TIDMBIOM

RNS Number : 4418X

Biome Technologies PLC

26 April 2023

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

26 April 2023

Biome Technologies plc

("Biome", the "Company" or the "Group")

Final Results 2022

Biome Technologies plc announces its audited Final Results for

the year ended 31 December 2022.

Highlights:

Final Results

-- Group revenues increased by 7.9%.

-- A mixed year for the Bioplastics division with revenues

declining by 8.4% in the year. This was caused by a significant

reduction in demand from a long established customer for filmic

material, which was partly offset by growth with other customers

and strengthening in the pipeline of commercial opportunities.

-- RF Technologies division revenues increased by 91.6% to

GBP1.8m (2021: GBP0.9m) (after elimination of intra-group trade) as

the division continues to diversify its application base.

-- Reported Group loss before interest, depreciation, taxation

and amortisation (LBITDA) of GBP0.4m (2021: LBITDA of GBP0.6m),

better than market expectations, with Group operating loss of

GBP0.7m (2021: loss of GBP1.1m).

-- Group cash position as at 31 December 2022 was GBP0.8m (31

December 2021: GBP1.0m) with no bank borrowings.

Paul Mines, Chief Executive Officer said : "The Group grew less

than we had originally anticipated in 2022 due to a sharp decline

in demand from one of our long standing customers in the

Bioplastics division. The greatly increased revenue from RF

Technologies division resulted in improved gross margins and

reduced LBITDA and operating loss for the Group. Demand from

customers in the Bioplastics division improved in the final quarter

of 2022 and this improvement has continued into the first quarter

of 2023."

- Ends -

For further information please contact: Biome Technologies plc

Paul Mines, Chief Executive Officer

Rob Smith, Chief Financial Officer

www.biometechnologiesplc.com Tel: +44 (0) 2380 867

100

Allenby Capital

David Hart/Alex Brearley (Nominated Adviser)

Kelly Gardiner/Tony Quirke (Sales and Corporate Broking)

www.allenbycapital.com Tel: +44 (0) 20 3328

5656

About Biome

Biome Technologies plc is an AIM listed, growth-orientated,

commercially driven technology group. Our strategy is founded on

building market-leading positions based on patented technology and

serving international customers in valuable market sectors. We have

chosen to do this by developing products in application areas where

the value-added pricing can be justified and are not reliant on

government legislation. These products are driven by customer

requirements and are compatible with existing manufacturing

processes. They are market rather than technology-led.

The Group comprises two divisions, Biome Bioplastics Limited

("Bioplastic") and Stanelco RF Technologies Limited ("RF

Technologies").

Biome Bioplastics is a leading developer of highly-functional,

bio-based and biodegradable plastics. The company's mission is to

produce bioplastics that challenge the dominance of oil- based

polymers.

Stanelco RF Technologies designs, builds and services advanced

radio frequency (RF) systems. Dielectric and induction heating

products are at the core of a product offering that ranges from

portable sealing devices to large furnaces for the fibre optics

markets.

www.biometechnologiesplc.com www.biomebioplastics.com and

www.thinkbioplastic.com www.stanelcorftechnologies.com

Chairman's Statement

Business performance

Group revenues grew 7.9% in the year to GBP6.2m (2021: GBP5.7m)

whilst the loss before interest, taxation, depreciation and

amortisation ("LBITDA") improved to GBP0.4m (2021: GBP0.6m LBITDA).

An increased focus on working capital management, particularly

around the size of manufacturing campaigns and timing, ensured that

the year-end cash position was better than anticipated at GBP0.8m

(2021: GBP1.0m).

The Group, however, grew less than we had originally anticipated

in 2022, consequently we reduced our expectations during the year

for a second year in a row. Following this, the Board decided to

adjust its forecasting methodology (particularly for the

Bioplastics division) such that new customer prospects are now only

included in management's expectations when large scale

commercialisation is proven.

We are delighted by the support received in the recent

Convertible Loan Note fundraising, including from a number of our

major shareholders, and by the support of shareholders as a whole

at the General Meeting held on 17 April 2023. The aggregate net

proceeds from the Convertible Loan Note issue will be used to

support the growth of the Group's Bioplastics and RF Technologies

divisions towards a position of Group operating cash flow

sustainability over time.

Bioplastics division

The Bioplastics division's revenues for the year to 31 December

2022 were GBP4.4m (2021: GBP4.8m) due mainly to a combination of

two factors. The first was a large reduction in demand from a

long-standing end-customer of Biome's materials which are used in

compostable packaging films. This reduction was offset

substantially by orders from new end-customers in both North

America and Europe, primarily related to materials for compostable

packaging films.

An increase in the number of orders for our compostable coffee

filtration mesh were received for delivery in the final quarter of

the year accompanied by encouraging signs of a sustained commitment

for 2023.

Market demand is building strongly for products that are

certified for 'home composting', rather than 'industrial

composting'. The technical requirements of 'home' vs 'industrial'

compostable material require that those designated as 'home' must

compost more quickly in temperatures akin to home/garden

temperature conditions. The division's scientists have made great

strides in delivering this technical performance at a competitive

price point and a patent for a new family of materials has been

filed. The first products exploiting this technology are expected

to enter the market during the course of 2023, following the

extensive development and testing required.

A number of important end-customer opportunities of scale are

being pursued by the division. These opportunities are at various

stages of progress and, whilst encouraging , can be subject to

technical, operational and commercial delays until they reach full

commercialisation. A selected few of these opportunities have been

outlined in previous statements and further details may be found in

the Strategic Report. Following the change in our forecasting

methodology, as mentioned above, this year, they are not included

in management's expectations for the financial outturn for

2023.

Over the last eight years, the Bioplastics division has

coordinated significant research and development funding in

conjunction with leading universities, in pursuit of bringing new

novel and patent protectable, and where possible, bio-based and

biodegradable polyesters to market. In November 2022, the division

was awarded a further GBP0.3m in funding from Innovate UK, the UK

Government's innovation agency, to support the scale-up of one such

polyester polymer ("PBAF"). This work is being carried out in

collaboration with Thomas Swan (www.thomasswan.co.uk) and the

University of Nottingham, both of whom we have worked with

previously. This polyester polymer is based on furan dicarboxylic

acid (FDCA), an important new bio-based chemical. The scale-up will

allow the performance and production process of this polymer to be

evaluated at an industrially relevant scale and will help map out

the pathway to full commercialisation.

We believe that the progress described above highlights the

growing reputation of the Bioplastics division for innovative

materials and demonstrates how it will lead to market success,

particularly in North America. Our ability to deliver growth from

the North America market was enhanced in 2022 by the relocation of

a senior Biome employee, responsible for business development in

Canada and the start-up of legal entities and associated

back-office services in both the USA and Canada. It is our

intention to build on this local presence as growth continues.

RF Technologies division

Revenues in the RF Technologies division in 2022 were GBP1.8m

(2021: GBP0.9m). The RF Technologies division's efforts to

diversify its revenue stream gained traction in 2022. Substantive

orders for the medical sector in the UK and for food packaging

sector in Continental Europe were delivered during the year. These

are important steps for the division as it refines and demonstrates

its capability on a wider stage.

The downturn in demand for capital goods in the fibre optic

cable manufacturing sector which was first seen during 2019

continued through 2022. Whilst spares and service orders for the

fibre optic sector remain robust and provide some indication that

current capacity is being well utilised, we are yet to see a

pipeline of further large-scale capacity increases emerge from this

area of the market.

The diversification strategy has delivered an encouraging

pipeline of enquiries for 2023 and beyond. Negotiations to convert

a number of these enquiries into contracts continue and these

underpin our expectations for 2023.

Covid-19 and economic instability

In the western economies, the direct impacts of the Covid-19

pandemic receded significantly in 2022 and local precautions were

largely removed in line with government guidance on these

matters.

Supply chain issues remained prevalent for the Bioplastics

division and whilst this turbulence is expected to continue through

2023, we are improving our capability to foresee and manage such

issues. We have seen and continue to see an increase in input

costs, including in relation to raw materials, shipping, energy and

staff. We have, in the main, been able to pass these costs on to

customers and we are continually working to mitigate the effects of

inflation on our business.

The RF Technologies division continued to experience the

disruptions to supply lines that other manufacturers have had to

contend with in the period. The widespread long lead times for

electronic components did abate in the year but some individual

items remained difficult to procure.

Results

The Group's results were in line with the expectations announced

in January for the year ended 31 December 2022, although with the

level of Group loss being better than market expectations.

Consolidated Group revenue for the year was GBP6.2m (2021:

GBP5.7m) reflecting the decrease in Bioplastics sales offset by a

healthy increase in those from the RF Technologies division. Group

gross margins for the year were 37.7% (2021: 33.8%) reflecting an

improved mix of sales during the year.

The Group loss before taxation decreased to GBP0.8m (2021:

GBP1.2m) whilst the non-GAAP measure of LBITDA was better than

January's guidance regarding market expectations at GBP0.4m (2021:

GBP0.6m LBITDA). A Group operating loss of GBP0.8m for the year was

incurred (2021: GBP1.1m loss).

The Bioplastics division saw a decrease in sales to GBP4.4m

(2021: GBP4.8m) representing an 8.4% decline and loss before

taxation of GBP0.7m (2021: GBP0.6m loss). The division recorded a

higher LBITDA of GBP0.4m (2021: GBP0.2m LBITDA) as sales

decreased.

The RF Technologies division's revenues, after elimination of

intercompany sales, were up 91.6% to GBP1.8m (2021: GBP0.9m)

reflecting the recovery in demand for the division's products.

Profit before taxation increased to GBP0.2m (2021: GBP0.1m lLoss

before taxation). The division reported an EBITDA of GBP0.2m for

the year (2021: GBPnil) and an operating profit of GBP0.2m (2021:

GBP0.1m operating loss).

Cash and debt

The Group's cash balances as at 31 December 2022 were GBP0.8m

(31 December 2021: GBP1.0m) reflecting trading losses for the year

offset by lower working capital. The Group had no debt, other than

leases in respect of right of use assets as at 31 December 2022

(2021: GBPnil). Capitalised product development in the Bioplastics

division was GBP0.4m (2021: GBP0.3m).

On 31 March 2023, the Company announced a proposed issue of

Convertible Loan Notes to raise GBP850,000 (before expenses) which

completed on 18 April 2023. The Board had for several months been

reviewing potential funding options for the Company to support the

medium-term funding needs of the Group and its businesses and

concluded that the issue of the Convertible Loan Notes was the best

available option in the circumstances. The Board is hopeful that

this funding will support the growth of the Group towards a

position of operating cash flow sustainability over time.

Following the recent fundraise the Group's gross cash balances

as at 18 April 2023 were GBP1.3m, post receipt of funds from

Convertible Loan Notes.

Strategy

The Group's strategy is set out in the strategic report on pages

6 to 14 of the report and accounts for the year ended 31 December

2022.

Economic conditions around the world including higher interest

rates and energy costs have led us to anticipate lower growth rates

generally than previously. Accordingly, we are altering our

medium-term growth aspirations for the Bioplastics division to 25%

per annum from 40%. We believe that this is a more realistic target

for our business in the current macro-economic circumstances and is

consistent with market expectations.

The following actions/undertakings have been specifically set by

the Bioplastics division to drive the overall growth target:

1. grow sales to existing customers where we have built substantial positions;

2. successfully introduce the 'home' compostable material to our end-customers;

3. expand the number of end-customers using our filtration mesh

material primarily within the beverage industry;

4. convert new customers to the use of our materials in

compostable film in the packaging segment; and

5. expand the number of customers using our rigid materials in

defined performance applications (e.g. coffee pods, tree

shelters).

The RF Technologies division is expanding into new sectors by

further exploiting its thermal process solutions knowhow based on

induction, dielectric and resistance heating technologies with the

objective of growing its sales by more than 25% per annum and with

more than 50% of its sales coming from sectors other than its

historic core fibre-optic market over the long-term.

Board

As noted in the circular to shareholders dated 31 March 2023,

the Board is in discussions with a view to Martin Rushton-Turner

joining the Board as a non-executive director following the

Company's 2023 annual general meeting.

Race to Zero

Biome Technologies signed up to the United Nations Race to Zero

Climate Campaign and is committed to reducing its carbon emissions

in line with publicly disclosed targets. Our reporting of actual

greenhouse gas emissions and medium-term targets commences in these

Statements and demonstrate good initial reductions of Scope 1 and 2

emissions (direct energy use) against the recent baseline. Plans

have been developed to drive progress towards both 2030 and 2050

targets.

Our Bioplastics division's products are, where appropriate,

subject to individual Life Cycle Analysis (LCA) that encompass the

Group's full supply chain. This allows decision making for Biome

and its customers on how to minimise climate impact. In due course,

we will look to extend our broader Group reporting beyond Biome's

boundary, to include Scope 3 emissions (those from toll

manufacture, growing, extraction, manufacture, and processing of

the raw materials used) as robust data becomes available.

Outlook

We believe the Group is positioned well for further growth in

the current and for future years.

The Bioplastics division will continue to benefit from the

global move to more sustainable materials as it continues to

broaden its product and customer portfolio particularly in the area

of 'home composting'. The product development and commercial

foundations laid previously provide a base from which to accelerate

a number of opportunities during 2023 and beyond.

The RF Technologies division has a good pipeline of

opportunities for 2023 that are diversified beyond the historical

fibre optic focus and we are confident that these will convert to

important new orders with deliveries expected during the second

half of the year.

As stated in the Company's announcement of 31 March 2023,

trading in the first quarter of 2023 was in line with the previous

guidance, with some improvement in sales mix, but there is much to

do yet to achieve our ambitions for the year. We remain cautious in

these difficult economic times and our outlook for the year

consequently remains unchanged relative to current market

expectations.

John Standen

Chairman

25 April 2023

Strategic Report

Biome Technologies plc aims to be a growth orientated,

commercially driven technology group. Its strategy is founded on

building market-leading positions based on its technology,

intellectual property and serving international customers in the

bioplastics and radio frequency heating sectors.

We pursue this ambition by developing products in application

areas where value-added pricing can be justified and that are not

reliant on government legislation. The growing portfolio of

products is driven by customer requirements and compatible with

existing manufacturing processes. They are market rather than

technology led.

The directors consider its shareholders, employees, customers

and suppliers as its key stakeholders and the divisional analysis

below outlines the strategies that have been adopted to promote the

success of the Group and to meet its objectives.

Bioplastics division

The Bioplastics division achieved sales revenue of GBP4.4m

(2021: GBP4.8m), a decrease of 8.4%. This decrease in reported

revenues, compared to the performance in 2021, was attributable to

lower demand from a long-standing customer as they reduced their

inventory holding ahead of an anticipated switch from industrially

to home compostable packaging and as other demand factors impacted

their own business. Additionally, an expected ramp-up in production

at one of our end-customers for filtration mesh was delayed and

only commenced in the final quarter of 2022. Whilst the delay was

disappointing, the ramp-up in offtake went well and we can confirm

that this end-customer has continued to purchase from the division

via its distributor, in line with our expectations through the

first quarter of 2023.

The industry-wide logistics challenges which were encountered

throughout 2021 eased to some extent during 2022 and whilst not

back to pre-pandemic levels of performance, lead-times for both

sea-freight and road logistics have become more predictable.

However, many of the division's customers continued to suffer

logistics, macro-economic disruption and labour issues during 2022

as the world adjusted to post-pandemic demand and inflationary

pressure.

The division's operating loss for the year was GBP0.7m (2021:

GBP0.6m loss), with the lower sales volume being offset somewhat by

a more profitable mix.

Markets

Plastics and their use or misuse by humanity remains a key

environmental topic of focus around the world. There is sustained

pressure from consumers, media and governments to reduce the

environmental impact of plastics. In recent years the focus of this

pressure has been on the "end-of-life" of such materials, how they

are disposed of and the consequences of fugitive release to the

environment. In addition, with rising concerns regarding climate

change and the pursuit of "Net Zero" strategies by governments,

there is greater interest in how such materials might also be

manufactured with lower carbon footprints.

The compelling case for compostable (biodegradable) bioplastics

often lies in their ability to ensure that organic food waste

reaches appropriate treatment (e.g. industrial scale anaerobic

digestion and composting facilities) and that the resulting

digestate and compost does not contain persistent plastic

contamination when finally spread to soils. This case is driving

the growth of the compostable packaging market around the world in

sectors such as food waste bags, coffee pods, tea bags and other

food contaminated packaging formats.

The growth of the compostable plastics market is often

facilitated when there is a clear route for food waste and food

contaminated packaging to reach appropriate sorting and treatment

facilities. This requires appropriate labelling, user education,

collection, sorting and treatment capacity. The quality of such

disposal supply chains for "Industrially compostable" materials

varies considerably by geographic territory and often within

countries. There is, in general, a move to improve and scale-up

such activities to prevent food waste reaching landfill with its

resultant release of methane (a significant Green House Gas).

The consumer desire to change the plastic landscape is pulling

through increased demand for compostable plastics at a rate that is

faster than (often government controlled) collection and disposal

supply chains are able to adapt. As a result, there is increased

demand from the market for bioplastics that can be composted at

home - known as "Home Compostable" products. Whilst it is a

minority of the population that has the access and/or desire to

treat organic waste and packaging at home, those that can, are

often highly motivated to treat such waste in their gardens. This

adoption by enthusiasts is driving the compostable plastics market

towards the production and certification of products that are

suitable for this end-of-life solution. Such products are required

to compost at lower temperatures and in less well managed

conditions than can be expected at industrial facilities. Home

Compostable bioplastics have the added benefit of degrading faster

than Industrially Compostable bioplastics in industrial

facilities.

Compostable (biodegradable) bioplastics do not provide a panacea

for the plastics litter problem. They are not (in general) designed

to biodegrade in the open environment such as water courses or

soils and so are not the answer to such pollution. However, in

certain application areas it makes sense to tailor bioplastic

materials for such fates to prevent the accumulation of

micro-plastics in the environment. Specific end-uses are in

agriculture and forestry where plastic can be compelling for

productivity but is often not collected or collectable.

The case for bio-based bioplastics is driven by the growing

scientific evidence that the use of biogenic inputs reduces the

carbon footprint of such materials and will in time lead to a more

sustainable plastics industry. There are a limited number of

territories that legislatively require bio-based inputs in some

plastics, but it might be expected that this trend is likely to

accelerate. There is some evidence that some consumers will choose

bio-based materials when offered a choice, but this appears, at

present, to rank behind the desire for compostable

functionality.

The division's main market of focus is North America where the

scale of adoption of compostable bioplastics has accelerated in

recent years. This has been driven by environmental awareness and

facilitated by the deployment of end-of-life composting capability.

The mid-size food and beverage providers have led the move away

from conventional plastics as they seek to differentiate their

products from those of the major brands. The division has

undertaken manufacturing at two locations in North America for some

years and has provided technical support from both local and

travelling personnel. In 2022 this market presence has been

reinforced by the location of a Business Development Manager in

Canada and the establishment of legal entities (Biome Bioplastics

Inc.) in both Canada and the USA with supporting back-office

capability. It is intended that these changes will provide the

division's customers with a more "local" experience and help drive

further revenue growth.

The UK market has been somewhat slower to embrace compostable

and bio-based materials than some other territories. Whilst there

is considerable focus on plastic waste, there is still a continuing

debate of how best to manage this problem. The local council

control of the disposal supply chain and its wide variability is

seen by some as part of the problem and a move in England towards

universal food waste collection in the latter half of this decade

presents an opportunity for compostable plastics. At present, the

UK market remains a smaller part of the Bioplastics division's

short-term focus with the more immediate sales opportunities and

growth being in the US market.

Cost and functionality will remain key hurdles over the

widespread adoption of bioplastics over petro-chemical plastics.

Current adoption is therefore driven by consumer pull, and their

willingness to pay a premium for biodegradability/compostability,

or government legislation. To overcome these hurdles the Group's

Bioplastics division focuses on areas of the market where there is

a high technical performance requirement, the cost of the

biomaterial is a small fraction of the end product price, and where

there is a consumer willingness to convert to a biodegradable

material.

Research and development within the Bioplastics division is

therefore focussed on these three areas and in particular targeted

towards customer requirements for a biodegradable solution. The

commercial lifecycle of our product developments can be categorised

in the following stages of the product lifecycle:

-- Research Phase - technology and product development occurring

within Biome's own laboratories or at external support

facilities

-- Development Phase - the product is being developed and tested

with small scale supplies to customers for end use testing

-- Initial Manufacturing Phase - the product is signed off by

the customer as suitable for its requirements and is now undergoing

significant long-term testing to ensure the end product can be run

in commercial quantities across the supply chain

-- Commercial phase - the product has been through the above

phases with the customer and is now achieving regular and

significant sales with the end product being purchased and used by

the final consumer

A number of important end-customer opportunities of scale are

being pursued by the Bioplastics division. These opportunities are

at various stages of progress and, whilst encouraging, can be

subject to technical, operational and commercial delays until they

reach full commercialisation. A selected few of these opportunities

have been outlined in Regulatory News Service announcements made by

the Company and are updated below. They are not included in

management's expectations for the financial outturn of 2023:

Filtration mesh Rigid parts Filmic (packaging)

materials

Name : Alternate Name : Second pod Name : Labels

coffee format opportunity Market : North America,

Market : USA commercial Market : North America global

coffee consumer pods Supply : Manufacturing

Supply : Materials Supply : Materials envisaged in North

and manufacturing (in part) from Asia. America and Europe

in USA Manufacturing in North Comment : Initial

Comment : Customer America technical validation

paid development; Comment : Technical completed; relies

success rests on Biome's challenges overcome on Biome's Home Compostable

Home Compostable technology; at small scale; larger technology (in part);

launch has been delayed scale operational engagement at brand

previously testing completed and converter level

Progress Q1 2023: Progress Q1 2023: Progress Q1 2023

Further samples manufactured Commercial discussions : Technical and commercial

in two separate trials, continue but without engagement continues,

further certification firm commitments to parties in supply

testing required - launch timelines chains becoming more

customer now auditing defined

production site for

quality compliance

------------------------------ ------------------------------

Name : Third pod Name : Treeguards Name : UK packaging

opportunity Market : UK, global Market : North America,

Market : North America Supply : Multi-stage Australia fresh food

consumer pods manufacturing process packaging

Supply : Materials Comment : Main technical Supply : European

and manufacturing challenges overcome; supply chain with

in USA performance in field some materials from

Comment: Early stage being validated; operational Asia

Progress Q1 2023: ramp-up phase Comment : Initial

Engagement increased Progress Q1 2023: quantities for validation

and early lab-based Larger scale production shipped; validation

trials undertaken campaign completed, for Australian certification

with good customer further operability required

interest improvements planned Progress Q1 2023:

Further application

testing complete and

Australian validation

commenced

------------------------------ ------------------------------

Technical Development

The Bioplastics division's development work remains focussed on

innovative developments where there is a customer requirement for

the product and a willingness to pay a premium for the functional

and environmental attributes. During 2022, the development team

worked on a variety of technical challenges that included the

development of a range of home compostable materials for different

applications, the improvement of oxygen and vapour barrier

performance, the soil degradability of materials to be used in tree

protectors and the improvement of temperature performance for a

variety of end-uses. The home compostable work gained traction in

the year, an important patent filing was made in this area and

deployment of this technology in a variety of customer applications

moved into the Initial Manufacturing Phase.

The Bioplastics division also continued its work in utilising

advanced Industrial Biotechnology. This research focuses on the

transformation of lignocellulose (often sourced from agricultural

waste) into bioplastics using microbial and enzymatic routes. These

routes are enabled using cutting edge synthetic biology techniques.

If successful, it is anticipated that this work will result in

bioplastics with improved functionality at a cost comparable to

current petroleum-based plastics. This development work continues

to be supported by research grants and much of the work is

undertaken in collaboration with leading UK universities. The scale

at which the polymerisation activities have been carried out has

been increased over the last twelve months and the differentiated

performance of materials is better understood. An important 18

month sub-project (supported by Government funding) started in the

year with Thomas Swan and the University of Nottingham. This work

will explore the production of novel polymers at pilot scale in

facilities with the capability to manufacture at commercial scale

in due course.

RF Technologies division

The RF Technologies division, through the use of radio frequency

technology, creates innovative solutions for thermal process

applications. The division's products are renowned for their

quality and durability. The division's systems are designed and

manufactured to provide exceptional sealing, welding and heating

process solutions to a wide variety of commercial sectors.

The division's traditional core offering has been the supply of

fibre optic furnaces. This market has been suppressed since 2018

with little sign of a return to the levels seen previously. The

focus for the RF Technologies division since 2018 has been to

develop alternative markets for its technology. This has been

challenging but we are pleased to report that 2022 saw a strong

improvement in both order intake and sales. Significant orders were

for food packaging and medical equipment markets as well as a good

base level of activity in aerospace and nuclear waste management

sectors. Total division revenues in 2022, after the elimination of

intercompany sales, were GBP1.8m (2021: GBP0.9m) representing an

91.6% improvement. As a consequence of the improved sales the

division achieved an operating profit for the period of GBP0.2m

(2021: GBP0.1m loss).

The business currently focuses on four main revenue streams:

Induction Heating Equipment

The division sells bespoke induction heating equipment into a

variety of application areas. These systems are destined mainly for

the UK and Continental European market but in recent years some

have been shipped to North America. Whilst this has been a small

part of the division's sales it is a strategic aim to increase the

product offering and expand sales of this type of equipment.

Speciality focus areas include medical, food and industrial heating

where RF technology can provide both control and efficiency

benefits. The division works both with end-customers and "system

integrators" providing complete factory solutions.

Optical Fibre Furnace Systems

The RF Technologies division is a world leader in the design and

manufacture of induction furnace systems used in the manufacture

and processing of silica glass "preforms" to produce optical fibre.

Each system is bespoke to customers' exact requirements. There has

been a sustained period of overcapacity in the fibre-optic

manufacturing industry but investment in maintenance and upgrades

of existing equipment is now at normal levels. It is expected that

as demand for fibre optic cable grows further furnace systems will

be ordered but it is not possible to predict the timing and scale

of further orders.

Plastic Welding Equipment

These units are used in a multitude of end-user applications

including the nuclear, medical and industrial sectors. The

equipment is provided in either hand-held, mobile or fully

automated static solutions, dependent on customers'

requirements.

Service and Spares

The business continues to support its large installed equipment

base through the provision of maintenance support, system upgrades

and specialist spares across the globe. This provides an underlying

base load of revenues for the division.

Race to Zero

Biome Technologies is signed up to the United Nations Race to

Zero Climate Campaign and is committed to reducing its carbon

emissions in line with publicly disclosed targets. Our reporting of

actual greenhouse gas emissions and medium-term targets continues

in these Statements. Plans have been developed to drive progress

towards both 2030 and 2050 targets.

Our Bioplastics division's products are subject to individual

Life Cycle Analysis (LCA) that encompass the full supply chain

where appropriate, and we will look to extend our broader Group

reporting to include Scope 3 emissions (those from toll

manufacture, growing, extraction, manufacture, and processing of

the raw materials used) as robust data becomes available.

Principal Risks and Uncertainties

Biome is subject to a number of risks. The Directors have set

out below the principal risks facing the business. The Directors

continually review the risks identified below and, where possible,

processes are in place to monitor or mitigate all of these

risks.

Risk Nature Mitigation Change in

strategies year

Customers The Group's ability The Group works One of the

and customer to generate revenues closely customers

concentration for a number of its with its customers accounting

products is reliant with the aim of for more than

on a small number ensuring 15% of sales

of customers. If that its products in 2021 had

one of these customers evolve in line a significant

was to significantly with decline in

reduce its orders, their activity. This

then this could have requirements. resulted in

a significant impact In addition, the an overall

on the Group's results. Group is reduction in

continually sales in the

seeking to add to Bioplastics

its customer base division. This

and, as its was offset

revenues by increased

grow, seeks to activity to

become other

less dependent on end-customers

any single but with

customer. increased

dependency

on our largest

customer.

============================================================ =================== ===============

Suppliers The Group's products To mitigate this Supply chains,

and Raw and manufacturing risk the division overall,

Materials processes utilise is seeking to became

a number of raw materials validate more stable

and other commodities. new materials in 2022 and

In particular the coming the mitigating

Bioplastics division onto the market steps taken

requires several which by both

key raw materials may be used in divisions

to manufacture its substitution. were, on the

biodegradable polymer To mitigate whole,

resins. There are increased effective.

very few suppliers shipping

of these key raw lead-times

materials and with the Bioplastics

the current increased division

demand for biodegradable is working closely

products there is with customers to

a risk that the division improve visibility

may not be able to and forecast

purchase the required accuracy

volumes of materials to ensure

to meet customer materials

demand or that prices are ordered

may be increased sufficiently

at short notice. far in advance to

The Bioplastics division ensure that they

sources raw materials are available to

internationally, meet demand.

some of which are The RF

bulk shipped via Technologies

sea freight mainly division has

to the US. adopted

Within the RF Technologies an agile design

division we are reliant and

on electronic subsystems sourcing strategy

that have extended to overcome the

global supply chains. long

Lead-times increased lead-times for

during 2022 due to electronic

semiconductor shortages products.

and various Covid-19

lockdowns in China.

============================================================ =================== ===============

Intellectual Although the Group The Group takes The Group

Property attempts to protect professional continues to

its intellectual advice from develop its

property, there is experienced intellectual

a risk that patents patent attorneys property and

will not be issued and works hard to has made good

with respect to applications win patents progress with

now pending. Furthermore, applied home

there is a risk that for and to ensure compostable

patents granted or that the scope is innovation

licensed to Group sufficiently which resulted

companies may not broad. in a patent

be sufficiently broad The Group keeps up application

in their scope to to date with its being made

provide protection competitors' in early 2022.

against other third-party product Our growing

technologies. developments and knowledge in

Other companies are patent portfolios home

actively engaged and aims to ensure compostable

in the development that no technology

of bioplastics. There infringements and know-how

is a risk that these occur. is

companies may have Professional increasingly

applied for (or been advice is sought important as

granted) patents from experienced this is a key

which impinge on patent attorneys driver for

the areas of activity if there are any the

of the Group. This concerns. compostable

could prevent the materials

Group from carrying market.

out certain activities

or, if the Group

manufactures products

which breach (or

may appear to breach)

such patents there

is a risk that the

Group could become

involved in litigation

which could be costly

and protracted and

ultimately be liable

for damages if the

breach is proven.

============================================================ =================== ===============

Commercialisation There is a risk that The Directors The Group

of New Products the Group will not ensure has

be successful in that regular consistently

the commercialisation reviews achieved

of its products from of product revenues

early-stage research development from new

and development to are undertaken so product

full-scale commercial that unsuccessful introductions

sales. The Group developments can and continues

develops a number be terminated to focus on

of products, and early market

some may not prove in their life opportunities

to be successful. cycle. and customers

Specifically, the Impairment testing that value

risks associated of the capitalised our products

with the product costs is performed and

life cycle are as twice a year with technology.

follows: any impaired

* Research and Development phase - the development of capitalised

the products may prove not to be technically feasible costs written off.

or do not exactly match the perceived customer need The Group seeks

Innovate

UK grants to

* Initial manufacturing phase - whilst the product mitigate

matches the customer needs it may not be able to be the cost of

produced at the required commercial speeds and/or at earlier

the required efficiency and quality stage research

that

carries the

* Commercialisation phase - the product may be greatest

superseded either through price or a competitor risk.

product being more advanced The Group works

closely

with customers to

identify

applications

that are most

likely

to progress

through

to

commercialisation.

This process

involves

a multifunctional

approach including

sales, technical,

operational and

finance

personnel to test

commercial and

technical

viability to the

greatest extent

possible

before investments

are made.

============================================================ =================== ===============

In addition to the principal risks the Group is subject to a

range of other risks and uncertainties. The Board maintains a risk

register and reviews this biannually to ensure that the Group's

operations management identifies actual and potential risks and

develops appropriate mitigating activities to ensure that these

risks are managed.

These risks, which also apply to many other industries and

businesses, include:

-- Financial

-- Political, Economic and Regulatory Environment

-- Exchange rate fluctuations

-- Competition

-- Brexit

-- Health and Safety (including Covid-19)

-- Cyber Security

-- Ongoing geo-political insecurity (including the Russian invasion of Ukraine)

Financial review

The KPIs which the Board uses to assess the performance of the

Group are detailed in the Chairman's Statement. The Chairman's

Statement forms part of the Strategic Report.

The summary results for the Group are shown below:

Like-for-like comparisons 2022 2021 Growth

GBP'm GBP'm

Revenues

Bioplastics 4.4 4.8 (8.4%)

RF Technologies 1.8 0.9 91.6%

Reported Group revenues 6.2 5.7 7.9%

------------------------------------ --------------------- --------------------- -------

(L)/EBITDA

Bioplastics (0.4) (0.2)

RF Technologies 0.2 -

Central Costs (0.2) (0.4)

Reported (L)/EBITDA (0.4) (0.6)

------------------------------------ --------------------- --------------------- -------

less depreciation, amortisation

and equity share option charges:

Bioplastics (0.3) (0.4)

RF Technologies - (0.1)

Central Costs (0.1) -

(0.4) (0.5)

(Loss)/Profit from Operations

Bioplastics (0.7) (0.6)

RF Technologies 0.2 (0.1)

Central Costs (0.3) (0.4)

Operating Loss (0.8) (1.1)

------------------------------------ --------------------- --------------------- -------

Net Assets

Non-current assets 1.3 1.2

Inventories 0.7 0.9

Trade and other receivables 0.6 1.4

Tax receivable 0.1 0.1

Cash 0.8 1.0

Trade and other payables (0.9) (1.3)

Long term lease commitments (0.3) (0.4)

Net assets 2.3 2.9

------------------------------------ --------------------- --------------------- -------

Revenues

Reported Group revenues for 2022 were GBP6.2m (2021: GBP5.7m)

reflecting the increased sales in the RF Technologies division

partly offset by lower sales of Bioplastics division products. Good

order intake in the final quarter of 2022 and first quarter of 2023

for the Bioplastics division and continuing growth in the

opportunity pipeline for the RF Technology division indicates that

positive momentum will be maintained over the longer-term.

(L)/EBITDA

Reported (Loss) / Earnings Before Interest, Taxation,

Depreciation and Amortisation ((L)/EBITDA) for the year was a loss

of GBP0.4m (2021: GBP0.6m loss). The improved LBITDA is a direct

result of the higher revenues in the RF Technologies division.

Operating Profits/(Losses)

The Group recorded an operating loss for the year of GBP0.8m

compared to an operating loss of GBP1.1m in the prior year.

Administrative expenses across the Group in 2022 were GBP3.3m

(2021: GBP3.4m). When the non-cash effects of depreciation,

amortisation and equity settled share option charges are removed,

the cash administrative expenses in 2022 marginally increased to

GBP3.0m (2021: GBP2.9m).

Investment in product research and development was GBP1.0m in

the year (2021: GBP1.0m), which includes the research work in grant

backed Industrial Biotechnology, of which GBP0.4m (2021: GBP0.3m)

was capitalised in the year. Tax R&D claims resulted in a

credit being recognised in the year of GBP131,000 (2021: credit of

GBP29,000) and other income from the Research and Development

Expenditure Credit scheme of GBP6,000 (2021: GBP50,000).

The Group recorded a loss after tax for the year of GBP0.7m

(2021: GBP1.1m loss), giving a basic and diluted loss per share of

18p (2021: loss per share of 30p).

Statement of Financial Position

The carrying value of intangible assets relates to capitalised

development costs predominantly within the Bioplastics division for

development of the Group's own intellectual property and product

range.

As at 31 December 2022, there was GBP0.8m of capitalised

development costs (2021: GBP0.7m) within the Group's statement of

financial position, of which GBP0.5m relates to Biome Mesh. An

assessment is made at least annually which assumes future potential

market take up of the products and the margins achievable.

Cashflow

2022 2021

GBP'000 GBP'000

Loss from operations (767) (1,135)

Adjustment for non-cash items 339 489

Movement in working capital 607 69

Cash generated/(utilised) by

operations 179 (577)

Investment activities (392) (266)

R&D Tax credit 79 239

Interest paid (35) (34)

Financing activities (50) (44)

Net decrease in cash (219) (682)

Opening cash balance 996 1,678

Exchange differences on cash and 2 -

cash equivalents

Closing cash balance 779 996

------------------------------------ --------------------- ----------------------

The cash utilised in operations, before working capital

movements, was GBP0.4m (2021: cash utilisation of GBP0.6m). Working

capital movements generated GBP0.6m cash in the year (2021: GBP0.1m

generation).

Investment in the year in capitalised product development and

capex was GBP0.4m (2021: GBP0.3m). Financing activities in the year

represented repayments of obligations under finance leases and

rounded to a net GBP0.1m (2021: net GBPnil). R&D tax credits of

GBP0.1m were received during 2022 (2021: GBP0.2m).

The resultant closing cash position was GBP0.8m (2021:

GBP1.0m).

Going Concern

The financial statements have been prepared on a going concern

basis as the directors believe that the Group has access to

sufficient resources to continue in business for the foreseeable

future. This is discussed more fully in the Directors' Report on

pages 15 to 18 of the 2022 annual report and accounts.

The key business risks and conditions that may impact the

Group's ability to continue as a going concern are the utilisation

of existing resources to finance growth, investment and

expenditure; the rates of growth and cash generated by group

revenues, the timing of breakeven and positive cashflow generation

and the ability to secure additional debt or equity financing in

future if this became necessary. The primary area of judgement that

the Board considered, in the going concern assessment, related to

revenue expectations and visibility.

The Board was mindful of the guidance surrounding a severe but

plausible assessment and, accordingly, considered a number of

scenarios in revenue reduction against the original plans. A

reverse stress test was constructed to identify at which point the

Group might run out of its available cash. The test was designed

specifically to understand how far revenue would need to fall short

of the base case forecast and does not represent the directors view

on current and projected trading. The test was modelled over a

24-month period commencing 1 January 2023 and was based on budgeted

trading that took into account contracted orderbook, existing

revenue streams from current customers / products, expected revenue

based on management's judgement of the likelihood of converting

current sales opportunities and the net proceeds from the

Convertible Loan Notes announced on 31 March 2023. The sales

revenue in the budgeted model was reduced evenly across the Group

to the point where the projected month-end cash was equal to zero

at any point during the 24-month cycle. In the model, zero

month-end cash was reached in May 2024 when projected sales revenue

was reduced to 87.1% of budget. Since the guidance for going

concern is usually based on a period of 12-months from the date of

signing the accounts, a further reverse stress test was conducted

over a period to 30 April 2024. In this test reducing sales to

85.4% of budgeted level resulted in a zero month-end cash position

at 31 March 2024. For the reverse stress test, the Board

specifically excluded any significant upsides to this scenario.

This is despite strong incremental demand potential at both

existing and new customers in the Bioplastics or RF Technology

divisions. This most severe scenario also excludes any mitigating

reduction in the cost base that the Board would clearly undertake

in this event or utilisation of the Group's invoice discounting

facility. In all scenarios modelled, including the reverse stress

test, the Group has sufficient resources to operate and meet its

liabilities throughout the going concern review period without the

inclusion of the impact of mitigating actions.

At 31 December 2022, the Group had a net cash balance of GBP0.8m

and as at 18 April 2023 a balance of GBP1.3m, post receipt of funds

from Convertible Loan Notes. On a revised base case scenario

adopted for their assessment, the Board is comfortable that the

Group can continue its operations for at least a 12-month period

following the approval of these financial statements.

As a result of this review, which incorporated sensitivities and

risk analysis, the Directors believe that the Group has sufficient

resources and

working capital to meet their present and foreseeable

obligations for a period of at least 12 months from the approval of

these financial statements.

Consolidated statement of comprehensive income

For the year ended 31 December 2022

Note 2022 2021

GBP'000 GBP'000

REVENUE 5 6,188 5,734

Cost of goods sold (3,857) (3,794)

GROSS PROFIT 2,331 1,940

Other operating income 211 364

Administrative expenses (3,309) (3,439)

LOSS FROM OPERATIONS (767) (1,135)

Finance charges (35) (34)

LOSS BEFORE TAXATION (802) (1,169)

Taxation 8 131 29

LOSS AND TOTAL COMPREHENSIVE LOSS FOR

THE YEAR (671) (1,140)

------------------------------------------- ----- ----------------- ------------------

Basic loss per share - pence (18)p (30)p

Diluted loss per share - pence (18)p (30)p

------------------------------------------- ----- ----------------- ------------------

Consolidated statement of financial position

as at 31 December 2022

2022 2022 2021 2021

GBP'000 GBP'000 GBP'000 GBP'000

NON-CURRENT ASSETS

Other intangible assets 841 726

Property, plant and

equipment 498 502

1,339 1,228

CURRENT ASSETS

Inventories 736 920

Trade and other

receivables 605 1,377

Tax receivable 141 79

Cash and cash

equivalents 779 996

2,261 3,372

TOTAL ASSETS 3,600 4,600

------------------------ -------------------- ---------------------- -------------------- ----------------------

CURRENT LIABILITIES

Trade and other

payables 933 1,298

Lease liabilities 55 40

988 1,338

NON-CURRENT

LIABILITIES

Lease liabilities 354 361

------------------------ -------------------- ---------------------- -------------------- ----------------------

354 361

TOTAL LIABILITIES 1,342 1,699

------------------------ -------------------- ---------------------- -------------------- ----------------------

NET ASSETS 2,258 2,901

------------------------ -------------------- ---------------------- -------------------- ----------------------

EQUITY

Share capital 189 189

Share premium account 2,282 2,282

Capital redemption

reserve 4 4

Share options reserve 102 487

Translation reserves (83) (85)

Treasury shares reserve (55) (55)

Retained earnings (181) 79

TOTAL EQUITY 2,258 2,901

------------------------ -------------------- ---------------------- -------------------- ----------------------

Consolidated statement of changes in equity

as at 31

December

2022

Share capital Share Capital Share Translation Treasury Retained TOTAL

premium redemption options reserve Shares earnings EQUITY

account reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January

2022 189 2,282 4 487 (85) (55) 79 2,901

--------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Currency

translation

movement

arising

on

consolidation - - - - 2 - - 2

Other

movements - - - - - - 26 26

Lapsed options - - - (385) - - 385 -

Transactions

with

owners - - - (385) 2 - 411 28

--------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Loss for the

year - - - - - - (671) (671)

--------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Total

comprehensive

loss for the

year - - - - - - (671) (671)

--------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Balance at 31

December

2022 189 2,282 4 102 (83) (55) (181) 2,258

--------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Balance at 1

January

2021 186 2,200 4 617 (85) - 1,062 3,984

--------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Share options

issued

in

share-based

payments - - - 48 - - - 48

Issue of share

capital 3 82 - - - - - 85

Purchase of

own

shares - - - - - (122) - (122)

Sale of

treasury

shares - - - - - 67 (21) 46

Exercise of

share

options - - - (170) - - 170 -

Lapsed options - - - (8) - - 8 -

Transactions

with

owners 3 82 - (130) - (55) 157 57

--------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Loss for the

year - - - - - - (1,140) (1,140)

--------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Total

comprehensive

loss for the

year - - - - - - (1,140) (1,140)

--------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Balance at 31

December

2021 189 2,282 4 487 (85) (55) 79 2,901

--------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Consolidated statement of cash flows

For the year ended 31 December 2022

2022 2021

GBP'000 GBP'000

Loss after taxation (671) (1,140)

Adjustments for: -

Taxation (131) (29)

Finance charges 35 34

Loss from operations (767) (1,135)

Adjustments for: -

Amortisation and impairment of intangible

assets 250 353

Depreciation of property, plant and equipment 89 88

Share based payments - equity settled - 48

Operating cash flows before movement in

working capital (428) (646)

Decrease/(increase) in inventories 184 (174)

Decrease in receivables 762 13

(Decrease)/increase in payables (339) 230

Cash generated from / utilised in operations 179 (577)

Corporate tax received 79 239

Interest paid (35) (34)

Net cash inflow / (outflow) from operating

activities 223 (372)

--------------------------------------------------- ---------------------- ----------------------

Investing activities

Investment in intangible assets (365) (258)

Purchase of property, plant and equipment (27) (8)

Net cash used in investing activities (392) (266)

--------------------------------------------------- ---------------------- ----------------------

Financing activities

Proceeds from issue of share capital - 1

Repayment of obligations under leasing activities (50) (45)

Net cash used in financing activities (50) (44)

--------------------------------------------------- ---------------------- ----------------------

Net decrease in cash and cash equivalents (219) (682)

Cash and cash equivalents at the beginning

of the year 996 1,678

Exchange differences on cash and cash equivalents 2 -

Cash and cash equivalents at the end of

the year 779 996

--------------------------------------------------- ---------------------- ----------------------

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2022

1. NON-STATUTORY FINANCIAL STATEMENTS

The financial information set out in this preliminary results

announcement does not constitute the Group's statutory financial

statements for the year ended 31 December 2022 or 2021 but is

derived from those financial statements. Statutory financial

statements for 2021 have been delivered to the Registrar of

Companies. Those for 2022 will be delivered following the Company's

Annual General Meeting on 25 May 2023. The auditors have reported

on those accounts: their reports on those financial statements were

unqualified and did not contain statements under Section 498 of the

Companies Act 2006.

The financial statements, and this preliminary statement, of the

Group for the year ended 31 December 2022 were authorised for issue

by the Board of Directors on 25 April 2023 and the statement of

financial position was signed on behalf of the Board by Paul Mines

and Rob Smith.

2. BASIS OF PREPARATION

The Group's financial statements have been prepared in

accordance with UK-adopted international accounting standards.

3. BASIS OF CONSOLIDATION

The Group financial statements consolidate the results of the

Company and all of its subsidiary undertakings drawn up to 31

December 2022. Subsidiaries are entities over which the Group has

control. Control comprises an investor having power over the

investee and is exposed, or has rights, to variable returns from

its involvement with the investee and has the ability to affect

those returns through its power. At 31 December 2022 the subsidiary

undertakings were Biome Bioplastics Limited, Biome Bioplastics Inc.

(USA), Biome Bioplastics Inc. (Canada), Stanelco RF Technologies

Limited, Aquasol Limited, and InGel Technologies Limited

(dormant).

4. GOING CONCERN

The financial statements have been prepared on a going concern

basis as the directors believe that the Group has access to

sufficient resources to continue in business for the foreseeable

future. This is discussed more fully in the Directors' Report on

pages 15 to 18 of the report and accounts for the year ended 31

December 2023.

The key business risks and conditions that may impact the

Group's ability to continue as a going concern are the utilisation

of existing resources to finance growth, investment and

expenditure; the rates of growth and cash generated by group

revenues, the timing of breakeven and positive cashflow generation

and the ability to secure additional debt or equity financing in

future if this became necessary. The primary area of judgement that

the Board considered, in the going concern assessment, related to

revenue expectations and visibility.

The Board was mindful of the guidance surrounding a severe but

plausible assessment and, accordingly, considered a number of

scenarios in revenue reduction against the original plans. A

reverse stress test was constructed to identify at which point the

Group might run out of its available cash. The test was designed

specifically to understand how far revenue would need to fall short

of the base case forecast and does not represent the directors view

on current and projected trading. The test was modelled over a

24-month period commencing 1 January 2023 and was based on budgeted

trading that took into account contracted orderbook, existing

revenue streams from current customers / products, expected revenue

based on management's judgement of the likelihood of converting

current sales opportunities and the net proceeds from the

Convertible Loan Notes announced on 31 March 2023. The sales

revenue in the budgeted model was reduced evenly across the Group

to the point where the projected month-end cash was equal to zero

at any point during the 24-month cycle. In the model, zero

month-end cash was reached in May 2024 when projected sales revenue

was reduced to 87.1% of budget. Since the guidance for going

concern is usually based on a period of 12-months from the date of

signing the accounts, a further reverse stress test was conducted

over a period to 30 April 2024. In this test reducing sales to

85.4% of budgeted level resulted in a zero month-end cash position

at 31 March 2024. For the reverse stress test, the Board

specifically excluded any significant upsides to this scenario.

This is despite strong incremental demand potential at both

existing and new customers in the Bioplastics or RF Technology

divisions. This most severe scenario also excludes any mitigating

reduction in the cost base that the Board would clearly undertake

in this event or utilisation of the Group's invoice discounting

facility. In all scenarios modelled, including the reverse stress

test, the Group has sufficient resources to operate and meet its

liabilities throughout the going concern review period without the

inclusion of the impact of mitigating actions.

At 31 December 2022, the Group had a net cash balance of GBP0.8m

and as at 18 April 2023 a balance of GBP1.3m, post receipt of funds

from Convertible Loan Notes. On a revised base case scenario

adopted for their assessment, the Board is comfortable that the

Group can continue its operations for at least a 12-month period

following the approval of these financial statements.

As a result of this review, which incorporated sensitivities and

risk analysis, the Directors believe that the Group has sufficient

resources and working capital to meet their present and foreseeable

obligations for a period of at least 12 months from the approval of

these financial statements.

5. SEGMENTAL INFORMATION FOR YEARED 31 DECEMBER 2021

2022 2021

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Bioplastics RF Central Total Bioplastics RF Central Total

Revenue from

sales 4,393 1,809 - 6,202 4,797 1,140 - 5,937

Removal of inter-segment

sales - (14) - (14) - (203) - (203)

Total external

sales 4,393 1,795 - 6,188 4,797 937 - 5,734

--------------------------- ----------------- ------------------- ----------------- ----------------- ----------------- ----------------- ----------------- -----------------

(Loss)/profit

from operations (734) 176 (209) (767) (601) (59) (475) (1,135)

--------------------------- ----------------- ------------------- ----------------- ----------------- ----------------- ----------------- ----------------- -----------------

Interest received - - - - - - - -

Finance charges - - (35) (35) - - (34) (34)

Loss before

taxation (734) 176 (244) (802) (601) (59) (509) (1,169)

--------------------------- ----------------- ------------------- ----------------- ----------------- ----------------- ----------------- ----------------- -----------------

Taxation 131 - - 131 29 - - 29

Loss for the

year (603) 176 (244) (671) (572) (59) (509) (1,140)

--------------------------- ----------------- ------------------- ----------------- ----------------- ----------------- ----------------- ----------------- -----------------

Reconciliation to Loss Before Interest Tax Depreciation and Amortisation

(LBITDA)

(Loss)/profit

from operations (734) 176 (209) (767) (601) (59) (475) (1,135)

Depreciation/amortisation 292 43 4 339 395 41 5 441

Share based payments - - - - 13 7 28 48

(L)/EBITDA (442) 219 (205) (428) (193) (11) (442) (646)

--------------------------- ----------------- ------------------- ----------------- ----------------- ----------------- ----------------- ----------------- -----------------

Other segmental information

Capital Expenditure

Property, plant

and equipment 15 69 1 85 3 12 1 16

Intangible assets 365 - - 365 258 - - 258

Total Capital

Expenditure 380 69 1 450 261 12 1 274

--------------------------- ----------------- ------------------- ----------------- ----------------- ----------------- ----------------- ----------------- -----------------

Total Assets 2,632 920 48 3,600 3,408 1,156 36 4,600

--------------------------- ----------------- ------------------- ----------------- ----------------- ----------------- ----------------- ----------------- -----------------

The Bioplastics division comprises of Biome Bioplastics Limited,

Biome Bioplastics Inc. (USA) and Biome Bioplastics Inc.

(Canada).

6. ALTERNATIVE PROFIT MEASURE

The Group, and divisions, define loss before interest, taxation,

depreciation and amortisation ("LBITDA") as the operating loss

adjusted for share option charges, depreciation, and amortisation.

The Group LBITDA is reconciled as follows:

2022 2021

GBP'000 GBP'000

Loss from operations per consolidated

statement

of comprehensive income (767) (1,135)

Amortisation 250 353

Depreciation 89 88

Share option charges - equity

settled - 48

(428) (646)

--------------------------------------- ---------------------- --------------------

7. LOSS PER SHARE

The calculation of loss per share is based on the loss

attributable to the equity holders of the parent for the year of

GBP671,000 (2021: GBP1,140,000 loss) and a weighted average of

3,742,655 (2021: 3,742,655) ordinary shares carrying voting rights

for basic loss per share and a weighted average of 3,742,655 (2021:

3,742,655) ordinary shares carrying voting rights for diluted loss

per share.

8. TAXATION

In the current year, other income includes GBP6,000 (2021:

GBP50,000) arising from Research and Development Expenditure Credit

scheme (RDEC) that is accounted for as a government grant.

The Group has estimated trading losses of GBP32.9m (2021:

GBP32.0m) available indefinitely for carry forward against future

trading profits. The Group had capital losses of GBP1.5m (2021:

GBP1.5m). Deferred tax assets have not been recognised in respect

of these losses as there is insufficient certainty of future

taxable profits against which to utilise them.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BLGDSCSDDGXU

(END) Dow Jones Newswires

April 26, 2023 02:00 ET (06:00 GMT)

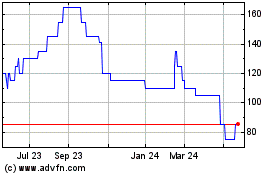

Biome Technologies (AQSE:BIOM.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

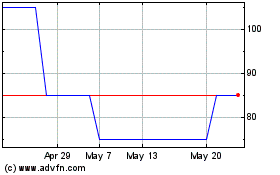

Biome Technologies (AQSE:BIOM.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025