FalseFalseQ30000019871--12-31falseFalseFalse3 months0000019871us-gaap:TreasuryStockCommonMember2022-12-310000019871cvr:MovingExpensesMember2024-07-012024-09-300000019871us-gaap:RetainedEarningsMember2023-06-300000019871us-gaap:AdditionalPaidInCapitalMember2024-09-300000019871us-gaap:PreferredStockMember2023-12-310000019871us-gaap:NonUsMembercvr:FastenerMember2023-01-012023-09-300000019871cvr:AssemblyEquipmentMembercountry:US2024-01-012024-09-300000019871cvr:FastenerMember2023-09-300000019871cvr:AssemblyEquipmentMembercountry:US2023-07-012023-09-300000019871cvr:AutomotiveMembercvr:FastenerMember2024-01-012024-09-300000019871us-gaap:TreasuryStockCommonMember2024-06-3000000198712024-09-300000019871country:US2023-01-012023-09-300000019871cvr:AutomotiveMembercvr:FastenerMember2023-07-012023-09-300000019871us-gaap:RetainedEarningsMember2023-01-012023-03-310000019871cvr:UnallocatedCorporateMember2024-01-012024-09-300000019871us-gaap:PreferredStockMember2024-03-310000019871cvr:AssemblyEquipmentMember2023-01-012023-09-300000019871us-gaap:RetainedEarningsMember2023-12-3100000198712023-12-310000019871us-gaap:NonUsMembercvr:AssemblyEquipmentMember2023-01-012023-09-300000019871cvr:FastenerMembercountry:US2023-01-012023-09-300000019871cvr:NonautomotiveMembercvr:FastenerMember2024-07-012024-09-300000019871us-gaap:AdditionalPaidInCapitalMember2023-06-300000019871us-gaap:AdditionalPaidInCapitalMember2023-09-300000019871us-gaap:NonUsMember2024-07-012024-09-300000019871us-gaap:PreferredStockMember2022-12-310000019871cvr:NonautomotiveMembercvr:AssemblyEquipmentMember2024-01-012024-09-300000019871us-gaap:CommonStockMember2023-09-3000000198712023-03-310000019871cvr:NonautomotiveMember2023-07-012023-09-300000019871us-gaap:CommonStockMember2023-06-3000000198712024-03-310000019871us-gaap:NonUsMembercvr:AssemblyEquipmentMember2024-07-012024-09-3000000198712024-01-012024-03-310000019871us-gaap:RetainedEarningsMember2023-03-310000019871us-gaap:RetainedEarningsMember2024-09-300000019871cvr:AutomotiveMembercvr:AssemblyEquipmentMember2024-07-012024-09-3000000198712023-01-012023-09-300000019871cvr:AutomotiveMember2023-01-012023-09-300000019871us-gaap:NonUsMember2024-01-012024-09-300000019871cvr:AutomotiveMember2024-07-012024-09-300000019871us-gaap:NonUsMembercvr:AssemblyEquipmentMember2023-07-012023-09-300000019871us-gaap:EmployeeRelocationMember2024-07-012024-09-3000000198712024-10-012024-09-300000019871cvr:AssemblyEquipmentMember2023-07-012023-09-300000019871us-gaap:AdditionalPaidInCapitalMember2022-12-310000019871cvr:FastenerMember2024-01-012024-09-300000019871us-gaap:NonUsMembercvr:FastenerMember2024-07-012024-09-300000019871cvr:AutomotiveMembercvr:AssemblyEquipmentMember2024-01-012024-09-3000000198712024-07-012024-09-300000019871us-gaap:TreasuryStockCommonMember2023-03-310000019871us-gaap:NonUsMember2023-07-012023-09-300000019871us-gaap:RetainedEarningsMember2024-03-310000019871us-gaap:AdditionalPaidInCapitalMember2024-06-300000019871us-gaap:PreferredStockMember2024-06-300000019871cvr:NonautomotiveMember2024-07-012024-09-300000019871cvr:NonautomotiveMembercvr:FastenerMember2023-07-012023-09-300000019871cvr:NonautomotiveMember2023-01-012023-09-3000000198712023-04-012023-06-3000000198712024-01-012024-09-300000019871us-gaap:RetainedEarningsMember2024-04-012024-06-300000019871us-gaap:RetainedEarningsMember2022-12-310000019871us-gaap:AdditionalPaidInCapitalMember2023-03-310000019871cvr:UnallocatedCorporateMember2023-01-012023-09-3000000198712024-07-012024-07-010000019871us-gaap:TreasuryStockCommonMember2023-12-310000019871cvr:UnallocatedCorporateMember2023-09-300000019871cvr:LocationMember2024-01-012024-09-300000019871us-gaap:CommonStockMember2024-03-310000019871cvr:NonautomotiveMembercvr:FastenerMember2023-01-012023-09-300000019871us-gaap:StateAndLocalJurisdictionMember2023-12-310000019871cvr:AssemblyEquipmentMember2023-09-300000019871us-gaap:PreferredStockMember2023-03-310000019871cvr:AutomotiveMember2023-07-012023-09-3000000198712024-04-012024-06-300000019871cvr:AutomotiveMembercvr:AssemblyEquipmentMember2023-07-012023-09-300000019871cvr:NonautomotiveMembercvr:AssemblyEquipmentMember2023-07-012023-09-300000019871us-gaap:CommonStockMember2022-12-310000019871cvr:FastenerMembercountry:US2024-01-012024-09-3000000198712024-06-300000019871us-gaap:PreferredStockMember2023-06-300000019871cvr:NonautomotiveMember2024-01-012024-09-300000019871us-gaap:TreasuryStockCommonMember2023-09-300000019871cvr:FastenerMember2024-09-300000019871cvr:NonautomotiveMembercvr:FastenerMember2024-01-012024-09-300000019871cvr:FastenerMember2023-07-012023-09-300000019871us-gaap:TreasuryStockCommonMember2024-09-300000019871us-gaap:RetainedEarningsMember2023-04-012023-06-3000000198712022-12-310000019871cvr:UnallocatedCorporateMember2024-09-300000019871cvr:NonautomotiveMembercvr:AssemblyEquipmentMember2024-07-012024-09-300000019871us-gaap:RetainedEarningsMember2024-06-3000000198712024-11-120000019871us-gaap:NonUsMembercvr:AssemblyEquipmentMember2024-01-012024-09-300000019871country:US2023-07-012023-09-300000019871us-gaap:AdditionalPaidInCapitalMember2024-03-310000019871cvr:AssemblyEquipmentMember2024-07-012024-09-3000000198712023-09-300000019871us-gaap:RetainedEarningsMember2023-09-300000019871cvr:NonautomotiveMembercvr:AssemblyEquipmentMember2023-01-012023-09-3000000198712023-01-012023-03-310000019871us-gaap:NonUsMembercvr:FastenerMember2023-07-012023-09-300000019871us-gaap:PreferredStockMember2023-09-300000019871cvr:FastenerMember2023-01-012023-09-300000019871cvr:UnallocatedCorporateMember2024-07-012024-09-300000019871cvr:AssemblyEquipmentMembercountry:US2024-07-012024-09-300000019871cvr:FastenerMembercountry:US2023-07-012023-09-300000019871cvr:UnallocatedCorporateMember2023-07-012023-09-300000019871us-gaap:DomesticCountryMember2023-12-310000019871cvr:FastenerMember2024-07-012024-09-300000019871cvr:AutomotiveMembercvr:AssemblyEquipmentMember2023-01-012023-09-300000019871us-gaap:RetainedEarningsMember2023-07-012023-09-300000019871us-gaap:CommonStockMember2024-06-300000019871us-gaap:CommonStockMember2023-12-310000019871country:US2024-01-012024-09-300000019871cvr:AssemblyEquipmentMember2024-09-300000019871cvr:AutomotiveMembercvr:FastenerMember2023-01-012023-09-300000019871us-gaap:OneTimeTerminationBenefitsMember2024-07-012024-09-300000019871us-gaap:PreferredStockMember2024-09-300000019871us-gaap:AdditionalPaidInCapitalMember2023-12-310000019871cvr:AssemblyEquipmentMembercountry:US2023-01-012023-09-300000019871us-gaap:CommonStockMember2023-03-310000019871us-gaap:NonUsMember2023-01-012023-09-300000019871cvr:AssemblyEquipmentMember2024-01-012024-09-300000019871cvr:EndMarketMember2024-01-012024-09-3000000198712023-07-012023-09-300000019871us-gaap:TreasuryStockCommonMember2023-06-300000019871us-gaap:NonUsMembercvr:FastenerMember2024-01-012024-09-300000019871us-gaap:CommonStockMember2024-09-300000019871us-gaap:RetainedEarningsMember2024-01-012024-03-310000019871us-gaap:RetainedEarningsMember2024-07-012024-09-300000019871us-gaap:TreasuryStockCommonMember2024-03-3100000198712023-06-300000019871cvr:AutomotiveMembercvr:FastenerMember2024-07-012024-09-300000019871cvr:FastenerMembercountry:US2024-07-012024-09-300000019871cvr:AutomotiveMember2024-01-012024-09-300000019871country:US2024-07-012024-09-30xbrli:purexbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_________________________________

FORM 10-Q

_________________________________

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2024

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ___________

Commission file number 000-01227

_________________________________

Chicago Rivet & Machine Co.

(Exact Name of Registrant as Specified in Its Charter)

|

|

Illinois |

36-0904920 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

|

901 Frontenac Road, Naperville, Illinois |

60563 |

(Address of Principal Executive Offices) |

(Zip Code) |

(630) 357-8500

Registrant’s Telephone Number, Including Area Code

_________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $1.00 per share |

CVR |

NYSE American (Trading privileges only, not registered) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically, every interactive data file required to be submitted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

|

|

Large accelerated filer |

Accelerated filer |

Non-accelerated filer |

Smaller reporting company |

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

As of November 12, 2024 there were 966,132 shares of the registrant’s common stock outstanding.

CHICAGO RIVET & MACHINE CO.

INDEX

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

CHICAGO RIVET & MACHINE CO.

Condensed Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024

(Unaudited) |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,665,325 |

|

|

$ |

1,387,075 |

|

Short-term investments |

|

|

496,592 |

|

|

|

1,771,120 |

|

Accounts receivable - less allowances of $160,000 |

|

|

4,606,800 |

|

|

|

4,275,882 |

|

Contract assets |

|

|

— |

|

|

|

118,301 |

|

Inventories, net |

|

|

7,404,782 |

|

|

|

7,327,653 |

|

Assets held for sale |

|

|

348,400 |

|

|

|

— |

|

Income taxes receivable |

|

|

75,344 |

|

|

|

580,287 |

|

Other current assets |

|

|

797,618 |

|

|

|

380,562 |

|

Total current assets |

|

|

15,394,861 |

|

|

|

15,840,880 |

|

Property, Plant and Equipment: |

|

|

|

|

|

|

Land and improvements |

|

|

1,401,402 |

|

|

|

1,510,513 |

|

Buildings and improvements |

|

|

6,095,394 |

|

|

|

6,835,619 |

|

Production equipment and other |

|

|

36,677,607 |

|

|

|

37,952,902 |

|

|

|

|

44,174,403 |

|

|

|

46,299,034 |

|

Less accumulated depreciation |

|

|

33,177,749 |

|

|

|

34,633,952 |

|

Net property, plant and equipment |

|

|

10,996,654 |

|

|

|

11,665,082 |

|

Deferred income taxes, net |

|

|

— |

|

|

|

324,943 |

|

Total assets |

|

$ |

26,391,515 |

|

|

$ |

27,830,905 |

|

Liabilities and Shareholders' Equity |

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

1,260,311 |

|

|

$ |

788,974 |

|

Accrued wages and salaries |

|

|

622,738 |

|

|

|

514,900 |

|

Other accrued expenses |

|

|

300,973 |

|

|

|

129,963 |

|

Unearned revenue and customer deposits |

|

|

372,132 |

|

|

|

430,179 |

|

Total current liabilities |

|

|

2,556,154 |

|

|

|

1,864,016 |

|

Deferred income taxes, net |

|

|

160,796 |

|

|

|

— |

|

Total liabilities |

|

|

2,716,950 |

|

|

|

1,864,016 |

|

Commitments and contingencies (Note 3) |

|

|

|

|

|

|

Shareholders' Equity: |

|

|

|

|

|

|

Preferred stock, no par value, 500,000 shares authorized: none outstanding |

|

|

— |

|

|

|

— |

|

Common stock, $1.00 par value, 4,000,000 shares authorized, 1,138,096 shares issued; 966,132 shares outstanding |

|

|

1,138,096 |

|

|

|

1,138,096 |

|

Additional paid-in capital |

|

|

447,134 |

|

|

|

447,134 |

|

Retained earnings |

|

|

26,011,433 |

|

|

|

28,303,757 |

|

Treasury stock, 171,964 shares at cost |

|

|

(3,922,098 |

) |

|

|

(3,922,098 |

) |

Total shareholders' equity |

|

|

23,674,565 |

|

|

|

25,966,889 |

|

Total liabilities and shareholders' equity |

|

$ |

26,391,515 |

|

|

$ |

27,830,905 |

|

See Notes to the Condensed Consolidated Financial Statements

CHICAGO RIVET & MACHINE CO.

Condensed Consolidated Statements of Operations (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2024 |

|

|

Three Months Ended September 30, 2023 |

|

|

Nine Months Ended September 30, 2024 |

|

|

Nine Months Ended September 30, 2023 |

|

Net sales |

|

$ |

6,969,921 |

|

|

$ |

7,946,172 |

|

|

$ |

22,882,579 |

|

|

$ |

24,726,828 |

|

Cost of goods sold |

|

|

6,274,934 |

|

|

|

7,905,019 |

|

|

|

20,027,584 |

|

|

|

24,537,208 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

694,987 |

|

|

|

41,153 |

|

|

|

2,854,995 |

|

|

|

189,620 |

|

Selling and administrative expenses |

|

|

1,518,558 |

|

|

|

1,273,175 |

|

|

|

4,474,310 |

|

|

|

3,890,335 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(823,571 |

) |

|

|

(1,232,022 |

) |

|

|

(1,619,315 |

) |

|

|

(3,700,715 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income |

|

|

28,146 |

|

|

|

16,980 |

|

|

|

102,570 |

|

|

|

83,030 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

|

(795,425 |

) |

|

|

(1,215,042 |

) |

|

|

(1,516,745 |

) |

|

|

(3,617,685 |

) |

Provision (benefit) for income taxes |

|

|

651,196 |

|

|

|

(251,000 |

) |

|

|

485,739 |

|

|

|

(759,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(1,446,621 |

) |

|

$ |

(964,042 |

) |

|

$ |

(2,002,484 |

) |

|

$ |

(2,858,685 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share data: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic net loss per share |

|

$ |

(1.50 |

) |

|

$ |

(1.00 |

) |

|

$ |

(2.07 |

) |

|

$ |

(2.96 |

) |

Diluted net loss per share |

|

$ |

(1.50 |

) |

|

$ |

(1.00 |

) |

|

$ |

(2.07 |

) |

|

$ |

(2.96 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

966,132 |

|

|

|

966,132 |

|

|

|

966,132 |

|

|

|

966,132 |

|

Diluted |

|

|

966,132 |

|

|

|

966,132 |

|

|

|

966,132 |

|

|

|

966,132 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per share |

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.30 |

|

|

$ |

0.54 |

|

See Notes to the Condensed Consolidated Financial Statements

CHICAGO RIVET & MACHINE CO.

Consolidated Statements of Shareholders’ Equity (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

|

|

|

|

|

|

Treasury Stock, At Cost |

|

|

|

|

|

|

Preferred

Stock

Amount |

|

|

Shares |

|

|

Amount |

|

|

Additional

Paid-In

Capital |

|

|

Retained

Earnings |

|

|

Shares |

|

|

Amount |

|

|

Total

Shareholders’

Equity |

|

Balance, December 31, 2023 |

|

$ |

0 |

|

|

|

966,132 |

|

|

$ |

1,138,096 |

|

|

$ |

447,134 |

|

|

$ |

28,303,757 |

|

|

|

171,964 |

|

|

$ |

(3,922,098 |

) |

|

$ |

25,966,889 |

|

Net Loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(698,004 |

) |

|

|

|

|

|

|

|

|

(698,004 |

) |

Dividends Declared ($0.10 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(96,613 |

) |

|

|

|

|

|

|

|

|

(96,613 |

) |

Balance, March 31, 2024 |

|

$ |

0 |

|

|

|

966,132 |

|

|

$ |

1,138,096 |

|

|

$ |

447,134 |

|

|

$ |

27,509,140 |

|

|

|

171,964 |

|

|

$ |

(3,922,098 |

) |

|

$ |

25,172,272 |

|

Net Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

142,141 |

|

|

|

|

|

|

|

|

|

142,141 |

|

Dividends Declared ($0.10 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(96,613 |

) |

|

|

|

|

|

|

|

|

(96,613 |

) |

Balance, June 30, 2024 |

|

$ |

0 |

|

|

|

966,132 |

|

|

$ |

1,138,096 |

|

|

$ |

447,134 |

|

|

$ |

27,554,668 |

|

|

|

171,964 |

|

|

$ |

(3,922,098 |

) |

|

$ |

25,217,800 |

|

Net Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,446,621 |

) |

|

|

|

|

|

|

|

|

(1,446,621 |

) |

Dividends Declared ($0.10 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(96,613 |

) |

|

|

|

|

|

|

|

|

(96,613 |

) |

Balance, September 30, 2024 |

|

$ |

0 |

|

|

|

966,132 |

|

|

$ |

1,138,096 |

|

|

$ |

447,134 |

|

|

$ |

26,011,433 |

|

|

|

171,964 |

|

|

$ |

(3,922,098 |

) |

|

$ |

23,674,565 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2022 |

|

$ |

0 |

|

|

|

966,132 |

|

|

$ |

1,138,096 |

|

|

$ |

447,134 |

|

|

$ |

33,323,666 |

|

|

|

171,964 |

|

|

$ |

(3,922,098 |

) |

|

$ |

30,986,798 |

|

Net Loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(583,137 |

) |

|

|

|

|

|

|

|

|

(583,137 |

) |

Dividends Declared ($0.22 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(212,549 |

) |

|

|

|

|

|

|

|

|

(212,549 |

) |

Balance, March 31, 2023 |

|

$ |

0 |

|

|

|

966,132 |

|

|

$ |

1,138,096 |

|

|

$ |

447,134 |

|

|

$ |

32,527,980 |

|

|

|

171,964 |

|

|

$ |

(3,922,098 |

) |

|

$ |

30,191,112 |

|

Net Loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,311,506 |

) |

|

|

|

|

|

|

|

|

(1,311,506 |

) |

Dividends Declared ($0.22 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(212,549 |

) |

|

|

|

|

|

|

|

|

(212,549 |

) |

Balance, June 30, 2023 |

|

$ |

0 |

|

|

|

966,132 |

|

|

$ |

1,138,096 |

|

|

$ |

447,134 |

|

|

$ |

31,003,925 |

|

|

|

171,964 |

|

|

$ |

(3,922,098 |

) |

|

$ |

28,667,057 |

|

Net Loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(964,042 |

) |

|

|

|

|

|

|

|

|

(964,042 |

) |

Dividends Declared ($0.10 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(96,613 |

) |

|

|

|

|

|

|

|

|

(96,613 |

) |

Balance, September 30, 2023 |

|

$ |

0 |

|

|

|

966,132 |

|

|

$ |

1,138,096 |

|

|

$ |

447,134 |

|

|

$ |

29,943,270 |

|

|

|

171,964 |

|

|

$ |

(3,922,098 |

) |

|

$ |

27,606,402 |

|

See Notes to the Condensed Consolidated Financial Statements.

CHICAGO RIVET & MACHINE CO.

Condensed Consolidated Statements of Cash Flows (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2024 |

|

|

Nine Months Ended September 30, 2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(2,002,484 |

) |

|

$ |

(2,858,685 |

) |

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: |

|

|

|

|

|

|

Depreciation |

|

|

969,958 |

|

|

|

920,430 |

|

Gain on disposal of equipment |

|

|

(36,886 |

) |

|

|

(31,500 |

) |

Deferred income taxes |

|

|

485,739 |

|

|

|

(703,599 |

) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

(330,918 |

) |

|

|

(831,171 |

) |

Contract assets |

|

|

118,301 |

|

|

|

– |

|

Inventories |

|

|

(77,129 |

) |

|

|

326,034 |

|

Other current assets |

|

|

87,886 |

|

|

|

(97,553 |

) |

Accounts payable |

|

|

471,337 |

|

|

|

310,567 |

|

Accrued wages and salaries |

|

|

107,838 |

|

|

|

316,609 |

|

Other accrued expenses |

|

|

171,010 |

|

|

|

(180,486 |

) |

Unearned revenue and customer deposits |

|

|

(58,047 |

) |

|

|

96,308 |

|

Net cash (used in) provided by operating activities |

|

|

(93,395 |

) |

|

|

(2,733,046 |

) |

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Capital expenditures |

|

|

(709,396 |

) |

|

|

(949,862 |

) |

Proceeds from the sale of equipment |

|

|

96,350 |

|

|

|

31,500 |

|

Proceeds from short-term investments |

|

|

3,000,815 |

|

|

|

2,591,000 |

|

Purchases of short-term investments |

|

|

(1,726,284 |

) |

|

|

(100,000 |

) |

Net cash provided by investing activities |

|

|

661,485 |

|

|

|

1,572,638 |

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Cash dividends paid |

|

|

(289,840 |

) |

|

|

(521,711 |

) |

Net cash used in financing activities |

|

|

(289,840 |

) |

|

|

(521,711 |

) |

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

|

278,250 |

|

|

|

(1,682,119 |

) |

Cash and cash equivalents at beginning of period |

|

|

1,387,075 |

|

|

|

4,045,101 |

|

Cash and cash equivalents at end of period |

|

$ |

1,665,325 |

|

|

$ |

2,362,982 |

|

See Notes to the Condensed Consolidated Financial Statements

CHICAGO RIVET & MACHINE CO.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. In the opinion of the Company, the accompanying unaudited interim financial statements contain all adjustments necessary to present fairly the financial position of the Company as of September 30, 2024 (unaudited) and December 31, 2023 and the results of operations and changes in cash flows for the indicated periods. Certain information and note disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been omitted from these unaudited financial statements in accordance with applicable rules. Please refer to the financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The results of operations for the nine month period ended September 30, 2024 are not necessarily indicative of the results to be expected for the year.

The Company classifies assets as held-for-sale if all held-for-sale criteria are met pursuant to ASC 360-10, Property, Plant and Equipment. Criteria include management commitment to sell the disposal group in its present condition and the sale being deemed probable of being completed within one year. Assets classified as held for sale are not depreciated and are measured at the lower of their carrying amount or fair value less cost to sell. The Company assesses the fair value of a disposal group, less any costs to sell, each reporting period it remains classified as held-for-sale and reports any subsequent changes as an adjustment to the carrying value of the disposal group, as long as the new carrying value does not exceed the initial carrying value of the disposal group.

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which requires a public entity to disclose its significant segment expense categories and amounts for each reportable segment. The new guidance is effective for fiscal years beginning after December 15, 2023, and interim periods in fiscal years beginning after December 15, 2024. This new accounting standard will result in expanded disclosures but it is not expected to have a material impact on the Company's financial position, results of operation or cash flows.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, to enhance the transparency and decision usefulness of income tax disclosures providing investors with information to better assess how an entity’s operations and related tax risks and tax planning and operational opportunities affect its tax rate and prospects for future cash flows. The new guidance is effective for annual periods beginning after December 15, 2024. The Company is evaluating the impact that it will have on our consolidated financial statements and disclosures.

2. The Company extends credit on the basis of terms that are customary within our markets to various companies doing business primarily in the automotive industry. The Company has a concentration of credit risk primarily within the automotive industry and in the Midwestern United States. The Company has established an allowance for accounts that may become uncollectible in the future. This estimated allowance is based primarily on management's evaluation of the financial condition of the customer and historical experience. The Company monitors its accounts receivable and charges to expense an amount equal to its estimate of potential credit losses. The Company considers a number of factors in determining its estimates, including the length of time its trade accounts receivable are past due, the Company's previous loss history and the customer's current ability to pay its obligation. The Company also considers current economic conditions, the economic outlook and industry-specific factors in its evaluation. Accounts receivable balances are charged off against the allowance when it is determined that the receivable will not be recovered.

3. The Company is, from time to time, involved in litigation, including environmental claims and contract disputes, in the normal course of business. While it is not possible at this time to establish the ultimate amount of liability with respect to contingent liabilities, including those related to legal proceedings, management is of the opinion that the aggregate amount of any such liabilities, for which provision has not been made, will not have a material adverse effect on the Company's financial position, liquidity, results of operations or cash flows.

The Company recognizes a provision if it is probable that an outflow of cash or other economic resources that can be reliably measured will be required to settle the provision. In determining the likelihood and timing of potential cash outflows, management needs to make estimates, the assessment of which is based in part on internal and external financial and legal guidance and other related factors. For contingencies, the Company is required to exercise significant

judgement to determine whether the risk of loss is possible but not probable. Contingencies involve inherent uncertainties including, but not limited to, negotiations between affected parties, among other factors, and the amount of actual loss may be significantly more or less that what was provided for with respect to such contingencies.

As previously disclosed, the Company was recently notified by one of its customers that certain fasteners manufactured by the Company’s wholly-owned subsidiary, H&L Tool Company Inc., may not conform to customer specifications. These fasteners become part of an assembly that is ultimately used in the braking system of certain vehicles. Based on information provided to the Company and discussions with the customer as well as the Company’s internal review, we understand that it was necessary for the customer to identify and sort the non-conforming parts in its inventory and take certain other related actions as a result of the alleged non-conforming parts. The customer has also indicated that its end customer has incurred costs relating to the alleged defective part, including costs to repair certain of the vehicles that included these non-conforming fasteners. Based on discussions with our customer as to the scope of the actions taken by the customer to date and the Company’s own internal analysis to date, we determined an estimate of $243,000 as a contingent liability within other accrued expenses in our financial statements during the three months ended March 31, 2024, in anticipation of potential reimbursement of certain expenses that the customer may have incurred as a result of the non-conforming parts. Our discussions with the customer and our internal review process are ongoing, and the ultimate amount of such liability, if any, may be more or less than the amount reflected in our financial statements.

The Company may also incur additional potentially significant costs related to this issue, which could materially and adversely affect our results of operations and financial condition. At this time, the Company cannot quantify potential additional financial liability, if any, due to the ultimate costs that may or may not be incurred by the parties involved in this matter, and the allocation of those costs among the parties involved. It is not possible at this time to establish the ultimate amount of any such contingent liabilities, including those related to any legal proceedings that may result related to this matter. Accordingly, no additional amount has been accrued in our financial statements at September 30, 2024.

4. Revenue—The Company operates in the fastener industry and is in the business of producing and selling rivets, cold-formed fasteners and parts, screw machine products, automatic rivet setting machines and parts and tools for such machines. Revenue is recognized when control of the promised goods or services is transferred to our customers, generally upon shipment of goods or completion of services, in an amount that reflects the consideration we expect to receive in exchange for those goods or services. For certain assembly equipment segment transactions, revenue is recognized based on progress toward completion of the performance obligation using a labor-based measure. Labor incurred and specific material costs are compared to milestone payments per sales contract. Based on our experience, this method most accurately reflects the transfer of goods under such contracts. During the third quarter of 2024, the Company realized no revenue related to such contract and has a remaining performance obligation of $372,132 which is expected to be recognized in the fourth quarter of 2024.

Sales taxes we may collect concurrent with revenue producing activities are excluded from revenue. Revenue is recognized net of certain sales adjustments to arrive at net sales as reported on the statement of operations. These adjustments primarily relate to customer returns and allowances, which vary over time. The Company records a liability and reduction in sales for estimated product returns based upon historical experience. If we determine that our obligation under warranty claims is probable and subject to reasonable determination, an estimate of that liability is recorded as an offset against revenue at that time. As of September 30, 2024 and December 31, 2023 reserves for warranty claims were not material. Cash received by the Company prior to transfer of control is recorded as unearned revenue.

Shipping and handling fees billed to customers are recognized in net sales, and related costs as cost of sales, when incurred.

Sales commissions are expensed when incurred because the amortization period is less than one year. These costs are recorded within selling and administrative expenses in the statement of operations.

The following table presents revenue by segment, further disaggregated by end-market:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fastener |

|

|

Assembly

Equipment |

|

|

Consolidated |

|

Three Months Ended September 30, 2024: |

|

|

|

|

|

|

|

|

|

Automotive |

|

$ |

3,578,390 |

|

|

$ |

14,386 |

|

|

$ |

3,592,776 |

|

Non-automotive |

|

|

2,348,926 |

|

|

|

1,028,219 |

|

|

|

3,377,145 |

|

Total net sales |

|

$ |

5,927,316 |

|

|

$ |

1,042,605 |

|

|

$ |

6,969,921 |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2023: |

|

|

|

|

|

|

|

|

|

Automotive |

|

$ |

5,184,547 |

|

|

$ |

12,363 |

|

|

$ |

5,196,910 |

|

Non-automotive |

|

|

1,792,894 |

|

|

|

956,368 |

|

|

|

2,749,262 |

|

Total net sales |

|

$ |

6,977,441 |

|

|

$ |

968,731 |

|

|

$ |

7,946,172 |

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2024: |

|

|

|

|

|

|

|

|

|

Automotive |

|

|

13,050,096 |

|

|

$ |

171,094 |

|

|

$ |

13,221,190 |

|

Non-automotive |

|

|

6,510,624 |

|

|

|

3,150,765 |

|

|

|

9,661,389 |

|

Total net sales |

|

$ |

19,560,720 |

|

|

$ |

3,321,859 |

|

|

$ |

22,882,579 |

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2023: |

|

|

|

|

|

|

|

|

|

Automotive |

|

$ |

15,150,117 |

|

|

$ |

95,464 |

|

|

$ |

15,245,581 |

|

Non-automotive |

|

|

7,045,250 |

|

|

|

2,435,997 |

|

|

|

9,481,247 |

|

Total net sales |

|

$ |

22,195,367 |

|

|

$ |

2,531,461 |

|

|

$ |

24,726,828 |

|

The following table presents revenue by segment, further disaggregated by location:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fastener |

|

|

Assembly

Equipment |

|

|

Consolidated |

|

Three Months Ended September 30, 2024: |

|

|

|

|

|

|

|

|

|

United States |

|

$ |

4,657,979 |

|

|

$ |

659,306 |

|

|

$ |

5,317,285 |

|

Foreign |

|

|

1,269,337 |

|

|

|

383,299 |

|

|

|

1,652,636 |

|

Total net sales |

|

$ |

5,927,316 |

|

|

$ |

1,042,605 |

|

|

$ |

6,969,921 |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2023: |

|

|

|

|

|

|

|

|

|

United States |

|

$ |

5,398,688 |

|

|

$ |

961,618 |

|

|

$ |

6,360,306 |

|

Foreign |

|

|

1,578,753 |

|

|

|

7,113 |

|

|

|

1,585,866 |

|

Total net sales |

|

$ |

6,977,441 |

|

|

$ |

968,731 |

|

|

$ |

7,946,172 |

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2024 |

|

|

|

|

|

|

|

|

|

United States |

|

$ |

15,694,640 |

|

|

$ |

2,871,084 |

|

|

$ |

18,565,724 |

|

Foreign |

|

|

3,866,080 |

|

|

|

450,775 |

|

|

|

4,316,855 |

|

Total net sales |

|

$ |

19,560,720 |

|

|

$ |

3,321,859 |

|

|

$ |

22,882,579 |

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2023 |

|

|

|

|

|

|

|

|

|

United States |

|

$ |

17,927,910 |

|

|

$ |

2,402,734 |

|

|

$ |

20,248,872 |

|

Foreign |

|

|

4,267,457 |

|

|

|

128,727 |

|

|

|

4,477,956 |

|

Total net sales |

|

$ |

22,195,367 |

|

|

$ |

2,531,461 |

|

|

$ |

24,726,828 |

|

5. The Company’s effective tax rates were approximately (81.9)% and 20.7% for the third quarter of 2024 and 2023, respectively, and (32.0)% and 21.0% for the nine months ended September 30, 2024 and 2023, respectively.

The Company’s federal income tax returns for the 2020 through 2023 tax years are subject to examination by the Internal Revenue Service (“IRS”). Management does not anticipate any adjustments that would result in a material change to the results of operations or financial condition of the Company as a result of any unrecognized tax benefits. No statutes of limitation have been extended on any of the Company’s federal income tax filings. The statute of limitations on the Company’s 2020 through 2023 federal income tax returns were set to expire on September 15, 2024 through 2027, respectively.

The Company’s state income tax returns for the 2020 through 2023 tax years remain subject to examination by various state authorities with the latest closing period on October 31, 2027. The Company is not currently under examination by any state authority for income tax purposes and no statutes of limitation for state income tax filings have been extended.

Our income tax expense, deferred tax assets and liabilities, and liabilities for unrecognized tax benefits reflect management’s best estimate of current and future taxes to be paid. Significant judgments and estimates are required in the determination of the consolidated income tax expense. Deferred income taxes arise from temporary differences between the tax basis of assets and liabilities and their reported amounts in the financial statements, which will result in taxable or deductible amounts in the future. In evaluating our ability to recover our deferred tax assets in the jurisdiction from which they arise, we consider all available positive and negative evidence, including scheduled reversals of deferred tax liabilities, projected future taxable income, tax-planning strategies, and results of recent operations. In projecting future taxable income, we begin with historical results and incorporate assumptions about the amount of future state and federal pretax operating income adjusted for items that do not have tax consequences. The assumptions about future taxable income require the use of significant judgment and are consistent with the plans and estimates we are using to manage the underlying businesses.

A valuation allowance is established when necessary to reduce deferred income tax assets to the amounts expected to be realized. Based upon the analysis performed as of September 30, 2024, management believes that it is more likely than not that the benefit from net operating loss ("NOL") carryforwards and other deferred tax assets will not be realized. Accordingly, management concluded to record a valuation allowance of $961,755 on the deferred tax assets and recognized $651,196 in deferred tax expense in the three months ended September 30, 2024. As of December 31, 2023, we have federal income tax NOL carryforwards of $5,711,828 and state NOL carryforwards of $2,997,091.

6. Inventories are stated at the lower of cost or net realizable value, cost being determined by the first-in, first-out method.

A summary of inventories at the dates indicated is as follows:

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

Raw material |

|

$ |

2,956,245 |

|

|

$ |

2,878,869 |

|

Work-in-process |

|

|

2,027,415 |

|

|

|

2,374,795 |

|

Finished goods |

|

|

2,961,122 |

|

|

|

2,614,989 |

|

Inventories, gross |

|

|

7,944,782 |

|

|

|

7,868,653 |

|

Valuation reserves |

|

|

(540,000 |

) |

|

|

(541,000 |

) |

Inventories, net |

|

$ |

7,404,782 |

|

|

$ |

7,327,653 |

|

7. Segment Information—The Company operates in two business segments as determined by its products. The fastener segment includes rivets, cold-formed fasteners and parts and screw machine products. The assembly equipment segment includes automatic rivet setting machines and parts and tools for such machines.

Information by segment for the periods presented is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fastener |

|

|

Assembly Equipment |

|

|

Unallocated Corporate |

|

|

Consolidated |

|

Three Months Ended September 30, 2024: |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

5,927,316 |

|

|

$ |

1,042,605 |

|

|

|

- |

|

|

$ |

6,969,921 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

305,612 |

|

|

|

18,384 |

|

|

|

540 |

|

|

|

324,536 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment operating profit |

|

|

95,902 |

|

|

|

(111,368 |

) |

|

|

- |

|

|

|

(15,466 |

) |

Selling and administrative expenses |

|

|

- |

|

|

|

- |

|

|

|

(808,105 |

) |

|

|

(808,105 |

) |

Interest income |

|

|

- |

|

|

|

- |

|

|

|

28,146 |

|

|

|

28,146 |

|

Loss before income taxes |

|

|

|

|

|

|

|

|

|

|

$ |

(795,425 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

307,773 |

|

|

|

2,959 |

|

|

|

- |

|

|

|

310,732 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

4,270,096 |

|

|

|

336,704 |

|

|

|

- |

|

|

|

4,606,800 |

|

Inventories, net |

|

|

6,032,338 |

|

|

|

1,372,444 |

|

|

|

- |

|

|

|

7,404,782 |

|

Assets held for sale |

|

|

- |

|

|

|

348,400 |

|

|

|

- |

|

|

|

348,400 |

|

Property, plant and equipment, net |

|

|

8,935,154 |

|

|

|

1,042,448 |

|

|

|

1,019,052 |

|

|

|

10,996,654 |

|

Other assets |

|

|

- |

|

|

|

- |

|

|

|

3,034,879 |

|

|

|

3,034,879 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

26,391,515 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2023: |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

6,977,441 |

|

|

$ |

968,731 |

|

|

|

- |

|

|

$ |

7,946,172 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

276,989 |

|

|

|

30,732 |

|

|

|

602 |

|

|

|

308,323 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment operating profit (loss) |

|

|

(773,213 |

) |

|

|

166,927 |

|

|

|

- |

|

|

|

(606,286 |

) |

Selling and administrative expenses |

|

|

- |

|

|

|

- |

|

|

|

(625,701 |

) |

|

|

(625,701 |

) |

Interest income |

|

|

- |

|

|

|

- |

|

|

|

16,945 |

|

|

|

16,945 |

|

Loss before income taxes |

|

|

|

|

|

|

|

|

|

|

$ |

(1,215,042 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

189,614 |

|

|

|

- |

|

|

|

— |

|

|

|

189,614 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

5,410,548 |

|

|

|

395,760 |

|

|

|

- |

|

|

|

5,806,308 |

|

Inventories, net |

|

|

7,269,490 |

|

|

|

1,525,706 |

|

|

|

- |

|

|

|

8,795,196 |

|

Property, plant and equipment, net |

|

|

9,672,334 |

|

|

|

1,211,301 |

|

|

|

1,007,590 |

|

|

|

11,891,225 |

|

Other assets |

|

|

- |

|

|

|

- |

|

|

|

3,592,401 |

|

|

|

3,592,401 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

30,085,130 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2024: |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

19,560,720 |

|

|

$ |

3,321,859 |

|

|

|

- |

|

|

$ |

22,882,579 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

890,986 |

|

|

|

77,352 |

|

|

|

1,620 |

|

|

|

969,958 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment operating profit |

|

|

195,190 |

|

|

|

575,173 |

|

|

|

- |

|

|

|

770,363 |

|

Selling and administrative expenses |

|

|

- |

|

|

|

- |

|

|

|

(2,388,393 |

) |

|

|

(2,388,393 |

) |

Interest income |

|

|

- |

|

|

|

- |

|

|

|

101,285 |

|

|

|

101,285 |

|

Loss before income taxes |

|

|

|

|

|

|

|

|

|

|

$ |

(1,516,745 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

427,000 |

|

|

|

282,395 |

|

|

|

- |

|

|

|

709,396 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2023: |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

22,195,367 |

|

|

$ |

2,531,461 |

|

|

|

- |

|

|

$ |

24,726,828 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

822,304 |

|

|

|

92,196 |

|

|

|

5,930 |

|

|

|

920,430 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment operating profit (loss) |

|

|

(2,294,932 |

) |

|

|

443,408 |

|

|

|

- |

|

|

|

(1,851,524 |

) |

Selling and administrative expenses |

|

|

- |

|

|

|

- |

|

|

|

(1,845,437 |

) |

|

|

(1,845,437 |

) |

Interest income |

|

|

- |

|

|

|

- |

|

|

|

79,276 |

|

|

|

79,276 |

|

Loss before income taxes |

|

|

|

|

|

|

|

|

|

|

$ |

(3,617,685 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

932,309 |

|

|

|

- |

|

|

|

17,553 |

|

|

|

949,862 |

|

8. Exit and Disposal – On July 1, 2024, the Company announced the closure of its manufacturing facility in Albia, Iowa on or before October 1, 2024. The Albia facility has supplied tooling for the Company’s full line of mechanical, hydraulic and pneumatic riveting machines serving both existing customers who own machines and customers purchasing new machines manufactured in the Company’s Tyrone, Pennsylvania manufacturing facility. As of September 30, 2024, all 19 full and part-time employees at this facility were impacted.

After careful consideration, the Company’s Board of Directors determined that it is in the Company’s best interest to consolidate the operations of the Albia facility into the Tyrone facility. The strategic consolidation is seen as a step to streamline processes, improve delivery, reduce costs and add value for the Company’s customers, shareholders and stakeholders.

In the third quarter ended September 30, 2024, the Company incurred selling and administrative expenses for one-time termination benefits of $64,856, employee travel of $40,277, moving expenses of $27,563 and employee wages of $8,060 as well as cost of goods expenses for direct and indirect labor of $30,517.

CHICAGO RIVET & MACHINE CO.

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Results of Operations

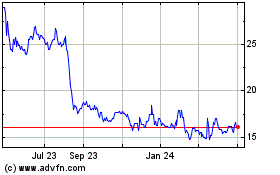

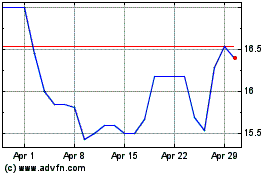

Net sales for the third quarter of 2024 were $6,969,921 compared to $7,946,172 in the third quarter of 2023, a decrease of $976,251 or 12.3%. Assembly equipment segment sales increased $73,874 which slightly offset the $1,050,125 decline in fastener segment sales for the current year quarter. Although overall net sales were down compared to the third quarter of 2023, gross margins for both the fastener and assembly equipment segments improved in the current quarter. This improvement resulted from the improved pricing that the Company obtained earlier in the year, a reduction in certain operating costs and improved operating efficiency. However, the lower revenue level, deferred tax expense of $651,196 discussed in Note 5 above, and certain selling and administrative expenses had a negative impact on earnings for the third quarter of 2024. As a result, the Company recorded a net loss of ($1,446,621), or ($1.50) per share for the third quarter 2024, compared to a net loss of $(964,042), or $(1.00) per share, in the third quarter of 2023. During the third quarter of 2024, a regular quarterly dividend of $0.10 per share was paid on September 20, 2024, to shareholders of record on September 5, 2024.

For the first nine months of 2024, net sales totaled $22,882,579 compared to $24,726,828 in the first nine months of 2023, a decrease of $1,844,249, or 7.5%. The net loss for the first nine months of 2024 was ($2,002,484), or ($2.07) per share, compared to a net loss of ($2,858,685) or ($2.96) per share, for the same period in 2023.

Fastener segment revenues were $5,927,316 in the third quarter of 2024 compared to $6,977,441 in the third quarter of 2023, a decline of $1,050,125 or 15.1%. The automotive sector is the primary market for our fastener segment products, and sales to automotive customers were $3,578,390 in the third quarter this year compared to $5,184,547 in the third quarter of 2023, a decrease of $1,606,157, or 31.0%. Additionally, fastener segment sales to non-automotive customers, including those in the construction and electronics industries, were $2,348,926 in the third quarter of this year compared to $1,792,894 in the third quarter of 2023, an increase of $556,062 or 31.0%. Fastener segment gross margins were $703,955 in the third quarter of 2024 compared to $(161,831) in the third quarter of 2023, an increase of $865,786. Despite significantly lower volumes from the automotive fastener segment, this gross margin improvement is due, as noted above, to price increases secured since the end of the third quarter of 2023, certain operating cost reductions and improved efficiency.

For the first nine months of 2024, fastener segment revenues were $19,560,720 compared to $22,195,367 in the first nine months of 2023, a decline of $2,634,647, or 11.9%. On a year-to-date basis fastener segment operating profit was $195,190 compared to an operating loss of $(353,158) in the first nine months of 2023, an increase of $584,348. This gross margin improvement was due to price increases, operational efficiencies and cost reduction projects.

Assembly equipment segment revenues were $1,042,605 in the third quarter of 2024 compared to $968,731 in the third quarter of 2023, an increase of $73,874, or 7.6%. Both automotive and non-automotive assembly equipment revenue increased in this segment by $2,023 and $71,851 respectively over the same period last year. The increase in sales contributed to a $508,177, or 250.4%, improvement in segment gross margin, from $202,984 in 2023 to $711,161 in 2024.

For the first nine months of 2024, assembly equipment revenues were $3,321,859 compared to $2,531,461 in the first nine months of 2023, an increase of $790,398, or 31.2%. During the first nine months of 2024, assembly equipment operating profit was $575,173 compared to $542,778 in the first nine months of 2023, an increase of $32,395.

Selling and administrative expenses during the third quarter of 2024 were $1,518,557 compared to $1,273,175 recorded in the third quarter of 2023, an increase of $245,382, or 19.3% primarily due to higher professional fees and partially offset by reduced commissions of $79,761 for the period. Selling and administrative expenses were 21.8% of net sales in the third quarter of 2024 compared to 16.0% in the second quarter of 2023. For the first nine months of 2024, selling and administrative expenses were $4,474,310 compared to $3,890,335 for the first nine months of 2023, an increase of $583,975. The Company believes that it has made substantial progress in continuing to implement its plans to reduce costs and improve efficiency, and as the Company completes activities relating to the closure of the Albia facility, the Company plans to focus on reducing certain selling and administrative expenses.

As previously disclosed, the Company was recently notified by one of its customers that certain fasteners manufactured by the Company’s wholly-owned subsidiary, H&L Tool Company Inc., may not conform to customer specifications. These fasteners become part of an assembly that is ultimately used in the braking system of certain vehicles. Based on information provided to the Company by the customer and the Company’s internal review, we

understand that it was necessary for the customer to identify and sort the non-conforming parts in its inventory and take certain other related actions as a result of the alleged non-conforming parts. The customer has also indicated that its end customer has incurred costs relating to the alleged defective part, including costs to repair certain of the vehicles that included these non-conforming fasteners. Based on discussions with our customer as to the scope of the actions taken by the customer to date and the Company’s own internal analysis to date, we determined an estimate of $243,000 as a contingent liability in our financial statements during the three months ended March 31, 2024, in anticipation of potential reimbursement of certain expenses that the customer may have incurred as a result of the non-conforming parts. Our discussions with the customer and our internal review process are ongoing, and the ultimate amount of such liability, if any, may be more or less than the amount reflected in our financial statements for the second quarter of 2024.

The Company may also incur additional potentially significant costs related to this issue, which could materially and adversely affect our results of operations and financial condition. At this time, the Company cannot quantify potential additional financial liability, if any, due to the ultimate costs that may or may not be incurred by the parties involved in this matter, and the allocation of those costs among the parties involved. It is not possible at this time to establish the ultimate amount of any such contingent liabilities, including those related to any legal proceedings that may result related to this matter. Accordingly, no additional amount has been accrued in our financial statements at September 30, 2024.

Other Income

Other income in the third quarter of 2024 was $28,146 compared to $16,980 in the third quarter of 2023. Other income for the first nine months of 2024 was $102,570, compared to $83,030 in the first nine months of 2023. Other income is primarily comprised of interest income, which increased during the current year due to higher interest rates earned on such balances.

Income Tax Expense

The Company’s effective tax rates were approximately (81.9)% and 20.7% for the third quarter of 2024 and 2023, respectively, and (32.0)% and 23.2% for the nine months ended September 30, 2024 and 2023, respectively.

Liquidity and Capital Resources

Working capital was $12,838,707 as of September 30, 2024, compared to $13,976,864 at the beginning of the year, a decline of $2,190,540. Contributing to that decline were capital expenditures during the first nine months of $709,396, which primarily consisted of equipment used in production activities, and dividends paid of $96,613. The net result of these changes and other cash flow activity was to leave cash, cash equivalents and short-term investments at $2,161,917 as of September 30, 2024, compared to $3,158,195 as of the beginning of the year. Management believes that current cash, cash equivalents and operating cash flow will provide adequate working capital for the next twelve months.

Results of Operations Summary

The Company's automotive fastener segment volumes have experienced a significant decline during 2024, when compared to 2023. This segment volume decline has mitigated our pricing relief efforts, productivity gains and overall operating profit improvement. The reduced automotive fastener segment volume has been driven primarily by overall inventory reductions from our largest automotive customers as light vehicle production was weak in the third quarter, declining by close to 5% globally. Non-automotive fastener and non-automotive assembly equipment segments continue to outpace prior period comparisons and we believe both represent future opportunities for growth and profitability. While we anticipate automotive fastener segment business conditions and volume demand for the remainder of 2024 to reflect the current trend, we expect to leverage our cost structure and improved operating efficiencies once these customer platform volumes return to normal levels. Additionally, we intend to continue to seek to drive growth in our non-automotive fastener and assembly equipment segments.

Forward-Looking Statements

This discussion contains certain "forward-looking statements" which are inherently subject to risks and uncertainties that may cause actual events to differ materially from those discussed herein. Factors which may cause such differences in events include those disclosed under the section captioned “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, and in other fillings we make with the Securities and Exchange Commission. These factors include, among other things: risk related to conditions in the domestic and international automotive industry, upon which we rely for sales revenue, the intense competition in our markets, the concentration of

our sales with major customers, risks related to export sales, the price and availability of raw materials, supply chain disruptions, labor relations issues and rising costs, losses related to product liability, warranty and recall claims, costs relating to compliance with environmental laws and regulations, information systems disruptions and the threat of cyber attacks, and the loss of the services of our key employees. Many of these factors are beyond our ability to control or predict. Readers are cautioned not to place undue reliance on these forward-looking statements. We undertake no obligation to publish revised forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events unless required under the federal securities laws.

CHICAGO RIVET & MACHINE CO.

Item 4. Controls and Procedures.

(a) Disclosure Controls and Procedures. The Company's management, with the participation of the Company's Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of the Company's disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the "Exchange Act")) as of the end of the period covered by this report. Based on such evaluation, the Company's Chief Executive Officer and Chief Financial Officer have concluded that, as of the end of such period, the Company's disclosure controls and procedures are effective in recording, processing, summarizing and reporting, on a timely basis, information required to be disclosed by the Company in reports that it files or submits under the Exchange Act.

Material Weaknesses in Internal Control Over Financial Reporting

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis.

As previously disclosed, a material weakness in internal control over financial reporting related to inventory valuation was identified in the Company’s internal control over financial reporting as of December 31, 2023. Specifically, the Company did not design and maintain effective controls related to the review of the valuation of inventory.

Remediation Plans for Material Weakness Relating to Inventory Valuation

The Company’s management, under the oversight of the Audit Committee, is in the process of designing and implementing changes and enhancements in processes and controls to remediate the material weakness in internal control over financial reporting related to inventory valuation. Our enhanced design includes the timely review and update of new accounting standards and guidance applicable to inventory valuation as well as subsequent review and reconciliation of variance accounts.

This material weakness will not be considered remediated until management completes its remediation plans and the enhanced controls operate for a sufficient period of time and management has concluded, through testing, that the related controls are effective. The Company will monitor the effectiveness of its remediation plans and will continue to refine its remediation plans as appropriate.

Notwithstanding the material weakness noted above, the Company’s management, including the Company's Chief Executive Officer and Chief Financial Officer has concluded that our unaudited interim consolidated financial statements included in this Quarterly Report present fairly, in all material respects, our financial position, results of operations, and cash flows for the periods presented in accordance with accounting principles generally accepted in the United States of America.