UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date: March 1, 2024

Commission File Number: 001-33414

Denison Mines Corp.

(Name of

registrant)

1100-40 University Avenue

Toronto Ontario

M5J 1T1 Canada

(Address of

principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form

40-F.

Form

20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(1): ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, thereunto duly

authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

DENISON MINES

CORP.

|

|

|

|

|

|

|

|

|

|

/s/ Amanda Willett

|

|

Date: March

1, 2024

|

|

|

|

Amanda

Willett

|

|

|

|

|

|

Vice

President Legal and Corporate Secretary

|

FORM 6-K

EXHIBIT INDEX

Exhibit 99.1

|

|

Denison Mines

Corp.

1100 – 40

University Ave

Toronto, ON M5J

1T1

www.denisonmines.com

|

PRESS

RELEASE

Denison Reports Impressive Financial and Operational Results for

2023

Including Significant Increase in Phoenix ISR Project Economics

and

a $134 Million Gain on Physical Uranium Holdings

Toronto, ON – February

29, 2024. Denison Mines Corp. (‘Denison’ or the

‘Company’) (TSX: DML, NYSE American: DNN) today filed

its Audited Consolidated Financial Statements and

Management’s Discussion & Analysis

(‘MD&A’) for the year ended December 31, 2023. Both

documents are or will be available on the Company’s website

at www.denisonmines.com,

SEDAR+ (at www.sedarplus.ca)

and EDGAR (at www.sec.gov/edgar.shtml).

The highlights provided below are derived from these documents and

should be read in conjunction with them. All amounts in this

release are in Canadian dollars unless otherwise

stated.

The

Company reported earnings per share (‘EPS’) from

continuing operations of $0.11 for the year ended December 31,

2023, representing a 450% increase from the 2022 EPS of $0.02,

driven by the recognition of a significantly larger gain on the

Company’s physical uranium holdings offset by operating

expenses primarily related to the Company’s advancement of

its flagship Wheeler River Project.

A

description of the Company’s plans and budget for 2024

(‘2024 Outlook’) is included in the

MD&A.

David Cates, President and CEO of Denison

commented, “The

sheer magnitude of Denison’s numerous operational

accomplishments in 2023 reflects an extraordinarily productive time

for our Company. With the completion of the Phoenix Feasibility

Study in June, we have cemented Phoenix’s position as a

globally leading uranium development project, showcasing

Denison’s industry leadership in the de-risking and

application of the In-Situ Recovery mining method in the Athabasca

Basin. The results from an updated Pre-Feasibility Study for the

Gryphon deposit, completed as part of a newly issued Technical

Report for the Company’s flagship Wheeler River property,

also demonstrate the significant potential additional leverage that

comes from Denison’s diversified portfolio of

projects.

We achieved a notable milestone for the project in 2023 with the

signing of a Shared Prosperity Agreement with English River First

Nation supporting the development and operation of Wheeler River.

The SPA reflects ERFN’s consent to the advancement of the

project and acknowledges that Wheeler River is located within

ERFN’s Ancestral Lands. The SPA further describes a mutual

commitment to maintain an open, respectful, and cooperative

relationship between Denison and ERFN to ensure mutual prosperity

as the development and operation of the project

progresses.

Significant progress has also been made in support of permitting

the planned Phoenix ISR mine, consistent with our plans and

objective to achieve first production in 2027 or 2028. The Company

has responded to multiple rounds of technical comments and

information requests from both the Provincial and Federal

regulators in respect of its draft Environmental Impact Statement

and has successfully reduced the number of outstanding requests,

including confirmation from the Saskatchewan Ministry of

Environment that it is satisfied with our responses and that

Denison may proceed to finalize the EIS for provincial

approval.

The evolution of the uranium market in

2023 has been quite interesting and has had a significant positive

impact on Denison’s balance sheet. With the uranium price

rising from US$48/lb U3O8

at the start of the year to US$91/lb

U3O8

at year end, Denison’s strategic

physical uranium holdings have appreciated considerably –

driving the Company’s highest earnings per share since 2007.

It is apparent that the uranium market has entered a new phase and

we are pleased to see the market recognize the growing scarcity of

available future uranium production and that higher prices are

required to incentivize sufficient new uranium production to meet

current and growing demand. Importantly, the higher price

environment follows an initial wave of long-term contracting that

has already incentivized a series of mine restarts from the

industry’s incumbent producers. This transition to a

production cost-based market environment is consistent with

Denison’s expectations and validates the Company’s

tireless work to advance Phoenix towards a final investment

decision during several challenging years of negative uranium

market conditions.

Our hard work in past years has paved the way for an incredibly

exciting time for our Company as we focus on delivery of our

Phoenix ISR project. As outlined in our 2024 Outlook, the

Company’s expected priorities for Phoenix include advancement

of detailed design engineering, long-lead procurement, permitting,

and project financing. In parallel, we plan to continue to pursue

opportunities to drive additional value from our diverse project

portfolio – including preparations for the restart of uranium

mining at McClean Lake, a robust exploration program, and

advancement of both the Midwest and Waterbury Lake projects through

the next stages of technical and economic

evaluations.”

Highlights

■

Exceptional

annual earnings from continuing operations driven by $134 million

gain on physical uranium investments

During 2023, the

Company’s earnings from continuing operations of $89.4

million ($0.11 per share) were driven by an impressive $134.2

million fair value gain on the Company’s investments in

physical uranium. The Company acquired 2.5 million pounds

U3O8 in 2021 at an

average price of $36.67 per pound U3O8 (US$29.66 per

pound U3O8). In the fourth

quarter, the Company sold 200,000 pounds U3O8 at an average

selling price of $99.50 per pound U3O8 (US$73.38 per

pound U3O8), representing a

realized gain on sale of $12.6 million (US$8.8 million). As at

December 31, 2023, the Company’s remaining uranium portfolio

has increased in value by 228% to $120.35 per pound U3O8 (US$91.00 per

pound U3O8) for an aggregate

value of approximately $276.8 million (US$209.3

million).

■

Feasibility

Study for Wheeler River Phoenix deposit yields significant increase

in project economics

In June 2023,

Denison released the results of the Feasibility Study

(‘Phoenix FS’) completed for In-Situ Recovery

(‘ISR’) mining of the high-grade Phoenix uranium

deposit (‘Phoenix’), which is part of the

Company’s flagship Wheeler River Project (‘Wheeler

River’ or the ‘Project’).

The Phoenix FS

demonstrates robust economics including:

●

Base case pre-tax Net Present

Value (‘NPV’) (8%) of $2.34 billion (100%

ownership-basis) representing a 150% increase in the base-case

pre-tax NPV8% for Phoenix from

the 2018 Pre-Feasibility Study (‘2018

PFS’).

●

Very robust base-case pre-tax

Internal Rate of Return (‘IRR’) of 105.9%.

●

Adjusted base case after-tax

NPV8%

of $1.56 billion (100% basis) and IRR of 90.0% – with

Denison’s effective 95% interest in the project equating to

an adjusted base case after-tax NPV8% of $1.48

billion.

●

Base case pre-tax and

after-tax (adjusted) payback period of 10 months – equating

to a reduction of 11 months for the pre-tax payback period from the

2018 PFS.

●

Optimized production profile,

based on ISR mine planning efforts evaluating production potential

for individual well patterns – resulting in an increase to

the planned rate of production by approximately 43% during the

first five years of operations.

●

Estimated pre-production

capital costs of under $420 million (100% basis), yielding an

impressive base-case after-tax (adjusted) NPV to initial capital

cost ratio in excess of 3.7 to 1.

●

Robust economics that easily

absorb cost-inflation and design changes impacting both operating

and capital costs, confirming Phoenix’s estimated cash

operating and all-in costs to be amongst the lowest-cost uranium

mining projects in the world.

●

Phoenix FS plans aligned and

costed to meet or exceed environmental criteria expected to be

required by the ongoing regulatory approval process.

●

Updated mineral resource

estimate, reflecting the results of 70 drill holes completed in

support of ISR de-risking and resource delineation activities,

which has upgraded 30.9 million pounds U3O8 into measured

mineral resources. The updated mineral resource also resulted in an

increase to the average grade of the Zone A high-grade domain,

which is now estimated to contain 56.3 million pounds U3O8 in Measured and

Indicated mineral resources at an average grade of 46.0%

U3O8.

●

Upgraded 3.4 million pounds

U3O8 into Proven

mineral reserves, representing the equivalent of 85% of production

planned during the first calendar year of operations.

■

Phoenix

ISR de-risking completed and focus transitions to engineering

design

The Phoenix FS

reflects independent third-party validation of the selection of the

ISR mining method for Phoenix and builds on the findings from a

comprehensive and rigorous multi-year technical de-risking process

highlighted by the highly successful completion of the leaching and

neutralization phases of the Phoenix Feasibility Field Test

(‘FFT’) in late 2022.

Through the

technical de-risking process, Denison acquired extensive

deposit-specific data and developed a robust ISR mine planning

model that involved evaluation of the production potential for

individual well patterns. With technical de-risking of the

application of ISR at Phoenix substantially complete, Denison

undertook front-end engineering design (‘FEED’) to

support the advancement of the planned Phoenix operation and, with

the results thereof substantially complete, is transitioning into

detailed engineering design.

■

Landmark

Shared Prosperity Agreement signed with English River First

Nation

In September

2023, Denison announced the signing of a Shared Prosperity

Agreement (‘SPA’) with English River First Nation

(‘ERFN’) supporting the development and operation of

Wheeler River. The SPA received support from a substantial majority

of ERFN members who participated in a ratification vote on its key

terms.

The signing of

the SPA follows years of active engagement, including a

four-month-long ERFN-led community consultation process ahead of

the ratification vote, and represents a significant milestone in

the history of both Denison's relationship with ERFN and the

Project.

The SPA

acknowledges that the Project is located within ERFN’s

Ancestral Lands and provides Denison with ERFN’s consent to

advance the Project. Additionally, the SPA outlines a shared

recognition that ERFN is the Knowledge Keeper of the culture, ways,

customs, and values of ERFN in relation to the environment and its

Members and reflects ERFN’s desire to prioritize

sustainability. Amongst other key commitments, the SPA provides

ERFN and its Members with (i) an important role in environmental

monitoring and management, and (ii) benefits from community

investment, business opportunities, employment and training

opportunities, and financial compensation. Overall, the SPA

describes a mutual commitment to maintain an open, respectful, and

cooperative relationship between Denison and ERFN to ensure mutual

prosperity as the development and operation of the Project

progresses.

■

Phoenix

Environmental Impact Statement (‘EIS’) advanced through

regulatory review

Denison’s

draft EIS for Phoenix was submitted to the Saskatchewan Minister of

Environment (‘SKMOE’) and the Canadian Nuclear Safety

Commission (‘CNSC’) in late 2022. The EIS submission

outlines the Company’s assessment of the potential effects,

including applicable mitigation measures, of the proposed ISR

uranium mine and processing plant planned for Phoenix, and reflects

several years of baseline environmental data collection, technical

assessments, plus extensive engagement and consultation with

Indigenous and non-Indigenous interested parties.

In the first

quarter of 2023, the Company received technical comments and

information requests from both regulatory agencies and the Company

has provided technical responses to both the Provincial and Federal

regulators.

In August 2023,

reflective of the extensive efforts undertaken by and for the

Company, the CNSC deemed complete the Company’s responses to

the approximately 250 Federal comments from the CNSC. In November

2023, a second round of information requests was received from the

CNSC. Following the successful resolution of the outstanding

comments from the Federal Indigenous Review Team, the Company

expects to then be in position to submit a final version of EIS for

consideration at a future hearing of the CNSC.

In October 2023

the Saskatchewan Ministry of Environment confirmed its satisfaction

with Denison’s comment responses and proposed EIS updates.

The confirmation would allow Denison to finalize the EIS for the

purpose of obtaining a Provincial Environmental Assessment

(‘EA’) approval, however this would delink the

currently coordinated Provincial – Federal EA process, which

is not expected to provide a meaningful schedule advantage for the

Phoenix project. Denison plans to submit one version of the final

EIS to both authorities once the Federal information requests have

been resolved.

■

Phoenix

ISR Feasibility Field Test Recovered Solution Management phase

completed

In November 2023,

the Company announced the successful completion of the recovered

solution management phase of the FFT. The FFT was designed to use

the existing commercial-scale ISR test pattern to perform a

combined assessment of the Phoenix deposit’s hydraulic flow

properties along with the leaching characteristics that had been

assessed through the metallurgical core-leach testing program. The

prior phases of the FFT, completed in 2022, were highlighted by the

recovery of 14,400 pounds of U3O8 dissolved in

solutions generated during the leaching and neutralization phases

of the test.

The solution

recovered during the FFT was stored on site and this final phase of

the FFT involved the treatment of the recovered solution via an

on-site purpose-built treatment system. Following treatment, a

uranium precipitate product and a treated effluent were produced.

The mineralized precipitates have been recovered from the process

with over 99.99% efficiency. The treated effluent was tested to

ensure compliance with permit conditions before being injected into

a designated subsurface area.

■

Cost update to the 2018 PFS for Wheeler River

Gryphon deposit (‘Gryphon’) confirms the project’s position amongst

the lowest-cost uranium mining projects in the

world

During 2023, the

Company also completed a cost update (‘Gryphon Update’)

to the 2018 PFS for conventional underground mining of the

basement-hosted Gryphon deposit. The scope of the Gryphon Update

was targeted at the review and update of capital and operating

costs. Mining and processing plans remain largely unchanged from

the 2018 PFS aside from minor scheduling and construction

sequencing optimizations. The key points include:

●

Base case pre-tax NPV (8%) of

$1.43 billion (100% basis) is a 148% increase in the base-case

pre-tax NPV8% for Gryphon from

the 2018 PFS.

●

Strong base-case pre-tax IRR

of 41.4%.

●

Base case after-tax

NPV8%

of $864.2 million (100% basis) and IRR of 37.6% – with

Denison’s effective 95% interest in the project equating to a

base case after-tax NPV8% of $821.0

million.

●

Base case pre-tax payback

period of 20 months, and base case after-tax payback period of 22

months – equating to a reduction of 17 months for the pre-tax

payback period from the 2018 PFS.

Importantly,

Gryphon remains a highly valuable project that provides Denison

with an additional source of low-cost potential production to

deploy significant free cash flows expected from

Phoenix.

■

$113

million raised through equity financings to fund operations and the

advancement of Phoenix

In October 2023,

Denison completed a bought deal public offering resulting in the

issuance of 37,000,000 shares at a price of $2.03 (US$1.49) per

share for total gross proceeds of $75.1 million (US$55.1 million).

Throughout 2023, Denison also issued 19,786,160 shares under its

At-The-Market (‘ATM’) equity program at an average

price of $1.91 per share for aggregate gross proceeds of $37.9

million.

■

Waterbury

Lake inaugural ISR field test program completed

In November 2023,

the Company announced the completion of an inaugural ISR field test

program at the Tthe Heldeth Túé uranium deposit

(‘THT’) on the Waterbury Lake property. The program

included (i) the installation of an eight well ISR test pattern

designed to collect an initial database of hydrogeological data,

(ii) testing of a permeability enhancement technique, (iii) the

completion of hydrogeologic test work, highlighted by the

achievement of hydraulic conductivity values consistent with those

from the 2020 Preliminary Economic Assessment (‘PEA’),

and (iv) the execution of an ion tracer test which established a 10

hour breakthrough time between the injection and extraction wells,

while also demonstrating hydraulic control of the injected

solution. Overall, the program successfully achieved each of its

planned objectives.

■

Midwest

internal concept study completed to examine potential application

of ISR mining method

The Company

completed an internal conceptual mining study examining the

potential application of ISR at the Company’s 25.17% owned

Midwest Project (‘Midwest’). The concept study was

prepared by Denison during 2022 and formally issued to the Midwest

Joint Venture (‘MWJV’) in early 2023. Based on the

positive results of the concept study, the MWJV provided Denison

with approval to complete additional ISR-related work, to be

undertaken for Midwest in 2023 and 2024.

■

Moon Lake

South discovery of high-grade uranium mineralization

In April 2023,

Denison reported the discovery of high-grade sandstone hosted

uranium mineralization approximately 30 metres above the

unconformity in drill hole MS 23-10A, which was completed as part

of the 2023 winter exploration program at the Moon Lake South

property. The intersection in MS 23-10A returned 2.46%

U3O8

over 8.0 metres, including a sub-interval grading 3.71%

U3O8 over 4.5 metres.

This result represents the best drill hole completed on the Moon

Lake South property to date and is a high priority for follow-up

exploration.

■

$15

million strategic investment in F3 Uranium Corp.

In October 2023,

the Company completed a $15 million strategic investment in F3

Uranium Corp. (‘F3’) in the form of unsecured

convertible debentures (the ‘Debentures’), which carry

a 9% coupon and will be convertible at Denison’s option into

common shares of F3 at a conversion price of $0.56 per share. F3

has the right to pay up to one third of the quarterly interest

payable by issuing common shares. F3 will also have certain

redemption rights on or after the third anniversary of the date of

issuance of the Debentures and/or in the event of an F3 change of

control.

■

Executive

team changes undertaken in 2023

In December 2023,

Denison announced the promotion of Ms. Elizabeth Sidle to the

position of Chief Financial Officer, in addition to her position as

the Company’s Vice President Finance. Ms. Sidle joined

Denison in 2016, advancing to the position of Vice President

Finance in 2021. Ms. Sidle had been serving as Denison’s

Interim Chief Financial Officer since September 1, 2023, during a

temporary medical leave of absence of the Company’s previous

Chief Financial Officer and since his departure from Denison in

late October 2023.

Denison also

announced the addition of Mr. Geoff Smith to the position of Vice

President Corporate Development & Commercial. Mr. Smith will be

focused on supporting Denison’s investor and customer

engagement, the evaluation and execution of growth opportunities

and financing arrangements, and the development and oversight of

the Company’s uranium sales and contracting

strategies.

About Denison

Denison Mines

Corp. was formed under the laws of Ontario and is a reporting

issuer in all Canadian provinces and territories. Denison’s

common shares are listed on the Toronto Stock Exchange (the

‘TSX’) under the symbol ‘DML’ and on the

NYSE American exchange under the symbol

‘DNN’.

Denison is a

uranium exploration and development company with interests focused

in the Athabasca Basin region of northern Saskatchewan, Canada. The

Company has an effective 95% interest in its flagship Wheeler River

Uranium Project, which is the largest undeveloped uranium project

in the infrastructure rich eastern portion of the Athabasca Basin

region of northern Saskatchewan. In mid-2023, a Feasibility Study

was completed for Wheeler River’s Phoenix deposit as an ISR

mining operation, and an update to the previously prepared PFS was

completed for Wheeler River’s Gryphon deposit as a

conventional underground mining operation. Based on the respective

studies, both deposits have the potential to be competitive with

the lowest cost uranium mining operations in the world. Permitting

efforts for the planned Phoenix ISR operation commenced in 2019 and

have advanced significantly, with licensing in progress and a draft

Environmental Impact Statement (‘EIS’) submitted for

regulator and public review October 2022.

Denison’s

interests in Saskatchewan also include a 22.5% ownership interest

in the McClean Lake Joint Venture (‘MLJV’), which

includes several uranium deposits and the McClean Lake uranium

mill, which is contracted to process the ore from the Cigar Lake

mine under a toll milling agreement, plus a 25.17% interest in the

Midwest Main and Midwest A deposits and a 69.35% interest in the

Tthe Heldeth Túé (‘THT,’ formerly J Zone) and

Huskie deposits on the Waterbury Lake property. The Midwest Main,

Midwest A, THT and Huskie deposits are located within 20 kilometres

of the McClean Lake mill.

Through its

50% ownership of Japan (Canada) Exploration Company, Ltd

(‘JCU’), Denison holds additional interests in various

uranium project joint ventures in Canada, including the Millennium

project (JCU, 30.099%), the Kiggavik project (JCU, 33.8118%) and

Christie Lake (JCU, 34.4508%).

Denison’s

exploration portfolio includes further interests in properties

covering approximately 385,000 hectares in the Athabasca Basin

region.

Technical Disclosure and Qualified Person

The technical

information contained in this press release has been reviewed and

approved by Chad Sorba, P.Geo., Denison’s Vice President

Technical Services and Project Evaluation, and Andy Yackulic,

P.Geo., Denison’s Vice President Exploration, who are both

Qualified Persons in accordance with the requirements of NI

43-101.

Further details

of the Phoenix FS and Gryphon Update are provided in

Denison’s press release of June 26, 2023. The results of the

Phoenix FS and Gryphon Update are also detailed in a technical

report entitled “NI 43-101 Technical Report on the Wheeler

River Project Athabasca Basin, Saskatchewan, Canada,” with an

effective date of June 23, 2023 and dated August 8, 2023.

The technical report is available on

the Company’s website at www.denisonmines.com,

on SEDAR+ (at www.sedarplus.ca)

and on EDGAR (at www.sec.gov/edgar.shtml).

For more information, please contact

David

Cates

(416) 979-1991 ext.

362

President and

Chief Executive Officer

Geoff

Smith

(416) 979-1991 ext.

358

Vice President

Corporate Development & Commercial

Follow Denison on

Twitter

@DenisonMinesCo

Non-GAAP Financial Measures

This release

includes certain terms or performance measures commonly used in the

mining industry that are not defined under International Financial

Reporting Standards (‘IFRS’).

Such non-GAAP

performance measures, including NPV, are included because the

Company understands that investors use this information to

determine the Company’s ability to generate earnings and cash

flows. The Company believes that conventional measures of

performance prepared in accordance with IFRS do not fully

illustrate the ability of mines to generate cash flows. Non-GAAP

financial measures should not be considered in isolation as a

substitute for measures of performance prepared in accordance with

IFRS and are not necessarily indicative of operating costs,

operating profit or cash flows presented under IFRS.

Cautionary Statement Regarding Forward-Looking

Statements

Certain

information contained in this press release constitutes

‘forward-looking information’, within the meaning of

the applicable United States and Canadian legislation concerning

the business, operations and financial performance and condition of

Denison.

Generally, these

forward-looking statements can be identified by the use of

forward-looking terminology such as ‘plans’,

‘expects’, ‘budget’,

‘scheduled’, ‘estimates’,

‘forecasts’, ‘intends’,

‘anticipates’, or ‘believes’, or the

negatives and/or variations of such words and phrases, or state

that certain actions, events or results ‘may’,

‘could’, ‘would’, ‘might’ or

‘will be taken’, ‘occur’, ‘be

achieved’ or ‘has the potential to’.

In particular,

this press release contains forward-looking information pertaining

to the following: projections with respect to exploration,

development and expansion plans and objectives, including the

results of the FS and the scope, objectives and interpretations of

the technical de-risking process for the proposed ISR operation for

the Phoenix deposit, including the FFT, and the interpretation of

the results therefrom; expectations with respect to future

evaluation and development of Phoenix, including engineering design

efforts, long-lead item procurement; expectations regarding

regulatory applications and approvals and the elements thereof,

including the EIS; expectations with respect to Company resources

and project financing; expectations regarding the performance of

the uranium market and global sentiment regarding nuclear energy;

expectations regarding Denison’s joint venture ownership

interests; and expectations regarding the continuity of its

agreements with third parties. Statements relating to

‘mineral reserves’ or ‘mineral resources’

are deemed to be forward-looking information, as they involve the

implied assessment, based on certain estimates and assumptions that

the mineral reserves and mineral resources described can be

profitably produced in the future.

Forward looking

statements are based on the opinions and estimates of management as

of the date such statements are made, and they are subject to known

and unknown risks, uncertainties and other factors that may cause

the actual results, level of activity, performance or achievements

of Denison to be materially different from those expressed or

implied by such forward-looking statements. For example, the

results and underlying assumptions and interpretations of the FS as

well as de-risking efforts such as the ISR field programs discussed

herein may not be maintained after further testing or be

representative of actual conditions within the applicable deposits.

In addition, Denison may decide or otherwise be required to extend

its evaluation activities and/or discontinue testing, evaluation

and development work if it is unable to maintain or otherwise

secure the necessary approvals or resources (such as testing

facilities, capital funding, etc.). Denison believes that the

expectations reflected in this forward-looking information are

reasonable, but no assurance can be given that these expectations

will prove to be accurate and results may differ materially from

those anticipated in this forward-looking information. For a

discussion in respect of risks and other factors that could

influence forward-looking events, please refer to the factors

discussed in the MD&A dated February 29, 2024 under the heading

‘Risk Factors’. These factors are not, and should not

be, construed as being exhaustive.

Accordingly,

readers should not place undue reliance on forward-looking

statements. The forward-looking information contained in this press

release is expressly qualified by this cautionary statement. Any

forward-looking information and the assumptions made with respect

thereto speaks only as of the date of this press release. Denison

does not undertake any obligation to publicly update or revise any

forward-looking information after the date of this press release to

conform such information to actual results or to changes in

Denison's expectations except as otherwise required by applicable

legislation.

Cautionary Note to United States Investors Concerning Estimates of

Mineral Resources and Mineral Reserves:

This news release

may use the terms ‘measured’, ‘indicated’

and ‘inferred’ mineral resources. United States

investors are advised that such terms have been prepared in

accordance with the definition standards on mineral reserves of the

Canadian Institute of Mining, Metallurgy and Petroleum referred to

in NI 43-101 and are recognized and required by Canadian

regulations. ‘Inferred mineral resources’ have a great

amount of uncertainty as to their existence, and as to their

economic and legal feasibility. Under Canadian rules, estimates of

inferred mineral resources may not form the basis of feasibility or

other economic studies. United States investors are cautioned not

to assume that all or any part of an inferred mineral resource

exists and/or will ever be upgraded to a higher category, nor

assume that all or any part of measured or indicated mineral

resources will ever be converted into mineral

reserves.

Effective

February 2019, the United States Securities and Exchange Commission

(‘SEC’) adopted amendments to its disclosure rules to

modernize the mineral property disclosure requirements for issuers

whose securities are registered with the SEC under the Exchange Act

and as a result, the SEC now recognizes estimates of

‘measured mineral resources’, ‘indicated mineral

resources’ and ‘inferred mineral resources’. In

addition, the SEC has amended its definitions of ‘proven

mineral reserves’ and ‘probable mineral reserves’

to be ‘substantially similar’ to the corresponding

definitions under the CIM Standards, as required under NI 43-101.

However, information regarding mineral resources or mineral

reserves in Denison's disclosure may not be comparable to similar

information made public by United States companies.

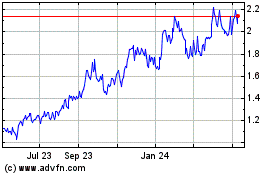

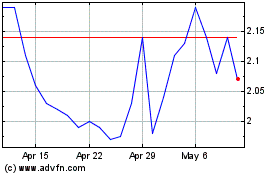

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Nov 2023 to Nov 2024