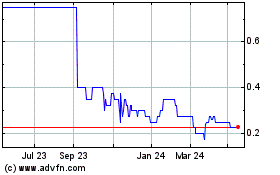

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Jun 2024 to Jul 2024

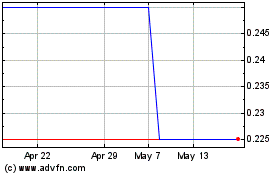

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Jul 2023 to Jul 2024