Over the past year, the Indian stock markets have been posting

phenomenally high returns. This can be mainly attributed to the

recent investor friendly reforms and proactive steps taken by

Government to stabilize the fast deteriorating investment climate

in the Indian economy.

The measures taken by the Government to allow direct investments

in the retail industry has been severely criticized but finally saw

the green light when it received majority support from political

parties thereby eliminating any doubt relating to implementation of

the proposed plan.

This surely is a welcome step by the government as it is

expected to boost funds inflow in the economy, especially

considering that similar steps have been taken to boost investments

in the economy’s debt plagued air and broadcast industries as well

(see India ETFs: Getting Back On Track?).

Also, for an emerging economy like India, foreign portfolio

flows are major movers of the equity markets. Therefore the policy

inactions thus far from the Government to tame the mounting debt

level have long chased foreign institutional investors away from

the Indian capital markets. As a result the Indian equity markets

underperformed severely in 2011.

Adding to the volatility of the Indian markets is the twin

fiscal and trade deficits which have, for quite some time, blurred

the growth outlook for the Indian economy. It also faces

significant headwinds from rating agencies like Standard and Poor’s

and Moody’s which have warned that if the economy does not keep a

check on the mounting debt levels, it could soon lose its

investment grade status.

Presently, the economy sports a ‘BBB’ rating from Standard and

Poor’s with a negative outlook, which is just one notch above the

junk grade level (see France's Credit Downgrade: How Does it Impact

the French ETF?).

However, recent policy measures have paved the way for a remedy.

Also, the above par corporate earnings reported in the latest

quarter and favorable forward guidance by the management of various

companies is a sure indicator of rising business spending and

demand restoration in the economy.

These factors have led to the S&P CNX Nifty

— a popular benchmark of Indian stocks measuring the performance of

the 50 biggest companies in the economy, to go up by about 20% in

2012 (see Time to Buy the India Infrastructure ETF).

For investors expecting this trend to continue, a play could be

made on any of the popular Indian ETFs that are currently in the

U.S. market. We have highlighted some of our favorites below for

those who are looking for a continued surge in the Indian stock

market in the near to medium term:

WisdomTree India Earnings ETF

(EPI) is a Zacks # 2 or

‘Buy’ ranked ETF which tracks the WisdomTree India Earnings Index.

It tracks the performance of roughly 196 securities which implies

it has exposure in the mid and small cap space as well.

The ETF allocates around 40% of its total assets in the top 10

holdings. EPI charges 83 basis points as expense ratio and has an

asset base of $1.21 billion. It has a strong average daily volume

of about 3 million shares and it has returned 18% in 2012.

iPath MSCI India Index ETN

(INP) is a Zacks # 2 or

‘Buy’ ranked ETN. At 89 basis points the expense ratio for the ETF

stands pretty high. It has an asset base of $466 million and does

volume of 78,000 shares daily. INP has returned around 18% in 2012

(see the Zacks ETF Center).

PowerShares India ETF

(PIN) is a Zacks # 3 or

‘Hold’ ranked ETF which tracks the Indus India Index. Unlike EPI

which spreads out its portfolio across a variety of stocks across

different levels of market capitalization, PIN actually tries to

replicate Indian equities through a sampling approach of 50 stocks

which are predominantly large cap.

It has an asset base of $387 million and an average daily volume

of around 738,000 shares. PIN has returned around 22% YTD in

2012.

iShares S&P India Nifty 50 ETF

(INDY) is a Zacks # 2 or

‘Buy’ ranked ETF which tracks the S&P CNX Nifty Index which is

a benchmark index for measuring the performance of Indian equities.

It tracks the performance of the 50 largest companies from India

based on their market capitalization.

Despite the focus on large caps though, the fund is one the

pricey end charging investors 92 basis points a year in fees. The

ETF has an asset base of $354 million and does a daily volume of

145,000 shares. INDY has returned around 20% during 2012.

Investors seeking a small cap exposure to Indian equities can

consider the Market Vectors India Small Cap ETF

(SCIF). It has a Zacks

Rank of 3 or ‘Hold’ and tracks the Market Vectors India Small Cap

Index which follows the performance of small cap stocks in India.

It has an expense ratio of 0.85% and pays out a yield of 1.45%.

Being a relatively new fund it has been able to amass a modest

asset base of around $86 million, however, it has a strong average

daily volume of 87,000 shares. Not surprisingly, this small cap ETF

has outperformed its large cap peers in this uptrend returning

around 20% in 2012.

Investors seeking exposure in the Indian ETFs must note that

these ETFs are highly correlated to each other. The following

correlation matrix summarizes their strong correlation among each

other.

Table1: Correlation Matrix

|

ETF

|

EPI

|

INP

|

PIN

|

INDY

|

SCIF

|

|

EPI

|

100%

|

96.62%

|

96.74%

|

95.94%

|

91.59%

|

|

INP

|

|

100%

|

96.40%

|

95.41

|

88.13%

|

|

PIN

|

|

|

100%

|

94.98%

|

88.10%

|

|

INDY

|

|

|

|

100%

|

88.00%

|

|

SCIF

|

|

|

|

|

100%

|

Thus we see that these ETFs, especially the large cap ones are

very strongly correlated among each other with a minimum

correlation of around 95%. This is in spite of not tracking same

indexes and varying allocations across various sectors.

Nevertheless, Financials, Energy and Technology seem to be the

favorite sectors of these Indian ETFs as the three sectors account

for a lion’s share of each of these ETFs.

Given their strong correlations it isn’t too surprising that

these ETFs have similar risk-return tradeoffs, and as we have seen

thus far their performances seem to have a strong resemblance in

the positive direction.

Yet, if we go back in time a couple of years we see that this

strong correlation of Indian equity ETFs is not always beneficial

for investors. The following table explains this phenomenon:

Table 2: Yearly Returns Analysis

|

Year

|

EPI

|

INP

|

PIN

|

INDY

|

SCIF

|

|

2012

|

18%

|

18%

|

22%

|

20%

|

20%

|

|

2011

|

-40.24%

|

-40%

|

-36%

|

-36.70%

|

-55.80%

|

|

2010

|

16.19%

|

17.24%

|

13.03%

|

20.57%

|

N.A

|

While it is true that the Indian ETFs have emerged as clear

winners in 2012, the opposite was also true the previous

fiscal.

In 2011, these ETFs had a forgettable run as the space was one

of the worst performing markets after a great performance in 2010

as well. This can also be attributable to a weak currency — The

Indian Rupee had lost significantly within that time frame versus

the U.S. Dollar (see Zacks Top Ranked Currency ETF: ICN).

Such high volatility might not be a great moral booster for

investors and there is no denying the fact that the Indian economy

still has a lot of work to do. However, the inevitable question

that lurks in everybody’s mind as we inch further into 2013 is

“Will history repeat itself and there will be a significant

fall in these ETFs as happened in 2011?” Well the odds

are certainly against it.

After the dismal run in 2011, Indian equities finally

seem to be bottoming out. Also, while the macroeconomic and

political headwinds still hint towards the negative side, the

economy seems to have got a jumpstart on the policy front with the

much needed amendments as of late (see 3 Emerging Market ETFs

Protected from Global Events).

Also, India’s huge domestic market coupled with the persistent

efforts to create an investor friendly climate is sure to attract

foreign funds into the system in the quest for above par growth

potential.

India has earned a Zacks outlook of

‘Outperform’ and we are bullish on Indian equities in

the near to medium term, suggesting any of the above ETFs could be

worth a closer look for investors seeking more international

exposure this year.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

WISDMTR-IN EARN (EPI): ETF Research Reports

ISHARS-SP INDIA (INDY): ETF Research Reports

IPATH-MS INDIA (INP): ETF Research Reports

PWRSH-INDIA POR (PIN): ETF Research Reports

MKT VEC-INDI SC (SCIF): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

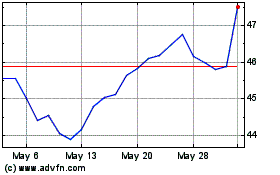

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Feb 2025 to Mar 2025

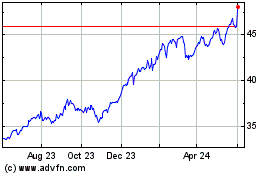

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Mar 2024 to Mar 2025