UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to § 240.14a-12

|

NOVABAY PHARMACEUTICALS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

No fee required

|

|

☒

|

Fee paid previously with preliminary materials

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

NOVABAY PHARMACEUTICALS, INC.

2000 Powell Street, Suite 1150

Emeryville, California 94608

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

|

Date:

|

Time:

|

Place:

|

|

Friday, November 22, 2024

|

11:00 a.m. Pacific Time

|

Virtual meeting at:

www.virtualshareholdermeeting.com/NBY2024SM

|

To the Stockholders of NovaBay Pharmaceuticals, Inc.:

You are cordially invited to attend the 2024 Special Meeting of Stockholders (the “Special Meeting”) of NovaBay Pharmaceuticals, Inc., a Delaware corporation (“NovaBay,” the “Company,” “we,” “our” and “us”). The Special Meeting will be a virtual meeting of stockholders. We encourage you to attend online and participate. You will not be able to attend the Special Meeting in person.

Stockholders may attend the Special Meeting online, vote their shares electronically, and submit questions during the Special Meeting by visiting www.virtualshareholdermeeting.com/NBY2024SM and entering the 16-digit control number included in their proxy card or the voting information form provided by their broker, bank, or other nominee. Prior to the Special Meeting, stockholders can vote at www.proxyvote.com using their 16-digit control number or by the other methods described in the accompanying proxy statement (the “Proxy Statement”). We recommend that you log in fifteen (15) minutes before 11:00 a.m. Pacific Time on November 22, 2024 to ensure you are logged in when the Special Meeting starts.

The Special Meeting will be held for the following purposes:

|

Proposal One:

(The Asset Sale Proposal)

|

To approve the sale of Avenova, representing substantially all of the assets of the Company (the “Asset Sale”), pursuant to the Asset Purchase Agreement dated September 19, 2024 (the “Asset Purchase Agreement”), by and between the Company and PRN Physician Recommended Nutriceuticals, LLC (“PRN”).

|

| |

|

|

Proposal Two:

(The Dissolution Proposal)

|

To approve the liquidation and dissolution of the Company (the “Dissolution”), pursuant to the Plan of Complete Liquidation and Dissolution of the Company (the “Plan of Dissolution”), which, if approved, will authorize the Company to liquidate and dissolve in accordance with the Plan of Dissolution, and pursuant to the discretion of the Board of Directors to proceed with the Dissolution.

|

| |

|

|

Proposal Three:

(The Adjournment Proposal)

|

To grant discretionary authority to our Board of Directors to adjourn the Special Meeting from time to time, if necessary or appropriate, to establish a quorum or, even if a quorum is present, to permit further solicitation of proxies if there are not sufficient votes cast at the time of the Special Meeting in favor of Proposal One and/or Proposal Two.

|

Proposal One (the Asset Sale Proposal), Proposal Two (the Dissolution Proposal), and Proposal Three (the Adjournment Proposal) are collectively referred to as the “Proposals”.

After careful consideration, the NovaBay Board of Directors has determined that the Proposals are advisable and in the best interests of NovaBay and its stockholders and recommends that the holders of the Company’s common stock entitled to vote at the Special Meeting on each of the Proposals vote or give instruction to vote “FOR” Proposal One, “FOR” Proposal Two and “FOR” Proposal Three.

The Proposals, as well as the proposed Asset Sale and the proposed Dissolution, and the related determinations of our Board of Directors in connection with its evaluation of the Asset Sale, the Asset Purchase Agreement, the Plan of Dissolution and the Dissolution, are described in the accompanying Proxy Statement. A copy of the Asset Purchase Agreement is attached as Annex A to the Proxy Statement, a copy of the fairness opinion delivered to the Board of Directors of the Company in connection with the Asset Sale is attached as Annex B and a copy of the Plan of Dissolution is attached as Annex C to the Proxy Statement. In particular, we urge you to read the Proxy Statement, the Asset Purchase Agreement and the Plan of Dissolution carefully in their entirety as they contain important information about the Asset Sale and the Dissolution and how both affect you as a stockholder.

The record date for the Special Meeting is October 15, 2024. Only stockholders of record at the close of business on that date are entitled to notice of, and may vote at, the virtual Special Meeting or any adjournment thereof. This Notice of Special Meeting and the accompanying Proxy Statement are being distributed and being made available on or about October 16, 2024.

A list of stockholders entitled to vote at the Special Meeting will be available at NovaBay Pharmaceuticals, Inc., 2000 Powell Street, Suite 1150, Emeryville, California 94608, for a period of ten days prior to the Special Meeting. If you wish to inspect the stockholder list, please contact our Corporate Secretary at (510) 899-8800. The stockholder list will also be available during the virtual Special Meeting through the following secure link www.virtualshareholdermeeting.com/NBY2024SM.

|

October 16, 2024

|

|

|

By Order of the Board of Directors,

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

Paul E. Freiman

Chair of the Board

|

|

|

You are cordially invited to attend, via live webcast, the virtual Special Meeting. Your vote is important. We encourage you to promptly vote your shares either by telephone, over the Internet or by completing, signing, dating and returning your proxy card, which contains instructions on how you would like your shares to be voted at the Special Meeting. Please submit your vote by proxy through one of these methods regardless of whether you will attend the Special Meeting. This will help us ensure that your shares are represented at the Special Meeting. A return envelope (which is postage prepaid if mailed in the United States) has been provided for your convenience if you plan to return your proxy card. Signing and submitting your proxy will not prevent you from voting electronically at the virtual Special Meeting should you be able to attend the virtual Special Meeting, but will assure that your vote is counted, if for any reason you are unable to attend. Voting instructions are printed on your proxy card and are also included in the accompanying Proxy Statement.

|

Neither the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Asset Sale or the Dissolution, passed upon the merits of the Asset Sale or the Dissolution, or passed upon the adequacy or accuracy of the information contained in the accompanying Proxy Statement and any documents incorporated by reference. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

| |

Page

|

| |

|

|

SUMMARY OF THE PROXY STATEMENT

|

1

|

| About NovaBay |

1 |

| Background for the Asset Sale and the Dissolution |

1 |

| Summary Term Sheet: Proposal One (The Asset Sale Proposal) |

2 |

| Summary: Proposal Two (The Dissolution Proposal) |

6 |

| Summary: Proposal Three (The Adjournment Proposal) |

9 |

| Summary: The Special Meeting |

9 |

| QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING |

11 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

19

|

| RISK FACTORS |

20 |

| General Risks Related to the Asset Sale and the Dissolution |

20 |

| Risks Related to the Asset Sale |

22 |

| Risks Related to the Dissolution |

23 |

| THE SPECIAL MEETING |

27

|

| Purpose of Meeting |

27 |

| Attendance at the Special Meeting |

27 |

| Voting; Quorum |

27 |

| Required Votes and Effects of Abstentions and Broker Non-Votes |

27 |

| Effect of Not Voting |

28 |

| Voting Methods |

29 |

| Revoking Proxies |

29 |

| Solicitation |

30 |

| Results of Voting at the Special Meeting |

30 |

| MATTERS TO BE CONSIDERED AT THE SPECIAL MEETING |

31 |

|

PROPOSAL ONE: THE ASSET SALE PROPOSAL

|

31

|

| General |

31 |

| The Parties to the Asset Sale |

31 |

| Summary of Key Deal Terms of the Asset Purchase Agreement |

32 |

| Background for the Asset Sale and the Dissolution |

32 |

| Reasons for the Asset Sale |

35 |

| Fairness of the Asset Sale: Opinion of Hemming Morse |

38 |

| Principal Terms and Conditions of the Asset Purchase Agreement |

45 |

| Accounting Treatment of the Asset Sale |

54 |

| No Appraisal Rights in Respect of the Asset Sale |

54 |

| Certain U.S. Federal Income Tax Consequences of the Asset Sale |

54 |

| Stockholder Approval of the Asset Sale |

54 |

| Unanimous Recommendation of the Board of Directors |

54 |

|

PROPOSAL TWO: THE DISSOLUTION PROPOSAL

|

55

|

| General |

55 |

| Summary of the Dissolution |

55 |

| Background for the Dissolution |

56 |

| Reasons for the Dissolution |

56 |

| Dissolution Under Delaware Law |

57 |

| Principal Terms and Conditions of the Plan of Dissolution |

60 |

| Estimated Liquidating Distributions |

63 |

| Contingency Reserve |

64 |

| Reporting Requirements & Cessation of Trading of Common Stock |

65 |

| Regulatory Approvals |

65 |

| Accounting Treatment of the Dissolution |

65 |

| No Appraisal Rights in Respect of the Asset Sale |

65 |

| Certain U.S. Federal Income Tax Consequences of the Dissolution |

65 |

| Stockholder Approval of the Dissolution |

67 |

| Unanimous Recommendation of the Board of Directors |

67 |

| INTERESTS OF DIRECTORS AND EXECUTIVE OFFICERS IN THE APPROVAL OF THE ASSET SALE AND PLAN OF DISSOLUTION |

68 |

| Continuing Service and Compensation of our Directors |

68 |

| Equity Ownership |

68 |

| Indemnification and Insurance |

68 |

|

PROPOSAL THREE: THE ADJOURNMENT PROPOSAL

|

69

|

| Overview |

69 |

| Stockholder Approval of the Adjournment Proposal |

69 |

| Unanimous Recommendation of the Board of Directors |

69 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

70 |

| ADDITIONAL INFORMATION |

71 |

| Description of Business |

71 |

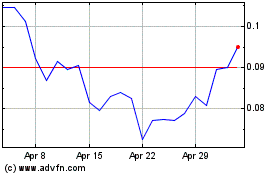

| Market Price and Dividend Data |

71 |

| Deadlines for Receipt of Future Stockholder Proposals and Nominations for Our 2025 Annual Meeting |

71 |

| Householding of Proxy Materials |

72 |

| Method of Proxy Solicitation |

73 |

| Where You Can Find More Information; Incorporation by Reference |

73 |

| Other Business |

74 |

| |

|

|

ANNEX A - ASSET PURCHASE AGREEMENT BETWEEN NOVABAY PHARMACEUTICALS, INC. AND PRN PHYSICIAN RECCOMENDED NUTRICEUTICALS, LLC, DATED AS OF SEPTEMBER 19, 2024

|

A-1

|

| ANNEX B - FAIRNESS OPINION OF HEMMING MORSE, LLC |

B-1 |

| ANNEX C - PLAN OF COMPLETE LIQUIDATION AND DISSOLUTION OF NOVABAY PHARMACEUTICALS, INC. |

C-1 |

2000 Powell Street, Suite 1150

Emeryville, California 94608

PROXY STATEMENT

FOR THE 2024 SPECIAL MEETING OF STOCKHOLDERS

This proxy statement (“Proxy Statement”), the accompanying Notice of the Special Meeting of Stockholders and proxy card are being furnished in connection with the solicitation of proxies by the Board of Directors of NovaBay Pharmaceuticals, Inc., a Delaware corporation (“NovaBay,” the “Company,” “we,” “our,” or “us”), to be voted at the 2024 Special Meeting of Stockholders to be held on Friday, November 22, 2024 (the “Special Meeting”), and at any adjournment or postponement of the Special Meeting. This Special Meeting will be held at 11:00 a.m. Pacific Time and will be a virtual meeting of stockholders. You will be able to participate in the 2024 Special Meeting, vote, and submit your questions during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/NBY2024SM. You must have your 16-digit control number on your proxy card to enter and participate in the virtual meeting. This Proxy Statement and the accompanying proxy card are being made available over the Internet or delivered by mail on or about October 16, 2024, to stockholders of record as of October 15, 2024 (the “Record Date”).

This Proxy Statement is available for viewing, printing and downloading by following the instructions at www.proxyvote.com.

SUMMARY OF THE PROXY STATEMENT

The following is a summary of selected information contained in this Proxy Statement for the Special Meeting relating to the Asset Purchase Agreement, the Asset Sale, the Plan of Dissolution and the Dissolution (each as defined below) and does not contain all the information that is important to you. For a more complete description of the terms of the Asset Sale and the related Asset Purchase Agreement and the Dissolution and the related Plan of Dissolution, please refer to the sections titled “Proposal One: The Asset Sale Proposal” and “Proposal Two: The Dissolution Proposal,” beginning on pages 31 and 55 of this Proxy Statement, respectively, and the Asset Purchase Agreement itself, a copy of which is included as Annex A to this Proxy Statement, and the Plan of Dissolution itself, a copy of which is included as Annex C to this Proxy Statement. We urge you to carefully read this Proxy Statement, the annexes to this Proxy Statement and the documents referred to or incorporated by reference in this Proxy Statement in their entirety before you decide whether to vote to approve the Asset Sale and the Dissolution. The below summary includes page references directing you to a more complete description of the related topic.

About NovaBay

NovaBay is focused on the development and sale of scientifically-created and clinically-proven eyecare and wound care products. Our leading product, Avenova® Lid and Lash Solution, or Avenova Spray, is proven in laboratory testing to have broad antimicrobial properties as it removes foreign material including microorganisms and debris from the skin around the eye, including the eyelid. NovaBay was originally incorporated as a California corporation on January 19, 2000, and converted to a Delaware corporation in June 2010. Our principal assets, product offerings and business primarily consist of the Avenova products, assets and business (collectively, the “Avenova Business”). Our common stock is listed on the NYSE American under the ticker symbol “NBY”. NovaBay’s principal executive offices are located at 2000 Powell Street, Suite 1150, Emeryville, California 94608, and our telephone number is (510) 899-8800. Our website address is www.novabay.com.

Background for the Asset Sale and the Dissolution (page 32)

Over NovaBay’s corporate history, and in particular in recent years, we have faced meaningful operational and financial challenges. Since 2022, based on the amount of capital and liquidity available for continuing operations, NovaBay has publicly disclosed in its periodic filings with the Securities and Exchange Commission (the “SEC”) that its planned operations raised substantial doubt about its ability to continue as a going concern. We have worked diligently to fund our operations over the years through capital raise transactions, including our most recently completed public offering of NovaBay common stock and common stock warrants that closed in July 2024, a warrant reprice transaction completed in June 2024 and the divestiture of our former subsidiary, DERMAdoctor, LLC (“DERMAdoctor”) in March 2024. While the capital raised in these recent transactions resulted in proceeds that were important to maintaining our operations to date, such amounts are not sufficient to continue to fund our current operations beyond the fourth quarter of 2024. As a result of the imminent need for capital in the near term and capital raise transactions having become increasingly complex and difficult to identify and close, we have continued to evaluate our current business plan and our overall strategic direction, including a potential divestiture of certain businesses or product lines and related assets. After diligently evaluating our strategic options available to us in the near- and long-term, and our current cash position, and in an effort to maximize stockholder value, NovaBay’s Board of Directors (the “Board of Directors”) has determined that it is in the best interests of stockholders to seek a divestiture of the Avenova Business, which represents substantially all of the assets of NovaBay, pursuant to the Asset Purchase Agreement (as defined below) (the “Asset Sale”), which is subject to stockholder approval at this Special Meeting pursuant to Proposal One of this Proxy Statement, which contains more information that will be important for you to consider. On September 25, 2024, NovaBay received a non-binding Alternative Unsolicited Offer (as defined and described in “Proposal One: The Asset Sale—Background for the Asset Sale and the Dissolution”), which the Board of Directors is currently continuing to evaluate in accordance with the terms and specific procedures of the Asset Purchase Agreement (as summarized in “Proposal One: The Asset Sale Proposal—Principal Terms and Conditions of the Asset Purchase Agreement—Acquisition Proposals”). Notwithstanding the receipt of the Alternative Unsolicited Offer, the Board of Directors continues to support the Asset Sale, believes it is in the best interests of the Company and its stockholders and unanimously recommends stockholders approve the Asset Sale pursuant to Proposal One of this Proxy Statement.

In connection with the Asset Sale, the Board of Directors further considered what would be in the best interests of stockholders after the Asset Sale if it is approved by stockholders and completed, or, alternatively, if the Asset Sale is ultimately not able to be completed. After consideration of various factors, including the significantly reduced and remaining business, assets, revenue and operating expenses, if the Asset Sale is completed and the absence of viable strategic options/transactions available to us particularly due to the Company’s current cash available for operations, the Board of Directors has determined that the best opportunity available to optimize value to our stockholders following the consummation of the Asset Sale is to wind-up the affairs of NovaBay and pursue a liquidation and dissolution of NovaBay under Delaware law that will ultimately result in distribution to our stockholders of our remaining asset value, if any (the “Dissolution”). The Dissolution is subject to stockholder approval at this Special Meeting and is the subject of Proposal Two of this Proxy Statement, which contains more information that will be important for you to consider.

See “Proposal One: The Asset Sale Proposal—Background for the Asset Sale and the Dissolution” for additional detail regarding the Board of Directors’ consideration of the Asset Sale, including the Alternative Unsolicited Offer, and the Dissolution and related negotiation with respect to the Asset Sale.

Summary Term Sheet: Proposal One (The Asset Sale Proposal) (page 31)

At the Special Meeting, we are asking our stockholders to authorize and approve the Asset Sale pursuant to the Asset Purchase Agreement, dated September 19, 2024 (the “Asset Purchase Agreement”), by and between NovaBay and PRN Physician Recommended Nutriceuticals, LLC (“PRN”). Our Board of Directors unanimously recommends that you vote “FOR” Proposal One to approve the Asset Sale.

Buyer in the Asset Sale (page 31)

PRN owns and operates several brands focused on the eyecare industry. PRN partners with ophthalmologists and optometrists to provide patients with specialty oral supplements to support long-term ocular health. Importantly, PRN is an industry leader with a leading physician recommended nutraceutical dry eye product and a synergistic business model to the Avenova Business. PRN was formed as a Delaware limited liability company on July 2, 2014. Its principal executive offices are located at 960 Harvest Drive, Suite B205, Blue Bell, Pennsylvania 19422. Its telephone number is (844) 776-4968 and its website address is www.prnvision.com.

Reasons for the Asset Sale (page 35)

Our Board of Directors believes that effecting the Asset Sale pursuant to the Asset Purchase Agreement is advisable and in the best interests of NovaBay and its stockholders and unanimously approved the Asset Sale, including the Asset Purchase Agreement and the contemplated transactions. In reaching its decision to approve the Asset Sale, our Board of Directors, in consultation with Company management and its financial, accounting, legal and tax advisors, carefully considered, among other factors: (i) the terms of the Asset Purchase Agreement, including the Purchase Price (as defined below) and the requirement of stockholder approval to ensure the support of our stockholders, (ii) the Company’s familiarity with PRN and likelihood of completing the Asset Sale in a timely manner, (iii) the timing, viability and potential impact to our stockholders of the strategic alternatives potentially available to us before the Company runs out of cash and (iv) the risks, including the potential for bankruptcy if the Asset Sale is not completed in a timely manner and the other risks described in the section titled “Risk Factors” beginning on page 20 of this Proxy Statement. For additional information on the material factors considered by our Board of Directors in reaching its recommendation, please refer to the section titled “Proposal One: The Asset Sale Proposal—Reasons for the Asset Sale.”

Vote Required

The affirmative vote of the holders of a majority of the outstanding shares of common stock as of the Record Date is required for approval of Proposal One.

Asset Sale Cash Consideration (page 47), Net Working Capital Adjustment (page 47) and Escrow (page 47)

On September 19, 2024, we entered into the Asset Purchase Agreement with PRN. If the Asset Sale is approved by our stockholders at the Special Meeting and the other conditions to closing set forth in the Asset Purchase Agreement are satisfied or waived, PRN will purchase the Avenova Business and assume specified Assumed Liabilities (as defined in the Asset Purchase Agreement) of the Avenova Business for $9.5 million in cash, subject to a net working capital adjustment (the “Net Working Capital Adjustment”) after the closing of the Asset Sale to PRN (the “Closing”) which adjustment, if any, is payable by either party with the Net Working Capital Adjustment limited to an upward or downward adjustment of up to $500,000 (the “Purchase Price”). NovaBay will not sell in this transaction the business or the assets that primarily relate to its wound care, urology or dermatology businesses.

At the Closing, a portion of the Purchase Price in the amount of $500,000 (the “Escrow”) will be placed into escrow for a period of six (6) months for any post-Closing indemnification obligations of NovaBay under the Asset Purchase Agreement or for any payment by NovaBay to PRN as a result of the Net Working Capital Adjustment. On the six (6) month anniversary of the Closing, the escrow agent will release to NovaBay the remaining balance of the Escrow that has not been distributed to PRN to satisfy any Net Working Capital Adjustment or indemnified losses, except that the escrow agent will retain some or all of the escrow amount to the extent necessary to satisfy unresolved claims for indemnification, if any.

A copy of the Asset Purchase Agreement is attached as Annex A to this Proxy Statement. We encourage you to read the Asset Purchase Agreement carefully and in its entirety as it is the legal document that governs the Asset Sale.

Opinion of Hemming Morse (page 38)

On September 12, 2024, Hemming Morse, LLC (“Hemming Morse”) delivered its oral opinion to our Board of Directors, which was subsequently confirmed in writing on September 19, 2024, that, as of that date and based upon and subject to the various assumptions made, procedures followed, matters considered and qualifications and limitations on the scope of review undertaken by Hemming Morse as set forth in its written opinion, the consideration to be received by NovaBay in the Asset Sale pursuant to the Asset Purchase Agreement was fair to NovaBay from a financial point of view. As discussed above, the Purchase Price to be received by NovaBay is subject to the Net Working Capital Adjustment, which may result in higher or lower proceeds to NovaBay, and an Escrow of $500,000 to be maintained in an escrow account and available to satisfy NovaBay’s indemnification obligations under the Asset Purchase Agreement or payment obligations to PRN as a result of the Net Working Capital Adjustment.

The full text of Hemming Morse’s written opinion to the Board of Directors, dated September 19, 2024, is attached as Annex B to this Proxy Statement and is hereby incorporated into this Proxy Statement by reference in its entirety. Holders of shares of NovaBay common stock should read the opinion in its entirety for a discussion of the review undertaken by Hemming Morse in rendering its opinion. This summary is qualified in its entirety by reference to the full text of such opinion. Hemming Morse’s opinion was directed to the Board of Directors for the purpose of the Board of Directors’ evaluation of the transactions contemplated by the Asset Purchase Agreement, and addressed only the fairness from a financial point of view, as of the date of the written opinion, of the consideration to be received by NovaBay pursuant to the Asset Purchase Agreement, which was determined through arm’s-length negotiations between us and PRN. Hemming Morse’s opinion does not address any other aspect of the Asset Sale and did not, and does not, constitute a recommendation to any stockholder of NovaBay as to how that stockholder should vote or act on any matter relating to the Asset Sale at this Special Meeting. Hemming Morse’s opinion does not express any opinion as to the value of our common stock or the prices at which our common stock will actually trade at any time.

Risk Factors Relating to the Asset Sale (page 20)

In considering whether to vote in favor of the Asset Sale, you should consider a number of risks and uncertainties, including, among others, that:

| |

●

|

Although NovaBay has been unprofitable to date, the Avenova Business that we propose to sell to PRN has, since 2015, been responsible for the majority of our revenue and without it, we will not be able to continue our operations.

|

| |

●

|

Although the NovaBay Board and management have negotiated and offered what it believes to be the best transaction outcome for stockholders and mitigated transaction risks to the best of their ability, there can be no guarantees that the Asset Sale will be completed and, if not completed, it would be very difficult for us to continue our business operations.

|

| |

●

|

Although we are working closely with PRN to ensure a smooth transition, while the Asset Sale is pending, it creates uncertainty about our future, which could materially and adversely affect our business, financial condition and results of operations.

|

| |

●

|

As a result of the Asset Sale, our common stock will likely be delisted from the NYSE American.

|

| |

●

|

Although our intent is to distribute remaining proceeds to stockholders as a part of our Dissolution, if approved by stockholders, we cannot guarantee that there will be remaining proceeds and specifically, you are not guaranteed any of the proceeds from the Asset Sale.

|

| |

●

|

We will incur significant expenses and effort in connection with the Asset Sale, regardless of whether the Asset Sale is completed.

|

| |

●

|

The Asset Purchase Agreement contemplates that PRN will obtain debt financing to fund the Purchase Price, and while PRN has obtained financing commitments from its debt financing sources, there is otherwise no guarantee that PRN will be able to complete such financing when all other Closing conditions for the Asset Sale have been satisfied.

|

| |

●

|

The Asset Purchase Agreement limits our ability to pursue alternatives to the Asset Sale.

|

| |

●

|

The Asset Purchase Agreement will expose us to contingent liabilities after the Closing of the Asset Sale that could have a material adverse effect on our financial condition and the amount of proceeds available (if any) in the Dissolution.

|

Principal Terms and Conditions of the Asset Purchase Agreement (page 45)

The Asset Sale will be conducted in accordance with the Asset Purchase Agreement. This summary may not contain all of the information that is important to you. You should carefully read this entire Proxy Statement, including “Proposal One: The Asset Sale—Principal Terms and Conditions of the Asset Purchase Agreement” and the Asset Purchase Agreement attached as Annex A to this Proxy Statement.

Transaction Structure (page 45). Pursuant to the Asset Purchase Agreement, PRN will purchase specified Purchased Assets (as defined below) and assume certain specified Assumed Liabilities (as defined below), all related primarily to our Avenova Business, for the Purchase Price of $9.5 million in cash (subject to the Net Working Capital Adjustment as described above). See “Proposal One: The Asset Sale—Principal Terms and Conditions of the Asset Purchase Agreement” for additional detail regarding the Purchased Assets and the Assumed Liabilities.

Representations and Warranties (page 48). Both NovaBay and PRN made certain representations and warranties to each other in the Asset Purchase Agreement, which are generally standard in a transaction of this nature and many of which contain knowledge qualifiers, materiality standards, references to our disclosure schedules or a material adverse effect standard. NovaBay’s representations and warranties in the Asset Purchase Agreement will survive Closing until: (i) sixty (60) days after the expiration of the applicable statute of limitations for certain fundamental representations (e.g., due authorization, tax matters, etc.) or (ii) twelve (12) months after the Closing for all other representations and warranties. Except for the representations and warranties contained in the Asset Purchase Agreement (as clarified by the disclosure schedules), neither NovaBay nor any other person has made any representation or warranty to PRN, on behalf of NovaBay, as to the Avenova Business.

PRN Financing for the Asset Sale (page 49). PRN will obtain debt financing in order to fund the payment of the Purchase Price, and prior to signing the Asset Purchase Agreement PRN delivered to NovaBay an executed commitment letter, by and among PRN and its affiliates, as co-borrowers, and Capital One National Association and CIBC Bank USA, as lenders, which obligates the lenders to fund such debt financing on the terms and subject to the conditions set forth therein and which does not include any due diligence contingencies. Capital One National Association and CIBC Bank USA are current lenders to PRN and have been since 2021. The Asset Purchase Agreement obligates PRN to use commercially reasonable efforts to obtain such debt financing as promptly as reasonably practicable prior to the Closing.

Conditions to the Closing (page 49). Each party’s obligation to effectuate the Asset Sale is subject to the satisfaction or waiver of the following conditions:

| |

●

|

The stockholders of NovaBay shall have approved the Asset Sale.

|

| |

●

|

All third-party or governmental approvals identified by the parties shall have been obtained.

|

| |

●

|

No governmental order shall be in place that makes the Asset Sale illegal or otherwise prohibits the transactions contemplated by the Asset Purchase Agreement.

|

PRN’s obligation to effectuate the Asset Sale is subject to the satisfaction or waiver of the following additional conditions:

| |

●

|

NovaBay’s representations and warranties shall generally be true and correct, with certain of those representations and warranties being subject to materiality and material adverse effect qualifications for purposes of satisfying this condition.

|

| |

●

|

We shall have complied in all material respects with all of our covenants in the Asset Purchase Agreement and other transaction documents.

|

| |

●

|

No material adverse effect shall have occurred after the date of the Asset Purchase Agreement that is continuing.

|

| |

●

|

No action shall have been threatened or commenced before any governmental authority prohibiting the Asset Sale or making it illegal.

|

| |

●

|

We shall have executed and/or delivered all applicable closing deliveries.

|

Our obligation to effectuate the Asset Sale is subject to the satisfaction or waiver of the following additional conditions:

| |

●

|

PRN’s representations and warranties shall generally be true and correct, except to the extent a failure to be true and correct does not prevent or materially delay the Closing of the Asset Sale.

|

| |

●

|

PRN shall have complied in all material respects with all of its covenants in the Asset Purchase Agreement and other transaction documents.

|

| |

●

|

PRN shall have executed and/or delivered all applicable closing deliveries.

|

Termination of the Asset Purchase Agreement (page 50). The Asset Purchase Agreement may be terminated at any time prior to the Closing as follows:

| |

●

|

by mutual written consent of NovaBay and PRN; or

|

| |

●

|

by either NovaBay or PRN if:

|

| |

o

|

any governmental order that is final and nonappealable prohibits the Asset Sale;

|

| |

o

|

the approval of the Asset Sale by our stockholders at the Special Meeting is not obtained (subject to certain exceptions); or

|

| |

o

|

if the Closing has not occurred by December 31, 2024 (the “Outside Date”) unless the party seeking the termination has breached the Asset Purchase Agreement and such breach is a substantial cause of the Closing not occurring by such date.

|

| |

o

|

any of NovaBay’s representations and warranties become inaccurate or NovaBay breaches the Asset Purchase Agreement and cannot complete the Closing conditions, and NovaBay is not able to cure such inaccuracies or breach within 30 days of PRN notifying NovaBay (though PRN is not able to terminate for such reason if PRN is in material breach of any of its covenants under the Asset Purchase Agreement); or

|

| |

o

|

after signing the Asset Purchase Agreement and prior to receiving stockholder approval of the Asset Sale Proposal (as defined below), the Board of Directors effects an Adverse Recommendation Change (as defined and described below).

|

| |

o

|

any of PRN’s representations and warranties become inaccurate or PRN breaches the Asset Purchase Agreement and cannot complete the Closing conditions, and PRN is not able to cure such inaccuracies or breach within 30 days of NovaBay notifying PRN (though NovaBay is not able to terminate for such reason if NovaBay is in material breach of any of its covenants under the Asset Purchase Agreement);

|

| |

o

|

prior to receiving stockholder approval of the Asset Sale Proposal, NovaBay agrees to a Superior Proposal (as defined in “Proposal One: The Asset Sale Proposal—Principal Terms and Conditions of the Asset Purchase Agreement—Acquisition Proposals”) in accordance with the process provided in the Asset Purchase Agreement and pays a termination fee of $500,000; or

|

| |

o

|

NovaBay has met all of its closing conditions under the Asset Purchase Agreement, notified PRN accordingly and PRN does not complete the Closing within three business days of such notice.

|

Termination Fees and Expenses (page 52). PRN will be entitled to receive a termination fee of $500,000 from NovaBay under specified circumstances that include (i) termination of the Purchase Agreement by the Company to enter into a definitive agreement with respect to a Superior Proposal, (ii) when NovaBay has effected an Adverse Recommendation Change or (iii) if there is an Acquisition Proposal (as defined in “Proposal One: The Asset Sale Proposal—Principal Terms and Conditions of the Asset Purchase Agreement—Acquisition Proposals”) and thereafter the Asset Purchase Agreement is terminated for specified reasons and NovaBay then consummates the Acquisition Proposal within 12 months of termination of the Asset Purchase Agreement. NovaBay is entitled to a termination fee of $500,000 from PRN if the closing conditions in the Purchase Agreement have been satisfied and PRN does not complete the Closing when required pursuant to the terms of the Asset Purchase Agreement. Except as expressly set forth in the Asset Purchase Agreement and the related transactions, all costs and expenses incurred in connection with the Asset Purchase Agreement will be paid by the party incurring such costs and expenses, whether or not the Asset Sale is completed.

No Solicitation of Other Offers (page 52). Under the Asset Purchase Agreement, NovaBay and its representatives are not permitted to, among other things:

| |

●

|

solicit, initiate, facilitate or knowingly encourage, or knowingly facilitate or induce any Acquisition Proposal;

|

| |

●

|

make available any non-public information regarding NovaBay to any person in connection with or in response to an Acquisition Proposal; or

|

| |

●

|

engage, facilitate or participate in discussions or negotiations with any person with respect to any Acquisition Proposal or acquisition inquiry.

|

Notwithstanding the restrictions described above, prior to receiving stockholder approval of the Asset Sale, NovaBay may furnish non-public information regarding NovaBay to, and enter into and maintain (but only during such period of time such Acquisition Proposal constitutes or is reasonably likely to result in a Superior Proposal) discussions or negotiations with, any person in response to an unsolicited, bona fide, written Acquisition Proposal that is submitted to NovaBay by such person, but only if: (i) such Acquisition Proposal did not result from a breach of any of the provisions set forth in the non-solicitation provisions; and (ii) the NovaBay Board of Directors determines in good faith, after consultation with its independent financial advisor and outside legal counsel, that such Acquisition Proposal constitutes or would reasonably likely expect to lead to a Superior Proposal. NovaBay agreed to provide PRN with written notice within 24 hours of receipt of any such Acquisition Proposal and its material terms and conditions. NovaBay has followed these procedures with respect to the Alternative Unsolicited Offer and has not made any determination with respect to whether or not the Alternative Unsolicited Offer would constitute a Superior Proposal, as further described in “Proposal One: The Asset Sale—Background for the Asset Sale and the Dissolution”.

Change in NovaBay’s Board Recommendation (page 52). Pursuant to the Purchase Agreement, the Board also agreed to recommend to Company stockholders that they approve the Asset Sale at a special meeting of stockholders and not change its recommendation or take certain other actions inconsistent with such recommendation (any such action, as defined more specifically in the Asset Purchase Agreement, an “Adverse Recommendation Change”); except that, the Board of Directors, in certain limited circumstances prior to stockholders approving the Asset Sale, may change its recommendation in response to a Qualifying Acquisition Proposal (as defined in “Proposal One: The Asset Sale Proposal—Principal Terms and Conditions of the Asset Purchase Agreement—Acquisition Proposals”) that constitutes a Superior Proposal. If PRN or NovaBay terminates the Asset Purchase Agreement under certain circumstances, including because the Board of Directors effects an Adverse Recommendation Change, then NovaBay will be required to pay PRN a termination fee of $500,000.

Indemnification (page 53). NovaBay and PRN have agreed to indemnify each other after the closing of the Asset Sale for losses sustained under certain circumstances, as more fully described in this Proxy Statement and the Asset Purchase Agreement.

Covenants and Agreements Related to the Asset Purchase Agreement (page 53). Pursuant to the Asset Purchase Agreement, we agreed to maintain the confidentiality of non-public information relating to the Avenova Business after the closing of the Asset Sale and for a period of five (5) years after the Asset Sale closing not to compete in the Avenova Business or invest or contract with a party who competes with the Avenova Business along with agreeing to specified non-solicitation obligations. In connection with the Asset Sale, we and PRN agreed to enter into at the closing of the Asset Sale (i) an Escrow Agreement to provide the Escrow to be maintained with an escrow agent and (ii) a transition services agreement (the “Transition Services Agreement”) pursuant to which NovaBay will provide PRN with certain accounting, marketing, administrative and other services following the closing of the Asset Sale.

Regulatory Approvals (page 65). Neither we nor PRN are aware of any regulatory requirements or governmental approvals or actions that may be required to consummate the Asset Sale, except for compliance with the applicable regulations of the SEC in connection with this Proxy Statement and our compliance with the rules of our exchange, the NYSE American LLC.

Summary: Proposal Two (The Dissolution Proposal) (page 55)

At the Special Meeting, we are asking our stockholders to authorize and approve the voluntary liquidation and dissolution of the Company pursuant to the Plan of Complete Liquidation and Dissolution of NovaBay (the “Plan of Dissolution”). Our Board of Directors unanimously recommends that you vote “FOR” Proposal Two to approve the Dissolution.

General Overview (page 55)

If NovaBay dissolves pursuant to the Plan of Dissolution, we will cease conducting our business, wind up our affairs, dispose of our non-cash assets, pay or otherwise provide for our obligations, and distribute our remaining assets, if any, during a post-dissolution period of at least three (3) years (or longer as the Delaware Court of Chancery shall in its discretion direct) (the “Survival Period”), as required by the Delaware General Corporation Law (the “DGCL”). Within the Survival Period and subject to the discretion of the Delaware Court of Chancery, we expect distributions to stockholders, if any, to occur in nine (9) to twelve (12) months after filing the Certificate of Dissolution with the Secretary of State of the State of Delaware (the “Secretary of State”), which we would plan to do as soon as practical following the Special Meeting and the closing of the Asset Sale (though the Board of Directors may delay such filing in its sole discretion). The effective time of the Dissolution (the “Effective Time”) will be when the Certificate of Dissolution is filed with the office of the Secretary of State or such later date and time that is stated in the Certificate of Dissolution (within ninety (90) days).

The Company intends to rely on the “safe harbor” procedures under Sections 280 and 281(a) of the DGCL to, among other things, obtain an order from the Delaware Court of Chancery establishing the amount and form of security for contested known, contingent and potential future claims that are likely to arise or become known within five (5) years of filing of the Certificate of Dissolution (or such longer period of time as the Delaware Court of Chancery may determine not to exceed ten years). The “safe harbor” procedures limit our stockholders’ liability from claims against NovaBay once dissolved and protects our directors from personal liability to NovaBay’s claimants once dissolved. See “Proposal Two: The Dissolution Proposal—Dissolution Under Delaware Law” beginning on page 57 of this Proxy Statement for a detailed description of the process under Delaware law to dissolve and liquidate a corporation.

If stockholders do not approve the Asset Sale or the Asset Sale is not otherwise completed, the Board will evaluate all strategic options available to the Company on the necessary timing before the Company’s operating cash runs out, which may include proceeding with the Dissolution (if the Dissolution Proposal (as defined below) is approved by stockholders) even if the Asset Sale is not first completed. If the Company does proceed with the Dissolution without first completing the Asset Sale, the Company can sell its assets, including the Avenova Business, as part of the Dissolution process. If our stockholders do not approve the Dissolution Proposal, we will continue our corporate existence and the Board of Directors will continue to explore alternatives for returning capital to stockholders in a manner intended to maximize value or, to the extent any viable alternatives are not available, the Company may need to file for bankruptcy protection or commence a similar state law proceeding.

Reasons for the Dissolution (page 56)

Our Board of Directors believes that effecting the Dissolution pursuant to the Plan of Dissolution is advisable and in the best interests of NovaBay and its stockholders and unanimously approved the Dissolution, including the Plan of Dissolution and the contemplated transactions. In reaching its decision to approve the Dissolution, our Board of Directors, in consultation with Company management and its financial, accounting, legal and tax advisors, carefully considered, among other factors: (i) the terms of the Plan of Dissolution, (ii) the Company’s recent capital raise transaction and limited opportunities for further financing, (iii) the timing, viability and potential impact to our stockholders of the strategic alternatives potentially available to us before the Company runs out of cash, and (iv) the risks, including the potential for bankruptcy if the Dissolution is not completed in a timely manner and the other risks described in the section titled “Risk Factors” beginning on page 20 of this Proxy Statement. For additional information on the material factors considered by our Board of Directors in reaching its recommendation, please refer to the section titled “Proposal Two: The Dissolution Proposal—Reasons for the Dissolution.”

Vote Required

The affirmative vote of the holders of a majority of the outstanding shares of common stock as of the Record Date is required for approval of Proposal Two.

Principal Terms and Conditions of the Plan of Dissolution (page 60)

The Dissolution will be conducted in accordance with the Plan of Dissolution. This summary may not contain all of the information that is important to you. You should carefully read this entire Proxy Statement, including “Proposal Two: The Dissolution—Principal Terms and Conditions of the Plan of Dissolution” and the Plan of Dissolution attached as Annex C to this Proxy Statement.

Survival Period (page 60). During the Survival Period, we will continue as a corporate entity for the limited purpose of prosecuting and defending suits by or against us and enabling us to settle and close our business and dispose of and distribute our remaining assets. We will no longer engage in any business activities, except to the extent deemed necessary to preserve the value of the Company’s assets, comply with all laws and regulatory requirements, wind up the Company’s business affairs and distribute the Company’s assets in accordance with the Plan of Distribution.

Continuing Employees and Consultants (page 61). During the Survival Period, we may hire or retain employees, consultants and advisors (including legal counsel, accountants and financial advisors), as the Board of Directors deems necessary or desirable, from time to time, to supervise or facilitate the Dissolution and winding up of the Company, and may pay such individuals for such services in the Board of Directors’ discretion. After filing the Certificate of Dissolution, the Board of Directors expects it will reduce the size of the Board of Directors and reduce its employees to only those necessary to wind-up the Company.

Sale, Exchange, or Disposition of Our Remaining Assets (page 61). The Plan of Dissolution allows for the disposition of all of our remaining assets (which includes our wound care, urology or dermatology businesses, and the Avenova Business to the extent the Asset Sale is not completed prior to the Dissolution), without further stockholder approval. The proceeds of any such sale, including the Asset Sale, will be paid out to our stockholders, pursuant to the Plan of Dissolution and as permitted by the DGCL. We do not anticipate soliciting any further stockholder votes to approve the specific terms of any particular sales or other dispositions of assets approved by the Board of Directors, as such approval is covered by the approval of the Plan of Dissolution.

Indemnification (page 61). We will continue to indemnify our officers, directors, employees, agents and trustees in accordance with, and to the extent required or permitted by, the DGCL, our Amended and Restated Certificate of Incorporation, as amended (“Certificate of Incorporation”), our Bylaws, as amended and restated (the “Bylaws”), and any contractual arrangements. During the Survival Period, we plan to maintain the Company’s existing directors’ and officers’ liability insurance policy. The Board is authorized to obtain and maintain insurance as may be necessary to cover the Company’s indemnification obligations.

Legal Claims (page 62). As part of the Dissolution, we will defend any claims against us, or our current or former officers or directors, whether a claim exists before the Effective Time or is brought during the Survival Period. At our discretion, we may defend, prosecute, and/or settle any lawsuits, as applicable.

Unclaimed Distributions (page 62). If any distribution to a stockholder cannot be made (e.g., the stockholder cannot be located or for any other reason), the stockholder’s distribution will be transferred to the official of such state or other jurisdiction authorized by applicable law to receive the proceeds of the distribution. The proceeds of any such distribution will not revert to, or become the property of, us or any other stockholder.

Abandonment, Modifications and Amendments (page 62). To the extent the Dissolution Proposal is approved by our stockholders, our Board of Directors will have the right, as permitted by the DGCL, to modify, amend or abandon the Dissolution at any time before the Effective Time and terminate our Plan of Dissolution, without any action by our stockholders. Such discretion of the Board of Directors to amend the Plan of Dissolution includes no longer complying with the “safe harbor” process and dissolving and liquidating the Company under alternative processes under the DGCL.

A copy of the Plan of Dissolution is attached as Annex C to this Proxy Statement. We encourage you to read the Plan of Dissolution carefully and in its entirety as it is the legal document that governs the Dissolution.

Estimated Liquidating Distributions (page 63)

We intend to liquidate our cash assets and sell or dispose of our remaining non-cash assets (including the Company’s wound care business) for the best price available and to maximize the potential stockholder distribution amount as soon as reasonably practicable after the Effective Time. The amount of any contingency reserve established by the Board of Directors, and approved by the Delaware Court of Chancery, will be deducted before determining amounts available for distribution to stockholders. Based on the foregoing, we estimate that the aggregate amount of cash distributions to our stockholders will be in the range of $0.01 and $0.91 per share of common stock. Calculating such an estimate is inherently uncertain and requires that we make a number of assumptions regarding future events, many of which are unlikely to ultimately be true. Accordingly, you will not know the exact amount of any liquidating distributions you may receive as a result of the Plan of Dissolution when you vote on Proposal Two. You may receive no distribution at all.

Risk Factors Relating to the Dissolution (page 23)

In considering whether to vote in favor of the Dissolution, you should consider a number of risks and uncertainties, including, among others, that:

| |

●

|

We cannot assure you as to the amount of distributions, if any, to be made to our stockholders.

|

| |

●

|

We cannot predict the timing of the distributions to our stockholders, if any.

|

| |

●

|

The Board of Directors may determine not to proceed with the Dissolution.

|

| |

●

|

Our stockholders may be liable to our creditors for part or all of the amount received from us in our liquidating distributions if reserves are inadequate, subject to the stockholder protections provided by Delaware’s “safe harbor” process.

|

| |

●

|

If our stockholders vote against the Dissolution pursuant to the Plan of Dissolution, we may pursue other alternatives, but there can be no assurance that any of these alternatives would result in greater (or even equivalent) stockholder value than the proposed Dissolution, and any limited alternative we have may entail additional risks and costs (e.g., bankruptcy).

|

| |

●

|

Our stockholders will not be able to buy or sell shares of our common stock after we close our stock transfer books at the Effective Time of the Dissolution.

|

| |

●

|

Further stockholder approval will not be required in connection with the implementation of the Plan of Dissolution, including the sale or disposition of all or substantially all of the Company’s assets following the effective time of the Dissolution pursuant to the Plan of Dissolution.

|

Reporting Requirements & Cessation of Trading of Common Stock (page 65)

Whether or not the Dissolution is approved, we will have an obligation to continue to comply with the applicable reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) until we have exited from such reporting requirements. We plan to request that our common stock stop trading on the NYSE American at the Effective Time or as soon thereafter as is reasonably practicable and to initiate steps to exit from certain reporting requirements under the Exchange Act. This process may be protracted and require us to incur expenses that will reduce the amount available for distribution. We also expect to close our stock transfer books on or around the Effective Time and to discontinue recording transfers and issuing stock certificates at that time. Accordingly, it is expected that trading in our shares of common stock will cease on or very soon after the Effective Time.

Interests of NovaBay’s Directors and Executive Officers in the Asset Sale and the Dissolution (page 68)

Certain of our directors and executive officers may have interests in the Asset Sale and the Dissolution that are different from, or in addition to, your interests as a stockholder and that may create potential conflicts of interest. These interests include NovaBay’s obligations related to certain consulting and service arrangements and indemnifying and insuring our directors and officers as further described in “Interests of Directors and Executive Officers in the Approval of the Asset Sale and Plan of Dissolution” on page 68 of this Proxy Statement. As a result of these interests, NovaBay’s directors and executive officers could be more likely to recommend a vote in favor of the Asset Sale and the Dissolution than if they did not hold these interests, and may have reasons for doing so that are not the same as the interests of our other stockholders. Our Board of Directors was aware that these interests existed when it approved the Asset Sale and approved the Dissolution.

Certain U.S. Federal Income Tax Consequences of the Asset Sale and the Dissolution (page 54 and 65, respectively)

The Asset Sale and the Dissolution may have a variety of potential tax implications to the Company and its stockholders for U.S. federal income tax purposes as further described in “Proposal One: The Asset Sale Proposal—Certain U.S. Federal Income Tax Consequences of the Asset Sale” and “Proposal Two: The Dissolution Proposal —Certain U.S. Federal Income Tax Consequences of the Dissolution” on pages 54 and 65 of this Proxy Statement, respectively.

No Appraisal Rights in Respect of the Asset Sale or the Dissolution (page 54)

Neither Delaware law nor our Certificate of Incorporation provides for stockholder appraisal rights in connection with the Asset Sale or the Dissolution.

Summary: Proposal Three (The Adjournment Proposal) (page 69)

At the Special Meeting, we are asking our stockholders to grant discretionary authority to the Board of Directors to adjourn this Special Meeting, from time to time, if necessary or appropriate, to establish a quorum or, even if a quorum is present, to permit further solicitation of proxies if there are not sufficient votes cast at the time of the Special Meeting in favor of Proposal One and/or Proposal Two. Our Board of Directors unanimously recommends that you vote “FOR” Proposal Three.

Reasons for Approval of Proposal Three

If NovaBay fails to receive a sufficient number of votes to approve Proposal One, Proposal Two or establish a quorum for the Special Meeting or we do not receive a sufficient number of votes to approve Proposal One and/or Proposal Two, then we may adjourn or postpone the Special Meeting. The vote regarding adjournment or postponement of the Special Meeting will be disregarded if there are sufficient votes to approve Proposal One and Proposal Two.

Vote Required

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Special Meeting is required for approval of Proposal Three.

Summary: The Special Meeting (Page 1)

Date, Time and Place. The Special Meeting will be held virtually on Friday, November 22, 2024 at 11:00 a.m. Pacific Time. Stockholders may attend the Special Meeting online, vote their shares electronically, and submit questions during the Special Meeting by visiting www.virtualshareholdermeeting.com/NBY2024SM and entering the 16-digit control number included in their proxy card or the voting information form provided by their broker, bank, or other nominee. You will not be able to attend the Special Meeting in person.

Purpose. You will be asked to consider and vote upon the following proposals (with Proposal One, Proposal Two and Proposal Three collectively referred to as the “Proposals”):

|

Proposal One:

(the “Asset Sale Proposal”)

|

To approve the sale of Avenova, representing substantially all of the assets of the Company pursuant to the Asset Purchase Agreement.

|

| |

|

|

Proposal Two:

(the “Dissolution Proposal”)

|

To approve the liquidation and dissolution of NovaBay pursuant to the Plan of Dissolution, which, if approved, will authorize NovaBay to liquidate and dissolve in accordance with the Plan of Dissolution, and pursuant to the discretion of the Board of Directors to proceed with the Dissolution.

|

| |

|

|

Proposal Three:

(the “Adjournment Proposal”)

|

To grant discretionary authority to our Board of Directors to adjourn the Special Meeting from time to time, if necessary or appropriate, to establish a quorum or, even if a quorum is present, to permit further solicitation of proxies if there are not sufficient votes cast at the time of the Special Meeting in favor of Proposal One and/or Proposal Two.

|

Record Date and Quorum. You are entitled to vote at the Special Meeting if you owned shares of our common stock at the close of business on the record date of stockholders entitled to vote at the virtual Special Meeting, which is October 15, 2024. You will have one vote for each share of our common stock that you owned on the Record Date. As of the Record Date, there were 4,885,693 shares of our common stock issued, outstanding and entitled to vote at the Special Meeting. One-third of the shares of our common stock issued, outstanding and entitled to vote at the Special Meeting constitutes a quorum for the purpose of considering the Proposals.

Vote Required. The affirmative vote of the holders of a majority of the outstanding shares of our common stock is required to approve both the Asset Sale Proposal and the Dissolution Proposal. Approval for the Adjournment Proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the Special Meeting.

Voting and Proxies. Any stockholder of record entitled to vote at the Special Meeting may submit a proxy by returning the enclosed proxy card by mail, by voting via Internet or telephone, or by logging on and voting during our virtual Special Meeting using their 16-digit control number. If you hold your shares in “street name,” you should instruct your broker how to vote in accordance with the voting instruction card you will receive from your broker, bank or other nominee. The failure of any stockholder to submit a signed proxy card, to vote by Internet or telephone, or to vote in person at the virtual Special Meeting will have the same effect as a vote “AGAINST” both the proposal to approve the Asset Sale and the proposal to approve the Dissolution, but will not have an effect on the Adjournment Proposal. If you hold your shares in “street name,” the failure to instruct your broker, bank or other nominee how to vote your shares will have the same effect as a vote “AGAINST” both the Asset Sale Proposal and the Dissolution Proposal, but will not have an effect on the Adjournment Proposal. Your prompt cooperation is greatly appreciated. Stockholders voting at this Special Meeting on all three of the Proposals is very important to the future of NovaBay and the likelihood of receiving a return on your investment.

Revocability of Proxy. If you hold your shares in your name as a stockholder of record, you have the right to change or revoke your proxy at any time before the vote is taken at the Special Meeting in any of the following ways: (i) submitting another proxy on a later date via the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Special Meeting will be counted); (ii) attending the Special Meeting live via webcast and voting during the meeting (simply attending the virtual meeting will not, by itself, revoke your proxy); or (iii) sending a notice of revocation or another signed proxy card with a later date to our Corporate Secretary, Mr. Justin Hall, Esq., at our principal executive offices at 2000 Powell Street, Suite 1150, Emeryville, California 94608. If you hold your shares in “street name” through a broker, bank or other nominee, and you wish to change or revoke your proxy at any time before the vote is taken at the Special Meeting, please follow the directions received from your broker, bank or other nominee to change or revoke those instructions.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

The following questions and answers are intended to address briefly some possible questions regarding the Special Meeting, the Asset Sale Proposal and the Dissolution Proposal. These questions and answers may not address all questions that may be important to you as a stockholder of the Company. Please refer to the more detailed information contained elsewhere in this Proxy Statement, the annexes to this Proxy Statement and the documents referred to in this Proxy Statement. Also see “Where You Can Find More Information”, beginning on page 73.

Questions and Answers Related to the Special Meeting

|

Q:

|

Why am I receiving these proxy materials?

|

|

A:

|

We have sent you this Proxy Statement and the enclosed form of proxy card because our Board of Directors is soliciting your proxy to vote at the Special Meeting. You are invited to attend our virtual Special Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Special Meeting to vote your shares of common stock. Instead, you may simply complete, sign and return the enclosed proxy card, follow the instructions below to submit your proxy over the telephone or on the Internet, or follow the instructions received from your broker, bank or other nominee if you hold your shares of common stock in “street” name. Refer to “How do I vote?” below.

|

Under rules adopted by the SEC, we have mailed the full set of our proxy materials, including this Proxy Statement and the proxy card, to our stockholders of record as of the close of business on the Record Date of October 15, 2024, on or around October 16, 2024. The proxy materials are also available to view and download at www.proxyvote.com.

|

Q:

|

What do I need to do now?

|

|

A:

|

We urge you to carefully read and consider this entire Proxy Statement and the annexes to this Proxy Statement, along with all of the documents that we refer to in this Proxy Statement, as they contain important information about, among other things, the current financial condition of the Company, the efforts of the Board of Directors and the Company’s management to maximize stockholder value, and the Asset Sale Proposal and the Dissolution Proposal and how both affect you as a stockholder.

|

Even if you plan to attend the Special Meeting, if you hold your shares in your own name as the stockholder of record, please vote your shares by signing, dating and returning, as promptly as possible, the enclosed proxy card in the accompanying reply envelope, or grant your proxy electronically over the Internet or by telephone (using the instructions provided in the enclosed proxy card), so that your shares of common stock can be voted at the Special Meeting. If you hold your shares in “street name,” please refer to the voting instruction forms provided by your broker, bank or other nominee to vote your shares.

|

Q:

|

How do I attend and participate in the Special Meeting online?

|

|

A:

|

The Special Meeting will be a completely virtual meeting of stockholders. You will not be able to attend the Special Meeting in person. Stockholders attending the Special Meeting virtually will be afforded the same rights and opportunities to participate as they would at an in-person meeting. Any stockholder can attend the virtual Special Meeting live online at www.virtualshareholdermeeting.com/NBY2024SM. The webcast will start at 11:00 a.m. Pacific Time. Stockholders as of the Record Date may vote and submit questions while attending the Special Meeting online. If you encounter any difficulties accessing the virtual Special Meeting, please refer to the technical support information located at www.virtualshareholdermeeting.com/NBY2024SM.

|

In order to enter the Special Meeting, you will need the control number, which is included in your proxy materials if you are a stockholder of record of shares of common stock, or included with your voting instructions and materials received from your broker, bank or other nominee if you hold your shares of common stock in a “street name.” Instructions on how to attend and participate are available at www.virtualshareholdermeeting.com/NBY2024SM. We recommend that you log in fifteen (15) minutes before 11:00 a.m. Pacific Time to ensure you are logged in when the Special Meeting starts. The webcast will open fifteen (15) minutes before the start of the Special Meeting.

If you would like to submit a question during the Special Meeting, you may log in to www.virtualshareholdermeeting.com/NBY2024SM using your control number, type your question into the “Ask a Question” field, and click “Submit.”

|

Q:

|

When and where is the Special Meeting?

|

|

A:

|

The Special Meeting will be held virtually at www.virtualshareholdermeeting.com/NBY2024SM, on Friday, November 22, 2024 at 11:00 a.m. Pacific Time.

|

|

Q:

|

Who is entitled to vote at the Special Meeting?

|

|

A:

|

Only stockholders of the Company’s common stock held by such stockholder as of the close of business on the Record Date (October 15, 2024) are entitled to receive notice of the Special Meeting and to vote the shares of our common stock that they held at that time at the Special Meeting. On the Record Date, there were 4,885,693 shares of common stock outstanding and entitled to vote.

|

Stockholder of Record: Shares of Common Stock Registered in Your Name

If, on the Record Date, your shares of common stock were registered directly in your name with our transfer agent, Equinti Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote online during the Special Meeting or vote by proxy. Whether or not you plan to attend the Special Meeting, we urge you to vote by proxy to ensure your vote is counted. Refer to “How do I vote?” below.

Beneficial Owner: Shares of Common Stock Registered in the Name of a Broker, Bank or Other Agent

If, on the Record Date, your shares of common stock were held in an account at a broker, bank or other nominee, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to direct your broker, bank or other nominee regarding how to vote the shares in your account. You are also invited to attend the virtual Special Meeting. However, since you are not the stockholder of record, you may not vote your shares online during the Special Meeting unless you request and obtain a valid proxy from your broker, bank or other nominee.

|

Q:

|

What am I being asked to vote on at the Special Meeting?

|

|

A:

|

You will be asked to consider and vote upon the following proposals:

|

| |

1.

|

To approve the Asset Sale Proposal.

|

| |

2.

|

To approve the Dissolution Proposal.

|

| |

3.

|

To approve the Adjournment Proposal.

|

|

Q:

|

How does the Board of Directors recommend that I vote?

|

|

A:

|

The Board of Directors unanimously recommends that the stockholders vote:

|

| |

●

|

“FOR” the Asset Sale Proposal;

|

| |

●

|

“FOR” the Dissolution Proposal; and

|

| |

●

|

“FOR” the Adjournment Proposal.

|

You should read the sections titled “Proposal One: The Asset Sale Proposal—Reasons for the Asset Sale” beginning on page 31 of this Proxy Statement and “Proposal Two: The Dissolution Proposal — Reasons for the Dissolution” beginning on page 55 of this Proxy Statement for a discussion of the factors that our Board of Directors considered in deciding to recommend approval of the Asset Sale Proposal and the Dissolution Proposal.

In addition, when considering the recommendation of our Board of Directors, you should be aware that some of our directors and executive officers may have interests in the Asset Sale and the Dissolution that are different from, or in addition to, the interests of our stockholders more generally. For a discussion of these interests, please refer to the sections titled “Interests of Directors and Executive Officers in Approval of the Asset Sale and Plan of Dissolution” beginning on page 68 of this Proxy Statement.

|

A:

|

For each proposal, you may vote “FOR” or “AGAINST” or abstain from voting. The procedures for voting are described below.

|

Stockholder of Record: Shares of Common Stock Registered in Your Name

If you are a stockholder of record, you may vote online during the virtual Special Meeting, or you may vote by proxy using the enclosed proxy card. Whether or not you plan to attend the Special Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Special Meeting and vote online, even if you have already voted by proxy.

| |

●

|

To vote online during the Special Meeting, follow the provided instructions to join the Special Meeting at www.virtualshareholdermeeting.com/NBY2024SM, starting at 11:00 a.m. Pacific Time on November 22, 2024. The webcast will open 15 minutes before the start of the Special Meeting.

|

| |

●

|

To vote in advance of the Special Meeting through the Internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy card. Your Internet vote must be received by 11:59 p.m. Eastern Time on November 21, 2024 to be counted.

|

| |

●

|

To vote in advance of the Special Meeting by telephone, dial 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your telephone vote must be received by 11:59 p.m. Eastern Time on November 21, 2024 to be counted.

|

| |

●

|

To vote using the enclosed proxy card, complete, sign and date the enclosed proxy card and return it promptly in the accompanying postage-paid envelope. If you return your signed proxy card to us before the Special Meeting, we will vote your shares as you direct.

|

Beneficial Owner: Shares Common Stock Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares of common stock registered in the name of your broker, bank or other nominee, you should have received a voting instruction form with these proxy materials from that organization rather than from us. Complete and mail the voting instruction form to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet if so instructed by your broker, bank or other nominee. To vote online at the Special Meeting, you must obtain a valid proxy from your broker, bank or other nominee. Follow the instructions from your broker, bank or other nominee included with these proxy materials, or contact your broker, bank or other nominee to request a proxy form. Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions.

|

Q:

|

How many votes do I have?

|

|

A:

|

On each matter to be voted upon, you have one vote for each share of common stock you owned as of the close of business on the Record Date.

|

|

Q:

|

How many votes are needed to approve each proposal?

|

|

A:

|

Asset Sale Proposal — The affirmative vote of the holders of a majority of the voting power of all outstanding shares of our common stock entitled to vote at the Special Meeting is required to approve the Asset Sale Proposal. If you fail to authorize a proxy or vote online at the Special Meeting, abstain from voting at the Special Meeting, or fail to instruct your broker, bank or other nominee on how to vote, such failure will have the same effect as a vote cast “AGAINST” this proposal.

|