false

0001120970

0001120970

2024-10-01

2024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 1, 2024

COMSTOCK INC.

(Exact Name of Registrant as Specified in its Charter)

| Nevada |

001-35200 |

65-0955118 |

|

(State or Other

Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification Number)

|

117 American Flat Road, Virginia City, Nevada 89440

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code: (775) 847-5272

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.000666 per share

|

LODE

|

NYSE AMERICAN

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On October 1, 2024, Comstock Inc. (the “Company”) entered into a binding letter agreement (the “Letter Agreement” with Deep Interstellar Research LLC (“DIR”) and Quantum Generative Materials LLC (“GenMat”) to (i) separate GenMat’s materials development activities (“Materials Science Business”) and space development activities (“Space Business”); (ii) assign all assets, operations, and liabilities relating to the Materials Business to GenMat; (iii) assign all assets, operations, and liabilities relating to the Space Business to GenMat Development LLC; (iv) exchange 100% of GenMat’s equity in GenMat Development LLC for 100% of DIR’s equity in GenMat; and (v) devise and implement a mutually agreeable transition plan to assist GenMat in developing independent operations for the Material Science Business without the need for support from assets, personnel, and vendors that are utilized by the Space Business. In connection with the foregoing transactions, GenMat will additionally pay $1,000,000 to the founder of GenMat in exchange for assignment of all rights to related intellectual properties, plus a contingent earn-out payment equal to 3% of either (a) the consideration paid in connection with the liquidation of substantially all of the equity of GenMat in excess of $100,000,000, or (b) the funds raised by GenMat upon completion of an initial public offering of GenMat at a valuation in excess of $100,000,000. Upon completion of the transactions described above, GenMat will become a 100% owned subsidiary of the Company.

The foregoing summary of the terms of the Letter Agreement is not intended to be exhaustive and is qualified in its entirety by the terms of the Letter Agreement, a copy of which is attached hereto as Exhibit 10.1, which is incorporated by reference herein.

A copy of the press release announcing the transactions contemplated by the Letter Agreement is attached as Exhibit 99.1 to the Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

COMSTOCK INC.

|

| |

|

|

|

Date: October 7, 2024

|

By:

|

/s/ Corrado De Gasperis

|

| |

|

Corrado De Gasperis

Executive Chairman and Chief Executive Officer

|

Exhibit 10.1

| Deeptanshu Prasad, Chief Executive Officer |

October 1, 2024 |

|

QUANTUM GENERATIVE MATERIALS LLC

14135 230 St.

Maple Ridge, ON V4R 0G9

|

|

COMSTOCK INC. and its wholly owned and/or controlled subsidiaries (the “Company”) is pleased to confirm its interest in completing the amendments outlined in Annex A hereto (the “Summary” and, together with this letter, the “Letter Agreement”).

The undersigned each hereby agree, represent and warrant that it has all requisite power and authority to execute, deliver and perform this Letter Agreement; that this Letter Agreement has been duly and validly executed and delivered; and, that the execution, delivery and performance by the undersigned of this Letter Agreement and the consummation of the actions contemplated herein and therein have been duly authorized by all necessary action.

Thank you for your consideration of this Letter Agreement. We appreciate the opportunity to work with you and look forward to the prospect of doing so.

|

|

|

Kindest regards,

|

|

| |

|

COMSTOCK INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Corrado De Gasperis

|

|

|

|

Name:

|

|

Corrado De Gasperis

|

|

|

|

Title: |

|

Executive Chairman and Chief Executive Officer

|

|

|

QUANTUM GENERATIVE MATERIALS LLC

|

| |

|

| By: |

/s/ Deeptanshu Prasad

|

| Name: |

Deeptanshu Prasad

|

| Title: |

Chief Executive Officer

|

| |

COMSTOCK INC.

P.O. Box 1118

1200 American Flat Road

Virginia City, Nevada 89440

D (775) 848-5310 • F (800) 750-5740

degasperis@comstockinc.com

www.comstockinc.com

|

ANNEX A

SUMMARY TERMS AND CONDITIONS

This Annex outlines a possible Transaction between COMSTOCK INC.(“Company”), DEEP INTERSTELLAR RESEARCH LLC (“DIR”), and QUANTUM GENERATIVE MATERIALS LLC (“GenMat”). Except for Sections 5 to 24 (collectively, the “Binding Terms”), this Letter Agreement is only a non-binding expression of the present intentions of the parties and, unless and until definitive agreements with respect to the proposed Transaction described herein have been executed and delivered by the parties (“Definitive Agreements”), no legally binding agreement exists between the parties to consummate the Transaction contemplated hereby:

| 1. |

Entities

|

|

QUANTUM GENERATIVE MATERIALS LLC (“GenMat”), directly and indirectly owns all assets, operations, and liabilities pertaining to the Materials Science Business and the Space Business (as such terms are defined below), including through its two wholly-owned subsidiaries.

|

| |

|

|

|

| |

|

|

GENMAT DEVELOPMENT LLC (“DevCo”), GenMat’s wholly-owned subsidiary, administers certain GenMat assets, operations, and liabilities.

|

| |

|

|

|

| |

|

|

GENMAT LICENSING LLC (“IPCo”), GenMat’s wholly-owned subsidiary, administers certain GenMat assets, operations, and liabilities.

|

| |

|

|

|

| |

|

|

DEEP INTERSTELLAR RESEARCH LLC (“DIR”) is the beneficial owner of 374,425 issued and vested membership interest units in GenMat. Deeptanshu Prasad (“Principal”) is the beneficial owner of 100% of the issued and outstanding membership interest units of DIR.

|

| |

|

|

|

| |

|

|

COMSTOCK INC. (“Company”) is the beneficial owner of (i) 285,000 issued and vested membership interest units in GenMat, and (ii) 215,000 issued and unvested membership interest units in GenMat (“Unvested Units”).

|

| |

|

|

|

| |

|

|

COMSTOCK IP HOLDINGS LLC (“CIPH”), the Company’s wholly-owned subsidiary, holds 100% of the Company’s intellectual properties and administers 100% of the Company’s research and development activities.

|

| |

|

|

|

| 2. |

Background

|

|

The Company, DIR, and GenMat are party to certain transaction documents effective June 24, 2021, including, without limitation, a Limited Liability Company Operating Agreement (“Operating Agreement”), and a Membership Interest Purchase Agreement (“MIPA” and, together with the Operating Agreement and ancillary documents, instruments, and agreements, the “Transaction Documents”). The Company’s issued and vested membership interest units in GenMat correspond to 43% of GenMat’s equity and voting power (unvested units are deemed disregarded). DIR’s issued and vested membership interest units in GenMat correspond to 56% of GenMat’s equity and voting power.

|

| |

|

|

|

| 3. |

Purpose

|

|

The Company, DIR, and GenMat have agreed to (i) separate GenMat’s materials development activities (“Materials Science Business”) and space development activities (“Space Business”); (ii) assign all assets, operations, and liabilities relating to the Materials Business to GenMat; (iii) assign all assets, operations, and liabilities relating to the Space Business to DevCo; (iv) exchange 100% of GenMat’s equity in DevCo for 100% of DIR’s equity in GenMat; and (v) devise and implement a mutually agreeable transition plan to assist GenMat in developing independent operations for the Materials Science Business without the need for support from assets, personnel, and vendors that are utilized by the Space Business.

|

| |

|

|

|

| 4. |

Sequence

|

|

Schedule A hereto provides a visual representation of the itemized steps required to complete the Transaction, as described more fully below.

|

| |

|

|

|

| 5. |

Process and Timing

|

|

This Letter Agreement shall be executed and effective as of October 1, 2024. The Definitive Agreements shall be executed on or before October 15, 2024 (“Closing Date”), and shall be made effective as of October 1, 2024. The parties shall use their best efforts on a TIME OF THE ESSENCE basis, to complete the Transaction on the stated timing on or before the Closing Date, unless otherwise agreed to in writing by the parties; provided, however that no closing shall occur until and unless the following conditions precedent have been satisfied as of the Closing Date: (i) completion of due diligence; (ii) all necessary approvals will have been obtained; (iii) no breaches hereunder, or under any document or instrument delivered in connection herewith, or other material adverse changes shall have occurred; and (iv), the Definitive Agreements shall have been drafted and executed, and any and all closing deliveries shall be fully performed or waived by the applicable parties.

|

|

TRANSACTIONS TO BE COMPLETED PRIOR TO EQUITY EXCHANGE

|

| 6. |

Business Assignments

|

|

GenMat and IPCo shall each assign to DevCo 100% of their respective right, title and interest in, to, and under all assets, operations, and liabilities relating to the Space Business, including, without limitation, GenMat’s satellite, mission control software, geospatial modeling software, applicable intellectual properties, switch data center (collectively, the “Space Assets and Liabilities”), and all related agreements, rights, and obligations pertaining thereto (“Space Business Assignment”).

|

| |

|

|

|

| |

|

|

DevCo and IPCo shall each assign to GenMat 100% of their respective right, title and interest in, to, and under all assets, operations, and liabilities that are not explicitly included in the Space Assets and Liabilities (collectively, the “Materials Science Assets and Liabilities”), and all related agreements, rights, and obligations pertaining thereto for no additional consideration (“Materials Science Business Assignment”). On and subject to the terms and conditions hereof, including completion of due diligence, and the Definitive Agreements, GenMat shall assume all liabilities that are not included in the Space Assets and Liabilities.

|

| |

|

|

|

| 7. |

Principal Assignment

|

|

Principal shall assign to GenMat 100% of any and all intellectual properties that Principal has conceived of and or acquired involving GenMat’s Materials Science Business prior to March 31, 2025, including, without limitation, GenMat’s physics-based high performance and artificial intelligence computing platforms for use in simulating materials (“Zeno”), including all trade secrets and know how pertaining thereto (collectively, the “Principal IP Assets”), in exchange for the payment by GenMat of (i) a fixed payment of $1,000,000 in installments of (a) $250,000 on the Closing Date, (b) $250,000 on November 15, 2024, and (c) $500,000 on March 31, 2025 (“Fixed Payment”); and (ii) a contingent earn-out payment equal to 3% of either (a) the consideration paid in connection with the liquidation of substantially all of the equity of GenMat in excess of $100,000,000, or (b) the funds raised by GenMat upon completion of an initial public offering of GenMat at a valuation in excess of $100,000,000 (“Earn-Out Payment”).

|

| |

|

|

|

| 8. |

Employee Assignments

|

|

DevCo’s employees (“DevCo Employees”) shall assign to GenMat all intellectual properties that each employee has conceived of and or acquired involving GenMat’s Materials Science Business prior to March 31, 2025, including, without limitation, Zeno and all trade secrets and know how pertaining thereto (collectively, the “Employee IP Assets”) for no additional consideration.

|

| |

|

|

|

| 9. |

Caminosoft Assignment

|

|

Caminosoft AI, Inc. (“Caminosoft”) shall assign to GenMat 100% all intellectual properties that Caminosoft has conceived of and or acquired involving GenMat’s Materials Science Business prior to March 31, 2025, including, without limitation, Zeno and all trade secrets and know how pertaining thereto (collectively, the “Caminosoft IP Assets”) for no additional consideration.

|

| |

|

|

|

| 10. |

Mining Information

|

|

DevCo shall agree to provide all imaging and other data, analytics, AI and other models, and other information completed to date, in both the form of data and a promulgated report (“DevCo Information”), relating to the Company’s mining properties in Nevada on or before the Closing Date. DevCo shall also agree to use its best efforts to complete and provide all imaging data (via satellite, UAV, or otherwise) on or before the second anniversary of the Closing Date.

|

| 11. |

GenMat Cancellation

|

|

GenMat shall dissolve IPCo immediately after completion of the transactions described in Sections 6 to 9 hereof.

|

| |

|

|

|

| 12. |

Company Cancellation

|

|

The Company shall assign to GenMat 100% of its right, title, and interest in, to and under all Unvested Units in GenMat as of the Closing Date. GenMat shall immediately surrender and cancel the Unvested Units.

|

| |

|

|

|

| 13. |

Pre-Exchange Structure

|

|

After completion of the transactions in Sections 6 to 12 hereof, (i) GenMat shall own 100% of the Materials Science Business, all intellectual properties relating to Zeno and the Materials Science Business, and all other Materials Assets and Liabilities, and none of the Space Business and Space Assets and Liabilities; (ii) DevCo shall own 100% of the Space Business and all Space Assets and Liabilities and none of the Materials Science Business and Materials Science Assets and Liabilities; and (iii), IPCo shall be dissolved with no assets or liabilities.

|

| |

|

|

|

|

EQUITY EXCHANGE AND TRANSACTIONS TO BE COMPLETED AT CLOSING

|

| |

| 14. |

Equity Exchange

|

|

GenMat shall purchase and redeem 100% of DIR’s equity in GenMat (“Redemption Units”) in exchange for 100% of the issued and outstanding membership interest units of DevCo (“Equity Exchange”). GenMat shall surrender and cancel all the Redemption Units immediately after completing the Equity Exchange, thereby reducing GenMat’s issued and outstanding membership interest units as of the Closing Date to 285,575.

|

| |

|

|

|

| 15. |

Amended and Restated GenMat Operating Agreement

|

|

The Company, DIR, and GenMat shall terminate the Operating Agreement effective as of the Closing Date. Immediately after completion of the Equity Exchange, Comstock shall assign 100% of its right, title, and interest in GenMat to CIPH. CIPH and GenMat shall enter into an amended and restated operating GenMat agreement at the Closing Date.

|

| |

|

|

|

| 16. |

Amended and Restated DevCo Operating Agreement

|

|

GenMat shall terminate the existing DevCo operating agreement effective as of the Closing Date. DIR and DevCo shall enter into an amended and restated DevCo operating agreement at the Closing Date.

|

| |

|

|

|

| 17. |

Transition Services

|

|

GenMat and DevCo shall enter into a transition services agreement (“TSA”) under which DevCo shall use its best efforts to train and assist GenMat staff in operating the Materials Science Business, including, without limitation, all software, systems, and other requirements needed to access, use, and develop Zeno (“Transition Services”), with an objective of transitioning GenMat staff to independent operations of Zeno and the Materials Science Business as soon as possible after the Closing Date, but in no event later than March 31, 2025 (“Transition Completion Date”). Minimum requirements must be met including paying Caminosoft AI for the GPU related loan they took out on behalf of GenMat.

|

| |

|

|

|

| |

|

|

DevCo shall enter into a corresponding agreement with Caminosoft to ensure to provide any and all applicable services and support, with an objective of transitioning Zeno and any related requirements to an alternative qualified vendor designated by GenMat on or before the Transition Completion Date.

|

| |

|

|

|

| |

|

|

The purpose of the foregoing agreement is to give GenMat the ability to operate the Materials Science Business independently by the Transition Completion Date, without the need to rely on DevCo and Caminosoft.

|

|

MISCELLANEOUS TERMS

|

|

|

| |

|

|

| 18. |

Representations and Warranties

|

|

Schedule B hereto contains a true and accurate schedule of (i) the Space Assets and Liabilities, (ii) the Materials Assets and Liabilities, (iii) all material agreements (“Material Agreements”), (iv) all employment agreements (“Employment Agreements”), (v) all third party proposals and published marketing collateral for the Materials Science Business (“Marketing Collateral”), (vi) the issued and outstanding equity of GenMat, DevCo and IPCo (“Capitalization Table”), (vii) all agreements to issue any form of equity or other interest (“Equity Agreements”), and (viii) all documentation, specifications, operating instructions, and other information pertaining to Zeno (“Zeno Documentation”).

|

| 19. |

Restrictive Covenants

|

|

The Definitive Agreements shall include commercially reasonable restrictive covenants regarding non-competition, non-solicitation, and confidentiality between GenMat and DevCo.

|

| |

|

|

|

| 20. |

Release

|

|

GenMat and DevCo shall release each other from and against all claims arising from all actions and transactions occurring prior to the Closing Date. GenMat’s release shall extend to Principal, Caminosoft and DevCo employees.

|

| |

|

|

|

| 21. |

Disclosure Standards

|

|

The undersigned shall comply with the Confidentiality Agreement attached hereto (“NDA”), which is hereby incorporated by reference into the Binding Terms hereof. The undersigned hereby further agree that the term Confidential Information defined in the NDA shall be construed to include the existence and terms of this Letter Agreement. Until and unless the Closing Date has occurred, no party shall make any public or other disclosure of regarding the Transaction in the absence of each of the other parties’ express written consent.

|

| |

|

|

|

| 22. |

Status of Parties

|

|

GenMat and DevCo shall be independent entities and not affiliates of each other. GenMat and DevCo acknowledge and agree that no partnership, joint venture, or other relationship shall be construed by this Letter Agreement.

|

| |

|

|

|

| 23. |

Authorization

|

|

The Company, GenMat, and DIR, each on their own behalf, agree, represent, and warrant that it has all requisite power and authority to execute, deliver and perform this Letter Agreement; that this Letter Agreement has been duly and validly executed and delivered, and constitutes legal, valid and binding obligations in respect of the terms hereof; and, that the execution, delivery and performance by the Company, GenMat, and DIR of this Letter Agreement and the consummation of the actions contemplated herein have been duly authorized by all necessary action on behalf of the Company, GenMat, and DIR.

|

| |

|

|

|

| 24. |

Binding Terms

|

|

The terms of this Letter Agreement shall be deemed to be binding with regard to the essential business and economic terms hereof, on and subject to the terms and conditions hereof, until such time as the Company, GenMat, and DIR have executed the Definitive Agreements in respect of the Transaction, after which those Definitive Agreements shall in all respects govern the terms and conditions of the parties’ agreements in connection with the subject matter hereof.

|

Exhibit 99.1

COMSTOCK TO ACQUIRE QUANTUM GENERATIVE MATERIALS LLC

Strategic Investment in Artificial Intelligence for Materials Discovery in Energy Applications

VIRGINIA CITY, NEVADA, October 7, 2024 – Comstock Inc. (NYSE: LODE) (“Comstock” and the “Company”) today announced the execution of an agreement by Comstock, Deep Interstellar Research LLC (“DIR”), and Quantum Generative Materials LLC (“GenMat”) under which Comstock effectively acquired substantially all of the equity in GenMat, including GenMat’s artificial intelligence materials discovery platform, materials synthesis, and related assets, business, and most of the related technical team. Concurrently, as part of the acquisition of GenMat, Deep Prasad’s holding company will be receiving GenMat’s consolidated satellite, mission control software, other related low earth orbit assets, and space team. As a result of the transaction, Comstock will own substantially all of GenMat’s issued and outstanding equity and continue development and commercialization of its breakthrough physics-based artificial intelligence products and services to discover new materials and other technologies, primarily for decarbonizing energy.

“Our interest in GenMat was and remains grounded in the critical need and use of artificial intelligence for materials science and mineral discovery, for breakthrough energy applications and other mature industries with large addressable markets,” said Corrado De Gasperis, Comstock’s executive chairman and chief executive officer. “Artificial intelligence is even more critical today, as rapidly evolving AI platforms have begun to accelerate the pace of global innovation and redefine industries and competitive requirements. Frankly, anyone that is not integrating AI into their core competencies and capacities will likely either be disrupted or completely replaced.”

OpenAI’s ChatGPT employs a generative large language model to generate new, valuable information for a wide range of use cases at orders of magnitude faster than what was previously possible. GenMat’s AI operates similarly, but instead of generating words and language for a wide range of use cases, it generates new atoms, molecules, and physical systems for a wide range of materials applications, harnessing aspects of humanity’s collective knowledge of physics and chemistry combined with proprietary synthetic datasets to discover new materials in an exponentially shorter time than traditional methods have allowed.

Kevin Kreisler, Comstock’s chief technology officer, added, “focusing and building on GenMat’s team and competencies in materials science, computational chemistry, and computational machine learning, while incorporating the bleeding edge of emerging artificial intelligence technologies will reinforce our competitive advantages in our metals, mining, and fuels businesses, while dramatically expanding our existing innovation capacity as we continue to develop more advanced solutions for enabling systemic decarbonization.”

Since our initial investment in 2021, GenMat has built an exceptional team and achieved a series of critical milestones in materials simulation and synthesis, in addition to successfully launching its orbital imaging and remote sensing satellite, developing its proprietary mission control software, and commencing commercial sales in its space business.

“Deep Prasad positioned GenMat for an extraordinary second opportunity commercializing satellite development, manufacturing and management that requires different skills and dedication,” continued De Gasperis. “Launching a new company that will leverage GenMat’s existing space-based assets evolved as the logical, win-win solution that allowed our respective companies to maximize the value of each enterprise, with Comstock fully owning and dedicating to GenMat, and Deep fully dedicated to, owning, and leading the new space-based enterprise.”

“GenMat is one of the world’s first physics-based AI for materials science startup companies,” added Deep Prasad, GenMat’s founder and former chief executive officer. “We couldn’t be prouder of our accomplishments in materials simulation and synthesis, and the emerging opportunities with space-based systems and technologies. We are excited with Comstock’s plans to build on our work to date, and our ability to now fully dedicate and focus on building our space-based technologies, assets, and operations.”

“The strategic value of leveraging physics-based AI cannot be overstated,” concluded Kreisler. “AI will allow us to build on our competitive advantages in this rapidly changing world, while positioning us to generate extraordinary shareholder value as we fulfill our mission to enable systemic decarbonization by innovating, developing, commercializing, and monetizing new technologies for producing, distributing, storing, and using energy more efficiently.”

Mr. Kreisler will lead the management of GenMat’s ongoing technology development and commercialization efforts, including as part of Comstock’s growing innovation capabilities, projects, and partner networks.

Technology Readiness Level

Comstock uses the technology readiness scale to estimate the readiness of technology from conception to commercialization, iterating sequentially as follows: (i) TRL 1 (basic principles observed and reported); (ii) TRL 2 (technology concept and application formulated); (iii) TRL 3 (analytical and experimental proof of concept); (iv) TRL 4 (validation in laboratory environment); (v) TRL 5 (pre-pilot scale validation in relevant environment); (vi) TRL 6 (pilot prototype demonstration in relevant environment); (vii) TRL 7 (scaled-up commercial prototype in operational environment); (viii) TRL 8 (commercial system demonstration); (ix) TRL 9 (commercial maturity).

GenMat’s materials discovery AI is at TRL 3 in some applications. GenMat is focused on the minimum sufficient requirements for simulating and synthesizing breakthrough new materials for use in energy applications at TRL 6, followed by both commercialization and integration into Comstock’s businesses.

Comstock’s original 2021 investment agreement with GenMat called for a milestone-based investment of $50,000,000 for 50% of GenMat’s fully diluted equity, including about $15,000,000 previously paid by Comstock. Comstock and GenMat agreed to terminate each of their prior agreements as part of the new acquisition agreement. Comstock expects to efficiently operate, integrate, and commercialize GenMat.

About Comstock Inc.

Comstock Inc. (NYSE: LODE) commercializes innovative technologies that contribute to global decarbonization and the clean energy transition by efficiently converting under-utilized natural resources, primarily, woody biomass into low-carbon renewable fuels, end-of-life metal extraction and renewal, and generative AI-enabled advanced materials synthesis and mineral discovery for sustainable mining. To learn more, please visit www.comstock.inc.

Comstock Social Media Policy

Comstock Inc. has used, and intends to continue using, its investor relations link and main website at www.comstock.inc in addition to its Twitter, LinkedIn and YouTube accounts, as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Contacts

For investor inquiries:

RB Milestone Group LLC

Tel (203) 487-2759

ir@comstockinc.com

For media inquiries or questions:

Comstock Inc., Tracy Saville

Tel (775) 847-7573

questions@comstockinc.com

Forward-Looking Statements

This press release and any related calls or discussions may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “would,” “potential” and similar expressions identify forward-looking statements but are not the exclusive means of doing so. Forward-looking statements include statements about matters such as: future market conditions; future explorations or acquisitions; future changes in our research, development and exploration activities; future financial, natural, and social gains; future prices and sales of, and demand for, our products and services; land entitlements and uses; permits; production capacity and operations; operating and overhead costs; future capital expenditures and their impact on us; operational and management changes (including changes in the Board of Directors); changes in business strategies, planning and tactics; future employment and contributions of personnel, including consultants; future land and asset sales; investments, acquisitions, joint ventures, strategic alliances, business combinations, operational, tax, financial and restructuring initiatives, including the nature, timing and accounting for restructuring charges, derivative assets and liabilities and the impact thereof; contingencies; litigation, administrative or arbitration proceedings; environmental compliance and changes in the regulatory environment; offerings, limitations on sales or offering of equity or debt securities, including asset sales and associated costs; business opportunities, growth rates, future working capital, needs, revenues, variable costs, throughput rates, operating expenses, debt levels, cash flows, margins, taxes and earnings. These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical and current trends, current conditions, possible future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties, many of which are unforeseeable and beyond our control and could cause actual results, developments, and business decisions to differ materially from those contemplated by such forward-looking statements. Some of those risks and uncertainties include the risk factors set forth in our filings with the SEC and the following: adverse effects of climate changes or natural disasters; adverse effects of global or regional pandemic disease spread or other crises; global economic and capital market uncertainties; the speculative nature of gold or mineral exploration, and lithium, nickel and cobalt recycling, including risks of diminishing quantities or grades of qualified resources; operational or technical difficulties in connection with exploration, metal recycling, processing or mining activities; costs, hazards and uncertainties associated with precious and other metal based activities, including environmentally friendly and economically enhancing clean mining and processing technologies, precious metal exploration, resource development, economic feasibility assessment and cash generating mineral production; costs, hazards and uncertainties associated with metal recycling, processing or mining activities; contests over our title to properties; potential dilution to our stockholders from our stock issuances, recapitalization and balance sheet restructuring activities; potential inability to comply with applicable government regulations or law; adoption of or changes in legislation or regulations adversely affecting our businesses; permitting constraints or delays; challenges to, or potential inability to, achieve the benefits of business opportunities that may be presented to, or pursued by, us, including those involving battery technology and efficacy, quantum computing and generative artificial intelligence supported advanced materials development, development of cellulosic technology in bio-fuels and related material production; commercialization of cellulosic technology in bio-fuels and generative artificial intelligence development services; ability to successfully identify, finance, complete and integrate acquisitions, joint ventures, strategic alliances, business combinations, asset sales, and investments that we may be party to in the future; changes in the United States or other monetary or fiscal policies or regulations; interruptions in our production capabilities due to capital constraints; equipment failures; fluctuation of prices for gold or certain other commodities (such as silver, zinc, lithium, nickel, cobalt, cyanide, water, diesel, gasoline and alternative fuels and electricity); changes in generally accepted accounting principles; adverse effects of war, mass shooting, terrorism and geopolitical events; potential inability to implement our business strategies; potential inability to grow revenues; potential inability to attract and retain key personnel; interruptions in delivery of critical supplies, equipment and raw materials due to credit or other limitations imposed by vendors; assertion of claims, lawsuits and proceedings against us; potential inability to satisfy debt and lease obligations; potential inability to maintain an effective system of internal controls over financial reporting; potential inability or failure to timely file periodic reports with the Securities and Exchange Commission; potential inability to list our securities on any securities exchange or market or maintain the listing of our securities; and work stoppages or other labor difficulties. Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows, or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Neither this press release nor any related calls or discussions constitutes an offer to sell, the solicitation of an offer to buy or a recommendation with respect to any securities of the Company, the fund, or any other issuer.

v3.24.3

Document And Entity Information

|

Oct. 01, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

COMSTOCK INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 01, 2024

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

001-35200

|

| Entity, Tax Identification Number |

65-0955118

|

| Entity, Address, Address Line One |

117 American Flat Road

|

| Entity, Address, City or Town |

Virginia City

|

| Entity, Address, State or Province |

NV

|

| Entity, Address, Postal Zip Code |

89440

|

| City Area Code |

775

|

| Local Phone Number |

847-5272

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

LODE

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001120970

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

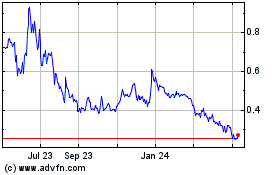

Comstock (AMEX:LODE)

Historical Stock Chart

From Nov 2024 to Dec 2024

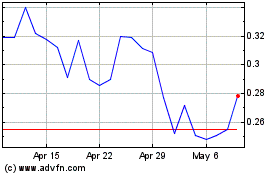

Comstock (AMEX:LODE)

Historical Stock Chart

From Dec 2023 to Dec 2024