Emerging Markets: Play with BICS or US Multinationals? - Real Time Insight

April 27 2012 - 10:33AM

Zacks

There is no doubt that emerging economies have

kept growth alive for the US in the past three years. With 45% of

S&P profits coming from abroad, the global economy is a daily

reality for many successful US companies including Caterpillar,

Eaton, Cummins, Boeing, McDonalds, Starbucks, Microsoft, and

Apple.

I have been looking lately at various ways to get

exposure to high single-digit and double-digit growth rates in

emerging markets. The sell-offs in Brazil and India are especially

attractive. And yesterday I saw Blackstone strategist Byron Wien on

Bloomberg offer these 3 investment stats on EM:

1) Emerging

Economies represent 37% of global GDP.

2) But they

are 75% of the growth.

3) And most

institutions only allocate 10% of investment capital to EM

equities.

My rough

sense of the situation is that we have over 2 billion people likely

aspiring to the lifestyles of the West. And their governments must

do everything to support development and commerce that will

allow them to have their wishes.

How are you

allocating to this powerful growth trend that does not appear like

it will let up for decades?

Do you

invest directly in BIICS companies (drop Russia, add South Africa

and maybe Indonesia)?

Do you buy

select country ETFs like those for South Korea (EWY) or India

(EPI)?

Do you

stick with US multinationals like those named

above?

To read this article on Zacks.com click here.

Zacks Investment Research

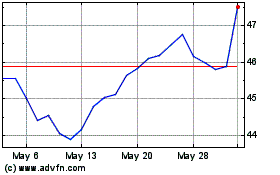

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Oct 2024 to Nov 2024

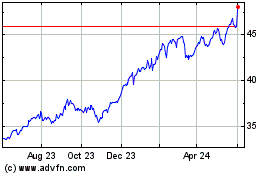

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Nov 2023 to Nov 2024