Ring Energy, Inc. (NYSE American: REI) (“Ring”) (“Company”)

announced today financial results for the first quarter ended March

31, 2018. For the three month period ended March 31, 2018, Ring had

oil and gas revenues of $29,891,391 compared to $12,243,793 for the

quarter ended March 31, 2017, and net income of $5,665,634, or

$0.10 per diluted share, compared to net income of $1,279,281, or

$0.03 per diluted share.

For the three months ended March 31, 2018, the net income

included a pre-tax “Unrealized Loss on Derivatives” of $790,701.

Excluding this item, the net income per diluted share would have

been $0.11.

For the three months ended March 31, 2018, oil sales volume

increased to 479,864 barrels, compared to 240,260 barrels for the

same period in 2017, an 99.7% increase, and gas sales volume

increased to 210,031 MCF (thousand cubic feet), compared to 168,349

MCF for the same period in 2017, a 24.7% increase. On a barrel of

oil equivalent (“BOE”) basis for the three months ended March 31,

2018, production sales increased to 514,869 BOEs, compared to

268,318 BOEs for the same period in 2017, a 91.9% increase. The

average commodity prices received by Ring were $60.73 per barrel of

oil and $3.58 per MCF of natural gas for the quarter ended March

31, 2018, compared to $48.69 per barrel of oil and $3.25 per MCF of

natural gas for the quarter ended March 31, 2017.

Lease operating expenses, including production taxes, for the

three months ended March 31, 2018 were $14.00 per BOE, a 14%

increase from the prior year. Depreciation, depletion and

amortization costs, including accretion, increased 25% to $16.82

per BOE. General and administrative costs, which included a

$1,081,199 charge for stock based compensation, were $5.99 per BOE,

a 43% decrease.

Cash provided by operating activities, before changes in working

capital, for the three months ended March 31, 2018 was $19,168,262

or $0.33 per fully diluted share, compared to $7,221,936, or $0.14

per fully diluted share for the same period in 2017. Earnings

before interest, taxes, depletion and other non-cash items

(“Adjusted EBITDA”) for the three months ended March 31, 2018 was

$19,203,791, or $0.33 per fully diluted share, compared to

$7,105,257, or $0.14 per fully diluted share for the same period in

2017. (See accompanying table for a reconciliation of net income to

adjusted EBITDA).

In February 2018, the Company closed on an underwritten public

stock offering of 6,164,000 shares of its common stock, including

804,000 shares sold pursuant to the full exercise of an

over-allotment option, at $14.00 per share for gross proceeds of

$86,296,000. Total net proceeds from the offering were $81,822,066

after deducting underwriting commissions and offering expenses.

There was no outstanding debt on the Company’s $500 million

senior secured credit facility at March 31, 2018.

Ring’s Chief Executive Officer, Mr. Kelly Hoffman, stated, “Our

first quarter results have gotten the Company off to a great start

for 2018. We continue to have excellent results from our horizontal

drilling program. We have 60 wells scheduled to be drilled this

year and look forward to continued exceptional results. Our new gas

pipeline is completed, and now, instead of having to flare the gas

associated with our horizontal drilling, we are selling it. This,

along with added saltwater disposal wells and the restimulation of

some of our older wells, is only adding to our momentum. The North

Gaines and Brushy Canyon wells are on track with encouraging

results that will be released in the near future. Our goal of being

cash flow positive by year end is on track. Our dedicated staff

continues to search for and evaluate complementary, accretive

properties and opportunities that will build on our success. With

the completion of our stock offering in February, we have

strengthened an already strong balance sheet. We look forward to

the rest of 2018 and couldn’t be more excited for Ring and its

shareholders.”

Non-GAAP Financial Measures:

Net income for the three months ended March 31, 2018 includes a

non-cash charge for stock based compensation of $1,081,199.

Excluding this item, the Company’s net income would have been $0.11

per diluted share for the three months ended March 31, 2018. The

Company believes results excluding this item are more comparable to

estimates provided by security analysts and, therefore, are useful

in evaluating operational trends of the Company and its

performance, compared to other similarly situated oil and gas

producing companies.

About Ring Energy, Inc.

Ring Energy, Inc. is an oil and gas exploration, development and

production company with current operations in

Texas.www.ringenergy.com

Safe Harbor Statement

This release contains forward-looking statements within the

meaning of the “safe-harbor” provisions of the Private Securities

Litigation Reform Act of 1995 that involve a wide variety of risks

and uncertainties, including, without limitations, statements with

respect to the Company’s strategy and prospects. Such statements

are subject to certain risks and uncertainties which are disclosed

in the Company’s reports filed with the SEC, including its Form

10-K for the fiscal year ended December 31, 2017, its Form 10-Q for

the quarter ended March 31, 2018 and its other filings with the

SEC. Readers and investors are cautioned that the Company’s actual

results may differ materially from those described in the

forward-looking statements due to a number of factors, including,

but not limited to, the Company’s ability to acquire productive oil

and/or gas properties or to successfully drill and complete oil

and/or gas wells on such properties, general economic conditions

both domestically and abroad, and the conduct of business by the

Company, and other factors that may be more fully described in

additional documents set forth by the Company.

RING ENERGY, INC. STATEMENTS OF

OPERATIONS Three Months Ended

March 31,

2018 2017

(Unaudited)

(Unaudited)

Oil and Gas Revenues $ 29,891,391 $

12,243,793

Costs and Operating Expenses Oil

and gas production costs 5,781,910 2,705,371 Oil and gas production

taxes 1,425,882 583,264 Depreciation, depletion and amortization

8,501,379 3,474,019 Asset retirement obligation accretion 161,120

137,176 General and administrative expense 3,085,980

2,841,111

Total Costs and Operating

Expenses 18,956,271 9,740,941

Income from Operations 10,935,120

2,502,852

Other Income

(Expense) Interest income 8,953 116,679 Interest expense

(44,483 ) - Realized loss on derivatives (1,475,026 ) - Unrealized

loss on change in fair value of derivatives (790,701 )

-

Net Other Income (Expense)

(2,301,257 ) 116,679

Income

before tax provision 8,633,863 2,619,531

Provision

for Income Taxes (2,968,229 ) (1,340,250 )

Net Income $ 5,665,634 $ 1,279,281

Basic Income Per Common Share $ 0.10 $ 0.03

Diluted Income Per Common Share $ 0.10 $ 0.03

Basic Weighted-Average Common Shares Outstanding 56,415,673

49,114,731

Diluted Weighted-Average Common Shares

Outstanding 57,949,389 50,414,435

COMPARATIVE OPERATING STATISTICS

Three Months Ended March 31, 2018 2017 Change Net Production

- BOE per day 5,721 2,981 92 % Per BOE:

Average Sales Price

$58.06

$45.63

27 % Lease Operating Expenses 11.23 10.08 11 % Production

Taxes 2.77 2.17 28 % DD&A 16.51 12.95 27 % Accretion 0.31 0.51

-39 % General & Administrative Expenses 5.99 10.59 -43 %

RING ENERGY, INC. CONSOLIDATED BALANCE SHEET

March 31,

December 31,

2018

2017

ASSETS Current Assets Cash $47,036,101

$15,006,581 Accounts receivable 13,447,211 12,833,883 Joint

interest billing receivable 636,336 1,054,022 Prepaid expenses and

retainers

131,027

229,438

Total Current Assets 61,250,675 29,123,924

Properties and Equipment Oil and natural gas properties

subject to depletion and amortization 483,115,061 433,591,134 Fixed

assets subject to depreciation 1,848,405 1,884,818

Total

Property and Equipment 484,963,466 435,475,952 Accumulated

depreciation, depletion and amortization (70,344,636) (61,864,932)

Net Property and Equipment 414,618,830 373,611,020

Deferred Income Taxes 8,263,971 11,232,200

Deferred Financing Costs

67,671 135,342

Total Assets $484,201,147 $414,102,486

LIABILITIES AND STOCKHOLDERS' EQUITY Current

Liabilities Accounts payable $24,822,069 $44,475,163 Derivative

Liabilities $4,758,987 $3,968,286

Total Current Liabilities

29,581,056 48,443,449 Asset retirement obligations 9,447,852

9,055,697

Total Liabilities 39,028,908 57,499,146

Stockholders' Equity

Preferred stock - $0.001 par value;

50,000,000 shares authorized; No shares issued or outstanding

- -

Common stock - $0.001 par value;

150,000,000 shares authorized; 60,388,029 shares and 54,224,029

shares outstanding, respectively

60,388 54,224 Additional paid-in capital 480,801,870 397,904,769

Accumulated deficit (35,690,019) (41,355,653)

Total

Stockholders' Equity 445,172,239 356,603,340

Total

Liabilities and Stockholders' Equity $484,201,147 $414,102,486

RING ENERGY, INC. STATEMENTS OF CASH

FLOW Three Months Ended March 31,

2018

2017

Cash Flows From Operating Activities Net income $

5,665,634 $ 1,279,281

Adjustments to reconcile net income to net

cash used in operating activities:

Depreciation, depletion and amortization 8,501,379 3,474,019

Accretion expense 161,120 137,176 Share-based compensation

1,081,199 991,210 Deferred income tax provision 1,809,625 923,390

Excess tax deficiency related to share-based compensation 1,158,604

416,860 Change in fair value of derivative instruments 790,701 -

Changes in assets and liabilities: Accounts receivable (195,642 )

(1,119,947 ) Prepaid expenses and retainers 166,082 161,693

Accounts payable (32,653,094 ) 4,761,819 Settlement of asset

retirement obligation (149,772 ) (8,929

)

Net Cash Provided by (Used in) Operating Activities

(13,664,164 ) 11,016,572

Cash Flows

from Investing Activities Payments to purchase oil and natural

gas properties (1,061,195 ) (3,924,404 ) Payments to develop oil

and natural gas properties (35,081,925 ) (19,796,719 ) Disposal of

fixed assets subject to depreciation 14,738 - Purchase of inventory

for development - (2,816,165 )

Net Cash Used in Investing Activities (36,128,382 )

(26,537,288 )

Cash Flows From Financing

Activities Amounts paid for registration statement for future

offerings - (147,537 ) Proceeds from issuance of common stock, net

of offering costs 81,822,066 -

Net Cash Provided by (Used in) Financing Activities

81,822,066 (147,537 )

Net

Decrease in Cash 32,029,520 (15,668,253 )

Cash at Beginning

of Period 15,006,581

71,086,381

Cash at End of Period $ 47,036,101

$ 55,418,128

Supplemental Cash Flow

Information Cash paid for interest $ 44,483

-

Noncash Investing and Financing

Activities Asset retirement obligation incurred during

development $ 380,807 $ 244,372 Use of inventory in property

development - $ 687,443

Capitalized expenditures attributable to

drilling projects financed through current liabilities

$ 13,000,000 $ 4,700,000

RECONCILIATION OF CASH FLOW FROM

OPERATIONS Net cash provided by operating activities

($13,664,164 ) $ 11,016,572 Change in operating assets and

liabilities 32,832,426

(3,794,636 ) Cash flow from operations $ 19,168,262

$ 7,221,936 Management believes that

the non-GAAP measure of cash flow from operations is useful

information for investors because it is used internally and is

accepted by the investment community as a means of measuring the

Company's ability to fund its capital program. It is also used by

professional research analysts in providing investment

recommendations pertaining to companies in the oil and gas

exploration and production industry.

RING

ENERGY, INC. NON-GAAP DISCLOSURE RECONCILIATION

March 31, March 31,

2018

2017

NET INCOME (LOSS) $ 5,665,634 $ 1,279,281

Interest (income) (8,953 ) (116,679 ) Interest expense 44,483 -

Income tax expense (benefit) 1,809,625 923,390 Excess tax benefits

related to share-based compensation 1,158,604 416,860 Depreciation,

depletion and amortization 8,501,379 3,474,019 Accretion of

discounted liabilities 161,120 137,176 Share-based compensation

1,081,199 991,210 Change in fair value of derivative instruments

790,701 -

ADJUSTED EBITDA

$ 19,203,792 $ 7,105,257

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180508006672/en/

K M Financial, Inc.Bill Parsons, 702-489-4447

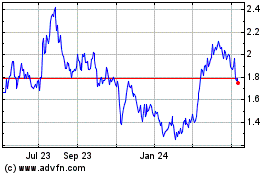

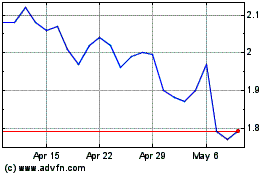

Ring Energy (AMEX:REI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ring Energy (AMEX:REI)

Historical Stock Chart

From Jul 2023 to Jul 2024