U S Liquids Inc. Provides Update on Business Unit Sales and Preliminary Operating Results for the Third Quarter of 2003

November 17 2003 - 4:00PM

PR Newswire (US)

U S Liquids Inc. Provides Update on Business Unit Sales and

Preliminary Operating Results for the Third Quarter of 2003

HOUSTON, Nov. 17 /PRNewswire-FirstCall/ -- U S Liquids Inc. , a

provider of liquid waste management services, provided an update on

business unit sales and announced preliminary results for the

quarter ended September 30, 2003. Since the quarter ended June 30,

2003, the Company has sold business units or assets in the

following transactions: As previously announced, on July 31, 2003

the Company sold its Oilfield Waste Division, its Beverage Division

and its Romic Environmental Technologies business to ERP

Environmental Services, Inc. ("ERP Environmental"). At the closing,

the Company received $68 million in sales proceeds from ERP

Environmental. These proceeds were used to reduce outstanding

indebtedness under the Company's credit facility, pay transaction

expenses, fund employee severance obligations, and for other

matters required by the purchase agreement. In accordance with the

terms of the purchase agreement, the purchase price was

subsequently reduced by $3.5 million based upon the final

determination of the closing date net worth of the businesses sold.

ERP Environmental also paid the Company $2 million for transition

services provided by the Company. From late September through early

November 2003, the Company completed several additional

divestitures generating total proceeds of $7 million. Commercial

Division businesses sold include Waste Stream Environmental,

Northern A-1, Gateway Terminal Services, and National Solvent

Exchange. The proceeds from these transactions were used to reduce

the outstanding indebtedness under the Company's credit facility

and pay transaction expenses. As a result of these sales, the

Company has reduced borrowings under its credit facility by $66.4

million since July 31, 2003 such that the outstanding balance is

$13.5 million with additional letters of credit outstanding of $6.7

million. The Company has also modified the financial covenants

contained in its credit facility and extended the maturity date to

December 1, 2003. The Company is engaged in discussions with its

lenders to further extend the maturity date of the credit facility

in order to provide for the Company's liquidity needs. No

assurances can be given that the Company will be able to extend the

credit facility beyond December 1, 2003. Currently, the Company is

in compliance with the financial covenants contained in the

facility. However, the Company is restricted from making any

additional borrowings without the approval of its lenders. A

default under the Company's credit facility could result in the

maturity of substantially all of the Company's indebtedness being

accelerated. The Company is pursuing the sale of additional

operating units and assets in order to reduce its indebtedness.

There can be no assurance that the Company will be successful in

selling additional business units or assets or that the proceeds

received from future sales will be sufficient to satisfy the

Company's obligations. In the event the proceeds from future sales

are not sufficient, the Company may be required to seek protection

from its creditors under the federal bankruptcy laws. As a result

of the financial statement restatements, which are required in

order to treat certain sales of business units as discontinued

operations, discussions with lenders to extend the maturity date of

the credit facility, personnel reductions, negotiations with

prospective purchasers of additional business units, and the

requirement that the filing be reviewed by the Company's

independent auditors, the Company will not meet the filing deadline

for the Form 10-Q for the quarter ended September 30, 2003. The

Company expects to file its third quarter Form 10-Q by December 31,

2003. In connection with filing its third quarter Form 10-Q, the

Company expects to report revenues from continuing operations in

the range of $17 million to $18 million for the quarter ended

September 30, 2003. In the comparable prior year quarter, the

Company's revenues from continuing operations were $19 million to

$20 million. Revenues from continuing operations exclude the

revenues of the business units sold to ERP Environmental and the

revenues of Waste Stream Environmental. Revenues from continuing

operations include the revenues of the Northern A-1, Gateway

Terminal Services and National Solvent Exchange business units that

were sold in the fourth quarter of 2003. This document contains

forward-looking statements that are subject to certain risks,

uncertainties and assumptions. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those

anticipated, estimated or projected. Key factors that could cause

actual results to differ materially from expectations include, but

are not limited to: (1) the Company's inability to further extend

its credit facility; (2) uncertainties caused by the Company's

failure to comply with the terms of its credit facility; (3) the

impact that our financial condition may have on our customers,

suppliers and employees; (4) the Company's general lack of

liquidity; (5) the outcome of litigation and administrative

proceedings pending against the Company; (6) obtaining or

maintaining governmental permits and approvals required for the

operation of the Company's facilities; (7) changes in the laws and

regulations governing the Company's operations; (8) the failure to

comply with laws and regulations governing the Company's

operations; and (9) the insufficiency of the Company's insurance

coverage or the impact of the insolvency of Reliance Insurance

Company. These and other risks and assumptions are described in the

Company's reports that are available from the United States

Securities and Exchange Commission. DATASOURCE: U S Liquids Inc.

CONTACT: William DeArman, Chief Executive Officer of U S Liquids

Inc., +1-281-272-4511, or Web site: http://www.usliquids.com/

Copyright

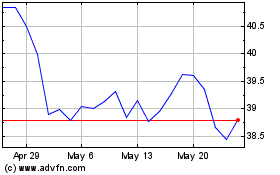

United States 12 Month Oil (AMEX:USL)

Historical Stock Chart

From Jun 2024 to Jul 2024

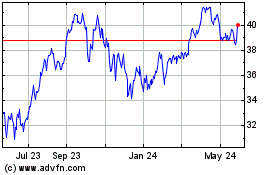

United States 12 Month Oil (AMEX:USL)

Historical Stock Chart

From Jul 2023 to Jul 2024