MILESTONE SCIENTIFIC AND SUBSIDIARIES

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e) (2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Milestone Scientific Inc.

(Name of Registrant as Specified in its Charter)

Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☑

|

No fee required.

|

| |

|

|

☐

|

Fee paid previously with preliminary materials

|

| |

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

Milestone Scientific Inc.

Notice of Annual Meeting of Stockholders

To be held on June 28, 2023

To the Stockholders of Milestone Scientific Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Meeting”) of Milestone Scientific Inc. (“Milestone” or the “Company”) will be held in a virtual-only meeting format conducted via live audio webcast located at www.virtualshareholdermeeting.com/MLSS2023 on June 28, 2023 at 9:00 a.m. (ET).

The following items are scheduled for consideration and action at the Meeting.

|

1.

|

Election of six (6) directors;

|

| |

|

|

2.

|

Approval of an amendment to the Company’s 2020 Equity Incentive Plan to increase the number of shares of Common Stock which may be issued from 4,000,000 shares to 11,500,000 shares.

|

| |

|

|

3.

|

Ratification of the appointment of Marcum LLP as the Company's independent auditors for the fiscal year ending December 31, 2023; and

|

| |

|

|

4.

|

Such other business as may legally come before the Meeting and any adjournments or postponements thereof.

|

The Board of Directors has fixed the close of business on May 8, 2023 as the record date for determining the stockholders having the right to notice of and to vote at the Meeting.

Attending the Virtual Meeting

As described in the proxy materials for the Meeting, you are entitled to attend and participate in the virtual Meeting if you were a stockholder of record as of the close of business on May 8, 2023, the record date, or if you hold a legal proxy for the Meeting provided by your bank, broker-dealer, or other similar organization. The accompanying proxy materials include instructions on how to participate in the Meeting and how to vote your shares of the Company’s stock in the Meeting.

Stockholders attending the Meeting will be in a listen-only mode. However, virtual attendees will be able to vote and submit questions during the Meeting using the virtual Meeting website.

Your vote is important. Whether or not you plan to attend the Meeting, you are encouraged to vote as soon as possible to ensure that your shares are represented at the Meeting.

Important Notice Regarding the Internet Availability of Proxy Material for the Annual Meeting of Stockholders to be Held on June 28, 2023 : This Proxy Statement, the Proxy Card, and our Annual Report for 2022 are available at: www.virtualshareholdermeeting.com/MLSS2023.

By order of the Board of Directors

Neil Goldman

Chairman of the Board

Roseland, New Jersey

May 1, 2023

IMPORTANT: Every stockholder, whether he or she expects to attend the Annual Meeting, is urged to execute the proxy and return it promptly in the enclosed business reply envelope. Sending in your proxy will not prevent you from voting your stock at the Annual Meeting if you desire to do so, as your proxy is revocable at your option. We would appreciate your giving this matter your prompt attention.

MILESTONE SCIENTIFIC INC.

PROXY STATEMENT

For Annual Meeting of Stockholders

To be Held on June 28, 2023

Proxies in the form enclosed with this statement are solicited by the Board of Directors (the “Board”) of Milestone Scientific Inc. (“we”, “us”, “our”, the “Company” or “Milestone Scientific”) to be used at the Annual Meeting of Stockholders (the “Annual Meeting”) and any adjournments thereof, to be held on a virtual on June 28, 2023 at 9:00 a.m., Eastern Time, for the purposes set forth in the Notice of Meeting and this Proxy Statement. The Board knows of no other business which will come before the Annual Meeting. This Proxy Statement and the accompanying proxy are being mailed to stockholders on or about May 26, 2023.

THE VOTING AND VOTE REQUIRED

Record Date and Quorum

Only stockholders of record at the close of business on May 8, 2023 (the “Record Date”) are entitled to notice of and vote at the Annual Meeting. On the Record Date, there were 69,998,525 outstanding shares of common stock, par value $.001 per share (“Common Stock”). Each share of Common Stock is entitled to one vote. Shares represented by each properly executed, unrevoked proxy received in time for the Annual Meeting will be voted as specified. A quorum will be present at the Annual Meeting if stockholders owning not less than one-third of the shares issued and outstanding on the Record Date are present at the meeting in person or by proxy.

Voting of Proxies

The persons acting as proxies pursuant to the enclosed proxy will vote the shares represented as directed in the signed proxy. Unless otherwise directed in the proxy, the proxyholders will vote the shares represented by the proxy: (i) for the election of the six (6) director nominees named in this Proxy Statement; (ii) for the increase in the number of shares of common stock which may be issued under the Company’s 2020 Equity Incentive Plan (iii) for the ratification of the appointment of Marcum LLP as Milestone Scientific’s independent auditors for the fiscal year ending December 31, 2023; and (iv) in the proxyholders’ discretion, on any other business that may come before the Annual Meeting and any adjournments thereof.

All votes will be tabulated by the Inspector of Elections appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions, and broker non-votes. Under Milestone Scientific’s Bylaws and Delaware law: (1) shares represented by proxies that reflect abstentions or “broker non-votes” (i.e., shares held by a broker or nominee that are represented at the Annual Meeting, but with respect to which such broker or nominee is not empowered to vote on a particular proposal) will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum; (2) there is no cumulative voting, and the director nominees receiving the highest number of votes, up to the number of directors to be elected, are elected and, accordingly, abstentions, broker non-votes and withholding of authority to vote will not affect the election of directors; (3) proxies that reflect abstentions will be treated as voted for purposes of determining approval of that proposal and will be counted as votes against that proposal; and (4) proxies that reflect broker non-votes will be treated as not voted for purposes of determining approval of that proposal and may, in some circumstances, be counted as votes against that proposal.

Voting Requirements

Election of Directors. The election of the director nominees will require a plurality of the votes cast on the matter at the Annual Meeting. With respect to the election of directors, votes may be cast in favor of or withheld with respect to each nominee. Votes that are withheld will be excluded entirely from the vote and will have no effect on the outcome of the vote.

Approval of an increase in the number of shares of common stock which may be issued under the Company’s 2020 Equity Incentive Plan. The affirmative vote of the majority of the votes cast at the Annual Meeting by stockholders entitled to vote at the Annual Meeting is required to approve this matter. An abstention will be treated as “present” for quorum purposes. Abstention's will have the same effect as an against vote on the matter and broker non-votes will have no effect on the matter.

Ratification of the appointment of Independent Auditors. The affirmative vote of a majority of the votes cast at the Annual Meeting by stockholders entitled to vote at the Annual Meeting is required to approve this matter. An abstention will be treated as “present” for quorum purposes. Abstention's will have the same effect as an against vote on the matter and broker non-votes will have no effect on the matter.

Revocability of Proxy. A proxy may be revoked by the stockholder giving the proxy at any time before it is voted by delivering oral or written notice to the Corporate Secretary of Milestone Scientific at or prior to the Annual Meeting, and a prior proxy is automatically revoked by a stockholder giving a subsequent proxy or attending and voting at the Annual Meeting. Attendance at the Annual Meeting in and of itself does not revoke a prior proxy.

Expenses of Solicitation. Milestone Scientific will pay the expenses of the preparation of proxy materials and the solicitation of proxies for the Annual Meeting. In addition to the solicitation of proxies by mail, solicitation may be made by certain directors, officers, or employees of Milestone Scientific telephonically, electronically or by other means of communication. Milestone Scientific will reimburse brokers and other nominees for costs incurred by them in mailing proxy materials to beneficial owners in accordance with applicable rules.

PROPOSAL 1

ELECTION OF DIRECTORS

(ITEM 1 ON THE PROXY CARD)

The Board currently consists of six directors: Neil Goldman, Leonard A. Osser, Gian Domenico Trombetta, Michael McGeehan, Benedetta I. Casamento, and Arjan Haverhals. Directors are elected for a term of one year and until the next Annual Meeting of Stockholders and until their successors are duly elected and qualified. The Nominating Committee (described below), with the concurrence of the Board, has nominated the present directors for re-election to the Board at the Annual Meeting.

It is intended that votes pursuant to the enclosed proxy will be cast for the election of the nominees named below. If any such nominee should become unable or unwilling to serve as a director, the proxy will be voted for the election of such person, if any, as shall be designated by the Board. Management has no reason to believe that any of these nominees will not be available to serve as a director if re-elected.

The following table sets forth the names and ages of each nominee, the positions, and the period during which each has served as a director of Milestone Scientific. Information as to the stock ownership of each nominee is set forth under “Security Ownership of Certain Beneficial Owners and Management.” All the director nominees have been approved and nominated by the Nominating Committee (described below), with the concurrence of the Board, for re-election to the Board.

The names, ages and titles of our directors and nominees, as of the Record Date, are as follows:

|

NAME

|

AGE

|

POSITION

|

DIRECTOR

SINCE

|

|

Neal Goldman (1) (2) (3)

|

79

|

Chairman of the Board

|

2019

|

|

Leonard Osser

|

75

|

Vice Chairman of the Board

|

1991

|

|

Jan Adriaan (Arjan ) Haverhals

|

60

|

President, Chief Executive Officer and Director

|

2023

|

|

Benedetta Casamento (1) (2) (3)

|

53

|

Director

|

2022

|

|

Gian Domenico Trombetta

|

62

|

Director

|

2014

|

|

Michael McGeehan (1) (2) (3)

|

57

|

Director

|

2017

|

1. Member of the Audit Committee

2. Member of the Compensation Committee

3. Member of the Nominating and Corporate Governance Committee

Recommendation of the Board

The Board recommends that the stockholders vote “FOR” the election of all the nominees as directors.

The principal occupations and brief summaries of the backgrounds, as of the Record Date, of the directors nominees are as follows:

Neal Goldman, Chairman of the Board

Neal Goldman has been a director of Milestone Scientific since 2019 and has served as Chairman of the Board since January 2023. Mr. Goldman is the President and Founder of Goldman Capital Management, Inc., a family office since 2018, which was previously an investment advisory firm founded in 1985. He was First Vice President of Research at Shearson Lehman Hutton. He has also held senior positions as a money manager and research analyst with a variety of firms including Neuberger Berman, Moseley Hallgarten Estabrook and Weeden, Bruns Nordeman, and Russ and Company. Mr. Goldman serves as Chairman of Charles & Colvard, Ltd. since 2016 and served on the board of Imageware Systems, Inc. until November 2020. He also serves on the board of Deep-Down Inc. Prior to their respective acquisitions, he served on the boards of Blyth Industries and IPASS Corporation. Mr. Goldman received his B.A. degree in Economics from The City University of New York (City College). Mr. Goldman’s professional experience and financial background have given him the expertise needed to serve as one of our directors.

Leonard Osser, Vice Chairman of the Board

Leonard Osser has been a director of Milestone Scientific since 1991 and has served as Milestone Scientific’s Vice Chairman of the Board since May 2021. Mr. Osser had been Interim Chief Executive Officer from December 2017 until May 2021. From July 2017 to December 2017, he had been Managing Director –China Operations. Prior to that, he served as Milestone Scientific’s Chairman from 1991 until September 2009, and during that time, from 1991 until 2007, was also Chief Executive Officer of Milestone Scientific. In September 2009, he resigned as Chairman of Milestone Scientific, but remained director, and assumed the position of Chief Executive Officer. From 1980 until the consummation of Milestone Scientific’s public offering in November 1995, Mr. Osser is the Managing Member of U.S. Asian Consulting Group, LLC, a New Jersey-based provider of consulting services specializing in distressed or turnaround situations in both the public and private markets. Mr. Osser also serves as a special consultant to the board of directors of Nexalin Technology, Inc. where he is also Managing Director of China Operations. Mr. Osser’s knowledge of our business and background with us since 1980 provides the Board with valuable leadership skills and insight into our business and accordingly, the expertise needed to serve as one of our directors.

Jan Adriaan (Arjan) Haverhals, President, Chief Executive Officer and Director

Arjan Haverhals has been Milestone Scientific's President since September 2020, Chief Executive Officer since May 2021 and has served as the President and Chief Executive Officer of Milestone Scientific’s Dental Division (Wand Dental Inc.) since June 2020. In January 2023, Mr. Haverhals was appointed to the Board. He brings more than 30 years of sales, marketing, product development, and international expansion experience within the medical device, pharmaceutical, and other industries. Prior to joining Wand Dental and Milestone Scientific, Mr. Haverhals was senior vice president of sales at Xcentric Mold & Engineering from 2019 until 2020 where he was instrumental in increasing sales productivity and efficiency for the company's prototype injection molding services, which included leading healthcare company clients. From 2012 until 2018, Mr. Haverhals worked at Straumann, LLC, a global leader in manufacturing medical and dental devices, where he held a series of senior sales and marketing roles including vice president of customer marketing & education, where he oversaw all product franchises and led the launch of more than 30 products in the North American market. He also served as senior vice president for the Nordic Region at Straumann AB, senior vice president of global sales digital solutions, which included oversight of the strategic acquisition of Etkon; and served as vice president of the Prosthetics Business Unit, where he introduced a new implant and prosthetics product line within a new market segment.

He also served as senior vice president for the Nordic Region at Straumann AB, senior vice president of global sales digital solutions, which included oversight of the strategic acquisition of Etkon; and served as vice president of the Prosthetics Business Unit, where he introduced a new implant and prosthetics product line within a new market segment. He also served as vice president of global marketing & sales at Elkem AS, one of Norway's largest industrial companies. Previously, Mr. Haverhals served as executive vice president of marketing & sales at Cresco Ti Systems Sàrl, a global dental implant company, where he was responsible for turning around and managing global sales, marketing, international business. Mr. Haverhals holds an MS in Pharmacy from the University of Leyden in the Netherlands. Mr. Haverhals’ knowledge of Milestone Scientific’s day-to-day operations gives him the expertise needed to serve as one of our directors.

Benedetta I. Casamento, Director

Benedetta Casamento has served as a director of the Company since April 2022. Since August 2017, Ms. Casamento has served as a Retail Consultant specializing in finance, business operations, and financial planning and analysis. Ms. Casamento previously served as Chairman and President of Allyke, Inc., an artificial intelligence company creating digital imagery insights for retail and other industries, from June 2016 to August 2017. From December 2014 to April 2016, she served as Chief Executive Officer of Calypso St. Barth, a luxury boutique retailer of women’s apparel and accessories. Prior to her role as CEO at Calypso St. Barth, Ms. Casamento served as a consultant to private equity firms with portfolio interests in retail and fashion from July 2012 to December 2014. Ms. Casamento previously served as Executive Vice President, Finance & Operations of The Talbots, Inc. (“Talbots”), a specialty retailer and direct marketer of women’s apparel, accessories, and shoes, from March 2009 to July 2012. Prior to joining Talbots, Ms. Casamento served in various leadership roles within Liz Claiborne Inc. from February 1999 to November 2008, culminating in her position as President of Liz Claiborne Brands. Ms. Casamento started her career at Saks Fifth Avenue. Our Board has determined that Ms. Casamento’s extensive business experience, as well as her background in accounting and finance, qualifies her to serve on the Board.

Gian Domenico Trombetta, Director

Gian Domenico Trombetta has been a director of Milestone Scientific since May 2014 and served as the President and Chief Executive Officer of Milestone Scientific’s Dental Division (Wand Dental Inc.) from October 2014 until May 2020. He founded Innovest S.p.A, headquartered in Milan, Italy, in 1993, a special situation firm acting in development and distressed capital investments. He has been its President and Chief Executive Officer since its inception. He served as the Chief Executive Officer or a board member of several private commercial companies in different industries including both industrial (e.g. IT, media, web, and fashion) and holding companies. Before founding Innovest, Mr. Trombetta was Project Manager for Booz Allen & Hamilton Inc., a management consulting firm from 1988 to 1992. Mr. Trombetta holds a degree in business administration from the Luiss University in Rome, Italy, and an MBA degree from INSEAD-Fontainbleau-France. Mr. Trombetta’s business background and experience has given him the expertise needed to serve as one of our directors.

Michael McGeehan, Director

Michael McGeehan has been a director of Milestone Scientific since October 2017. Mr. McGeehan is a business consultant with 30 years of experience in a variety of business domains, including financial services, medical and healthcare products, consumer package goods and the software technology industry. Mr. McGeehan started his career at Metaphor Computer Systems in 1988 and then went to work at Microsoft Corporation in 1991. In 1995, Mr. McGeehan left Microsoft and founded Forefront Information Strategies, an information technology consulting firm. In 2002, Mr. McGeehan returned to Microsoft where he worked until 2017, when he returned to and re-started Forefront. Mr. McGeehan was on the Board of Directors of Wand Dental. Mr. McGeehan has a master’s in business administration from Pace University and a Bachelor of Science in Electrical Engineering and Computer Science from Marquette University. Mr. McGeehan’s professional experience and background have given him the expertise needed to serve as one of our directors.

Board Leadership Structure

The Board believes that the segregation of the roles of Board Chairman and the Chief Executive Officer ensures better overall governance of the Company and provides meaningful checks and balances regarding its overall performance. This structure allows our Chief Executive Officer to focus on developing and implementing the Company’s business plans and supervising the Company’s day-to-day business operations and allows our chairman to lead the Board in its oversight and advisory roles. Because of the many responsibilities of the Board and the significant time and effort required by each of the Chairman and the Chief Executive Officer to perform their respective duties, the Company believes that having separate persons in these roles enhances the ability of each to discharge those duties effectively and enhances the Company’s prospects for success. The Company also believes that having separate positions provides a clear delineation of responsibilities for each position and fosters greater accountability of management. For the foregoing reasons, the Board has determined that its leadership structure is appropriate and in the best interest of stockholders.

The Board’s Oversight of Risk Management

The Board recognizes that companies face a variety of risks, including China operation risk, liquidity/capital accessibility risk, medical product acceptance risk, and operational risk. The Board believes an effective risk management system will (1) timely identify the material risks that we face; (2) communicate necessary information with respect to material risks to senior executives and, as appropriate, to the Board or relevant Board committee; (3) implement appropriate and responsive risk management strategies consistent with the Company’s risk profile; and (4) integrate risk management into the Company’s decision-making. The Board encourages, and management promotes a corporate culture that incorporates risk management into the Company’s corporate strategy and day-to-day business operations. The Board also continually works, with the input of management and executive officers, to assess and analyze the most likely areas of future risk for the Company.

Committees of the Board

The Board has standing audit, compensation, and nominating and corporate governance committees (respectively, the “Audit Committee,” the “Compensation Committee,” and the “Nominating Committee.”)

Attendance at Committee and Board Meetings

In 2022, the Board held a total of eight meetings and acted by written consent four times, the Audit Committee held a total of five meetings, the Compensation Committee held a total of two meetings and acted by written consent five times, and the Nominating and Corporate Governance Committee held one meeting. Each of our directors attended 100% of the Board meetings and all the meetings of the committees of the Board on which he or she served. It is our policy to invite and encourage all the directors to attend the Annual Meeting. All our directors attended our annual meeting of stockholders in 2022.

Compensation Committee

The Compensation Committee reviews and recommends to the Board the compensation and benefits of all officers of the Company, reviews general policy matters relating to compensation and benefits of employees of the Company and administers the issuance of stock options to the Company’s officers, employees, directors, and consultants. The Compensation Committee is comprised of three members, Michael McGeehan (Chairman), Neal Goldman and Benedetta Casamento. A copy of the Compensation Committee Charter has been posted on our website at www.milestonescientific.com.

Audit Committee

The Audit Committee meets with management and the Company’s independent accountants to determine the adequacy of internal controls and other financial reporting matters. The Audit Committee’s purpose is to: (A) assist the Board in its oversight of: (i) the integrity of our financial statements; (ii) our compliance with legal and regulatory requirements; (iii) our independent auditors’ qualifications and independence; (iv) the performance of our internal audit function and independent auditors to decide whether to appoint, retain or terminate our independent auditors; and (v) the preparation of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “Annual Report”); and (B) to pre-approve all audit, audit-related and other services, if any, to be provided by the independent auditors. The members of the Audit Committee are comprised of Benedetta Casamento (Chairman), Neil Goldman and Michael McGeehan, all of whom are independent as defined in the listing standards of the NYSE American and Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). A copy of the Audit Committee Charter has been posted on our website at www.milestonescientific.com.

Audit Committee Financial Expert

The Board has determined that Benedetta Casamento is an “audit committee financial expert,” as that term is defined in Item 407(d)(5) of Regulation S-K, and “independent” for purposes of the listing standards of the NYSE American and Section 10A(m)(3) of the Exchange Act.

Nominating Committee

The Nominating Committee identifies potential director nominees and evaluates their suitability to serve on the Board. Based on its evaluation, it recommends to the Board the director nominees for Board membership. In addition, the Nominating Committee also evaluates each existing Board member’s suitability for continued service as a director. The members of the Nominating Committee are Benedetta Casamento (Chairman), Michael McGeehan, and Neal Goldman. A copy of the Nominating Committee Charter has been posted on our website at www.milestonescientific.com.

The Nominating Committee believes that the minimum qualifications for service as a director of the Company are that a nominee possess an ability, as demonstrated by recognized success in his or her field, to make meaningful contributions to the Board’s oversight of the business and affairs of the Company and an impeccable reputation of integrity and competence in his or her personal or professional activities. The Nominating Committee’s criteria for evaluating potential candidates include the following: an understanding of the Company’s business environment; and the possession of such knowledge, skills, expertise and diversity of experience so as to enhance the Board’s ability to manage and direct the affairs and business of the Company including, when applicable, to enhance the ability of committees of the Board to fulfill their duties and/or satisfy any independence requirements imposed by law, regulation or listing requirements.

The Nominating Committee considers director candidates recommended by stockholders. In considering candidates submitted by stockholders, the Committee will take into consideration the needs of the Board and the qualifications of the candidate. The Nominating Committee may also take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held. To have a candidate considered by the Nominating Committee, a stockholder must submit the recommendation in writing and must include the following information: the name of the stockholder and evidence of the person’s ownership of Company stock, including the number of shares owned and the length of time of ownership; the name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director of the Company; and, the person’s consent to be named as a director if selected by the Nominating Committee and nominated by the Board.

The Nominating Committee may also receive suggestions from current Board members, the Company’s executive officers or other sources, which may be either unsolicited or in response to requests from the Nominating Committee for such candidates. The Nominating Committee also, from time to time, may engage firms that specialize in identifying director candidates.

Once a person has been identified by the Nominating Committee as a potential candidate, it may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Nominating Committee determines that the candidate warrants further consideration, the Chairman or another member of the Nominating Committee may contact the person. Generally, if the person expresses a willingness to be considered and to serve on the Board, the Nominating Committee may request information from the candidate, review the person’s accomplishments and qualifications and may conduct one or more interviews with the candidate. The Nominating Committee may consider all such information considering information regarding any other candidates that it might be evaluating for membership on the Board. In certain instances, Nominating Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Nominating Committee’s evaluation process does not vary based on whether a candidate is recommended by a stockholder, although, as stated above, the Board may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.

Director Independence

The Board has determined that Michael McGeehan, Benedetta Casamento, and Neal Goldman (the “Independent Directors”) are independent, as that term is defined in the listing standards of the NYSE American. In determining director independence, the Board also considered all equity awards, if any, to the Independent Directors for the year ended December 31, 2022, disclosed in “Director Compensation” below, and determined that such awards were compensation for services rendered to the Board and therefore did not impact their ability to continue to serve as Independent Directors.

Stockholder Communication with the Board

The Board has established a process to receive communications from stockholders. Stockholders and other interested parties may contact any member (or all members) of the Board, or the non-management directors as a group, any Board committee, or any chair of any such committee by mail or electronically. To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Board or any such individual directors or group or committee of directors by either name or title. All such correspondence should be sent “c/o Corporate Secretary” at 425 Eagle Rock Ave., Suite 403, Roseland, New Jersey 07068. All communications received as set forth in the preceding paragraph will be opened by the Corporate Secretary of the Company for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service, patently offensive material or matters deemed inappropriate for the Board will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the Company’s Corporate Secretary will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope is addressed.

Executive Officers

The names, ages and titles of our executive officers are as follows:

|

NAME

|

AGE

|

POSITION

|

|

Jan Adriaan (Arjan ) Haverhals

|

60

|

President and Chief Executive Officer

|

|

Peter Milligan

|

55

|

Chief Financial Officer

|

A brief summary of the backgrounds of our executive officers are as follows

Jan Adriaan (Arjan ) Haverhals, President and Chief Executive Officer

Arjan Haverhals has been Milestone Scientific's President since September 2020, Chief Executive Officer since May 2021 and has served as the President and Chief Executive Officer of Milestone Scientific’s Dental Division (Wand Dental Inc.) since June 2020. In January 2023, Mr. Haverhals was appointed to the Board. He brings more than 30 years of sales, marketing, product development, and international expansion experience within the medical device, pharmaceutical, and other industries. Prior to joining Wand Dental and Milestone Scientific, Mr. Haverhals was senior vice president of sales at Xcentric Mold & Engineering from 2019 until 2020 where he was instrumental in increasing sales productivity and efficiency for the company's prototype injection molding services, which included leading healthcare company clients. From 2012 until 2018, Mr. Haverhals worked at Straumann, LLC, a global leader in manufacturing medical and dental devices, where he held a series of senior sales and marketing roles including vice president of customer marketing & education, where he oversaw all product franchises and led the launch of more than 30 products in the North American market. He also served as senior vice president for the Nordic Region at Straumann AB, senior vice president of global sales digital solutions, which included oversight of the strategic acquisition of Etkon; and served as vice president of the Prosthetics Business Unit, where he introduced a new implant and prosthetics product line within a new market segment.

He also served as vice president of global marketing & sales at Elkem AS, one of Norway's largest industrial companies. Previously, Mr. Haverhals served as executive vice president of marketing & sales at Cresco Ti Systems Sàrl, a global dental implant company, where he was responsible for turning around and managing global sales, marketing, international business. Mr. Haverhals holds an MS in Pharmacy from the University of Leyden in the Netherlands.

Peter Milligan, Chief Financial Officer

Peter Milligan was appointed as the Company’s Chief Financial Officer, on a part-time basis, effective February1, 2023. Prior to joining the Company, Mr. Milligan was a fractional Chief Financial Officer at Travecta Therapeutics Pte. Ltd., an early stage bio-technology company, from August 2021 until October 2022. From June 2021 to October 2022, Mr. Milligan was a fractional Chief Financial Officer at Vinci Pharmaceuticals, Inc., an early-stage bio-technology company. From 2018 to March 2021, Mr. Milligan was Chief Financial Officer of Melinta Therapeutics, LLC (previously Melinta Therapeutics, Inc., a Nasdaq listed company), where he guided the company through its Chapter 11 reorganization in 2020. From 2016 to 2018, Mr. Milligan was Chief Financial Officer at G&W Laboratories, Inc., a privately held generic pharmaceutical company. Prior to that, Mr. Milligan served as Senior Vice President and Chief Financial Officer of Exelis, Inc., an NYSE listed and leading global defense and aerospace company, effective with its 2011 spin-off from ITT Inc. (formerly ITT Corporation) through the sale of the business to Harris Corp. in 2015. Prior to that, Mr. Milligan held various senior finance roles within ITT, Inc. Mr. Milligan also spent over 10 years at AT&T in roles of increasing responsibility within its finance function. Mr. Milligan holds an M.B.A. from New York University with a concentration in Finance and Economics and a B.B.A. in Accounting from Hofstra University.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table, together with the accompanying footnotes, sets forth information, as the Record Date, regarding stock ownership of all persons known by Milestone Scientific to own beneficially more than 5% of Milestone Scientific’s outstanding common stock, Named Executives, all directors, and all directors and executive officers of Milestone Scientific as a group:

|

Names of Beneficial Owner (1)

|

Shares of Common Stock Beneficially

Owned (2)

|

Percentage

|

|

Executive Officers and Directors

|

|

|

|

Jan Adriaan (Arjan) Haverhals (3)

|

153,705

|

*

|

|

Neal Goldman (4)

|

1,853,003

|

2.64%

|

|

Benedetta Casamento (5)

|

134,828

|

*

|

|

Michael McGeehan (6)

|

370,576

|

*

|

|

Leonard Osser (7)

|

4,727,805

|

6.72%

|

|

Gian Domenico Trombetta (8)

|

10,397,238

|

14.79%

|

|

Peter Milligan (9)

|

78,125

|

*

|

|

All directors & executive officers as group (7 persons)

|

17,715,280

|

25.20%

|

| |

1.

|

The addresses of the persons named in this table are as follows: Leonard Osser, Jan Adriaan (Arjan) Haverhals, Gian Domenico Trombetta, Neal Goldman, Michael McGeehan, Benedetta Casamento and Peter Milligan are at 425 Eagle Rock Avenue, Roseland, New Jersey 07068.

|

| |

2.

|

A person is deemed to be a beneficial owner of securities that can be acquired by such person within 60 days from the record date, May 8, 2023, as applicable, upon the exercise of options and warrants or conversion of convertible securities. Each beneficial owner's percentage ownership is determined by assuming that options, warrants and convertible securities that are held by such person (but not held by any other person) and that are exercisable or convertible within 60 days from May 8, 2023, have been exercised or converted. Except as otherwise indicated, and subject to applicable community property and similar laws, each of the persons named has sole voting and investment power with respect to the shares shown as beneficially owned. The percentages for each beneficial owner are determined based on dividing the number of shares of common stock beneficially owned by the sum of the outstanding shares of common stock on May 8, 2023 and the number of shares underlying options exercisable and convertible securities convertible within 60 days from May 8, 2023 held by the beneficial owner.

|

| |

3.

|

Includes 153,705 shares to be issued at the termination of Mr. Haverhals employment agreement, and 98,424 vested stock options to purchase common stock of the Company

|

| |

4.

|

Includes 1,853,003 shares held by Mr. Goldman.

|

| |

5.

|

Includes 134,828 shares held by Mrs. Casamento.

|

| |

6.

|

Includes 349,326 shares held by Mr. McGeehan and 21,250 shares subject to common stock warrants to purchase common stock of the Company.

|

| |

7.

|

Includes 2,744,947 shares held by Mr. Osser or his family, 2,019,266 shares to be issued at the termination of his employment agreement, and 1,279,975 vested stock options to purchase common stock of the Company.

|

| |

8.

|

Includes 521,475 shares held by Mr. Trombetta directly, 178,571 shares subject to warrants to purchase common stock of the Company in the name of Bp4 Sr.l, and 9,875,763 shares held directly by BP4 S.r.l. ("BP4") of which 5,982,906 shares were issued upon the conversion of $7 million of preferred stock at $1.17 per share, as adjusted to date. Innovest S.p.A. ("Innovest") is the controlling shareholder of BP4 and Mr. Trombetta is a controlling shareholder and director of Innovest, and, as such, is deemed to have voting and investment power over the securities held by BP4. Mr. Trombetta disclaims beneficial ownership of all securities held by BP4.

|

| |

9.

|

Includes 78,125 shares to be issued by Mr. Milligan at the termination of his employment agreement.

|

Securities Authorized for Issuance under Equity Compensation Plans

Equity Compensation Plan Information (as of December 31, 2022)

|

Equity compensation plan approved by stockholders

|

|

Number of Securities to be issued upon exercise of outstanding options and warrants

|

|

|

Weighted-average exercise price of outstanding options and warrants

|

|

|

Number of securities remaining available for future issuance under equity compensation plan

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Grants under our 2020 Stock Option Plan (1)

|

|

|

3,151,652

|

|

|

$

|

1.48

|

|

|

|

323,990

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

3,151,652

|

|

|

$

|

-

|

|

|

|

323,990

|

|

| |

1.

|

The 2020 Plan provides for awards of restricted common stock and options to purchase up to a maximum of 4,000,000 shares of common stock and expires in December 2030. Options may be granted to employees, directors, and consultants of Milestone Scientific for the purchase of shares of common stock at a price not less than the fair market value of common stock on the date of grant. In general, options become exercisable over a three-year period from the grant date and expire five years after the date of grant. During the year ended December 31, 2022, 323,990 options and shares were issued.

|

SUMMARY COMPENSATION TABLE

The following Summary Compensation Table sets forth all compensation earned, in all capacities, during the fiscal years ended December 31, 2022 and 2021 by Milestone Scientific’s (i) chief executive officer and (ii) two most highly compensated executive officers, other than the chief executive officer, who were serving as executive officers at the end of the 2022 fiscal year and whose salary as determined by Regulation S-K, Item 402, exceeded $100,000 (the individuals falling within categories (i) and (ii) are collectively referred to as the “Named Executive Officers”).

|

Name and Principal

Position

|

Year

|

Salary

|

Bonuses

|

Option Awards

(6)

|

Other

Compensation

|

Total

|

|

Jan Adriaan (Arjan) Haverhals (1) (2)

|

|

|

|

|

|

|

|

Chief Executive Officer -

|

2022

|

$ 350,000

|

$ 246,603

|

$ 216,385

|

$ 28,153

|

$ 841,141

|

|

President of Milestone Scientific Inc.

|

2021

|

$ 318,513

|

$ 296,000

|

$ 85,200

|

$ 35,311

|

$ 735,024

|

|

Leonard Osser

Interim Chief Executive Officer (3)

|

2021

|

$ 112,500

|

$ 50,000

|

$ -

|

$ 126,793

|

$ 289,293

|

|

Joseph D'Agostino (4)

|

|

|

|

|

|

|

|

Chief Financial Officer and Chief Operating Officer

|

2021

|

$ 59,003

|

$ 237,067

|

$ -

|

$ 5,547

|

$ 301,617

|

|

Scott Kahn (5)

|

|

|

|

|

|

|

|

Chief Financial Officer

|

2021

|

$ 37,879

|

$ -

|

$ -

|

$ -

|

$ 37,879

|

| |

1.

|

Arjan Haverhals - During 2022, other compensation represents payments made for health insurance coverage of approximately $13,753 and car allowance of approximately $14,400.

|

| |

2.

|

Arjan Haverhals - During 2021, other compensation represents payments made for health insurance coverage of approximately $29,600 and car allowance of approximately $5,400. Mr. Haverhals received $296,000 in a discretionary performance bonus for the year ended December 31, 2021 and was awarded 40,000 stock options during 2021.

|

| |

3.

|

Leonard Osser - During 2021, other compensation represents payments made for health insurance coverage of approximately $12,393, car allowance of approximately $14,400, and directors fees of $100,000. Mr. Osser was granted under a succession plan options to purchase 2,000,000 shares of common stock, exercisable at the fair market value of the common stock on the date of grant, vesting over a five-year period.

|

| |

4.

|

Joseph D’Agostino - During 2021, other compensation includes payments made for health insurance coverage of approximately $3,200 and a car allowance of approximately $2,400. Mr. D’Agostino retired from company in April 2021 and was awarded a bonus of approximately $237,000 in 2021.

|

| |

5.

|

Scott Kahn was appointed as the Chief Financial Officer of the Company May 24, 2021. On July 2, 2021, the Company announced that Scott Kahn, and the Company have reached a mutual decision to part ways.

|

| |

6.

|

The amounts in this column reflect the fair value of the options on the date of grant. For details used in the assumption calculating the fair value of the option reward, see Note C to the Financial Statements for the year ended December 31, 2022, a which is located on pages F-9 through F-13 of the Company’s 2022 Annual Report on Form 10-K. Compensation cost is generally recognized over the vesting period of the award. See the table below entitled Outstanding Equity Awards at December 31, 2022.

|

Pay versus Performance Table

|

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Item 402(v) of Regulation S-K, we are providing the following information about the relationship between executive compensation actually paid (as defined by SEC rules) and certain financial performance metrics of the Company. For further information concerning the Company’s compensation philosophy and how the Company aligns executive compensation with the Company’s performance, refer to “—Compensation Philosophy and Objectives” and “—Compensation Elements”.

|

| |

|

(a)

|

|

|

(b)

|

|

|

(c)

|

|

|

(d)

|

|

|

(e)

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value of Initial Fixed $100 Investment Based on:

|

|

|

|

|

|

|

Year

|

|

Summary Compensation Table Total for PEO($)

|

|

|

Compensation Actually Paid to PEO($)

|

|

|

Average Summary Compensation Table Total for Non-PEO NEO's($)

|

|

|

Average Compensation Actually Paid to Non-PEO NEO's($)

|

|

|

Total Shareholder Return ($)

|

|

|

Net Income ($)

|

|

|

2022

|

|

|

841,141 |

|

|

|

649,824 |

|

|

|

n/a |

|

|

|

n/a |

|

|

|

22.86 |

|

|

|

(8,706,131 |

) |

|

2021

|

|

|

735,024 |

|

|

|

624,756 |

|

|

|

616,568 |

|

|

|

616,568 |

|

|

|

93.21 |

|

|

|

(6,818,317 |

) |

(a) The amounts reported in this column are the amounts of total compensation reported for Mr. Haverhals, Chief Executive Officer, for each corresponding year in the "Total" column of the Summary Compensation Table (“SCT’) on page 12 of this proxy statement.

(b) The amounts reported in this column represent the amount of compensation actually paid (“CAP”) Mr. Haverhals as computed in accordance with Item 402(v) of Regulation S-K, but do not reflect the actual amount of compensation earned by or paid to Mr. Haverhals during the applicable year. The determination of CAP begins with the total compensation reported in the SCT, which is then adjusted by equity-based and other compensation as set forth in the following table. For equity-based awards made during the year, the recorded grant date value is replaced with the estimated year-end value. For equity-based awards made in prior years that remain unvested at year-end, the estimated change in value from the beginning to the end of the year is included. For equity-based awards made in prior years, but vested during the year, the estimated change in value from the beginning of the year to the date of vesting is included:

|

Calculation of Compensation Actually Paid to PEO (column b)

|

|

2022

|

|

2021

|

|

|

Total Summary Compensation Paid Table (SCT) - column (a)

|

|

|

735,024 |

|

|

841,141 |

|

|

Less: value reported under stock awards in the SCT

|

|

|

(85,200 |

) |

|

(216,385 |

) |

|

Add: FV of unvested equity awards at year end 2021

|

|

|

- |

|

|

- |

|

|

Add: FV of vested awards as of the vesting date

|

|

|

- |

|

|

- |

|

|

Compensation actually paid

|

|

|

649,824 |

|

|

624,756 |

|

(c) The amounts reported in this column represent the average of the amounts reported for the Company's Non-CEO named executive officer’s (“NEOs”) as a group in the "Total" column of the SCT in each applicable year. There were no NEO’s at the company during 2022. For 2021, the names of each of the Non-CEO NEOs included for purposes of calculating the average amounts in each applicable year are Joseph D’Agostino and Scott Kahn. Since both executives served in the same role as CFO during various points in the year, their compensation was calculated on an annualized basis.

(d) The amounts reported in this column represent the average amount of CAP to the Non-CEO NEOs as a group, as computed in accordance with Item 402(v) of Regulation S-K. Since there were no adjustments to be made for these NEO’s, the amounts actually paid are equal to the SCT amounts calculated in the previous column.

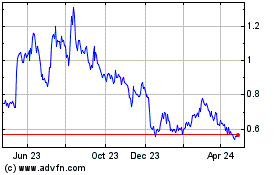

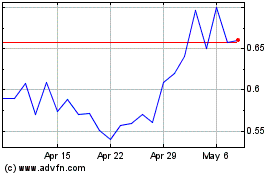

(e) This represents the year-end value of an initial $100 investment made at the beginning of the period.

Employment Contracts

On March 2, 2021, the Company entered into a Royalty Sharing Agreement with Leonard Osser, pursuant to which Mr. Osser sold, transferred and assigned to the Company all of his rights in and to a certain patent application as to which he is a co-inventor with Mark Hochman, a consultant to the Company, and the Company agreed to pay to Mr. Osser, beginning May 9, 2027, half of the royalty (2.5%) on net sales that would otherwise be payable to Mark and Claudia Hochman under their existing Technology Sale Agreement, dated January 1, 2005 and amended from time to time, with the Company. In connection with the Royalty Sharing Agreement, the Hochman's agreed with the Company, pursuant to an addendum to such Technology Sale Agreement dated February 25, 2021, to reduce from 5% to 2.5% the payments due to them under their Technology Sale Agreement beginning on May 9, 2027, and thereafter with respect to dental products embodying the new invention.

As part of the Succession Plan of the Company, Mr. Osser agreed, pursuant to an agreement dated April 6, 2021 (the “Succession Agreement”), to restructure certain of his existing agreements with the Company, which provide for additional and broader executive support, and at such time as he elects to step down as Interim Chief Executive Officer of the Company, to become the Vice Chairman of the Board of the Company. With respect to Mr. Osser’s July 2017 Employment Agreement and July 2017 Consulting Agreement (each as previously disclosed), the compensation under the Employment Agreement was modified to reduce the overall compensation by $100,000 to $200,000, split equally between a cash amount and an amount in shares, and the compensation under the Consulting Agreement was increased by $100,000 to $200,000, equally split between a cash amount and an amount in shares, which shares were formerly payable under the Employment Agreement. If the Company terminates Mr. Osser’s employment “Without Cause,” other than due to his death or disability, or if Mr. Osser terminates his employment for “Good Reason” (both as defined in the agreement), Mr. Osser is entitled to be paid in one lump sum payment as soon as practicable following such termination: an amount equal to the aggregate present value (as determined in accordance with Section 280G(d)(4) of the Code) of all compensation pursuant to this agreement from the effective date of termination hereunder through the remainder of the Employment Term. In connection with his acceptance of the Vice Chairman position and in consideration of his services as a member of the Board and agreement to provide certain additional general consulting services, Mr. Osser was granted options to purchase 2,000,000 shares of common stock, exercisable at the fair market value of the common stock on the date of grant, vesting over the five-year period after he steps down as Interim Chief Executive Officer of the Company or ten years from the date of grant, whichever shall end first. The Company believes that the effect of such existing agreements and the Succession Agreement, all of which relate to the period after such time Mr. Osser steps down as Interim Chief Executive Officer of the Company, collectively expand Mr. Osser’s consulting to and support of the Company beyond its Chinese operations to also include its medical and other products, while enhancing the retention aspects of the Company’s relationship with Mr. Osser. On May 19, 2021, Mr. Osser resigned as Interim Chief Executive Officer of the Company and assumed the role of Vice Chairman of the Board.

Compensation under the Employment Agreement and the Consulting Agreement is payable for 9.5 years from May 19, 2021. The Company recorded expense of $200,000 and $125,000 related to the Employment Agreement for the year ended December 31, 2022 and 2021, respectively. The Company recorded expense of $200,000 and $125,000 related to the Consulting Agreement for the year ended December 31, 2022 and 2021, respectively.

Objective of Executive Compensation Program

The primary objective of the executive compensation program is to attract and retain qualified, energetic managers who are enthusiastic about the mission and culture of Milestone Scientific. A further objective of the compensation program is to provide incentives and reward each manager for their contribution. In addition, Milestone Scientific strives to promote an ownership mentality among key leadership and the Board of Directors.

The Compensation Committee reviews and approves, or in some cases recommends for the approval of the full Board, the annual compensation procedures for the Named Executive Officers.

The compensation program is designed to reward teamwork, as well as each manager’s individual contribution. In measuring the Named Executive Officers’ contribution, the Compensation Committee considers numerous factors including the growth, strategic business relationships and financial performance. Regarding most compensation matters, including executive and director compensation, management provides recommendations to the Compensation Committee; however, the Compensation Committee does not delegate any of its functions to others in setting compensation. Milestone Scientific does not currently engage any consultant to advise on executive and/or director compensation matters.

Stock price performance has not been a factor in determining annual compensation because the price of Milestone Scientific’s common stock is subject to a variety of factors outside of Milestone Scientific’s control. Milestone Scientific does not have an exact formula for allocating between cash and non-cash compensation.

Annual CEO compensation consists of a base salary component, a bonus component (payable in a mix of cash and stock) and periodic stock option grants. It is the Compensation Committee’s intention to set totals for the CEO for cash compensation sufficiently high enough to attract and retain a strong motivated leadership team, but not so high that it creates a negative perception with the other stakeholders. The CEO receives stock option grants under the stock option plan. The number of stock options granted to the executive officer is made on a discretionary rather than a formula basis by the Compensation Committee.

The CEO’s current and prior compensation is considered in setting future compensation. To some extent, the compensation plan is based on the market and the companies that compete for executive management. The elements of the plan (e.g., base salary, bonus, and stock options) are like the elements used by many companies. The exact base pay, stock option grant, and bonus amounts are chosen to balance the competing objectives of fairness to all stakeholders and attracting and retaining executive managers.

Outstanding Equity Awards at December 31, 2022

The following table includes certain information with respect to all unexercised stock options and unvested shares of common stock of Milestone Scientific outstanding owned by the Named Executive Officers at December 31, 2022.

|

Name

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable (1)

|

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Un-exercisable (1)

|

|

|

Option

Exercise

Price ($)

|

|

Option

Expiration

Date

|

|

Number of

Shares or

Units of Stock

that have not

vested (#) (2)

|

|

|

Market Value of Number of Shares or Units of Stock that have not vested (#) (3)

|

|

|

Jan Adriaan (Arjan ) Haverhals

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

26,333 |

|

|

|

13,667 |

|

|

$ |

2.13 |

|

12/23/2024

|

|

|

153,705 |

|

|

$ |

73,778 |

|

| |

|

|

72,091 |

|

|

|

144,205 |

|

|

$ |

1.52 |

|

3/30/2025

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

98,425 |

|

|

|

157,871 |

|

|

|

|

|

|

|

|

153,705 |

|

|

$ |

73,778 |

|

|

Leonard Osser

|

|

|

469,036 |

|

|

|

234,482 |

|

|

$ |

1.99 |

|

12/22/2025

|

|

|

2,019,266 |

|

|

$ |

969,248 |

|

| |

|

|

400,000 |

|

|

|

1,600,000 |

|

|

|

2.47 |

|

4/23/2031

|

|

|

|

|

|

|

|

|

| |

|

|

10,714 |

|

|

|

21,461 |

|

|

$ |

3.11 |

|

2/9/2026

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

879,750 |

|

|

|

1,855,943 |

|

|

|

|

|

|

|

|

2,019,266 |

|

|

$ |

969,248 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

978,175 |

|

|

|

2,013,814 |

|

|

|

|

|

|

|

|

2,172,971 |

|

|

|

1,043,026 |

|

| |

1.

|

Represents stock option grants at fair market value on the date of grant.

|

| |

2.

|

Issuance of the shares of common stock have been deferred until the termination of employment with Milestone Scientific in accordance with the terms of respective employment arrangements.

|

| |

3.

|

Based on the closing price per share of $0.48 as reported on the NYSE American on December 31, 2022

|

Director Compensation

The following table shows the compensation earned by, awarded, and paid in 2022 to the individuals who served as directors of such period.

| |

|

Fees

earned or

paid in

cash $

|

|

|

Stock awards $ (1)

|

|

|

Option

awards $

|

|

|

Non-equity incentive

plan compensation

$

|

|

|

Change in pension value and nonqualified deferred compensation earnings $

|

|

|

All other compensation $

|

|

|

Total $

|

|

|

Leslie Bernhard

|

|

$ |

27,500 |

|

|

$ |

130,000 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

157,500 |

|

|

Leonard Schiller *

|

|

|

|

|

|

$ |

52,500 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

52,500 |

|

|

Michael McGeehan

|

|

|

|

|

|

$ |

102,500 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

102,500 |

|

|

Neal Goldman

|

|

|

|

|

|

$ |

100,000 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

100,000 |

|

|

Gian Domenico Trombetta

|

|

|

|

|

|

$ |

100,000 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

100,000 |

|

|

Benedetta Casamento

|

|

|

|

|

|

$ |

112,877 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

112,877 |

|

|

Leonard Osser

|

|

|

|

|

|

$ |

100,000 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

100,000 |

|

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our officers and directors, and person who own more than ten percent of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than ten-percent stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file. Based solely on review of the copies of such forms furnish to us, or written representations that no Forms 5 were required, we believe that all Section 16(a) filing requirements applicable to our officers and director were complied with during the fiscal year ended December 31, 2022.

Code of Ethics

Milestone Scientific has adopted a code of ethics that applies to its directors, principal executive officer, principal financial officer and other persons performing similar functions. This code of ethics is posted on Milestone Scientific’s web site at www.milestonescientific.com. Milestone Scientific will also provide a copy of the Code of Ethics to any person without charge, upon written request addressed to the Chairman of the Board, Neal Goldman, at the Company’s principal executive office, located at 425 Eagle Rock Avenue Roseland, NJ 07068.

Certain Relationships and Related Transactions.

Milestone Scientific has a supply agreement with United Systems (whose controlling shareholder, Tom Cheng, is a stockholder of Milestone Scientific), the principal supplier of its handpieces, pursuant to which it procures manufactured products under specific purchase orders, but without minimum purchase commitments. Purchases from this supplier were approximately $3.4 million and $1.7 million for the twelve months ended December 31, 2022 and 2021, respectively. As December 31, 2022, and December 31, 2021, Milestone Scientific owed this supplier approximately $819,000 and $548,000, respectively, which is included in accounts payable and accrued expenses related party on the consolidated balance sheets. In June 2021, the Company signed a ten-year agreement with United Systems for supplying the handpieces.

In first quarter of 2020, Milestone China and certain manufacturing/marketing affiliates entered into a reorganization agreement (the “Transaction”) pursuant to which Milestone China was to merge into an affiliated manufacturing company, Anhui Maishida Medical Technology, Co. Ltd. (“Anhui”), with Anhui as the surviving entity and to have complete responsibility for sales, marketing, and distribution for the Company’s dental products in China. After completion of the Transaction, Milestone Scientific was expected to have an approximate 28.4% direct ownership in Anhui. Due to the COVID-19 pandemic, the regulatory approval of the planned Transaction was delayed while applicable government offices were closed in China and Hong Kong. Until the completion of the transaction Milestone Scientific's 28.4% in Anhui was held by Milestone China.

On November 23, 2021, management of Milestone Scientific became aware that on October 8, 2021, without approval from Milestone Scientific, (i) Milestone China entered into an Equity Transfer Agreement whereby Milestone China’s 28.4% equity stake in Anhui was transferred to Lidong Zhang, the CEO of Milestone China and Anhui, in exchange for RMB 2,840 million (approximately $440,351) of which no amounts have been or are expected to be received, see below, and (ii) Anhui held a shareholders’ meeting at which the Equity Transfer Agreement was approved by the shareholders of Anhui, eliminating Milestone China’s equity interest in Anhui and Milestone Scientific’s indirect equity interest in Anhui. Based on a review of the minutes of the Anhui shareholders’ meeting, Milestone China was not listed as a shareholder in such meeting due to the executed Equity Transfer Agreement between Lidong Zhang and Milestone China.

Though management believes that this conveyance by Milestone China to Lidong Zhang is outside of the laws of Hong Kong and/or China, as may be applicable, at this juncture Milestone Scientific has no ownership in Anhui and Milestone China has no assets or operations. After considering taking action to assert our rights in the matter, and based on the acknowledgement that such course of action is not without its procedural and substantive challenges in Hong Kong and/or China and, importantly, in view of Michelle Zhang dba Solee Science & Technology USA (“Solee”) (see below), a company located in New Jersey, then becoming the independent distributor for Milestone China and its subsidiaries, and due to the good working relationship then developing between Milestone Scientific and Solee and to the reduction of Milestone Scientific’s credit exposure to a Chinese entity, management is not pursuing any legal action at this time to recover our equity interest. The Company does not believe it is prudent at this time to continue to pursue its investigation of any options it may have regarding its Chinese distributor, and therefore, in order to preserve cash the Company is for the time being suspending its investigation.

At this time, Milestone Scientific has not received any consideration, does not know if any of such consideration promised to Milestone China for its interest in Anhui has been paid and, if paid, whether it can recover its share of such consideration. Unless circumstances change, Milestone Scientific does not expect it will receive any of the consideration received by Milestone China for its assets without pursuing legal action. As a result, Milestone Scientific has not recorded a gain or receivable related to the transfer of Anhui. As of December 31, 2022 and December 31, 2021, the investment in Milestone China was zero.

K. Tucker Andersen, a significant stockholder of Milestone Scientific, has an agreement with Milestone Scientific to provide financial and business strategic services. Expenses recognized on this agreement were $100,000 for each of the years ended December 31, 2022 and 2021.

The Director of Clinical Affairs’ royalty fee was approximately $442,000 and $446,000 for the years ended December 31, 2022 and 2021, respectively. Additionally, Milestone Scientific expensed consulting fees to the Director of Clinical Affairs of $154,000 and $158,000 for the year ended December 31, 2022 and 2021, respectively. As of December 31, 2022, and 2021, Milestone Scientific owed the Director Clinical Affairs for royalties of approximately $120,000 and $123,000, respectively, which is included in accounts payable, related party and accrued expense, related party, in the consolidated balance sheet.

On March 2, 2021, Milestone Scientific entered into a Royalty Sharing Agreement with Leonard Osser, the Company’s then Interim Chief Executive Officer, pursuant to which Mr. Osser sold, transferred and assigned to the Company all of his rights in and to a certain patent application as to which he is a co-inventor with Dr. Hochman, and the Company agreed to pay to Mr. Osser, beginning May 9, 2027, half of the royalty (2.5%) on net sales that would otherwise be payable to Dr. Hochman and his wife under their Technology Sale Agreement with the Company, the Hochman's having agreed with the Company pursuant to an addendum to such Technology Sale Agreement dated February 25, 2021 to reduce from 5% to 2.5% the payments due to them on May 9, 2027 and thereafter, with respect to dental products.

Pursuant to a Succession Agreement dated April 6, 2021 between Mr. Osser and the Company: (i) the Employment Agreement dated as of July 10, 2017 between Mr. Osser and the Company, pursuant to which upon Mr. Osser stepping down as Interim Chief Executive Officer of the Company, the Company agreed to employ him as Managing Director, China Operations of the Company (the “China Operations Agreement”), and (ii) the Consulting Agreement dated as of July 10, 2017 (the “Consulting Agreement”) between the Company and U.S. Asian Consulting Group, LLC, a company of which Mr. Osser is a managing member, the compensation under the China Operations Agreement was modified to reduce the overall compensation by $100,000 to $200,000, split equally between a cash amount and an amount in shares, and the compensation under the Consulting Agreement is increased by $100,000 to $200,000, equally split between a cash amount and an amount in shares, which shares were formerly payable under the China Operations Agreement. Compensation under the China Operations Agreement and the Consulting Agreement are payable for 9.5 years from May 19, 2021.The Company recorded expense of $200,000 and $125,000 related to the Managing Director, China Operations for the year ended December 31, 2022 and 2021, respectively. The Company recorded expense of $200,000 and $125,000 related to the US Asian Consulting Group, LLC for the year ended December 31, 2022 and 2021, respectively.

PROPOSAL 2

APPROVAL TO INCREASE THE NUMBER OF SHARES OF COMMON STOCK WHICH MAY BE ISSUED UNDER THE COMPANY’S 2020 EQUITY INCENTIVE PLAN FROM 4,000,000 TO 11,500,000

(ITEM 2 ON THE PROXY CARD)

General

Milestone's Board adopted, and Milestone’s shareholders approved, the 2020 Equity Inventive (as amended and restated, the "2020 Plan”), subject to stockholder approval. The 2020 Plan provides for the grant to our employees, directors and consultants of incentive and non-qualified stock options, shares of restricted stock and other stock-based awards, up to an aggregate of 4,000,000 shares of Common Stock. The Board and Compensation Committee has approved (subject to stockholder approval) an increase in the aggregate number of shares issuable under the 2020 Plan from 4,000,000 shares to11,500,000 shares. As of the Record Date, the Company has issued an aggregate of 3,151,652 shares and options to purchase shares under the 2020 Plan, leaving only 323,990 shares available for issuance. The Board believes it to be in the best interests of the Company and its shareholders to have a sufficient number of shares available for issuance under the 2020 Plan in order to adequately incentivize its current and future, employees, directors and consultants.

The purpose of the 2020 Plan is to provide incentives to employees, directors and consultants whose performance will contribute to our long-term success and growth, to strengthen the Company's ability to attract and retain employees, directors and consultants of high competence, to increase the identity of interests of such people with those of its stockholders and to help build loyalty to Milestone through recognition and the opportunity for stock ownership. The Compensation Committee of the Board administers the 2020 Plan.

The following description of the 2020 Plan is a summary and is qualified in its entirety by reference to the 2020 Plan, a copy of which has been filed on April 30, 2021 with the SEC as Appendix A to the Company’s proxy statement for its 2021 annual meeting.

Summary of the Key Terms of the 2020 Plan

Purpose. The purpose of the 2020 Plan is to provide incentives to employees, directors and consultants whose performance will contribute to our long-term success and growth, to strengthen the Company's ability to attract and retain employees, directors and consultants of high competence, to increase the identity of interests of such people with those of its stockholders and to help build loyalty to Milestone through recognition and the opportunity for stock ownership.

Types of Awards. The 2020 Plan provides for the grant of incentive stock options intended to qualify under Section 422 of the Internal Revenue Code of 1986, as amended (the "Code”), non-qualified stock options, restricted stock awards, and other stock-based awards.

Administration. The 2020 Plan is administered by the Compensation Committee of the Board of Directors (the "Committee”), which may in turn delegate administrative authority to one or more of our executive officers.

Number of Shares Available. The aggregate number of shares of common stock that may be issued pursuant to equity awards granted under the 2020 Plan may not exceed 9,500,000 shares, subject to stockholder approval. If any outstanding award granted under the 2020 Plan should for any reason expire, be cancelled or be forfeited without having been exercised in full, the shares of Common Stock allocable to the unexercised, cancelled or terminated portion of such award shall become available for subsequent grants of awards under the 2020 Plan. The 2020 Plan is intended to constitute an "unfunded” plan for incentive and deferred compensation that does not meet the tax code requirements for a qualified retirement plan and is not subject to most of the requirements of ERISA.

Eligibility. Incentive stock options may be granted only to employees of the Company, or a "subsidiary corporation” (as such term is defined in Section 424(f) of the Code) of the Company. Equity awards other than incentive stock options may be granted to employees, directors, and consultants.