Power REIT (NYSE - AMERICAN: PW and PW.PRA) (“Power REIT” or the

“Trust”), Power REIT with a focused “Triple Bottom Line” strategy

and a commitment to profit, planet, and people, today announced

that it is providing an update that includes highlights of the

Trust’s financial and operating results for the three and six

months ended June 30, 2021.

FINANCIAL HIGHLIGHTS

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

2,267,848 |

|

|

$ |

975,122 |

|

|

$ |

4,088,775 |

|

|

$ |

1,762,510 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income

Attributable to Common Shareholders |

|

$ |

1,376,493 |

|

|

$ |

409,695 |

|

|

$ |

2,321,411 |

|

|

$ |

591,724 |

|

| Net Income per Common Share

(diluted) |

|

|

0.41 |

|

|

|

0.21 |

|

|

|

0.74 |

|

|

|

0.30 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core FFO Available to

Common Shareholders |

|

$ |

1,677,636 |

|

|

$ |

555,252 |

|

|

$ |

2,952,578 |

|

|

$ |

906,901 |

|

| Core FFO per Common Share |

|

|

0.51 |

|

|

|

0.29 |

|

|

|

0.97 |

|

|

|

0.48 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Growth

Rates: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

133 |

% |

|

|

|

|

|

|

132 |

% |

|

|

|

|

| Net Income Attributable to

Common Shareholders |

|

|

236 |

% |

|

|

|

|

|

|

292 |

% |

|

|

|

|

| Net Income per Common Share

(diluted) |

|

|

95 |

% |

|

|

|

|

|

|

147 |

% |

|

|

|

|

| Core FFO Available to Common

Shareholders |

|

|

202 |

% |

|

|

|

|

|

|

226 |

% |

|

|

|

|

| Core FFO per Common Share |

|

|

76 |

% |

|

|

|

|

|

|

102 |

% |

|

|

|

|

*See Net Income to Core FFO Reconciliation at

the end of this release.

2Q-2021 PORTFOLIO HIGHLIGHTS (3 months

ended June 30, 2021)

| ● |

Acquired 4 Controlled Environmental Agriculture (“CEA”) facilities

in Colorado and Oklahoma totaling approximately 206,000 square feet

of greenhouse and cultivation/processing space. |

| |

○ |

Approximately $12.4 million was committed to these acquisitions,

which includes the purchase price and development costs, but

excludes transaction costs. |

| |

○ |

Entered into 4 new long-term triple-net leases. |

| |

○ |

Leasing activity is expected to generate straight-line annualized

rent of approximately $2.3 million, representing more than an 18%

unleveraged yield on invested capital. |

1H-2021 PORTFOLIO HIGHLIGHTS (6 months

ended June 30, 2021)

| ● |

Grew the CEA portfolio by 8 properties, or approximately 317,000

square feet through accretive acquisitions, which should generate

straight-line annualized rent of approximately $4.6 million,

representing more than a 17% yield on invested capital. |

| ● |

Completed Rights Offering that generated approximately $37 million.

Existing common stockholders were offered the right to purchase

additional shares at $26.50. |

| ● |

Shelf Registration Statement filed and declared effective, which

will provide the Trust with better access to capital sources. |

Commenting on the 2021 second quarter

and first half activities, David Lesser, Chief Executive Officer

stated, “We continued to make significant progress on our

external growth strategy during the first half of 2021. In addition

to completing approximately $26 million of accretive acquisitions,

we successfully completed an investor friendly Rights Offering,

which generated approximately $37 million and allowed existing

investors the opportunity to benefit from our attractive growth

trajectory. This capital fueled our accretive acquisition strategy.

To date, we have deployed approximately $20 million of the Rights

Offerings proceeds into accretive acquisitions so we still have

additional capital to deploy that should drive further growth

including the potential to close on the previously announced

acquisition in Michigan. In addition, we continue to explore

non-dilutive capital sources to fund our continued growth while

creating shareholder value.”

FORWARD CORE FFO PER SHARE

GUIDANCE

Power REIT has now deployed approximately $20

million of the capital raised in its recently closed Rights

Offering across several transactions. This leaves approximately $17

million to deploy. Assuming the full deployment of its remaining

proceeds into additional acquisitions at an average 16% yield to

common equity (i.e. a lower yield than recent transactions), the

Trust estimates a forward Core FFO per share run rate of $3.24 as

described in our most recently published Investor Presentation

which is available at: www.pwreit.com/investors. However, it is

important to understand that near-term quarterly results could be

below this run-rate due to uncertainty of transaction timing and

dilution from the additional shares issued pursuant to the Rights

Offering that generated the available cash on Power REIT’s balance

sheet for investment.

The following table provides a roadmap analysis for forward Core

FFO per share:

| Rights Offering Proceeds Net

of Costs (est.) |

|

$ |

36,568,291 |

|

| |

|

|

|

|

| Announced Transactions Using

Proceeds from Rights Offering: |

|

|

|

|

|

Apotheke |

|

|

1,813,893 |

|

|

Canndescent |

|

|

2,685,000 |

|

|

Grail Project Expansion |

|

|

517,663 |

|

|

Gas Station |

|

|

2,118,717 |

|

|

Cloud Nine |

|

|

2,947,905 |

|

|

Walsenburg |

|

|

3,876,600 |

|

|

Vinita |

|

|

2,650,000 |

|

|

JKL |

|

|

2,928,293 |

|

| |

|

|

- |

|

|

Total |

|

|

19,538,071 |

|

|

Remaining Rights Offering Proceeds for Investment |

|

$ |

17,030,220 |

|

| |

|

|

|

|

| Unleveraged FFO Yield on

Investments (Net) |

|

|

|

|

| Annualized Run Rate Core FFO

Guidance (existing portfolio) |

|

$ |

8,246,834 |

|

| Incremental FFO from

Acquisitions with Remaining RO Proceeds (@16 % yield) |

|

|

2,724,914 |

|

| Incremental G&A to expand

Power REIT team |

|

|

(200,000 |

) |

| Annualized Run Rate Pro Forma

Core FFO |

|

|

10,771,748 |

|

| |

|

|

|

|

| Shares Outstanding |

|

|

3,322,433 |

|

| |

|

|

|

|

| Annualized Run Rate Pro Forma

Core FFO Per Share |

|

$ |

3.24 |

|

| Quarterly Run Rate Pro Forma

Core FFO Per Share |

|

$ |

.81 |

|

| Increase from Q2 2019 (start

of business plan) |

|

|

479 |

% |

| Increase from Q4 2020 |

|

|

59 |

% |

Mr. Lesser continued, “Our

updated business plan that we put into motion in the second half of

2019 continues to drive substantial growth. Our Core FFO per Common

Share for the six months ended June 30, 2021, increased

approximately 102% year over year. This demonstrates our dynamic

growth as a function of the attractive yields we can achieve with

our strategic CEA investments coupled with our relatively small

size which amplifies the impact of these transactions. With the

current stock price at 36.46 and a forward Core FFO run rate of

$3.24 per share, Power REIT trades at a 11.4 multiple. We believe

our potential growth rate driven by acquisitions combined with a

relatively low forward Core FFO multiple provides a compelling

value proposition for investors. We have previously announced the

potential acquisition of an approximately 565,000 square foot green

house facility in Michigan. Assuming this transaction closes on

terms with similar yields to our recent acquisitions and assuming

no additional investment beyond the $18.5 million purchase price,

Power REIT’s Forward Core FFO would grow to approximately $3.42.

There can be assurance as to when or if this acquisition will

occur. We have an active pipeline of acquisitions and hope to

announce additional activity in the near future.”

DISTRIBUTIONS

For the quarter ended June 30, 2021, the Trust

paid dividends of approximately $163,000 (or $0.484375 per share

per quarter for a total of $1.9375 per share total) on Power REIT’s

7.75% Series A Cumulative Redeemable Perpetual Preferred Stock.

Subsequent to the end of the second quarter in

2021, the Board of Trustees declared a cash dividend of $0.484375

per depository share on its 7.75% Series A Cumulative Redeemable

Perpetual Preferred Stock, which equates to an annual dividend rate

of $1.9375 per depository share. The dividend is payable on

September 15, 2021, to stockholders of record as of August 15,

2021.

CAPITAL MARKETS ACTIVITY

On June 21, 2021, Power REIT had its shelf

registration made effective by the SEC. This positions the Trust to

efficiently access additional capital sources through a variety of

potential common and preferred stock offerings.

On February 5, 2021, Power REIT closed on its

Rights offering, generating proceeds of approximately $36.6 million

of proceeds and issued an additional 1,383,394 common shares.

Through this Offering, shareholders of record as of December 28,

2020 were offered the opportunity to purchase additional shares at

$26.50 per share.

Cash and Cash Equivalents totaled approximately

$28.8 million as of June 30, 2021 compared to $5.6 million as of

December 31, 2020. The increase is the result of the capital raised

in the Rights Offering offset by investment activity.

ACQUISITION ACTIVITY

During the first half of 2021, Power REIT acquired eight new

properties and signed long-term leases in conjunctions with these

transactions.

| |

● |

On June 18, 2021, through a newly formed wholly owned subsidiary,

PW CO CanRE JKL, LLC, (“PW JKL”), we purchased a property totaling

10 acres of vacant land (“JKL Property”) approved for medical

cannabis cultivation in Ordway, Colorado for $400,000 plus

acquisition costs. As part of the transaction, the Trust agreed to

fund the immediate construction of an approximately 12,000 square

feet of greenhouse and 12,880 square feet of support buildings for

approximately $2.5 million. Accordingly, PW JKL’s total capital

commitment is approximately $2.9 million. Concurrent with the

acquisition, PW JKL entered into a 20-year “triple-net” lease (the

“JKL Lease”) with JKL2 Inc. (“JKL”) which will operate a cannabis

cultivation facility. The rent for the JKL Lease is structured

whereby after an eighth-month free-rent period, the rental payments

provide Power REIT a full return of invested capital over the next

three years in equal monthly payments. The JKL Lease is structured

to provide an annual straight-line rent of approximately $546,000,

representing an estimated yield on costs of over 18%. |

| |

|

|

| |

● |

On June 11, 2021, through a newly formed wholly owned subsidiary,

PW CO CanRE Vinita, LLC, (“PW Vinita”), we purchased a 9.35-acre

property that includes approximately 40,000 square feet of

greenhouse space, 3,000 square feet of office space and 100,000

square feet of fully fenced outdoor growing space including hoop

houses (“Vinita Property”) approved for medical cannabis

cultivation in Craig County, OK for $2.1 million plus acquisition

costs. As part of the transaction, the Trust, agreed to fund

$550,000 to upgrade the facilities. Accordingly, PW Vinita’s total

capital commitment is approximately $2.65 million. Concurrent with

the acquisition, PW Vinita entered into a 20-year “triple-net”

lease (the “Vinita Lease”) with VinCann LLC (“VC LLC”) which will

operate a cannabis cultivation facility. The rent for the Vinita

Lease is structured whereby after a seven-month free-rent period,

the rental payments provide Power REIT a full return of invested

capital over the next three years in equal monthly payments. The

Vinita Lease is structured to provide an annual straight-line rent

of approximately $503,000, representing an estimated yield on costs

of over 18%. |

| |

|

|

| |

● |

On May 21, 2021, through a newly formed wholly owned subsidiary, PW

CO CanRE Walsenburg, LLC, (“PW Walsenburg”), we purchased a 35-acre

property that includes four greenhouses plus processing/auxiliary

facilities (“Walsenburg Property”) approved for medical cannabis

cultivation in Huerfano County, Colorado for $2.33 million plus

acquisition costs. As part of the transaction, the Trust will fund

approximately $1.6 million to upgrade the buildings and construct

additional greenhouse space resulting in 102,800 square feet of

greenhouse and related space. Accordingly, PW Walsenburg’s total

capital commitment is approximately $3.9 million. Concurrent with

the acquisition, PW Walsenburg entered into a 20-year “triple-net”

lease (the “Walsenburg Lease”) with Walsenburg Cannabis LLC (“WC”)

which will operate a cannabis cultivation facility. The rent for

the Walsenburg Lease is structured whereby after a sixth-month

free-rent period, the rental payments provide Power REIT a full

return of invested capital over the next three years in equal

monthly payments. The Walsenburg Lease is structured to provide an

annual straight-line rent of approximately $729,000, representing

an estimated yield on costs of over 18%. |

| |

|

|

| |

● |

On April 20, 2021, through a newly formed wholly owned subsidiary,

PW CO CanRE Cloud Nine, LLC, (“PW Cloud Nine”), we purchased two

properties totaling 4.0 acres of vacant land (“Cloud Nine

Property”) approved for medical cannabis cultivation in southern

Colorado for $300,000 plus acquisition costs. As part of the

transaction, we agreed to fund the immediate construction of an

approximately 38,440 square foot greenhouse and processing facility

for approximately $2.65 million. Accordingly, PW Cloud Nine’s total

capital commitment is approximately $2.95 million. Concurrent with

the acquisition, PW Cloud Nine entered into a 20-year “triple-net”

lease (the “Cloud Nine Lease”) with Cloud Nine LLC (“Cloud Nine”)

which will operate a cannabis cultivation facility. The rent for

the Cloud Nine Lease is structured whereby after a seven-month

free-rent period, the rental payments provide Power REIT a full

return on invested capital over the next three years in equal

monthly payments. The Cloud Nine Lease is structured to provide an

annual straight-line rent of approximately $553,000, representing

an estimated yield on costs of over 18%. |

| |

|

|

| |

● |

On March 12, 2021, through a newly formed wholly owned subsidiary,

PW CO CanRE Gas Station, LLC, (“PW Gas Station”), we purchased a

property totaling 2.2 acres of vacant land (“Gas Station Property”)

approved for medical cannabis cultivation in southern Colorado for

$85,000 plus acquisition costs. As part of the transaction, we

agreed to fund the immediate construction of an approximately

24,512 square foot greenhouse and processing facility for

approximately $2.03 million. Accordingly, PW Gas Station’s total

capital commitment is approximately $2.1 million. Concurrent with

the acquisition, PW Gas Station entered into a 20-year “triple-net”

lease (the “Gas Station Lease”) with The Gas Station, LLC (“Gas

Station”) which will operate a cannabis cultivation facility. The

rent for the Gas Station Lease is structured whereby after a

seven-month free-rent period, the rental payments provide Power

REIT a full return of invested capital over the next three years in

equal monthly payments. The Gas Station Lease is structured to

provide an annual straight-line rent of approximately $400,000,

representing an estimated yield on costs of over 18%. |

| |

|

|

| |

● |

On February 23, 2021, we amended the Grail Project Lease making

approximately $518,000 of more funds available to construct an

additional 6,256 square feet to the cannabis cultivation and

processing space. Once completed, our total capital commitment will

be approximately $2.4 million. As part of the agreement, PW Grail

and Grail Project have amended the Lease (“Grail Amended Lease”)

whereby after an eight-month period, the additional rental payments

provide PW Grail with a full return of its original invested

capital over the next three years and thereafter, provide a 12.9%

return increasing 3% per annum. The additional annual straight-line

rent of approximately $105,000 represents an estimated yield on

costs of over 18% over our investment. |

| |

|

|

| |

● |

On February 3, 2021, we acquired a property located in Riverside

County, CA (the “Canndescent Property”) through a newly formed

wholly owned subsidiary (“PW Canndescent”). The purchase price was

$7.685 million and we paid for the .85 acre property with $2.685

million cash on hand and the issuance of 192,308 shares of Power

REIT’s Series A Preferred Stock. PW Canndescent received an

assignment of a lease (the “Canndescent Lease”) to allow the tenant

(“Canndescent”) to operate the 37,000 square foot greenhouse

cultivation facility on the Canndescent Property. The rent for the

Canndescent Lease is structured to provide straight-line annual

rent of approximately $1,074,000. |

| |

|

|

| |

● |

On January 14, 2021, through a newly formed wholly owned

subsidiary, PW CO CanRE Apotheke, LLC, (“PW Apotheke”), we

completed the acquisition of a property totaling 4.31 acres of

vacant land (“Apotheke Property”) approved for medical cannabis

cultivation in southern Colorado for $150,000 plus acquisition

costs. As part of the transaction, we agreed to fund the immediate

construction of an approximately 21,548 square foot greenhouse and

processing facility for approximately $1.66 million. Accordingly,

PW Apotheke’s total capital commitment is approximately $1.81

million. Concurrent with the acquisition, PW Apotheke entered into

a 20-year “triple-net” lease (the “Apotheke Lease”) with Dom F, LLC

(“Dom F”) which will operate a cannabis cultivation facility. The

rent for the Apotheke Lease is structured whereby after an

eight-month free-rent period, the rental payments provide Power

REIT a full return of invested capital over the next three years in

equal monthly payments. After the 44th month, rent is structured to

provide a 12.9% return of the original invested capital with

increases of 3% rate per annum. The Apotheke Lease is structured to

provide an annual straight-line rent of approximately $342,000,

representing an estimated yield on costs of over 18%. |

| |

|

|

| |

● |

On January 4, 2021, through a newly formed wholly owned subsidiary,

PW CO CanRE Grail, LLC, (“PW Grail”), we completed the acquisition

of two properties totaling 4.41 acres of vacant land (“Grail

Properties”) approved for medical cannabis cultivation in southern

Colorado for $150,000 plus acquisition costs. As part of the

transaction, we agreed to fund the immediate construction of an

approximately 21,732 square foot greenhouse and processing facility

for approximately $1.69 million. Accordingly, PW Grail’s total

capital commitment is approximately $1.84 million. Concurrent with

the acquisition, PW Grail entered into a 20-year “triple-net” lease

(the “Grail Project Lease”) with The Grail Project LLC (“Grail

Project”) which will operate a cannabis cultivation facility. The

rent for the Grail Project Lease is structured whereby after a

six-month free-rent period, the rental payments provide Power REIT

a full return on invested capital over the next three years in

equal monthly payments. The Grail Project Lease is structured to

provide an annual straight-line rent of approximately $350,000,

representing an estimated yield on costs of over 18%. |

SUBSEQUENT EVENTS

On July 22, the Registrant declared a quarterly

dividend of $0.484375 per share on Power REIT’s 7.75% Series A

Cumulative Redeemable Perpetual Preferred Stock payable on

September 15, 2021 to shareholders of record on August 15,

2021.

PORTFOLIO

Power REIT’s portfolio currently comprises:

| |

● |

20 Controlled Environment

Agriculture (CEA) properties with totaling almost 533,000 square

feet; |

| |

● |

7 solar farm ground leases

totaling 601 acres; and |

| |

● |

112 miles of railroad

property. |

POWER REIT’S INVESTMENT

THESIS

Power REIT believes agricultural production is

ripe for technological transformation and the industry is in the

early stages of an agricultural venture capital boom that, among

other things, will shift production for certain crops from

traditional outdoor farms to Controlled Environment Agriculture

“plant factories.” Since a significant portion of any given CEA

enterprise is real estate, the Trust has identified a unique

opportunity to participate in the upward trend of indoor

agriculture.

CEA FOR CANNABIS

Power REIT is focused on investing in the

cultivation and production side of the cannabis industry through

the ownership of real estate. As such it is not directly in the

cannabis business and also not even indirectly involved with

facilities that sell cannabis directly to consumers. By serving as

a landlord, Power REIT believes it can generate attractive risk

adjusted returns related to the fast-growing cannabis industry,

which is anticipated to offer a safer approach than investing

directly in cannabis operating businesses.

CEA FOR FOOD

CEA for food production is widely adopted in

parts of Europe and is becoming an increasingly competitive

alternative to traditional farming for a variety of reasons. CEA

caters to consumer desires for sustainable and locally grown

products. Locally grown indoor produce will have a longer shelf

life as the plants are healthier and also travel shorter distances

thereby reducing food waste. In addition, a controlled environment

produces high-quality pesticide free products that eliminates

seasonality and provides highly predictable output that can be used

to simplify the supply chain to the grocer’s shelf.

STATEMENT ON

SUSTAINABILITYPower REIT owns real estate related to

infrastructure assets including properties for Controlled

Environment Agriculture (CEA Facilities), Renewable Energy and

Transportation.

CEA Facilities, such as

greenhouses, provide an extremely environmentally friendly

solution, which consume approximately 70% less energy than indoor

growing operations that do not benefit from “free” sunlight. CEA

facilities use 90% less water than field grown plants, and all of

Power REIT’s greenhouse properties operate without the use of

pesticides and avoid agricultural runoff of fertilizers and

pesticides. These facilities cultivate medical Cannabis, which has

been recommended to help manage a myriad of medical symptoms,

including seizures and spasms, multiple sclerosis, post-traumatic

stress disorder, migraines, arthritis, Parkinson’s disease, and

Alzheimer’s.

Renewable Energy assets are

comprised of land and infrastructure associated with utility scale

solar farms. These projects produce power with the use of fossil

fuels thereby lowering carbon emissions. The solar farms produce

approximately 50,000,000 kWh of electricity annually which is

enough to power approximately 4,600 home on a carbon free

basis.

Transportation assets are

comprised of land associated with a railroad, an environmentally

friendly mode of bulk transportation.

ABOUT POWER REIT

Power REIT is a specialized real estate

investment trust (REIT) that owns sustainable real estate related

to infrastructure assets including properties for Controlled

Environment Agriculture, Renewable Energy and Transportation. Power

REIT is actively seeking to expand its real estate portfolio

related to Controlled Environment Agriculture for the cultivation

of food and cannabis.

Power REIT is focused on the “Triple Bottom

Line” with a commitment to Profit, Planet and People.

Additional information about Power REIT can be

found on its website: www.pwreit.com

ADDITIONAL INFORMATION

Further details regarding Power REIT’s

consolidated results of operations and financial condition as of

and for the year ended December 31, 2020 are contained in the

Trust’s annual report on Form 10-K filed with the Securities and

Exchange Commission, which can be viewed at the Trust’s website at

www.pwreit.com under the Investor Relations section, and in

EDGAR on the SEC’s website, www.sec.gov.

FORWARD-LOOKING STATEMENTS

This document may contain forward-looking

statements within the meaning of the Securities Act of 1933, as

amended, and the Securities Exchange Act of 1934, as amended.

Forward-looking statements are those that predict or describe

future events or trends and that do not relate solely to historical

matters. You can usually identify forward-looking statements as

containing the words “believe,” “expect,” “will,” “anticipate,”

“intend,” “estimate,” “would,” “should,” “project,” “plan,”

“assume” or other similar expressions, or negatives of those

expressions, although not all forward-looking statements contain

these identifying words. All statements contained in this document

regarding Power REIT’s future strategy, future operations,

projected financial position, estimated future revenues and annual

run rate, projected costs, acquisition pipeline, future prospects

and growth from potential investments, the future of Power REIT’s

industries and results that might be obtained by pursuing

management’s current or future objectives are forward-looking

statements. While Power REIT believes these forward-looking

statements are reasonable, undue reliance should not be placed on

any such forward-looking statements, which are based on information

available to us on the date of this release. These forward-looking

statements are subject to various risks and uncertainties, many of

which are difficult to predict that could cause actual results to

differ materially from current expectations and assumptions from

those set forth or implied by any forward-looking statements.

Important factors that could cause actual results to differ

materially from current expectations include, among others, Power

REIT’s ability to implement its future strategy and achieve the

estimated future revenues, earnings, and Core FFO per share, as

planned, Power REIT’s ability to complete future acquisitions and

generate growth from the investments, as planned, Power REIT’s

ability to maintain compliance with the NYSE listing requirements,

and the other factors discussed in the Power REIT’s Annual Report

on Form 10-K for the year ended December 31, 2020 and Power REIT’s

subsequent filings with the SEC, including subsequent periodic

reports on Forms 10-Q and 8-K. The information in this release is

provided only as of the date of this release, and Power REIT

undertakes no obligation to update any forward-looking statements

contained in this release on account of new information, future

events, or otherwise, except as required by law.

Non-GAAP Financial Measures

This document contains supplemental financial

measures that are not calculated pursuant to U.S. generally

accepted accounting principles (“GAAP”), including the measure

identified by us as Core Funds From Operations Available to Common

Shares (“Core FFO”). Management believes that Core FFO is a useful

supplemental measure of the Trust’s operating performance.

Management believes that alternative measures of performance, such

as net income computed under GAAP, or Funds From Operations

computed in accordance with the definition used by the National

Association of Real Estate Investment Trusts (“NAREIT”), include

certain financial items that are not indicative of the results

provided by the Trust’s asset portfolio and inappropriately affect

the comparability of the Trust’s period-over-period performance.

These items include non-recurring expenses, such as those incurred

in connection with litigation, one-time upfront acquisition

expenses that are not capitalized under ASC-805 and certain

non-cash expenses, including non-cash, stock-based compensation

expense. Therefore, management uses Core FFO and defines it as net

income excluding such items. Management believes that, for the

foregoing reasons, these adjustments to net income are appropriate.

The Trust believes that Core FFO is a useful supplemental measure

for the investing community to employ, including when comparing the

Trust to other REITs that disclose similarly adjusted FFO figures,

and when analyzing changes in the Trust’s performance over time.

Readers are cautioned that other REITs may use different

adjustments to their GAAP financial measures than we do, and that

as a result the Trust’s Core FFO may not be comparable to the FFO

measures used by other REITs or to other non-GAAP or GAAP financial

measures used by REITs or other companies.

RECONCILIATION NET INCOME TO CORE

FFO

Management believes that Core FFO is a useful

supplemental measure of the Trust’s operating performance.

Management believes that alternative measures of performance, such

as net income computed 56 under GAAP, or Funds From Operations

computed in accordance with the definition used by the National

Association of Real Estate Investment Trusts (“NAREIT”), include

certain financial items that are not indicative of the results

provided by the Trust’s asset portfolio and inappropriately affect

the comparability of the Trust’s period-over-period performance.

These items include non-recurring expenses, such as those incurred

in connection with litigation, one-time upfront acquisition

expenses that are not capitalized under ASC-805 and certain

non-cash expenses, including stock-based compensation expense

amortization and certain up front financing costs. Therefore,

management uses Core FFO and defines it as net income excluding

such items. Management believes that, for the foregoing reasons,

these adjustments to net income are appropriate. The Trust believes

that Core FFO is a useful supplemental measure for the investing

community to employ, including when comparing the Trust to other

REITs that disclose similarly adjusted FFO figures, and when

analyzing changes in the Trust’s performance over time. Readers are

cautioned that other REITs may use different adjustments to their

GAAP financial measures than Power REIT do, and that as a result,

the Trust’s Core FFO may not be comparable to the FFO measures used

by other REITs or to other non-GAAP or GAAP financial measures used

by REITs or other companies.

CORE FUNDS FROM OPERATIONS

(FFO)(Unaudited)

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| Revenue |

|

$ |

2,267,848 |

|

|

$ |

975,122 |

|

|

$ |

4,088,775 |

|

|

$ |

1,762,510 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

1,539,695 |

|

|

$ |

479,753 |

|

|

$ |

2,647,823 |

|

|

$ |

731,840 |

|

| Stock-Based Compensation |

|

|

86,815 |

|

|

|

48,133 |

|

|

|

152,973 |

|

|

|

123,291 |

|

| Interest Expense -

Amortization of Debt Costs |

|

|

8,528 |

|

|

|

8,528 |

|

|

|

17,055 |

|

|

|

17,055 |

|

| Amortization of Intangible

Asset |

|

|

59,286 |

|

|

|

59,284 |

|

|

|

118,571 |

|

|

|

118,569 |

|

| Depreciation on Land

Improvements |

|

|

146,515 |

|

|

|

29,612 |

|

|

|

342,566 |

|

|

|

56,262 |

|

| Core FFO Available to

Preferred and Common Stock |

|

|

1,840,839 |

|

|

|

625,310 |

|

|

|

3,278,988 |

|

|

|

1,047,017 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred Stock Dividends |

|

|

(163,202 |

) |

|

|

(70,058 |

) |

|

|

(326,412 |

) |

|

|

(140,116 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core FFO Available to

Common Shares |

|

$ |

1,677,637 |

|

|

$ |

555,252 |

|

|

$ |

2,952,576 |

|

|

$ |

906,901 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average Shares

Outstanding (basic) |

|

|

3,312,001 |

|

|

|

1,912,939 |

|

|

|

3,033,751 |

|

|

|

1,906,126 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core FFO per Common

Share |

|

|

0.51 |

|

|

|

0.29 |

|

|

|

0.97 |

|

|

|

0.48 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Growth

Rates: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

133 |

% |

|

|

|

|

|

|

132 |

% |

|

|

|

|

| Net Income |

|

|

221 |

% |

|

|

|

|

|

|

262 |

% |

|

|

|

|

| Core FFO Available to Common

Shareholders |

|

|

202 |

% |

|

|

|

|

|

|

226 |

% |

|

|

|

|

| Core FFO per Common Share |

|

|

76 |

% |

|

|

|

|

|

|

102 |

% |

|

|

|

|

|

CONACT: |

|

|

David H. Lesser, Chairman & CEO |

Mary Jensen, Investor Relations |

|

dlesser@pwreit.com |

mary@irrealized.com |

|

212-750-0371 |

310-526-1707 |

|

|

|

| 301 Winding Road |

|

| Old Bethpage, NY 11804 |

|

| www.pwreit.com |

|

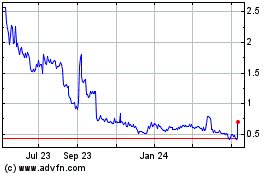

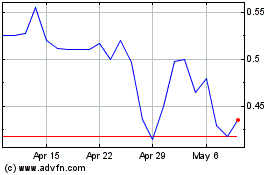

Power REIT (AMEX:PW)

Historical Stock Chart

From Jan 2025 to Feb 2025

Power REIT (AMEX:PW)

Historical Stock Chart

From Feb 2024 to Feb 2025