Form 8-K - Current report

March 06 2024 - 5:00PM

Edgar (US Regulatory)

2/29/20240000732712false00007327122024-02-292024-02-290000732712exch:XNYMus-gaap:CommonStockMember2024-02-292024-02-290000732712exch:XNGSus-gaap:CommonStockMember2024-02-292024-02-290000732712vz:A4.073NotesDue2024Member2024-02-292024-02-290000732712vz:A0.875NotesDue2025Member2024-02-292024-02-290000732712vz:A3.250NotesDue2026Member2024-02-292024-02-290000732712vz:A1.375NotesDue2026Member2024-02-292024-02-290000732712vz:A0.875NotesDue2027Member2024-02-292024-02-290000732712vz:A1.375NotesDue2028Member2024-02-292024-02-290000732712vz:A1125NotesDue2028Member2024-02-292024-02-290000732712vz:A2350FixedRateNotesDue2028Member2024-02-292024-02-290000732712vz:A1.875NotesDue2029Member2024-02-292024-02-290000732712vz:A0375NotesDue2029Member2024-02-292024-02-290000732712vz:A1.250NotesDue2030Member2024-02-292024-02-290000732712vz:A1.875NotesDue2030Member2024-02-292024-02-290000732712vz:NotesDue20304250Member2024-02-292024-02-290000732712vz:A2.625NotesDue2031Member2024-02-292024-02-290000732712vz:A2.500NotesDue2031Member2024-02-292024-02-290000732712vz:A3000FixedRateNotesDue2031Member2024-02-292024-02-290000732712vz:A0.875NotesDue2032Member2024-02-292024-02-290000732712vz:A0750NotesDue2032Member2024-02-292024-02-290000732712vz:A1300NotesDue2033Member2024-02-292024-02-290000732712vz:NotesDue2034475Member2024-02-292024-02-290000732712vz:A4.750NotesDue2034Member2024-02-292024-02-290000732712vz:A3.125NotesDue2035Member2024-02-292024-02-290000732712vz:A1125NotesDue2035Member2024-02-292024-02-290000732712vz:A3.375NotesDue2036Member2024-02-292024-02-290000732712vz:A2.875NotesDue2038Member2024-02-292024-02-290000732712vz:A1875NotesDue2038Member2024-02-292024-02-290000732712vz:A1.500NotesDue2039Member2024-02-292024-02-290000732712vz:A3.500FixedRateNotesDue2039Member2024-02-292024-02-290000732712vz:A1850NotesDue2040Member2024-02-292024-02-290000732712vz:A3850FixedRateNotesDue2041Member2024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________________________

FORM 8-K

______________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: February 29, 2024

(Date of earliest event reported)

______________________________________________________________________________

Verizon Communications Inc.

(Exact name of registrant as specified in its charter)

_______________________________________________________________________________

| | | | | | | | | | | |

| | | |

| Delaware | 1-8606 | 23-2259884 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | |

| 1095 Avenue of the Americas | | 10036 |

| New York, | New York | | |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 395-1000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.10 | | VZ | | New York Stock Exchange |

| Common Stock, par value $0.10 | | VZ | | The Nasdaq Global Select Market |

| 4.073% Notes due 2024 | | VZ 24C | | New York Stock Exchange |

| 0.875% Notes due 2025 | | VZ 25 | | New York Stock Exchange |

| 3.25% Notes due 2026 | | VZ 26 | | New York Stock Exchange |

| 1.375% Notes due 2026 | | VZ 26B | | New York Stock Exchange |

| 0.875% Notes due 2027 | | VZ 27E | | New York Stock Exchange |

| 1.375% Notes due 2028 | | VZ 28 | | New York Stock Exchange |

| 1.125% Notes due 2028 | | VZ 28A | | New York Stock Exchange |

| 2.350% Fixed Rate Notes due 2028 | | VZ 28C | | New York Stock Exchange |

| 1.875% Notes due 2029 | | VZ 29B | | New York Stock Exchange |

| 0.375% Notes due 2029 | | VZ 29D | | New York Stock Exchange |

| 1.250% Notes due 2030 | | VZ 30 | | New York Stock Exchange |

| 1.875% Notes due 2030 | | VZ 30A | | New York Stock Exchange |

| 4.250% Notes due 2030 | | VZ 30D | | New York Stock Exchange |

| 2.625% Notes due 2031 | | VZ 31 | | New York Stock Exchange |

| 2.500% Notes due 2031 | | VZ 31A | | New York Stock Exchange |

| 3.000% Fixed Rate Notes due 2031 | | VZ 31D | | New York Stock Exchange |

| 0.875% Notes due 2032 | | VZ 32 | | New York Stock Exchange |

| 0.750% Notes due 2032 | | VZ 32A | | New York Stock Exchange |

| 1.300% Notes due 2033 | | VZ 33B | | New York Stock Exchange |

| 4.75% Notes due 2034 | | VZ 34 | | New York Stock Exchange |

| 4.750% Notes due 2034 | | VZ 34C | | New York Stock Exchange |

| 3.125% Notes due 2035 | | VZ 35 | | New York Stock Exchange |

| 1.125% Notes due 2035 | | VZ 35A | | New York Stock Exchange |

| 3.375% Notes due 2036 | | VZ 36A | | New York Stock Exchange |

| 2.875% Notes due 2038 | | VZ 38B | | New York Stock Exchange |

| 1.875% Notes due 2038 | | VZ 38C | | New York Stock Exchange |

| 1.500% Notes due 2039 | | VZ 39C | | New York Stock Exchange |

| 3.50% Fixed Rate Notes due 2039 | | VZ 39D | | New York Stock Exchange |

| 1.850% Notes due 2040 | | VZ 40 | | New York Stock Exchange |

| 3.850% Fixed Rate Notes due 2041 | | VZ 41C | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure

On February 29, 2024, Verizon Communications Inc. (“Verizon”) entered into two separate commitment agreements, one by and between Verizon, State Street Global Advisors Trust Company (“State Street”), as independent fiduciary of the Verizon Management Pension Plan and Verizon Pension Plan for Associates (the “Pension Plans”), and The Prudential Insurance Company of America (“Prudential”), and one by and between Verizon, State Street and RGA Reinsurance Company (“RGA”), under which the Pension Plans purchased a nonparticipating single premium group annuity contract from Prudential and a nonparticipating single premium group annuity contract from RGA to settle approximately $5.9 billion of benefit liabilities of the Pension Plans.

The purchase of the group annuity contracts closed on March 6, 2024. The group annuity contracts primarily cover a population that includes 56,000 retirees who commenced benefit payments from the Pension Plans prior to January 1, 2023 (“Transferred Participants”). Prudential and RGA each irrevocably guarantee and assume the sole obligation to make future payments to the Transferred Participants as provided under their respective group annuity contracts, with direct payments beginning July 1, 2024. Prudential and RGA will each assume 50% of the benefit obligation related to Transferred Participants, except in certain jurisdictions where Prudential will assume 100% of the benefit obligation related to Transferred Participants residing in such jurisdictions. The aggregate amount of each Transferred Participant’s payment under the group annuity contracts will be equal to the amount of each individual’s payment under the Pension Plans.

Participants in the Pension Plans who are not covered by the group annuity contracts, including management and associate retirees who commenced benefit payments on or after January 1, 2023 and active and term vested managers and associates, will not be affected by this transaction.

Transferred Participants will continue to receive their benefits from the Pension Plans until July 1, 2024, at which time Prudential will assume responsibility for administrative services, including distribution of payments to the Transferred Participants, on behalf of itself and, where applicable, RGA.

The purchase of the group annuity contracts was funded directly by assets of the Pension Plans. Verizon made additional contributions to the Pension Plans prior to the closing date of the transaction in the aggregate amount of approximately $365 million. With these contributions, the funded ratio of each of the Pension Plans does not change as a result of this transaction.

As a result of the transaction, Verizon expects to recognize a one-time non-cash pension settlement credit in the first quarter of 2024. The actual amount of the credit will depend on finalization of the actuarial and other assumptions.

The information provided pursuant to this Item 7.01 is “furnished” and shall not be deemed to be “filed” with the Securities and Exchange Commission or incorporated by reference in any filing under the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in any such filing.

Forward-Looking Statements

In this report we have made forward-looking statements. These statements are based on our estimates and assumptions and are subject to risks and uncertainties. Forward-looking statements include the information concerning our possible or assumed future results of operations. Forward-looking statements also include those preceded or followed by the words "anticipates," "assumes," "believes," "estimates," "expects," "forecasts," "hopes," "intends," "plans," "targets" or similar expressions. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Verizon Communications Inc. |

| | | | | | (Registrant) |

| | | | |

| Date: | | March 6, 2024 | | | | /s/ Mary-Lee Stillwell |

| | | | | | Mary-Lee Stillwell |

| | | | | | Senior Vice President and Controller |

Cover

|

Feb. 29, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 29, 2024

|

| Entity Registrant Name |

Verizon Communications Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-8606

|

| Entity Tax Identification Number |

23-2259884

|

| Entity Address, Address Line One |

1095 Avenue of the Americas

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

212

|

| Local Phone Number |

395-1000

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000732712

|

| Amendment Flag |

false

|

| 4.073% Notes due 2024 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

4.073% Notes due 2024

|

| Trading Symbol |

VZ 24C

|

| Security Exchange Name |

NYSE

|

| 0.875% Notes due 2025 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.875% Notes due 2025

|

| Trading Symbol |

VZ 25

|

| Security Exchange Name |

NYSE

|

| 3.250% Notes due 2026 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.25% Notes due 2026

|

| Trading Symbol |

VZ 26

|

| Security Exchange Name |

NYSE

|

| 1.375% Notes due 2026 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.375% Notes due 2026

|

| Trading Symbol |

VZ 26B

|

| Security Exchange Name |

NYSE

|

| 0.875% Notes due 2027 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.875% Notes due 2027

|

| Trading Symbol |

VZ 27E

|

| Security Exchange Name |

NYSE

|

| 1.375% Notes due 2028 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.375% Notes due 2028

|

| Trading Symbol |

VZ 28

|

| Security Exchange Name |

NYSE

|

| 1.875% Notes due 2029 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.875% Notes due 2029

|

| Trading Symbol |

VZ 29B

|

| Security Exchange Name |

NYSE

|

| 1.250% Notes due 2030 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.250% Notes due 2030

|

| Trading Symbol |

VZ 30

|

| Security Exchange Name |

NYSE

|

| 1.875% Notes due 2030 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.875% Notes due 2030

|

| Trading Symbol |

VZ 30A

|

| Security Exchange Name |

NYSE

|

| 2.625% Notes due 2031 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.625% Notes due 2031

|

| Trading Symbol |

VZ 31

|

| Security Exchange Name |

NYSE

|

| 2.500% Notes due 2031 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.500% Notes due 2031

|

| Trading Symbol |

VZ 31A

|

| Security Exchange Name |

NYSE

|

| 0.875% Notes due 2032 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.875% Notes due 2032

|

| Trading Symbol |

VZ 32

|

| Security Exchange Name |

NYSE

|

| 1.300% Notes due 2033 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.300% Notes due 2033

|

| Trading Symbol |

VZ 33B

|

| Security Exchange Name |

NYSE

|

| 4.750% Notes due 2034 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

4.750% Notes due 2034

|

| Trading Symbol |

VZ 34C

|

| Security Exchange Name |

NYSE

|

| 3.125% Notes due 2035 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.125% Notes due 2035

|

| Trading Symbol |

VZ 35

|

| Security Exchange Name |

NYSE

|

| 3.375% Notes due 2036 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.375% Notes due 2036

|

| Trading Symbol |

VZ 36A

|

| Security Exchange Name |

NYSE

|

| 2.875% Notes due 2038 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.875% Notes due 2038

|

| Trading Symbol |

VZ 38B

|

| Security Exchange Name |

NYSE

|

| 1.500% Notes due 2039 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.500% Notes due 2039

|

| Trading Symbol |

VZ 39C

|

| Security Exchange Name |

NYSE

|

| 3.500% Fixed Rate Notes Due 2039 [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.50% Fixed Rate Notes due 2039

|

| Trading Symbol |

VZ 39D

|

| Security Exchange Name |

NYSE

|

| 1.850% Notes Due 2040 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.850% Notes due 2040

|

| Trading Symbol |

VZ 40

|

| Security Exchange Name |

NYSE

|

| 1.125% Notes Due 2028 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.125% Notes due 2028

|

| Trading Symbol |

VZ 28A

|

| Security Exchange Name |

NYSE

|

| 1.875% Notes Due 2038 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.875% Notes due 2038

|

| Trading Symbol |

VZ 38C

|

| Security Exchange Name |

NYSE

|

| 0.375% Notes Due 2029 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.375% Notes due 2029

|

| Trading Symbol |

VZ 29D

|

| Security Exchange Name |

NYSE

|

| 0.750% Notes Due 2032 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.750% Notes due 2032

|

| Trading Symbol |

VZ 32A

|

| Security Exchange Name |

NYSE

|

| 1.125% Notes Due 2035 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.125% Notes due 2035

|

| Trading Symbol |

VZ 35A

|

| Security Exchange Name |

NYSE

|

| 2.350% Fixed Rate Notes Due 2028 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.350% Fixed Rate Notes due 2028

|

| Trading Symbol |

VZ 28C

|

| Security Exchange Name |

NYSE

|

| 3.000% Fixed Rate Notes Due 2031 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.000% Fixed Rate Notes due 2031

|

| Trading Symbol |

VZ 31D

|

| Security Exchange Name |

NYSE

|

| 3.850% Fixed Rate Notes Due 2041 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.850% Fixed Rate Notes due 2041

|

| Trading Symbol |

VZ 41C

|

| Security Exchange Name |

NYSE

|

| Notes Due 2030, 4.250% |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

4.250% Notes due 2030

|

| Trading Symbol |

VZ 30D

|

| Security Exchange Name |

NYSE

|

| Notes Due 2034, 4.75% |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

4.75% Notes due 2034

|

| Trading Symbol |

VZ 34

|

| Security Exchange Name |

NYSE

|

| New York Stock Exchange | Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.10

|

| Trading Symbol |

VZ

|

| Security Exchange Name |

NYSE

|

| The NASDAQ Global Select Market | Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.10

|

| Trading Symbol |

VZ

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A4.073NotesDue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A0.875NotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A3.250NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A1.375NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A0.875NotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A1.375NotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A1.875NotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A1.250NotesDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A1.875NotesDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A2.625NotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A2.500NotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A0.875NotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A1300NotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A4.750NotesDue2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A3.125NotesDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A3.375NotesDue2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A2.875NotesDue2038Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A1.500NotesDue2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A3.500FixedRateNotesDue2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A1850NotesDue2040Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A1125NotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A1875NotesDue2038Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A0375NotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A0750NotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A1125NotesDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A2350FixedRateNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A3000FixedRateNotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_A3850FixedRateNotesDue2041Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_NotesDue20304250Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vz_NotesDue2034475Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYM |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNGS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

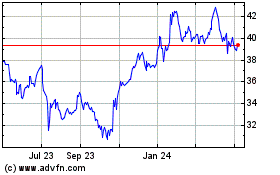

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

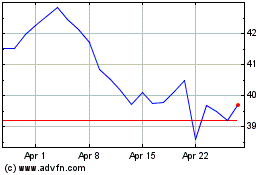

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024