Form 8-K - Current report

February 27 2024 - 4:22PM

Edgar (US Regulatory)

false

0001487428

0001487428

2024-02-27

2024-02-27

0001487428

hrzn:CommonStockParValue0001PerShareCustomMember

2024-02-27

2024-02-27

0001487428

hrzn:NotesDue20264875CustomMember

2024-02-27

2024-02-27

0001487428

hrzn:NotesDue2027625CustomMember

2024-02-27

2024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2024

HORIZON TECHNOLOGY FINANCE CORPORATION

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

|

Delaware

|

|

814-00802

|

|

27-2114934

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

312 Farmington Avenue

Farmington, CT 06032

(Address of principal executive offices and zip code)

(860) 676-8654

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Ticker symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

|

HRZN

|

|

The Nasdaq Stock Market LLC

|

|

4.875% Notes due 2026

|

|

HTFB

|

|

The New York Stock Exchange

|

|

6.25% Notes due 2027

|

|

HTFC

|

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Section 8

|

|

Other Events

|

|

Item 8.01

|

|

Other Events

|

On February 27, 2024, Horizon Technology Finance Corporation (the “Company”) announced that its Board of Directors has declared monthly distributions totaling $0.33 per share, and a special distribution of $0.05 per share, payable in such amounts and on such dates to stockholders of record, as set forth below.

Monthly Distributions

|

Ex-Dividend Date

|

Record Date

|

Payment Date

|

|

Amount Per Share

|

|

|

March 18, 2024

|

March 19, 2024 |

April 16, 2024 |

|

$ |

0.11 |

|

| April 17, 2024 |

April 18, 2024 |

May 15, 2024 |

|

$ |

0.11 |

|

| May 16, 2024 |

May 17, 2024 |

June 14, 2024 |

|

$ |

0.11 |

|

| |

|

Total:

|

|

$ |

0.33 |

|

Special Distribution

|

Ex-Dividend Date

|

Record Date

|

Payment Date

|

|

Amount Per Share

|

|

| March 18, 2024 |

March 19, 2024 |

April 16, 2024 |

|

$ |

0.05 |

|

| |

|

Total:

|

|

$ |

0.05 |

|

A copy of the press release announcing such dividend is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

|

Section 9

|

|

Financial Statements and Exhibits

|

|

Item 9.01

|

|

Financial Statements and Exhibits

|

(d) Exhibits.

| Exhibit No. |

|

Description |

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

Date: February 27, 2024

|

HORIZON TECHNOLOGY FINANCE

CORPORATION

|

| |

|

|

| |

By:

|

/s/ Robert D. Pomeroy, Jr.

|

| |

|

Robert D. Pomeroy, Jr.

|

| |

|

Chief Executive Officer

|

3

Exhibit Index

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Press Release of the Company dated February 27, 2024.

|

4

EXHIBIT 99.1

Horizon Technology Finance Announces Monthly Distributions for April, May and June 2024 Totaling $0.33 per Share and Special Distribution for April 2024 of $0.05 per Share

Farmington, Connecticut – February 27, 2024 – Horizon Technology Finance Corporation (NASDAQ: HRZN) (“Horizon”) (the “Company”), an affiliate of Monroe Capital, and a leading specialty finance company that provides capital in the form of secured loans to venture capital-backed companies in the technology, life science, healthcare information and services, and sustainability industries, announced today that its board of directors has declared monthly cash distributions of $0.11 per share, payable in each of April, May and June 2024, and a special distribution of $0.05 per share, payable in April 2024. The following tables show these distributions, payable as set forth in the tables below, total $0.38 per share. Since its 2010 initial public offering, Horizon has paid a total of $253 million in distributions to its shareholders.

Monthly Distributions Declared in First Quarter 2024

|

Ex-Dividend Date

|

Record Date

|

Payment Date

|

Amount per Share

|

|

March 18, 2024

|

March 19, 2024

|

April 16, 2024

|

$0.11

|

|

April 17, 2024

|

April 18, 2024

|

May 15, 2024

|

$0.11

|

|

May 16, 2024

|

May 17, 2024

|

June 14, 2024

|

$0.11

|

| |

|

Total:

|

$0.33

|

Special Distribution

|

Ex-Dividend Date

|

Record Date

|

Payment Date

|

Amount per Share

|

|

March 18, 2024

|

March 19, 2024

|

April 16, 2024

|

$0.05

|

When declaring distributions, Horizon’s board of directors reviews estimates of taxable income available for distribution, which may differ from consolidated net income under generally accepted accounting principles due to (i) changes in unrealized appreciation and depreciation, (ii) temporary and permanent differences in income and expense recognition, and (iii) the amount of spillover income carried over from a given year for distribution in the following year. The final determination of taxable income for each tax year, as well as the tax attributes for distributions in such tax year, will be made after the close of the tax year.

Horizon maintains a “Dividend Reinvestment Plan” (“DRIP”) that provides for the reinvestment of distributions on behalf of its stockholders, unless a stockholder has elected to receive distributions in cash. As a result, if Horizon declares a distribution, its stockholders who have not “opted out” of the DRIP by the distribution record date will have their distribution automatically reinvested into additional shares of Horizon’s common stock. Horizon has the option to satisfy the share requirements of the DRIP through the issuance of new shares of common stock or through open market purchases of common stock by the DRIP plan administrator. Newly-issued shares will be valued based upon the final closing price of Horizon’s common stock on a specified valuation date for each distribution as determined by Horizon’s board of directors. Shares purchased in the open market to satisfy the DRIP requirements will be valued based upon the average price of the applicable shares purchased by the DRIP plan administrator, before any associated brokerage or other costs, which are borne by Horizon.

About Horizon Technology Finance

Horizon Technology Finance Corporation (NASDAQ: HRZN), externally managed by Horizon Technology Finance Management LLC, an affiliate of Monroe Capital, is a leading specialty finance company that provides capital in the form of secured loans to venture capital backed companies in the technology, life science, healthcare information and services, and sustainability industries. The investment objective of Horizon is to maximize its investment portfolio’s return by generating current income from the debt investments it makes and capital appreciation from the warrants it receives when making such debt investments. Horizon is headquartered in Farmington, Connecticut, with a regional office in Pleasanton, California, and investment professionals located throughout the U.S. Monroe Capital is an $18 billion asset management firm specializing in private credit markets across various strategies, including direct lending, technology finance, venture debt, opportunistic, structured credit, real estate and equity. To learn more, please visit horizontechfinance.com.

Forward-Looking Statements

Statements included herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this press release may constitute forward-looking statements and are not guarantees of future performance, condition or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in Horizon’s filings with the Securities and Exchange Commission. Horizon undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this press release.

Contacts:

Investor Relations:

ICR

Garrett Edson

ir@horizontechfinance.com

(646) 200-8885

Media Relations:

ICR

Chris Gillick

HorizonPR@icrinc.com

(646) 677-1819

v3.24.0.1

Document And Entity Information

|

Feb. 27, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

HORIZON TECHNOLOGY FINANCE CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 27, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

814-00802

|

| Entity, Tax Identification Number |

27-2114934

|

| Entity, Address, Address Line One |

312 Farmington Avenue

|

| Entity, Address, City or Town |

Farmington

|

| Entity, Address, State or Province |

CT

|

| Entity, Address, Postal Zip Code |

06032

|

| City Area Code |

860

|

| Local Phone Number |

676-8654

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001487428

|

| CommonStockParValue0001PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

HRZN

|

| Security Exchange Name |

NASDAQ

|

| NotesDue20264875 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.875% Notes due 2026

|

| Trading Symbol |

HTFB

|

| Security Exchange Name |

NYSE

|

| NotesDue2027625 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.25% Notes due 2027

|

| Trading Symbol |

HTFC

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hrzn_CommonStockParValue0001PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hrzn_NotesDue20264875CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hrzn_NotesDue2027625CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

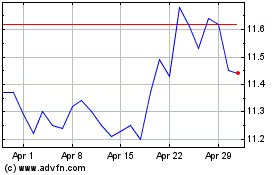

Horizon Technology Finance (NASDAQ:HRZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

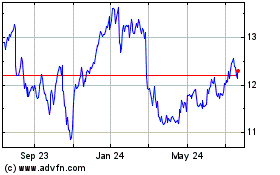

Horizon Technology Finance (NASDAQ:HRZN)

Historical Stock Chart

From Apr 2023 to Apr 2024