The policy makers in India seem to have woken up finally after a

long slumber. More reform measures have been announced in the

country in the last 10 days than in the last ten years or so.

Among the reforms announced:

· Diesel subsidies

cut

· Stake sales in four

public sector companies

· Foreign direct

investment (FDI) guidelines relaxed

· Tax on foreign

borrowings by Indian corporates reduced

Major rating agencies, country’s central bank and the

multilateral institutions had been warning the government to take

up appropriate measures to boost investors’ confidence and

encourage capital inflows.

Earlier this year, S&P and Fitch had downgraded the outlook

on the country and warned of a sovereign credit downgrade. If

downgraded, India would be the first country in the BRICs block to

lose its investment grade rating. (Read: India ETFs: Trouble

On The Horizon?)

Government action on policy reforms came in face of significant

political risks. The cut in diesel subsidies—an important step

towards fiscal consolidation—was met with protests and withdrawal

of the support to the government by a key political ally.

(Read: 3 ETFs To Prepare For The Fiscal Cliff)

The same coalition partner—Trinamool Party—had opposed the

government effort to open the retail sector last year and had

succeeded in blocking the move. The party accuses the government of

pursuing "an anti-people's agenda’. New FDI rules allow up to 51%

foreign investment in mass retail outlets. (Read: Three Biggest

Mistakes of ETF Investing)

India’s fiscal deficit had widened to 5.9% of GDP in the fiscal

year ended March 31, substantially higher than the government's

target of 4.6%, mainly due to massive fuel and fertilizer

subsidies. The government targets to reduce the fiscal deficit to

5.1% of GDP in the current fiscal year which began April 1.

The economy grew at 5.5% during the first quarter of current

fiscal year (April-June), slightly up from 5.3% in the previous

quarter, but much slower than the 8.5% average of the preceding

eight years. The IMF expects India’s economy to grow at 6.1% in

2012, while the World Bank’s expectation stands at 6.9%. The

central bank lowered the India's growth forecast for the year to

6.5% from 7.5% in July. (Read: Forget the BRICs, Focus on the

PICKs)

As a result of the optimism generated by the reforms, foreign

investors poured more than $1 billion in the country’s stock

markets since the announcement, sending the stocks to their highest

levels in more than one year. The currency also recovered to its

multi-month high.

Many market participants believe that the reforms were mainly

aimed at avoiding the downgrade and the Indian government’s

commitment to implement the reforms still needs to be seen. Further

we cannot expect the reforms to result in accelerating the economic

growth or bringing down the fiscal deficit anytime soon.

Nevertheless the reforms are a welcome change after many years

of policy paralysis in the country. Government’s willingness to

take political risks even in the face of looming elections will go

a long way in improving the investors’ confidence in the country

even though the actual impact of the reforms will be seen only

after some time.

The central bank left the rates unchanged in its recent meeting

while reducing the cash reserve ratio for banks by 25 bps. While

many had expected a rate cut after the reforms announcement, the

central bank said that its decision was influenced by still-high

inflation rate (~7.5%) and other imbalances in the economy.

For investors seeking broad exposure to Indian equities,

following ETF choices are available:

Wisdom Tree India Earning

Fund (EPI)

EPI is the most popular ETF in this space, with about $1.1

billion in AUM. It tracks the Wisdom Tree India Earning

Index, which weights the Indian companies based on their earnings,

adjusted for a factor that takes into account the shares available

to the foreign investors. It charges the investors 83 basis points

for annual expenses.

In terms of sector weightings, the fund has highest exposure to

financials (28%), followed by energy (23%), information technology

(14%) and materials (13%).Top 10 holdings account for about 40% of

total holdings. The fund has returned 20.8% year-to-date.

PowerShares India Portfolio

(PIN)

PIN which tracks the Indus India Index, has assigned highest

weighting to the Energy sector (26%), followed by financials (18%)

and information technology (17%).

The expense ratio of the ETF is 79 basis points. Top ten

holdings constitute 53.7% of the holdings. The fund has returned

15.0% year-to-date.

S&P India Nifty 50 Index Fund

(INDY)

INDY follows S&P CNX Nifty Index, a free float market

cap weighted index of 50 largest and most liquid Indian companies.

It charges the investors 92 basis points for annual expenses.

Top 10 companies in the fund account for 56.47% of the fund.

Sector weighting are: financials (27), Information Technology (13%)

and power (13%). The fund has returned 23.1% year-to-date.

iShares MSCI India Index Fund

(INDA)

This is the newest in the space, launched in February this

year. The fund follows MSCI India Index, which is float adjusted

market cap weighted index. Holdings are not very different from the

older three discussed above but with the expense ratio at 0.65%,

this is the cheapest option now.

Financials enjoy highest weighting (29%), followed by

information technology (16%) and energy (13%). Top ten companies

account for more than half of the total holdings.

Want the

latest recommendations from Zacks Investment Research? Today, you

can download 7 Best Stocks for the

Next 30 Days. Click to

get this free report >>

WISDMTR-IN EARN (EPI): ETF Research Reports

ISHARS-M INDIA (INDA): ETF Research Reports

ISHARS-SP INDIA (INDY): ETF Research Reports

PWRSH-INDIA POR (PIN): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

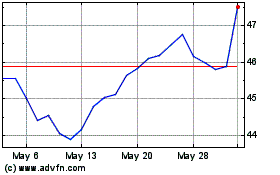

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Oct 2024 to Nov 2024

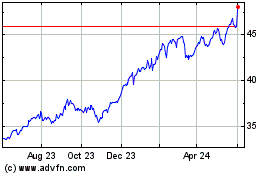

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Nov 2023 to Nov 2024