Caledonia Mining Corporation Plc (“Caledonia” or “the Company”)

provides the following trading update for the year ended December

31, 2023.

Caledonia reports that Blanket Mine has

continued to perform well since the end of the quarter ended

September 30, 2023 with full year production for 2023 of 75,416

ounces. As a result, the Company expects to report revenue for the

full year in line with market expectations.

However, increased operating costs for 2023 and

several significant one-off, non-operating costs in the final

quarter of the year have resulted in reduced profit for the full

year. The increase in operating costs comprises of higher than

expected overtime payments and power costs at Blanket Mine. In

relation to non-operating costs, general and administrative costs

rose with global inflation and these also included higher than

expected staff termination costs. The Company also encountered

higher financing costs, including hedging, interest, and foreign

exchange losses and a one-off impairment charge in relation to a

VAT refund claim at the Blanket Mine solar project.

As a result of the above, the Company now

expects to report an adjusted profit before tax for the year ended

December 31, 2023 materially below market expectations.

Further information on the increase in costs

will be provided in the operating and financial results for the

quarter ended December, 31 2023.

Reassuringly, a significant proportion of these

cost increases are not expected to be carried through into 2024.

Specifically, costs associated with Bilboes are now reduced to care

and maintenance only and the project was cash neutral in the fourth

quarter of 2023. Production and costs at Blanket in 2024 to-date is

also within expectations of full year guidance, and the Company is

introducing measures aimed at reducing electricity costs over the

medium term.

At December 31, 2023, the Company had cash on

hand of $6.7 million and overdrafts and term loans of $17.7

million.

Notice of ResultsThe Company announces that its

operating and financial results for the quarter ended December 31,

2023 will be published on or before March 28, 2024.

Mark Learmonth, Chief Executive Officer,

commented:

“It is regrettable that, at a group level, we

have been adversely affected by a series of higher-than-expected

costs in the second half of 2023 which have had a negative effect

on the full year profitability. The performance of Blanket Mine

remains strong and, notwithstanding some unforeseen overtime and

power cost issues in the second half, has met guidance and produced

a robust performance for the second half of 2023.

“A number of the other cost items are not

anticipated to be recurring, whereas others have arisen from our

decisions to invest in the business, most notably around personnel

and advancing the Bilboes sulphide project. I am confident that

many of these will not recur in 2024 which has started positively

and I look forward to the future with optimism as we pursue our

goal of becoming a multi-asset production company.”

|

Caledonia Mining Corporation PlcMark

LearmonthCamilla Horsfall |

Tel: +44 1534 679 802Tel: +44 7817 841793 |

|

|

|

|

Cavendish Capital Markets Limited (Nomad and Joint

Broker)Adrian HaddenPearl Kellie |

Tel: +44 207 397 1965Tel: +44 131 220 9775 |

|

|

|

|

Liberum Capital Limited (Joint Broker)Scott

Mathieson/ Matt Hogg |

Tel: +44 20 3100 2000 |

|

|

|

|

Camarco, Financial PR (UK) |

|

|

Gordon PooleJulia TilleyElfie Kent |

Tel: +44 20 3757 4980 |

|

|

|

|

3PPB (Financial PR, North America)Patrick

ChidleyPaul Durham |

Tel: +1 917 991 7701Tel: +1 203 940 2538 |

|

|

|

|

Curate Public Relations (Zimbabwe)Debra

Tatenda |

Tel: +263 77802131 |

|

|

|

|

IH Securities (Private) Limited (VFEX Sponsor –

Zimbabwe)Lloyd Mlotshwa |

Tel: +263 (242) 745 119/33/39 |

|

|

|

Note: The information contained within

this announcement is deemed by the Company to constitute inside

information under the Market Abuse Regulation (EU) No.

596/2014 (“MAR”) as it forms part

of UK domestic law by virtue of the European Union (Withdrawal) Act

2018 and is disclosed in accordance with the

Company's obligations under Article 17 of MAR.

Cautionary Note Concerning

Forward-Looking InformationInformation and statements

contained in this news release that are not historical facts are

“forward-looking information” within the meaning of applicable

securities legislation that involve risks and uncertainties

relating, but not limited, to Caledonia’s current expectations,

intentions, plans, and beliefs. Forward-looking information can

often be identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “goal”, “plan”, “target”, “intend”,

“estimate”, “could”, “should”, “may” and “will” or the negative of

these terms or similar words suggesting future outcomes, or other

expectations, beliefs, plans, objectives, assumptions, intentions

or statements about future events or performance. Examples of

forward-looking information in this news release include: our

expectations in respect of future costs and how to control them,

the publication of annual financial results, the performance of our

investments and achieving our production guidance for the year. The

forward-looking information contained in this news release is

based, in part, on assumptions and factors that may change or prove

to be incorrect, thus causing actual results, performance or

achievements to be materially different from those expressed or

implied by forward-looking information. Such factors and

assumptions include, but are not limited to: the establishment of

estimated resources and reserves, the grade and recovery of

minerals which are mined varying from estimates, success of future

exploration and drilling programs, reliability of drilling,

sampling and assay data, the representativeness of mineralization

being accurate, success of planned metallurgical test-work, capital

availability and accuracy of estimated operating costs, obtaining

required governmental, environmental or other project approvals,

inflation, changes in exchange rates, fluctuations in commodity

prices, delays in the development of projects, the assessment of

the existing capital intensity of the Bilboes gold project and

Caledonia’s experience of project development in Zimbabwe and other

factors.

Security holders, potential security holders and

other prospective investors should be aware that these statements

are subject to known and unknown risks, uncertainties and other

factors that could cause actual results to differ materially from

those suggested by the forward-looking statements. Such factors

include, but are not limited to: risks relating to risks relating

to estimates of mineral reserves and mineral resources proving to

be inaccurate, fluctuations in gold price, risks and hazards

associated with the business of mineral exploration, development

and mining, risks relating to the credit worthiness or financial

condition of suppliers, refiners and other parties with whom the

Company does business; inadequate insurance, or inability to obtain

insurance, to cover these risks and hazards, employee relations;

relationships with and claims by local communities and indigenous

populations; political risk; risks related to natural disasters,

terrorism, civil unrest, public health concerns (including health

epidemics or outbreaks of communicable diseases such as the

coronavirus (COVID-19)); availability and increasing costs

associated with mining inputs and labour; the speculative nature of

mineral exploration and development, including the risks of

obtaining or maintaining necessary licenses and permits,

diminishing quantities or grades of mineral reserves as mining

occurs; global financial condition, the actual results of current

exploration activities, changes to conclusions of economic

evaluations, and changes in project parameters to deal with

unanticipated economic or other factors, risks of increased capital

and operating costs, environmental, safety or regulatory risks,

expropriation, the Company’s title to properties including

ownership thereof, increased competition in the mining industry for

properties, equipment, qualified personnel and their costs, risks

relating to the uncertainty of timing of events including targeted

production rate increase and currency fluctuations. Security

holders, potential security holders and other prospective investors

are cautioned not to place undue reliance on forward-looking

information. By its nature, forward-looking information involves

numerous assumptions, inherent risks and uncertainties, both

general and specific, that contribute to the possibility that the

predictions, forecasts, projections and various future events will

not occur. Caledonia undertakes no obligation to update publicly or

otherwise revise any forward-looking information whether as a

result of new information, future events or other such factors

which affect this information, except as required by law.

This news release is not an offer of the shares

of Caledonia for sale in the United States or elsewhere. This news

release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of the shares of

Caledonia, in any province, state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such province, state

or jurisdiction.

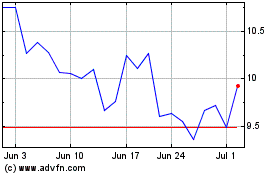

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

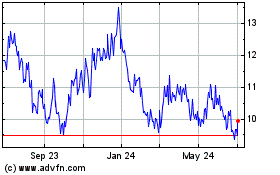

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Apr 2023 to Apr 2024