TIDMGLR

RNS Number : 1089Y

Galileo Resources PLC

28 December 2023

28 December 2023

Galileo Resources PLC

("Galileo" or "the Company" or "the Group")

Unaudited interim results for the six months ended 30 September

2023

Galileo (AIM: GLR) , the exploration and development mining

company, announces its unaudited interim results for the six-month

period ended 30 September 2023. A copy of the interim results is

available on the Company's website, www.galileoresources.com .

Operational Highlights

ZAMBIA

Luansobe Copper Project

The Company holds a 75% interest in the Luansobe project.

The Luansobe area is situated some 15km to the northwest of

Mufulira Mine in the Zambian Copperbelt which produced well over

9Mt of copper metal during its operation. It forms part of the

north-western limb of the northwest - southeast trending Mufulira

syncline and is essentially a strike continuation of Mufulira, with

copper mineralisation hosted in the same stratigraphic horizons. At

the Luansobe prospect mineralisation occurs in at least two

horizons, dipping at 20-30 degrees to the northeast, over a strike

length of about 3km and to a vertical depth of at least 1,250m.

Period Under Review

On the 9(th of) February 2023 the Company announced a new

Inferred Mineral Resource for the project estimated by external

consultants Addison Mining Services and inclusive of:

- Approximately 5.8 million tonnes gross at 1% total Cu above a

cut-off grade of 0.25% total Cu for 56,000 tonnes of contained Cu,

potentially amenable to open pit mining.

- Approximately 6.3 million tonnes gross at 1.5% total Cu above

a cut-off grade of 1% total Cu for 97,000 tonnes of contained Cu,

potentially amenable to underground mining.

Since then, work has continued towards development of a

potential open pit mine plan and associated works.

Shinganda Copper-Gold Project

On the 27 June 2023 the Company exercised its option to enter a

joint venture and acquire an initial 51% interest in the Shinganda

Copper-Gold project, Zambia, following the expenditure of over

US$500,000 in direct exploration costs.

The project area covers part of a major 10km structural trend

with two previously developed small-scale open pit copper-gold

mines. Very limited historic drilling on the property is reported

to have intersected 1.07% Cu over a true width of 28.3m at shallow

depth within supergene copper oxides. Drilling on the structure

within the Shinganda property further to the west by Vale S.A.

recorded a 2m interval @ 3.93% Cu, 1.72g/t Au.

Period Under Review

A licence-wide review and re-interpretation of previously

available geophysical data, combined with the company's own

geophysical surveys, soil sampling and prospecting unlocked a new

structural framework for the licence and delineated new targets for

immediate follow-up drill testing, a number of which are

prospective for deposits of copper and gold mineralisation

associated with Iron Oxide Copper Gold (IOCG) deposits.

Conclusions of the study included;

- Three large clusters of intense iron alteration towards the

West, identified in the high-resolution aeromagnetics, where

historical drilling returned hematite, magnetite and lesser pyrite

mineralisation that was not assayed. The clusters also host several

coincident historical IP-chargeability anomalies, which have been

insufficiently drill-tested.

- Identification of a high-order splay fault at the Shinganda

Copper-Gold prospect in the aeromagnetic data that is the probable

primary control of the copper-gold mineralisation

- Co-incident copper-in-soil anomalies with >285ppm Cu

occurring both along the Shinganda Splay Fault and at Iron

Alteration Cluster A, which are prospective for IOCG

mineralisation.

- Limited historical drilling and sampling at Shinganda returned

best intercepts of up to 50.3m @ 1.54% Cu from 21m downhole depth

in drill hole SHDD002, and a peak of 33.90g/t Au was returned from

a composite grab sample in an exploration pit.

Post Period Under Review

A follow-up drill programme with up to 2,000m of planned

drilling commenced in late 2023 to test multiple shallow

copper-gold targets along, and parallel to, the Shinganda Splay

Fault and to test the IOCG deposit potential related to the iron

alteration clusters and IP targets highlighted by the geophysical

study.

As announced on the 7 November 2023 seven holes had so far been

completed for a total of 890m of drilling, including positive

intersections received in the most recent drill hole SHDD017. The

drill hole, SHDD017, which is located less than 1km along strike

from the Shinganda copper-gold prospect drilled in the previous

reporting period, intersected an extensive interval of alteration

and brecciation with associated copper mineralisation over a 264.5m

interval from a downhole depth of 65.5m within the Shinganda Splay

Fault system. Mineralisation generally occurs as clusters and

disseminations associated with brecciation and quartz-carbonate

veining and has been confirmed by pXRF analysis, with follow-up

laboratory assay results awaited.

Several follow-up holes are planned through the wide mineralised

zone, as well as further drilling to test the iron alteration

clusters and IP targets highlighted by a previous geophysical

study.

Anomalous copper has been detected via pXRF analysis in shallow

oxide mineralisation intersected in a number of shallow holes

designed to test outcropping supergene gossan occurrences. Split

core samples have been submitted for multi-element laboratory

analysis, including copper and gold.

Kashitu

Period under review

A new small-scale exploration licence was issued on 23 February

2022 covering the core of the Kashitu project area. The licence

will run for four years from the issue date.

The Company has held meetings with the majority of interested

and affected parties associated with the deposit including

small-scale and artisanal miners, nearby residents, and potential

providers of third-party processing capacity specifically to find

the most appropriate way to develop the resource and more

specifically mine and process the balance of the open pittable

high-grade willemite. The Company recognises that wholesale removal

of access to parts of the Kashitu licence for small-scale and

artisanal miners could have a profound impact on livelihoods hence

the proposal to enter into an arrangement that benefits all

parties. Navigating the expectations of the various parties is

challenging and the Company's representatives will continue to

build a business plan. Once priority locations have been

identified, further shallow drilling on a close-spaced grid for

grade control purposes will take place.

NW Zambia Joint Venture

On 05 September 2023 the Company announced that it had entered

into a joint venture agreement with Cooperlemon Consultancy Limited

in relation to the exploration for copper at large scale

exploration license 28001-HQ-LEL in Northwest Zambia.

The exploration licence covering 52,000 hectares runs along the

Angolan-Zambian border and is closely associated with the perceived

Western Foreland geological district boundary that potentially

hosts Kamoa - Kakula deposits in Northwest Zambia. Historically

there has been limited exploration over the licence area and

initial work by Galileo has focused on interpretation of available

data including information generated by other explorers and

available in the public domain. Licence acquisition coincided with

the start of the Rain Season and as a result, mobilisation on the

ground and detailed fieldwork will commence once the weather

improves and easy access is possible.

.

Under the joint venture agreement ("JV Agreement"), Galileo

agreed the following key terms:

Earn-in and Phase 1 exploration budget: Galileo will earn a 65%

interest in the joint venture by:

i) An immediate cash payment of US$230,000 to Cooperlemon;

ii) Funding exploration expenditure over an initial

eighteen-month period ("Phase 1") on the Licence of not less than

US$750,000. Exploration is expected to commence in September /

October 2023, and will comprise both physical activity within the

Licence boundaries (including but not limited to mapping, soil

geochemistry, geophysics and drilling), and desktop studies,

laboratory analysis and interpretation of data and results. Galileo

anticipates funding this exploration expenditure from existing

resources; and

iii) For the issue of 2,500,000 Galileo Resources plc shares

(the "Consideration Shares") at a price of 1.175 pence per share

being the closing Galileo share price on 4 September 2023

(totalling GBP29,375). The Consideration Shares are subject to a

three month lock up arrangement and thereafter a further three

months orderly market arrangement. Under the orderly market

arrangement, the Consideration Shares can be sold via the Company's

broker at a price determined by the vendor (the "Nominated Sale

Price") which shall not be less than the lower of i) the 10 day

VWAP and ii) the closing bid price on the day before the fixing of

the Nominated Sale Price and the Company's broker will have 10

business days to sell the shares at the Nominated Sale Price.

If the Phase 1 exploration results are successful and prove the

continuity of mineralisation at grades suggesting the potential for

the future development of a Mineral Resource of not less than

500,000 tonnes of contained copper, consistent with economic

recovery at the depth of discovery with a minimum internal rate of

return of not less than 25% and a payback period not exceeding 42

months (including the recovery of capital expenditure), then there

will be a second two year exploration period ("Phase 2").

ZIMBABWE

Galileo announced an agreement entered into on 04 March 2022

which assigned to Galileo an option granted under an agreement

dated 21 January 2022 between BC Ventures and Cordoba Investments

Limited to acquire a 51% interest in BC Ventures. BC Ventures is

the owner of a highly prospective lithium project in western

Zimbabwe (the Kamativi Lithium Project) and two gold licences (the

Bulawayo Gold Project) close to Bulawayo through its wholly owned

Zimbabwe subsidiary Sinamatella Investments (Private) Limited.

Under the terms of the agreement the Company committed to spend

US$1.5 million on exploration expenditure by 21 January 2024.

On 10 August 2022, the Company further announced an agreement to

acquire a further 29% shareholding in the Sinamatella projects and

an extension on the commitment to spend US$1.5 million on

exploration expenditure by 6 months to 21 July 2024. Post the

financial period under review the Company announced that all

conditions had been met in relation to the agreement to acquire a

29% shareholding in BC Ventures Limited (the "Share Acquisition")

accordingly, the Company issued 50,000,000 Galileo ordinary shares

at a price of 1.2 pence per share being the consideration shares

due in relation to the Share Acquisition. As a result, Galileo now

has an interest of 29% in BC Ventures alongside an option to

acquire a further 51% interest through the Company spending

$1.5million on exploration and evaluation of the Projects by 21

July 2024.

Zimbabwe is recognised as one of the most potentially

prospective countries in Africa for pegmatite-hosted lithium. Among

other explorers, Prospect Resources Ltd (ASX: PSC) estimates that

its Arcadia open pit lithium deposit, hosted within a stacked

series of pegmatite dykes, contains JORC- compliant proven and

probable ore reserves of 37.4Mt, grading at 1.22% Li2O. China's

Zhejiang Huayou Cobalt previously agreed a deal to purchase 100% of

the Arcadia hard-rock lithium project for US$422m. Zimbabwe has

also long been a significant gold producer, primarily from

Greenstone Belt quartz 'reef' deposits that are host to many small

to mid-size quartz reef gold mines and deposits.

Kamativi Lithium Project

The Kamativi Lithium Project comprises EPO 1782, covering

520km2, and lies on the Kamativi Belt directly adjacent to, and

along strike from the historic Kamativi tin- tantalum mine which

operated from 1936 to 1994. The Kamativi Mine produced 37,000

tonnes of tin and 3,000 tonnes of tantalum ore from pegmatites, and

in 2018 Chimata Gold Corp (Zimbabwe Lithium Company) announced a

new JORC (2012) compliant Indicated Mineral Resource of 26Mt @

0.58% Li2O within the Kamativi mine tailings, confirming that the

mine contained significant quantities of lithium. The mine has

recently been brought back into production for hardrock lithium by

its current Chinese owners.

The Sinamatella licence area encloses extensions and splays of

the Kamativi Tin Mine host unit, including mapped pegmatites, and

it has been reported that there are old tin-fluorite workings

within the Sinamatella property. The licence area also contains a

large extent of the pre-Cambrian Malaputese Formation which is

considered to be strongly prospective for VMS hosted copper,

surrounding the old Gwaii River Copper Mine and including numerous

other copper prospects and occurrences.

Little exploration has been carried out on the licence area in

the past 25+ years, however there is very good historical data

available to advance exploration for lithium prospects.

Period Under Review

On 15 June 2023 the company announced that a contract had been

signed with a drilling contractor in order to commence drill

testing of a substantial lithium-in-soil anomaly on the Kamativi

licence EPO 1782 adjoining the historic Kamativi tin-tantalum mine

(in which Galileo does not have an interest) which contains a

significant lithium tailings resource.

The Kamativi soil anomaly peaks at over 1,000ppm Li and extends

over a strike length of almost 3km, comparable to the footprint of

the Arcadia Lithium Project near Harare, considered to be one of

the world's largest hard rock lithium resources. A swarm of

coincident pegmatite dykes was mapped within the soil anomaly area

covering about 1km x 0.5km which was targeted by the Company in the

first phase of drilling, with approximately 1,000m of drilling

planned in at least 10 holes.

Phase One drilling advanced promptly at Kamativi during the

reporting period and on the 10 August 2023 the company reported the

return of strongly encouraging assay results from the first hole

drilled. The drill hole, KSDD001, returned peak values of 4m @1%

Li2O from 35m downhole depth, including an intercept of 1m at 2.04%

Li2O within an 18m wide pegmatite.

Analysis of newly received soil sampling data revealed an

extension to the original anomaly over considerable distance, and

with the addition of detailed mapping, a much larger target area

than previously realised was delineated which allowed for the

extension of the drilling programme.

Post Period Under Review

The Company reported the completion of Phase One drilling at

Kamativi for lithium and associated elements on the 17 October

2023, with a total of 1,428.4m drilled in ten drill holes.

Initial results from the remainder of the Phase One drilling

programme were promising, with mineralisation and alteration

similar to that reported in the first drill hole, KSDD001 observed

in several subsequent holes. Core logging and sampling was

underway, preparing samples for export to ALS Laboratory in

Johannesburg for lithium and associated element analysis.

Mineralogical examination of samples from KSDD001 carried out at

the University of Zimbabwe has identified prospective spodumene

mineralisation in thin sections - further samples will be subjected

to full XRD mineralogical examination in South Africa.

The Company is also testing the southern part of the licence for

VMS-type copper mineralisation.

A site visit by external recognised lithium exploration experts

resulted in a recommendation for a greater emphasis on detailed

geological mapping with follow up trenching over prospective

targets and significantly more emphasis on petrological studies to

identify specific lithium-bearing minerals. This work has continued

and successfully highlighted new areas of interest. To date only a

small portion of the licence has been covered by detailed

geological mapping offering further potential for additional

discoveries.

Bulawayo Gold-Nickel-Copper Project

The Bulawayo Project comprises EPO 1783 and EPO 1784, covering a

large 1,300km2 licence area near Bulawayo with extensive Greenstone

Belt rock formations in Zimbabwe. No systematic exploration has

been carried out in the area for more than 25 years due to the

previously unfavourable investment climate in Zimbabwe. Prospective

areas with thin sand/alluvial/Karoo basalt cover have never been

explored and preliminary grab sampling on the property reported

assays ranging from 3.9-16g/t Au, confirming the prospectivity of

the ground.

The aim is to explore for resources to support the development

of a large scale mine. The licences adjoin and enclose a number of

small-scale gold mines on pre-existing mining permits which

provides the opportunity to integrate the production from these

operations which have a total historic production reported as more

than 1Moz Au.

Period Under Review

Work during the period focussed on defining drill ready targets

at the Queen's Mine Area prospective for gold mineralisation

associated with greenstone belt terranes. Follow-up soil sampling

of a number of geophysical targets delineated by Galileo's

previously reported ground geophysical (magnetic and resistivity)

surveys have defined a number of new targets marginal to the

Queen's Gold Mine area (not part of Galileo's licence area), where

historical gold production >44,000 ounces was reported up to

1984, when reliable record keeping ceased.

The results include definition of a number of new targets

adjacent to and along-strike from the Queen's Mine area, the

majority of the new discoveries are under shallow alluvial and

Karoo sandstone cover, made visible by the previous airborne

magnetic survey flown by Galileo in June 2022.

A total of 2,455 soil samples were sent for laboratory analysis,

with results peaking at 2.1g/t Au. An anomalous 5km2 area with

gold-in-soil values up to 680ppb Au has been highlighted over a

number of structures delineated by the aeromagnetic survey to the

southeast of the Queen's Mine area, with further anomalous zones

indicated along-strike from the Queen's Mine area mineralisation

within consistent and prospective greenstone lithology.

New targets represent extensions of known gold-bearing

structures that typically host both commercial and small-scale gold

mining operations in the Queen's Mine region, and pXRF analyses

indicate coincident anomalies of associated elements. Zimbabwean

gold mineralisation is typically associated with narrow high-grade

structures that can be mined from underground. The Company is

targeting areas where the confluence of structures and other

factors potentially create a much larger bulk target for follow

up.

BOTSWANA

Kalahari Copperbelt

Galileo's exploration project currently encompasses a total of

19 exploration licences, 8 of which were included in the final sale

agreement completed in September 2021 with Sandfire Resources,

which was required to spend US$4 million on the licences in the

first two years of the agreement. The remaining KCB licences were

retained 100% by Galileo.

Kalahari Copper Belt (Retained Licences)

PL253/2018

The Licence is located in the north-western portion of the

Kalahari Copper Belt with part of the Licence sandwiched between

Cobre Limited ("Cobre") exploration licences. Cobre has recently

issued a series of press releases that demonstrate the emergence of

a potential new discovery in this under-explored portion of the

Belt. In this area the D'Kar/Ngwako Pan contact is interpreted to

be tightly folded and thrust repeated.

PL039/2018

The north-eastern section of the licence is dominated by a

prominent NNW-SSE trending conductor, the geometry of which

suggests this area is situated at the southwest end of a conductive

dome. If the interpretation is correct, the potential exists for

the discovery of the highly prospective D'Kar Formation/Ngwako Pan

Formation contact. The setting of a conductive dome with major

faulting within the licence suggests that a A4/T3 style dome drill

target with possible mineralisation at the stratigraphic boundary

between the Ngwako Pan/D'Kar and remobilized upwards via low-angle

thrusts is the most likely exploration model for this area.

PL040/2018

The interpreted strike length of the prospective D'Kar formation

contact extends over 30km within this licence. Historic wide-spaced

drilling reportedly intersected D'Kar/Ngwako Pan contact but did

not intercept mineralisation. Historic soil sampling identified the

D'Kar Formation/Ngwako Pan Formation contact further to the

southwest of the licence. The Company has selected priority zones

for soil sampling along the interpreted 30km strike of the contact

with a view to identifying potential higher-grade zones along

strike of and in between the current widely spaced drill holes.

Period under review

Exploration has continued apace on the Kalahari Copperbelt

licences sold to Sandfire Resources in 2021, and those retained by

Galileo. The Kalahari Copperbelt region is currently receiving

global attention with new mine development and a rapid advance of

exploration work from new entrants and previous players providing

new thinking on the controls of mineralisation.

Sandfire Licences

Considerable work has been completed by Sandfire Resources in

the region within the period to date, a summary of which

includes:

PL250/2020 - approximately 7.24km of prospective Lower D'Kar

contact has been identified warranting a TerraleachTM* soil

geochemical survey. Area will also be covered by regional airborne

gravity survey ('AGG')

PL367/2018 - Four multi-element soil anomalies identified as

priority targets with infill TerraleachTM* soil surveys

planned.

PL251/2020 - Scheduled TerraleachTM* soil survey over an area

described by Sandfire as a T3/A4-type target. AGG survey also to be

flown.

PL366/2018 - Soil anomaly identified warranting additional soil

geochemistry in conjunction with Sandfire's announced AGG regional

survey.

PL044/2018 & PL045/2018 - Airborne magnetic and radiometric

geophysics and follow up drilling confirmed the presence of

magnetite and disseminated copper-zinc mineralisation in

intermediate to acid volcanic rocks - follow up under review.

PL122/2020 & PL154/2020 - Considered low order priorities

with no additional work planned in the short to medium-term subject

to results of the pending AGG survey.

Galileo (Retained) Licences

An Airborne Gravity Gradient (AGG) survey jointly commissioned

by Cobre Limited and Sandfire Resources was undertaken during the

reporting period to include part of Galileo's licence PL253/2018,

with results of the survey to be released to Galileo, free of

charge, later in the year. The results of the survey are expected

to provide valuable information on basin architecture and identify

the potential location of copper-silver bearing trap-sites

analogous to Sandfire's neighbouring T3 and A4 deposits.

A low detection mobile metal-ion (TerraleachTM*) soil sampling

programme was commenced by the Company in the reporting period,

with more than 3,000 samples planned ranging over critical contact

zones in three of the retained licences, PLs 253, 39 and 40.

Sampling was planned to include ground adjacent to the licence

hosting Cobre's recent drill discoveries at Ngami and Kitlanya,

where similar soil programmes led to drill target identification.

Galileo will utilise the soil geochemical results, in conjunction

with the results of the AGG survey, to develop new targets for

drilling.

Post Period Under Review

On the 11 October 2023 it was announced that the soil sampling

survey had completed, with a total of 3,373 (excluding QAQC

inserts) samples collected over critical contact zones across the

retained licences. The samples are now being processed via a sample

preparation laboratory in South Africa for dispatch to Intertek

laboratory in Perth for analysis.

NEVADA

Ferber gold-copper project

Period Under Review

An earlier Galileo project review identified several drill

targets at Ferber to test both skarn-type gold-copper occurrences

and Carlin-type gold occurrences on the 100% held property. Due to

strong demand for drill machines in Nevada, it proved difficult to

find a contractor to undertake diamond core drilling at Ferber in

2022. However, the Company has proceeded with an application for an

environmental permit for the planned programme and has engaged

Rangefront Mining Services, based in Elko, Nevada, to assist in

seeking quotes from drilling contractors for Reverse Circulation

(RC) drilling with the aim of completing the planned programme

during 2024.

SOUTH AFRICA

Glenover Phosphate Project (" Glenover")

Period Under Review

On the 21 June 2023 Galileo announced progress in relation to

JSE Listed Afrimat Limited's option to buy for ZAR300 million

(approx. GBP12.8 million) shares in and shareholder loans made to

Glenover Phosphate Proprietary Limited, in which Galileo has a

30.8% direct and 4.99% indirect investment held via Galagen

Proprietary Limited.

An addendum to the conditional sale agreement was signed by the

parties on the 21 June 2023 giving rise to Afrimat's Option (the

"Addendum") that removed the requirement for the previous

suspensive conditions to be met before the first two tranches of

consideration are paid and set a revised timetable for the receipt

of funds, as well as amending the second tranche to be paid in

cash.

Revised timetable detailed as follows:

First tranche payment of ZAR150 million (approx. GBP6.4 million)

in respect of Sales Claims was settled in July 2023, by the issue

of Afrimat shares calculated on a 30-day volume weighted average

price ("VWAP") on the payment date. Galileo's portion was ZAR52.6

million (approx. GBP2.1 million).

30 April 2024 : Second tranche payment of ZAR147 million

(approx. GBP6.3 million) in respect of Sales Claims to be settled

in cash. Galileo's estimated portion will be approximately ZAR49

million (approx. GBP2.1 million).

30 April 2024: Cash consideration of ZAR3 million (approx.

GBP0.13 million) in respect of the Glenover shares subject to the

fulfilment of the suspensive conditions (Note 1). Galileo's

estimated portion will be approximately ZAR1 million (approx.

GBP0.04 million).

Note 1: The suspensive conditions applicable to the sale of

Glenover shares are:

i) the Approval in terms of section 11 of the Mineral and

Petroleum Resources Development Act No. 28 of 2002 ("MPRDA");

and

ii) the completion of the 30 June 2023 audited financial

statements and collation of all company documentation on or before

30 April 2024.

Financial Highlights

The Group reported loss of GBP521,764 (2022: loss of

GBP1,554,313) after taxation. Loss reported is 0.05 pence (2022:

loss of 0.13 pence) per share. Loss per share is based on a

weighted average number of ordinary shares in issue of

1,160,943,355 (2022: 1,115,819,649).

For further information, please contact:

Colin Bird, Chairman and Tel +44 (0) 20 7581 4477

CEO

Edward Slowey, Executive Tel +353 (1) 601 4466

Director

www.galileoresources.com

Beaumont Cornish Limited

Nominated Advisor

Roland Cornish/James Biddle Tel +44 (0)20 7628 3396

Novum Securities Limited

- Broker Tel +44 (0)20 7382 8416

Colin Rowbury/ Jon Belliss

Statement of Responsibility for the six months ended 30

September 2023

The directors are responsible for preparing the consolidated

interim financial statements for the six months ended 30 September

2023 and they acknowledge, to the best of their knowledge and

belief, that:

-- the consolidated interim financial statements for the six

months ended 30 September 2023 have been prepared in accordance

with UK adopted IAS 34 - Interim Financial Reporting;

-- based on the information and explanations given by

management, the system of internal control provides reasonable

assurance that the financial records may be relied on for the

preparation of the consolidated interim financial statements.

However, any system of internal financial control can provide only

reasonable, and not absolute, assurance against material

misstatement or loss;

-- the going concern basis has been adopted in preparing the

consolidated interim financial statements and the directors of

Galileo have no reason to believe that the Group will not be a

going concern in the foreseeable future, based on forecasts and

available cash resources;

-- these consolidated interim financial statements support the viability of the Company; and

-- having reviewed the Group's financial position at the balance

sheet date and for the period ending on the anniversary of the date

of approval of these financial statements they are satisfied that

the Group has, or has access to, adequate resources to continue in

operational existence for the foreseeable future.

Colin Bird

Chairman and Chief Executive Officer

28 December 2023

CONSOLIDATED STATEMENTS

OF FINANCIAL POSITION

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBPs (Restated) GBPs

GBPs

ASSETS

Intangible assets 6 5,370,610 4,382,659 5,161,591

Investment in joint ventures

7 835,149 - 835,149

Loans to joint ventures,

associates and subsidiaries 9,103 284,792 9,547

Other financial assets 8 5,074,564 2,318,549 2,556,034

---------------- --------------- --------------

Non-current assets 11,289,426 6,986,000 8,562,321

---------------- --------------- --------------

Trade and other receivables 300,308 387,734 284,923

Cash and cash equivalents 88,719 3,309,842 1,435,511

Other financial assets 51,136 - 47,351

--------------- --------------

Current assets 440,163 3,697,576 1,767,785

---------------- --------------- --------------

Non-current assets held for

sale 9 160,883 2,411,269 2,323,807

---------------- --------------- --------------

Total Assets 11,890,472 13,094,845 12,653,913

---------------- --------------- --------------

EQUITY AND LIABILITIES

Share capital 32,782,905 32,146,730 32,753,530

Reserves 198,676 1,388,743 421,097

Accumulated loss (21,318,604) (20,905,667) (20,815,887)

---------------- --------------- --------------

11,662,977 12,629,806 12,358,740

Non-controlling interest 117,754 117,754 117,754

---------------- --------------- --------------

Equity 11,780,731 12,747,560 12,476,494

---------------- --------------- --------------

Liabilities

Other financial liabilities - 6 5

Non-current liabilities - 6 5

---------------- --------------- --------------

Trade and other payables 109,741 141,628 177,414

Taxation payable - 205,651 -

---------------- --------------- --------------

109,741 347,279 177,414

---------------- --------------- --------------

Total liabilities 109,741 347,285 177,419

---------------- --------------- --------------

Total Equity and liabilities 11,890,472 13,094,845 12,653,913

---------------- --------------- --------------

Joel Silberstein

28 December 2023

Company number: 05679987

CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBPs (Restated)GBPs GBPs

Other Income 435 - 289,040

Operating expenses (585,411) (599,130) (1,257,877)

---------------- --------------- --------------

Operating loss (584,976) (599,130) (968,837)

Investment revenue 295,433 218,012 90,096

Fair value adjustments (162,802) (401,274) 71,074

Profit/(loss) on sale of

investments (19,416) - 291,758

Provision for impairment - - (274,314)

Share of (loss)/profit from

equity accounted investments - (771,921) (765,172)

---------------- --------------- --------------

Profit/(loss) for the period

before taxation (471,761) (1,554,313) (1,555,395)

Taxation (50,003) - 88,865

---------------- --------------- --------------

Profit/(loss) for the period

after taxation (521,764) (1,554,313) (1,466,530)

---------------- --------------- --------------

Other comprehensive loss:

Exchange differences on translating

foreign operations (203,374) 127,741 (837,904)

---------------- --------------- --------------

Other adjustments - - 1,996

---------------- --------------- --------------

Total comprehensive income/(loss) (725,138) (1,426,572) (2,302,438)

---------------- --------------- --------------

Total comprehensive loss

attributable to:

Owners of the parent (725,138) (1,426,572) (2,302,438)

Weighted average number of

ordinary shares in issue 1,160,943,355 1,115,819,649 1,130,693,464

Basic earnings/(loss) per

share - pence (0.05) (0.13) (0.13)

STATEMENTS OF CHANGES IN EQUITY as at 30 September 2023

Share Share Total Foreign Merger Shares Share based Total Accumulated Total equity

Capital capital currency reserve to be issued payment reserves loss

premium translation reserve reserve

reserve

----------

Figures in Pound Sterling

reserve

---------------------------------------------------------------------------------------------------- --------------- ---------------- ----------------------------- ----------------- ------------ --- ----- -------------- ----------------------

Balance at 1 April 2022 6,707,168 25,289,562 31,996,730 (293,176) 1,047,821 150,000 319,156 1,223,801 (19,351,353) 13,869,178

Loss for the year - - - - - - - - (1,466,530) (1,466,530)

Other comprehensive income - - - (837,904) - - - (837,904) 1,996 (835,908)

------------------- -------------------- ----------------------------------- -------------- --------------------- --------------------------- ----------- ---------------- -------------- --------------------

Total comprehensive income

for the year - - - (837,904) - - - (837,904) (1,464,534) (2,302,438)

Issue of shares net of

issue costs 63,742 693,058 756,800 - - (150,00) - (150,000) - 606,800

Options issued - - - - - - 185,200 185,200 - 185,200

Options lapsed - - - - - - - - - -

Warrants lapsed - - - - - - - - - -

Warrants issued - - - - - - - - - -

Warrants exercised - - - - - - - - - -

Shares to be issued - - - - - - - - - -

Total contributions by

and distributions to owners

of company recognised

directly in equity 63,742 693,058 756,800 - - (150,000) 185,200 35,200 - 792,000

Balance at 1 April 2023 6,770,910 25,982,620 32,753,530 (1,131,080) 1,047,821 - 504,356 421,097 (20,815,887) 12,358,740

------------------- -------------------- ----------------------------------- -------------- --------------------- --------------------------- ----------- ---------------- -------------- --------------------

Loss for the 6 months - - - - - - - - (521,764) (521,764)

Other comprehensive income - - - (203,374) - - - (203,374) - (203,374)

------------------- -------------------- ----------------------------------- -------------- --------------------- --------------------------- ----------- ---------------- -------------- --------------------

Total comprehensive income

for the 6 months - - - (203,374) - - - (203,374) (521,764) (725,138)

------------------- -------------------- ----------------------------------- -------------- --------------------- --------------------------- ----------- ---------------- -------------- --------------------

Warrants lapsed - - - - - - (19,047) (19,047) 19,047 -

Issue of shares 2,500 26,875 29,375 - - - - - - 29,375

Total contributions by

and distributions to owners

of company recognised

directly in equity 2,500 26,875 29,375 - - - (19,047) (19,047) 19,047 29,375

Balance at 30 September

2023 6,773,410 26,009,495 32,782,905 (1,334,454) 1,047,821 - 485,309 198,676 (21,318,604) 11,662,977

------------------- -------------------- ----------------------------------- -------------- --------------------- --------------------------- ----------- ---------------- -------------- --------------------

CONSOLIDATED STATEMENTS OF Six months Six months Year

CASH FLOW ended ended ended

30 September 30 September 31 March

2023 2022 2023

(Unaudited) (Unaudited) (Audited)

GBPs (Restated)GBPs GBPs

Cash used in operations (714,898) (595,708) (1,495,390)

Interest income - - -

Net cash from operating activities (714,898) (592,708) (1,495,390)

-------------- --------------- ------------

Additions to intangible assets (236,652) (154,106) (1,229,886)

Sale of intangible - - 291,760

Distributions from Joint Ventures - - -

(incl subs, JVs & Assoc)

Proceeds on sale of non-current - - -

assets held for sale

Net movement in loans 444 509,567 369,579

Purchase of financial assets (965,385) (1,101,906) (1,149,545)

Sale of financial assets 569,704 - -

Net cash flows from investing

activities (631,889) (746,445) (1,718,092)

-------------- --------------- ------------

Net Proceeds on share issue - - -

Repayment of loans from group

companies (5) - (1)

Net cash flows from financing

activities (5) - (1)

Total cash movement for the

period (1,346,792) (1,339,153) (3,213,483)

Cash at the beginning of the

period 1,435,511 4,648,995 4,648,994

-------------- --------------- ------------

Total cash at end of the period 88,719 3,309,842 1,435,511

-------------- --------------- ------------

Notes to the Financial Statements

1. Status of interim report

The Group unaudited condensed interim results for the six months

ended 30 September 2023 have been prepared using the accounting

policies applied by the Company in its 31 March 2023

annual report, which are in accordance with UK adopted

international Accounting Standard, the AIM rules of the London

Stock Exchange and the Companies Act 2006 (UK). This condensed

consolidated interim financial report does not include all notes of

the type normally included in an annual financial report.

Accordingly, this report is to be read in conjunction with the

annual report for the year ended 31 March 2023 and any public

announcements by Galileo Resources Plc. All monetary information is

presented in the presentation currency of the Company being Great

British Pound. The Group's principal accounting policies and

assumptions have been applied consistently over the current and

prior comparative financial period. The financial information for

the year ended 31 March 2023 contained in this interim report does

not constitute statutory accounts as defined by section 435 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The auditor's

report on those accounts was unqualified and did not contain a

statement under section 498(2)-(3) of the Companies Act 2006.

2. Basis of preparation

The consolidated financial statements incorporate the financial

statements of the Company and all entities for the six months ended

30 September 2023, including special purpose entities, which are

controlled by the Company. Control exists when the Company has the

power to govern the financial and operating policies of an entity

to obtain benefits from its activities. The results of subsidiaries

are included in the consolidated annual financial statements from

the effective date of acquisition to the effective date of

disposal. Adjustments are made when necessary to the annual

financial statements of subsidiaries to bring their accounting

policies in line with those of the Group.

All intra-group transactions, balances, income and expenses are

eliminated in full on consolidation. Non-controlling interests in

the net assets of consolidated subsidiaries are identified and

recognised separately from the Group's interest therein and are

recognised within equity. Losses of subsidiaries attributable to

non-controlling interests are allocated to the non-controlling

interest even if this results in a debit balance being recognised

for non-controlling interest. Transactions which result in changes

in ownership levels, where the Group has control of the subsidiary

both before and after the transaction, are regarded as equity

transactions and are recognised directly in the statement of

changes in equity. The difference between the fair value of

consideration paid or received and the movement in non-controlling

interest for such transactions is recognised in equity attributable

to the owners of the parent.

3. Segmental analysis

Business unit

The Company's investments in subsidiaries and associates, that

were operational at year-end, operate in four geographical

locations being South Africa, Botswana, Zambia, Zimbabwe and USA,

and are organised into one business unit, namely Mineral Assets,

from which the Group's expenses are incurred and future revenues

are expected to be earned. This being the exploration for and

extraction of its mineral assets through direct and indirect

holdings. The reporting on these investments to the board focuses

on the use of funds towards the respective projects and the

forecasted profit earnings potential of the projects.

The Company's investment in Zambia did not contribute to the

operating profit or losses and is excluded from the segmental

analysis.

Geographical segments

An analysis of the profit/(loss) on ordinary activities before

taxation is given below:

Six months Six months Year

ended 30 ended 30

September September ended

2023 2022 31 March

(Unaudited) (Unaudited) 2023

(Audited)

GBPs GBPs GBPs

Profit/(loss) on ordinary

activities before taxation:

Rare earths, aggregates

and iron ore and manganese

- South Africa 90,469 (572,195) (717,323)

Gold - USA (1,155) (4,214) (9,892)

Copper - Botswana (47,696) (22,664) 110,901

Copper and Corporate costs

- United Kingdom (563,382) (955,240) (939,081)

Gold and lithium - Zimbabwe - - -

(521,764) (1,554,313) (1,555,395)

-------------- ------------- ------------

Geographical segments

An analysis of total liabilities:

Six months Six months Year

ended 30 ended 30

September September ended

2023 2022 31 March

(Unaudited) (Unaudited) 2023

(Audited)

GBPs GBPs GBPs

Rare earths, aggregates

and iron ore and manganese

- South Africa (1,915) (95) (64,546)

Gold - USA - - -

Copper - Botswana (4,759) (205,651) (4,794)

Copper and Corporate costs

- United Kingdom (103,067) (141,539) (108,074)

Gold and lithium - Zimbabwe - - -

(109,741) (347,285) (177,414)

-------------- ------------- ------------

Geographical segments

An analysis of total assets:

Six months Six months Year

ended 30 ended 30

September September ended

2023 2022 31 March

(Unaudited) (Unaudited) 2023

(Audited)

GBPs GBPs GBPs

Rare earths, aggregates

and iron ore and manganese

- South Africa 2,288,091 5,726,276 3,459,946

Gold - USA 1,750,566 1,769,023 1,613,873

Copper -Zambia 2,964,971 2,338,362 2,508,201

Copper - Botswana 1,478,873 1,653,284 1,481,683

Copper and Corporate costs

- United Kingdom 1,138,263 897,360 2,743,833

Gold and lithium - Zimbabwe 2,269,708 710,540 846,377

11,890,472 13,094,845 12,653,913

-------------- ------------- ------------

4. Financial review

The Group reported loss of GBP521,764 (2022: loss of

GBP1,554,313) after taxation. Loss reported is 0.05 pence (2022:

loss of 0.13 pence) per share. Loss per share is based on a

weighted average number of ordinary shares of 1,160,943,355 (2022:

1,115,819,649).

5. Share Capital

During the period under review the Company issued new ordinary

shares as follows:

Number of

Date ordinary shares

================ ================

Opening balance 1 160 688 453

Acquisition 2 500 000

================ ================

Closing balance 1 163 188 453

================ ================

No new ordinary shares were issued by the Company post the

period under review.

Warrants

The Company had the no warrants outstanding at the period

end.

Share Options 30 September 30 September 31 March

2023 2022 2023

Outstanding at the beginning

of the year 98,700,000 58,700,000 58,700,000

Options granted during the

year - 39,000,000 40,000,000

98,700,000 97,700,000 98,700,000

--------------- --------------- -----------

6. Intangible assets

Reconciliation of Intangible assets:

Group as at 30 September 2023

Asset Opening Additions Foreign Closing

currency balance exchange balance

movements

Exploration

and evaluation

asset - Botswana BWP 1,470,267 50,810 (43,070) 1,478,007

----------- ------------- ----------- ----------- ----------

Exploration

and evaluation

asset - U.S.A. US$ 2,154,613 114,881 15,437 2,284,931

----------- ------------- ----------- ----------- ----------

Exploration

and evaluation

asset - Zambia ZMW 1,536,711 70,961 - 1,607,672

----------- ------------- ----------- ----------- ----------

Total intangible

assets 5,161,591 236,652 (27,633) 5,370,610

------------- ----------- ----------- ----------

Group as at 30 September 2022

Asset Opening Additions Foreign Closing

currency balance exchange balance

movements

Exploration

and evaluation

asset - Botswana BWP 1,467,320 32,692 12,976 1,512,988

------------ -------------- ----------- ------------ ------------

Exploration

and evaluation

asset - U.S.A. US$ 1,893,024 121,414 340,007 2,354,445

------------ -------------- ----------- ------------ ------------

Exploration

and evaluation

asset - Zambia ZMW 515,226 - - 515,226

------------ -------------- ----------- ------------ ------------

Total intangible

assets 3,875,570 154,106 352,983 4,382,659

-------------- ----------- ------------ ------------

Group as at 31 March 2023

Asset Opening Additions Foreign Total

currency exchange

movements

Exploration

and evaluation

asset - Botswana BWP 1,467,320 77,614 (74,667) 1,470,267

----------- ---------- ---------- ------------------ -----------

Exploration

and evaluation

asset - U.S.A. US$ 1,893,024 130,788 130,801 2,154,613

----------- ---------- ---------- ------------------ -----------

Exploration

and evaluation

asset - Zambia ZMW 515,226 1,021,485 - 1,536,711

----------- ---------- ---------- ------------------ -----------

3,875,570 1,229,887 56,134 5,161,591

------------------------------- ---------- ---------- ------------------ -----------

Botswana

The Company currently holds copper licenses in the highly

prospective Kalahari Copper Belt ("KCB"), The KCB is approximately

800km long by up to 250km wide, is a northeast-trending Meso- to

Neoproterozoic belt that occurs discontinuously from western

Namibia and stretches into northern Botswana along the northwestern

edge of the Paleoproterozoic Kalahari Craton. The belt contains

copper-silver mineralisation, which is generally stratabound and

hosted in metasedimentary rocks of the D'Kar Formation near the

contact with the underlying Ngwako Pan Formation. The hanging

wall-footwall redox contact is a distinctive target horizon that

consistently hosts copper-silver mineralization in fold-hinge

settings. The geological setting is similar to that of the major

Central African Copper Belt and Kupferschiefer in Poland.

7. Investment in joint ventures

Six months Six months Year

ended 30 ended 30

September September ended

2023 2022 31 March

(Unaudited) (Unaudited) 2023

(Audited)

GBPs GBPs GBPs

Cordoba -BC Ventures 835,149 - 835,149

835,149 - 835,149

-------------- ------------- ------------

On 21 January 2022, Cordoba and BC Ventures entered into an

option agreement (the "Principal Agreement") which provided Cordoba

with an option to acquire 51% of BC Ventures by funding

US$1,500,000 of exploration expenditure within 2 years for BC

Venture's 100% owned Zimbabwean subsidiary Sinamatella Investments

(Private) Limited ('Sinamatella') holds three Exclusive Prospecting

Orders ('EPOs') No's 1782, 1783 and 1784 in the Kamativi Regional,

'Bulawayo North' and 'Bulawayo South' areas in the Republic of

Zimbabwe. EPO 1782 is primarily prospective for lithium (tantalum,

niobium, tin, tungsten, REE's and copper) whilst EPO5 1783 and 1784

are primarily prospective for gold. The three EPOs were issued on

12 March 2021 and have a term of 3 years.

On 4 March 2022 Galileo entered into a Deed of Assignment with

Cordoba and BC Ventures (the "Deed of Assignment") under which

Cordoba has assigned all its rights and obligations under the

Principal Agreement to Galileo for GBP150,000 which was settled by

the issue of 13,741,609 new ordinary Galileo Resources plc shares

in relation to the Consideration Shares.

On 9 August 2022, Galileo signed an addendum (the "Addendum") to

an agreement dated 21 January 2022. Under the Addendum, Galileo

acquired a 29% shareholding in BC Ventures (the "Share

Acquisition") for the issue of 50,000,000 Galileo Resources plc

shares (the "Consideration Shares").

The period for the expenditure of US$1.5M to be incurred by the

Company under the Principal Agreement to acquire 51% of BC Ventures

was extended by 6 months to 21 July 2024.

As 31 March 2022, all amounts in relation to BC Ventures were

accounted for as Other Financial Assets.

8. Other Financial assets

Six months Six months Year

ended 30 ended 30

September September ended

2023 2022 31 March

(Unaudited) (Unaudited) 2023

(Audited)

GBPs GBPs GBPs

Cordoba -BC Ventures 1,434,559 710,540 836,107

Sandfire listed investment 702,228 799,129 1,271,476

Afrimat listed investment 2,096,802 - -

Kashitu project - 39,050 -

Luansobe project - 498,801 -

Shinganda Project 611,190 249,651 430,523

Star Zinc 18,162 21,378 17,928

Northwest Zambia project 211,623 - -

5,074,564 2,318,549 2,556,034

-------------- ------------- ------------

Sandfire listed investment

As announced on 16 September 2021, Galileo sold 9 of its

Company's Kalahari Copper Belt Licences to Sandfire Resources. As

part of the consideration Sandfire issued 370,477 Sandfire ordinary

shares to the Company. As the 30 September 2032, the Company held

216,000 Sandfire ordinary shares.

Sandfire Resources is an Australian listed company and have an

enviable track record of copper/gold discovery, development

execution and operation.

Afrimat Limited listed investment

As announced on 23 June 2023, the Company received the first

tranche payment of was ZAR52.6 million (approx. GBP2.1 million) in

respect of Sales Claims which was settled by the issue of 903,994

Afrimat shares calculated on a 30-day volume weighted average price

("VWAP") of ZAR55.91.

Afrimat is a leading mid-tier mining and materials company. The

Group listed on the JSEMain Board in 2006 and is currently listed

in the Basic Materials: General Mining sector.

The group supplies a broad range of products ranging from

Construction Materials (aggregates, bricks, blocks, pavers and

readymix concrete), Industrial Minerals (lime and lime products),

and Bulk Commodities (iron ore, anthracite and manganese).

9. Non-Current Held For Sale asset

Group as at 30 September 2023

Glenover Phosphate (Pty) Ltd

The Company currently holds a 30.70% direct investment in

Glenover and also has an indirect investment of 4.99% in Glenover

through its shareholding in Galagen Proprietary Limited, a special

purpose vehicle incorporated to hold the BEE shareholding in the

Glenover project, resulting in a total interest in Glenover of

35.69%.

As announced on 9 December 2021, Glenover entered into a

conditional sale of shares agreement with JSE Limited listed

Afrimat Limited (JSE: AFT) ("Afrimat") Glenover also between

Afrimat, Glenover and the shareholders of Glenover including

Galileo Resources SA (Pty) Ltd the Company's wholly owned South

African subsidiary under which Afrimat has the option to acquire

the shares in and shareholders loans made to Glenover for ZAR300

million (approximately GBP14 .3 million).

On 26 October 2022 , the Company announced that Afrimat had

given notice to Glenover of its intention to conditionally acquire

100% of the shares in Glenover from the current shareholders of

Glenover for consideration of ZAR300 million (approximately GBP14.3

million) with the Company to receive ZAR107 million (approximately

GBP5.1 million).

On the 21 June 2023 Galileo announced progress in relation to

JSE Listed Afrimat Limited's option to buy for ZAR300 million

(approx. GBP12.8 million) shares in and shareholder loans made to

Glenover Phosphate Proprietary Limited, in which Galileo has a

30.8% direct and 4.99% indirect investment held via Galagen

Proprietary Limited.

An addendum to the conditional sale agreement was signed by the

parties on the 21 June 2023 giving rise to Afrimat's Option (the

"Addendum") that removed the requirement for the previous

suspensive conditions to be met before the first two tranches of

consideration are paid and set a revised timetable for the receipt

of funds, as well as amending the second tranche to be paid in

cash.

Revised timetable detailed as follows:

First tranche payment of ZAR150 million (approx. GBP6.4 million)

in respect of Sales Claims was settled in July 2023, by the issue

of Afrimat shares calculated on a 30-day volume weighted average

price ("VWAP") on the payment date. Galileo's portion was ZAR52.6

million (approx. GBP2.1 million).

30 April 2024 : Second tranche payment of ZAR147 million

(approx. GBP6.3 million) in respect of Sales Claims to be settled

in cash. Galileo's estimated portion will be approximately ZAR49

million (approx. GBP2.1 million).

30 April 2024: Cash consideration of ZAR3 million (approx.

GBP0.13 million) in respect of the Glenover shares subject to the

fulfilment of the suspensive conditions. Galileo's estimated

portion will be approximately ZAR1 million (approx. GBP0.04

million).

10. Going concern

The Company has sufficient financial resources to enable it to

continue in operational existence for the foreseeable future and

meet its liabilities as they fall due.

The directors have further reviewed the financial position of

the Company at the date of this report and Company's cash flow

forecast which includes the receipt of GBP2.1 million from the

proceeds of the sale of shares in Glenover which the Company

anticipates will be received by the April 2024. The Company has a

very prospective portfolio of projects all of which will be pursued

during 2024. The progress of certain projects beyond the second

half of 2024 will depend on receipt of the funds from the Glenover

sale proceeds as referred to above. Should the receipt of funds be

delayed, then certain low priority projects may be deferred until

receipt of the funds or alternative funding is secured.

Accordingly, the directors consider it appropriate to continue

to adopt the going-concern basis in preparing these financial

statements. This basis presumes that funds will be available to

finance future operations and that the realisation of assets and

settlement of liabilities and commitments will occur in the

ordinary course of business.

11. Prior Period Adjustment

CONSOLIDATED STATEMENTS OF 30 September Adjustment Restated

COMPREHENSIVE INCOME 2022 30 September

2022

Fair value on Non-Current

asset held for sale (2,763,857) 2,763,857 -

------------- ----------- --------------

Other comprehensive income 91,182 36,559 127,741

------------- ----------- --------------

CONSOLIDATED STATEMENTS 30 Adjustment Restated

OF FINANCIAL POSITION September 30 September

2022 2022

Non-Current asset held for

sale 5,138,367 (2,727,068) 2,411,269

----------- ------------ --------------

Accumulated Loss 18,142,010 2,763,657 20,905,667

----------- ------------ --------------

Foreign currency translation

reserve 201,994 (36,559) 165,435

----------- ------------ --------------

The 30 September 2022 unaudited balances have been restated in

the 30 September 2023 unaudited financial statements. The balances

have been restated due to the Non-Current asset held for sale being

measured at the fair value instead of the carrying amount. The held

for sale assets are measured at the lower of their carrying amount

and fair value less costs to sell.

12 . Post balance sheet events

There were no significant events.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FEIFIAEDSEFE

(END) Dow Jones Newswires

December 28, 2023 10:18 ET (15:18 GMT)

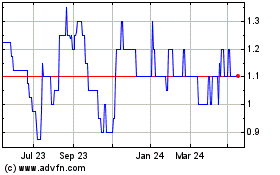

Galileo Resources (AQSE:GLR.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

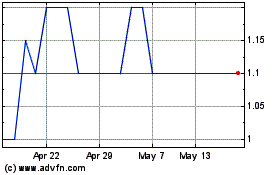

Galileo Resources (AQSE:GLR.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025