Current Report Filing (8-k)

August 27 2020 - 5:00PM

Edgar (US Regulatory)

false0001604738true

0001604738

2020-08-26

2020-08-26

0001604738

us-gaap:CommonStockMember

2020-08-26

2020-08-26

0001604738

ainc:PreferredStockPurchaseRightMember

2020-08-26

2020-08-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): August 26, 2020

ASHFORD INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Nevada

|

|

001-36400

|

|

84-2331507

|

|

(State or other jurisdiction of incorporation

or organization)

|

|

(Commission

File Number)

|

|

(IRS employer

identification number)

|

|

14185 Dallas Parkway

|

|

|

|

|

|

Suite 1100

|

|

|

|

|

|

Dallas

|

|

|

|

|

|

Texas

|

|

|

|

75254

|

|

(Address of principal executive offices)

|

|

|

|

(Zip code)

|

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

AINC

|

|

NYSE American LLC

|

|

Preferred Stock Purchase Rights

|

|

|

|

NYSE American LLC

|

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On August 26, 2020, Ashford Inc. (the “Company”) received a letter (the “Letter”) from the NYSE American LLC (the “NYSE American”) stating that it is not in compliance with the continued listing standards set forth in Sections 1003(a)(i) and (ii) of the NYSE American Company Guide (the “Company Guide”). Section 1003(a)(i) requires a listed company to have stockholders’ equity of $2 million or more if the listed company has reported losses from continuing operations and/or net losses in two of its three most recent fiscal years. Section 1003(a)(ii) requires a listed company to have stockholders’ equity of $4 million or more if the listed company has reported losses from continuing operations and/or net losses in three of its four most recent fiscal years. The Company reported a stockholders’ deficit of $159.1 million as of June 30, 2020, and has had losses from continuing operations and/or net losses in each of its five most recent fiscal years, except for the fiscal year ended December 31, 2018.

However, Section 1003(a) states that the NYSE American will not normally consider suspending dealings in, or removing from the list, the securities of a listed company which is below standards (i) and (ii) of Section 1003(a) if the listed company is in compliance with the following two standards: (1) total value of market capitalization of at least $50 million; or total assets and revenue of $50 million each in its last fiscal year, or in two of its last three fiscal years; and (2) the listed company has at least 1.1 million shares publicly held, a market value of publicly held shares of at least $15 million and 400 round lot shareholders. As of August 26, 2020, the Company was in compliance with the first standard because it had total assets and total revenue of at least $50 million in its last fiscal year and was in compliance with the second standard, except that the current market value of publicly held shares was below $15 million.

Accordingly, the Letter states that the Company must submit a plan of compliance (the “Plan”) by September 25, 2020 addressing how it intends to regain compliance with Sections 1003(a)(i) and (ii) of the Company Guide by February 26, 2022, or sooner if the NYSE American determines that the nature and circumstances of the Company’s continued listing status warrant a shorter period of time. The Company intends to fully comply with the NYSE American’s requests and will submit its Plan accordingly.

The Company’s stock will continue to be listed on the NYSE American while the Company evaluates its various alternatives. The Company’s receipt of such notification from the NYSE American does not affect the Company’s business, operations or reporting requirements with the U.S. Securities and Exchange Commission.

A copy of the Company’s press release dated August 27, 2020, regarding the receipt of the Letter from the NYSE American is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Number Description

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

ASHFORD INC.

|

|

|

|

|

|

|

By:

|

/s/ ROBERT G. HAIMAN

|

|

|

|

Robert G. Haiman

|

|

|

|

Executive Vice President, General Counsel & Secretary

|

Date: August 27, 2020

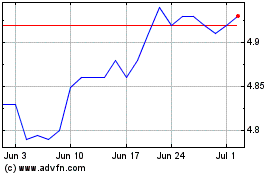

Ashford (AMEX:AINC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ashford (AMEX:AINC)

Historical Stock Chart

From Sep 2023 to Sep 2024