Filed by: Everi Holdings Inc.

(Commission File No.: 001-32622)

pursuant to Rule 425 under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Subject Company: Everi Holdings Inc.

(Commission File No.: 001-32622)

Everi Holdings Inc.

Employee Video Transcript

Mike Rumbolz

This is a red-letter day for Everi. Today begins an exciting new chapter in our Company’s continuing journey to become a leading provider of games, systems and FinTech products and services to the casino industry. The proposed merger we announced seeks to combine Everi with IGT’s Global Gaming and PlayDigital businesses. The purpose is to provide an enhanced industry presence, growth opportunities, and avenues for innovation as a combined company. Together we expect to be part of an over 6 billion dollar global enterprise that is expected to generate approximately 2.6 billion dollars in revenues. Upon closing, the combined company will be re-named International Game Technology, Inc.

Regarding our corporate leadership. Once the proposed merger closes, we expect to welcome Vincent Sadusky as our new CEO and Fabio Celadon as our new CFO, both are from the IGT team. Randy and I both expect to transition to the Board of Directors and will continue to help guide our overall strategic direction. Mark Labay is expected to transition from CFO to a role leading the integration of the two companies. We believe this integration at the executive level will provide a crucial, unified vision and effective governance of our newly merged entity.

In closing, I want to emphasize that this proposed merger with IGT is a monumental step forward for all of us. It is an opportunity to enhance our combined capabilities and achieve even greater success. It has been YOUR hard work, dedication, and resilience that have brought us to this point, and it will be your continuing hard work, dedication and resilience that propels us forward into an exciting future.

Randy Taylor

Hello, Everi-one,

Firstly, l want to discuss the strategic reasons behind this proposed merger. Our goal has always been to enhance our business and increase profitability. IGT's global reach, impressive track record, and expertise, particularly in the Digital and Gaming sectors, complement our strengths. This proposed merger is a strategic move expected to create additional value for our stakeholders. We also anticipate significant upside for FinTech and Loyalty as complementary pieces to their strong Digital and Systems businesses.

Many of you have questions about what this means for our day-to-day operations and your roles within the company. Let me assure you, in the short term, it's business as usual. Our focus remains on fulfilling our existing commitments, achieving our operating priorities and accomplishing our financial goals for 2024.

Some of you may ask, “What does this mean for me?” The answer will seem simple, but it is powerfully true. Please keep doing a great job in your roles. We still need to perform to a level expected by our customers.

A smooth cultural integration is essential. Both Everi and IGT have a history of fostering positive work environments. Our leadership is focused on preserving and enhancing the best aspects of both organizations' cultures. We'll engage in open dialogue, adapt as necessary, and aim to emerge stronger, with a unified vision and values.

On the operational front, while we anticipate no immediate changes, as always, we will continue to review and refine our operations to remain competitive. Any adjustments will be communicated clearly and with ample support for our teams.

We recognize that throughout this process, communication is critical. We are establishing a dedicated SharePoint site and an email inbox for your questions and concerns. We encourage you to stay engaged, provide feedback, and participate in this dialogue.

Measuring our success during this transition involves balancing our ongoing business objectives with the proposed merger's demands on our time and efforts. Your leadership, adaptability, and commitment to excellence will drive our success.

Our commitment to our customers and ongoing projects remains unwavering. We will maintain the high-quality service and performance our customers and patrons expect, targeting a seamless transition.

I am excited to introduce you to Vince Sadusky who will be named CEO of our merged companies upon closing. As we explored this opportunity to join together, I have gotten to know Vince and am impressed by his leadership, strategic vision and value on culture. My plan is to become a Board Member of the combined company upon the merger and continue my commitment to our employees, our shareholders, and our customers.

I will now turn things over to Vince, who will provide some brief words.

Vince Sadusky

Hello everyone!

First, I would like to thank all the talented individuals from both companies who worked tirelessly to evaluate and support the combination we announced today.

I’ve had the good fortune to lead several multibillion-dollar public companies, including the merger of two large media companies. I can honestly say this combination of Everi and IGT Global Gaming and PlayDigital is the one I am most excited about. This is a great opportunity to create the leading gaming and Fintech company.

The combination of our leading, complementary products provides the foundation for us to achieve our goal of being the most fun and exciting supplier of B2B gaming equipment, content and solutions.

I am absolutely confident that by working together, we will create great value for shareholders, customers, and all of us.

Over the upcoming months we will collaborate and plan for the future of our new organization. I am really excited for the closing, when we all will be one team.

I look forward to meeting each one of you in the coming months. Thank you.

Additional Information and Where to Find It

In connection with the proposed transaction (the “Proposed Transaction”) between Everi Holdings Inc. (“Everi”), International Game Technology PLC (“IGT”), Ignite Rotate LLC (“Spinco”) and Ember Sub LLC (“Merger Sub”), Everi, IGT and Spinco will file relevant materials with the Securities and Exchange Commission (“SEC”). Everi will file a registration statement on Form S-4 that will include a joint proxy statement/prospectus relating to the Proposed Transaction, which will constitute a proxy statement and prospectus of Everi and a proxy statement of IGT. A definitive proxy statement/prospectus will be mailed to stockholders of Everi and a definitive proxy statement will be mailed to shareholders of IGT. INVESTORS AND SECURITY HOLDERS OF EVERI ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, AND INVESTORS AND SECURITY HOLDERS OF IGT ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT EVERI, IGT AND SPINCO, AND THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by Everi or IGT through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Everi will be available free of charge on Everi’s website at www.everi.com or by contacting Everi’s Investor Relations Department at Everi Holdings Inc., Investor Relations, 7250 S. Tenaya Way, Suite 100, Las Vegas, NV 89113. Copies of the documents filed with the SEC by IGT will be available free of charge on IGT’s website at www.igt.com or by contacting IGT’s Investor Relations Department at International Game Technology PLC, Investor Relations, 10 Memorial Boulevard, Providence, RI 02903.

No Offer or Solicitation

This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell, any securities of Everi, IGT, Spinco or Merger Sub, or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the Proposed Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), and otherwise in accordance with applicable law.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of Everi or IGT. However, Everi and IGT and each of their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the Proposed Transaction. Information about the directors and executive officers of Everi may be found in its most recent Annual Report on Form 10-K and in its most recent proxy statement for its annual meeting of stockholders, in each case as filed with the SEC. Information about the directors, executive officers and

members of senior management of IGT is set forth in its most recent Annual Report on Form 20-F as filed with the SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, related to Everi, IGT and the proposed spin-off of IGT’s Global Gaming and PlayDigital businesses (the “Spinco Business”), and the proposed acquisition of the Spinco Business by Everi. All statements other than statements of historical fact are forward-looking statements for purposes of federal and state securities laws. These forward-looking statements involve risks and uncertainties that could significantly affect the financial or operating results of Everi, IGT, the Spinco Business, or the combined company. These forward-looking statements may be identified by terms such as “anticipate,” “believe,” “foresee,” “estimate,” “expect,” “intend,” “plan,” “project,” “forecast,” “may,” “will,” “would,” “could” and “should” and the negative of these terms or other similar expressions. Forward-looking statements in this communication include, among other things, statements about the potential benefits and synergies of the Proposed Transaction, including enhancement of Everi’s industry position, increase of profitability, broadening of Everi’s products and service offerings, creation of additional value, growth opportunities for the combined company, and avenues of innovation; the integration process; leadership and governance of the combined company, future financial and operating results, goals, objectives and expectations; and the anticipated timing of closing of the Proposed Transaction. In addition, all statements that address operating performance, events or developments that Everi or IGT expects or anticipates will occur in the future — including statements relating to creating value for stakeholders, benefits of the Proposed Transaction to customers, employees, stakeholders and other constituents of the combined company and IGT, separating and integrating the companies, cost savings and the expected timetable for completing the Proposed Transaction — are forward-looking statements. These forward-looking statements involve substantial risks and uncertainties that could cause actual results, including the actual results of Everi, IGT, the Spinco Business, or the combined company, to differ materially from those expressed or implied by such statements. These risks and uncertainties include, among other things, risks related to the possibility that the conditions to the consummation of the Proposed Transaction will not be satisfied (including the failure to obtain necessary regulatory, stockholder and shareholder approvals or any necessary waivers, consents, or transfers, including for any required licenses or other agreements) in the anticipated timeframe or at all; risks related to the ability to realize the anticipated benefits of the Proposed Transaction, including the possibility that Everi and IGT may be unable to achieve the expected benefits, synergies and operating efficiencies in connection with the Proposed Transaction within the expected timeframes or at all and to successfully separate and/or integrate the Spinco Business; the ability to retain key personnel; negative effects of the announcement or the consummation of the proposed acquisition on the market price of the capital stock of Everi and IGT and on Everi’s and IGT’s operating results; risks relating to the value of Everi’s shares to be issued in the Proposed Transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement relating to the Proposed Transaction (the “Merger Agreement”); changes in the extent and characteristics of the common stockholders of Everi and ordinary shareholders of IGT and its effect pursuant to the Merger Agreement for the Proposed Transaction on the number of shares of Everi’s common stock issuable pursuant to the Proposed Transaction, magnitude of the dividend payable to Everi’s stockholders pursuant to the Proposed Transaction and the extent of indebtedness to be incurred by Everi in connection with the Proposed Transaction; significant transaction costs, fees, expenses and charges (including unknown liabilities and risks relating to any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects); operating costs, customer loss, and business disruption (including, without limitation, difficulties in maintaining employee, customer, or other business, contractual, or operational relationships following the Proposed Transaction announcement or closing of the Proposed Transaction); failure to consummate or delay in consummating the Proposed Transaction for any reason; risks related to competition in the gaming and lottery industry; issues and costs arising from the separation and integration of acquired companies and businesses and the timing and impact of accounting adjustments; risks related to the financing of the Proposed Transaction, Everi’s overall debt levels and its ability to repay principal and interest on its outstanding debt, including debt assumed or incurred in connection with the Proposed Transaction; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies and other external factors that Everi and IGT cannot control; regulation and litigation matters relating to the Proposed Transaction or otherwise impacting Everi, IGT, Spinco, the combined company or the gaming industry generally; unanticipated liabilities of acquired businesses; unanticipated adverse effects or liabilities from business divestitures; effects on earnings of any significant impairment of goodwill or intangible assets; risks related to intellectual property, privacy matters, and cyber security (including losses and other consequences from failures, breaches, attacks, or disclosures involving information technology infrastructure and data); other business effects (including the effects of industry, market, economic, political, or regulatory conditions); and other risks and uncertainties, including, but not limited to, those described in Everi’s Annual Report on Form 10-K on file with the SEC and from time to time in other filed reports including Everi’s Quarterly Reports on Form 10-Q, and those described in IGT’s Annual Report on Form 20-F on file with the SEC and from time to time in other filed reports including IGT’s Current Reports on Form 6-K.

A further description of risks and uncertainties relating to Everi can be found in its most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and relating to IGT can be found in its most recent Annual Report on Form 20-F and Current Reports on Form 6-K, all of which are filed with the SEC and available at www.sec.gov.

Everi does not intend to update forward-looking statements as the result of new information or future events or developments, except as required by law.

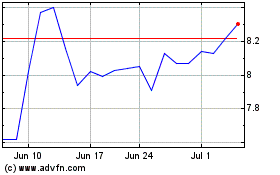

Everi (NYSE:EVRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

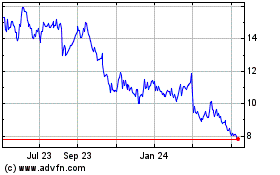

Everi (NYSE:EVRI)

Historical Stock Chart

From Apr 2023 to Apr 2024