TIDMBOIL

RNS Number : 2463C

Baron Oil PLC

28 September 2018

28 September 2018

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

BARON OIL Plc

("Baron Oil", "Baron" or "the Company")

Unaudited Interim Results

for the six months ended 30 June 2018

Baron Oil Plc, the AIM-listed oil and gas exploration and

production company primarily focused on opportunities in the UK and

Latin America, announces its unaudited interim financial

information and results for the six months ended 30 June 2018.

Highlights

-- The Wick exploration well and Colter appraisal well rig site

surveys have been completed, the contract has been signed for the

Ensco 72 rig and the two well programme is expected to commence at

Wick during the 4(th) Quarter of 2018, subject to receipt of the

necessary regulatory approvals and consents for both wells. Follows

Farmout Agreements signed with Corallian Energy Limited in March

and June 2018 in respect of UK Offshore Licenses P2235 (Wick) and

P1918 (Colter).

-- Wick has been defined by 3D seismic mapping by Baron and

others and a recent announcement by Upland Resources Limited stated

Wick has estimated in-place P50 Prospective Resources of around 250

million barrels of oil (unrisked) in sands of Jurassic and Triassic

age in the licence area, a large part of which will be tested by

the Wick well.

-- Colter is estimated to have the potential to hold unrisked

Pmean Prospective Resources of 23 million barrels of oil equivalent

recoverable.

-- Peru Block XXI: The El Barco-3X exploration well is now

targeted for early 2019, but the drilling programme is subject to

completion of a farm out agreement with an interested third party

and removal from Force Majeure.

-- Operating loss of GBP400,000 and net loss after finance and

tax of GBP405,000 (0.07p per share) for the period, down from a net

loss of GBP916,000 in the same period in 2017, and from a net loss

of GBP1,539,000 in the year ended 31 December 2017.

-- Cash balance at 30 June 2018 was GBP3,236,000 with remaining

obligations on Wick of GBP831,300 and Colter of GBP707,700 on the

same date, based on latest AFE information.

United Kingdom offshore licence P2235 block 11/24b ("Wick"

Prospect) (Baron 15%)

Baron announced on 13 March 2018 that it had signed a definitive

Farmout Agreement with Corallian Energy Limited, ("Corallian") in

respect of UK Offshore Licence P2235 (Block 11/24b), which contains

the Wick Prospect. Under the Agreement, the Company will pay 20% of

the costs of the Wick well, up to a maximum gross cost of GBP4.2

million, and 15% of other costs on the licence and it has now been

assigned a 15% working interest in P2235. It was announced on 25

July 2018 that an Authorisation for Expenditure ("AFE") for the

Wick well had been signed in the amount of GBP5.2 million, of which

Baron's share will be GBP990,000 (GBP831,000 remaining at 30 June

2018). The Wick Prospect lies close to the shore of NE Scotland, 5

kilometres north and updip from the Lybster Field, which has been

developed from onshore facilities. The Wick prospect has been

defined by 3D seismic mapping by Baron and others and a recent

announcement by Upland Resources Limited stated Wick has estimated

in-place P50 Prospective Resources of around 250 million barrels of

oil (unrisked) in sands of Jurassic and Triassic age in the 11/24b

licence area, a large part of which will be tested by the Wick

well. The Wick well will be drilled to a total depth of 1250 metres

subsea in a water depth of 39 metres during the 4(th) Quarter of

2018, subject to receipt of the necessary approvals and consents.

Baron has now been notified by Corallian that the site survey for

the drilling location had been completed and that an agreement has

been signed with Ensco UK Limited to provide the Ensco 72 jack-up

drilling rig to drill this well.

United Kingdom offshore licence P1918 block 98/11a ("Colter"

Prospect) and onshore PEDLs 330 & 345 (Baron 8%)

Baron initially announced on 13 March 2018 that it had entered

into a Farmout Agreement with Corallian under which it would earn a

5% working interest in UK Offshore Licence P1918, which contains

the Colter Prospect, on which an appraisal well is planned to be

drilled in the 4(th) Quarter of this year, following the Wick Well,

subject to receipt of the necessary approvals and consents. By

participating in this well, Baron would also earn a 5% interest in

nearby onshore licences PEDL 330 and PEDL 345. On 25 July 2018, the

Company announced that it had agreed to increase its working

interest to 8% in this project. Under the terms of the revised

agreement with Corallian, the Company will pay 10.67% of the costs

related to this well, capped at a gross cost of GBP8.0 million.

Costs above this cap will be funded at 8%. It was also announced

that a AFE had been signed for the drilling of the Colter well at a

total cost of GBP7.6 million, including GBP0.4 million of back

costs. The total payable by the Company is currently estimated at

some GBP810,000 (GBP707,700 remaining at 30 June 2018) to earn an

8% interest in each of P1918, PEDL330 and PEDL345.

The Colter Prospect lies in Poole Bay, immediately southeast of

the Wytch Farm oilfield which has been developed from onshore

facilities. The Colter Prospect is estimated to have the potential

to hold unrisked Pmean Prospective Resources of 23 million barrels

of oil equivalent recoverable from this reservoir. The Prospect

will be appraised by a well drilled to a total depth of 1850 metres

subsea in a water depth of 16 metres. Baron has now been notified

by Corallian that the site survey for the drilling location had

been completed and that an agreement has been signed with Ensco UK

Limited to provide the Ensco 72 jack-up drilling rig to drill this

well,

Preliminary mapping of a separate area around the 98/11-1 well,

south of the Colter prospect, suggest the potential for Prospective

Resources of up to 27 million barrels of recoverable oil. Further

definition of this separate area will be possible once the results

of the Colter well are available.

Legacy Exploration Activity

Peru Onshore Block XXI (Baron 100%)

The Company owns a 100% interest in the contract for block XXI

through its 100%-owned subsidiary Gold Oil Peru SAC ("GOP"). The

block lies onshore in the Sechura Desert, close to the town of

Piura, and covers a current area of 2,425 square kilometres.

Plans are still active to drill the El Barco prospect, to a

depth of 1850 metres, most likely in early 2019, subject to the

execution of a satisfactory farmout agreement with an interested

third party. Mapping of the El Barco prospect by GOP indicates that

unrisked Prospective Resources are in the range of 6.4 billion

cubic feet of recoverable gas in a low-risk shallow sand and 7.1

million barrels of recoverable oil in a much higher risk fractured

basement play. The block XXI contract is currently in Force

Majeure, because of local opposition to the drilling at El Barco.

If the well is not drilled within 6 months of expiry of the Force

Majeure situation, the contract will terminate and the Company will

forfeit its guarantee bond of US$160,000.

Operations In Colombia

The Colombian company Inversiones Petroleras de Colombia

("Invepetrol"), in which Baron is a 50% shareholder, is now

controlled by our partner, CI International Fuels, and Baron has no

further involvement in its activities. Proceedings to liquidate

this company were entered into on 23 May 2018.

Sea Asia Study Group

There has been no further progress on the SundaGas project. A

decision by the host government continues to be delayed and it

seems unlikely that an award, if any, will be made before the

beginning of 2019.

Financial Results

In the six month period to 30 June 2018, the Company experienced

an operating loss of GBP400,000 (30 June 2017: loss of

GBP1,430,000; year to 31 December 2017: loss of GBP2,069,000).

The consolidated Income Statement includes exploration and

evaluation expenditure and impairment of GBP121,000 in respect of

block XXI Peru and GBP4,000 in respect of the the Southeast Asia

Joint Study Agreement with SundaGas and final costs on block PL1/10

Ireland.

Administration expenses, excluding exchange differences, in the

period were GBP267,000 (30 June 2017: GBP269,000; year to 31

December 2016: GBP510,000). These have now stabilised following the

the removal of Colombia administrative costs in 2017 and the

efforts to reduce Head Office costs in prior periods. The Board

does not consider that there is scope for further cost reductions

in this area. Exchange differences gave rise to a small gain of

GBP14,000 in the period (30 June 2017: loss of GBP392,000, year to

31 December 2017: loss of GBP508,000).

There was no other operating income during the period (30 June

2017: GBP12,000; year to 31 December 2017: GBP21,000).

After finance and tax, the Company shows a net loss of

GBP405,000 (June 2017: net loss of GBP916,000; 2017 year: net loss

of GBP1,539,000), representing a loss of 0.03p per share (June

2017: 0.07p; year to 31 December 2017: 0.112p).

Cash balance at 30 June 2018 was GBP3,359,330 (30 June 2017:

GBP1,671,000; 31 December 2017: GBP3,873,000).

Malcolm Butler, Chairman of Baron commented:

"The rig contract for the Wick and Colter wells has now been

signed and the wells will be drilled once the permitting process

has been completed. Encouragingly, we are now moving ahead with the

purchase of wellheads and casing and we believe the remaining

permits will be obtained shortly. We look forward to sharing with

shareholders the results of these exciting wells in due

course."

For further information on the Company, visit

www.baronoilplc.com or contact:

Baron Oil Plc:

Malcolm Butler (Chairman & CEO) Tel: +44 (0)1892 838948

SP Angel Corporate Finance LLP (Nominated Advisor and

Broker):

Lindsay Mair, Richard Redmayne, Richard Hail Tel: +44 (0)20 3470

0470

Baron Oil plc

Consolidated Income Statement

for the six months ended 30 June 2018

6 months 6 months

to to Year to

30 June 30 June 31 December

2018 2017 2017

Note Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue - - -

Cost of sales - - -

Gross loss - - -

Exploration and evaluation

expenditure (4) (81) (109)

Intangible assets written

off - - (1,837)

Intangible asset impairment (121) (1,556) -

Goodwill impairment - - -

Receivables impairment (22) 25 43

Disposal of Colombia operations - 831 831

Administration expenses 5 (267) (269) (510)

Profit/(loss) arising

on foreign exchange 14 (392) (508)

Other operating income - 12 21

Operating profit/(loss) (400) (1,430) (2,069)

--------------------------------- ----- --------------------- ----------------------- -----------------------

Finance cost (7) (7) (8)

Finance income 2 2 19

Loss on ordinary activities

before taxation 6 (405) (1,435) (2,058)

Income tax (expense)/benefit 7 - 519 519

Loss on ordinary activities

after taxation (405) (916) (1,539)

--------------------------------- ----- --------------------- ----------------------- -----------------------

Loss on ordinary actvities

after taxation is attributable

to:

Equity shareholders (405) (916) (1,539)

Non-controlling interests 0 - -

Loss on ordinary activities

after taxation (405) (916) (1,539)

--------------------------------- ----- --------------------- ----------------------- -----------------------

Earnings/(loss) per share:

basic 8 (0.03)p (0.07)p (0.112)p

--------------------------------- ----- --------------------- ----------------------- -----------------------

Diluted 8 (0.03)p (0.07)p (0.112)p

--------------------------------- ----- --------------------- ----------------------- -----------------------

Baron Oil plc

Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2018

6 months 6 months

to to Year to

30 June 30 June 31 December

2018 2017 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Loss on ordinary activities

after taxation attributable

to the parent (405) (916) (1,539)

Other comprehensive income

Currency translation

differences (8) 97 35

Total comprehensive income

for the period (413) (819) (1,504)

------------------------------- ---------- ---------- ------------

Total comprehensive income

attributable to :

Owners of the company (413) (819) (1,504)

------------------------------- ---------- ---------- ------------

Baron Oil plc

Consolidated Statement of Financial Position

for the six months ended

30 June 2018

6 months 6 months

to to Year to

30 June 30 June 31 December

2018 2017 2017

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and

equipment 1 2 -

Intangibles 1,397 1,256 1,260

Goodwill - - -

1,398 1,258 1,260

------------------------- ------ ------------------------- ------------------------- -------------------------

Current assets

Inventories - - -

Receivables 41 216 18

Cash and cash

equivalents 3,236 1,671 3,873

Cash held as security

for bank guarantees 123 2,890 119

3,400 4,777 4,010

------------------------- ------ ------------------------- ------------------------- -------------------------

Total assets 4,798 6,035 5,270

------------------------- ------ ------------------------- ------------------------- -------------------------

Equity and liabilities

Capital and reserves

attributable

to owners of the parent

Called up share capital 9 344 344 344

Share premium account 30,237 30,237 30,237

Share option reserve 122 81 122

Foreign exchange

translation

reserve 1,715 1,785 1,723

Retained earnings (28,568) (27,540) (28,163)

Total equity 3,850 4,907 4,263

------------------------- ------ ------------------------- ------------------------- -------------------------

Current liabilities

Trade and other payables 142 232 195

Taxes payable 806 896 812

948 1,128 1,007

------------------------- ------ ------------------------- ------------------------- -------------------------

Total equity and

liabilities 4,798 6,035 5,270

------------------------- ------ ------------------------- ------------------------- -------------------------

Baron Oil plc

Consolidated Statement of Cash Flows

for the six months ended 30 June 2018

6 months 6 months

to to Year to

30 June 30 June 31 December

2018 2017 2017

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

Operating activities 9 (417) (361) (680)

Investing activities

Return from investment

and servicing of

finance 2 2 19

Sale of intangible

assets - - -

Cash previously not

available

now released - - 2,674

Acquisition of

intangible

assets (222) (128) (298)

Acquisition of tangible

assets - - -

(220) (126) 2,395

------------------------- ------------------------- -------------------------

Financing activities

Proceeds from issue of

share capital - - -

Net cash

(outflow)/inflow (637) (487) 1,715

Cash and cash

equivalents

at the beginning of the

period 3,873 2,158 2,158

Cash and cash

equivalents

at the end of the

period 3,236 1,671 3,873

========================= ========================= =========================

As at 30 June 2018, bank deposits include amounts totaling US$160,000

(30 June 2017: US$3.74M and 31 December 2017: US$160,000) that

are being held in respect of guarantees and are not available

for use until the Group fulfils certain licence commitment in

Peru. This is not considered to be liquid cash and has therefore

been excluded from the cash flow statement.

Baron Oil plc

Consolidated Statement of Changes in Equity

for the six months ended 30 June 2018

6 months 6 months

to to Year to

30 June 30 June 31 December

2018 2017 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Opening equity 4,263 6,073 6,073

Loss for the period (405) (916) (1,498)

Deconsolidation of non-controlling

interest - (347) (347)

Foreign exchange translation (8) 97 35

Closing equity 3,850 4,907 4,263

========== ========== ============

Baron Oil plc

Notes to the Interim Financial Information

1. General Information

Baron Oil Plc is a company incorporated in England and Wales and

quoted on the AIM Market of the London Stock Exchange. The

registered office address is Finsgate, 5-7 Cranwood Street, London

EC1V 9EE.

The principal activity of the Group is that of oil and gas

exploration and production.

These financial statements are a condensed set of financial

statements and are prepared in accordance with the requirements of

IAS 34 and do not include all the information and disclosures

required in annual financial statements and should be read in

conjunction with the Group's annual financial statements as at 31

December 2017. The financial statements for the half period ended

30 June 2018 are unaudited and do not comprise statutory financial

statements within the meaning of Section 435 of the Companies Act

2006.

Statutory financial statements for the year ended 31 December

2017, prepared under IFRS, were approved by the Board of Directors

on 24 May 2018 and delivered to the Registrar of Companies.

2. Basis of Preparation

This consolidated interim financial information have been

prepared in accordance with International Financial Reporting

Standards ("IFRS") as adopted by the European Union and on the

historical cost basis, using the accounting policies which are

consistent with those set out in the Company's Annual Report and

Financial Statements for the year ended 31 December 2017. This

interim financial information for the six months to 30 June 2018,

which complies with IAS 34 'Interim Financial Reporting', was

approved by the Board on 28 September 2018.

3. Accounting Policies

Except as described below, the accounting policies applied are

consistent with those of the annual financial statements for the

period ended 31 December 2017, as described in those annual

financial statements.

The preparation of financial statements requires management to

make estimates and assumptions that affect the amounts reported for

assets and liabilities as at the balance sheet date and the amounts

reported for revenues and expenses during the period. The nature of

estimation means that actual outcomes could differ from those

estimates. Estimates and assumptions used in the preparation of the

financial statements are continually reviewed and revised as

necessary. Whilst every effort is made to ensure that such

estimates and assumptions are reasonable, by their nature they are

uncertain, and as such, changes in estimates and assumptions may

have a material impact in the financial statements.

i) Carrying value of property, plant and equipment and of

intangible exploration and evaluation fixed assets.

Valuation of petroleum and natural gas properties: consideration

of impairment includes estimates relating to oil and gas reserves,

future production rates, overall costs, oil and natural gas prices

which impact future cash flows. In addition, the timing of

regulatory approval, the general economic environment and the

ability to finance future activities through the issuance of debt

or equity also impact the impairment analysis. All these factors

may impact the viability of future commercial production from

developed and unproved properties, including major development

projects, and therefore the need to recognise impairment.

ii) Commercial reserves estimates

Oil and gas reserve estimates: estimation of recoverable

reserves include assumptions regarding commodity prices, exchange

rates, discount rates, production and transportation costs all of

which impact future cashflows. It also requires the interpretation

of complex geological and geophysical models in order to make an

assessment of the size, shape, depth and quality of reservoirs and

their anticipated recoveries. The economic, geological and

technical factors used to estimate reserves may change from period

to period. Changes in estimated reserves can impact developed and

undeveloped property carrying values, asset retirement costs and

the recognition of income tax assets, due to changes in expected

future cash flows. Reserve estimates are also integral to the

amount of depletion and depreciation charged to income.

Baron Oil plc

Notes to the Interim Financial Information

(continued)

iii) Decommissioning costs

Asset retirement obligations: the amounts recorded for asset

retirement obligations are based on each field's operator's best

estimate of future costs and the remaining time to abandonment of

oil and gas properties, which may also depend on commodity

prices.

iv) Share based payments

The fair value of share-based payments recognised in the income

statement is measured by use of the Black-Scholes model, which

takes into account conditions attached to the vesting and exercise

of the equity instruments. The expected life used in the model is

adjusted; based on management's best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations. The share price volatility percentage factor used

in the calculation is based on management's best estimate of future

share price behaviour and is selected based on past experience,

future expectations and benchmarked against peer companies in the

industry.

4. Segmental information

United South South Total

Kingdom America East

Asia

Six months ended 30 GBP'000 GBP'000 GBP'000 GBP'000

June 2018

Unaudited

Revenue

Sales to external customers - - - -

_______ _______ _______ _______

Segment revenue - - - -

Results

Segment result (254) (150) (1) (405)

Total net assets 3,236 614 - 3,850

United South South Total

Kingdom America East

Asia

Six months ended 30 GBP'000 GBP'000 GBP'000 GBP'000

June 2017

Unaudited

Revenue

Sales to external customers - - - -

_______ _______ _______ _______

Segment revenue - - - -

Results

Segment result (565) (270) (81) (916)

Total assets 4,266 641 - 4,907

Baron Oil plc

Notes to the Interim Financial Information

(continued)

4. Segmental information

(continued)

United South South Total

Kingdom America East Asia

Year ended 31 December GBP'000 GBP'000 GBP'000 GBP'000

2017

Audited

Revenue

Sales to external customers - - - -

_______ _______ _______ _______

Segment revenue - - - -

Results

Segment result (990) (459) (90) (1,539)

Total assets less liabilities 3,762 501 - 4,263

6 months 6 months

5. Administration expenses to to Year to

30 June 30 June 31 December

2018 2017 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

United Kingdom operations 267 269 510

(Profit)/loss arising on

foreign exchange (14) 392 508

253 661 1,018

========== ========== ============

Baron Oil plc

Notes to the Interim Financial Information

(continued)

6. Loss from operations

6 months 6 months

to to Year to

30 June 30 June 31 December

2018 2017 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

The loss on ordinary activities before

taxation includes:

Auditors' remuneration

Audit 11 15 21

Other non-audit services 2 - 5

Depreciation of oil and

gas assets - 1 -

Intangible asset writtten

off - - 1,837

Impairment of intangible

assets 121 1,556 -

Impairment of property, plant

and equipment - - -

Impairment of foreign tax

receivables 22 (25) (43)

Disposal of operations - 831 831

(Profit)/Loss on exchange (14) 392 508

7. Income tax expense

The income tax charge for the period relates to the (provision)/reduction

in provision for foreign taxation on the profit or loss.

8. Earnings/(loss) per Share

6 months

6 months to to Year to

30 June 30 June 31 December

2018 2017 2017

Unaudited Unaudited Audited

Pence Pence Pence

Earnings/(loss) per ordinary

share

Basic -GBP0.03 -GBP0.07 -GBP0.112

Diluted -GBP0.03 -GBP0.07 -GBP0.112

The earnings/(loss) per ordinary share is based on the Group's

loss for the period of GBP405,000 (30 June 2017: GBP916,000; 31

December 2017: GBP1,539,000) and a weighted average number of

shares in issue of 1,433,344,040 (30 June 2017: 1,376,409,576;

31 December 2017: 1,405,269,472).

The potentially dilutive options issued were 41,000,000 (30 June

2017: 35,172,414; 31 December 2017: 76,172,414).

Baron Oil plc

Notes to the Interim Financial Information

(continued)

9. Called up Share Capital

There have been no changes to share capital in the reporting

period.

10. Reconciliation of operating loss

to net cash outflow from operating

activities

6 months 6 months

to to Year to

30 June 30 June 31 December

2018 2017 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Profit/(loss) for the

period (405) (916) (1,539)

Depreciation and amortisation 121 1,557 2

Share based payments - - 41

Non-cash movement arising

on deconsolidation of

non-controlling interests - (346) (347)

Finance income shown as

an investing activity (2) (2) (19)

Tax Expense/(Benefit) - (519) (519)

Foreign currency translation (33) 458 512

(Increase)/decrease in

receivables (23) 316 2,052

Tax paid (22) (87) (4)

Increase/(decrease) in

payables (53) (822) (859)

______ ______ _______

(417) (361) (680)

11. Related party transactions

During the period, the company purchased accounting and administrative

services amounting to GBP4,500 (30 June 2017: GBP4,500; 31 December

2017: GBP8,250) from Langley Associates Limited, a company controlled

by Mr G Barnes, a director.

Baron Oil plc

Notes to the Interim Financial Information (continued)

12. Financial information

The unaudited interim financial information for period ended

30 June 2018 does not constitute statutory financial statements

within the meaning of Section 435 of the Companies Act 2006.

The comparative figures for the year ended 31 December 2017

are extracted from the statutory financial statements which

have been filed with the Registrar of Companies and which contain

an unqualified audit report and did not contain statements under

Section 498 to 502 of the Companies Act 2006.

Copies of this interim financial information document are available

from the Company at its registered office at Finsgate, 5-7 Cranwood

Street, London EC1V 9EE. The interim financial information document

will also be available on the Company's website www.baronoilplc.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EAXNXAASPEFF

(END) Dow Jones Newswires

September 28, 2018 02:01 ET (06:01 GMT)

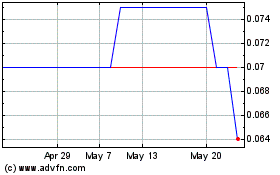

Baron Oil (AQSE:BOIL.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baron Oil (AQSE:BOIL.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024