false

0001484769

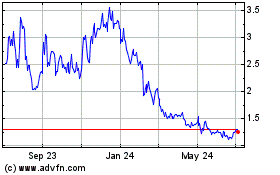

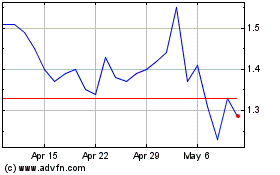

fuboTV Inc. /FL

0001484769

2024-03-01

2024-03-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): March 1, 2024

FUBOTV

INC.

(Exact

name of registrant as specified in its charter)

| Florida |

|

001-39590 |

|

26-4330545 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

Number) |

1290

Avenue of the Americas

New

York, NY 10104

(Address

of principal executive offices) (Zip Code)

(212)

672-0055

(Registrant’s

telephone number, including area code)

N/A

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

FUBO |

|

New

York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

March 1, 2024, fuboTV Inc. announced its financial results for the quarter and fiscal year ended December 31, 2023. The full text of

the shareholder letter and press release issued in connection with the announcement are attached as Exhibits 99.1 and 99.2, respectively,

to this Current Report on Form 8-K.

The

information in this Item 2.02, including the information contained in Exhibits 99.1 and 99.2 of this Current Report on Form 8-K, shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange

Act or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such a filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

The

following exhibits relating to Item 2.02 shall be deemed to be furnished, and not filed:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

FUBOTV

INC. |

| |

|

|

| Date:

March 1, 2024 |

By: |

/s/

David Gandler |

| |

|

David

Gandler |

| |

|

Chief

Executive Officer |

Exhibit

99.1

March

1, 2024

Fellow

Shareholders:

We

continue to execute on our long-term strategy to provide an aggregated and curated sports-centric entertainment offering to our customers.

We believe that a sports-first, live streaming experience should benefit all market participants, and we strive to be champions of the

consumer on this front.

Our

mission has always been to serve the consumer by aggregating the best in TV, including premium sports, news and entertainment content,

through a single app with must-have features. And since our founding in 2015, our subscriber base has steadily grown - a testament to

the high-value that consumers place on our compelling and technologically innovative content offering. Our performance in Q4 and FY 2023

reaffirms our belief in Fubo’s value proposition and the unparalleled streaming experience that we aim to bring to consumers.

The

fourth quarter capped another great year for Fubo, as we again exceeded guidance across key financial and operational metrics. In Q4,

Fubo posted 12% year-over-year growth in subscribers and 29% year-over-year revenue growth in North America (NA), along with strong results

across several key performance metrics, including an all-time high $86.65 average revenue per user (ARPU). The quarter also marked a

healthy year-over-year improvement in profitability and cash usage, reflecting the success of our continuing initiatives focused on increasing

efficiency across our operations.

We

enter 2024 with considerable optimism, strong momentum, and with meaningful improvements across just about every facet of our business.

We expect both top-line growth across revenue and subscribers as well as further leverage in reducing our expenses. We also plan to continue

strategically investing in our business, including expanding our content offering, furthering the use of technology (including AI), and

in other areas that increase monetization, such as advertising. We have also recently taken meaningful steps in response to actions by

competitors that we believe are harmful to Fubo, the industry as a whole, and most importantly, to consumers.

| | |  |

| | | 1 |

Q4

2023 Highlights1:

| ● |

Posted

NA subscribers of 1.618 million, an all-time high and ahead of the midpoint of our Q4 NA subscriber guidance of 1.592 million. |

| ● |

Grew

NA Revenue to $402 million, representing a 29% increase over the prior year period and surpassing the midpoint of our guidance

of $387.5 million. |

| |

○ |

NA

Subscription revenue growth of 30% year-over-year. |

| |

○ |

NA

Advertising revenue growth of 15% year-over-year. |

| ● |

Gross

Margin of 10% representing an 888 bps year-over-year improvement. |

| ● |

Expanded

NA ARPU by 15% year-over-year to $86.65, representing an all-time high. |

| ● |

Drove

a 662 bps reduction in Subscriber-related expenses (SRE) as a percentage of revenue to 87%, reflecting significant progress

in optimizing content costs. |

| ● |

Achieved

year-over-year improvement in Net Loss of $25 million and a $19 million improvement in net cash used in operating activities. |

| ● |

Marked

progress towards our goal of positive cash flow and Adjusted EBITDA (AEBITDA) in 2025, with a Q4 AEBITDA improvement of $25

million and a Q4 Free Cash Flow improvement of $15 million, compared to Q4 2022. |

Note:

Except as otherwise indicated, financial information presented and discussed in this letter reflects Fubo’s results on a continuing

operations basis, which excludes our former wagering reportable segment. See “Basis of Presentation – Continuing Operations”

below for further detail.

Q4

2023 Results and Q1 Guidance2

Summary Financials (millions) (GLOBAL) | |

4Q22 | | |

4Q23 | | |

4Q23 YoY % |

| Revenue | |

$ | 319.3 | | |

$ | 410.2 | | |

+28% |

| Total Operating Expenses | |

$ | 413.2 | | |

$ | 482.3 | | |

+17% |

| Net Loss | |

$ | -95.9 | | |

$ | -71.0 | | |

+26% |

| Net Loss Margin | |

| -30.0 | % | |

| -17.3 | % | |

+1,272 bps |

| Adjusted EBITDA | |

$ | -75.4 | | |

$ | -50.7 | | |

+33% |

| Adjusted EBITDA Margin | |

| -23.6 | % | |

| -12.4 | % | |

+1,126 bps |

Key Operating Metrics (NORTH AMERICA STREAMING) | |

4Q22 | | |

4Q23 | | |

4Q23 YoY % |

| Subscribers (thousands) | |

| 1,445 | | |

| 1,618 | | |

+12% |

| Revenue ($ in millions) | |

$ | 312.1 | | |

$ | 401.8 | | |

+29% |

| ARPU | |

$ | 75.20 | | |

$ | 86.65 | | |

+15% |

1 Except as otherwise indicated, financial information presented in this letter reflects Fubo’s results on a continuing operations

basis, which excludes our former wagering reportable segment. See “Basis of Presentation – Continuing Operations” below.

2

Our consolidated Net Loss for 4Q23 was $70.5 million, which includes $0.5 million gain from discontinued operations. Net Loss from

continuing operations was $71.0 million.

| | |  |

| | | 2 |

Key Operating Metrics (REST OF WORLD STREAMING) | |

4Q22 | | |

4Q23 | | |

4Q23 YoY % |

| Subscribers (thousands) | |

| 420 | | |

| 406 | | |

-3% |

| Revenue ($ in millions) | |

$ | 7.2 | | |

$ | 8.4 | | |

+18% |

| ARPU | |

$ | 6.09 | | |

$ | 6.81 | | |

+12% |

| Guidance

(NA) |

|

1Q24 |

|

FY24 |

| Revenue

($ in millions) |

|

$365-$375 |

|

$1,505-$1,525 |

| Subscribers

(thousands) |

|

1,415-1,435 |

|

1,665-1,685 |

| Guidance

(ROW) |

|

1Q24 |

|

FY24 |

| Revenue

($ in millions) |

|

$6.6-$8.6 |

|

$31-$35 |

| Subscribers

(thousands) |

|

380-385 |

|

390-410 |

Net

Loss from continuing operations in the fourth quarter was $71 million, leading to an earnings per share (EPS) loss of $0.24. This compares

favorably to a Net Loss from continuing operations of $95.9 million, or an EPS loss of $0.48 in the fourth quarter of 2022. Adjusted

EPS in the fourth quarter of 2023 improved to a loss of $0.17, compared to an adjusted EPS loss of $0.39 in Q4 2022. Adjusted EPS excludes

the impact of stock-based compensation, amortization of intangibles, amortization of debt discount and other non-cash items.

In

Q4 2023 we achieved a $15 million improvement in Free Cash Flow and a $25 million improvement in AEBITDA, when compared to Q4 2022. These

improvements were a result of our ongoing efforts to drive operating leverage across the business, and represent the 4th consecutive

quarter of year-over-year improvements in these metrics.

We

maintained a strong balance sheet and healthy liquidity position, ending the quarter with $251 million in cash, cash equivalents and

restricted cash. We believe that we have sufficient liquidity to fund our current operating plan as we progress towards our stated profitability

goals.

| | |  |

| | | 3 |

Q4

2023 Operational Highlights

North

America Ad Sales

Fubo

delivered North America ad revenue of $38.6 million in the quarter, an increase of 15% year-over-year. 2023 FY ad revenues were $114

million for a year-over-year increase of 14%. This performance reflects the continued positive impact of our improved go-to market strategies

to better leverage our premium sports-first content and our highly sought-after audience with top agency holding companies. This is especially

true around key tentpoles and seasonal events that typically drive higher viewer engagement and premium CPMs.

We

ended the year with 158 FAST channels on the platform. FAST channels represent a key pillar of our strategy to provide a greater diversity

of content to our users and, at the same time, expand advertising.

North

America Content

We

continue to gain added leverage over our subscriber related expenses (SRE), which decreased from 93% to 87% of revenue in Q4 versus the

same period in the prior year. We expect this year-over-year trend to continue as we work to grow subscribers, optimize our pricing,

manage our cost structure, and further improve our mix of premium plans.

| | |  |

| | | 4 |

Product

Roadmap

In

2023, Fubo made significant progress on the roll-out of our global Unified Platform (UP), with every application being re-built and re-designed

to better leverage technology synergies across the globe. This new technical architecture is already allowing us to rapidly iterate our

product experience while also laying the foundation for additional platform level enhancements. We expect to deliver an increasingly

personalized Fubo experience, including incorporating various AI features. We will also continue to focus on building our technology

advantage to create must-have product features designed with the consumer top of mind across the entire demand curve at a range of price

points.

Guidance

North

America Streaming

Our

FY 2024 subscriber guidance projects 1,665,000 to 1,685,000 subscribers, representing 4% year-over-year growth at the midpoint. This

reflects conservatism in our outlook, and in particular, our exposure to potential industry volatility, and our intention to maintain

discipline in subscriber acquisition costs relative to monetization.

Our

FY 2024 revenue guidance projects $1,505 to $1,525 million, representing 13% year-over-year growth at the midpoint. Our projection of

revenue growth meaningfully outpacing subscriber growth reflects our continued expectation of ARPU expansion as the result of improved

unit economics and margin gains.

Our

1Q 2024 subscriber guidance projects 1,415,000 to 1,435,000 subscribers, representing 11% year-over-year growth at the midpoint. Our

1Q 2024 revenue guidance projects $365 to $375 million, representing 17% year-over-year growth at the midpoint.

Rest

of World

Our

FY 2024 subscriber guidance projects 390,000 to 410,000 subscribers, representing a -2% year-over-year decline at the midpoint. Our FY

2024 revenue guidance projects $31 to $35 million, representing 2% year-over-year growth at the midpoint.

Our

1Q 2024 subscriber guidance projects 380,000 to 385,000 subscribers, representing 1% year-over-year growth at the midpoint. Our 1Q 2024

revenue guidance projects $6.6 to $8.6 million, representing a -2% year-over-year decline at the midpoint.

Conclusion

As

we enter 2024, we remain focused on continuing to provide consumers a differentiated experience, while also balancing profitability targets

and growth. We believe that our balance sheet, which includes $251 million in cash, cash equivalents and restricted cash, provides us

with liquidity to both continue to strategically support the business and reach positive cash flow in 2025. Our company has never been

more aligned in its vision and strategy, and we are excited about the opportunities ahead of us to deliver long-term value to our employees,

partners, customers, and shareholders.

We

look forward to keeping you updated on our progress in the quarters to come.

Sincerely,

| David

Gandler, co-founder and CEO |

|

Edgar

Bronfman Jr., executive chairman |

|

| | |  |

| | | 5 |

Q4

2023 Earnings Live Conference Call

Fubo

CEO, David Gandler, and CFO, John Janedis, will host a live conference call today at 8:30 a.m. ET to deliver brief remarks followed by

Q&A. The live webcast will be available on the Events & Presentations page of Fubo’s investor relations website.

An archived replay will be available on Fubo’s website following the call. Participants should join the call 10 minutes prior to

ensure that they are connected prior to the event.

More

Information

We

encourage you to read our full set of financial statements and SEC filings, and to sign up for email alerts, on the investor relations

section of our website at ir.fubo.tv.

Additional

information is available at www.sec.gov under FuboTV Inc.’s filings, as well as https://ir.fubo.tv.

Fubo

intends to use its website as a disclosure channel and investors are encouraged to refer to it, as well as press releases and SEC filings.

The company encourages reading the full set of financial statements and related disclosures in its Annual Report on Form 10-K for the

year ended December 31, 2023 that will be filed with the SEC.

About

Fubo

With

a global mission to aggregate the best in TV, including premium sports, news and entertainment content, through a single app, FuboTV

Inc. (d/b/a Fubo) (NYSE: FUBO) aims to transcend the industry’s current TV model. The company operates Fubo in the U.S., Canada

and Spain and Molotov in France.

In

the U.S., Fubo is a sports-first cable TV replacement product that aggregates more than 300 live sports, news and entertainment networks

and is the only live TV streaming platform with every Nielsen-rated sports channel (source: Nielsen Total Viewers, 2023). Leveraging

Fubo’s proprietary data and technology platform optimized for live TV and sports viewership, subscribers can engage with the content

they are watching through an intuitive and personalized streaming experience. Fubo has continuously pushed the boundaries of live TV

streaming. It was the first virtual MVPD to launch 4K streaming and MultiView, which it did years ahead of its peers, as well as Instant

Headlines, a first-of-its-kind AI feature that generates contextual news topics as they are reported live on air.

Learn

more at https://fubo.tv

| | |  |

| | | 6 |

Forward-Looking

Statements

This

letter contains forward-looking statements of FuboTV Inc. (“Fubo”) that involve substantial risks and uncertainties. All

statements contained in this letter that do not relate to matters of historical fact are forward-looking statements within the meaning

of The Private Securities Litigation Reform Act of 1995, including statements regarding our business strategy and plans, including content

partnerships, market opportunity, expectations regarding innovation, growth, profitability and becoming cash flow positive in 2025, industry,

advertising and consumer trends, anticompetitive practices among our competitors and our response plan, planned product offerings, including

technology advancements, our anticipated cash requirements, our financial condition and our anticipated financial performance, including

quarterly and annual guidance, and cash flow and Adjusted EBITDA targets. The words “could,” “will,” “plan,”

“intend,” “anticipate,” “approximate,” “expect,” “potential,” “believe”

or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking

statements contain these identifying words. Actual results or events could differ materially from the plans, intentions and expectations

disclosed in the forward-looking statements that Fubo makes due to a number of important factors, including but not limited to the following:

our ability to achieve or maintain profitability; risks related to our access to capital and fundraising prospects to fund our financial

operations and support our planned business growth; our revenue and gross profit are subject to seasonality; our operating results may

fluctuate; our ability to effectively manage our growth; the long-term nature of our content commitments; our ability to renew our long-term

content contracts on sufficiently favorable terms; our ability to attract and retain subscribers; obligations imposed on us through our

agreements with certain distribution partners; we may not be able to license streaming content or other rights on acceptable terms; the

restrictions imposed by content providers on our distribution and marketing of our products and services; our reliance on third party

platforms to operate certain aspects of our business; risks related to the difficulty in measuring key metrics related to our business;

risks related to preparing and forecasting our financial results; risks related to the highly competitive nature of our industry; risks

related to our technology, as well as cybersecurity and data privacy-related risks; risks related to ongoing or future legal proceedings;

and other risks, including the effects of industry, market, economic, political or regulatory conditions, future exchange and interest

rates, and changes in tax and other laws, regulations, rates and policies. Further risks that could cause actual results to differ materially

from those matters expressed in or implied by such forward-looking statements are discussed in our Quarterly Report on Form 10-Q for

the quarterly period ended September 30, 2023 filed with the Securities and Exchange Commission (“SEC”), our Annual Report

on Form 10-K for the year ended December 31, 2023 to be filed with the SEC, and our other periodic filings with the SEC. We encourage

you to read such risks in detail. The forward-looking statements in this letter represent Fubo’s views as of the date of this letter.

Fubo anticipates that subsequent events and developments will cause its views to change. However, while it may elect to update these

forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. You should, therefore, not

rely on these forward-looking statements as representing Fubo’s views as of any date subsequent to the date of this letter.

(FuboTV

Inc. Financial Statements begin on the following pages)

| | |  |

| | | 7 |

fuboTV

Inc.

Condensed

Consolidated Statements of Operations and Comprehensive Loss

(in

thousands, except share and per share amounts)

| | |

For the Three Months Ended | | |

For the Years Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Unaudited | | |

Unaudited | | |

Audited | | |

Audited | |

| Revenues | |

| | | |

| | | |

| | | |

| | |

| Subscription | |

$ | 370,087 | | |

$ | 284,864 | | |

$ | 1,249,579 | | |

$ | 905,886 | |

| Advertising | |

| 38,987 | | |

| 33,853 | | |

| 115,370 | | |

| 101,739 | |

| Other | |

| 1,107 | | |

| 598 | | |

| 3,276 | | |

| 1,071 | |

| Total revenues | |

| 410,181 | | |

| 319,315 | | |

| 1,368,225 | | |

| 1,008,696 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Subscriber related expenses | |

| 354,854 | | |

| 297,388 | | |

| 1,213,253 | | |

| 976,415 | |

| Broadcasting and transmission | |

| 15,546 | | |

| 19,315 | | |

| 68,824 | | |

| 73,377 | |

| Sales and marketing | |

| 69,786 | | |

| 57,615 | | |

| 207,045 | | |

| 183,615 | |

| Technology and development | |

| 14,164 | | |

| 14,905 | | |

| 67,675 | | |

| 69,264 | |

| General and administrative | |

| 18,286 | | |

| 15,436 | | |

| 64,282 | | |

| 81,151 | |

| Depreciation and amortization | |

| 9,638 | | |

| 8,557 | | |

| 36,496 | | |

| 36,731 | |

| Total operating expenses | |

| 482,274 | | |

| 413,216 | | |

| 1,657,575 | | |

| 1,420,553 | |

| Operating loss | |

| (72,093 | ) | |

| (93,901 | ) | |

| (289,350 | ) | |

| (411,857 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (3,457 | ) | |

| (3,568 | ) | |

| (13,712 | ) | |

| (14,194 | ) |

| Interest income | |

| 2,908 | | |

| 1,546 | | |

| 10,971 | | |

| 2,498 | |

| Amortization of debt discount | |

| (656 | ) | |

| (632 | ) | |

| (2,574 | ) | |

| (2,476 | ) |

| Gain (loss) on extinguishment of debt | |

| 1,607 | | |

| - | | |

| 1,607 | | |

| - | |

| Change in fair value of warrant liabilities | |

| - | | |

| - | | |

| - | | |

| (1,701 | ) |

| Other income (expense) | |

| 252 | | |

| 124 | | |

| (923 | ) | |

| 1,019 | |

| Total other income (expense) | |

| 654 | | |

| (2,530 | ) | |

| (4,631 | ) | |

| (14,854 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from continuing operations before income taxes | |

| (71,439 | ) | |

| (96,431 | ) | |

| (293,981 | ) | |

| (426,711 | ) |

| Income tax benefit | |

| 397 | | |

| 516 | | |

| 879 | | |

| 1,666 | |

| Net loss from continuing operations | |

| (71,042 | ) | |

| (95,915 | ) | |

| (293,102 | ) | |

| (425,045 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Discontinued operations | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from discontinued operations before income taxes | |

| 515 | | |

| (56,167 | ) | |

| 5,185 | | |

| (136,874 | ) |

| Income tax benefit | |

| - | | |

| - | | |

| - | | |

| - | |

| Net income (loss) from discontinued operations | |

| 515 | | |

| (56,167 | ) | |

| 5,185 | | |

| (136,874 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (70,527 | ) | |

| (152,082 | ) | |

| (287,917 | ) | |

| (561,919 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Less: Net loss attributable to non-controlling interest | |

| 437 | | |

| 101 | | |

| 463 | | |

| 442 | |

| Net loss attributable to common shareholders | |

$ | (70,090 | ) | |

$ | (151,981 | ) | |

$ | (287,454 | ) | |

$ | (561,477 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss) | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 3,857 | | |

| 10,840 | | |

| 4,822 | | |

| (767 | ) |

| Comprehensive loss attributable to common shareholders | |

$ | (66,233 | ) | |

$ | (141,141 | ) | |

$ | (282,632 | ) | |

$ | (562,244 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributable to common shareholders | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted loss per share from continuing operations | |

$ | (0.24 | ) | |

$ | (0.48 | ) | |

$ | (1.06 | ) | |

$ | (2.33 | ) |

| Basic and diluted income (loss) per share from discontinued operations | |

$ | 0.00 | | |

$ | (0.28 | ) | |

$ | 0.02 | | |

$ | (0.75 | ) |

| Basic and diluted net loss per share | |

$ | (0.24 | ) | |

$ | (0.76 | ) | |

$ | (1.04 | ) | |

$ | (3.08 | ) |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 294,737,521 | | |

| 200,129,461 | | |

| 276,282,572 | | |

| 182,472,069 | |

| | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation was allocated as follows: | |

| | | |

| | | |

| | | |

| | |

| Subscriber related expenses | |

| 64 | | |

| 53 | | |

| 211 | | |

| 144 | |

| Sales and marketing | |

| 4,308 | | |

| 3,699 | | |

| 22,886 | | |

| 22,198 | |

| Technology and development | |

| 3,101 | | |

| 2,538 | | |

| 12,024 | | |

| 9,998 | |

| General and administrative | |

| 4,291 | | |

| 3,623 | | |

| 16,094 | | |

| 20,114 | |

| Total stock-based compensation | |

| 11,764 | | |

| 9,913 | | |

| 51,215 | | |

| 52,454 | |

| | |  |

| | | 8 |

fuboTV

Inc.

Condensed

Consolidated Balance Sheets

(in

thousands)

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

Unaudited | | |

Audited | |

| ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 245,278 | | |

$ | 337,087 | |

| Accounts receivable, net | |

| 80,299 | | |

| 43,996 | |

| Prepaid sports rights | |

| 39,911 | | |

| 37,668 | |

| Prepaid and other current assets | |

| 20,804 | | |

| 13,508 | |

| Assets of discontinued operations | |

| 462 | | |

| 4,643 | |

| Total current assets | |

| 386,754 | | |

| 436,902 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 4,835 | | |

| 4,975 | |

| Restricted cash | |

| 6,142 | | |

| 6,139 | |

| Intangible assets, net | |

| 158,448 | | |

| 171,832 | |

| Goodwill | |

| 622,818 | | |

| 618,506 | |

| Right-of-use assets | |

| 35,825 | | |

| 35,888 | |

| Other non-current assets | |

| 17,818 | | |

| 3,532 | |

| Total assets | |

$ | 1,232,640 | | |

$ | 1,277,774 | |

| | |

| | | |

| | |

| LIABILITIES, TEMPORARY EQUITY AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

| 74,311 | | |

| 66,952 | |

| Accrued expenses and other current liabilities | |

| 320,041 | | |

| 264,415 | |

| Notes payable | |

| 6,323 | | |

| 5,687 | |

| Deferred revenue | |

| 90,203 | | |

| 65,370 | |

| Long-term borrowings - current portion | |

| 1,612 | | |

| 1,986 | |

| Current portion of lease liabilities | |

| 5,247 | | |

| 1,763 | |

| Liabilities of discontinued operations | |

| 19,608 | | |

| 32,581 | |

| Total current liabilities | |

| 517,345 | | |

| 438,754 | |

| | |

| | | |

| | |

| Convertible notes, net of discount | |

| 391,748 | | |

| 394,094 | |

| Deferred income taxes | |

| - | | |

| 765 | |

| Lease liabilities | |

| 38,087 | | |

| 39,266 | |

| Other long-term liabilities | |

| 1,635 | | |

| 1,565 | |

| Total liabilities | |

| 948,815 | | |

| 874,444 | |

| | |

| | | |

| | |

| Redeemable non-controlling interest | |

| - | | |

| 1,648 | |

| | |

| | | |

| | |

| Shareholders’ equity: | |

| | | |

| | |

| Common stock par value $0.0001: 800,000,000 shares authorized; 299,215,160 and 209,684,548 shares issued and outstanding at December 31, 2023 and December 31, 2022, respectively | |

| 30 | | |

| 21 | |

| Additional paid-in capital | |

| 2,136,870 | | |

| 1,972,006 | |

| Accumulated deficit | |

| (1,845,542 | ) | |

| (1,558,088 | ) |

| Non-controlling interest | |

| (11,751 | ) | |

| (11,662 | ) |

| Accumulated other comprehensive income (loss) | |

| 4,218 | | |

| (595 | ) |

| Total shareholders’ equity | |

| 283,825 | | |

| 401,682 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY AND TEMPORARY EQUITY | |

$ | 1,232,640 | | |

$ | 1,277,774 | |

| | |  |

| | | 9 |

fuboTV

Inc.

Condensed

Consolidated Statements of Cash Flows

(in

thousands)

| | |

For the Twelve Months Ended | |

| | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

Unaudited | | |

Unaudited | |

| Cash flows from operating activities | |

| | | |

| | |

| Net loss | |

$ | (287,917 | ) | |

$ | (561,919 | ) |

| Less: Income (loss) from discontinued operations, net of tax | |

| 5,185 | | |

| (136,874 | ) |

| Net loss from continuing operations | |

| (293,102 | ) | |

| (425,045 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 36,496 | | |

| 36,731 | |

| Stock-based compensation | |

| 51,215 | | |

| 52,454 | |

| Amortization of debt discount | |

| 2,574 | | |

| 2,476 | |

| Gain on extinguishment of debt | |

| (1,607 | ) | |

| - | |

| Deferred income tax benefit | |

| (995 | ) | |

| (1,666 | ) |

| Change in fair value of warrant liabilities | |

| - | | |

| 1,701 | |

| Amortization of right-of-use assets | |

| 3,126 | | |

| 3,078 | |

| Other adjustments | |

| 695 | | |

| 1,155 | |

| Changes in operating assets and liabilities of business, net of acquisitions: | |

| | | |

| | |

| Accounts receivable, net | |

| (36,200 | ) | |

| (9,778 | ) |

| Prepaid expenses and other assets | |

| (14,498 | ) | |

| (950 | ) |

| Prepaid sports rights | |

| (1,525 | ) | |

| (34,384 | ) |

| Accounts payable | |

| 6,635 | | |

| 12,014 | |

| Accrued expenses and other liabilities | |

| 52,180 | | |

| 50,116 | |

| Deferred revenue | |

| 24,774 | | |

| 21,102 | |

| Lease liabilities | |

| (2,813 | ) | |

| 1,210 | |

| Net cash used in operating activities - continuing operations | |

| (173,045 | ) | |

| (289,786 | ) |

| Net cash used in operating activities - discontinued operations | |

| (4,577 | ) | |

| (26,915 | ) |

| Net cash used in operating activities | |

| (177,622 | ) | |

| (316,701 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchases of short-term investments | |

| - | | |

| (100,000 | ) |

| Proceeds from maturity of short-term investments | |

| - | | |

| 100,000 | |

| Purchases of property and equipment | |

| (1,071 | ) | |

| (1,130 | ) |

| Sale of property and equipment | |

| 28 | | |

| - | |

| Capitalization of Internal Use Software | |

| (17,282 | ) | |

| (4,857 | ) |

| Purchase of intangible assets | |

| (3,592 | ) | |

| - | |

| Purchase of strategic investment | |

| (3,500 | ) | |

| - | |

| Net cash used in investing activities - continuing operations | |

| (25,417 | ) | |

| (5,987 | ) |

| Net cash used in investing activities - discontinued operations | |

| - | | |

| (6,436 | ) |

| Net cash used in investing activities | |

| (25,417 | ) | |

| (12,423 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Proceeds from sale of common stock, net of fees | |

| 116,886 | | |

| 292,123 | |

| Redemption of non-controlling interest | |

| (2,147 | ) | |

| - | |

| Repurchase of convertible notes | |

| (3,313 | ) | |

| - | |

| Vested restricted stock unit settled for cash | |

| (125 | ) | |

| - | |

| Proceeds from exercise of stock options | |

| 373 | | |

| 829 | |

| Proceeds from the exercise of warrants | |

| - | | |

| 5,000 | |

| Repayments of notes payable and long-term borrowings | |

| (441 | ) | |

| (1,682 | ) |

| Net cash provided by financing activities - continuing operations | |

| 111,233 | | |

| 296,270 | |

| Net cash provided by financing activities - discontinued operations | |

| - | | |

| - | |

| Net cash provided by financing activities | |

| 111,233 | | |

| 296,270 | |

| | |

| | | |

| | |

| Net decrease in cash, cash equivalents and restricted cash | |

| (91,806 | ) | |

| (32,854 | ) |

| Cash, cash equivalents and restricted cash at beginning of period | |

| 343,226 | | |

| 376,080 | |

| Cash, cash equivalents and restricted cash at end of period | |

$ | 251,420 | | |

$ | 343,226 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flows information: | |

| | | |

| | |

| Interest paid | |

| 13,169 | | |

| 13,469 | |

| Income tax paid | |

| 258 | | |

| - | |

| | |

| | | |

| | |

| Non cash financing and investing activities: | |

| | | |

| | |

| Strategic investment - marketing commitment | |

| 4,000 | | |

| - | |

| Reclassification of the equity components of the 2026 Convertible Notes to liability upon adoption of ASU 2020-06 | |

| - | | |

| 75,264 | |

| Cashless exercise of warrants | |

| - | | |

| 5,249 | |

| Accrued expenses - At-the-market offering | |

| 15 | | |

| 18 | |

| Accounts payable - purchase of intangible assets | |

| 540 | | |

| - | |

| Accounts payable - purchase of property and equipment | |

| 12 | | |

| - | |

| | |  |

| | | 10 |

Basis

of Presentation – Continuing Operations

In

connection with the dissolution of Fubo Gaming, Inc. and termination of Fubo Sportsbook, the assets and liabilities and the operations

of our former wagering reportable segment are presented as discontinued operations in our consolidated financial statements. With respect

to our continuing operations, we operate as a single reportable segment. Financial information presented in this letter reflects Fubo’s

results on a continuing operations basis, which excludes our former wagering reportable segment.

Key

Performance Metrics and Non-GAAP Measures

Paid

Subscribers

We

believe the number of paid subscribers is a relevant measure to gauge the size of our user base. Paid subscribers (“subscribers”)

are total subscribers that have completed registration with Fubo, have activated a payment method (only reflects one paying user per

plan), from which Fubo has collected payment in the month ending the relevant period. Users who are on a free (trial) period are not

included in this metric.

Average

Revenue per User (ARPU)

Beginning

in the third quarter of 2022, Average Revenue Per User (ARPU) is calculated using GAAP Subscription revenue and GAAP Advertising revenue.

Previously, ARPU was calculated using Platform Bookings, which consisted of GAAP Subscription revenue and GAAP Advertising revenue, adjusted

for deferred revenue.

We

believe ARPU provides useful information for investors to gauge the revenue generated per subscriber on a monthly basis. ARPU, with respect

to a given period, is defined as total Subscription revenue and Advertising revenue recognized in such period, divided by the average

daily paid subscribers in such period, divided by the number of months in such period. Advertising revenue, like Subscription revenue,

is primarily driven by the number of subscribers to our platform and per-subscriber viewership such as the type of, and duration of,

content watched on platform. We believe ARPU is an important metric for both management and investors to evaluate the Company’s

core operating performance and measure our subscriber monetization, as well as evaluate unit economics, payback on subscriber acquisition

cost and lifetime value per subscriber. In addition, we believe that presenting a geographic breakdown for North America ARPU and ROW

ARPU allows for a more meaningful assessment of the business because of the significant differences in both Subscription revenue and

Advertising revenue generated on a per subscriber basis in North America when compared to ROW due to our current subscription pricing

models and advertising monetization in the two geographic regions.

| | |  |

| | | 11 |

Adjusted

EBITDA

Adjusted

EBITDA is a non-GAAP measure defined as Net Loss from Continuing Operations, adjusted for depreciation and amortization, stock-based

compensation, income tax benefit, other expenses, and one-time non-cash expenses.

Adjusted

EBITDA Margin

Adjusted

EBITDA Margin is a non-GAAP measure defined as Adjusted EBITDA divided by Revenue.

Adjusted

Net Loss

Adjusted

Net Loss is a non-GAAP measure defined as Net Loss Attributable to Common Shareholders, adjusting for discontinued operations, stock-based

compensation, change in fair value of warrants, amortization of debt discount, amortization of intangible assets and other non-cash items.

Adjusted

EPS (Earnings per Share)

Adjusted

EPS is a non-GAAP measure defined as Adjusted Net Loss divided by weighted average shares outstanding.

Free

Cash Flow

Free

Cash Flow is a non-GAAP measure defined as net cash used in operating activities - continuing operations, reduced by capital expenditures

(consisting of purchases of property and equipment), purchases of intangible assets and capitalization of internal use software. We believe

Free Cash Flow is an important liquidity measure of the cash that is available for operational expenses, investments in our business,

strategic acquisitions, and for certain other activities such as repaying debt obligations and stock repurchases. Free Cash Flow is a

key financial indicator used by management. Free Cash Flow is useful to investors as a liquidity measure because it measures our ability

to generate or use cash. The use of Free Cash Flow as an analytical tool has limitations due to the fact that it does not represent the

residual cash flow available for discretionary expenditures. Because of these limitations, Free Cash Flow should be considered along

with other operating and financial performance measures presented in accordance with GAAP.

Gross

Profit and Gross Margin (GAAP)

Gross

Profit is defined as Revenue less Subscriber related expenses and Broadcasting and transmission. Gross Margin is defined as Gross Profit

divided by Revenue. We believe these measures are useful because they represent key profitability metrics for our business and are used

by management to evaluate the performance of our business, including measuring the cost to deliver our product to subscribers against

revenue.

Subscriber

Acquisition Cost

Subscriber

Acquisition Cost (SAC) reflects total GAAP sales and marketing expenses less headcount related to sales and marketing spend for a given

period divided by Gross Paid Subscriber Additions for the same period.

| | |  |

| | | 12 |

Reconciliation

of Key Performance Metrics and Non-GAAP Financial Measures

Certain

measures used in this letter, including Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Loss, Adjusted EPS and Free Cash Flow are

non-GAAP financial measures. We believe these are useful financial measures for investors as they are supplemental measures used by management

in evaluating our core operating performance. Our non-GAAP financial measures have limitations as analytical tools and you should not

consider them in isolation or as a substitute for an analysis of our results under GAAP. There are a number of limitations related to

the use of these non-GAAP financial measures versus their nearest GAAP equivalents. First, these non-GAAP financial measures are not

a substitute for GAAP financial measures. Second, these non-GAAP financial measures may not provide information directly comparable to

measures provided by other companies in our industry, as those other companies may calculate their non-GAAP financial measures differently.

The

following tables include reconciliations of the non-GAAP financial measures used in this letter to their most directly comparable GAAP

financial measures. The tables also include reconciliations of GAAP Subscription revenue and GAAP Advertising revenue to North America

ARPU and ROW ARPU, respectively, each of which is a key performance metric.

| | |  |

| | | 13 |

fuboTV

Inc.

Reconciliation

of GAAP Subscription and Advertising Revenue to North America ARPU

(in

thousands, except average subscribers and average per user amounts)

Year-over-Year

Comparison

| | |

Three Months Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

As-Reported | | |

As-Reported | |

| Subscription Revenue (GAAP) | |

$ | 370,087 | | |

$ | 284,864 | |

| Advertising Revenue (GAAP) | |

| 38,987 | | |

| 33,853 | |

| Subtract: | |

| | | |

| | |

| ROW Subscription Revenue | |

| (8,042 | ) | |

| (6,892 | ) |

| ROW Advertising Revenue | |

| (382 | ) | |

| (277 | ) |

| Total | |

| 400,650 | | |

| 311,548 | |

| Divide: | |

| | | |

| | |

| Average Subscribers (North America) | |

| 1,541,290 | | |

| 1,380,956 | |

| Months in Period | |

| 3 | | |

| 3 | |

| North America Monthly Average Revenue per User (NA ARPU) | |

$ | 86.65 | | |

$ | 75.20 | |

| | |  |

| | | 14 |

fuboTV

Inc.

Reconciliation

of GAAP Subscription and Advertising Revenue to North America ARPU

(in

thousands, except average subscribers and average per user amounts)

Full

Year Comparison

| | |

Years Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

As-Reported | | |

As-Reported | |

| Subscription Revenue (GAAP) | |

$ | 1,249,579 | | |

$ | 905,886 | |

| Advertising Revenue (GAAP) | |

| 115,370 | | |

| 101,739 | |

| Subtract: | |

| | | |

| | |

| ROW Subscription Revenue | |

| (31,674 | ) | |

| (23,207 | ) |

| ROW Advertising Revenue | |

| (1,123 | ) | |

| (1,134 | ) |

| Total | |

| 1,332,152 | | |

| 983,284 | |

| Divide: | |

| | | |

| | |

| Average Subscribers (North America) | |

| 1,349,647 | | |

| 1,126,461 | |

| Months in Period | |

| 12 | | |

| 12 | |

| North America Monthly Average Revenue per User (NA ARPU) | |

$ | 82.25 | | |

$ | 72.74 | |

| | |  |

| | | 15 |

fuboTV

Inc.

Reconciliation

of GAAP Subscription and Advertising Revenue to ROW ARPU

(in

thousands, except average subscribers and average per user amounts)

Year-over-Year

Comparison

| | |

Three Months Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

As-Reported | | |

As-Reported | |

| Subscription Revenue (GAAP) | |

$ | 370,087 | | |

$ | 284,864 | |

| Advertising Revenue (GAAP) | |

| 38,987 | | |

| 33,853 | |

| Subtract: | |

| | | |

| | |

| North America Subscription Revenue | |

| (362,045 | ) | |

| (277,972 | ) |

| North America Advertising Revenue | |

| (38,605 | ) | |

| (33,576 | ) |

| Total | |

| 8,424 | | |

| 7,169 | |

| Divide: | |

| | | |

| | |

| Average Subscribers (ROW) | |

| 412,565 | | |

| 392,558 | |

| Months in Period | |

| 3 | | |

| 3 | |

| ROW Monthly Average Revenue per User (ROW ARPU) | |

$ | 6.81 | | |

$ | 6.09 | |

| | |  |

| | | 16 |

fuboTV

Inc.

Reconciliation

of GAAP Subscription and Advertising Revenue to ROW ARPU

(in

thousands, except average subscribers and average per user amounts)

Full

Year Comparison

| | |

Years Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

As-Reported | | |

As-Reported | |

| Subscription Revenue (GAAP) | |

$ | 1,249,579 | | |

$ | 905,886 | |

| Advertising Revenue (GAAP) | |

| 115,370 | | |

| 101,739 | |

| Subtract: | |

| | | |

| | |

| North America Subscription Revenue | |

| (1,217,905 | ) | |

| (882,679 | ) |

| North America Advertising Revenue | |

| (114,247 | ) | |

| (100,605 | ) |

| Total | |

| 32,797 | | |

| 24,341 | |

| Divide: | |

| | | |

| | |

| Average Subscribers (ROW) | |

| 401,009 | | |

| 330,222 | |

| Months in Period | |

| 12 | | |

| 12 | |

| ROW Monthly Average Revenue per User (ROW ARPU) | |

$ | 6.82 | | |

$ | 6.14 | |

| | |  |

| | | 17 |

fuboTV

Inc.

Reconciliation

of Net Loss from Continuing Operations to Non-GAAP Adjusted EBITDA

(in

thousands)

Year-over-Year

Comparison

| | |

Three Months Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

As-Reported | | |

As-Reported | |

| Reconciliation of Net Loss from Continuing Operations to Adjusted EBITDA | |

| | | |

| | |

| Net loss from continuing operations | |

$ | (71,042 | ) | |

$ | (95,915 | ) |

| Depreciation and amortization | |

| 9,638 | | |

| 8,557 | |

| Stock-based compensation | |

| 11,764 | | |

| 9,913 | |

| Other income (expense) | |

| (654 | ) | |

| 2,530 | |

| Income tax benefit | |

| (397 | ) | |

| (516 | ) |

| Adjusted EBITDA | |

| (50,691 | ) | |

| (75,431 | ) |

| | |

| | | |

| | |

| Adjusted EBITDA | |

| (50,691 | ) | |

| (75,431 | ) |

| Divide: | |

| | | |

| | |

| Revenue | |

| 410,181 | | |

| 319,315 | |

| Adjusted EBITDA Margin | |

| -12.4 | % | |

| -23.6 | % |

| | |  |

| | | 18 |

fuboTV

Inc.

Reconciliation

of Net Loss from Continuing Operations to Non-GAAP Adjusted EBITDA

(in

thousands)

Full

Year Comparison

| | |

Years Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

As-Reported | | |

As-Reported | |

| Reconciliation of Net Loss from Continuing Operations to Adjusted EBITDA | |

| | | |

| | |

| Net loss from continuing operations | |

$ | (293,102 | ) | |

$ | (425,045 | ) |

| Depreciation and amortization | |

| 36,496 | | |

| 36,731 | |

| Stock-based compensation | |

| 51,215 | | |

| 52,454 | |

| One-time non-cash operating expenses | |

| - | | |

| (1,162 | ) |

| Other income (expense) | |

| 4,631 | | |

| 14,854 | |

| Income tax benefit | |

| (879 | ) | |

| (1,666 | ) |

| Adjusted EBITDA | |

| (201,639 | ) | |

| (323,834 | ) |

| | |

| | | |

| | |

| Adjusted EBITDA | |

| (201,639 | ) | |

| (323,834 | ) |

| Divide: | |

| | | |

| | |

| Revenue | |

| 1,368,225 | | |

| 1,008,696 | |

| Adjusted EBITDA Margin | |

| -14.7 | % | |

| -32.1 | % |

| | |  |

| | | 19 |

fuboTV

Inc.

Reconciliation

of Net Cash Used in Operating Activities - Continuing Operations to Free Cash Flow

(in

thousands)

Year-over-Year

Comparison

| | |

Three Months Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

As-Reported | | |

As-Reported | |

| Net cash used in operating activities - continuing operations | |

$ | (57 | ) | |

$ | (19,118 | ) |

| Subtract: | |

| | | |

| | |

| Purchases of property and equipment | |

| (696 | ) | |

| (99 | ) |

| Capitalization of internal use software | |

| (4,407 | ) | |

| (1,338 | ) |

| Purchase of intangible assets | |

| (693 | ) | |

| - | |

| Free Cash Flow | |

| (5,853 | ) | |

| (20,555 | ) |

| | |  |

| | | 20 |

fuboTV

Inc.

Reconciliation

of Net Cash Used in Operating Activities - Continuing Operations to Free Cash Flow

(in

thousands)

Full

Year Comparison

| | |

Years Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

As-Reported | | |

As-Reported | |

| Net cash used in operating activities - continuing operations | |

$ | (173,045 | ) | |

$ | (289,786 | ) |

| Subtract: | |

| | | |

| | |

| Purchases of property and equipment | |

| (1,071 | ) | |

| (1,130 | ) |

| Capitalization of internal use software | |

| (17,282 | ) | |

| (4,857 | ) |

| Purchase of intangible assets | |

| (3,592 | ) | |

| - | |

| Free Cash Flow | |

| (194,990 | ) | |

| (295,773 | ) |

| | |  |

| | | 21 |

fuboTV

Inc.

Reconciliation

of Net Loss Attributable to Common Shareholders to Non-GAAP Adjusted Net Loss and Adjusted EPS

(in

thousands)

Year-over-Year

Comparison

| | |

Three Months Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

As-Reported | | |

As-Reported | |

| Net loss attributable to common shareholders | |

$ | (70,090 | ) | |

$ | (151,981 | ) |

| Subtract: | |

| | | |

| | |

| Net income (loss) from discontinued operations, net of tax | |

| 515 | | |

| (56,167 | ) |

| Net loss from continuing operations attributable to common shareholders | |

| (70,605 | ) | |

| (95,814 | ) |

| | |

| | | |

| | |

| Net loss from continuing operations attributable to common shareholders | |

| (70,605 | ) | |

| (95,814 | ) |

| Stock-based Compensation | |

| 11,764 | | |

| 9,913 | |

| Amortization of debt discount | |

| 656 | | |

| 632 | |

| Amortization of intangibles | |

| 9,282 | | |

| 8,241 | |

| Adjusted net loss from continuing operations | |

| (48,903 | ) | |

| (77,028 | ) |

| | |

| | | |

| | |

| Weighted average shares outstanding: | |

| | | |

| | |

| Basic and diluted | |

| 294,737,521 | | |

| 200,129,461 | |

| | |

| | | |

| | |

| Adjusted EPS from continuing operations | |

$ | (0.17 | ) | |

$ | (0.39 | ) |

| | |  |

| | | 22 |

fuboTV

Inc.

Reconciliation

of Net Loss Attributable to Common Shareholders to Non-GAAP Adjusted Net Loss and Adjusted EPS

(in

thousands)

Full

Year Comparison

| | |

Years Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

As-Reported | | |

As-Reported | |

| Net loss attributable to common shareholders | |

$ | (287,454 | ) | |

$ | (561,477 | ) |

| Subtract: | |

| | | |

| | |

| Net loss from discontinued operations, net of tax | |

| 5,185 | | |

| (136,874 | ) |

| Net loss from continuing operations attributable to common shareholders | |

| (292,639 | ) | |

| (424,603 | ) |

| | |

| | | |

| | |

| Net loss from continuing operations attributable to common shareholders | |

| (292,639 | ) | |

| (424,603 | ) |

| Stock-based Compensation | |

| 51,215 | | |

| 52,454 | |

| Other Non-GAAP Adj.* | |

| - | | |

| 1,701 | |

| Amortization of debt discount | |

| 2,574 | | |

| 2,476 | |

| Amortization of intangibles | |

| 35,043 | | |

| 35,484 | |

| Adjusted net loss from continuing operations | |

| (203,807 | ) | |

| (332,488 | ) |

| | |

| | | |

| | |

| Weighted average shares outstanding: | |

| | | |

| | |

| Basic and diluted | |

| 276,282,572 | | |

| 182,472,069 | |

| | |

| | | |

| | |

| Adjusted EPS from continuing operations | |

$ | (0.73 | ) | |

$ | (1.83 | ) |

*Includes

Change in fair value of warrant liabilities in 2022

| | |  |

| | | 23 |

#

# #

Contacts

Investor

Contacts:

Alison

Sternberg, Fubo

asternberg@fubo.tv

JCIR

for Fubo

ir@fubo.tv

Media

Contacts:

Jennifer

L. Press, Fubo

jpress@fubo.tv

Bianca

Illion, Fubo

billion@fubo.tv

| | |  |

| | | 24 |

Exhibit 99.2

FOR

IMMEDIATE RELEASE

FUBO’S

NORTH AMERICAN BUSINESS CLOSED Q4 2023

WITH

RECORD 1.618 MILLION PAID SUBSCRIBERS, 29% YEAR-OVER-YEAR REVENUE GROWTH; EXCEEDED GUIDANCE ACROSS KEY PERFORMANCE METRICS

NEW

YORK – MARCH 1, 2024 – FuboTV Inc. (d/b/a/ Fubo) (NYSE: FUBO), the leading sports-first live TV streaming platform, today

announced its financial results for the fourth quarter and full year ended December 31, 2023.

The

Company exceeded guidance across key financial and operating metrics in North America, posting double digit year-over-year (YoY) revenue

and subscriber growth during the fourth quarter. Fubo ended the quarter with 1.618 million paid subscribers, up 12% YoY, and $402 million

in total revenue, up 29% YoY. Ad revenue in the quarter also increased double digits, closing at $38.6 million, up 15% YoY. Furthermore,

ad revenue grew 14% for the full year 2023, totaling $114 million, despite an overall challenged ad market in 2023. Additionally, Fubo

achieved an all-time high $86.65 average revenue per user (ARPU), up 15% YoY, and 10% gross margin, representing an 888 basis points

(bps) YoY improvement.

In

the Rest of World (ROW), Fubo delivered $8.4 million total revenue, up 18% year-over-year, and 406,000 paid subscribers, down 3% year-over-year,

during the quarter. ARPU was $6.81, up 12% YoY. ROW includes the results of Molotov, the French live TV streaming service acquired by

Fubo in December 2021.

During

the quarter, Fubo achieved YoY improvement in net loss of $25 million and a $19 million improvement in net cash used in operating activities.

Fubo also achieved a $15 million improvement in Free Cash Flow and a $25 million improvement in Adjusted EBITDA (AEBITDA), when compared

to the fourth quarter of 2022. These improvements were a result of the Company’s ongoing efforts to drive operating leverage across

the business, and represent the fourth consecutive quarter of YoY improvements in these metrics.

Fubo

continued to maintain a strong balance sheet and healthy liquidity position, ending the quarter with $251 million in cash, cash equivalents

and restricted cash. Fubo believes it has sufficient liquidity to fund its current operating plan and the momentum necessary to reach

its 2025 positive cash flow goal.

Guidance

North

America

For

the first quarter 2024, Fubo is forecasting 1.415 million-1.435 million paid subscribers, representing 11% YoY growth at the midpoint,

and $365 million-$375 million total revenue, representing 17% YoY growth at the midpoint.

For

the full year 2024, Fubo is guiding to 1.665 million-1.685 million paid subscribers, representing 4% YoY growth at the midpoint, and

$1.505 billion-$1.525 billion total revenue, representing 13% YoY growth at the midpoint.

Fubo’s

projection of revenue growth outpacing subscriber growth reflects the Company’s continued expectation of ARPU expansion as the

result of improved unit economics and margin gains. Subscriber growth reflects conservatism in the Company’s outlook and, in particular,

exposure to potential industry volatility, as well as Fubo’s intention to maintain discipline in subscriber acquisition costs relative

to monetization.

ROW

For

the first quarter 2024, the Company is forecasting 380,000-385,000 paid subscribers, representing 1% YoY growth at the midpoint, and

$6.6 million-$8.6 million total revenue, representing a -2% YoY decline at the midpoint.

For

the full year 2024, Fubo is guiding to 390,000-410,000 paid subscribers, representing a -2% YoY decline at the midpoint, and $31 million-$35

million total revenue, representing 2% YoY growth at the midpoint.

Complete

fourth quarter and full year 2023 results are detailed in Fubo’s shareholder letter available on the company’s IR

site.

“The

fourth quarter capped a great year for Fubo, as we again exceeded guidance across key financial and operational metrics,” said

David Gandler, co-founder and CEO, Fubo. “Our strong results in North America included 12% year-over-year growth in subscribers,

29% year-over-year revenue growth and a record $86.65 average revenue per user (ARPU). The quarter also marked a healthy year-over-year

improvement in profitability and cash usage, reflecting the success of our continuing initiatives focused on adding efficiency across

our operations. We remain confident in achieving our 2025 positive cash flow goal.”

Gandler

continued: “The results for the fourth quarter and full year 2023 demonstrate that Fubo continues to execute on our long-term strategy

and that we are well positioned to capitalize on our aggregated and curated sports-centric entertainment offering, leveraging the evolving

trends across the media and consumer landscape. These results are especially impressive given the years-long challenges Fubo has faced

as a result of what we believe have been anticompetitive practices by The Walt Disney Company, FOX Corp. and Warner Bros. Discovery.

As evident in the antitrust lawsuit we filed against these parties last month, their proposed sports streaming joint venture is only

the latest example of the pernicious practices they have inflicted to suppress our business and harm consumers. We are asking for an

opportunity to compete fairly as a business, and to offer consumers a streaming option that gives them the channels they want, and at

a fair price. Going forward, despite these challenges, consumers should still expect a compelling sports-centric entertainment offering,

and investors should expect Fubo to continue to execute well against our stated business objectives.”

“Fubo

enters 2024 with good momentum and with meaningful improvements across just about every facet of our business, reaffirming our confidence

in our 2025 positive cash flow goal,” said Edgar Bronfman Jr., executive chairman, Fubo. “We expect both top-line growth

across revenue and subscribers as well as further leverage in our expenses. Fubo continues to execute on our long-term strategy to provide

an aggregated and curated sports-centric entertainment offering to our customers. We believe that a sports-first live TV streaming experience

should benefit all market participants, and we strive to be champions of the consumer on this front.”

Live

Webcast

CEO,

Gandler and CFO, John Janedis will host a live conference call today at 8:30 a.m. ET to deliver brief remarks followed by Q&A. The

live webcast will be available on the Events & Presentations page of Fubo’s investor relations website. An archived

replay will be available on Fubo’s website following the call. Participants should join the call 10 minutes in advance to ensure

that they are connected prior to the event.

About

Fubo

With

a global mission to aggregate the best in TV, including premium sports, news and entertainment content, through a single app, FuboTV

Inc. (d/b/a Fubo) (NYSE: FUBO) aims to transcend the industry’s current TV model. The company operates Fubo in the U.S., Canada

and Spain and Molotov in France.

In

the U.S., Fubo is a sports-first cable TV replacement product that aggregates more than 300 live sports, news and entertainment networks

and is the only live TV streaming platform with every Nielsen-rated sports channel (source: Nielsen Total Viewers, 2023). Leveraging

Fubo’s proprietary data and technology platform optimized for live TV and sports viewership, subscribers can engage with the content

they are watching through an intuitive and personalized streaming experience. Fubo has continuously pushed the boundaries of live TV

streaming. It was the first virtual MVPD to launch 4K streaming and MultiView, which it did years ahead of its peers, as well as Instant

Headlines, a first-of-its-kind AI feature that generates contextual news topics as they are reported live on air.

Learn

more at https://fubo.tv

Basis

of Presentation – Continuing Operations

In

connection with the dissolution of Fubo Gaming, Inc. and termination of Fubo Sportsbook, the assets and liabilities and the operations

of our former wagering reportable segment are presented as discontinued operations in our consolidated financial statements. With respect

to our continuing operations, we operate as a single reportable segment. Financial information presented in this release reflects Fubo’s

results on a continuing operations basis, which excludes our former wagering reportable segment.

Key

Performance Metrics and Non-GAAP Measures

Paid

Subscribers

We

believe the number of paid subscribers is a relevant measure to gauge the size of our user base. Paid subscribers (“subscribers”)

are total subscribers that have completed registration with Fubo, have activated a payment method (only reflects one paying user per

plan), from which Fubo has collected payment in the month ending the relevant period. Users who are on a free (trial) period are not

included in this metric.

Average

Revenue per User (ARPU)

Beginning

in the third quarter of 2022, Average Revenue Per User (ARPU) is calculated using GAAP Subscription revenue and GAAP Advertising revenue.

Previously, ARPU was calculated using Platform Bookings, which consisted of GAAP Subscription revenue and GAAP Advertising revenue, adjusted

for deferred revenue.

We

believe ARPU provides useful information for investors to gauge the revenue generated per subscriber on a monthly basis. ARPU, with respect

to a given period, is defined as total Subscription revenue and Advertising revenue recognized in such period, divided by the average

daily paid subscribers in such period, divided by the number of months in such period. Advertising revenue, like Subscription revenue,

is primarily driven by the number of subscribers to our platform and per-subscriber viewership such as the type of, and duration of,

content watched on platform. We believe ARPU is an important metric for both management and investors to evaluate the Company’s

core operating performance and measure our subscriber monetization, as well as evaluate unit economics, payback on subscriber acquisition

cost and lifetime value per subscriber. In addition, we believe that presenting a geographic breakdown for North America ARPU and ROW

ARPU allows for a more meaningful assessment of the business because of the significant differences in both Subscription revenue and

Advertising revenue generated on a per subscriber basis in North America when compared to ROW due to our current subscription pricing

models and advertising monetization in the two geographic regions.

Adjusted

EBITDA

Adjusted

EBITDA is a non-GAAP measure defined as Net Loss from Continuing Operations, adjusted for depreciation and amortization, stock-based

compensation, income tax benefit, other expenses, and one-time non-cash expenses.

Gross

Profit and Gross Margin (GAAP)

Gross Profit is defined as Revenue less Subscriber related expenses and Broadcasting and transmission. Gross Margin is defined

as Gross Profit divided by Revenue. We believe these measures are useful because they represent key profitability metrics for our business

and are used by management to evaluate the performance of our business, including measuring the cost to deliver our product to subscribers

against revenue.

Free

Cash Flow

Free Cash Flow is a non-GAAP measure defined as net cash used in operating activities -

continuing operations, reduced by capital expenditures (consisting of purchases of property and equipment), purchases of intangible assets

and capitalization of internal use software. We believe Free Cash Flow is an important liquidity measure of the cash that is available

for operational expenses, investments in our business, strategic acquisitions, and for certain other activities such as repaying debt

obligations and stock repurchases. Free Cash Flow is a key financial indicator used by management. Free Cash Flow is useful to investors

as a liquidity measure because it measures our ability to generate or use cash. The use of Free Cash Flow as an analytical tool has limitations

due to the fact that it does not represent the residual cash flow available for discretionary expenditures. Because of these limitations,

Free Cash Flow should be considered along with other operating and financial performance measures presented in accordance with GAAP..

Reconciliation

of Key Performance Metrics and Non-GAAP Financial Measures

Certain

measures used in this release, including Adjusted EBITDA and Free Cash Flow, are non-GAAP financial measures. We believe these are useful

financial measures for investors as they are supplemental measures used by management in evaluating our core operating performance. Our

non-GAAP financial measures have limitations as analytical tools and you should not consider them in isolation or as a substitute for

an analysis of our results under GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus

their nearest GAAP equivalents. First, these non-GAAP financial measures are not a substitute for GAAP financial measures. Second, these

non-GAAP financial measures may not provide information directly comparable to measures provided by other companies in our industry,

as those other companies may calculate their non-GAAP financial measures differently.

The

following tables include reconciliations of the non-GAAP financial measures used in this press release to their most directly comparable

GAAP financial measures. The tables also include reconciliations of GAAP Subscription revenue and GAAP Advertising revenue to North America

ARPU and ROW ARPU, respectively, each of which is a key performance metric.

fuboTV

Inc.

Reconciliation

of GAAP Subscription and Advertising Revenue to North America ARPU

(in

thousands, except average subscribers and average per user amounts)

Year-over-Year

Comparison

| | |

Three Months Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

As-Reported | | |

As-Reported | |

| Subscription Revenue (GAAP) | |

$ | 370,087 | | |

$ | 284,864 | |

| Advertising Revenue (GAAP) | |

| 38,987 | | |

| 33,853 | |

| Subtract: | |

| | | |

| | |

| ROW Subscription Revenue | |

| (8,042 | ) | |

| (6,892 | ) |

| ROW Advertising Revenue | |

| (382 | ) | |

| (277 | ) |

| Total | |

| 400,650 | | |

| 311,548 | |

| Divide: | |

| | | |

| | |

| Average Subscribers (North America) | |

| 1,541,290 | | |

| 1,380,956 | |

| Months in Period | |

| 3 | | |

| 3 | |

| North America Monthly Average Revenue per User (NA ARPU) | |

$ | 86.65 | | |

$ | 75.20 | |

fuboTV

Inc.

Reconciliation

of Net Loss from Continuing Operations to Non-GAAP Adjusted EBITDA

(in

thousands)

Year-over-Year

Comparison

| | |

Three Months Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

As-Reported | | |

As-Reported | |

| Reconciliation of Net Loss from Continuing Operations to Adjusted EBITDA | |

| | | |

| | |

| Net loss from continuing operations | |

$ | (71,042 | ) | |

$ | (95,915 | ) |

| Depreciation and amortization | |

| 9,638 | | |

| 8,557 | |

| Stock-based compensation | |

| 11,764 | | |

| 9,913 | |

| Other income (expense) | |

| (654 | ) | |

| 2,530 | |

| Income tax benefit | |

| (397 | ) | |

| (516 | ) |

| Adjusted EBITDA | |

| (50,691 | ) | |

| (75,431 | ) |

| | |

| | | |

| | |

| Adjusted EBITDA | |

| (50,691 | ) | |

| (75,431 | ) |

| Divide: | |

| | | |

| | |

| Revenue | |

| 410,181 | | |

| 319,315 | |

| Adjusted EBITDA Margin | |

| -12.4 | % | |

| -23.6 | % |

fuboTV

Inc.

Reconciliation

of Net Cash Used in Operating Activities - Continuing Operations to Free Cash Flow

(in

thousands)

Year-over-Year

Comparison

| | |

Three Months Ended | |

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

As-Reported | | |

As-Reported | |

| Net cash used in operating activities - continuing operations | |

$ | (57 | ) | |

$ | (19,118 | ) |

| Subtract: | |

| | | |

| | |

| Purchases of property and equipment | |

| (696 | ) | |

| (99 | ) |

| Capitalization of internal use software | |

| (4,407 | ) | |

| (1,338 | ) |

| Purchase of intangible assets | |

| (693 | ) | |

| - | |

| Free Cash Flow | |

| (5,853 | ) | |

| (20,555 | ) |

Cautionary

Note Regarding Forward-Looking Statements

This

press release contains forward-looking statements of FuboTV Inc. (“Fubo”) that involve substantial risks and uncertainties.

All statements contained in this press release that do not relate to matters of historical fact are forward-looking statements within

the meaning of The Private Securities Litigation Reform Act of 1995, including statements regarding our business strategy and plans,

industry trends, anticompetitive practices among our competitors and our response plan, our anticipated cash requirements, our financial

condition, our anticipated financial performance, including quarterly and annual guidance and our expectations regarding profitability

and becoming cash flow positive in 2025. The words “could,” “will,” “plan,” “intend,”

“anticipate,” “approximate,” “expect,” “potential,” “believe” or the negative

of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements

contain these identifying words. Actual results or events could differ materially from the plans, intentions and expectations disclosed

in the forward-looking statements that Fubo makes due to a number of important factors, including but not limited to the following: our

ability to achieve or maintain profitability; risks related to our access to capital and fundraising prospects to fund our financial