Target Surpasses Expectations with a Robust 58% Increase in Q4 Profits

March 05 2024 - 8:36AM

IH Market News

In an impressive display of resilience and strategic

maneuvering, Target Corporation (NYSE:TGT) has reported a

substantial 58% surge in its fourth-quarter profits, surpassing

Wall Street’s expectations. This remarkable achievement comes as

the retailer adeptly navigated through economic challenges by

implementing effective cost-cutting measures and maintaining a lean

inventory, showcasing its ability to adapt and thrive in a

fluctuating market environment.

Financial Highlights and Revenue Growth

Target’s latest financial results reveal a slight uptick in

revenue compared to the previous year, further exceeding analyst

projections. Despite a 4.4% dip in comparable sales, which includes

metrics from both physical stores and digital channels operating

for at least 12 months, there’s a silver lining as the rate of

decline seems to be decelerating. This is evidenced by a lesser

4.9% fall in the third quarter and a 5.4% decrease in the second

quarter, indicating a potential stabilization in sales

dynamics.

Cautious Outlook Amidst Economic Pressures

The Minneapolis-based retailer has adopted a cautious stance

regarding its future sales and profit outlook, reflecting the

broader uncertainties plaguing the retail sector amidst

inflationary pressures and rising borrowing costs. Target’s

financial prudence comes at a critical juncture, especially with

its annual investor meeting looming, where it’s expected to unveil

strategic initiatives aimed at bolstering sales and catering to

consumers grappling with financial constraints.

Navigating Discretionary Spending Dilemmas

Target’s product assortment, heavily skewed towards

discretionary items such as toys, fashion, and electronics, poses a

unique challenge as consumer spending patterns shift due to

economic pressures. Unlike Walmart and other discount giants,

Target’s reliance on non-essential goods makes it more susceptible

to fluctuations in consumer behavior. In response, the retailer has

been meticulously working to strike a delicate balance between

offering value and maintaining its reputation for trendy, desirable

products.

Strategic Moves and New Launches

In a bid to attract price-conscious shoppers without

compromising on style, Target introduced the Dealworthy collection

last month, featuring an array of everyday basics at competitive

prices, with the majority of items priced under $10. Additionally,

Target’s collaborations, such as the exclusive jewelry line with

designer Kendra Scott and the introduction of its own kitchenware

brand, Figmint, have resonated well with customers, adding a layer

of exclusivity and allure to its product offerings.

Inventory Management and Membership Program

Acknowledging the lessons from past inventory challenges,

especially the overstock situation in the summer of 2022, Target

has sharpened its focus on inventory management. The retailer’s

strategic adjustments have paid off, allowing it to navigate

through excess stock issues more gracefully. Moreover, the

announcement of a new membership program, although details remain

scarce, signals Target’s ongoing efforts to enhance customer

loyalty and engagement.

Robust Financial Performance

For the quarter ending February 3, Target posted net earnings of

$1.38 billion, or $2.98 per share, a significant jump from $876

million, or $1.89 per share, in the same period last year. These

figures comfortably beat the analyst estimates of $2.42 per share.

With a 1.7% increase in revenue to $31.92 billion, the retailer

continues to demonstrate solid financial health, outpacing the

anticipated $31.83 billion.

Future Outlook and Market Reaction

Looking ahead, Target has set a cautious yet optimistic

forecast, with expected comparable sales declines of 3% to 5% for

the current quarter. The full-year outlook suggests a slight uptick

in comparable sales, ranging from unchanged to a 2% increase, with

adjusted earnings per share projected between $8.60 and $9.60.

These projections have been met with enthusiasm by the market, as

evidenced by a more than 9% rise in Target’s shares in early

trading on Tuesday.

In summary, Target’s latest financial report underscores its

agility and strategic foresight in navigating the complex retail

landscape. By balancing cost-efficiency with a keen eye on consumer

trends and preferences, Target not only exceeded expectations but

also set a positive tone for its future endeavors in a challenging

economic climate.

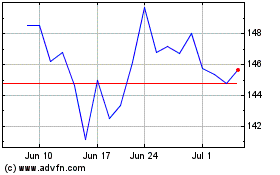

Target (NYSE:TGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

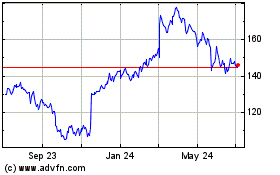

Target (NYSE:TGT)

Historical Stock Chart

From Apr 2023 to Apr 2024