What Inflation Hawks Don't Get - Tactical Trading

November 15 2011 - 7:00PM

Zacks

Prepare to run and hide. It's coming, very soon. It will eat your

paycheck and your savings in no time at all. Your standard of

living and your wealth will evaporate like dollar bills in a fire.

What is it? Inflation, of course. Or so the

doomsayers have been warning us since the Federal Reserve's

quantitative easing (QE) policies officially began in March of

2009.

Why have they been way too early, if not down-right

wrong? First, if you fear a run away secular and structural trend

like inflation, you always worry about it. It's in your blood. You

constantly wait for it. So, of course, you are early.

Second, they don't understand the nature of a

systemic banking/housing meltdown and its major consequences:

credit contraction and deflation. Or how stubbornly persistent

these can be. They don't appreciate what happened/is happening in

Japan and so they can't apply the lessons here.

I've been defending Bernanke on his policies for

over two years. In fact, I've been praising him for his resolve --

in the face of massive criticism ("treason," for instance) -- in

understanding the depth and persistence of the problems our economy

faces.

In the first half of 2010, I wrote many articles

pointing out how silly the hawks were to cry of inflation and

higher interest rates right around the corner.

I tried to explain the depth of the housing bust

and bank contraction, and that these would not only hold inflation

back but also demand more QE. But you can only talk about facts so

much with an inflation hawk because they just refuse to get some

things.

The hawks don't get a few realities...

1) Hawks don't get that deflation is worse than

inflation. And that our systemic, generational banking/housing

crisis has not been pushing us toward the lesser evil.

2) Hawks don't get that the volatility in crude oil

prices is more a function of the secular and geological trends in

energy than dollar devaluation. In other words, if energy is one of

the biggest and costliest economic inputs, it will surely impact

inflation at some point. But that is our future regardless of

QE.

3) Hawks don't get that capital will seek returns

anywhere and everywhere. There will always be bubbles, in all asset

classes. While rates are low and dollars plentiful, they seek yield

in equities and gold. And a balance of safety in US treasuries. Who

knows what the next bubble will be, but it probably won't be

another housing one any time soon so I'm busy looking

elsewhere.

4) Hawks don't get that you beat inflation by being

an active, intelligent investor. I'm still wondering why we bother

to make pennies. And I am prepared to see nickels become obsolete

in my lifetime too. Good riddance. I'll enjoy the double-digit

returns I made investing and not worry about the 5% that inflation

ate.

5) Hawks don't get that inflation equals growth and

progress. It's as inevitable as death and taxes. Or at least they

will wish it so if they ever wake up in a deflationary spiral some

morning.

But don't take my word on any of this. I'm not an

economist. I'm just a trader. Take it from our resident quant, Dirk

Van Dijk, in his latest rant Inflation Low (and will stay that

way).

Kevin Cook is a Senior Stock Strategist with

Zacks.com

Zacks Investment Research

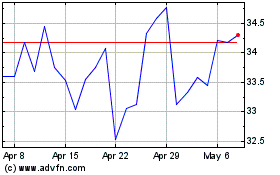

VanEck Gold Miners ETF (AMEX:GDX)

Historical Stock Chart

From Jun 2024 to Jul 2024

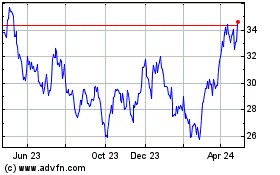

VanEck Gold Miners ETF (AMEX:GDX)

Historical Stock Chart

From Jul 2023 to Jul 2024