Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

March 05 2024 - 5:14PM

Edgar (US Regulatory)

Free Writing Prospectus

Filed pursuant to Rule 433

Dated March 5, 2024

Relating to Preliminary Prospectus Supplement dated March 5, 2024

Registration Statement No. 333-277512

Microchip Technology Incorporated

$1,000,000,000 5.050% Senior Notes due 2029

This pricing term sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement, dated March 5, 2024 (the “Preliminary

Prospectus Supplement”). The information in this pricing term sheet supplements the Preliminary Prospectus Supplement and updates and supersedes the information in the Preliminary Prospectus Supplement to the extent it is inconsistent with the

information in the Preliminary Prospectus Supplement. Terms used and not defined herein have the meanings assigned in the Preliminary Prospectus Supplement.

|

|

|

| Issuer: |

|

Microchip Technology Incorporated |

|

|

| Guarantors: |

|

Each of our existing and future subsidiaries that on the Issue Date is or thereafter becomes an obligor under our Senior Credit Facilities. |

|

|

| Security description: |

|

5.050% Senior Notes due 2029 (the “Notes”) |

|

|

| Principal amount: |

|

$1,000,000,000 |

|

|

| Maturity: |

|

March 15, 2029 |

|

|

| Coupon: |

|

5.050% |

|

|

| Price to the Public (Issue Price): |

|

99.823% of face amount |

|

|

| Yield to maturity: |

|

5.090% |

|

|

| Spread to Benchmark Treasury: |

|

+95 basis points |

|

|

| Benchmark Treasury: |

|

UST 4.250% due February 28, 2029 |

|

|

| Benchmark Treasury Price and Yield: |

|

100-15 3/4 / 4.140% |

|

|

| Interest Payment Dates: |

|

March 15 and September 15, commencing September 15, 2024 |

|

|

| Day Count Convention: |

|

30/360 |

|

|

| Par Call Date: |

|

February 15, 2029 |

|

|

|

| Redemption at Issuer’s Option: |

|

Prior to the Par Call Date, the Issuer may redeem the Notes at its option, in whole or in part, at any time and from time to time, at a redemption price (expressed as a percentage of principal amount and rounded to three decimal

places) equal to the greater of: (1) (a) the sum of the present values of the remaining scheduled payments of principal and interest thereon discounted to the redemption date (assuming such Notes matured on the Par Call Date) on a semi-annual basis

(assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate plus 15 basis points less (b) interest accrued to the date of redemption, and (2)

100% of the principal amount of the Notes to be redeemed, plus, in either case, accrued and unpaid interest thereon to, but excluding, the redemption date. On or after the Par Call Date, the Issuer may redeem the Notes, in whole or in part, at any

time and from time to time, at a redemption price equal to 100% of the principal amount of such Notes being redeemed, plus accrued and unpaid interest thereon to, but excluding, the redemption date. |

|

|

| Change of Control: |

|

Upon the occurrence of a change of control repurchase event, the Issuer must offer to repurchase all or any part of the Notes at a repurchase price in cash equal to 101% of the aggregate principal amount of the Notes repurchased,

plus any accrued and unpaid interest to, but excluding, the repurchase date. |

|

|

| Denominations: |

|

$2,000 and integral multiples of $1,000 in excess thereof. |

|

|

| CUSIP / ISIN: |

|

595017BE3 / US595017BE37 |

|

|

| Trade Date: |

|

March 5, 2024 |

|

|

| Settlement Date: |

|

T+2; March 7, 2024 |

|

|

| Ratings:* |

|

Baa1 / BBB (Moody’s / Fitch) |

|

|

| Joint book-running managers: |

|

J.P. Morgan Securities LLC BNP Paribas

Securities Corp. BofA Securities, Inc. |

|

|

| Joint book runners: |

|

Truist Securities, Inc. Wells Fargo Securities,

LLC |

|

|

| Co-managers: |

|

Siebert Williams Shank & Co., LLC

Mizuho Securities USA LLC MUFG Securities Americas Inc.

RBC Capital Markets LLC Scotia Capital (USA) Inc.

SMBC Nikko Securities America, Inc. TD Securities (USA) LLC

BMO Capital Markets Corp. U.S. Bancorp Investments, Inc.

Citizens JMP Securities, LLC Fifth Third Securities, Inc.

PNC Capital Markets LLC |

| * |

A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision

or withdrawal at any time. |

The Issuer has filed a registration statement (No. 333-277512) (including a prospectus, dated

February 29, 2024) and a preliminary prospectus supplement dated March 5, 2024 with the U.S. Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read

the prospectus in that registration statement, the prospectus supplement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may obtain these documents for free by visiting

EDGAR on the SEC website at www.sec.gov. Alternatively, copies of the preliminary prospectus supplement and accompanying prospectus may be obtained from: J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, Attn: Prospectus Department,

1155 Long Island Avenue, Edgewood, NY 11717, by telephone: 1-866-803-9204 (toll free); BNP Paribas Securities Corp., by

telephone: 1-800-854-5674 (toll free); or BofA Securities, Inc., by telephone 1-800-294-1322 (toll free) or by emailing: dg.prospectus_requests@bofa.com.

Any disclaimer or other notice that may appear below is not applicable to this communication and should be disregarded. Such disclaimer or notice was

automatically generated as a result of this communication being sent by Bloomberg or another email system.

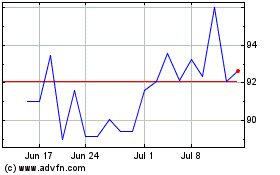

Microchip Technology (NASDAQ:MCHP)

Historical Stock Chart

From Apr 2024 to May 2024

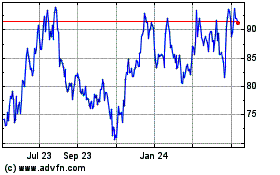

Microchip Technology (NASDAQ:MCHP)

Historical Stock Chart

From May 2023 to May 2024