The Marygold Companies, Inc. (“TMC,” or the “Company”) (NYSE

American: MGLD), a diversified global holding firm, today reported

financial results for the three and six months ended December 31,

2023.

Revenue for the three months ended December 31, 2023 was $8.5

million, compared with $8.8 million, last year. The Company

registered a net loss of $1.2 million, equal to a loss of $0.03 per

share, for the fiscal 2024 second quarter, principally reflecting

continued investment in the Marygold & Co. fintech app. TMC

reported net income of $0.2 million, or approximately breakeven per

share, for the same quarter a year ago.

For the six-month period ended December 31, 2023, revenue was

$16.7 million, versus $17.7 million for the comparable period last

year. A net loss of $1.7 million, or $0.04 per share, was recorded

for the six months ended December 31, 2023, versus net income of

$0.7 million, equal to $0.02 per fully diluted share, for the same

period a year ago.

TMC’s balance sheet remained strong at December 31, 2023. Cash

and cash equivalents amounted to $6.2 million and investments

totaled $12.4 million at the end of the quarter, and the Company

has essentially no debt. Total assets at December 31, 2023, were

$35 million, and total stockholders’ equity at quarter’s end was

$29 million.

“Operating results are within the range of expectations,” said

David Neibert, TMC’s Chief Operations Officer. “Our core businesses

are all operating efficiently and producing cash, which is being

used to build our fintech business under the Marygold & Co.

brand. The more we earn at our other divisions, the more we can

invest in growing the fintech app. As we are seeing, those

investments will continue to negatively impact TMC’s income

statement over the near term until our mobile banking app gains

traction. While we are not showing profits at the consolidated

level, the fundamentals of our Company remain on solid footing, and

we are building what we believe to be a highly valued business and

doing so without any dilutive effects of equity or debt funding

from outside sources.”

Nicholas Gerber, TMC’s Chief Executive Officer, added, “We have

started the marketing of our innovative fintech app, a unique

mobile app with a debit card feature that enables account holders

to invest in Money Pools, send money to anyone in the U.S., monitor

spending habits and budgets, and to transact business at retailers

throughout the world. In the background, we are readying even more

features to be incorporated into the app, as daily onboarding of

new accountholders increases. Following our successful soft launch

in the second half of 2023, we are excited as ever that Marygold

& Co. is gaining attention. I strongly believe that the

strategy of using of our capital reserves to develop this app,

versus borrowing or diluting our shareholders, will prove to be a

sound investment as the true value is realized in the coming

years.”

Business Units

The Company’s USCF Investments subsidiary,

www.uscfinvestments.com, acquired in 2016 and based in Walnut

Creek, Calif., serves as manager, operator or investment adviser to

15 exchange traded products, structured as limited partnerships or

investment trusts that issue shares trading on the NYSE Arca.

Gourmet Foods, https://gourmetfoodsltd.co.nz/, acquired in 2015,

is a commercial-scale bakery that produces and distributes iconic

meat pies and pastries throughout New Zealand under the brand names

Pat’s Pantry and Ponsonby Pies. Acquired by Gourmet Foods in 2020,

Printstock Products Limited https://www.printstocknz.com/, is a

printer of specialized food wrappers and is located in Napier, New

Zealand. Its operations are consolidated with those of Gourmet

Foods.

Brigadier Security Systems, www.brigadiersecurity.com, acquired

in 2016 and headquartered in Saskatoon, Canada, provides

comprehensive security solutions to homes and businesses,

government offices, schools and other public buildings throughout

the province under the brands Brigadier Security Systems in

Saskatoon and Elite Security in Regina, Canada.

Original Sprout, acquired in 2017, with warehouse and office

facilities located in San Clemente, California

www.originalsprout.com, produces and distributes a full line of

vegan, safe, non-toxic hair and skin care products, distributed in

the U.S. and its territories, the U.K., E.U., Turkey, Middle East,

Africa, Taiwan, Mexico, South America, Singapore, Hong Kong,

Malaysia, New Zealand, Australia and Canada among other areas.

Marygold & Co., formed in the U.S. during 2019 and operating

from offices in Denver, CO, together with its wholly owned

subsidiary, Marygold & Co. Advisory Services, LLC, was

established to explore opportunities in the financial technology

sector. The company continues further development of its mobile

banking app, having completed the initial development stage and

soft launch in the U.S. in June 2023.

https://marygoldandco.com/

Marygold & Co. (UK) Limited, formed in the U.K. during 2021,

operates through its subsidiary acquired in 2022, Tiger Financial

& Asset Management Limited (“Tiger”), a U.K. based investment

adviser. Tiger’s core business is managing clients’ financial

wealth across a diverse product range, including cash, national

savings, individual savings accounts, unit trusts, insurance

company products such as investment bonds and other investment

vehicles. http://www.tfam.co.uk/

About The Marygold Companies, Inc.

The Marygold Companies, Inc., which changed its name from

Concierge Technologies, Inc. in 2022, was founded in 1996 and

repositioned as a global holding firm in 2015. The Company

currently has operating subsidiaries in financial services, food

manufacturing, printing, security systems and beauty products,

under the trade names USCF Investments, Marygold & Co., Tiger

Financial & Asset Management Limited, Gourmet Foods, Printstock

Products, Brigadier Security Systems and Original Sprout,

respectively. Offices and manufacturing operations are in the U.S.,

New Zealand, U.K., and Canada. For more information, visit

www.themarygoldcompanies.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of U.S. federal securities laws. Words such as

“expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may” “will,” “could,” “should”

“believes,” “predicts,” “potential,” “continue” and similar

expressions are intended to identify such forward-looking

statements. These forward-looking statements, including, but not

limited to, tangible benefits expected to be realized in the 2024

calendar year from current investments, involve significant risks

and uncertainties that could cause actual results to differ

materially from the expected results and, consequently, should not

be relied upon as predictions of future events. These

forward-looking statements, including the factors disclosed in the

Company’s most recent Annual Report on Form 10-K, and in the

Company’s other filings with the Securities and Exchange

Commission, are not exclusive. Readers are cautioned not to place

undue reliance upon any forward-looking statements, which speak

only as of the date made. Except as required by law, the Company

disclaims any obligation to update or publicly announce any

revisions to any of the forward-looking statements contained in

this press release.

THE MARYGOLD COMPANIES,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except per

share data)

(unaudited)

December 31, 2023

June 30, 2023

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

6,214

$

8,161

Accounts receivable, net (of which $1,624

and $1,674, respectively, due from related parties)

2,596

3,026

Inventories

2,389

2,254

Prepaid income tax and tax receivable

1,618

992

Investments, at fair value

12,379

11,481

Other current assets

1,057

904

Total current assets

26,253

26,818

Restricted cash

434

425

Property and equipment, net

1,215

1,255

Operating lease right-of-use assets

1,287

821

Goodwill

2,307

2,307

Intangible assets, net

2,112

2,330

Deferred tax assets, net

771

771

Other assets

553

554

Total assets

$

34,932

$

35,281

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES

Accounts payable and accrued expenses

$

3,287

$

2,771

Operating lease liabilities, current

portion

715

457

Purchase consideration payable

637

605

Loans - property and equipment, current

portion

352

359

Total current liabilities

4,991

4,192

LONG-TERM LIABILITIES

Loans - property and equipment, net of

current portion

82

88

Operating lease liabilities, net of

current portion

582

381

Deferred tax liabilities, net

242

242

Total long-term liabilities

906

711

Total liabilities

5,897

4,903

STOCKHOLDERS’ EQUITY

Preferred stock, $0.001 par value; 50,000

shares authorized Series B: 49 shares issued and outstanding at

December 31, 2023 and June 30, 2023

-

-

Common stock, $0.001 par value; 900,000

shares authorized; 39,383 shares issued and outstanding at December

31, 2023 and June 30, 2023

39

39

Additional paid-in capital

12,605

12,397

Accumulated other comprehensive loss

(12

)

(144

)

Retained earnings

16,403

18,086

Total stockholders’ equity

29,035

30,378

Total liabilities and stockholders’

equity

$

34,932

$

35,281

THE MARYGOLD COMPANIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share data)

(unaudited)

Three Months Ended

December 31,

Six Months Ended

December 31,

2023

2022

2023

2022

Revenue

Fund management - related party

$

4,997

$

5,266

$

10,047

$

10,686

Food products

1,920

1,932

3,649

3,870

Beauty products

842

785

1,617

1,588

Security systems

570

665

1,123

1,295

Financial services

128

124

256

258

Revenue

8,457

8,772

16,692

17,697

Cost of revenue

2,091

2,231

4,128

4,256

Gross profit

6,366

6,541

12,564

13,441

Operating expense

Salaries and compensation

2,999

2,805

5,589

5,173

General and administrative expense

2,306

1,820

4,556

3,512

Fund operations

1,187

1,112

2,461

2,253

Marketing and advertising

718

556

1,685

1,329

Depreciation and amortization

153

148

307

297

Total operating expenses

7,363

6,441

14,598

12,564

(Loss) income from operations

(997

)

100

(2,034

)

877

Other income (expense):

Interest and dividend income

138

63

331

115

Interest expense

(3

)

(4

)

(7

)

(11

)

Other (expense) income, net

(503

)

130

(458

)

32

Total other (expense) income, net

(368

)

189

(134

)

136

(Loss) income before income taxes

(1,365

)

289

(2,168

)

1,013

Benefit (provision) for income taxes

182

(107

)

484

(334

)

Net (loss) income

$

(1,183

)

$

182

$

(1,684

)

$

679

Weighted average shares of common

stock

Basic

40,397

40,371

40,397

40,371

Diluted

40,397

40,371

40,397

40,384

Net (loss) income per common share

Basic

$

(0.03

)

$

-

$

(0.04

)

$

0.02

Diluted

$

(0.03

)

$

-

$

(0.04

)

$

0.02

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240214787407/en/

Media and investors, for more Information, contact: Roger

S. Pondel PondelWilkinson Inc. 310-279-5965 rpondel@pondel.com

Contact the Company: David Neibert, Chief Operations

Officer 949-429-5370 dneibert@themarygoldcompanies.com

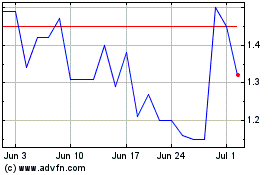

Marygold Companies (AMEX:MGLD)

Historical Stock Chart

From Dec 2024 to Jan 2025

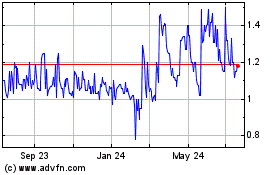

Marygold Companies (AMEX:MGLD)

Historical Stock Chart

From Jan 2024 to Jan 2025