Duke Royalty Limited Trading Update and Follow-on Investment (1124Y)

December 29 2023 - 2:00AM

UK Regulatory

TIDMDUKE

RNS Number : 1124Y

Duke Royalty Limited

29 December 2023

29 December 2023

Duke Royalty Limited

("Duke Royalty", "Duke" or the "Company")

Trading Update and Follow-on Investment

Duke Royalty, a provider of alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and North America, is pleased to provide guidance on its

trading for its third financial quarter ending 31 December 2023

("Q3 FY24") and to announce a follow-on investment of CA$8.6

million (approximately GBP5.1 million) into its existing royalty

partner Cre -Tech Industrial Group Inc. ("Cre -Tech").

Trading Update

Based on current trading, Duke expects to achieve recurring cash

revenue* of GBP6.3 million in Q3 FY24. This represents a 12%

increase on Q3 FY23 (GBP5.6 million) and an increase on the prior

quarter, Q2 FY24, which saw the Company deliver record recurring

cash revenue of GBP6.2 million.

Overview of quarterly revenue growth:

Recurring Cash Revenue* Total Cash Revenue**

Q2 FY23 GBP5.3 million GBP5.3 million

------------------------ ---------------------

Q3 FY23 GBP5.6 million GBP5.6 million

------------------------ ---------------------

Q4 FY23 GBP5.7 million GBP5.8 million

------------------------ ---------------------

Q1 FY24 GBP6.0 million GBP7.8 million

------------------------ ---------------------

Q2 FY24 GBP6.2 million GBP6.2 million

------------------------ ---------------------

* Recurring cash revenue excludes buyback premium receipts and

cash gains from equity sales

** Total cash revenue is monthly cash distributions from Duke's

royalty partners plus cash gains received from the sales of equity

assets and buyback premiums

Other Highlights

-- In December, Duke invested a further CA$8.6 million into Cre

-Tech, taking its total exposure to CA$27.1 million (GBP16.0

million). The investment will be used to facilitate the refinancing

of its existing senior lender.

-- During the quarter, Duke strengthened its investment team

adding two new associate hires to take advantage of the current

market opportunities.

-- Duke also embarked on a review of the Company's branding and

positioning. This review is still ongoing, and the Board looks

forward to sharing these exciting changes upon completion in the

next quarter.

Neil Johnson, CEO of Duke Royalty, said:

"We are pleased to report that despite the ongoing macroeconomic

uncertainties, we continue to deliver revenue growth, with Q3 FY24

on course to maintain this upward trend, underpinning our stable

dividend which at the current share price, represents an

approximate 9% yield.

"W e believe the Company's rebrand, alongside our expanded

investment team, will position Duke to take advantage of the

abundance of new opportunities in the Private Credit market, which

has become increasingly mainstream in the SME lending space."

***ENDS***

For further information, please visit www.dukeroyalty.com or

contact:

Neil Johnson / Charles

Cannon Brookes / Hugo

Duke Royalty Limited Evans +44 (0) 1481 231 816

Cavendish Capital

Markets Limited

(Nominated Adviser Stephen Keys / Callum

and Joint Broker) Davidson / Michael Johnson +44 (0) 207 220 0500

Canaccord Genuity

(Joint Broker) Adam James / Harry Rees +44 (0) 207 523 8000

SEC Newgate (PR) Elisabeth Cowell / Alice +44 (0) 20 3757 6882

Cho / Matthew Elliott dukeroyalty@secnewgate.co.uk

About Duke Royalty

Duke Royalty Limited provides alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and abroad. Duke Royalty's experienced team provide

financing solutions to private companies that are in need of

capital but whose owners wish to maintain equity control of their

business. Duke Royalty's royalty investments are intended to

provide robust, stable, long term returns to its shareholders. Duke

Royalty is listed on the AIM market under the ticker DUKE and is

headquartered in Guernsey.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAKAPAAADFFA

(END) Dow Jones Newswires

December 29, 2023 02:00 ET (07:00 GMT)

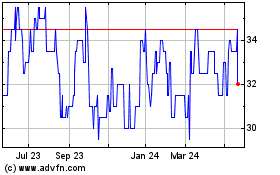

Duke Capital (AQSE:DUKE.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

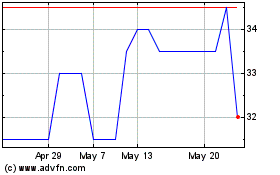

Duke Capital (AQSE:DUKE.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024