Form 8-K - Current report

February 29 2024 - 5:23PM

Edgar (US Regulatory)

false

0001297937

0001297937

2024-02-29

2024-02-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

| February

29, 2024 (February 26, 2024) |

|

000-51254 |

| Date

of Report (Date of earliest event reported) |

|

Commission

File Number |

PARKS!

AMERICA, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

91-0626756 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification

Number) |

1300

Oak Grove Road

Pine

Mountain, GA 31822

(Address

of Principal Executive Offices) (Zip Code)

(706)

663-8744

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(g) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

PRKA |

|

OTCPink |

Item

5.07. Submission of Matters to a Vote of Security Holders

On

February 26, 2024, Parks! America, Inc. (the “Company”) held a Special Meeting of Stockholders (“Special Meeting”),

related to a demand letter submitted to the Company on December 22, 2023 by Focused Compounding Fund, LP (“Focused Compounding”).

On December 30, 2023, the Company provided notice of the Special Meeting pursuant to Section 3.6(b) of the Company’s Bylaws, as

adopted by the Company’s Board of Directors (the “Board”) on January 30, 2004, and as revised June 12, 2012 (the “Bylaws”).

The Special Meeting was held for the purpose of asking stockholders to consider and vote upon five proposals submitted by Focused Compounding

(collectively, the “Focused Compounding Proposals”).

At

the close of business on February 8, 2024, the record date for the determination of shareholders entitled to vote at the Special Meeting,

there were 75,726,851 shares of Common Stock issued and outstanding, each share being entitled to one vote. At the Special Meeting, the

holders of 63,354,186 shares of the Company’s Common Stock, or approximately 83.7% of the outstanding Common Shares, were represented

in person or by proxy, and, therefore, a quorum was present.

At

the Special Meeting, the Company’s shareholders voted on the following Focused Compounding Proposals:

| |

1.

|

Proposal

1: Repeal any provision of the

Bylaws, including any amendments thereto, in effect at the time this Proposal becomes effective, which was not included in the Bylaws

that were in effect as of June 12, 2012 and were filed with the U.S. Securities and Exchange Commission (the “SEC”) on

July 16, 2012 (the “Bylaw Restoration Proposal”) to restore the Bylaws to their current form if the Board attempts to

amend them in any manner prior to the completion of Focused Compounding’s proxy solicitation; |

The

results of the vote were as follows:

| Votes For | |

Votes Against | | |

Abstentions | |

| 36,457,178 | |

| 26,887,763 | | |

| 9,245 | |

| |

2. |

Proposal

2: Subject to the concurrent approval

of the Bylaw Amendment Proposal and the Election Proposal (each as defined below), remove each of the following individuals from

the Board pursuant to Section 4.9(a) of the Bylaws; |

The

results of the vote were as follows:

| Nominees for Removal | |

Votes For | | |

Votes Against | | |

Abstentions | |

| 2(a) Lisa Brady | |

| 36,451,618 | | |

| 26,895,823 | | |

| 6,745 | |

| 2(b) Todd White | |

| 36,452,318 | | |

| 26,895,123 | | |

| 6,745 | |

| 2(c) Dale Van Voorhis | |

| 36,446,318 | | |

| 26,901,123 | | |

| 6,745 | |

| 2(d) John Gannon | |

| 36,452,318 | | |

| 26,895,123 | | |

| 6,745 | |

| 2(e) Charles Kohnen | |

| 36,452,318 | | |

| 26,895,123 | | |

| 6,745 | |

| 2(f) Jeffery Lococo | |

| 36,445,118 | | |

| 26,902,323 | | |

| 6,745 | |

| 2(g) Rick Ruffolo | |

| 36,451,118 | | |

| 26,896,323 | | |

| 6,745 | |

Because

Proposal 2 required approval by a two-thirds vote of shareholders, Proposal 2 was not passed and none of the above individuals

were removed from the Board.

| |

3.

|

Proposal

3: Subject to the concurrent approval

of each Removal Proposal and the Election Proposal, amend and restate Section 4.7 of the Bylaws (the “Bylaw Amendment Proposal”)

to read as follows: |

“4.7

Vacancy on Board of Directors. In case of a vacancy on the Board of Directors because of a director’s resignation, removal

or other departure from the board, or because of an increase in the number of directors, the remaining directors, by majority vote, may

elect a successor to hold office for the unexpired term of the director whose position is vacant, and until the election and qualification

of a successor. In the event any directors are removed by a vote of the shareholders, then the shareholders shall have the right to elect

successors to hold office for the unexpired term of the director or directors whose positions are vacant, and until the election and

qualification of their successors.”

The

results of the vote were as follows:

| Votes For | |

Votes Against | | |

Abstentions | |

| 36,405,147 | |

| 26,936,419 | | |

| 12,170 | |

Because

Proposal 3 required concurrent approval of Proposal 2 (which did not occur), Proposal 3 was not passed.

| |

4. |

Proposal

4: Subject to the concurrent approval

of each Removal Proposal and the Bylaw Amendment Proposal, elect each of the following individuals as a member of the Board (the

“Election Proposal): |

The

results of the vote were as follows:

| Nominees for Election | |

Votes For | | |

Votes Against | | |

Abstentions | |

| 4(a) Andrew Kuhn | |

| 36,494,677 | | |

| 26,844,316 | | |

| 15,193 | |

| 4(b) Geoff Gannon | |

| 35,804,701 | | |

| 27,532,292 | | |

| 17,193 | |

| 4(c) James Ford | |

| 35,804,426 | | |

| 27,553,967 | | |

| 15,793 | |

Because

Proposal 4 required concurrent approval of Proposal 2 (which did not occur), Proposal 4 was not passed.

| |

5.

|

Proposal

5:

Authorize Focused Compounding, or an authorized representative thereof, to adjourn the Special Meeting to a later date or dates,

if necessary or appropriate, to permit further solicitation and vote of proxies in the event there are insufficient votes for, or

otherwise in connection with, any of the Bylaw Restoration Proposal, the Removal Proposals, the Bylaw Amendment Proposal or the Election

Proposal (the “Adjournment Proposal”). |

The

results of the vote were as follows:

| Votes For | |

Votes Against | | |

Abstentions | |

| 36,343,593 | |

| 27,000,196 | | |

| 10,397 | |

Focused

Compounding did not adjourn the Special Meeting to a later date.

Item

9.01. Financial Statements and Exhibits.

(a)

Financial statements of businesses acquired:

Not

applicable

(b)

Pro forma financial information:

Not

applicable

(c)

Shell company transactions:

Not

applicable

(d)

Exhibits:

| Exhibit

No. |

|

Description

of Exhibit |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

February 29, 2024

| |

PARKS!

AMERICA, INC. |

| |

|

|

| |

By: |

/s/

Todd R. White |

| |

Name: |

Todd

R. White |

| |

Title: |

Chief

Financial Officer |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

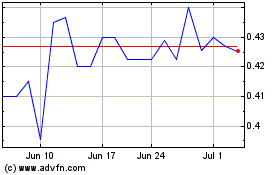

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From Apr 2023 to Apr 2024