0001865107false00018651072024-03-072024-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 7, 2024

a.k.a. Brands Holding Corp.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 001-40828 | 87-0970919 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

100 Montgomery Street, Suite 1600

San Francisco, California 94104

(Address of Principal Executive Offices, including Zip Code)

415-295-6085

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol(s): | | Name of each exchange on which registered: |

| Common Stock, par value $0.001 per share | | AKA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

| | | | | |

Item 2.02 | Results of Operations and Financial Condition. |

On March 7, 2024, a.k.a. Brands Holding Corp. (the "Company") issued a press release announcing its financial results for the fiscal quarter and year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

In accordance with General Instructions B.2 and B.6 of Form 8-K, the information contained in Items 2.02 and 7.01 of this Current Report on Form 8-K and Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| | | | | |

Item 7.01 | Regulation FD Disclosure. |

The disclosure contained in Item 2.02 is incorporated herein by reference.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibits are filed as part of this report:

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover page interactive data file (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | a.k.a. Brands Holding Corp. |

| | | |

| Date: March 7, 2024 | By: | /s/ Ciaran Long |

| | Name: | Ciaran Long |

| | Title: | Interim Chief Executive Officer and Chief Financial Officer |

Exhibit 99.1

a.k.a. Brands Holding Corp. Reports Fourth Quarter and Full Year 2023 Financial Results

U.S. Net Sales Grew ~12% Compared to the Fourth Quarter of 2022

Strengthened Balance Sheet Through $50.7 Million Debt Paydown in FY23

Scaling Omnichannel Strategy through Additional Stores, Marketplace and Wholesale Opportunities in 2024

SAN FRANCISCO – March 7, 2024 – a.k.a. Brands Holding Corp. (NYSE: AKA), a brand accelerator of next generation fashion brands, today announced financial results for the fourth quarter and full year ended December 31, 2023.

Fourth Quarter Financial Highlights

•Net sales decreased 0.1% to $148.9 million, compared to $149.1 million in the fourth quarter of 2022; and was flat on a constant currency basis1.

•In the U.S., net sales increased 11.6% compared to the fourth quarter of 2022.

•Net loss was $(13.9) million, or $(1.31) per share, and (9.3%) of net sales in the fourth quarter of 2023, compared to net loss of $(173.9) million, or $(16.26) per share, and (116.6%) of net sales in the fourth quarter of 2022.

•Adjusted EBITDA2 was $1.3 million, or 0.9% of net sales, compared to $6.1 million, or 4.1% of net sales in the fourth quarter of 2022.

Fiscal 2023 Financial Highlights

•Net sales decreased 10.7% to $546.3 million, compared to $611.7 million in 2022; and decreased 8.7% on a constant currency basis1.

•Net loss was $(98.9) million, or $(9.24) per share, and (18.1%) of net sales in 2023, compared to net loss of $(176.7) million, or $(16.47) per share, and (28.9%) of net sales in 2022.

•Adjusted EBITDA2 was $13.8 million, or 2.5% of net sales, compared to $31.9 million, or 5.2% of net sales in 2022.

“2023 was a transformational year for a.k.a. Brands, and I want to thank our teams for their continued dedication to building next-generation fashion brands for the next generation of consumers,” said Ciaran Long, Interim Chief Executive Officer and Chief Financial Officer. “I’m pleased that we delivered net sales growth in the U.S. in the fourth quarter of 2023, which marks the second consecutive quarter of growth in our largest market. I’m proud of the teams’ strong execution across regions, which enabled us to reduce our year-end inventory by 28% compared to last year. Additionally, we continued to manage the business prudently and strengthened our balance sheet - we paid off more than $50 million of debt this year, effectively reducing our debt by 35% in fiscal 2023.”

“As we look ahead, we will continue to deepen our relationships with customers by delivering fashion newness, launching new categories and leveraging innovative technologies. Additionally, based on the success of our omnichannel tests in 2023, we are expanding our omnichannel initiatives in 2024 with the opening of three to four Princess Polly stores and new marketplace and wholesale opportunities to attract new customers and expand our total addressable market. And lastly, we remain committed to streamlining our operations to deliver long-term profitable growth,” concluded Long.

Recent Brand Highlights

•Princess Polly will expand its omnichannel strategy and open three to four stores in the second half of 2024, including signed leases for stores in Boston and San Diego.

•Culture Kings U.S. registered double-digit net sales growth in 2023 and continues to disrupt the streetwear market with its one-of-a-kind store experience and marketing activations.

1 In order to provide a framework for assessing the performance of our underlying business, excluding the effects of foreign currency rate fluctuations, we compare the percent change in the results from one period to another period using a constant currency methodology wherein current and comparative prior period results for our operations reporting in currencies other than U.S. dollars are converted into U.S. dollars at constant exchange rates (i.e., the rates in effect on December 31, 2022, which was the last day of our prior fiscal year) rather than the actual exchange rates in effect during the respective periods.

2 See additional information at the end of this release regarding non-GAAP financial measures.

•Petal & Pup continues to expand its marketplace presence and launched on Nordstrom’s website in the first quarter of 2024, adding to the brands successful marketplace tests on Macy’s and Target’s websites.

•mnml continues to be a highly-sought after streetwear brand and remains a top-selling brand at the Culture Kings store in the U.S.

Fourth Quarter Financial Details

•Net sales decreased 0.1% to $148.9 million, compared to $149.1 million in the fourth quarter of 2022. The decrease was driven by a decline in the number of orders and average order value during the quarter, primarily driven by adverse macroeconomic conditions in Australia and New Zealand. On a constant currency1 basis, net sales were flat.

•Gross margin was 51.3% in the fourth quarter of 2023, compared to 52.8% in the same period last year. The decline was primarily driven by targeted discounting in Culture Kings Australia and a higher merchandise return rate, partially offset by lower freight expenses.

•Selling expenses were $42.3 million, compared to $39.0 million in the fourth quarter of 2022. Selling expenses were 28.4% of net sales, compared to 26.2% of net sales in the fourth quarter of 2022. The increase was primarily due to softness in Australia and New Zealand.

•Marketing expenses were $17.3 million, compared to $15.4 million in the fourth quarter of 2022. Marketing expenses were 11.6% of net sales, compared to 10.3% of net sales in the fourth quarter of 2022.

•General and administrative (“G&A”) expenses were $22.3 million, compared to $26.1 million in the fourth quarter of 2022. G&A expenses were 15.0% of net sales, compared to 17.5% of net sales in the fourth quarter of 2022. The decline in G&A expenses as a percentage of net sales was primarily due to a decrease in wages and benefits and a decrease in insurance costs.

•Adjusted EBITDA2 was $1.3 million, or 0.9% of net sales, compared to $6.1 million, or 4.1% of net sales in the fourth quarter of 2022.

Full year 2023 financial details are included in the Company’s Form 10-K for the year ended December 31, 2023.

Balance Sheet and Cash Flow

•Cash and cash equivalents at the end of the fourth quarter totaled $21.9 million, compared to $46.3 million at the end of the fourth quarter of 2022.

•Inventory at the end of the fourth quarter totaled $91.0 million, compared to $126.5 million at the end of the fourth quarter of 2022. Inventory decreased $8.9 million, or 9%, from the end of the third quarter of 2023.

•Debt at the end of the fourth quarter totaled $93.4 million, compared to $143.6 million at the end of the fourth quarter of 2022.

•Cash flow from operations for the year ended December 31, 2023 was $33.4 million, compared to cash used in operations of $0.3 million for the year ended December 31, 2022.

Outlook

For the full year fiscal 2024, the Company expects:

•Net sales between $540 million and $555 million

•Adjusted EBITDA3 between $16 million and $18 million

•Weighted average diluted share count of 10.7 million

•Capital expenditures of approximately $10 million to $12 million

For the first quarter of 2024, the Company expects:

•Net sales between $108 million and $112 million

•Adjusted EBITDA3 between $0.3 million and $0.7 million

•Weighted average diluted share count of 10.5 million

3 The Company has not provided a quantitative reconciliation of its Adjusted EBITDA outlook to a GAAP net income (loss) outlook because it is unable, without making unreasonable efforts, to project certain reconciling items. These items include, but are not limited to, future equity-based compensation expense, income taxes, interest expense and transaction costs. These items are inherently variable and uncertain and depend on various factors, some of which are outside of the Company’s control or ability to predict. See additional information at the end of this release regarding non-GAAP financial measures.

The above outlook is based on several assumptions, including but not limited to, foreign exchange rates remaining at the current levels, the opening of three to four Princess Polly stores and continued macroeconomic pressures, specifically in Australia and New Zealand. See “Forward-Looking Statements” for additional information.

Conference Call

A conference call to discuss the Company’s fourth quarter and full year 2023 results is scheduled for March 7, 2024, at 4:15 p.m. ET. Those who wish to participate in the call may do so by dialing (877) 858-5495 (or (201) 689-8853 for international callers). The conference call will also be webcast live at https://ir.aka-brands.com in the Events and Presentations section. A recording will be available shortly after the conclusion of the call. To access the replay, please dial (877) 660-6853 or (201) 612-7415 for international callers, conference ID 13744095. An archive of the webcast will be available on a.k.a. Brands’ investor relations website.

Use of Non-GAAP Financial Measures and Other Operating Metrics

In addition to results determined in accordance with accounting principles generally accepted in the United States of America (GAAP), management utilizes certain non-GAAP financial measures such as Adjusted EBITDA, Adjusted EBITDA margin, net income (loss), as adjusted, net income (loss) per share, as adjusted and pro forma net sales for purposes of evaluating ongoing operations and for internal planning and forecasting purposes. We believe that these non-GAAP financial measures, when reviewed collectively with our GAAP financial information, provide useful supplemental information to investors in assessing our operating performance. The non-GAAP financial measures should not be considered in isolation or as a substitute for the GAAP financial measures. The non-GAAP financial measures used by the Company may be different from similarly-titled non-GAAP financial measures used by other companies. See additional information at the end of this release regarding non-GAAP financial measures.

About a.k.a. Brands

a.k.a. Brands is a brand accelerator of next generation fashion brands. Each brand in the a.k.a. portfolio targets a distinct Gen Z and millennial audience, creates authentic and inspiring social content and offers quality exclusive merchandise. a.k.a. Brands leverages its next-generation retail platform to help each brand accelerate its growth, scale in new markets and enhance its profitability. Current brands in the a.k.a. Brands portfolio include Princess Polly, Culture Kings, mnml and Petal & Pup.

Forward-Looking Statements

Certain statements made in this release are “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements.

Important factors, among others, that may affect actual results or outcomes include the effects of economic downturns and unstable market conditions; our ability in the future to continue to comply with the New York Stock Exchange’s (NYSE) listing standards and maintain the listing of our common stock on the NYSE; risks related to doing business in China; our ability to anticipate rapidly-changing consumer preferences in the apparel, footwear and accessories industries; our ability to execute our strategic initiatives, including transitioning Culture Kings to a data-driven, short lead time merchandising cycle; our ability to acquire new customers, retain existing customers or maintain average order value levels; the effectiveness of our marketing and our level of customer traffic; merchandise return rates; our ability to manage our inventory effectively; our success in identifying brands to acquire, integrate and manage on our platform; our ability to expand into new markets; the global nature of our business, including international economic, geopolitical instability (including the ongoing Russia-Ukraine and Israel-Palestine wars), legal, compliance and supply chain risks; interruptions in or increased costs of shipping and distribution, which could affect our ability to deliver our products to the market; our use of social media platforms and influencer sponsorship initiatives, which could adversely affect our reputation or subject us to fines or other penalties; fluctuating operating results; the inherent challenges in measuring certain of our key operating metrics, and the risk that real or perceived inaccuracies in such metrics may harm our reputation and negatively affect our business; the potential for tax liabilities that may increase the costs to our

consumers; our ability to attract and retain highly qualified personnel, including key members of our leadership team; fluctuations in wage rates and the price, availability and quality of raw materials and finished goods, which could increase costs; foreign currency fluctuations; and other risks and uncertainties set forth in the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Forward-Looking Statements” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission (SEC) on March 7, 2024. a.k.a. Brands does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Investor Contact

investors@aka-brands.com

Media Contact

media@aka-brands.com

a.k.a. BRANDS HOLDING CORP.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | $ | 148,912 | | | $ | 149,126 | | | $ | 546,258 | | | $ | 611,738 | |

| Cost of sales | 72,456 | | | 70,379 | | | 245,978 | | | 274,491 | |

| Gross profit | 76,456 | | | 78,747 | | | 300,280 | | | 337,247 | |

| Operating expenses: | | | | | | | |

| Selling | 42,309 | | | 39,002 | | | 149,307 | | | 166,070 | |

| Marketing | 17,265 | | | 15,429 | | | 68,907 | | | 66,730 | |

| General and administrative | 22,270 | | | 26,086 | | | 96,951 | | | 102,700 | |

| Goodwill impairment | — | | | 173,786 | | | 68,524 | | | 173,786 | |

| Total operating expenses | 81,844 | | | 254,303 | | | 383,689 | | | 509,286 | |

Loss from operations | (5,388) | | | (175,556) | | | (83,409) | | | (172,039) | |

| Other expense, net: | | | | | | | |

| Interest expense | (2,676) | | | (2,556) | | | (11,165) | | | (7,043) | |

| | | | | | | |

Other expense | (65) | | | 503 | | | (2,391) | | | (1,532) | |

| Total other expense, net | (2,741) | | | (2,053) | | | (13,556) | | | (8,575) | |

Loss before income taxes | (8,129) | | | (177,609) | | | (96,965) | | | (180,614) | |

(Provision for) benefit from income tax | (5,754) | | | 3,713 | | | (1,921) | | | 3,917 | |

Net loss | $ | (13,883) | | | $ | (173,896) | | | $ | (98,886) | | | $ | (176,697) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Net loss per share, basic and diluted* | $ | (1.31) | | | $ | (16.26) | | | $ | (9.24) | | | $ | (16.47) | |

| | | | | | | |

| | | | | | | |

Weighted average shares outstanding, basic and diluted* | 10,619,178 | | | 10,694,559 | | | 10,707,024 | | | 10,726,392 | |

| | | | | | | |

* Adjusted for the one-for-12 reverse stock split effected on September 29, 2023 (the “Reverse Stock Split”).

a.k.a. BRANDS HOLDING CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| December 31,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 21,859 | | | $ | 46,319 | |

| Restricted cash | 2,170 | | | 2,054 | |

| Accounts receivable | 4,796 | | | 3,231 | |

| Inventory, net | 91,024 | | | 126,533 | |

| Prepaid income taxes | — | | | 6,089 | |

| Prepaid expenses and other current assets | 15,846 | | | 13,378 | |

| Total current assets | 135,695 | | | 197,604 | |

| Property and equipment, net | 27,154 | | | 28,958 | |

| Operating lease right-of-use assets | 37,465 | | | 37,317 | |

| Intangible assets, net | 64,322 | | | 76,105 | |

| Goodwill | 94,898 | | | 167,731 | |

| Deferred tax assets | 1,569 | | | 1,070 | |

| Other assets | 618 | | | 853 | |

| Total assets | $ | 361,721 | | | $ | 509,638 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 28,279 | | | $ | 20,903 | |

| Accrued liabilities | 25,223 | | | 39,806 | |

| Sales returns reserve | 9,610 | | | 3,968 | |

| Deferred revenue | 11,782 | | | 11,421 | |

| Income taxes payable | 257 | | | — | |

| Operating lease liabilities, current | 7,510 | | | 6,643 | |

| Current portion of long-term debt | 3,300 | | | 5,600 | |

| Total current liabilities | 85,961 | | | 88,341 | |

| Long-term debt | 90,094 | | | 138,049 | |

| Operating lease liabilities | 35,344 | | | 34,404 | |

| Other long-term liabilities | 1,704 | | | 1,483 | |

| Deferred income taxes | — | | | 284 | |

| Total liabilities | 213,103 | | | 262,561 | |

| | | |

| Stockholders’ equity: | | | |

| Preferred stock | — | | | — | |

| Common stock | 128 | | | 129 | |

| Additional paid-in capital | 466,172 | | | 460,660 | |

| Accumulated other comprehensive loss | (50,269) | | | (45,185) | |

Accumulated deficit | (267,413) | | | (168,527) | |

| | | |

| Total stockholders’ equity | 148,618 | | | 247,077 | |

| Total liabilities and stockholders’ equity | $ | 361,721 | | | $ | 509,638 | |

a.k.a. BRANDS HOLDING CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (98,886) | | | $ | (176,697) | |

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | |

| Depreciation expense | 7,605 | | | 6,156 | |

| Amortization expense | 11,536 | | | 14,192 | |

| Amortization of inventory fair value adjustment | — | | | 707 | |

| Amortization of debt issuance costs | 624 | | | 647 | |

| | | |

| | | |

| Lease incentives | 1,596 | | | 1,722 | |

Loss on disposal of businesses | 1,533 | | | — | |

| Non-cash operating lease expense | 7,766 | | | 9,779 | |

| Equity-based compensation | 7,640 | | | 6,730 | |

| Deferred income taxes, net | (745) | | | (4,064) | |

| Goodwill impairment | 68,524 | | | 173,786 | |

| Changes in operating assets and liabilities, net of effects of acquisitions: | | | |

| Accounts receivable | (1,283) | | | (602) | |

| Inventory | 32,149 | | | (16,257) | |

| Prepaid expenses and other current assets | (2,789) | | | 6,134 | |

| Accounts payable | 7,512 | | | (1,888) | |

| Income taxes payable | 6,214 | | | (2,442) | |

| Accrued liabilities | (13,982) | | | (7,419) | |

| Returns reserve | 5,566 | | | (2,678) | |

| Deferred revenue | 522 | | | 267 | |

| Lease liabilities | (7,676) | | | (8,392) | |

| | | |

| Net cash provided by (used in) operating activities | 33,426 | | | (319) | |

Cash flows from investing activities: | | | |

Acquisition of businesses, net of cash acquired | — | | | (5,321) | |

| | | |

| | | |

Purchases of intangible assets | (61) | | | (247) | |

| Purchases of property and equipment | (5,970) | | | (19,746) | |

Net cash used in investing activities | (6,031) | | | (25,314) | |

Cash flows from financing activities: | | | |

| | | |

| Payments of costs related to initial public offering | — | | | (1,142) | |

Proceeds from line of credit, net of issuance costs | 11,500 | | | 40,000 | |

| Repayment of line of credit | (51,500) | | | — | |

Proceeds from issuance of debt, net of issuance costs | — | | | (121) | |

| Repayment of debt | (10,700) | | | (5,600) | |

| Taxes paid related to net share settlement of equity awards | (191) | | | (104) | |

| Proceeds from issuances under equity-based compensation plans | 162 | | | 227 | |

| | | |

Repurchase of shares | (2,100) | | | — | |

Net cash (used in) provided by financing activities | (52,829) | | | 33,260 | |

Effect of exchange rate changes on cash, cash equivalents and restricted cash | 1,090 | | | (272) | |

Net change in cash, cash equivalents and restricted cash | (24,344) | | | 7,355 | |

Cash, cash equivalents and restricted cash at beginning of period | 48,373 | | | 41,018 | |

Cash, cash equivalents and restricted cash at end of period | $ | 24,029 | | | $ | 48,373 | |

| | | |

Reconciliation of cash, cash equivalents and restricted cash: | | | |

Cash and cash equivalents | $ | 21,859 | | | $ | 46,319 | |

Restricted cash | 2,170 | | | 2,054 | |

| Total cash, cash equivalents and restricted cash | $ | 24,029 | | | $ | 48,373 | |

a.k.a. BRANDS HOLDING CORP.

KEY OPERATING AND FINANCIAL METRICS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

(dollars in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

Gross margin | 51 | % | | 53 | % | | 55 | % | | 55 | % |

Net loss | $ | (13,883) | | | $ | (173,896) | | | $ | (98,886) | | | $ | (176,697) | |

Net loss margin | (9) | % | | (117) | % | | (18) | % | | (29) | % |

Adjusted EBITDA2 | $ | 1,339 | | | $ | 6,093 | | | $ | 13,790 | | | $ | 31,872 | |

Adjusted EBITDA2 margin | 1 | % | | 4 | % | | 3 | % | | 5 | % |

Key Operational Metrics and Regional Sales

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | | | Year Ended December 31, | | |

| (metrics in millions, except AOV; sales in thousands) | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Key Operational Metrics | | | | | | | | | | | |

Active customers4 | 3.7 | | | 3.8 | | | (2.6)% | | 3.7 | | | 3.8 | | | (2.6)% |

Average order value | $ | 76 | | | $ | 77 | | | (1.3)% | | $ | 80 | | | $ | 82 | | | (2.4)% |

Number of orders | 1.97 | | | 1.93 | | | 2.1% | | 6.85 | | | 7.42 | | | (7.7)% |

| | | | | | | | | | | |

| Sales by Region | | | | | | | | | | | |

| U.S. | $ | 79,057 | | | $ | 70,860 | | | 11.6% | | $ | 315,496 | | | $ | 312,977 | | | 0.8% |

| Australia/New Zealand | 63,272 | | | 72,235 | | | (12.4)% | | 202,777 | | | 268,873 | | | (24.6)% |

| Rest of world | 6,583 | | | 6,031 | | | 9.2% | | 27,985 | | | 29,888 | | | (6.4)% |

| Total | $ | 148,912 | | | $ | 149,126 | | | (0.1)% | | $ | 546,258 | | | $ | 611,738 | | | (10.7)% |

Year-over-year growth on a constant currency basis1 | — | % | | | | | | (8.7) | % | | | | |

| | | | | | | | | | | |

| Sales by Region - Two-Year Stack | Three Months Ended December 31, | | | | Year Ended December 31, | | |

| 2023 | | 2021 | | % Change | | 2023 | | 2021 | | % Change |

| U.S. | $ | 79,057 | | | $ | 79,558 | | | (0.6)% | | $ | 315,496 | | | $ | 270,028 | | | 16.8% |

| Australia/New Zealand | 63,272 | | | 95,487 | | | (33.7)% | | 202,777 | | | 265,365 | | | (23.6)% |

| Rest of world | 6,583 | | | 7,378 | | | (10.8)% | | 27,985 | | | 26,798 | | | 4.4% |

| Total | $ | 148,912 | | | $ | 182,423 | | | (18.4)% | | $ | 546,258 | | | $ | 562,191 | | | (2.8)% |

Active Customers

We view the number of active customers as a key indicator of our growth, our value proposition and consumer awareness of our brand, and their desire to purchase our products. In any particular period, we determine our number of active customers by counting the total number of unique customer accounts who have made at least one purchase in the preceding 12-month period, measured from the last date of such period.

Average Order Value

We define average order value (“AOV”) as net sales in a given period divided by the total orders placed in that period. AOV may fluctuate as we expand into new categories or geographies or as our assortment changes.

4 Trailing twelve months.

a.k.a. BRANDS HOLDING CORP.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(in thousands, except per share data)

(unaudited)

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures that management uses to assess our operating performance. Because Adjusted EBITDA and Adjusted EBITDA margin facilitate internal comparisons of our historical operating performance on a more consistent basis, we use these measures for business planning purposes.

We also believe this information will be useful for investors to facilitate comparisons of our operating performance and better identify trends in our business. We expect Adjusted EBITDA margin to increase over the long-term as we continue to scale our business and achieve greater leverage in our operating expenses.

We calculate Adjusted EBITDA as net income (loss) adjusted to exclude: interest and other expense; provision for (benefit from) income taxes; depreciation and amortization expense; equity-based compensation expense; costs to establish or relocate distribution centers; transaction costs; costs related to severance from headcount reductions; goodwill and intangible asset impairment; sales tax penalties; insured losses, net of any recoveries; and one-time or non-recurring items. We calculate Adjusted EBITDA margin as Adjusted EBITDA as a percentage of net sales. Adjusted EBITDA and Adjusted EBITDA margin are considered non-GAAP financial measures under the SEC’s rules because they exclude certain amounts included in net income (loss) and net income (loss) margin, the most directly comparable financial measures calculated in accordance with GAAP.

A reconciliation of non-GAAP Adjusted EBITDA to net loss for the three months and year ended December 31, 2023 and 2022 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

Net loss | $ | (13,883) | | | $ | (173,896) | | | $ | (98,886) | | | $ | (176,697) | |

| Add (deduct): | | | | | | | |

Total other expense, net | 2,741 | | | 2,053 | | | 13,556 | | | 8,575 | |

| Provision for (benefit from) income tax | 5,754 | | | (3,713) | | | 1,921 | | | (3,917) | |

| Depreciation and amortization expense | 4,446 | | | 4,975 | | | 19,141 | | | 20,348 | |

| Equity-based compensation expense | 2,162 | | | 2,282 | | | 7,640 | | | 6,730 | |

| Inventory step-up amortization expense | — | | | — | | | — | | | 707 | |

| | | | | | | |

| Transaction costs | — | | | — | | | — | | | 140 | |

| | | | | | | |

| Goodwill impairment | — | | | 173,786 | | | 68,524 | | | 173,786 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Non-routine items5 | 119 | | | 606 | | | 1,894 | | | 2,200 | |

| Adjusted EBITDA | $ | 1,339 | | | $ | 6,093 | | | $ | 13,790 | | | $ | 31,872 | |

Net loss margin | (9.3) | % | | (116.6) | % | | (18.1) | % | | (28.9) | % |

| Adjusted EBITDA margin | 0.9 | % | | 4.1 | % | | 2.5 | % | | 5.2 | % |

5 Non-routine items include costs to establish or relocate distribution centers; severance from headcount reductions; sales tax penalties; insured losses, net of recoveries; and non-routine legal matters.

Net Income (Loss), As Adjusted and Net Income (Loss) Per Share, As Adjusted

Net income (loss), as adjusted and net income (loss) per share, as adjusted are considered non-GAAP financial measures under the SEC’s rules because they exclude certain amounts included in net income (loss) and net income (loss) per share calculated in accordance with GAAP, the most directly comparable financial measures calculated in accordance with GAAP. Management believes that net income (loss), as adjusted, and net income (loss) per share, as adjusted, are meaningful measures to provide investors because they better enable comparison of the performance with that of the comparable period. In addition, net income (loss), as adjusted and net income (loss) per share, as adjusted, afford investors a view of what management considers to be a.k.a.’s core earnings performance, thereby providing investors the ability to make a more informed assessment of such core earnings performance with that of the prior year.

We have calculated net loss, as adjusted and net loss per share, as adjusted, for the year ended December 31, 2023, by adjusting net loss and net loss per share for the following:

1.Loss on disposal of the Rebdolls reporting unit; and

2.Impairment recognized on the goodwill recorded from the acquisitions of the Culture Kings and Petal & Pup reporting units, which is a result of the continued worsening global economic trends, elevated interest rates and unfavorable demand in Australia.

A reconciliation of non-GAAP net loss, as adjusted to net loss, as well as the resulting calculation of net loss per share, as adjusted, for the year ended December 31, 2023, are as follows:

| | | | | | | |

| | | | Year Ended December 31, 2023 |

| Net loss | | | $ | (98,886) | |

| Adjustments: | | | |

Loss on disposal of the Rebdolls reporting unit | | | 951 | |

| Goodwill impairment | | | 68,524 | |

| Tax effects of adjustments | | | — | |

| Net loss, as adjusted | | | $ | (29,411) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net loss per share, as adjusted | | | $ | (2.75) | |

| Weighted-average shares, diluted | | | 10,707,024 | |

We have calculated net loss, as adjusted and net loss per share, as adjusted for the three months and year ended December 31, 2022, by adjusting net loss and net loss per share for the following:

1.Inventory step-up amortization expense resulting from the acquisition of mnml;

2.Impairment recognized on the goodwill recorded from the acquisitions of the Culture Kings and Rebdolls reporting units, which is a result of the worsening economic trends, including continued inflation and rising interest rates, as well as unfavorable demand due to a gradual customer shift from primarily online shopping to a mix of online and physical store shopping; and

3.The tax benefit related to the finalization of Australia tax basis allocation pertaining to the inventory and intangibles included in the purchase of the Culture Kings non-controlling interest, as well as an intra-entity transfer of intellectual property rights.

A reconciliation of non-GAAP net loss, as adjusted, to net loss, as well as the resulting calculation of net loss per share, as adjusted for the three months and year ended December 31, 2022, are as follows:

| | | | | | | | | | | |

| | Three Months Ended December 31, 2022 | | Year Ended December 31, 2022 |

| Net loss | $ | (173,896) | | | $ | (176,697) | |

| Adjustments: | | | |

| Inventory step-up amortization expense | — | | | 707 | |

| Goodwill impairment | 173,786 | | | 173,786 | |

| Tax benefit - Culture Kings change in tax basis of inventory and intangibles; intra-entity transfer of intellectual property rights | (3,263) | | | (3,263) | |

| Tax effects of adjustments | — | | | (212) | |

| Net loss, as adjusted | $ | (3,373) | | | $ | (5,679) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Net loss per share, as adjusted* | $ | (0.31) | | | $ | (0.53) | |

Weighted-average shares, diluted* | 10,739,439 | | | 10,726,392 | |

*Adjusted for the one-for-12 Reverse Stock Split.

Pro Forma Net Sales

Pro forma net sales is considered a non-GAAP financial measure under the SEC’s rules. We believe that pro forma net sales is useful information for investors as it provides a better understanding of sales performance, and relative changes therein, on a comparable basis. We calculate pro forma net sales as net sales including the historical net sales relating to the pre-acquisition periods of Culture Kings, assuming that the Company acquired Culture Kings at the beginning of the period presented. Pro forma net sales is not necessarily indicative of what the actual results would have been if the acquisition had in fact occurred on the date or for the periods indicated nor does it purport to project net sales for any future periods or as of any date. A reconciliation of non-GAAP pro forma net sales to net sales, which is the most directly comparable financial measure calculated in accordance with GAAP, in each case disaggregated by geography, for the year ended December 31, 2023 and 2021, is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2023 | | Year Ended December 31, 2021 | | Growth Rate |

| | Actual | | Actual | | Culture Kings | | Pro Forma | | Actual | | Pro Forma |

| U.S. | $ | 315,496 | | | $ | 270,028 | | | $ | 7,669 | | | $ | 277,697 | | | 16.8 | % | | 13.6 | % |

| Australia/New Zealand | 202,777 | | | 265,365 | | | 43,314 | | | 308,679 | | | (23.6) | % | | (34.3) | % |

| Rest of world | 27,985 | | | 26,798 | | | 280 | | | 27,078 | | | 4.4 | % | | 3.3 | % |

| Total | $ | 546,258 | | | $ | 562,191 | | | $ | 51,263 | | | $ | 613,454 | | | (2.8) | % | | (11.0) | % |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

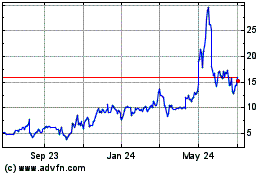

aka Brands (NYSE:AKA)

Historical Stock Chart

From Mar 2024 to Apr 2024

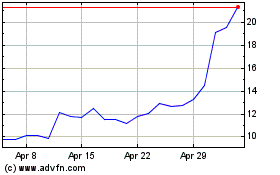

aka Brands (NYSE:AKA)

Historical Stock Chart

From Apr 2023 to Apr 2024