U.S. Stocks Show Modest Move To The Downside

March 25 2024 - 4:44PM

IH Market News

After an early move to the downside, stocks fluctuated over the

course of the trading session on Monday but largely maintained a

negative bias. The major averages all finished the day lower after

ending last Friday’s trading mixed.

The tech-heavy Nasdaq (NASDAQ:COMP) fell 44.35 points or 0.3

percent to 16,384.47, pulling back off the record closing high set

in the previous session, while the S&P 500 (SPI:SP500) dipped

15.99 points or 0.3 percent to 5,218.19 and the Dow (DOWI:DJI) slid

162.26 points or 0.4 percent to 39,313.64.

Weakness among technology stocks weighed on the markets early in

the session, with semiconductor giant Intel (NASDAQ:INTC) plunging

by as much as 4.7 percent to its lowest intraday level in over four

months.

The steep drop came after a report from the Financial Times said

China has introduced new guidelines to phase microprocessors from

Intel and Advanced Micro Devices (NASDAQ:AMD) out of government PCs

and servers.

Intel climbed well off its worst levels but still slumped by 1.7

percent, while AMD ended the day down by 0.6 percent.

Shares of Microsoft (NASDAQ:MSFT) also fell by 1.4 percent after

the FT said stricter Chinese government procurement guidance also

seeks to sideline the company’s Windows operating system and

foreign-made database software in favor of domestic options.

Selling pressure remained relatively subdued, however, as

traders seemed reluctant to make more significant moves ahead of

the release of some key economic data in the coming days.

Traders are likely to keep an eye on reports on durable goods

orders, consumer confidence and pending home sales, although a

report on personal income and spending that includes readings on

inflation said to be preferred by the Fed will be released when the

markets are closed for Good Friday.

The Commerce Department released a report this morning showing

new home sales in the U.S. unexpectedly decreased in the month of

February.

The report said new home sales dipped by 0.3 percent to an

annual rate of 662,000 in February after jumping by 1.7 percent to

a revised rate of 664,000 in January.

Economists had expected new home sales to surge by 2.9 percent

to a rate of 680,000 from the 661,000 originally reported for the

previous month.

Sector News

Despite the modest weakness shown by the broader markets,

airline stocks showed a strong move to the upside on the day, with

the NYSE Arca Airline Index climbing by 1.5 percent.

Oil service stocks also saw considerable strength amid a sharp

increase by the price of crude oil, driving the Philadelphia Oil

Service Index up by 1.2 percent to a five-month closing high.

Computer hardware and oil producer stocks also saw some strength

on the day, while software stocks moved to the downside.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly lower during trading on Monday. Japan’s Nikkei

225 Index slumped by 1.2 percent, while China’s Shanghai Composite

Index slid by 0.7 percent.

Meanwhile, the major European markets turned in a mixed

performance on the day. While the German DAX Index rose by 0.3

percent, the French CAC 40 Index closed just below the unchanged

line and the U.K.’s FTSE 100 Index dipped by 0.2 percent.

In the bond market, treasuries gave back ground after trending

higher over the past few sessions. As a result, the yield on the

benchmark ten-year note, which moves opposite of its price, rose

3.5 basis points to 4.253 percent.

Looking Ahead

Trading on Tuesday may be impacted by reaction to the latest

U.S. economic data, including reports on durable goods orders and

consumer confidence.

Source: RTTNEWS

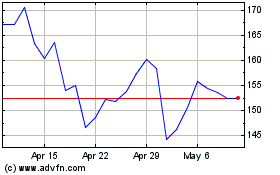

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Apr 2023 to Apr 2024