InnSuites Hospitality Trust (NYSE American: IHT) reported a

continuation of Hotel Revenue record results in the First Fiscal

Quarter of 2025, (February 1, 2024, to April 30, 2024), with Total

Revenue increasing to approximately $2.3 million, which is an

approximate increase of 4%, from the same prior year First Fiscal

Quarter of $2.2 million.

Total Consolidated Fiscal First Quarter Net

Income remained positive, at $86,598.

Consolidated Net Income before non-cash

depreciation expense was $259,640 for the 2025 First Fiscal Quarter

ended April 30, 2024 (February 1, 2024, through April 30,

2024).

IHT hotel operations were strong in the Fiscal

Year ended January 31, 2024, and the 2025 Fiscal First Quarter, and

are contributing to a solid start in the current 2025 Fiscal Second

Quarter, with both the Tucson Hotel and Albuquerque Hotel achieving

record results for the month of May, of the current Fiscal Year.

Combined May Revenue for both hotels was an impressive $644,741,

which has led to a record $2,938,711 for the first four Fiscal

Months of Fiscal Year 2025.

These are all positive signs for InnSuites, as

progress continues while the Travel Industry, and InnSuites

Hospitality Trust (IHT) specifically, continue to grow and

thrive.

InnSuites Hospitality Trust (IHT), in late 2019,

made a diversification investment in new development privately held

UniGen Power, Inc. (UniGen), a company developing a patented, high

profit potential, efficient clean energy generation innovation.

With the continued influx and popularity of electric cars, as well

as growing needs of artificial intelligence, increased demand for

electricity over the next five years is projected to approximately

double. IHT holds convertible bonds and warrants that, when fully

exercised, could result in IHT holding an approximately up to 20%

or more ownership stake in UniGen.

UniGen is currently concentrating on its next

round of capital raising.

UniGen is a high risk investment offering high

potential investment return if and when successful.

IHT management believes that due to real estate

held on the books of IHT at book values believed to be

significantly below current market value and due to the high clean

energy diversification profit potential ahead, the IHT future looks

bright.

IHT’s strong hotel operating results are

reflected in three successful, consecutive profitable Fiscal Years,

even after accounting for substantial non-cash depreciation

expense.

Fiscal Year 2025 extended IHT’s uninterrupted,

continuous annual dividends to 54 years, since 1971, with

semi-annual dividends paid February 5, 2024, and anticipated for

July 31, 2024.

The IHT Annual Shareholder Meeting has been

announced, and will be held at the IHT Corporate Office, on August

14, 2025, at 1 PM.

For more information, visit

www.innsuitestrust.com and www.innsuites.com.

Forward-Looking Statements

With the exception of historical information,

matters discussed in this news release may include “forward-looking

statements” within the meaning of the federal securities laws. All

statements regarding IHT’s review and exploration of potential

strategic, operational, and structural alternative diversification

investments, and expected associated costs and benefits, as well as

statements related to continuation of its 54 years of uninterrupted

payment of annual dividends, are forward-looking. Actual

developments and business decisions may differ materially from

those expressed or implied by such forward-looking statements.

Important factors, among others, that could cause IHT’s actual

results and future actions to differ materially from those

described in forward-looking statements include the uncertain

outcome, impact, effects and results of IHT’s success in finding

potential qualified purchasers for its hospitality real estate, or

a reverse merger partner, continuation of growth of hospitality

revenues and/or profit growth, timely collection of receivables,

the success of and timing of the UniGen clean energy

diversification innovation, the continuation of semi-annual

dividends in the year(s) ahead, and other risks discussed in IHT’s

SEC filings. IHT expressly disclaims any obligation to update any

forward-looking statement contained in this news release to reflect

events or circumstances that may arise after the date hereof, all

of which are expressly qualified by the foregoing, other than as

required by applicable law.

FOR FURTHER INFORMATION:

Marc Berg, Executive Vice President 602-944-1500

email: mberg@innsuites.com

INNSUITES HOTEL CENTRE1730 E. NORTHERN AVENUE,

#122Phoenix, Arizona 85020Phone: 602-944-1500

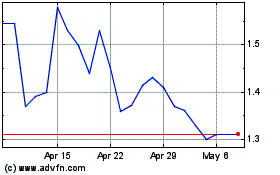

Innsuites Hospitality (AMEX:IHT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Innsuites Hospitality (AMEX:IHT)

Historical Stock Chart

From Jan 2024 to Jan 2025