American Stock Exchange and Victoria Bay Asset Management Launch United States Gasoline Fund, LP

February 26 2008 - 11:14AM

PR Newswire (US)

NEW YORK, Feb. 26 /PRNewswire/ -- Victoria Bay Asset Management,

LLC and the American Stock Exchange(R) (Amex(R)) today announced

the launch of trading in the United States Gasoline Fund, LP under

the ticker symbol "UGA." The investment objective of UGA is to have

the changes in percentage terms of the units' net asset value

reflect the changes in percentage terms of the price of gasoline,

as measured by the changes in the price of the futures contract on

unleaded gasoline (also known as reformulated gasoline blendstock

for oxygen blending, or "RBOB," for delivery to the New York

harbor), as traded on the New York Mercantile Exchange that is the

near month contract to expire, except when the near month contract

is within two weeks of expiration, in which case it will be

measured by the futures contract that is the next month contract to

expire, less UGA's expenses. "Gasoline plays an important role in a

modern economy and we are pleased to offer investors an innovative

way to gain exposure in the energy commodities market," said John

Hyland, Chief Investment Officer at Victoria Bay Asset Management.

"Investing in commodity related vehicles is complicated and we

encourage investors to read the prospectus to determine if the new

approach is suitable for them given their goals, risk tolerance,

and investment outlook." UGA is a commodity pool that is managed by

California-based Victoria Bay Asset Management, LLC. The

partnership's NAV will be calculated once daily on each trading

day. An Indicative Partnership Value will be published at least

every 15 seconds during regular Amex trading hours. The Amex

specialist for USL is Kellogg Capital Group, LLC. "We are proud to

support Victoria Bay Asset Management in growing their family of

futures-based products, all of which are listed on the Amex," said

Scott Ebner, Senior Vice President of Amex's ETF Marketplace.

"Innovation is at the core of the Amex identity and UGA, the first

fund to follow gasoline, is a welcome addition to our product

line-up." Bay Asset Management is the manager of publicly traded

securities that are designed to track the movements of different

commodities. United States Gasoline Fund, LP is the fourth product

to list on the Amex by Victoria Bay Asset Management. United States

Oil Fund, LP (AMEX:USO) listed in 2006, followed by the listing of

the United States Natural Gas Fund, LP (AMEX:USL) and the United

States 12 Month Oil Fund, LP (AMEX:USL) in 2007. Victoria Bay Asset

Management is registered with the CFTC as a commodity pool operator

and has $1.1 billion in assets under management as of December 31,

2007. Note: Investors should read the prospectus for UGA for more

complete information about this security, including risks,

expenses, and other important terms. In addition, there can be no

guarantee that UGA will be able to achieve its investment goals. A

copy of the prospectus may be obtained at

http://www.unitedstatesgasolinefund.com/ or by contacting the fund

at 800.920.0259. DATASOURCE: The American Stock Exchange CONTACT:

Bari Trontz of American Stock Exchange, +1-212-306-8964, ; or Katie

Rooney of Victoria Bay Asset Management, +1-818-206-8148, Web site:

http://www.amex.com/ http://www.unitedstatesgasolinefund.com/

Copyright

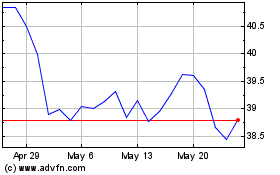

United States 12 Month Oil (AMEX:USL)

Historical Stock Chart

From Jun 2024 to Jul 2024

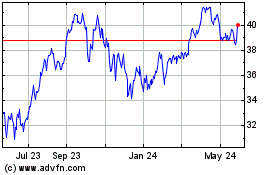

United States 12 Month Oil (AMEX:USL)

Historical Stock Chart

From Jul 2023 to Jul 2024