0001061983false00010619832024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 27, 2024 |

Cytokinetics, Incorporated

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-50633 |

94-3291317 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

350 Oyster Point Boulevard |

|

South San Francisco, California |

|

94080 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 624-3000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

CYTK |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 27, 2024, Cytokinetics, Incorporated announced its financial results for the fourth quarter and for the year ended December 31, 2023. The full text of the press release issued in connection with this announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information furnished under this Item 2.02 and under Exhibit 99.1 shall not be considered “filed” under the Securities Exchange Act of 1934, as amended, nor shall it be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, unless the Registrant expressly sets forth in such future filing that such information is to be considered “filed” or incorporated by reference therein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release dated February 27, 2024

104 The cover page of this report has been formatted in Inline XBRL

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CYTOKINETICS, INCORPORATED |

|

|

|

|

Date: |

February 27, 2024 |

By: |

/s/ John O. Faurescu |

|

|

|

John O. Faurescu, Esq.

Associate General Counsel & Secretary |

CYTOKINETICS REPORTS FOURTH QUARTER 2023 FINANCIAL RESULTS

Topline Results from SEQUOIA-HCM Announced in December

Showed Statistically Significant and Clinically Meaningful Increase

in Primary Efficacy Endpoint and Improvements in All Secondary Endpoints

Company Plans to Submit New Drug Application for Aficamten to FDA in Q3 2024

and Marketing Authorization Application to EMA in Q4 2024

Primary Results from SEQUOIA-HCM Are Expected

to be Presented at an Upcoming Medical Conference in Q2 2024

Company Provides 2024 Financial Guidance; Approximately 2 Years of Cash Runway

SOUTH SAN FRANCISCO, Calif., Feb. 27, 2024 - Cytokinetics, Incorporated (Nasdaq: CYTK) reported financial results for the fourth quarter and full year 2023. Net loss for the fourth quarter was $136.9 million or $1.38 per share and the net loss for the year 2023 was $526.2 million or $5.45 per share. Net loss for the fourth quarter of 2022 was $137.4 million or $1.45 per share and net loss for the year 2022 was $389.0 million or $4.33 per share. Cash, cash equivalents and investments totaled $655.4 million on December 31, 2023. This cash balance does not include approximately $83 million in net proceeds generated in early 2024 from the sale of common stock through an at-the-market equity vehicle.

“We ended 2023 strong with positive results from SEQUOIA-HCM which now propel our company forward to the next stages of planning towards our specialty cardiology business model,” said Robert I. Blum, Cytokinetics’ President and Chief Executive Officer. “As we prepare regulatory submissions for aficamten, we are executing on commercial readiness activities while also conducting Phase 3 clinical trials in patients with oHCM and nHCM which we believe may further generate evidence in support of our next-in-class objectives to reach a broader array of patients struggling with hypertrophic cardiomyopathy. With a strong balance sheet enabling ample cash runway and multiple levers to access capital, we are pleased to be turning the page onto the next chapter for Cytokinetics and all stakeholders.”

Q4 and Recent Highlights

Cardiac Muscle Programs

aficamten (cardiac myosin inhibitor)

•Announced positive results from SEQUOIA-HCM (Safety, Efficacy, and Quantitative Understanding of Obstruction Impact of Aficamten in HCM) in December demonstrating that treatment with aficamten significantly improved exercise capacity compared to placebo, increasing peak oxygen uptake (pVO2) measured by cardiopulmonary exercise testing (CPET) by a least square mean difference (95% CI) of 1.74 (1.04 - 2.44) mL/kg/min (p=0.000002). Statistically significant (p<0.0001) and clinically meaningful improvements were also observed in all 10 prespecified secondary endpoints. Aficamten was well-tolerated with an adverse event profile comparable to placebo. There were no instances of worsening heart failure or treatment interruptions due to low left ventricular ejection fraction (LVEF).

•Presented new long-term data from FOREST-HCM (Follow-up, Open-Label, Research Evaluation of Sustained Treatment with Aficamten in HCM) in January at CMR 2024 demonstrating that treatment with aficamten for 48 weeks resulted in favorable structural remodeling, improvements in cardiac function and stabilization of myocardial fibrosis.

•Convened meetings in February with the U.S. Food & Drug Administration (FDA) to discuss the topline results of SEQUOIA-HCM and prepare for the New Drug Application (NDA) submission.

•Engaged in commercial readiness activities for aficamten including market research with hypertrophic cardiomyopathy (HCM) patients and customer account profiling, and held initial conversations with specialty pharmacies and patient hub providers.

•Advanced profiling of HCM treatment programs, began development of payor clinical value proposition and continued support of medical education activities at medical conferences.

•Continued enrolling patients in MAPLE-HCM (Metoprolol vs Aficamten in Patients with LVOT Obstruction on Exercise Capacity in HCM), the Phase 3 clinical trial comparing aficamten as monotherapy to metoprolol as monotherapy in patients with symptomatic obstructive HCM.

•Continued enrolling patients in ACACIA-HCM (Assessment Comparing Aficamten to Placebo on Cardiac Endpoints In Adults with Non-Obstructive HCM), the pivotal Phase 3 clinical trial of aficamten in patients with non-obstructive HCM.

•Published manuscript entitled “Exercise Capacity in Patients with Obstructive Hypertrophic Cardiomyopathy: SEQUOIA-HCM Baseline Characteristics and Study Design” in the Journal of the American College of Cardiology: Heart Failure.

omecamtiv mecarbil (cardiac myosin activator)

•Received the Day 180 List of Outstanding Issues from the European Medicines Agency (EMA) regarding the Marketing Authorization Application (MAA) for omecamtiv mecarbil during Q4 2023, and submitted responses during Q1 2024.

•Received denial of our Formal Dispute Resolution Request (FDRR) to the Office of New Drugs of the FDA in connection to the Complete Response Letter (CRL) received in response to our NDA for omecamtiv mecarbil. FDA reaffirmed its decision in the CRL for omecamtiv mecarbil that GALACTIC-HF is not sufficiently persuasive to establish substantial evidence of effectiveness for reducing the risk of heart failure events and cardiovascular death in adults with chronic heart failure with reduced ejection fraction (HFrEF), in lieu of evidence from at least two adequate and well-controlled clinical investigations.

•Published manuscript entitled “Sex Differences in Heart Failure with Reduced Ejection Fraction in the GALACTIC-HF Trial” in the Journal of the American College of Cardiology: Heart Failure.

CK-4021586 (CK-586, cardiac myosin inhibitor)

•Proceeded to multiple ascending dose (MAD) cohorts of the Phase 1 study of CK-586 in healthy participants.

CK-3828136 (CK-136, cardiac troponin activator)

•Proceeded to MAD cohorts of the Phase 1 study of CK-136 in healthy participants.

Skeletal Muscle Program

reldesemtiv (fast skeletal muscle troponin activator (FSTA))

•Presented results from COURAGE-ALS (Clinical Outcomes Using Reldesemtiv on ALSFRS-R in a Global Evaluation in ALS) at the 34th International Symposium on ALS/MND showing that treatment with reldesemtiv for 24 weeks had no effect on the primary efficacy endpoint measure of change from baseline up to Week 24 in the ALS Functional Rating Scale Revised (ALSFRS-R) (joint rank test p=0.11).

Pre-Clinical Development and Ongoing Research

•Continued research activities directed to our other muscle biology research programs.

Corporate

•Raised $162.9 million, net, from the sale of common stock through an at-the-market (ATM) equity vehicle in Q4 2023, and approximately $83 million, net, in Q1 2024 as of February 26, 2024.

2024 Corporate Milestones

Cardiac Muscle Programs

aficamten (cardiac myosin inhibitor)

•Expect to present primary results from SEQUOIA-HCM at a medical conference in Q2 2024.

•Expect to submit a New Drug Application (NDA) to the FDA in Q3 2024 and a Marketing Authorization Application (MAA) to the European Medicines Agency (EMA) in Q4 2024.

•Complete enrollment of MAPLE-HCM in Q3 2024.

•Continue enrollment of ACACIA-HCM in 2024.

•Continue advancing go-to-market strategies for aficamten.

omecamtiv mecarbil (cardiac myosin activator)

•Expect the Committee for Medicinal Products for Human Use (CHMP) to issue an opinion regarding the MAA for omecamtiv mecarbil in Q2 2024.

CK-4021586 (CK-586, cardiac myosin inhibitor)

•Expect to share data from the Phase 1 study of CK-586 in Q2 2024.

CK-3828136 (CK-136, cardiac troponin activator)

•Expect to complete Phase 1 study of CK-136 in Q2 2024.

Financials

Revenues for the three months and year ended December 31, 2023 were $1.7 million and $7.5 million, respectively, compared to $2.0 million and $94.6 million in the corresponding periods of 2022. The decrease in revenues was primarily due to the recognition in 2022 of $87.0 million of deferred revenue for royalties on the net sales of products containing mavacamten as a result of the extinguishment of royalty obligations.

Research and development expenses for the three months and year ended December 31, 2023 increased to $85.0 million and $330.1 million, respectively, compared to $75.0 million and $240.8 million for the same periods in 2022, respectively, due primarily to spending on our cardiac myosin inhibitor programs.

General and administrative expenses for the three and twelve months ended December 31, 2023 decreased to $44.1 million and $173.6 million, respectively, from $54.0 million and $178.0 million for the same period in 2022 due to lower outside spending on commercial readiness activities offset by higher personnel related costs including stock-based compensation.

2024 Financial Guidance

The company today announced financial guidance for 2024. The company anticipates revenue will be in the range of $3 to $5 million, operating expenses will be in the range of $420 to 450 million, and net cash utilization will be approximately $390 to $420 million. Inclusive of approximately $83 million, net, raised in early 2024 through our ATM equity vehicle, our year end cash balance of $655.4 million, plus available long-term debt from Royalty Pharma, represents approximately two years of forward cash based on our projected 2024 operating expenses and net cash utilization.

Conference Call and Webcast Information

Members of Cytokinetics’ senior management team will review the company’s fourth quarter 2023 results on a conference call today at 4:30 PM Eastern Time. The conference call will be simultaneously webcast and can be accessed from the Investors & Media section of Cytokinetics’ website at www.cytokinetics.com. The live audio of the conference call can also be accessed by telephone by registering in advance at the following link: Cytokinetics Q4 2023 Earnings Conference Call. Upon registration, participants will receive a dial-in number and a unique passcode to access the call. An archived replay of the webcast will be available via Cytokinetics’ website for twelve months.

About Cytokinetics

Cytokinetics is a late-stage, specialty cardiovascular biopharmaceutical company focused on discovering, developing and commercializing first-in-class muscle activators and next-in-class muscle inhibitors as

potential treatments for debilitating diseases in which cardiac muscle performance is compromised. As a leader in muscle biology and the mechanics of muscle performance, the company is developing small molecule drug candidates specifically engineered to impact myocardial muscle function and contractility. Cytokinetics is preparing for regulatory submissions for aficamten, its next-in-class cardiac myosin inhibitor, following positive results from SEQUOIA-HCM, the pivotal Phase 3 clinical trial in obstructive hypertrophic cardiomyopathy. Aficamten is also currently being evaluated in two ongoing Phase 3 clinical trials: MAPLE-HCM, evaluating aficamten as monotherapy compared to metoprolol as monotherapy in patients with obstructive HCM and ACACIA-HCM, evaluating aficamten in patients with non-obstructive HCM. Cytokinetics is also developing omecamtiv mecarbil, a cardiac muscle activator, in patients with heart failure. Additionally, Cytokinetics is developing CK-586, a cardiac myosin inhibitor with a mechanism of action distinct from aficamten for the potential treatment of HFpEF, and CK-136, a cardiac troponin activator for the potential treatment HFrEF and other types of heart failure, such as right ventricular failure resulting from impaired cardiac contractility.

For additional information about Cytokinetics, visit www.cytokinetics.com and follow us on X, LinkedIn, Facebook and YouTube.

Forward-Looking Statements

This press release contains forward-looking statements for purposes of the Private Securities Litigation Reform Act of 1995 (the “Act”). Cytokinetics claims the protection of the Act’s Safe Harbor for forward-looking statements. Examples of such statements include, but not limited to, statements, express or implied, relating to our or our partners’ research and development and commercial readiness activities, including the initiation, conduct, design, enrollment, progress, continuation, completion, timing and results of any of our clinical trials, or more specifically, our ability to file a new drug application for aficamten in the United States or a marketing authorisation application for aficamten in the European Union, our ability to obtain approval of our marketing authorisation application for omecamtiv mecarbil in the E.U., the timing of interactions with FDA or any other regulatory authorities in connection to any of our drug candidates and the outcomes of such interactions; statements relating to the potential patient population who could benefit from aficamten, omecamtiv mecarbil, aficamten, CK-586, CK-136 or any of our other drug candidates; statements relating to our ability to receive additional capital or other funding, including, but not limited to, our ability to meet any of the conditions relating to or to otherwise secure additional loan disbursements under any of our agreements with entities affiliated with Royalty Pharma or additional milestone payments from Ji Xing; statements relating to our operating expenses or cash utilization for the remainder of 2024, and statements relating to our cash balance at year-end 2024 or any other particular date or the amount of cash runway such cash balances represent at any particular time. Such statements are based on management's current expectations, but actual results may differ materially due to various risks and uncertainties, including, but not limited to Cytokinetics’ need for additional funding and such additional funding may not be available on acceptable terms, if at all; potential difficulties or delays in the development, testing, regulatory approvals for trial commencement,

progression or product sale or manufacturing, or production of Cytokinetics’ drug candidates that could slow or prevent clinical development or product approval; patient enrollment for or conduct of clinical trials may be difficult or delayed; the FDA or foreign regulatory agencies may delay or limit Cytokinetics’ or its partners’ ability to conduct clinical trials; Cytokinetics may incur unanticipated research and development and other costs; standards of care may change, rendering Cytokinetics’ drug candidates obsolete; and competitive products or alternative therapies may be developed by others for the treatment of indications Cytokinetics’ drug candidates and potential drug candidates may target. For further information regarding these and other risks related to Cytokinetics’ business, investors should consult Cytokinetics’ filings with the Securities and Exchange Commission, particularly under the caption “Risk Factors” in Cytokinetics’ Annual Report on Form 10-K for the year 2023. Forward-looking statements are not guarantees of future performance, and Cytokinetics’ actual results of operations, financial condition and liquidity, and the development of the industry in which it operates, may differ materially from the forward-looking statements contained in this press release. Any forward-looking statements that Cytokinetics makes in this press release speak only as of the date of this press release. Cytokinetics assumes no obligation to update its forward-looking statements whether as a result of new information, future events or otherwise, after the date of this press release.

CYTOKINETICS® and the CYTOKINETICS and C-shaped logo are registered trademarks of Cytokinetics in the U.S. and certain other countries.

###

Contact:

Cytokinetics

Diane Weiser

Senior Vice President, Corporate Communications, Investor Relations

(415) 290-7757

|

|

|

|

|

Cytokinetics, Incorporated |

Condensed Consolidated Balance Sheets |

(in thousands) |

|

|

|

|

|

|

|

December 31, 2023 |

|

December 31, 2022 |

|

|

(unaudited) |

|

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and short-term investments |

|

$ 614,824 |

|

$ 782,577 |

Other current assets |

|

13,227 |

|

12,609 |

Total current assets |

|

628,051 |

|

795,186 |

Long-term investments |

|

40,534 |

|

46,708 |

Property and equipment, net |

|

68,748 |

|

80,453 |

Operating lease right-of-use assets |

|

78,987 |

|

82,737 |

Other assets |

|

7,996 |

|

9,691 |

Total assets |

|

$ 824,316 |

|

$ 1,014,775 |

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable and accrued liabilities |

|

$ 64,148 |

|

$ 69,707 |

Short-term lease liability |

|

17,891 |

|

12,829 |

Current portion of long-term debt |

|

10,080 |

|

958 |

Other current liabilities |

|

10,559 |

|

1,123 |

Total current liabilities |

|

102,678 |

|

84,617 |

Term loan, net |

|

58,384 |

|

63,810 |

Convertible notes, net |

|

548,989 |

|

545,808 |

Liabilities related to revenue participation right purchase agreements, net |

|

379,975 |

|

300,501 |

Long-term operating lease liabilities |

|

120,427 |

|

126,895 |

Other non-current liabilities |

|

186 |

|

1,044 |

Total liabilities |

|

1,210,639 |

|

1,122,675 |

Commitments and contingencies |

|

|

|

|

Stockholders’ deficit: |

|

|

|

|

Common stock |

|

102 |

|

94 |

Additional paid-in capital |

|

1,725,823 |

|

1,481,590 |

Accumulated other comprehensive loss |

|

(10) |

|

(3,590) |

Accumulated deficit |

|

(2,112,238) |

|

(1,585,994) |

Total stockholders’ deficit |

|

(386,323) |

|

(107,900) |

Total liabilities and stockholders’ deficit |

|

$ 824,316 |

|

$ 1,014,775 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cytokinetics, Incorporated |

Condensed Consolidated Statements of Operations |

(in thousands except per share data) |

(unaudited) |

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Years Ended December 31, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

Revenues: |

|

|

|

|

|

|

|

Research and development revenues |

$ 672 |

|

$ 1,957 |

|

$ 4,030 |

|

$ 6,588 |

Milestone revenues |

1,000 |

|

— |

|

3,500 |

|

1,000 |

Realization of revenue participation right purchase agreement |

— |

|

— |

|

— |

|

87,000 |

Total revenues |

1,672 |

|

1,957 |

|

7,530 |

|

94,588 |

Operating expenses: |

|

|

|

|

|

|

|

Research and development |

84,976 |

|

75,018 |

|

330,123 |

|

240,813 |

General and administrative |

44,114 |

|

53,969 |

|

173,612 |

|

177,977 |

Total operating expenses |

129,090 |

|

128,987 |

|

503,735 |

|

418,790 |

Operating loss |

(127,418) |

|

(127,030) |

|

(496,205) |

|

(324,202) |

Interest expense |

(7,164) |

|

(7,057) |

|

(28,306) |

|

(19,414) |

Loss on settlement of debt |

— |

|

— |

|

— |

|

(24,939) |

Non-cash interest expense on liabilities related to revenue participation right purchase agreements |

(9,900) |

|

(9,212) |

|

(29,362) |

|

(31,742) |

Interest and other income, net |

7,586 |

|

5,919 |

|

27,629 |

|

11,342 |

Net loss before income taxes |

(136,896) |

|

(137,380) |

|

(526,244) |

|

(388,955) |

Income tax benefit |

— |

|

— |

|

— |

|

— |

Net loss |

$ (136,896) |

|

$ (137,380) |

|

$ (526,244) |

|

$ (388,955) |

Net loss per share — basic and diluted |

$ (1.38) |

|

$ (1.45) |

|

$ (5.45) |

|

$ (4.33) |

Weighted-average shares in net loss per share — basic and diluted |

99,067 |

|

94,681 |

|

96,524 |

|

89,825 |

v3.24.0.1

Document And Entity Information

|

Feb. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity Registrant Name |

Cytokinetics, Incorporated

|

| Entity Central Index Key |

0001061983

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

000-50633

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

94-3291317

|

| Entity Address, Address Line One |

350 Oyster Point Boulevard

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

(650)

|

| Local Phone Number |

624-3000

|

| Entity Information, Former Legal or Registered Name |

n/a

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

CYTK

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

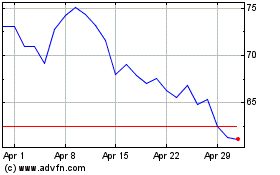

Cytokinetics (NASDAQ:CYTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cytokinetics (NASDAQ:CYTK)

Historical Stock Chart

From Apr 2023 to Apr 2024