Time to Buy the India Infrastructure ETF - ETF News And Commentary

July 31 2012 - 6:45AM

Zacks

As developed markets continue to struggle, many investors have

shifted their focus to emerging nations. Undoubtedly, three of the

most popular destinations have been in the BRIC bloc, specifically

in the case of Brazil, India, and China.

In terms of investment in these three emerging giants, some of

the biggest gains could be had in both the consumer and

infrastructure sectors. That is because these segments are often

considered to be ‘low hanging fruit’ and are usually some of the

first ones that newly industrialized economies see big gains in as

they make the transition to upper-middle income nations.

This is usually the result of more middle class consumers

demanding not only higher quality staple products, but more choices

in terms of discretionary goods as well, at least on the consumer

side. Beyond this, transportation and general infrastructure

systems like power grids and water treatment also must be upgraded

in order to support growing populations that are demanding more and

higher quality services, just like their developed market

peers.

While investors have seen a bump in the road in terms of

consumer spending growth in these markets thanks to rising

inflation and a general market slowdown, infrastructure spending is

continuing to roar ahead both as a necessary expenditure to keep

growth elevated and as a stimulus stopgap (read Five Emerging

Market Infrastructure ETFs for the Coming Boom).

The trend is already in full swing in both China and Brazil as

both of these nations have either recently undergone, or are in the

process of, spending more on various transportation and general

infrastructure systems. Both of the countries have been heavily

focused on transportation initiatives in this regard, as well as

spending due to high profile events like the Olympics (2016 in

Rio), or the World’s Expo in Shanghai in 2010.

Meanwhile, India has been left in the dust, as the country has

been shut out of a number of high profile international events

while the few that the nation has had, like the 2010 Commonwealth

Games, have turned out disastrously for the world’s most populous

democracy. If anything, events have been getting worse in the

country as close to 40% of the nation doesn’t have electricity

while close to 340 million people—basically the U.S. and

Canada—recently suffered through a massive power outage across much

of the Northern part of the country.

If that wasn’t enough, the incredible 340 million person power

outage was recently outdone by an even more massive loss of power

just a few hours later. In this failure, close to 600 million

people, more than the entire population of North America and half

of India’s population, suffered through another crippling

outage.

Clearly, if India wants to remain relevant in an era of

superpower emerging markets, it will have to vastly increase its

spending on infrastructure in order to keep up. The country

currently ranks in the bottom third for overall quality of

infrastructure including the bottom 20% in terms of electricity

supply and telephone lines, underscoring just how desperate the

situation has become in India (see Three Emerging Market ETFs to

Limit BRIC Exposure).

In fact, some in the sector believe that India will have to

raise infrastructure spending to 10% of GDP by 2017 in order to

keep hitting lofty growth targets. At current GDP levels, this

translates into spending of about $185 billion per year,

representing a huge windfall for companies that are focused in on

the space.

For investors who believe that this will be a key growth market

in the country for the foreseeable future, a closer look at a

quality option in the ETF space from Emerging Global Shares, the

INDXX India Infrastructure Index Fund (INXX),

could be an interesting pick. Below, we highlight some of the key

points regarding this targeted fund which could be a great way to

benefit from more Indian infrastructure spending in the near

future.

The fund holds roughly 30 securities in its basket and tracks

the INDXX India Infrastructure Index which is a benchmark of firms

in various infrastructure industries including metal miners, energy

producers, transportation, and utility companies. The product

charges investors 85 basis points a year in fees and trades on

modest volume of roughly 14,000 shares a day, suggesting modest bid

ask spreads (see more in the Zacks ETF Center).

From an industry perspective, construction materials take the

top spot at 16%, and are closely trailed by electric utilities

(15%), and mobile telecom services with a double digit weighting as

well. Interestingly, these are all some of the sectors that are the

worst-rated in the Indian economy, suggesting that they could be

among the biggest beneficiaries from a spending boom.

In terms of individual firms in the product, Tata Motors takes

the top spot, followed by Power Grid Corp of India and then

Ultratech Cement, which combined, represent 19% of the total assets

in the fund. Investors should also note that value stocks account

for roughly 60% of the total, while large caps make up over 80% of

the fund from a cap perspective (read Does Your Portfolio Need An

India ETF?).

Unfortunately, the fund has been a laggard in terms of 52 week

performance, losing 30.6% in the time period and lagging the main

ETFs tracking the India market by several hundred basis points over

the past year. However, the trend has seemingly reversed in recent

months as INXX is now among the best performing large-cap focused

India products, adding 8.6% in YTD terms.

This surge in performance, which has beaten out

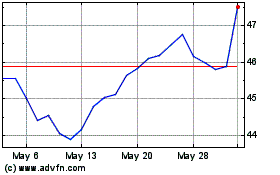

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Oct 2024 to Nov 2024

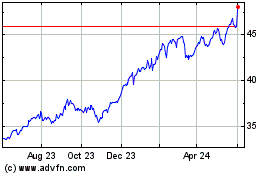

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Nov 2023 to Nov 2024