0001447028 False 0001447028 2024-02-29 2024-02-29 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 29, 2024

_______________________________

Arbutus Biopharma Corporation

(Exact name of registrant as specified in its charter)

_______________________________

| British Columbia, Canada | 001-34949 | 98-0597776 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

701 Veterans Circle

Warminster, Pennsylvania 18974

(Address of Principal Executive Offices) (Zip Code)

(267) 469-0914

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, without par value | ABUS | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 29, 2024, Arbutus Biopharma Corporation (the “Company”) issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2023 and certain other information. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

Item 8.01. Other Events.

On February 29, 2024, the Company posted an updated corporate presentation on its website at www.arbutusbio.com. A copy of the presentation is filed herewith as Exhibit 99.2 and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | Arbutus Biopharma Corporation |

| | | |

| | | |

| Date: February 29, 2024 | By: | /s/ David C. Hastings |

| | | David C. Hastings |

| | | Chief Financial Officer |

| | | |

EXHIBIT 99.1

Arbutus Reports Fourth Quarter and Year End 2023 Financial Results and Provides Corporate Update

On-track to report key clinical data in 2024 from two on-going Phase 2a clinical trials with imdusiran and the Phase 1a/1b clinical trial with AB-101

Plans to initiate a third Phase 2a clinical trial with imdusiran in first half of 2024

Claim Construction for Moderna LNP litigation occurred on February 8, 2024; trial date set for April 21, 2025

Strong financial position with cash and investments of $132M; cash runway into Q1 2026

Conference Call and Webcast Today at 8:45 am ET

WARMINSTER, Pa., Feb. 29, 2024 (GLOBE NEWSWIRE) -- Arbutus Biopharma Corporation (Nasdaq: ABUS) (“Arbutus” or the “Company”), a clinical-stage biopharmaceutical company leveraging its extensive virology expertise to develop a functional cure for people with chronic hepatitis B virus (cHBV) infection, today reports fourth quarter and year end 2023 financial results and provides a corporate update.

“I anticipate that 2024 will be a productive year for Arbutus as we continue to advance the development of our HBV assets: imdusiran, our RNAi therapeutic, and AB-101, our oral checkpoint inhibitor,” said Michael J. McElhaugh, Interim President and Chief Executive Officer of Arbutus Biopharma. “To date, we have dosed more than 170 HBV patients with imdusiran and continue to see notable and sustained reductions in surface antigen. We believe that a combination therapy that reduces surface antigen, suppresses HBV DNA and boosts the host immune response will be necessary to functionally cure HBV. We are currently evaluating imdusiran with other immune modulators and expect multiple data readouts this year, including the potential to see undetectable surface antigen at end of treatment. These trials, in addition to our plans to initiate an imdusiran + durvalumab clinical trial, will help inform our later stage clinical development program in addition to the dose and dosing duration for AB-101, potentially expediting imdusiran + AB-101 combinations.”

2024 Clinical Development Milestones

Imdusiran (AB-729, RNAi Therapeutic)

- AB-729-201 is a Phase 2a clinical trial that is evaluating the safety, tolerability and antiviral activity of the combination of imdusiran, nucleos(t)ide analogue (NA) therapy and pegylated interferon alfa-2a (IFN) in patients with cHBV. Preliminary data presented at the EASL Congress in June 2023 suggest that the addition of IFN to imdusiran was generally well-tolerated and appears to result in continued HBsAg declines in some patients. Arbutus plans to announce end-of-treatment data from this trial in the first half of 2024.

- AB-729-202 is a Phase 2a clinical trial that is evaluating the safety and immunogenicity of imdusiran, NA therapy and Barinthus Bio’s (formerly Vaccitech plc) VTP-300, an HBV antigen-specific immunotherapy. Preliminary data presented at AASLD – The Liver Meeting in November 2023 showed that the combination of imdusiran and VTP-300 provided a meaningful reduction of HBsAg levels that are maintained well below baseline. In addition, a subset of patients given imdusiran and then VTP-300 showed early signs of immune activation. Arbutus plans to announce end-of-treatment data from this portion of the trial in the first half of 2024.

- AB-729-202 was amended to include an additional cohort of 20 patients who will receive imdusiran plus NA therapy for 24 weeks followed by VTP-300 plus up to two low doses of nivolumab, an approved anti-PD-1 monoclonal antibody. Preliminary data from this additional cohort are expected in the second half of 2024.

- AB-729-203 is a Phase 2a clinical trial that Arbutus intends to initiate in the first half of 2024 to evaluate the safety, tolerability and antiviral activity of intermittent low doses of durvalumab, an approved anti-PD-L1 monoclonal antibody in combination with imdusiran and NA therapy. Insights gained from this clinical trial and the amended portion of the AB-729-202 clinical trial with nivolumab, may inform dosing for the planned imdusiran plus AB-101 Phase 2 clinical trial.

AB-101 (Oral PD-L1 Inhibitor)

- AB-101-001 is a Phase 1a/1b double-blind, randomized, placebo-controlled clinical trial designed to investigate the safety, tolerability, pharmacokinetics (PK), and pharmacodynamics (PD) of single- and multiple-ascending oral doses of AB-101 for up to 28 days in healthy subjects and patients with cHBV. Arbutus is advancing AB-101 into part two of this clinical trial which involves dosing healthy subjects with multiple-ascending doses of AB-101. Arbutus expects to report preliminary data from the healthy subject portion of this clinical trial, including target engagement and receptor occupancy data, in the first half of 2024.

LNP Litigation Update:

- Arbutus continues to protect and defend its intellectual property, which is the subject of the on-going lawsuits against Moderna and Pfizer/BioNTech. The Company is seeking fair compensation for Moderna’s and Pfizer/BioNTech’s use of its patented LNP technology that was developed with great effort and at a great expense, without which Moderna and Pfizer/BioNTech’s COVID-19 vaccines would not have been successful. With respect to the Moderna lawsuit, fact discovery is on-going and the claim construction hearing occurred on February 8, 2024. According to the Court Scheduling Order, which was issued on March 21, 2023, the court is expected to issue its claim construction order within 60 days of conclusion of the claim construction hearing. Expert testimony and depositions will then follow. A trial date has been set for April 21, 2025 and is subject to the Court’s availability. The lawsuit against Pfizer/BioNTech is ongoing and a date for a claim construction hearing has not been set.

Financial Results

Cash, Cash Equivalents and Investments

As of December 31, 2023, the Company had cash, cash equivalents and investments in marketable securities of $132.3 million compared to $184.3 million as of December 31, 2022. During the year ended December 31, 2023, the Company used $85.9 million in operating activities, which was partially offset by $29.9 million of net proceeds from the issuance of common shares under its “at-the-market” offering program. The Company expects its 2024 net cash burn to range from between $63 million to $67 million, excluding any proceeds received from its “at the market” offering program. The Company believes its cash, cash equivalents and investments in marketable securities of $132.3 million as of December 31, 2023, are sufficient to fund its operations into the first quarter of 2026.

Revenue

Total revenue was $18.1 million for the year ended December 31, 2023, compared to $39.0 million for the same period in 2022. The decrease of $20.9 million was due primarily to a decrease in revenue recognition from the Company’s license agreement with Qilu, the Company’s collaboration partner in China, Hong Kong, Macau and Taiwan, based on a decrease in employee labor hours expended by the Company during 2023 compared to 2022 to perform its manufacturing obligations under the license agreement. Additionally, license royalty revenues decreased in 2023 compared to 2022 due to a decrease in Alnylam’s sales of ONPATTRO.

Operating Expenses

Research and development expenses were $73.7 million for the year ended December 31, 2023 compared to $84.4 million for the same period in 2022. The decrease of $10.7 million was due primarily to: (i) a decrease in manufacturing expenses associated with supplying drug for the Company’s clinical trials; and (ii) a decrease in clinical expenses due to the discontinuation of the Company’s AB-836 program in 2022; partially offset by (iii) an increase in clinical expenses for the Company’s ongoing AB-101 Phase 1a/1b clinical trial in 2023. General and administrative expenses were $22.5 million for the year ended December 31, 2023, compared to $17.8 million for the same period in 2022. This increase was due primarily to an increase in legal fees, non-cash stock-based compensation expense and employee compensation costs.

Net Loss

For the year ended December 31, 2023, our net loss was $72.8 million, or a loss of $0.44 per basic and diluted common share, as compared to a net loss of $69.5 million, or a loss of $0.46 per basic and diluted common share, for the year ended December 31, 2022.

Outstanding Shares

As of December 31, 2023, the Company had 169.9 million common shares issued and outstanding, as well as 20.4 million stock options and unvested restricted stock units outstanding. Roivant Sciences Ltd. owned approximately 23% of the Company’s outstanding common shares as of December 31, 2023.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF LOSS

(in thousands, except share and per share data) |

|

| | Year Ended December 31, |

| | 2023 | | | 2022 | |

| Revenue | | | | | |

| Collaborations and licenses | $ | 14,274 | | | $ | 31,366 | |

| Non-cash royalty revenue | | 3,867 | | | | 7,653 | |

| Total revenue | | 18,141 | | | | 39,019 | |

| Operating expenses | | | | | |

| Research and development | | 73,700 | | | | 84,408 | |

| General and administrative | | 22,475 | | | | 17,834 | |

| Change in fair value of contingent consideration | | 69 | | | | 2,233 | |

| Total operating expenses | | 96,244 | | | | 104,475 | |

| Loss from operations | | (78,103 | ) | | | (65,456 | ) |

| Other income (loss) | | | | | |

| Interest income | | 5,688 | | | | 2,192 | |

| Interest expense | | (459 | ) | | | (1,726 | ) |

| Foreign exchange gain | | 25 | | | | (22 | ) |

| Total other income | | 5,254 | | | | 444 | |

| Loss before income taxes | | (72,849 | ) | | | (65,012 | ) |

| Income tax expense | | — | | | | (4,444 | ) |

| Net loss | $ | (72,849 | ) | | $ | (69,456 | ) |

| Net loss per common share | | | | | |

| Basic and diluted | $ | (0.44 | ) | | $ | (0.46 | ) |

| Weighted average number of common shares | | | | | |

| Basic and diluted | | 165,960,379 | | | | 150,939,337 | |

| | | | | | | | |

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

|

| |

| | | December 31,

2023 | | December 31,

2022 |

| Cash, cash equivalents and marketable securities, current | | $ | 126,003 | | $ | 146,913 |

| Accounts receivable and other current assets | | | 6,024 | | | 4,226 |

| Total current assets | | | 132,027 | | | 151,139 |

| Property and equipment, net of accumulated depreciation | | | 4,674 | | | 5,070 |

| Investments in marketable securities, non-current | | | 6,284 | | | 37,363 |

| Right of use asset | | | 1,416 | | | 1,744 |

| Other non-current assets | | | — | | | 103 |

| Total assets | | $ | 144,401 | | $ | 195,419 |

| | | | | | | |

| Accounts payable and accrued liabilities | | $ | 10,271 | | $ | 16,029 |

| Deferred license revenue, current | | | 11,791 | | | 16,456 |

| Lease liability, current | | | 425 | | | 372 |

| Total current liabilities | | | 22,487 | | | 32,857 |

| Liability related to sale of future royalties | | | 6,953 | | | 10,365 |

| Deferred license revenue, non-current | | | — | | | 5,999 |

| Contingent consideration | | | 7,600 | | | 7,531 |

| Lease liability, non-current | | | 1,343 | | | 1,815 |

| Total stockholders’ equity | | | 106,018 | | | 136,852 |

| Total liabilities and stockholders’ equity | | $ | 144,401 | | $ | 195,419 |

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

| |

| | | Twelve Months Ended December 31, |

| | | 2023 | | | 2022 | |

| Net loss | | $ | (72,849 | ) | | $ | (69,456 | ) |

| Non-cash items | | | 5,146 | | | | 4,857 | |

| Change in deferred license revenue | | | (10,664 | ) | | | 22,455 | |

| Other changes in working capital | | | (7,569 | ) | | | 6,788 | |

| Net cash used in operating activities | | | (85,936 | ) | | | (35,356 | ) |

| Net cash provided by (used in) investing activities | | | 50,773 | | | | (74,942 | ) |

| Issuance of common shares pursuant to Share Purchase Agreement | | | — | | | | 10,973 | |

| Issuance of common shares pursuant to the Open Market Sale Agreement | | | 29,852 | | | | 20,324 | |

| Cash provided by other financing activities | | | 795 | | | | 517 | |

| Net cash provided by financing activities | | | 30,647 | | | | 31,814 | |

| Effect of foreign exchange rate changes on cash and cash equivalents | | | 25 | | | | (22 | ) |

| Decrease in cash and cash equivalents | | | (4,491 | ) | | | (78,506 | ) |

| Cash and cash equivalents, beginning of period | | | 30,776 | | | | 109,282 | |

| Cash and cash equivalents, end of period | | | 26,285 | | | | 30,776 | |

| Investments in marketable securities | | | 106,002 | | | | 153,500 | |

| Cash, cash equivalents and marketable securities, end of period | | $ | 132,287 | | | $ | 184,276 | |

| | | | | | | | | |

Conference Call and Webcast Today

Arbutus will hold a conference call and webcast today, Thursday, February 29, 2024, at 8:45 AM Eastern Time to provide a corporate update. To dial-in for the conference call by phone, please register using the following link: Registration Link. A live webcast of the conference call can be accessed through the Investors section of Arbutus' website at www.arbutusbio.com.

An archived webcast will be available on the Arbutus website after the event.

About imdusiran (AB-729)

Imdusiran is an RNA interference (RNAi) therapeutic specifically designed to reduce all HBV viral proteins and antigens including hepatitis B surface antigen, which is thought to be a key prerequisite to enable reawakening of a patient’s immune system to respond to the virus. Imdusiran targets hepatocytes using Arbutus’ novel covalently conjugated N-Acetylgalactosamine (GalNAc) delivery technology enabling subcutaneous delivery. Clinical data generated thus far has shown single and multiple doses of imdusiran to be generally safe and well-tolerated, while also providing meaningful reductions in hepatitis B surface antigen and hepatitis B DNA. Imdusiran is currently in multiple Phase 2a clinical trials.

About AB-101

AB-101 is our oral PD-L1 inhibitor candidate that we believe will allow for controlled checkpoint blockade while minimizing the systemic safety issues typically seen with checkpoint antibody therapies. Immune checkpoints such as PD-1/PD-L1 play an important role in the induction and maintenance of immune tolerance and in T-cell activation. Preclinical data generated thus far indicates that AB-101 mediates re-activation of exhausted HBV-specific T-cells from cHBV patients. We believe AB-101, when used in combination with other approved and investigational agents, could potentially lead to a functional cure in patients chronically infected with HBV. AB-101 is currently being evaluated in a Phase 1a/1b clinical trial.

About HBV

Hepatitis B is a potentially life-threatening liver infection caused by the hepatitis B virus (HBV). HBV can cause chronic infection which leads to a higher risk of death from cirrhosis and liver cancer. Chronic HBV infection represents a significant unmet medical need. The World Health Organization estimates that over 290 million people worldwide suffer from chronic HBV infection, while other estimates indicate that approximately 2.4 million people in the United States suffer from chronic HBV infection. Approximately 820,000 people die every year from complications related to chronic HBV infection despite the availability of effective vaccines and current treatment options.

About Arbutus

Arbutus Biopharma Corporation (Nasdaq: ABUS) is a clinical-stage biopharmaceutical company leveraging its extensive virology expertise to identify and develop novel therapeutics with distinct mechanisms of action, which can be combined to provide a functional cure for patients with chronic hepatitis B virus (cHBV). We believe the key to success in developing a functional cure involves suppressing HBV DNA, reducing surface antigen, and boosting HBV-specific immune responses. Our pipeline of internally developed, proprietary compounds includes an RNAi therapeutic, imdusiran (AB-729), and an oral PD-L1 inhibitor, AB-101. Imdusiran has generated meaningful clinical data demonstrating an impact on both surface antigen reduction and reawakening of the HBV-specific immune response. Imdusiran is currently in two Phase 2a combination clinical trials. AB-101 is currently being evaluated in a Phase 1a/1b clinical trial. For more information, visit www.arbutusbio.com.

Forward-Looking Statements and Information

This press release contains forward-looking statements within the meaning of the Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and forward-looking information within the meaning of Canadian securities laws (collectively, forward-looking statements). Forward-looking statements in this press release include statements about our future development plans for our product candidates; our program updates; our belief that checkpoint inhibitors may play a key role in antiviral immune tolerance in cHBV; the expected cost, timing and results of our clinical development plans and clinical trials with respect to our product candidates; our expectations with respect to clinical trial design and the release of data from our clinical trials and the expected timing thereof; our expectations and goals for our collaborations with third parties and any potential benefits related thereto; the potential for our product candidates to achieve success in clinical trials; our plans with respect to the ongoing patent litigation matters; and our expected financial condition, including the anticipated duration of cash runways, our expectations regarding our 2024 cash burn and the timing regarding our needs for additional capital.

With respect to the forward-looking statements contained in this press release, Arbutus has made numerous assumptions regarding, among other things: the effectiveness and timeliness of preclinical studies and clinical trials, and the usefulness of the data; the timeliness of regulatory approvals; the continued demand for Arbutus’ assets; and the stability of economic and market conditions. While Arbutus considers these assumptions to be reasonable, these assumptions are inherently subject to significant business, economic, competitive, market and social uncertainties and contingencies, including uncertainties and contingencies related to the ongoing patent litigation matters.

Additionally, there are known and unknown risk factors which could cause Arbutus’ actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements contained herein. Known risk factors include, among others: anticipated pre-clinical studies and clinical trials may be more costly or take longer to complete than anticipated, and may never be initiated or completed, or may not generate results that warrant future development of the tested product candidate; Arbutus may elect to change its strategy regarding its product candidates and clinical development activities; Arbutus may not receive the necessary regulatory approvals for the clinical development of Arbutus’ products; economic and market conditions may worsen; uncertainties associated with litigation generally and patent litigation specifically; it may take considerable time and expense to resolve the clinical hold that has been placed on AB-101 by the FDA, and no assurance can be given that the FDA will remove the clinical hold; Arbutus and its collaborators may never realize the expected benefits of the collaborations; and market shifts may require a change in strategic focus; Arbutus’ plans to reduce its net cash burn may not materially extend the cash runway and may create a distraction or uncertainty that may adversely affect its operating results, business, or investor perceptions; and risks related to the sufficiency of Arbutus’ cash resources and its ability to obtain adequate financing in the future for its foreseeable and unforeseeable operating expenses and capital expenditures.

A more complete discussion of the risks and uncertainties facing Arbutus appears in Arbutus’ Annual Report on Form 10-K, Arbutus’ Quarterly Reports on Form 10-Q and Arbutus’ continuous and periodic disclosure filings, which are available at www.sedar.com and at www.sec.gov. All forward-looking statements herein are qualified in their entirety by this cautionary statement, and Arbutus disclaims any obligation to revise or update any such forward-looking statements or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future results, events or developments, except as required by law.

Contact Information

Investors and Media

Lisa M. Caperelli

Vice President, Investor Relations

Phone: 215-206-1822

Email: lcaperelli@arbutusbio.com

Exhibit 99.2

NASDAQ: ABUS www.arbutusbio.com February 29, 2024 Corporate Presentation © 2024 Arbutus Biopharma, Inc.

Forward - Looking Statements This presentation contains forward - looking statements within the meaning of the U . S . Private Securities Litigation Reform Act of 1995 and Canadian securities laws . All statements that are not historical facts are hereby identified as forward - looking statements for this purpose and include, among others, statements relating to : the potential market opportunity for HBV ; Arbutus’ ability to meet a significant unmet medical need ; the sufficiency of Arbutus’ cash and cash equivalents for the anticipated durations ; the expected cost, timing and results of Arbutus’ clinical development plans and clinical trials, including its clinical collaborations with third parties ; the potential for Arbutus’ product candidates to achieve their desired or anticipated outcomes ; Arbutus’ expectations regarding the timing and clinical development of Arbutus’ product candidates, including its articulated clinical objectives ; the timeline to a combination cure for HBV ; Arbutus’ expectations regarding its technology licensed to third parties ; the expected timing and payments associated with strategic and/or licensing agreements ; the patent infringement lawsuits ; and other statements relating to Arbutus’ future operations, future financial performance, future financial condition, prospects or other future events . With respect to the forward - looking statements contained in this presentation, Arbutus has made numerous assumptions regarding, among other things : the timely receipt of expected payments ; the effectiveness and timeliness of pre - clinical studies and clinical trials, and the usefulness of the data ; the timeliness of regulatory approvals ; the continued demand for Arbutus’ assets ; and the stability of economic and market conditions . While Arbutus considers these assumptions to be reasonable, these assumptions are inherently subject to significant business, economic, competitive, market and social uncertainties, and contingencies including uncertainties and contingencies related to patent litigation matters . Forward - looking statements herein involve known and unknown risks, uncertainties and other factors that may cause the actual results, events or developments to be materially different from any future results, events or developments expressed or implied by such forward - looking statements . Such factors include, among others : anticipated pre - clinical and clinical trials may be more costly or take longer to complete than anticipated, and may never be initiated or completed, or may not generate results that warrant future development of the tested drug candidate ; changes in Arbutus’ strategy regarding its product candidates and clinical development activities ; Arbutus may not receive the necessary regulatory approvals for the clinical development of Arbutus' products ; economic and market conditions may worsen ; uncertainties associated with litigation generally and patent litigation specifically ; market shifts may require a change in strategic focus ; and the parties may never realize the expected benefits of the collaborations . A more complete discussion of the risks and uncertainties facing Arbutus appears in Arbutus' Annual Report on Form 10 - K, Quarterly Report on Form 10 - Q and Arbutus' periodic disclosure filings, which are available at www . sec . gov and at www . sedar . com . All forward - looking statements herein are qualified in their entirety by this cautionary statement, and Arbutus disclaims any obligation to revise or update any such forward - looking statements or to publicly announce the result of any revisions to any of the forward - looking statements contained herein to reflect future results, events or developments, except as required by law . 2 © 2024 Arbutus Biopharma, Inc.

Our Strategy for Value Creation Leverage the proven track record of success established with our team's expertise in understanding and treating viral infections by discovering and developing a differentiated pipeline of therapies targeting chronic HBV. Develop a combination therapy that includes antivirals and immunologics to provide a finite duration treatment for people with cHBV that results ≥20% functional cure rate. HBV: Hepatitis B Virus | cHBV: chronic HB V 3 © 2024 Arbutus Biopharma, Inc.

Investment Highlights Strong financial position Indications with significant unmet medical need & large market opportunities Patented LNP technology Portfolio of internally discovered assets with distinct MOAs Lead HBV compound – imdusiran (AB - 729) RNAi therapeutic in multiple Phase 2a combination clinical trials Team with virology expertise and proven track record Focused on developing a functional cure for HBV Cash runway into Q1 2026 Data shows imdusiran is generally safe and well - tolerated and has shown meaningful suppression of HBsAg while on - or off - treatment RNAi therapeutic PD - L1 inhibitor Receiving licensing royalties arising from Alnylam’s Onpattro ® and seeking damages from patent litigation suits filed against Moderna & Pfizer/BioNTech for COVID - 19 vaccine sales Discovered, developed & commercialized multiple drugs MOA: Mechanism of Action | PD - L1: Programmed death - ligand 1 | HBsAg: Hepatitis B surface antigen 4 © 2024 Arbutus Biopharma, Inc.

Pipeline AB - 101 cHBV NA: Nucleoside Analogue 5 Imdusiran (AB - 729) cHBV RNAi Therapeutic PD - L1 Inhibitor AB - 101 - 001 single/ multiple - ascending dose © 2024 Arbutus Biopharma, Inc. Pre - Clinical Phase 1 Phase 2 Phase 3 Marketed AB - 729 - 201 Combo trial (imdusiran + Peg - IFN α - 2a + NA) AB - 729 - 202 Combo trial (imdusiran + vaccine + NA +/ - checkpoint inhibitor) AB - 729 - 001 single - ascending/multiple - ascending dose

HBV Overview Life - threatening liver infection caused by hepatitis B virus (HBV) Transmitted through body fluids and from mother to child Long - term chronic infection ( cHBV ) leads to higher risk of cirrhosis and/or liver cancer Cause & Symptoms Diagnosis HBsAg detection Additional biomarkers necessary to determine stage of disease Treatments NA therapy – lifelong daily therapy, aimed at reducing HBV DNA and risk of cirrhosis and/or HCC Peg - IFN α – administered weekly; poorly tolerated <5% of patients achieve functional cure Rationale Need for finite and more efficacious HBV treatments that further improve long - term outcomes and increase functional cure rate Combination therapy with different MOAs will be required to reduce HBsAg, suppress HBV DNA, and boost immune system Sources for all data on slide: 1 Hepatitis B Fact Sheet, WHO https://www.who.int/news - room/fact - sheets/detail/hepatitis - b ; Hep B Foundation link https://www.hepb.org/what - is - hepatitis - b/what - is - hepb/facts - and - figures/ ; Kowdley et al. Hepatology (2012) Prevalence of Chronic Hepatitis B Among Foreign - Born Persons Living in the US by Country of Origin 2 Pegasys , PEG - Intron, Baraclude and Viread Package Inserts HBsAg : HBV Surface Antigen | HCC: Hepatocellular carcinoma 6 © 2024 Arbutus Biopharma, Inc.

Africa 60M E Mediterranean 21M SE Asia 39M W Pacific 115M EU 15M Americas 7M ~820k people die every year as a consequence despite the availability of effective vaccines and antivirals. people are chronically infected with HBV, globally. >290M >290M Chronic HBV Sources: https://www.who.int/news - room/fact - sheets/detail/hepatitis - b https://www.hepb.org/what - is - hepatitis - b/what - is - hepb/facts - and - figures/ HBV Presents a Significant Unmet Medical Need 30M 6.6M 2.3% Treated Low due to sub - optimal SOC cure rate and asymptomatic nature of disease. 10.5% Diagnosed 2M USA 15M Europ e 90M China 7 SOC: Standard of Care © 2024 Arbutus Biopharma, Inc.

Suppress Reduce Boost Viral DNA and cccDNA Pool Viral Antigen - HBsAg Host Immune System Leading to an HBV Cure 3 - Pronged Approach to Therapeutic Success Therapeutic success will require a combination of agents with complementary MOAs. Suppress HBV DNA Reduce viral antigens Boost host immune response 8 NA RNAi RNAi RNAi PD - L1 Inhibitor Interferon Therapeutic Vaccines © 2024 Arbutus Biopharma, Inc.

9 RNAi Therapeutic © 2024 Arbutus Biopharma, Inc.

Proprietary GalNAc - conjugate delivery technology provides liver targeting and enables subcutaneous dosing Single trigger RNAi agent targeting all HBV transcripts Inhibits HBV replication and lowers all HBV antigens Pan - genotypic activity across HBV genotypes Demonstrated complementarity with other agents Actively targets the liver Active against cccDNA derived and integrated HBsAg transcripts Clean profile in long term preclinical safety studies RNAi Therapeutic Imdusiran GalNAc n Linker Polymerase, Core Ag, eAg , pgRNA sAg sAg HBx 10 © 2024 Arbutus Biopharma, Inc.

11 © 2024 Arbutus Biopharma, Inc. AB - 729 - 001: Comparable mean HBsAg declines were observed in all Cohorts All Cohorts achieved at least a - 1.8 log 10 decline in mean HBsAg at the end of the treatment period (Week 48) There were no significant differences in mean HBsAg declines between the 60 mg and 90 mg doses or between different dosing in ter vals Mean HBsAg levels remained below baseline values at Week 48 Follow Up AB - 729 was well - tolerated at all dose levels and intervals, with no discontinuations due to AEs or treatment - related Grade 3 or 4 AEs Data shown are for a minimum of 5 subjects/timepoint. Last dose of AB - 729: Cohort E, Week 44; Cohorts F, I, G, K: Week 40; Cohort J: Week 36. Mean HBsAg log 10 change from baseline Mean HBsAg log 10 IU/mL change from baseline at key timepoints Treatment period Follow Up period Data shown as mean (SE) log 10 IU/mL; minimum of 5 subjects/timepoint. Last AB-729 dose Cohort E: Week 44, Cohorts F, I, G, K: Week 40, Cohort J: Week 36; HBsAg Assay LLOQ = 0.07 IU/mL; *N=6; # N=5 Visit HBV DNA- HBV DNA+ CohortE 60mg Q4W HBV DNA- (N=7) Cohort F 60mg Q8W HBV DNA- (N=7) Cohort I 90mg Q8W HBV DNA- (N=6) Cohort J 90mg Q12W HBV DNA- (N=7) Cohort K 90mg Q8W HBV DNA-, HBeAg+ only (N=7) CohortG 90mg Q8W + TDF (N=7) Baseline 3.51 (0.20) 3.53 (0.17) 3.36 (0.23) 3.37 (0.28) 3.23 (0.14) 3.14 (0.14) Treatment Week 12 -1.10 (0.15) -1.02 (0.11) -1.30 (0.19) -1.06 (0.31) -1.63 (0.39) -1.56 (0.32) Treatment Week 24 -1.84 (0.16) -1.57 (0.09) -1.79 (0.22) -1.56 (0.25) -1.99 (0.35) -1.82 (0.29) Treatment Week 48 -1.89 (0.18) -1.90 (0.14) -1.91 (0.32) -1.80 (0.41) -2.57 (0.61) -2.05 (0.31) Follow Up Week 12 -1.74 (0.20) -1.59 (0.23) -1.42 (0.26) -1.52 (0.40) -2.38 (0.75) -1.50 (0.13) Follow Up Week 24 -1.43 (0.18) -1.26 (0.21) -1.37 (0.39) -1.49 (0.35) -1.82 (0.63) -1.53 (0.29) Follow Up Week 48 -1.55 (0.56) -1.01 (0.24) -0.88 (0.33) -1.04 (0.20) -1.86 (0.70) -1.10 (0.27) Data presented at EASL 2022, AASLD 2022, GHS 2023

AB - 729 - 001 : Treatment with Imdusiran Reactivates HBV Specific Immunity in Some Patients 12 0 4 812162024283236404448525660 0 1 2 3 4 5 0 20 40 60 H B s A g ( L o g 1 0 I U / m L ) Patient 43 60 mg Q4W 0 4 8 1216202428323640444852 0 1 2 3 4 0 10 20 30 40 50 60 H B s A g ( L o g 1 0 I U / m L ) Patient 48 60 mg Q8W Upregulation of HBV - specific T - cell activation markers observed in all 7 patients assessed to date Two profiles of HBV - specific T cell IFN - γ responses observed Elevation between Wk 16 - 28 which coincides with nadir of HBsAg reduction *Elevation after imdusiran dosing completed, between Wk 48 - 60 Data presented at EASL 2022 Patient 42* 60 mg Q4W Imdusiran Increased HBV - Specific T - Cell Activation Imdusiran Decreased Exhausted T - Cells B a s e l i n e E O T W k 3 2 ^ F / U W k 5 6 B a s e l i n e E O T W k 3 2 ^ F / U W k 5 6 0 10 20 30 F r e q u e n c y ( % ) Patient 43 ^ Last on - treatment PBMC sample available prior to last dose at Wk 44 B a s e l i n e E O T W k 4 0 F / U W k 5 2 B a s e l i n e E O T W k 4 0 F / U W k 5 2 0 10 20 30 F r e q u e n c y ( % ) Patient 48 B a s e l i n e E O T W k 4 4 F / U W k 6 0 B a s e l i n e E O T W k 4 4 F / U W k 6 0 0 10 20 30 F r e q u e n c y ( % ) Patient 42 © 2024 Arbutus Biopharma, Inc.

AB - 729 - 001 Clinical Trial Key Takeaways Imdusiran provided robust and comparable HBsAg declines regardless of dose, dosing interval, HBeAg or DNA status Discontinuation of both imdusiran and NA - therapy results in sustained reduction in HBsAg and HBV DNA in the majority of patients Imdusiran was generally safe and well - tolerated after completing dosing in 41 patients Imdusiran results in HBV - specific T - cell immune restoration and decrease of exhausted T - cells in some patients 13 © 2024 Arbutus Biopharma, Inc.

Phase 2a POC Clinical Trial Imdusiran in combination with ongoing NA therapy and short courses of Peg - IFN α - 2 a in cHBV patients AB - 729 - 201: Follow - up (24 - weeks) Imdusiran + NA + IFN (n=12) NA + IFN (n=12) Imdusiran +NA+IFN (n=8) NA + IFN (n=8) Imdusiran + NA (60mg Q8W) n=43 HBeAg - Randomize Follow - up (24 - weeks) 1 52 28 24 40 Weeks POC: Proof of Concept Primary objective : evaluate safety and tolerability of imdusiran in combination with Peg - IFNa - 2a in patients with NA - suppressed cHBV After 24 - weeks of follow - up, patients are assessed to stop NA therapy. Those patients that stop NA therapy will be followed for an additional 48 weeks. Preliminary data through 12 weeks of IFN treatment for the first 12 subjects were presented at EASL Congress 2023 Multi - center, open - label Phase 2a 14 End - of - treatment data expected in 1H 2024 © 2024 Arbutus Biopharma, Inc.

Individual and Mean HBsAg Results by Cohort Over Time 15 AB - 729 - 201: Imdusiran Treatment Led to Consistent HBsAg Declines; IFN may contribute to additional declines Mean (SE) HBsAg log 10 Change from Baseline at Key Timepoints Data presented at EASL 2023 Preliminary results: Treatment was generally well tolerated with continued HBsAg declines in some patients during the IFN treatment period Mean HBsAg decline during lead - in phase was 1.6 log 10 at week 24 of treatment 93% of patients (38 of 41 randomized) had HBsAg levels <100 IU/mL during treatment period 4 patients reached HBsAg levels <LLOQ during IFN treatment © 2024 Arbutus Biopharma, Inc.

Phase 2a POC Clinical Trial POC Phase 2a clinical trial evaluating imdusiran in combination with Barinthus Bio’s immunotherapeutic, VTP - 300, NA and with or without low dose nivolumab AB - 729 - 202: Primary objective: evaluate safety and reactogenicity of imdusiran followed by VTP - 300 or placebo At Week 48 all participants who are eligible to discontinue NA therapy will be followed for an additional 48 weeks Preliminary results presented at AASLD The Liver Meeting 2023 Clinical trial expanded to include an additional arm with nivolumab ( Opdivo ® ) with preliminary data expected in 2H 2024 Full rights retained by the Companies of their respective product candidates and all costs split equally 16 Follow - up (24 - 48 weeks) VTP - 300 + NA (n=20) NA + placebo (n=20) 1 Imdusiran + NA (60mg Q8W) n=40 Randomize Weeks Imdusiran + NA (60mg Q8W) n=20 24 VTP - 300 + NA + Nivo 1 48 26 24 Weeks 48 Follow - up (24 - 48 weeks) © 2024 Arbutus Biopharma, Inc. End - of - treatment data for Imdusiran + VTP - 300 + NA expected in 1H 2024

17 © 2024 Arbutus Biopharma, Inc. AB - 729 - 202: HBsAg Levels were Reduced and Sustained with Imdusiran and VTP - 300 Treatment Mean HBsAg Change from Baseline and Key Milestones Mean HBsAg Change from Baseline by Treatment Group Data presented at AASLD 2023 Preliminary results: Robust reductions of HBsAg were seen during the imdusiran treatment period, with 33/34 (97%) of patients <100 IU/mL at the time of VTP - 300/placebo administration VTP - 300 appears to maintain low HBsAg levels in the early post - treatment period, as the mean HBsAg levels in the placebo group begin to rebound starting ~12 weeks after the last dose of imdusiran All VTP - 300 treated patients have maintained HBsAg <100 IU/mL through Week 48, 60% have maintained HBsAg <10 IU/mL, and all have qualified to stop NA therapy

18 © 2024 Arbutus Biopharma, Inc. AB - 729 - 202: HBV - Specific T Cell Responses and Soluble Immune Biomarkers increased after VTP - 300 dosing Preliminary results: Elevations in HBV - specific T cell IFN - γ production were observed during imdusiran lead - in and after vaccination for n=7 patients profiled thus far Enhanced HBV - specific T cell responses were observed against HBsAg, PreS1/S2 peptides in VTP - 300 treated patients (n=4) Transient increases in other plasma immune biomarkers were also observed during imdusiran lead - in and vaccination period Data presented at AASLD 2023 Patient 30 (Group A/VTP - 300) experienced HBsAg decline and enhanced IFN - γ production (via ELISpot) after VTP - 300 through Week 48

Strategic Collaboration Exclusive Licensing* and Strategic Partnership Develop, manufacture and commercialize imdusiran in mainland China, Hong Kong, Macau and Taiwan Imdusiran Upfront payment (received in 2022) $40M Equity investment (received in 2022) $15M Commercialization and milestone payments Up to $245M Tiered royalties on annual sales Double - digit up to low twenties % *ABUS retains the non - exclusive right to develop and manufacture in the Qilu territory for exploiting AB - 729 in the rest of the world Deal economics for Arbutus: Qilu Pharmaceutical: One of the leading pharmaceutical companies in China, provides development, manufacturing, and commercialization expertise to this partnership China 19 © 2024 Arbutus Biopharma, Inc.

Oral PD - L1 Inhibitor 20 © 2024 Arbutus Biopharma, Inc.

AB - 101: Oral PD - L1 Inhibitor for HBV Immune Reactivation PD - 1: Programmed death ligand protein | Abs: Antibodies Currently in a Phase 1a/1b clinical trial Rationale • HBV immune tolerance is a critical driver of cHBV infection • PD - 1:PD - L1 checkpoint axis plays a key role in immune tolerization in cHBV • PD - L1 expression upregulated during HBV infection • PD - 1 upregulated on HBV - specific T - and B - cells • Inhibition associated with HBsAg loss in some cHBV patients AB - 101 • Blocks PD - L1/PD - 1 interaction at sub - nM concentrations • Activates HBV - specific immune responses in T - cells from cHBV patients in vitro • Novel MOA identified • Demonstrates a robust checkpoint mediated in vivo effect • Improves HBV - specific T - and B - cell responses ex vivo Small - Molecule Inhibitor Approach • Allows controlled checkpoint blockade • Enables oral dosing • Designed to reduce systemic safety issues seen with Abs 21 © 2024 Arbutus Biopharma, Inc.

AB - 101: Small - Molecule Oral PD - L1 Inhibitor for HBV AB - 101 is highly potent and activates HBV specific immune cells from chronic HBV patients AB - 101 reinvigorates HBV - specific cHBV patient T - cells PBMCs N= cells from 9 cHBV patients *p< - 0.05 PBMC: P eripheral Blood Mononuclear Cells PDL1 * Inactive AB - 101 * 0 3 2 1 IFN - y Fold Increase Over HBV peptide alone 22 © 2024 Arbutus Biopharma, Inc. Once daily oral administration of AB - 101 resulted in profound tumor reduction Study Day MC38 Tumor Mouse Model Tumor Volume (mm 3 ) Data presented at EASL 2022

23 © 2024 Arbutus Biopharma, Inc. Part 1: SAD (n=8/cohort – 6:2) 1C: Dose 3 1B: Dose 2 1A: Dose 1 Part 2: MAD (n=10/cohort – 8:2) 2A: Do se ≤ dose tested in Part 1; interval TBD 2B: Dose/interval TBD 3A: Dose ≤ dose tested in Part 2; interval TBD x 28d 3B: Dose/interval TBD x 28d 3C: Dose/interval TBD x 28d AB - 101 - 001: Phase 1a/1b Clinical Trial with AB - 101 Parts 1 & 2 – Healthy Subjects Part 3 – cHBV Patients (n=12/cohort – 10:2) Virally suppressed Additional optional dose panels may be used. Preliminary data in healthy subjects, including target engagement and receptor occupancy expected in 1H 2024

24 LNP Litigation: Update Moderna - Trial date April 21, 2025* • Fact discovery on - going • Markman Hearing occurred February 8, 2024 – judge heard arguments on claim construction and expected to issue his order within 60 days of the hearing date • Next Steps – Expert testimony / depositions 80% to Genevant Arbutus owns 16% of Genevant 20% to Arbutus Royalties/litigation related damages *Above referenced date is included in the 2/27/2024 Court's Scheduling Order Extension and is subject to change. © 2024 Arbutus Biopharma, Inc. Pfizer • Lawsuit ongoing • Date for claim construction hearing has not been set

2024 Key Milestones *Consists of cash, cash equivalents and marketable securities 25 Anticipated Timing 2024 Milestone 1H AB - 729 - 201 Phase 2a (imdusiran + IFN): End - of - treatment data 1H AB - 729 - 202 Phase 2a (imdusiran + VTP - 300): End - of - treatment data 1H AB - 729 - 203 (imdusiran + durvalumab): Initiate Phase 2a clinical trial 1H AB - 101 - 001: Preliminary data from healthy subject cohorts 2H AB - 729 - 202 Phase 2a ( imdusiran + VTP - 300 + nivolumab): Preliminary data © 2024 Arbutus Biopharma, Inc. Cash balance * of $132M as of December 31, 2023, cash runway into Q1 2026; 2024 net cash burn between $63M and $67M

Thank You

© 2024 Arbutus Biopharma, Inc.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

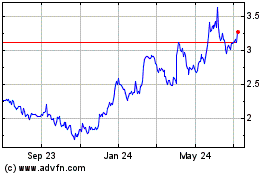

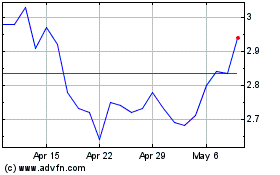

Arbutus Biopharma (NASDAQ:ABUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arbutus Biopharma (NASDAQ:ABUS)

Historical Stock Chart

From Apr 2023 to Apr 2024