Is the Dollar ETF About to Surge? - ETF News And Commentary

March 07 2013 - 8:00AM

Zacks

Most investors have been focused in on stocks so far in 2013,

and for good reason. The S&P 500 and broad U.S. market ETFs

like SPY and VOO have jumped

higher this year by more than 5.7% at time of writing, with many

projecting more gains ahead as well.

However, beyond these solid performances, investors have seen

another winning performance to start 2013, the U.S. dollar. This is

pretty surprising as many times when the dollar is surging, U.S.

stocks are floundering (read Can The Dollar ETF Breakout?).

This has not been the case so far in 2013 though, as investors

have bought up dollars across the board. However, this time it

wasn’t so much a flight to safety, but instead an exodus away from

slumping currencies such as the yen (FXY) and the

pound (FXB).

This has been great news for ETF investors who have purchased

the PowerShares DB US Dollar Index Bullish ETF

(UUP), as it has been a prime beneficiary of this trend,

as it is basically offers up exposure against a basket of world

currencies. These include key European currencies, as well as the

yen and the Canadian dollar.

This basket has done quite poorly against the greenback so far

in 2013, with the euro losing about 1% on the year, and then the

pound and the yen both losing over 7.3% in the same time period.

Since the basket of UUP is roughly 83% in these three

aforementioned currencies (euro, yen, and pound), it is easy to see

why the dollar ETF has been such a strong performer to start the

year (see Japanese Yen ETFs: Any Hope in 2013?).

However, there is also reason to believe that this is just the

beginning of the trend, and that more gains could be ahead for the

dollar ETF in the future. That is because there have been some

favorable trends in the charts, which have only added to some

investors’ bullishness over the dollar ETF in the short term.

As you can see, we have just witnessed a moving average

crossover for the dollar ETF. The short-term measure has now moved

above the longer-term 200 day average, suggesting more bullishness

in the near term if this holds (also read PIMCO Debuts Active

Currency ETF).

This could be especially true if major world currencies like the

yen and the pound continue to have problems, or if Europe has more

political issues. If any of these situations happen, this could

just be the beginning for dollar ETF investors, suggesting that

this fund could be worth a closer look.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

CRYSHS-BRI PD S (FXB): ETF Research Reports

CRYSHS-EURO TR (FXE): ETF Research Reports

CRYSHS-JAP YEN (FXY): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

VANGD-SP5 ETF (VOO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

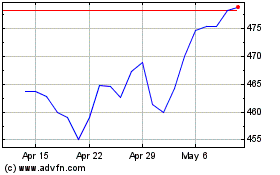

Vanguard S&P 500 (AMEX:VOO)

Historical Stock Chart

From Nov 2024 to Dec 2024

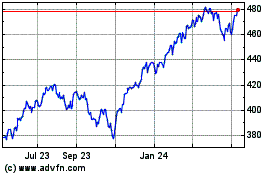

Vanguard S&P 500 (AMEX:VOO)

Historical Stock Chart

From Dec 2023 to Dec 2024