Zacks Top Ranked India ETF: EPI - ETF News And Commentary

December 18 2012 - 7:43AM

Zacks

Sovereign debt crisis in Europe and slow economic growth in the

U.S. were some of the reasons that caused massive capital outflows

from the Indian capital markets and imposed huge downward pressure

on the Indian Rupee (INR) and slowdown in the economy.

Manufacturing and agricultural bottlenecks and lack of proactive

measures by the government and the central bank (Reserve Bank of

India) were the main reasons behind the economy reporting a mere

5.3% GDP growth for the second quarter of fiscal 2012.

Some of the positives for investing in India are low levels of

correlations of Indian capital markets with the developed markets

and attractive valuations.

Recent economic policies will make India an attractive

destination for foreign investments once the global economic

conditions improve.

These policies include 1) diesel subsidy cut, 2) foreign direct

investment (FDI) guidelines relaxed, and 3) tax on foreign

borrowings by Indian corporate reduced (see India ETFs: Getting

Back On Track?).

Investors looking to tap this economy in basket form can invest

in WisdomTree India

Earnings fund (EPI) which is a #2 Zacks ETF Rank (Buy) fund. We

expect it to outperform its peers over the next year. The product

could be worth a closer look by investors seeking exposure to this

economy (see Zacks Top Ranked India ETF in Focus: INDY).

About the Zacks ETF Rank

The Zacks ETF Rank provides a recommendation for the ETF in the

context of our outlook for the underlying industry, sector, style

box, or asset class. Our proprietary methodology also takes into

account the risk preferences of investors. ETFs are ranked on a

scale of 1 (Strong Buy) to 5 (Strong Sell) while they also receive

one of three risk ratings, namely Low, Medium, or High (see more in

the Zacks ETF Center).

The aim of our models is to select the best ETFs within each

risk category. We assign each ETF one of five ranks within each

risk bucket. Thus, the Zacks Rank reflects the expected return of

an ETF relative to other products with a similar level of risk.

For investors seeking to apply this methodology to their

portfolio in the Indian market, we have taken a closer look at the

top ranked EPI below:

WisdomTree India Earnings Fund (EPI)

EPI is designed to provide a broad exposure to the Indian equity

market with a focus on resembling the risk-return characteristics

of total market equities. This ETF is appropriate for investors

seeking a broad exposure to Indian equity markets with a focus on

large cap equities with a long-term view. At 83 basis points, the

expense ratio for the ETF stands pretty high. Like any other

emerging market, investing in Indian equities requires a daunting

appetite for risk.

The fund offers ample liquidity, trading in daily volumes of

more than 2.8 million shares and has assets under management of

$1.15 billion. The fund appears to be highly concentrated in the

top 10 stocks where it has invested 40.4% of its assets (see Does

Your Portfolio Need An India ETF?).

From a sector perspective, the ETF relies heavily on its top

sectors. Financials, Energy, Information Technology, Materials and

Industrials are the sectors with double-digit exposure. Healthcare,

Consumer Staples and Telecommunication Services are sectors with

least allocation.

From an individual holdings point of view, the ETF holds 199

securities with almost 40% allocation to its top 10 holdings.

However, it is prudent to note that the top 10 holdings comprise of

stocks from a variety of sectors. Energy majors – Reliance

Industries and Oil and Natural Gas Corporation – together account

for almost 14% allocation.

Like many other funds in the space, EPI has been performing well

in the second half of this year and has 52-week high of $21.59 and

52-week low of 15.41 (read Time to Worry about Brazil ETFs?). The

fund has returned about 5.08% over the last one-year period and

22.26% year-to-date (as of September 30, 2012).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7

Best Stocks for the Next 30 Days. Click

to get this free report >>

WISDMTR-IN EARN (EPI): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

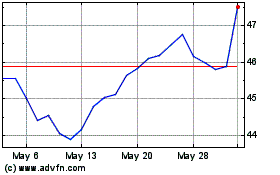

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Oct 2024 to Nov 2024

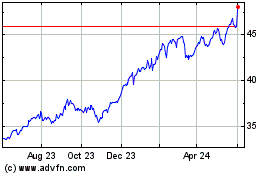

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Nov 2023 to Nov 2024