As filed with the Securities and Exchange Commission on March 7, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM S‑8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

_____________________________________________

AXOS FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | 9205 West Russell Road, Suite 400 | | |

| | Las Vegas, NV 89148 | | |

| Delaware | | Telephone: (858) 649-2218 | | 33-0867444 |

| (State or other jurisdiction of | | (Address of Principal Executive Offices) | | (I.R.S. Employer |

| incorporation or organization) | | | | Identification No.) |

AXOS FINANCIAL, INC.

AMENDED AND RESTATED 2014 STOCK INCENTIVE PLAN

(Full title of the plan)

GREGORY GARRABRANTS

PRESIDENT AND CHIEF EXECUTIVE OFFICER

AXOS FINANCIAL, INC.

9205 WEST RUSSELL ROAD, SUITE 400

LAS VEGAS, NV 89148

TELEPHONE: (858) 649-2218

(Name, address and telephone numbers,

including area code, of agent for service)

Copy to:

Brent R. Trame, ESQ.

Thompson Coburn LLP

One US Bank Plaza

St. Louis, Missouri 63101

Telephone: (314) 552-6569

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer ☒ | | Accelerated filer ☐ | | Non-accelerated filer ☐ | | Smaller reporting company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

EXPLANATORY NOTE

Axos Financial, Inc. (the “Registrant”) hereby files this Registration Statement on Form S-8 to register one million (1,000,000) shares of the Registrant’s Common Stock, $0.01 par value (the “Additional Shares”), for issuance to participants under the Axos Financial, Inc. Amended and Restated 2014 Stock Incentive Plan (the “Plan”). The Additional Shares are being registered in addition to the Common Stock previously registered by the Registrant on the Forms S-8 filed with the Securities and Exchange Commission (the “SEC”) on November 5, 2021 (Registration File No. 333-260815), November 25, 2019 (Registration File No. 333-235228), October 30, 2014 (Registration File No. 333-199691) and May 6, 2005 (Registration File No. 333-124702), (collectively, the “Prior Registration Statements”).

This Registration Statement relates to securities of the same class as that to which the Prior Registration Statements relate, and is submitted in accordance with General Instruction E to Form S-8 regarding registration of additional securities. Pursuant to such instruction, the contents of the Prior Registration Statements are incorporated by reference and made part of this Registration Statement, except to the extent superseded or modified by the specific information set forth below or the specific exhibits attached hereto.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The document(s) containing the information specified in this Part I will be sent or given to participants in the Plan as specified by Rule 428(b)(1) under the Securities Act of 1933, as amended (the “Securities Act”). Such documents need not be filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. These documents and the documents incorporated by reference in the Registration Statement pursuant to Item 3 of Part II of this Form, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed with the Securities and Exchange Commission (the “Commission”) by the Registrant are incorporated herein by reference:

(a) The Registrant’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023, filed August 29, 2023;

(b) The Registrant’s Quarterly Reports on Form 10-Q for the fiscal quarters ended September 30, 2023 and December 31, 2023, filed with the SEC on October 26, 2023 and January 30, 2024, respectively;

(c) The Registrant’s Current Reports on Form 8-K filed with the SEC on November 13, 2023 (with respect to Item 5.07), November 29, 2023 (with respect to Item 5.02), December 5, 2023 (with respect to Item 8.01), December 7, 2023 (with respect to Item 8.01) and February 12, 2024 (with respect to Item 8.01); and

(d) The description of the Registrant’s common stock which is contained in the Registration Statement on Form 8-A filed by the Registrant under Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on September 13, 2018, including any amendments or reports filed for the purpose of updating such description.

All documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, after the date of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all securities offered hereby

have been sold or which deregisters all securities remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be made a part hereof from the date of filing of such documents. Any statements contained herein or in a document incorporated herein by reference shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained in a subsequently filed document incorporated herein by reference modifies or supersedes such document. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Where any document or part thereof is incorporated by reference in this Registration Statement, the Registrant will provide without charge to each person to whom a prospectus with respect to the Plan is delivered, upon written or oral request of such person, a copy of any and all of the information incorporated by reference in this Registration Statement, excluding exhibits unless such exhibits are specifically incorporated by reference.

Item 8. Exhibits.

The following exhibits are filed as part of this Registration Statement.

EXHIBIT INDEX

| | | | | |

| Exhibit No. | |

| 4.1 | Certificate of Incorporation of the Company, filed with the Delaware Secretary of State on July 6, 1999, and amendments thereto filed on August 19, 1999, February 25, 2003 and January 25, 2005 (incorporated by reference to Exhibit 3.1, 3.2, 3.5, and 3.6, respectively, to the Registration Statement on Form S-1/A (File No. 333-121329) filed on January 26, 2005) |

| 4.2 | |

| 4.3 | |

| 4.4 | |

| 4.5 | |

| 4.6 | |

| 4.7 | |

| 5.1 | |

| 23.1 | |

| 23.2 | |

| 24.1 | Power of Attorney (set forth on signature page hereto) |

| 107 | |

SIGNATURES

The Registrant. Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Las Vegas, State of Nevada, on March 7, 2024.

AXOS FINANCIAL, INC.

By: /s/ Gregory Garrabrants

Gregory Garrabrants

President and Chief Executive Officer

POWER OF ATTORNEY

We, the undersigned officers and directors of Axos Financial, Inc., hereby severally and individually constitute and appoint Gregory Garrabrants and Derrick K. Walsh, and each of them, the true and lawful attorneys and agents of each of us to execute in the name, place and stead of each of us (individually and in any capacity stated below) any and all amendments (including post-effective amendments) to this Registration Statement on Form S-8 and all instruments necessary or advisable in connection therewith and to file the same with the Securities and Exchange Commission, each of said attorneys and agents to have the power to act with or without the other and to have full power and authority to do and perform in the name and on behalf of each of the undersigned every act whatsoever necessary or advisable to be done in the premises as fully and to all intents and purposes as any of the undersigned might or could do in person, and we hereby ratify and confirm our signatures as they may be signed by our said attorneys and agents and each of them to any and all such amendments and instruments.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | |

| Name | Title | Date |

/s/ Gregory Garrabrants Gregory Garrabrants | President, Chief Executive Officer and Director (Principal Executive Officer) | March 7, 2024 |

/s/ Derrick K. Walsh Derrick K. Walsh | Executive Vice President and Chief Financial Officer (Principal Financial Officer) | March 7, 2024 |

/s/ Paul J. Grinberg Paul J. Grinberg | Chairman and Director | March 7, 2024 |

/s/ Nicholas A. Mosich

Nicholas A. Mosich | Vice Chairman and Director | March 7, 2024 |

/s/ James S. Argalas James S. Argalas | Director | March 7, 2024 |

/s/ Tamara N. Bohlig Tamara N. Bohlig | Director | March 7, 2024 |

/s/ Stefani D. Carter Stefani D. Carter | Director | March 7, 2024 |

/s/ James J. Court James J. Court | Director | March 7, 2024 |

/s/ Uzair Dada Uzair Dada | Director | March 7, 2024 |

/s/ Edward J. Ratinoff Edward J. Ratinoff | Director | March 7, 2024 |

/s/ Roque A. Santi Roque A. Santi | Director | March 7, 2024 |

/s/ Sara Wardell-Smith Sara Wardell-Smith | Director | March 7, 2024 |

Exhibit 5.1

March 7, 2024

Axos Financial, Inc.

9205 West Russell Road, Suite 400

Las Vegas, NV 89148

Re: Registration Statement on Form S-8 for one million (1,000,000) shares of Axos Financial, Inc. Common Stock, par value $0.01, for issuance to participants under the Axos Financial, Inc. Amended and Restated 2014 Stock Incentive Plan

Ladies and Gentlemen:

We have served as counsel to Axos Financial, Inc., a Delaware corporation (the “Company”), in connection with the preparation and filing of a registration statement on Form S-8 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”), registering the offer and sale by the Company of up to one million (1,000,000) shares of common stock of the Company, par value $0.01 per share (the “Shares”), pursuant to the Axos Financial, Inc. Amended and Restated 2014 Stock Incentive Plan (the “Plan”).

We have examined such corporate records of the Company, such laws and such other information as we have deemed relevant, including the Company’s Certificate of Incorporation and all amendments thereto, Amended and Restated By-laws and statements we have received from officers and representatives of the Company. In delivering this opinion, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals, the conformity to the originals of all documents submitted to us as certified, photostatic or conformed copies, the authenticity of originals of all such latter documents, and the correctness of statements submitted to us by officers and representatives of the Company. Except to the extent expressly set forth herein, we have not undertaken any independent investigation to determine the existence or absence of such facts and no inference as to our knowledge of the existence or absence of such facts should be drawn from our representation of the Company.

Based solely on the foregoing, we are of the opinion that the Shares to be issued by the Company have been duly authorized and, when issued and sold by the Company in accordance with the Plan, will be legally issued, fully paid and non-assessable.

We hereby consent to the filing of this opinion as an Exhibit to the Registration Statement.

Our opinions set forth above are limited to the Federal laws of the United States of America and the General Corporation Law of the State of Delaware.

This opinion may only be used, quoted or relied upon for the purpose of complying with the Securities Act in connection with the filing of the Registration Statement and may not be furnished to, quoted to or relied upon by any other person or entity for any purpose, without our prior written consent. Please note that we are opining only as to the matters expressly set forth herein and no opinion should be inferred as to any other matters. This opinion is based upon currently existing statutes, rules, regulations and judicial decisions, and we disclaim any obligation to advise you of any change in any of these sources of law or subsequent legal or factual developments which might affect any matters or opinions set forth herein. No opinion is expressed herein with respect to the qualification of the Shares under the securities or blue sky laws of any state or any foreign jurisdiction.

Very truly yours,

/s/

Thompson Coburn LLP

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

Axos Financial, Inc.

Las Vegas, Nevada

We hereby consent to the incorporation by reference in the Registration Statement on Form S-8 of our reports dated August 29, 2023, relating to the consolidated financial statements and the effectiveness of Axos Financial, Inc.’s (the “Company”) internal control over financial reporting, which appear in the Company’s Annual Report on Form 10-K for the year ended June 30, 2023.

/s/ BDO USA, P.C.

March 7, 2024

Exhibit 107

Table 1: Newly Registered

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered | Proposed Maximum Offering Price Per Unit | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

Equity | Common stock, par value $0.01 per share | 457(c) and 457(h) | 1,000,000 (1) (2) | $50.24 (3) | $50,240,000.00 | $0.0001476 | $7,415.42 |

| Total Offering Amounts | | $50,240,000.00 | | $7,415.42 |

| Total Fee Offsets | | | | $0.00 |

| Net Fee Due | | | | $7,415.42 |

(1) Represents shares of common stock, par value $0.01 per share (the “Common Stock”), of Axos Financial, Inc., a Delaware corporation (the “Registrant”), to be issued pursuant to the Axos Financial, Inc. Amended and Restated 2014 Stock Incentive Plan (the “Plan”).

(2) The Plan authorizes the issuance of a maximum of 6,680,000 shares of Common Stock, of which 5,680,000 were previously registered on the Registrant’s registration statements on Form S-8 filed on November 5, 2021 (Registration File No. 333-260815), November 25, 2019 (Registration File No. 333-235228), October 30, 2014 (Registration File No. 333-199691) and May 6, 2005 (Registration File No. 333-124702) (collectively, the “Prior Registration Statements”), respectively. This registration statement on Form S-8 (this “Registration Statement”) registers an additional 1,000,000 shares of Common Stock under the Plan (the “Additional Shares”). This Registration Statement relates to securities of the same class as that to which the Prior Registration Statements relate, and is submitted in accordance with General Instruction E to Form S-8 regarding registration of additional securities. Pursuant to such instruction, the contents of the Prior Registration Statements are incorporated by reference and made part of this Registration Statement, except to the extent superseded or modified by the specific information set forth below or the specific exhibits attached hereto.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) promulgated under the Securities Act of 1933, as amended, using the average of the high and low prices as reported on as reported on the New York Stock Exchange on March 5, 2024.

Table 2: Fee Offset Claims and Sources

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Registrant or Filer Name | Form or Type of Filing | File Number | Initial Filing Date | Filing Date | Fee Offset Claimed | Security Type Associated with Fee Offset Claimed | Security Title Associated with Fee Offset Claimed | Unsold Securities Associated with Fee Offset Claimed | Unsold Aggregate Offering Amount Associated with Fee Offset Claimed | Fee Paid with Fee Offset Source |

| Rule 457(p) |

| Fee Offset Claims | | | | | | | | | | | |

| Fee Offset Sources | | | | | | | | | | | |

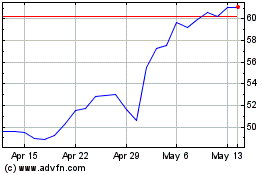

Axos Financial (NYSE:AX)

Historical Stock Chart

From Mar 2024 to Apr 2024

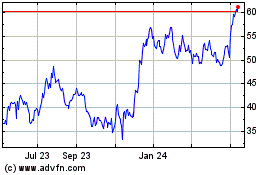

Axos Financial (NYSE:AX)

Historical Stock Chart

From Apr 2023 to Apr 2024