0001704711FALSE00017047112024-03-072024-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

March 7, 2024

Date of Report (Date of earliest event reported)

FUNKO, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38274 | | 35-2593276 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

2802 Wetmore Avenue

Everett, Washington 98201

(Address of Principal Executive Offices) (Zip Code)

(425) 783-3616

(Registrant’s telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

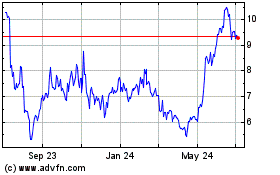

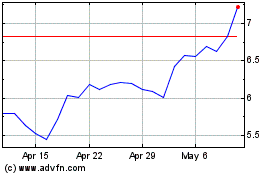

Class A Common Stock, $0.0001 par value per share | FNKO | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On March 7, 2024, Funko, Inc. (the “Company”) announced its financial results for the quarter and fiscal year ended December 31, 2023. The full text of the press release (the “Press Release”) issued in connection with the announcement is furnished as Exhibit 99.1 to this report and is incorporated herein by reference. The information contained in the website cited in the Press Release is not incorporated herein.

The information in Item 2.02 of this report (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 6, 2024, Steve Nave resigned as Chief Financial Officer and Chief Operating Officer of Funko, Inc. (the “Company”), effective March 15, 2024 (the "Effective Date"). Also on March 6, 2024, the Company’s Board of Directors (the “Board”) appointed Yves LePendeven as the Company’s Acting Chief Financial Officer and designated him as the Company’s principal financial officer and principal accounting officer, in each case effective as of the Effective Date. The Company is not planning to fill the Chief Operating Officer position at this time.

Mr. LePendeven, age 45, has served as the Company Deputy Chief Financial Officer since August 2023. Prior to that, Mr. Le Pendeven held several roles as a senior finance executive since joining Funko in October 2019. Prior to joining Funko, Mr. Le Pendeven served multiple finance roles at Volcom, a subsidiary of the Kering Group, most recently as Vice President, Financial Planning & Analysis, where he oversaw global financial planning. Prior to that, Mr. Le Pendeven was a Director, Financial Planning and Analysis in the corporate finance group at Quiksilver. Mr. Le Pendeven received an M.B.A. from the Paul Merage School of Business at University of California - Irvine and a B.A. in Science, Technology and Society from Stanford University.

In connection with Mr. LePendeven’s appointment as Acting Chief Financial Officer, the Company has entered into a Letter Agreement with Mr. LePendeven, dated March 6, 2024 (the “LePendeven Letter”). The LePendeven Letter provides, among other things, that, in connection with his appointment as Acting Chief Financial Officer, Mr. LePendeven will receive an additional $10,000 per month for each month that he serves as Acting Chief Financial Officer as well as a one-time award of 5,000 restricted stock units granted on the Effective Date, which will vest on the six-month anniversary of the date of grant, subject to his continued service through such date. In addition, the LePendeven Letter provides that in the event Mr. LePendeven’s employment is terminated by the Company without “cause” or by Mr. LePendeven for “good reason” (each as defined in the LePendeven Letter) then, subject to his execution and non-revocation of a release of claims, Mr. LePendeven will be entitled to receive separation benefits of: (i) continued base salary payments for six months, less applicable withholdings, and (ii) reimbursement for up to six months of the Company-paid portion of premium payments, as if Mr. LePendeven had remained an active employee, for any COBRA coverage that he elects, which shall be payable monthly. The foregoing description of the LePendeven Letter does not purport to be complete and is qualified in its entirety by reference to the full text of the LePendeven Letter, which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

In addition, the Company has entered into a Separation and Release of Claims Agreement with Mr. Nave, dated March 6, 2024 (the “Nave Agreement”), pursuant to which Mr. Nave’s employment will terminate on the Effective Date. Mr. Nave will be entitled to receive, subject to his execution and non-revocation of a waiver and release of claims agreement: (i) continued base salary payments for six months following the Effective Date, less applicable withholdings, (ii) reimbursement for up to six months following the Effective Date of the Company-paid portion of premium payments, as if Mr. Nave had remained an active employee, for any COBRA coverage that he timely elects, which shall be payable monthly, (iii) additional payments in an aggregate amount of $125,000, less applicable withholdings, payable in six equal monthly installments in accordance with the Company’s regular payroll practices, (iv) his fiscal year 2023 target annual bonus, which shall be payable at the same time annual bonuses are paid to similarly situated executives of the Company and (v) accelerated vesting of the 30,000 outstanding unvested restricted stock units granted to Mr. Nave on August 11, 2023 under the Company’s 2019 Incentive Award Plan and which were scheduled to vest on March 29, 2024. The payment of such separation benefits will also be subject to Mr. Nave’s continued compliance with certain applicable restrictive covenants set forth in his Employment Agreement with the Company, dated as of February 27, 2023. The foregoing description of the Nave Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Nave Agreement, which is attached hereto as Exhibit 10.2 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

|

|

|

|

|

|

| Exhibit No. |

| Description |

| 10.1 | | |

| 10.2 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

Date: March 7, 2024 | FUNKO, INC. | |

| | | | | | | | |

| By: | /s/ Steve Nave |

|

| Steve Nave |

|

| Chief Financial Officer and Chief Operating Officer (Principal Financial Officer) |

March 6, 2024

Yves LePendeven

Via Email

Re: Compensation Terms (Acting Chief Financial Officer)

Dear Yves:

Thank you for your ongoing contributions to the success of Funko, Inc. (the “Company”). We are pleased to confirm with this letter (this “Letter”) the terms of your compensation in connection with your promotion to Acting Chief Financial Officer of the Company.

A. Position. Effective as of the date upon which your predecessor’s employment as Chief Financial Officer of the Company ceases (expected to be on or around March 15, 2024) (the “Effective Date”), you will be employed with the Company in the position of Acting Chief Financial Officer and Deputy Chief Financial Officer and will report to the Chief Executive Officer of the Company, or if determined by the Board of Directors of the Company (the “Board”), the Board. You will have such responsibilities, duties and authority usual and customary for such position.

B. Salary. Effective as of the Effective Date, you will continue to receive your annual base salary, which is expected to be $400,000 as of the Effective Date, as well as an additional $10,000 each month that you serve as Acting Chief Financial Officer (which will not be prorated for any partial month of service), and which will be paid in accordance with the normal payroll procedures of the Company then in effect, subject to applicable withholdings and deductions. In the event your employment as Acting Chief Financial Officer ends and you continue to remain employed with the Company as Deputy Chief Financial Officer, you will only be eligible to receive your annual base salary rate of $400,000.

C. Equity Awards. Effective as of the Effective Date, you will be granted a one-time restricted stock unit award in connection with your promotion to Acting Chief Financial Officer with respect to 5,000 shares of the Company’s Class A Common Stock, subject to the approval of the Board or the compensation committee thereof (the “Retention Grant”). The Retention Grant will vest on the six-month anniversary of the grant date, subject to your continued service through the applicable vesting date and the terms of the applicable equity incentive plan and award agreement.

D. Separation Benefits on Termination without Cause; Resignation for Good Reason. If your employment is terminated by the Company without Cause or by you for Good Reason (each capitalized term, as defined below on Exhibit A), then, subject to your execution of a release of claims in a form acceptable to the Company (which shall also include the Company’s customary post-termination restrictive covenants, including covenants relating to confidentiality and non-solicitation), and any period for rescission of such Release shall have expired without your having rescinding such Release, you will be eligible to receive an amount equal to continuation of your annual base salary for up to six (6) months from the date of termination, payable in six (6) equal monthly installments in accordance with the Company’s regular payroll practices, and reimbursement, up to a maximum of six (6) months, of the Company-paid portion of premium payments, as if you had remained an active employee, for any COBRA coverage you elect, if any.

E. Code Section 409A. To the extent applicable, this Letter shall be interpreted in accordance with Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”) and Department of Treasury regulations and other interpretative guidance issued thereunder, including without limitation any such regulations or other such guidance that may be issued after the date of this Letter. For all purposes under this Letter, a “termination of employment” shall be interpreted to mean a “separation from service” within the meaning of Treasury Regulation Section 1.409A-1(h). Each separate installment payment hereunder shall be considered a separate payment under this Letter for purposes of Section 409A of the Code. To the extent required to avoid accelerated taxation and/or tax penalties under Section 409A of the Code, amounts that would otherwise be payable and benefits that would otherwise be provided pursuant to this Letter during the six-month period immediately following the date of termination shall instead be paid in a lump sum on the first day of the seventh month following the date of termination (or upon your death, if earlier). No provision of this Letter shall be interpreted or construed to transfer any liability for failure to comply with the requirements of Section 409A of the Code from you or any other individual to the Company or any of its affiliates, employees or agents.

Your employment with the Company is and will continue to be at-will, as defined under applicable law. This means that it is not for any specified period of time and can be terminated by you or by the Company at any time, with or without advance notice, and for any or no particular reason or cause. The Company will have the authority and the right to deduct or withhold, or require you to remit to the Company, an amount sufficient to satisfy all federal, state, local and foreign taxes (including any employment tax obligations) required by law to be withheld from amounts payable under this Letter.

Except as otherwise modified in this Letter, as of and following the date of this Letter, the current terms and conditions of your employment with the Company will remain unchanged and in full force and effect. This Letter sets forth the final and entire agreement of the parties with respect to the subject matter thereto, and supersedes all prior agreements, promises, covenants, arrangements, communications, representations or warranties, whether oral or written, by the Company and you, or any representative of the Company or you, with respect thereto.

This Letter shall be interpreted and construed in accordance with the laws of the State of Washington without regard to any conflicts of laws principles.

[Signature Page Follows]

Please acknowledge your acceptance of the terms of this Letter by signing where indicated below.

Sincerely,

/s/ Mike Lunsford

Mike Lunsford

Interim CEO

Funko, Inc.

I have received a copy of this Letter and accept the terms as outlined above.

/s/ Yves LePendeven March 6, 2024

__________________________________ ___________________

Yves LePendeven [Date]

Exhibit A

DEFINED TERMS

1.“Cause” Cause shall mean: (a) gross neglect or willful misconduct by you of your duties or your willful failure to carry out, or comply with, in any material respect any lawful and reasonable directive of the Board not inconsistent with the terms of this Agreement; (b) conviction of you of, or your plea of no contest, plea of nolo contendere or imposition of adjudicated probation with respect to, any felony or crime involving moral turpitude or your indictment for any felony or crime involving moral turpitude; provided if you are terminated following such indictment but are found not guilty or the indictment is dismissed, the termination shall be deemed to be a termination without Cause; (c) your habitual unlawful use (including being under the influence) or possession of illegal drugs on the Company’s premises or while performing your duties and responsibilities under this Agreement; (d) your commission at any time of any act of fraud, embezzlement, misappropriation, material misconduct, or breach of fiduciary duty against the Company (or any predecessor thereto or successor thereof); or (e) your material breach of the restrictive covenants in Sections 5 and 6 hereof or any other confidentiality, non-compete or non-solicitation covenant; provided that the Company shall provide you with fifteen (15) days prior written notice before any such termination in (a) or (e) (other than to the extent that (a) relates to any fraud or intentional misconduct) with an opportunity to meet with the Board and discuss or cure any such alleged violation.

2.“Good Reason” Good Reason shall mean: (a) a material adverse change in your title or reporting line or material duties, authorities or responsibilities, as determined by the Board (provided, that your title, reporting line or material duties, authorities or responsibilities shall not be deemed to be materially adversely changed solely because the Company (or its successor) is no longer an independently operated public entity or becomes a subsidiary of another entity); (b) a material breach by the Company of any material provision of this Letter; (c) a material reduction of your annual base salary or benefits (other than such a reduction that is generally consistent with a general reduction affecting the Company’s other similarly situated executives); or (d) failure by the Company to pay any portion of your earned annual base salary or bonus; provided that in the case of all the above events, you may not resign from your employment for Good Reason unless you provide the Company written notice within 90 days after the initial occurrence of the event, the Company has not corrected the event within 30 days of your provision of such written notice, and you terminate employment within six months of the expiration of such 30-day cure period.

Funko, Inc.

2802 Wetmore Avenue

Everett, WA 98201

March 6, 2024

Mr. Steve Nave

Via email

Re: Separation and Release of Claims Agreement

Dear Steve:

This letter agreement (this “Letter Agreement”) sets forth the understanding by and between you and Funko, Inc. (collectively with its direct and indirect subsidiaries, and any successor(s) thereto, the “Company”), regarding the cessation of your employment with the Company and the transition of your role as Chief Financial Officer of the Company.

1.Separation Date and Transition Services. Your active employment with the Company will terminate on March 15, 2024 (the “Separation Date”) and, as of the Separation Date, you will cease to be an employee of the Company and its direct and indirect subsidiaries. Until the Separation Date, that certain Employment Agreement by and between the Company and you, dated as of February 27, 2023 (the “Employment Agreement”) will continue to control with respect to your salary, benefits and other matters with respect to your employment with the Company. In addition, until the Separation Date you will use your reasonable best efforts to advance the interests of the Company and facilitate the successful transition of your responsibilities to the individual who succeeds you as Chief Financial Officer in whatever reasonable capacity may be requested by the Board of Directors of Funko, Inc. (the “Board”). You and the Company mutually agree that both parties will communicate a message consistent with the message mutually agreed to by you and the Board to key employees, investors, analysts, customers, suppliers, and other relevant third parties relating to your separation from the Company. You acknowledge and agree that you hereby resign from all other offices, directorships, and committees you may hold at the Company and its subsidiaries (including without limitation, as Chief Financial Officer and Chief Operating Officer), effective as of the Separation Date.

2.Separation Benefits. In addition to any payments and benefits due to you pursuant to Section 7.05(a) of the Employment Agreement, you will, subject to (and in consideration for): (a) your compliance with Section 1 above through the Separation Date, (b) your timely execution and return to the Company, non-revocation of, and compliance with the Waiver and Release of Claims Agreement attached hereto as Exhibit A (the “Release”), and (c) your continued compliance with the Restrictive Covenants (as defined in Section 3 below), be entitled to receive (i) the payments and benefits set forth in Section 7.05(b) of the Employment Agreement, which shall be subject to the terms of the Employment Agreement and, for the avoidance of doubt, will consist of (A) an amount equal to your continued base salary for 6 months following the Separation Date, which equals an aggregate amount of $375,000, less applicable withholdings, payable in six equal monthly installments in accordance with the Company’s regular payroll practices, and (B) reimbursement for up to 6 months following the Separation Date of the Company-paid portion of premium payments, as if you had remained an active employee, for any COBRA coverage that you timely elect (which for the avoidance of doubt will be based on the coverage levels in effect immediately prior to the Separation Date in 2024), which shall be payable monthly, (ii) additional payments in an aggregate amount of $125,000, less applicable withholdings, payable in six equal monthly installments in accordance with the Company’s regular payroll practices, (iii) your fiscal year 2023 target annual bonus (to

the extent not already paid as of the Separation Date), which shall be payable at the same time annual bonuses are paid to similarly situated executives of the Company, without regard to any requirement for continued employment through the payment date, and (iv) accelerated vesting of the 30,000 outstanding unvested restricted stock units granted to you on August 11, 2023 under the Company’s 2019 Incentive Award Plan and which were scheduled to vest on March 29, 2024 as of the Separation Date (and, for the avoidance of doubt, all other unvested Company equity-based compensation awards held by you will be forfeited as of the Separation Date)(the payments and benefits set forth in (i) through (iv), collectively, the “Separation Benefits”).

3.Restrictive Covenants. You acknowledge that the Company is providing you with the Separation Benefits in material part in consideration for your reaffirmation of your prior agreement to comply with the restrictive covenants set forth in Sections 5 and 6 of the Employment Agreement to the maximum extent provided by applicable law (the “Restrictive Covenants”) and that no Separation Benefits will be made following the date that you first violate any of the Restrictive Covenants.

4.Release. The Separation Benefits are contingent upon and subject to your timely execution and return to the Company of the Release no earlier than the Separation Date and no later than twenty-one (21) days after your receipt of this letter, in accordance with Section 7.05(b) of the Employment Agreement and your non-revocation and compliance with the Release.

5.Acknowledgement. Employee hereby acknowledges and agrees that, except for Employee’s base pay through the Separation Date and any payments owed to Employee under Sections 7.05(a) and 7.05(b) of the Employment Agreement, Employee has been paid all wages, bonuses, compensation and benefits from the Company and has no right to any additional wages, bonuses, compensation or benefits from the Company or any Released Parties.

6.Entire Agreement. This Letter Agreement sets forth the entire agreement between you and the Company with respect to the subject matter set forth herein and supersedes and replaces any and all prior oral or written agreements or understandings between you and the Company with respect to the subject matter hereof; provided, that, for the avoidance of doubt, (a) you will retain your rights under the terms of the Employment Agreement, except to the extent such terms result in duplication of compensation or benefits to you, and (b) the provisions of the Employment Agreement which by their terms survive termination of employment (including, without limitation, the Restrictive Covenants) will remain in full force and effect in accordance with their terms (as may be amended by this Letter Agreement). This Letter Agreement may be amended only by a subsequent writing signed by both parties. You represent that you have signed this Letter Agreement knowingly and voluntarily.

Please indicate your acceptance of the terms and provisions of this Letter Agreement by signing both copies of this Letter Agreement and returning one copy to me. The other copy is for your files. By signing below, you acknowledge and agree that you have carefully read this Letter Agreement; fully understand and agree to its terms and provisions; will comply with the Restrictive Covenants; and intend and agree that this Letter Agreement is final and legally binding on you and the Company. All payments described in this Letter Agreement will be subject to the withholding of any amounts required by federal, state or local law. This Letter Agreement will be governed and construed under the internal laws of the State of Washington and may be executed in several counterparts.

Very truly yours,

/s/ Michael Lunsford _________________________

Michael Lunsford

On behalf of Funko, Inc.

Signature Page to Transition and Release of Claims Agreement

I hereby agree to, acknowledge and accepted the terms of the Letter Agreement with Funko, Inc. dated as of March 6, 2024:

/s/ Steve Nave

______________________________

Steve Nave

Signature Page to Transition and Release of Claims Agreement

Exhibit A

WAIVER AND RELEASE OF CLAIMS AGREEMENT

In exchange for the separation payments and benefits provided (the “Separation Benefits”) pursuant to that certain Letter Agreement, dated as of March 6, 2024, by and between Funko, Inc. (“Company”) and Steve Nave (the “Employee”) (this “Agreement”) the Employee freely and voluntarily agrees to enter into and be bound by this Waiver and Release of Claims Agreement (this “Release”).

1.General Release. The Employee, on his own behalf and on behalf of his spouse, child or children (if any), heirs, personal representative, executors, administrators, successors, assigns and anyone else claiming through him (the “Releasors”), hereby releases and discharges forever Funko, Inc., and its affiliates, and each of their respective past, present or future parent, affiliated, related, and subsidiary entities and each of their respective past, present or future directors, officers, employees, trustees, agents, attorneys, administrators, plans, plan administrators, insurers, equity holders, members, representatives, predecessors, successors and assigns, and all Persons acting by, through, under or in concert with them (hereinafter collectively referred to as the “Released Parties”), from and against all liabilities, claims, demands, liens, causes of action, charges, suits, complaints, grievances, contracts, agreements, promises, obligations, costs, losses, damages, injuries, attorneys’ fees and other legal responsibilities (collectively referred to as “Claims”), of any form whatsoever (whether or not relating to Employee's employment with the Company), including, but not limited to, any claims in law, equity, contract or tort, claims under any policy, agreement, understanding or promise, written or oral, formal or informal, between the Employee and the Company or any of the other Released Parties, and any claims under the Civil Rights Act of 1866, the Civil Rights Act of 1871, the Civil Rights Act of 1964, the Americans With Disabilities Act of 1990, the Age Discrimination in Employment Act of 1967 (“ADEA”), the Sarbanes-Oxley Act of 2002, the Securities Act of 1933, the Securities Exchange Act of 1934 (the “Exchange Act”), the Employee Retirement Income Security Act of 1974, the Rehabilitation Act of 1973, the Family and Medical Leave Act of 1993, the Genetic Information Nondiscrimination Act of 2008, the Worker Adjustment and Retraining Notification Act of 1988, the Delaware Discrimination in Employment Act, the Delaware Persons with Disabilities Employment Protection Act, the Delaware Whistleblowers’ Protection Act, the Delaware Wage Payment and Collection Act, the Delaware Fair Employment Practices Act, Delaware's social media law, the Washington Industrial Welfare Act, the Washington Minimum Wage Act, the Washington Wage Payment Act, the Washington Wage Rebate Act, the Washington Law Against Discrimination, the Washington Leave Law, the California Family Rights Act, the California Labor Code, the California Workers’ Compensation Act, California Business & Professions Code Section 17200, and the California Fair Employment and Housing Act, the Minnesota Human Rights Act, the Minnesota Equal Pay for Equal Work Law, the Minnesota age discrimination statute, the Minnesota whistleblower protection statute, the Minnesota family leave statute, Minnesota Statute Chapter 181 (to the extent permitted under applicable law), and/or the Minnesota personnel record access statute, as each may have been amended from time to time, or any other federal, state or local statute, regulation, law, rule, ordinance or constitution, or common law, whether known or unknown, unforeseen, unanticipated, unsuspected or latent, that the Employee or any of the Releasors now possess or have a right to, or have at any time heretofore owned or held, or may at any time own or hold by reason of any matter or thing arising from any cause whatsoever prior to the date of execution of this Release to the maximum extent permitted by law, and without limiting the generality of the foregoing, from all claims, demands and causes of action based upon, relating to, or arising out of: (a) this Agreement; (b) that certain Employment Agreement, dated as of February 27, 2023, by and among the Company and the Employee (the “Employment Agreement”), or Employee’s employment or other relationship with any of the Released Parties or the termination thereof; and (c) the Employee’s status as a holder of

securities of any of the Released Parties. This Release includes, but is not limited to, all wrongful termination and “constructive discharge” claims, all discrimination claims, all claims relating to any contracts of employment, whether express or implied, any covenant of good faith and fair dealing, whether express or implied, and any tort of any nature. This Release is for any relief, no matter how denominated, including but not limited to wages, back pay, front pay, benefits, compensatory, liquidated or punitive damages and attorneys’ fees. The Employee acknowledges and reaffirms Employee’s obligations under the Employment Agreement, including but not limited to Sections 5 and 6 thereof.

The Employee acknowledges that the Employee has been advised of and is familiar with the provisions of California Civil Code § 1542, which states, in part: “A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE AND THAT, WHICH IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY.” The Employee expressly waives and releases any and all rights that the Employee may have under California Civil Code § 1542 as well as under any other statutes or common law principles of similar effect, to the fullest extent the Employee may do so lawfully.

2.Covenant Not To Sue. The Employee represents and covenants that he has not filed, initiated or caused to be filed or initiated any Claim, charge, suit, complaint, grievance, action, cause of action or proceeding against the Company or any of the other Released Parties. Except to the extent that such waiver is precluded by law, the Employee further promises and agrees that he will not file, initiate or cause to be filed or initiated any Claim, charge, suit, complaint, grievance, action, cause of action or proceeding based upon, arising out of or relating to any Claim released hereunder, nor shall the Employee participate, assist or cooperate in any Claim, charge, suit, complaint, grievance, action, cause of action or proceeding regarding any of the Released Parties relating to any Claims released hereunder, whether before a court or administrative agency or otherwise, unless required to do so by law.

3.Exclusions. Notwithstanding the foregoing, the Employee does not release his rights to receive the Separation Benefits or any right that may not be released by private agreement. In addition, this Release will not prevent the Employee from (i) filing a charge or complaint with the Equal Employment Opportunity Commission, the National Labor Relations Board, the Occupational Safety and Health Administration, the Securities and Exchange Commission or any other federal, state or local governmental agency or commission (“Government Agencies”) or (ii) reporting possible violations of federal law or regulation to, otherwise communicating with or participating in any investigation or proceeding that may be conducted by, or providing documents and other information, without notice to the Company, to, any Governmental Agency or entity, including in accordance with the provisions of and rules promulgated under Section 21F of the Exchange Act or Section 806 of the Sarbanes-Oxley Act of 2002, as each may have been amended from time to time, or any other whistleblower protection provisions of state or federal law or regulation. This Agreement does not limit Employee’s right to receive an award for information provided to any Government Agencies; provided, however, that the Employee acknowledges and agrees that any Claim by him, or brought on his behalf, for damages in connection with such a charge or investigation filed with the Equal Employment Opportunity Commission would be and hereby is barred. In addition, this Release will not prevent the Employee from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that Employee has reason to believe is unlawful.

4.No Assignment. The Employee represents and warrants that he has made no assignment or other transfer, and covenants that he will make no assignment or other transfer, of

any interest in any Claim that he may have against any of the Released Parties. This Agreement shall inure to the benefit of each of the Released Parties.

5.Indemnification of Released Parties. The Employee agrees to indemnify and hold harmless the Released Parties, and each of them, against any loss, claim, demand, damage, expenses or any other liability whatsoever, including reasonable attorneys’ fees and costs, resulting from: (i) any breach of this Release by him or his successors in interest; (ii) any assignment or transfer, or attempted assignment or transfer, of any Claims released hereunder; or (iii) any action or proceeding brought by him or his successors in interest, if such action or proceeding arises out of, is based upon, or is related to any Claims released hereunder. This indemnity does not require payment as a condition precedent to recovery by any of the Released Parties.

6.Acknowledgments. The Company is herein advising Employee to consult with an attorney before executing this Release. The Employee agrees that he has had the opportunity to consult with counsel, if he chose to do so, and that the Employee has had a sufficient and reasonable amount of time to read and consider this Release before executing it. The Employee acknowledges that he is responsible for any costs and fees resulting from his attorney reviewing this Release. The Employee agrees that he has carefully read this Release and knows its contents, and that he signs this Release voluntarily, with a full understanding of its significance, and intending to be bound by its terms. The Employee acknowledges that the provision of the Separation Benefits is in exchange in material part for the promises in the Release, and that, but for his execution of this Release, he would not be entitled to receive the Separation Benefits. The Employee further acknowledges that the provision of the Separation Benefits does not constitute an admission by the Released Parties of liability or of violation of any applicable law or regulation.

7.ADEA Provisions. The Employee understands that this Release includes a release of claims arising under the ADEA. The Employee acknowledges and agrees that he has had at least 21 days after the date of his receipt of this Release (such period, the “Consideration Period”) to review this Release and consider its terms before signing this Release and that the Consideration Period will not be affected or extended by any changes, whether material or immaterial, that might be made to this Release. The Employee further acknowledges and agrees that he understands that he may use as much or all of such 21-day period as he wishes before signing, and warrants that he has done so. The Employee may revoke and cancel this Release in writing at any time within fifteen days after his execution of this Release (such seven-day period, the “Revocation Period”). In order to revoke this Release, Employee must provide written notice of revocation to the Company (i) in person, by hand to Sarah Martinez at 2802 Wetmore Avenue, Everett, WA 98201, by no later than the 15th day after the date on which Employee signs this Agreement, (ii) by email to Sarah Martinez at sarah.martinez@funko.com by no later than the 15th day after the date on which Employee signs this Agreement, or (iii) by mail, postmarked within the 15-day period after the date on which Employee signs the Agreement, properly addressed to Sarah Martinez at 2802 Wetmore Avenue, Everett, WA 98201; provided, however, Employee will not receive any Severance Benefits if Employee exercises Employee’s right to revoke Release. This Release shall not become effective and enforceable until after the expiration of the Revocation Period; after such time, if there has been no revocation, this Release shall immediately be fully effective and enforceable.

8.Consequences of Breach or Revocation. The Employee agrees that, notwithstanding anything to the contrary in this Release, in the event that he breaches any of the terms of the Release, or revokes the Release pursuant to Section 7, he shall forfeit the Separation Benefits and reimburse the Company for any portion of the Separation Benefits that have already been paid, and, in the event of such a breach, he shall reimburse the Company for any expenses or damages incurred as a result of such breach.

9.Cooperation. Employee hereby agrees that Employee shall cooperate with the Company and its affiliates, upon the Company’s reasonable request, with respect to any internal investigation or administrative, regulatory or judicial proceeding involving matters within the scope of Employee’s duties and responsibilities to the Company or its affiliates during Employee’s employment with the Company (including, without limitation, Employee being available to the Company upon reasonable notice for interviews and factual investigations, appearing at the Company’s reasonable request to give testimony without requiring service of a subpoena or other legal process, and turning over to the Company all relevant Company documents which are or may have come into Employee’s possession during Employee’s employment); provided, however, that any such request by the Company shall not be unduly burdensome or interfere with Employee’s personal schedule or ability to engage in gainful employment.

10.Severability. If any provision of the Release is declared invalid or unenforceable, the remaining portions of the Release shall not be affected thereby and shall be enforced.

11.Governing Law. This Release is made under and shall be governed by and construed in accordance with the laws of the State of Washington.

IN WITNESS WHEREOF, the undersigned has signed and executed this Release on the date set forth below (which shall not be prior to March 15, 2024) as an expression of his intent to be bound by the foregoing terms of this Release.

____________________________________

Steve Nave

Date: _______________________________

Funko Reports 2023 Fourth Quarter, Full Year Financial Results;

Provides Full-Year Outlook for 2024

--Q4 Net Sales, Gross Margin and Adjusted EBITDA at Upper End of Expectations,

Driven by Strong DTC Growth and Continued Operational Improvement--

EVERETT, Wash. March 7, 2024 -- Funko, Inc. (Nasdaq: FNKO), a leading pop culture lifestyle brand, today reported its consolidated financial results for the fourth quarter and full year ended December 31, 2023. The company also provided financial guidance for the 2024 first quarter and full year.

Fourth-Quarter Financial Results Summary: 2023 vs 2022

•Net sales were $291.2 million versus $333.0 million

•Gross profit was $109.4 million, equal to gross margin of 37.6%, compared with $94.3 million, equal to gross margin of 28.3%

•SG&A expenses were $97.4 million, which included $8.0 million of non-recurring charges primarily related to fair market value adjustments for assets held for sale. This compares with $139.2 million, which included $32.5 million of non-recurring charges related to the write down of an enterprise resource planning system, for the fourth quarter of 2022

•Net loss was $10.8 million, or $0.21 per share, versus $42.2 million, or $0.89 per diluted share

•Adjusted net income* was $0.5 million, or $0.01 per diluted share, versus adjusted net loss of $17.9 million, or $0.35 per share

•Adjusted EBITDA* was $23.5 million versus negative adjusted EBITDA* of $6.3 million

Full-Year Financial Results Summary: 2023 vs 2022

•Net sales were $1.1 billion versus $1.3 billion

•Gross profit was $333.0 million, equal to gross margin of 30.4%, which included $39.0 million of non-recurring charges related to the disposal of excess inventory and finished and unfinished goods held at offshore factories. This compares with $434.0 million, equal to gross margin of 32.8%

•SG&A expenses were $377.1 million, which included $20.7 million of non-recurring charges primarily related to the termination of a lease agreement, fair market value adjustments for assets held for sale and severance and related charges. This compares with $398.3 million for the 2022 full year, which included $32.5 million of non-recurring charges related to the write-down of an enterprise resource planning system

•Net loss was $154.1 million, or $3.19 per share, compared with $8.0 million, or $0.18 per share

•Adjusted net loss* was $45.4 million, or $0.87 per share, versus adjusted net income* of $29.6 million, or $0.57 per diluted share

•Adjusted EBITDA* was $27.2 million compared with $97.4 million

"In 2023, we implemented a comprehensive plan to significantly reduce costs, improve operational efficiencies and focus on our core product offerings,” said Michael Lunsford, Funko’s Interim Chief Executive Officer. "The major elements of that plan, which addressed the company's inventory issues, unprofitable product lines and SKUs, workforce size, and several other factors, were successfully completed, and we believe our company is now on a significantly more solid foundation upon which we intend to build and grow.

"For the 2023 fourth quarter, net sales and adjusted EBITDA were at the upper end of our guidance range, fueled in part by growth in our direct-to-consumer (DTC) business, which accounted for 26 percent of

our revenue and increased nearly 30 percent compared with the same quarter of the prior year. Gross margin of 38 percent was the highest of any quarter in 2023.

“Turning to our balance sheet, we substantially lowered our inventory levels to $119 million at December 31, 2023 from $246 million at the end of last year and $162 million at September 30, 2023. We also paid down our debt by $26 million in the fourth quarter and used the proceeds from a transaction related to our Games business to further reduce our debt in the first quarter of 2024.

"Looking ahead, we face a softer content schedule following the recent Hollywood strikes and uncertainty around shipping costs caused by the Red Sea situation. Despite these headwinds, we expect our bottom line to significantly improve in 2024 compared with 2023. Our belief is based on the actions we are taking to, among other things, further expand our DTC business and increase sales of Pop! Yourself and limited-edition products – areas we control and can grow profitably."

Leadership Update

The company also announced today that Steve Nave, Funko’s Chief Financial Officer (CFO) and Chief Operating Officer, is resigning effective March 15, 2024. Yves LePendeven, the company’s Deputy CFO, will serve as Acting CFO as of the same date.

“Steve joined us a year ago to help with our cost reduction and operational improvement plan,” said Lunsford. “We have made significant progress against that plan and thank Steve for his contributions. We wish Steve success in his future endeavors.

“I have worked with Yves for several years now, as both a board member and as the interim CEO. I have complete faith in Yves to lead our Finance and Accounting functions. We believe we now have in place a strong, lean, aligned senior leadership team to support the arrival of a new CEO and the growth of Funko.”

Fourth Quarter 2023 Net Sales by Category and Geography

The tables below show the breakdown of net sales on a brand category and geographical basis (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Period Over Period Change |

| | 2023 | | 2022 | | Dollar | | Percentage |

| Net sales by product brand: | | | | | | | | |

| Core Collectibles | | $ | 212,776 | | | $ | 243,340 | | | $ | (30,564) | | | (12.6) | % |

| Loungefly Branded Products | | 54,908 | | | 73,346 | | | (18,438) | | | (25.1) | % |

| Other | | 23,552 | | | 16,354 | | | 7,198 | | | 44.0 | % |

| Total net sales | | $ | 291,236 | | | $ | 333,040 | | | $ | (41,804) | | | (12.6) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Period Over Period Change |

| | 2023 | | 2022 | | Dollar | | Percentage |

| Net sales by geography: | | | | | | | | |

| United States | | $ | 197,368 | | | $ | 240,647 | | | $ | (43,279) | | | (18.0) | % |

| Europe | | 78,138 | | | 61,869 | | | 16,269 | | | 26.3 | % |

| Other International | | 15,730 | | | 30,524 | | | (14,794) | | | (48.5) | % |

| Total net sales | | $ | 291,236 | | | $ | 333,040 | | | $ | (41,804) | | | (12.6) | % |

Balance Sheet Highlights - At December 31, 2023 vs December 31, 2022

•Total cash and cash equivalents were $36.5 million at December 31, 2023 versus $19.2 million at December 31, 2022

•Inventories were $119.5 million at December 31, 2023 versus $246.4 million at December 31, 2022

•Total debt was $273.6 million at December 31, 2023 versus $245.8 million at December 31, 2022. Total debt includes the amount outstanding under the company's term loan facility, net of unamortized discounts, revolving line of credit and the company's equipment finance loan

Outlook for 2024

Based on its current outlook, the company provided its 2024 full-year outlook and 2024 first-quarter guidance, as follows:

| | | | | | | | |

| Current Outlook | |

| 2024 Full Year | | |

Net Sales | $1.047 billion to $1.103 billion | |

| Adjusted EBITDA* | $65 million to $85 million | |

| | |

| 2024 First Quarter | | |

| Net sales | $214 million to $227 million | |

| Gross margin % | ~37% | |

| SG&A expense, in dollars | $87 million to $88 million | |

| Adjusted net loss* | $17 million to $13 million | |

| Adjusted net loss per share* | $0.32 to $0.24 | |

| Adjusted EBITDA* | $0 million to $5 million | |

*Adjusted net loss, adjusted net loss per diluted share and adjusted EBITDA are non-GAAP financial measures. For a reconciliation of historical adjusted net loss, adjusted loss per diluted share, and adjusted EBITDA, to the most directly comparable U.S. GAAP financial measures, please refer to the “Non-GAAP Financial Measures” section of this press release. A reconciliation of adjusted net loss, adjusted net loss per diluted share and adjusted EBITDA outlook to the corresponding GAAP measure on a forward-looking basis cannot be provided without unreasonable efforts, as we are unable to provide reconciling information with respect to certain items. However, for the first quarter of 2024 the company expects equity-based compensation of approximately $4 million, depreciation and amortization of approximately $16 million and interest expense of approximately $6 million. For the full year 2024, the company expects equity-based compensation of approximately $15 million, depreciation and amortization of approximately $64 million and interest expense of approximately $18 million, each of which is a reconciling item to net loss. See "Use of Non-GAAP Financial Measures" and the attached reconciliations for more information.

Conference Call and Webcast

The company will host a conference call at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time) today, March 7, 2024, to further discuss its fourth-quarter and full-year results and business update. A live webcast, presentation materials and a replay of the event will be available on the Investor Relations section on the Company’s website at investor.funko.com. The replay of the webcast will be available for one year.

Use of Non-GAAP Financial Measures

This release contains references to non-GAAP financial measures, including adjusted net income (loss), including per share amounts, adjusted EBITDA, and adjusted EBITDA margin, which are financial measures that are not prepared in conformity with United States generally accepted accounting principles (U.S. GAAP). Management uses these measures internally for evaluating its operating performance, for planning purposes, including the preparation of our annual operating budget and financials projections, and to assess incentive compensation for our employees, and to evaluate our capacity to expand our business. In addition, our senior secured credit facilities use adjusted EBITDA to measure our compliance with covenants such as senior leverage ratio. The company's management believes that the presentation of non-GAAP financial measures provides useful supplementary information regarding operational performance, because it enhances an investor's overall understanding of the financial results for the company's core business. Additionally, it provides a basis for the comparison of the financial results for the company's core business between current, past and future periods as they remove the impact of items not directly resulting from our core operations. The company also believes that including Adjusted EBITDA and the other non-GAAP financial measures presented in this release is appropriate to provide additional information to investors and help to compare against other companies in our industry. Non-GAAP financial measures have limitations as analytical tools and should be considered only as a supplement to, and not as a substitute for or as a superior measure to, financial measures prepared in accordance with U.S. GAAP. We caution investors that amounts presented in accordance with our definitions of adjusted net income (loss), including per share amounts, adjusted EBITDA and adjusted EBITDA margin may not be comparable to similar measures disclosed by our competitors, because not all companies and analysts calculate these measures in the same manner.

Detailed reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the financial tables following this release.

About Funko

Headquartered in Everett, Washington, Funko is a leading pop culture lifestyle brand. Funko designs, sources and distributes licensed pop culture products across multiple categories, including vinyl figures, action toys, plush, apparel, housewares and accessories for consumers who seek tangible ways to connect with their favorite pop culture brands and characters. Learn more at www.funko.com, and follow us on Twitter (@OriginalFunko) and Instagram (@OriginalFunko).

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including statements regarding our anticipated financial results and financial position, the underlying trends in our business and the retail industry, including ongoing impacts from the Hollywood strikes and uncertainty relating to the situation in the Red Sea, our potential for growth, expectations regarding annualized cost savings and the impact of restructuring initiatives; and our strategic growth priorities. These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: our ability to execute our business strategy; our ability to manage our inventories and growth; our ability to maintain and realize the full value of our license agreements; impacts from economic downturns; changes in the retail industry and markets for our consumer products; our ability to maintain our relationships with retail customers and distributors; risks related to the impact of COVID-19 on our business, financial results and financial condition; our ability to compete effectively; fluctuations in our gross margin; our dependence on content development and creation by third parties; the ongoing level of popularity of our products with consumers; our ability to develop and introduce products in a timely and cost-effective manner; our ability to obtain, maintain and protect our intellectual property rights or those of our licensors; potential violations of the intellectual property rights of others; risks associated with counterfeit versions of our products; our ability to attract and retain qualified employees and maintain our corporate culture; our use of third-party manufacturing; risks associated with climate change; increased attention to sustainability and environmental, social and governance initiatives; geographic concentration of our operations; risks associated with our international operations; changes in effective tax rates or tax law; our dependence on vendors and outsourcers; risks relating to government regulation; risks relating to litigation, including products liability claims and securities class action litigation; any failure to successfully integrate or realize the anticipated benefits of acquisitions or investments; future development and acceptance of blockchain networks; risks associated with receiving payments in digital assets; risk resulting from our e-commerce business and social media presence; our ability to successfully operate our information systems and implement new technology; risks relating to our indebtedness, including our ability to comply with financial and negative covenants under our Credit Agreement, as amended; our ability to secure additional financing on favorable terms or at all; the potential for our or our third party providers’ electronic data or the electronic data of our customers to be compromised; the influence of our significant stockholder, TCG, and the possibility that TCG’s interests may conflict with the interests of our other stockholders; risks relating to our organizational structure; volatility in the price of our Class A common stock; and risks associated with our internal control over financial reporting. These and other important factors discussed under the caption “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2023 and our other filings with the Securities and Exchange Commission could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

Investor Relations:

investorrelations@funko.com

Media:

pr@funko.com

Funko, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in thousands, except per share data) |

| Net sales | $ | 291,236 | | | $ | 333,040 | | | $ | 1,096,086 | | | $ | 1,322,706 | |

Cost of sales (exclusive of depreciation and

amortization shown separately below) | 181,827 | | | 238,711 | | | 763,085 | | | 888,685 | |

| Selling, general, and administrative expenses | 97,380 | | | 139,229 | | | 377,065 | | | 398,272 | |

| | | | | | | |

| Depreciation and amortization | 15,429 | | | 13,160 | | | 59,763 | | | 47,669 | |

| Total operating expenses | 294,636 | | | 391,100 | | | 1,199,913 | | | 1,334,626 | |

| (Loss) income from operations | (3,400) | | | (58,060) | | | (103,827) | | | (11,920) | |

| Interest expense, net | 7,419 | | | 4,480 | | | 27,970 | | | 10,334 | |

| Loss on extinguishment of debt | — | | | — | | | 494 | | | — | |

| Gain on tax receivable agreement liability adjustment | (603) | | | — | | | (100,223) | | | — | |

| Other (income) expense, net | (646) | | | (971) | | | (127) | | | 787 | |

| (Loss) income before income taxes | (9,570) | | | (61,569) | | | (31,941) | | | (23,041) | |

| Income tax expense (benefit) | 1,638 | | | (14,869) | | | 132,497 | | | (17,801) | |

| Net (loss) income | (11,208) | | | (46,700) | | | (164,438) | | | (5,240) | |

Less: net (loss) income attributable to non-controlling interests | (447) | | | (4,481) | | | (10,359) | | | 2,795 | |

| Net (loss) income attributable to Funko, Inc. | $ | (10,761) | | | $ | (42,219) | | | $ | (154,079) | | | $ | (8,035) | |

| | | | | | | |

(Loss) earnings per share of Class A common

stock: | | | | | | | |

| Basic | $ | (0.21) | | | $ | (0.89) | | | $ | (3.19) | | | $ | (0.18) | |

| Diluted | $ | (0.21) | | | $ | (0.89) | | | $ | (3.19) | | | $ | (0.18) | |

Weighted average shares of Class A common

stock outstanding: | | | | | | | |

| Basic | 50,384 | | | 47,179 | | | 48,332 | | | 44,555 | |

| Diluted | 50,384 | | | 47,179 | | | 48,332 | | | 44,555 | |

Funko, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| (in thousands, except per share data) |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 36,453 | | | $ | 19,200 | |

| Accounts receivable, net | 130,831 | | | 167,895 | |

| Inventory, net | 119,458 | | | 246,429 | |

| Prepaid expenses and other current assets | 56,134 | | | 39,648 | |

| Total current assets | 342,876 | | | 473,172 | |

| | | |

| Property and equipment, net | 91,335 | | | 102,232 | |

| Operating lease right-of-use assets | 61,499 | | | 71,072 | |

| Goodwill | 133,795 | | | 131,380 | |

| Intangible assets, net | 167,388 | | | 181,284 | |

| Deferred tax asset, net of valuation allowance | — | | | 123,893 | |

| Other assets | 7,752 | | | 8,112 | |

| Total assets | $ | 804,645 | | | $ | 1,091,145 | |

| | | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | | | |

| Line of credit | $ | 120,500 | | | $ | 70,000 | |

| Current portion long-term debt, net of unamortized discount | 22,072 | | | 22,041 | |

| Current portion of operating lease liabilities | 17,486 | | | 18,904 | |

| Accounts payable | 52,919 | | | 67,651 | |

| Income taxes payable | 986 | | | 871 | |

| Accrued royalties | 54,375 | | | 69,098 | |

| Accrued expenses and other current liabilities | 90,494 | | | 112,832 | |

| | | |

| Total current liabilities | 358,832 | | | 361,397 | |

| | | |

| Long-term debt, net of unamortized discount | 130,986 | | | 153,778 | |

| Operating lease liabilities, net of current portion | 71,309 | | | 82,356 | |

| Deferred tax liability | 402 | | | 382 | |

| Liabilities under tax receivable agreement, net of current portion | — | | | 99,620 | |

| Other long-term liabilities | 5,076 | | | 3,923 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Stockholders' equity: | | | |

| Class A common stock, par value $0.0001 per share, 200,000 shares authorized; 50,549 shares and 47,192 shares issued and outstanding as of December 31, 2023 and 2022, respectively | 5 | | | 5 | |

| Class B common stock, par value $0.0001 per share, 50,000 shares authorized; 2,277 shares and 3,293 shares issued and outstanding as of December 31, 2023 and 2022, respectively | — | | | — | |

| Additional paid-in-capital | 326,180 | | | 310,807 | |

| Accumulated other comprehensive loss | (180) | | | (2,603) | |

| (Accumulated deficit) retained earnings | (94,064) | | | 60,015 | |

| Total stockholders' equity attributable to Funko, Inc. | 231,941 | | | 368,224 | |

| Non-controlling interests | 6,099 | | | 21,465 | |

| Total stockholders' equity | 238,040 | | | 389,689 | |

| Total liabilities and stockholders' equity | $ | 804,645 | | | $ | 1,091,145 | |

Funko, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 | | 2021 |

| | | | | |

| (in thousands) |

| Operating Activities | | | | | |

| Net (loss) income | $ | (164,438) | | | $ | (5,240) | | | $ | 67,854 | |

Adjustments to reconcile net income to net cash (used in) provided by

operating activities: | | | | | |

| Depreciation, amortization and other | 57,389 | | | 47,919 | | | 40,056 | |

| Equity-based compensation | 10,534 | | | 16,591 | | | 12,994 | |

| Amortization of debt issuance costs and debt discounts | 1,274 | | | 902 | | | 1,118 | |

| Loss on debt extinguishment | 494 | | | — | | | 675 | |

| Gain on tax receivable agreement liability adjustment | (100,223) | | | — | | | — | |

| Deferred tax expense (benefit) | 123,124 | | | (17,414) | | | (361) | |

| Other | 4,090 | | | 5,244 | | | 1,403 | |

| Changes in operating assets and liabilities, net of amounts acquired: | | | | | |

| Accounts receivable, net | 40,513 | | | 19,075 | | | (56,648) | |

| Inventory | 122,479 | | | (82,214) | | | (107,166) | |

| Prepaid expenses and other assets | 3,242 | | | (7,263) | | | 3,700 | |

| Accounts payable | (17,968) | | | 11,043 | | | 26,933 | |

| Income taxes payable | 75 | | | (15,018) | | | 15,585 | |

| Accrued royalties | (14,723) | | | 9,082 | | | 17,633 | |

| Accrued expenses and other liabilities | (34,927) | | | (22,841) | | | 63,586 | |

| Net cash provided by (used in) operating activities | 30,935 | | | (40,134) | | | 87,362 | |

| | | | | |

| Investing Activities | | | | | |

| Purchase of property and equipment | $ | (35,131) | | | $ | (59,148) | | | $ | (27,759) | |

| Acquisitions of business and intangible assets, net of cash acquired | (5,364) | | | (19,479) | | | 199 | |

| Other | 699 | | | 562 | | | 179 | |

| Net cash used in investing activities | (39,796) | | | (78,065) | | | (27,381) | |

| | | | | |

| Financing Activities | | | | | |

| Borrowings on line of credit | $ | 71,000 | | | $ | 120,000 | | | $ | — | |

| Payments on line of credit | (20,500) | | | (50,000) | | | — | |

| Debt issuance costs | (1,957) | | | (405) | | | (1,055) | |

| Proceeds from long-term debt, net | — | | | 20,000 | | | 180,000 | |

| Payment of long-term debt | (22,581) | | | (18,000) | | | (198,375) | |

| Contingent consideration | — | | | — | | | (2,000) | |

| Distributions to continuing equity owners | (1,118) | | | (10,710) | | | (9,277) | |

| Payments under tax receivable agreement | (4) | | | (7,718) | | | (1,715) | |

| Proceeds from exercise of equity-based options | 756 | | | 1,472 | | | 3,794 | |

| Net cash provided by (used in) financing activities | 25,596 | | | 54,639 | | | (28,628) | |

| | | | | |

| Effect of exchange rates on cash and cash equivalents | 518 | | | (797) | | | (51) | |

| | | | | |

| Net change in cash and cash equivalents | 17,253 | | | (64,357) | | | 31,302 | |

| Cash and cash equivalents at beginning of period | 19,200 | | | 83,557 | | | 52,255 | |

| Cash and cash equivalents at end of period | $ | 36,453 | | | $ | 19,200 | | | $ | 83,557 | |

| | | | | |

| Supplemental Cash Flow Information | | | | | |

| Cash paid for interest | $ | 24,635 | | | $ | 8,856 | | | $ | 5,679 | |

| Income tax payments | 1,059 | | | 22,363 | | | 1,462 | |

| | | | | |

| Establishment of liabilities under tax receivable agreement | — | | | 30,034 | | | 20,691 | |

| Issuance of equity instruments for acquisitions | — | | | 1,487 | | | — | |

| Tenant allowance | — | | | 17,236 | | | — | |

The following tables reconcile the Non-GAAP Financial Measures to the most directly comparable U.S. GAAP financial performance measure, which is net income (loss), for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in thousands, except per share data) |

| Net (loss) income attributable to Funko, Inc. | $ | (10,761) | | | $ | (42,219) | | | $ | (154,079) | | | $ | (8,035) | |

Reallocation of net (loss) income attributable to non-controlling interests from the assumed exchange of common units of FAH, LLC for Class A common stock (1) | (447) | | | (4,481) | | | (10,359) | | | 2,795 | |

| | | | | | | |

Equity-based compensation (2) | 3,013 | | | 4,592 | | | 10,534 | | | 16,591 | |

| | | | | | | |

| | | | | | | |

Acquisition transaction costs and other expenses (3) | 7,320 | | | — | | | 14,241 | | | 2,850 | |

| | | | | | | |

Certain severance, relocation and related costs (4) | 702 | | | 1,572 | | | 6,486 | | | 9,775 | |

Loss on extinguishment of debt (5) | — | | | — | | | 494 | | | — | |

Foreign currency transaction (gain) loss (6) | (641) | | | (4,990) | | | 854 | | | (3,232) | |

Tax receivable agreement liability adjustments (7) | (603) | | | 3,987 | | | (100,223) | | | 3,987 | |

One-time cloud based computing arrangement abandonment (8) | — | | | 32,492 | | | — | | | 32,492 | |

One-time disposal costs for finished inventory held at offshore factories (9) | 135 | | | — | | | 6,283 | | | — | |

One-time disposal costs for unfinished inventory held at offshore factories (10) | — | | | — | | | 2,404 | | | — | |

Inventory write-down (11) | 254 | | | — | | | 30,338 | | | — | |

Income tax expense (9) | 1,486 | | | (8,890) | | | 147,630 | | | (27,657) | |

| Adjusted net income (loss) | $ | 458 | | | $ | (17,937) | | | $ | (45,397) | | | $ | 29,566 | |

Adjusted net income (loss) margin (13) | 0.2 | % | | (5.4) | % | | (4.1) | % | | 2.2 | % |

| Weighted-average shares of Class A common stock outstanding-basic | 50,384 | | | 47,179 | | | 48,332 | | | 44,555 | |

| Equity-based compensation awards and common units of FAH, LLC that are convertible into Class A common stock | 2,808 | | | 4,335 | | | 4,021 | | | 6,967 | |

| Adjusted weighted-average shares of Class A stock outstanding - diluted | 53,192 | | | 51,514 | | | 52,353 | | | 51,522 | |

| Adjusted earnings (loss) per diluted share | $ | 0.01 | | | $ | (0.35) | | | $ | (0.87) | | | $ | 0.57 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (in thousands) |

| Net (loss) income | $ | (11,208) | | | $ | (46,700) | | | $ | (164,438) | | | $ | (5,240) | |

| Interest expense, net | 7,419 | | | 4,480 | | | 27,970 | | | 10,334 | |

| Income tax expense | 1,638 | | | (14,869) | | | 132,497 | | | (17,801) | |

| Depreciation and amortization | 15,429 | | | 13,160 | | | 59,763 | | | 47,669 | |

| EBITDA | $ | 13,278 | | | $ | (43,929) | | | $ | 55,792 | | | $ | 34,962 | |

| Adjustments: | | | | | | | |

| | | | | | | |

Equity-based compensation (2) | 3,013 | | | 4,592 | | | 10,534 | | | 16,591 | |

| | | | | | | |

| | | | | | | |

Acquisition transaction costs and other expenses (3) | 7,320 | | | — | | | 14,241 | | | 2,850 | |

| | | | | | | |

Certain severance, relocation and related costs (4) | 702 | | | 1,572 | | | 6,486 | | | 9,775 | |

Loss on extinguishment of debt (5) | — | | | — | | | 494 | | | — | |

Foreign currency transaction (gain) loss (6) | (641) | | | (4,990) | | | 854 | | | (3,232) | |

Tax receivable agreement liability adjustments (7) | (603) | | | 3,987 | | | (100,223) | | | 3,987 | |

One-time cloud based computing arrangement abandonment (8) | — | | | 32,492 | | | — | | | 32,492 | |

One-time disposal costs for finished inventory held at offshore factories (9) | 135 | | | — | | | 6,283 | | | — | |

One-time disposal costs for unfinished inventory held at offshore factories (10) | — | | | — | | | 2,404 | | | — | |

Inventory write-down (11) | 254 | | | — | | | 30,338 | | | — | |

| Adjusted EBITDA | $ | 23,458 | | | $ | (6,276) | | | $ | 27,203 | | | $ | 97,425 | |

Adjusted EBITDA margin (14) | 8.1 | % | | (1.9) | % | | 2.5 | % | | 7.4 | % |

| | | | | | | | |

| (1) | Represents the reallocation of net income attributable to non-controlling interests from the assumed exchange of common units of FAH, LLC in periods in which income was attributable to non-controlling interests. | |

| (2) | Represents non-cash charges related to equity-based compensation programs, which vary from period to period depending on timing of awards. | |

(3) | For the three months ended December 31, 2023, includes fair market value adjustments for assets held for sale. For the year ended December 31, 2023, includes costs related to the termination of a lease agreement and related expenses, fair market value adjustments for assets held for sale, partially offset by acquisition-related benefits. For the year ended December 31, 2022, includes acquisition-related costs related to investment banking and due diligence fees. | |

(4)

| Represents certain severance, relocation and related costs. For the three months ended December 31, 2023, includes residual charges for severance and benefit costs for reductions-in-force. For the year ended December 31, 2023, includes charges to remove leasehold improvements and return multiple Washington-based warehouses, and charges related to severance and benefit costs for reductions-in-force. For the three months ended December 31, 2022, includes charges related to severance for the transition of management personnel. For the year ended December 31, 2022, includes charges related to residual one-time relocation and severance costs for U.S. warehouse personnel in connection with the opening of a warehouse and distribution facility in Buckeye, Arizona. | |

| (5) | Represents write-off of unamortized debt financing fees for the year ended December 31, 2023. | |

| (6) | Represents both unrealized and realized foreign currency losses (gains) on transactions other than in U.S. dollars. | |

| (7) | Represents recognized adjustments to the tax receivable agreement liability. For the year ended December 31, 2023, reduction of the tax receivable agreement liability as a result of recognizing a full valuation allowance of the Company's deferred tax assets and anticipated inability to realize future tax benefits. | |

| (8) | Represents abandoned cloud computing arrangement charge related to the enterprise resource planning project for the three months and year ended December 31, 2022. | |

| (9) | Represents one-time disposal costs related to unfinished goods held at offshore factories for the year ended December 31, 2023. | |

| (10) | Represents one-time disposal costs related to finished goods held at offshore factories primarily due to customer order cancellations for the year ended December 31, 2023. Incremental charge during the three months ended December 31, 2023 were related to a true-up of original estimate of third-party destruction costs. | |

| (11) | Represents an inventory write-down, outside of normal business operations, to improve U.S. warehouse operational efficiency for the year ended December 31, 2023. Incremental charge during the three months ended December 31, 2023 were related to a true-up of original estimate of third-party destruction costs. | |

| (12) | Represents the income tax expense effect of the above adjustments. This adjustment uses an effective tax rate of 25% for the years ended December 31, 2023 and 2022. For the year ended December 31, 2023, this also includes $123.2 million recognized valuation allowance on the Company’s deferred tax assets. For the year ended December 31, 2022, this also includes the $11.0 million discrete benefit from the release of a valuation allowance on the outside basis deferred tax asset. | |

| (13) | Adjusted net income (loss) margin is calculated as Adjusted net income (loss) as a percentage of net sales. | |

| (14) | Adjusted EBITDA margin is calculated as Adjusted EBITDA as a percentage of net sales. | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |