0001708599

false

0001708599

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): August 14, 2023

AgeX

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

1-38519 |

|

82-1436829 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

1101

Marina Village Parkway, Suite 201

Alameda,

California 94501

(Address

of principal executive offices)

(510)

671-8370

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

AGE |

|

NYSE

American |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Any

statements that are not historical fact (including, but not limited to statements that contain words such as “may,” “will,”

“believes,” “plans,” “intends,” “anticipates,” “expects,” “estimates”)

should also be considered to be forward-looking statements. Additional factors that could cause actual results to differ materially from

the results anticipated in these forward-looking statements are contained in AgeX’s periodic reports filed with the Securities

and Exchange Commission (the “SEC”) under the heading “Risk Factors” and other filings that AgeX may make with

the SEC. Undue reliance should not be placed on these forward-looking statements which speak only as of the date they are made, and the

facts and assumptions underlying these statements may change. Except as required by law, AgeX disclaims any intent or obligation to update

these forward-looking statements.

References

in this Report to “AgeX,” “we” or “us” refer to AgeX Therapeutics, Inc.

Item

2.02 - Results of Operations and Financial Condition.

On

August 14, 2023, AgeX issued a press release announcing its financial results for the quarter and six months ended June 30, 2023. A copy

of the press release is furnished as Exhibit 99.1 to this report.

The

information in this Item 2.02 and in the press release furnished as Exhibit 99.1 to this current report shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not to be incorporated

by reference into any filing of the registrant under the Securities Act of 1933, as amended, or the Exchange Act, whether made before

or after the date hereof, regardless of any general incorporation language in any such filing, except as shall be expressly set forth

by specific reference in such a filing.

Item

9.01 – Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AGEX

THERAPEUTICS, INC. |

| |

|

|

| Date:

August 14, 2023 |

By: |

/s/

Andrea E. Park |

| |

|

Chief

Financial Officer |

Exhibit 99.1

AgeX Therapeutics Reports Second Quarter 2023 Financial

Results

ALAMEDA, Calif.—(BUSINESS WIRE)—August

14, 2023—AgeX Therapeutics, Inc. (“AgeX”; NYSE American: AGE), a biotechnology company developing therapeutics for

human aging and regeneration, reported its financial and operating results for the quarter and six months ended June 30,

2023.

Balance Sheet Information

Cash, cash equivalents, and restricted cash totaled

$0.3 million as of June 30, 2023.

Debt Exchanged for Preferred Stock and Line of

Credit

As of June 30, 2023, AgeX owed Juvenescence Limited

(“Juvenescence”) $33 million in principal and origination fees on account of loans extended to AgeX. However, during July

2023 AgeX and Juvenescence entered into an Exchange Agreement pursuant to which AgeX issued shares of Series A Preferred Stock and Series

B Preferred Stock to Juvenescence in exchange for the extinguishment of a total of $36 million of indebtedness, including additional loans

made and origination fees accrued after June 30. As of August 11, 2023, AgeX had total outstanding debt payable to Juvenescence in the

amount of $1.2 million with $2 million of funds remaining for future borrowings which may be drawn down from time to time until October

31, 2023, subject to Juvenescence’s discretion to approve each loan draw.

Second Quarter 2023 Operating Results

Operating expenses: Operating expenses for

the three months ended June 30, 2023 were $1.9 million, as compared with $1.6 million for the same period in 2022.

Research and development expenses decreased by approximately

$0.1 million to $0.16 million from $0.26 million during the same period in 2022.

General and administrative expenses increased by $0.4

million to $1.7 million as compared to $1.3 million during the same period in 2022. The increase is largely attributable to professional

fees for legal services, consulting expenses incurred in connection with due diligence, and other expenses related to the possible merger

between AgeX and Serina Therapeutics Inc., an Alabama corporation (“Serina”).

Other expense, net: Net other expense for the

three months ended June 30, 2023 is comprised of $1 million amortization of deferred debt issuance costs and other debt related expenses

included in interest expense offset by $0.2 million net interest income primarily earned from a $10 million loan extended to Serina in

March 2023 (the “Serina Note”).

Net loss attributable to AgeX: The net loss

attributable to AgeX for the three months ended June 30, 2023 was $2.7 million, or ($0.07) per share (basic and diluted) compared to $2.6

million, or ($0.07) per share (basic and diluted), for 2022. The net loss per share is consistent year over year.

Going Concern Considerations

As required under Accounting Standards Update 2014-15,

Presentation of Financial Statements-Going Concern (ASC 205-40), AgeX evaluates whether conditions and/or events raise substantial

doubt about its ability to meet its future financial obligations as they become due within one year after the date its financial statements

are issued. Based on AgeX’s most recent projected cash flows, AgeX believes that its cash and cash equivalents and available sources

of debt and equity capital including the loan facilities provided by Juvenescence to advance up to an additional $2 million to AgeX as

of August 11, 2023 would not be sufficient to satisfy AgeX’s anticipated operating and other funding requirements for the twelve

months following the filing of AgeX’s Quarterly Report on Form 10-Q for the three and six months ended June 30, 2023. These factors

raise substantial doubt regarding the ability of AgeX to continue as a going concern.

Management Changes

On August 9, 2023, we made certain transitional changes

to our senior management. Michael D. West and AgeX entered into a Transition Services and Separation Agreement (the “Transition

Agreement”) pursuant to which Dr. West stepped down as Chief Executive Officer of AgeX but agreed to continue to serve as Chief

Executive Officer and as a director of AgeX’s subsidiary Reverse Bioengineering, Inc. during a “Transition Period” that

will end on October 31, 2023 or earlier if (i) AgeX consummates a merger with Serina Therapeutics, Inc., (ii) AgeX terminates Dr. West’s

employment for “Cause” or “Disability” as such terms are defined in his Employment Agreement, or (iii) Dr. West

dies.

On the same date, AgeX appointed Joanne Hackett as

Interim Chief Executive Officer. Dr. Hackett is and will continue to serve as the Chair of our Board of Directors but while serving as

Interim Chief Executive Officer she will no longer serve on the Audit Committee, Compensation Committee, and as Chair of the Nominating

and Corporate Governance Committee of the Board of Directors. AgeX entered into a Consulting Agreement with Dr. Hackett relating to her

performance of services as Interim Chief Executive Officer.

AgeX also appointed Jean-Christophe Renondin as a

director to fill a vacancy on the Board of Directors. Dr. Renondin has been appointed to serve on the Audit Committee, Compensation

Committee, and as Chair of the Nominating and Corporate Governance Committee of the Board of Directors.

Dr. Renondin is Managing Partner at Vesalius Biocapital,

a venture capital firm. From 2015 to 2022, Dr. Renondin served as Senior Healthcare Manager at the Sovereign Fund of Oman where he implemented

investment strategy and pursued investment opportunities in North America, Europe and Asia. Dr. Renondin has served in management roles

at a number of healthcare and investment firms, including serving for five years as managing director of Bryan Garnier & Co. Dr.

Renondin served as a director of Cognate Bioservices Limited, a company in the business of contract development and manufacturing, specializing

in cell and cell-mediated gene therapy products, which is now owned by Charles River Laboratories International, as a director of Juvenescence

Limited from March 2020 until June 2023, and as a director of Viscogliosi Brothers Acquisition Corp. Dr. Renondin received an

MBA degree from the Tuck School of Business at Dartmouth University and an MD degree from Universite Paris Cite.

About AgeX Therapeutics

AgeX Therapeutics, Inc. (NYSE American: AGE) is focused

on developing and commercializing innovative therapeutics to treat human diseases to increase healthspan and combat the effects of aging.

AgeX’s PureStem® and UniverCyte™ manufacturing and immunotolerance technologies are designed to work together

to generate highly defined, universal, allogeneic, off-the-shelf pluripotent stem cell-derived young cells of any type for application

in a variety of diseases with a high unmet medical need. AgeX has two preclinical cell therapy programs: AGEX-VASC1 (vascular progenitor

cells) for tissue ischemia and AGEX-BAT1 (brown fat cells) for Type II diabetes. AgeX’s revolutionary longevity platform induced

tissue regeneration (iTR™) aims to unlock cellular immortality and regenerative capacity to reverse age-related changes within tissues.

HyStem® is AgeX’s delivery technology to stably engraft PureStem or other cell therapies in the body. AgeX is seeking

opportunities to establish licensing and collaboration arrangements around its broad IP estate and proprietary technology platforms and

therapy product candidates. For more information, please visit www.agexinc.com or connect with the company on Twitter, LinkedIn,

Facebook, and YouTube.

Forward-Looking Statements

Certain statements contained in this release are “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not historical fact

including, but not limited to statements that contain words such as “will,” “believes,” “plans,” “anticipates,”

“expects,” “estimates” should also be considered forward-looking statements. Forward-looking statements involve

risks and uncertainties. Actual results may differ materially from the results anticipated in these forward-looking statements and as

such should be evaluated together with the many uncertainties that affect the business of AgeX Therapeutics, Inc. and its subsidiaries,

particularly those mentioned in the cautionary statements found in more detail in the “Risk Factors” section of AgeX’s

most recent Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission (copies of which may be obtained

at www.sec.gov). Subsequent events and developments may cause these forward-looking statements to change. AgeX specifically disclaims

any obligation or intention to update or revise these forward-looking statements as a result of changed events or circumstances that occur

after the date of this release, except as required by applicable law.

Contact for AgeX:

Andrea E. Park

apark@agexinc.com

(510) 671-8620

AGEX THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except par value amounts)

(unaudited)

| |

|

June 30,

2023 |

|

|

December 31,

2022 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

261 |

|

|

$ |

645 |

|

| Accounts and grants receivable, net |

|

|

6 |

|

|

|

4 |

|

| Prepaid expenses and other current assets |

|

|

1,083 |

|

|

|

1,804 |

|

| Total current assets |

|

|

1,350 |

|

|

|

2,453 |

|

| |

|

|

|

|

|

|

|

|

| Restricted cash |

|

|

50 |

|

|

|

50 |

|

| Intangible assets, net |

|

|

673 |

|

|

|

738 |

|

| Convertible note receivable |

|

|

10,204 |

|

|

|

- |

|

| TOTAL ASSETS |

|

$ |

12,277 |

|

|

$ |

3,241 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

|

$ |

961 |

|

|

$ |

1,034 |

|

| Loans due to Juvenescence, net of debt issuance costs, current portion |

|

|

22,943 |

|

|

|

7,646 |

|

| Related party payables, net |

|

|

230 |

|

|

|

141 |

|

| Warrant liability |

|

|

- |

|

|

|

180 |

|

| Insurance premium liability and other current liabilities |

|

|

371 |

|

|

|

1,077 |

|

| Total current liabilities |

|

|

24,505 |

|

|

|

10,078 |

|

| |

|

|

|

|

|

|

|

|

| Loans due to Juvenescence, net of debt issuance costs, net of current portion |

|

|

10,068 |

|

|

|

10,478 |

|

| TOTAL LIABILITIES |

|

|

34,573 |

|

|

|

20,556 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ deficit: |

|

|

|

|

|

|

|

|

| Preferred stock, $0.0001 par value, 5,000 shares authorized; none issued and outstanding |

|

|

- |

|

|

|

- |

|

| Common stock, $0.0001 par value, 200,000 shares authorized; and 37,951 and 37,949 shares issued and outstanding |

|

|

4 |

|

|

|

4 |

|

| Additional paid-in capital |

|

|

99,977 |

|

|

|

98,994 |

|

| Accumulated deficit |

|

|

(122,156 |

) |

|

|

(116,210 |

) |

| Total AgeX Therapeutics, Inc. stockholders’ deficit |

|

|

(22,175 |

) |

|

|

(17,212 |

) |

| Noncontrolling interest |

|

|

(121 |

) |

|

|

(103 |

) |

| Total stockholders’ deficit |

|

|

(22,296 |

) |

|

|

(17,315 |

) |

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

$ |

12,277 |

|

|

$ |

3,241 |

|

AGEX THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

9 |

|

|

$ |

12 |

|

|

$ |

19 |

|

|

$ |

17 |

|

| Cost of sales |

|

|

5 |

|

|

|

6 |

|

|

|

6 |

|

|

|

7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

4 |

|

|

|

6 |

|

|

|

13 |

|

|

|

10 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

160 |

|

|

|

259 |

|

|

|

334 |

|

|

|

655 |

|

| General and administrative |

|

|

1,730 |

|

|

|

1,338 |

|

|

|

3,723 |

|

|

|

2,998 |

|

| Total operating expenses |

|

|

1,890 |

|

|

|

1,597 |

|

|

|

4,057 |

|

|

|

3,653 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(1,886 |

) |

|

|

(1,591 |

) |

|

|

(4,044 |

) |

|

|

(3,643 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSE, NET: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

(792 |

) |

|

|

(863 |

) |

|

|

(1,892 |

) |

|

|

(1,434 |

) |

| Change in fair value of warrants |

|

|

(5 |

) |

|

|

(168 |

) |

|

|

(35 |

) |

|

|

(255 |

) |

| Other income, net |

|

|

4 |

|

|

|

4 |

|

|

|

7 |

|

|

|

7 |

|

| Total other expense, net |

|

|

(793 |

) |

|

|

(1,027 |

) |

|

|

(1,920 |

) |

|

|

(1,682 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS |

|

|

(2,679 |

) |

|

|

(2,618 |

) |

|

|

(5,964 |

) |

|

|

(5,325 |

) |

| Net loss attributable to noncontrolling interest |

|

|

10 |

|

|

|

- |

|

|

|

18 |

|

|

|

1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS ATTRIBUTABLE TO AGEX |

|

$ |

(2,669 |

) |

|

$ |

(2,618 |

) |

|

$ |

(5,946 |

) |

|

$ |

(5,324 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS PER COMMON SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BASIC AND DILUTED |

|

$ |

(0.07 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.14 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BASIC AND DILUTED |

|

|

37,951 |

|

|

|

37,943 |

|

|

|

37,950 |

|

|

|

37,943 |

|

AGEX THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| |

|

Six Months Ended

June 30, |

|

| |

|

2023 |

|

|

2022 |

|

| OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net loss attributable to AgeX |

|

$ |

(5,946 |

) |

|

$ |

(5,324 |

) |

| Net loss attributable to noncontrolling interest |

|

|

(18 |

) |

|

|

(1 |

) |

| Adjustments to reconcile net loss attributable to AgeX to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Change in fair value of warrants |

|

|

35 |

|

|

|

255 |

|

| Amortization of intangible assets |

|

|

65 |

|

|

|

66 |

|

| Amortization of debt issuance costs |

|

|

1,976 |

|

|

|

1,355 |

|

| Stock-based compensation |

|

|

105 |

|

|

|

437 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts and grants receivable |

|

|

(2 |

) |

|

|

13 |

|

| Prepaid expenses and other current assets |

|

|

721 |

|

|

|

614 |

|

| Interest on convertible note receivable |

|

|

(204 |

) |

|

|

- |

|

| Accounts payable and accrued liabilities |

|

|

(96 |

) |

|

|

(207 |

) |

| Related party payables |

|

|

186 |

|

|

|

65 |

|

| Insurance premium liability |

|

|

(711 |

) |

|

|

(653 |

) |

| Other current liabilities |

|

|

5 |

|

|

|

(2 |

) |

| Net cash used in operating activities |

|

|

(3,884 |

) |

|

|

(3,382 |

) |

| |

|

|

|

|

|

|

|

|

| INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Cash advanced on convertible note receivable |

|

|

(10,000 |

) |

|

|

- |

|

| Net cash used in investing activities |

|

|

(10,000 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Drawdown on loan facilities from Juvenescence |

|

|

13,500 |

|

|

|

3,500 |

|

| Net cash provided by financing activities |

|

|

13,500 |

|

|

|

3,500 |

|

| |

|

|

|

|

|

|

|

|

| NET CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH |

|

|

(384 |

) |

|

|

118 |

|

| |

|

|

|

|

|

|

|

|

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH: |

|

|

|

|

|

|

|

|

| At beginning of the period |

|

|

695 |

|

|

|

634 |

|

| At end of the period |

|

$ |

311 |

|

|

$ |

752 |

|

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity File Number |

1-38519

|

| Entity Registrant Name |

AgeX

Therapeutics, Inc.

|

| Entity Central Index Key |

0001708599

|

| Entity Tax Identification Number |

82-1436829

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1101

Marina Village Parkway

|

| Entity Address, Address Line Two |

Suite 201

|

| Entity Address, City or Town |

Alameda

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94501

|

| City Area Code |

(510)

|

| Local Phone Number |

671-8370

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

AGE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

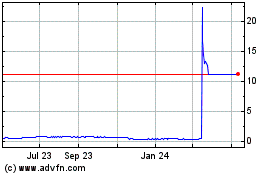

AgeX Therapeutics (AMEX:AGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

AgeX Therapeutics (AMEX:AGE)

Historical Stock Chart

From Apr 2023 to Apr 2024