UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

February 27, 2024

(Commission File Number: 001-15128)

United Microelectronics Corporation

(Translation of registrant’s name into English)

No. 3 Li-Hsin 2nd Road

Hsinchu Science Park

Hsinchu, Taiwan, R.O.C.

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

United Microelectronics Corporation |

|

|

|

By: |

Chitung Liu |

Name: |

Chitung Liu |

Title: |

CFO |

Date: February 27, 2024

EXHIBIT INDEX

www.umc.com

www.umc.com

Exhibit

Exhibit Description

99.1 Announcement on 2024/02/27: Important Resolutions from the Board Meeting

99.2 Announcement on 2024/02/27: Announcement of board meeting approved the consolidated financial statements for the year of 2023

99.3 Announcement on 2024/02/27: Board Meeting Resolution on dividend distribution

99.4 Announcement on 2024/02/27: The Board of Directors Approved the Cancellation of Restricted Shares to Employees Stock Awards

99.5 Announcement on 2024/02/27: Board Meeting Resolution on issuing Restricted Stock Awards for employees

99.6 Announcement on 2024/02/27: The announcement of UMC Board of Directors’ Resolution to convene the 2024 Annual General Meeting

99.7 Announcement on 2024/02/27: The board meeting approved capital budget execution

99.8 Announcement on 2024/02/27: To announce related materials on capital injection to UMC CAPITAL CORP.

99.9 Announcement on 2024/02/27: UMC’s donation to UMC Science and Culture Foundation

99.10 Announcement on 2024/02/27: Represent subsidiary UMC Capital Corporation to announce the board of directors approves the investment in 7V AI Capital LLC

Exhibit 99.1

Important Resolutions from the Board Meeting

1. Date of occurrence of the event: 2024/02/27

2. Company name: UNITED MICROELECTRONICS CORP.

3. Relationship to the Company (please enter “head office” or “subsidiaries”): head office

4. Reciprocal shareholding ratios: N/A

5. Cause of occurrence:

The board meeting has approved important resolutions as follows:

(1)Approved the 2023 Business Report and Financial Statements.

The Company’s consolidated revenue for 2023 was NT$222,533 million and net income attributable to the stockholders of the parent was NT$60,990 million, with EPS of NT$4.93.

(2)Approved the 2023 employee cash compensation of NT$5,439.1 million and director compensation of NT$45 million.

(3)Approved Dividend Distribution. (approximately NT$3.00 per share)

(4)Approved the Cancellation of Restricted Shares to Employees Stock Awards

(5)Approved the issuance of Restricted Stock Awards.

(6)The 2024 Annual General Meeting will be held at 9:00 AM on Thursday, May 30, 2024 at No. 16, Creation Rd. 1, Hsinchu Science Park (UMC's Fab8S Conference Hall).

(7)Approved this round’s capital budget execution of NTD 1,915 million towards capacity deployment.

(8)Approved the capital injection to subsidiary UMC CAPITAL CORP.

(9)Approved UMC’s donation of NTD$15,250,000 to UMC Science and Culture Foundation.

6. Countermeasures: N/A

7. Any other matters that need to be specified (the information disclosure also meets the requirements of Article 7, subparagraph 9 of the Securities and Exchange Act Enforcement Rules, which brings forth a significant impact on shareholders rights or the price of the securities on public companies.): None

Exhibit 99.2

Announcement of board meeting approved the consolidated financial statements for the year of 2023

1. Date of submission to the board of directors or approval by the board of directors: 2024/2/27

2. Date of approval by the audit committee: 2024/02/27

3. Start and end dates of financial reports or annual self-assessed financial information of the reporting period (XXXX/XX/XX~XXXX/XX/XX): 2023/01/01~2023/12/31

4. Operating revenue accumulated from 1/1 to end of the period (thousand NTD): 222,533,000

5. Gross profit (loss) from operations accumulated from 1/1 to end of the period (thousand NTD): 77,743,838

6. Net operating income (loss) accumulated from 1/1 to end of the period (thousand NTD): 57,890,661

7. Profit (loss) before tax accumulated from 1/1 to end of the period (thousand NTD):70,912,228

8. Profit (loss) accumulated from 1/1 to end of the period (thousand NTD): 61,439,817

9. Profit (loss) during the period attributable to owners of parent accumulated from 1/1 to end of the period (thousand NTD): 60,989,633

10. Basic earnings (loss) per share accumulated from 1/1 to end of the period (NTD): 4.93

11. Total assets end of the period (thousand NTD): 559,186,927

12. Total liabilities end of the period (thousand NTD): 199,608,355

13. Equity attributable to owners of parent end of the period (thousand NTD): 359,237,713

14. Any other matters that need to be specified: NA

Exhibit 99.3

Board Meeting Resolution on dividend distribution

1. Date of the board of directors’ resolution: 2024/02/27

2. Year or quarter which dividends belong to: 2023

3. Period which dividends belong to: 2023/01/01~2023/12/31

4. Appropriations of earnings in cash dividends to shareholders (NT$ per share): 3.00

5. Cash distributed from legal reserve and capital surplus to shareholders (NT$ per share): 0

6. Total amount of cash distributed to shareholders (NT$): 37,587,101,925

7. Appropriations of earnings in stock dividends to shareholders (NT$ per share): 0

8. Stock distributed from legal reserve and capital surplus to shareholders (NT$ per share): 0

9. Total amount of stock distributed to shareholders (shares): 0

10. Any other matters that need to be specified: None

11. Per value of common stock: NT$10.0000

Exhibit 99.4

The Board of Directors Approved the Cancellation of Restricted Shares to Employees Stock Awards

1. Date of the board of directors’ resolution: 2024/02/27

2. Reason for capital reduction: The Restricted shares to employees will be returned to the Company and cancelled due to non-fulfillment of the vesting conditions.

3. Amount of capital reduction: NT$7,881,850

4. Cancelled shares: 788,185 shares

5. Capital reduction percentage: 0.0063%

6. Share capital after capital reduction: NT$125,290,339,750

7. Scheduled date of the shareholders meeting: N/A

8. Estimated no. of listed common shares after issuance of new shares upon capital reduction: N/A

9. Estimated ratio of listed common shares after issuance of new shares upon capital reduction to outstanding common shares: N/A

10. Please explain any countermeasures for lower circulation in shareholding if the aforesaid estimated no. of listed common shares upon capital reduction does not reach 60 million and the percentage does not reach 25%: N/A

11. The record date for capital reduction: 2024/02/27

12. Any other matters that need to be specified: None

Exhibit 99.5

Board Meeting Resolution on issuing Restricted Stock Awards for employees

1. Date of the board of directors’ resolution: 2024/02/27

2. Expected issue price: The current issue is gratuitous. The price for issuance is NT$0 per share.

3. Expected total amount (shares) of issuance:

A maximum of 66,000,000 common shares will be issued, accounting for approximately 0.5% of the outstanding common shares of the Company.

The par value per share is NT$10, and the total amount is NT$660,000,000.

4. Vesting conditions:

(1) If an employee, after having been granted a restricted stock award, remains on the job on the vesting date, during performance period, is determined by the company employee works for, as having not violated the employment contract, employee code of conduct, trust agreement, corporate governance best practice principles, ethical corporate management best practice principles, work handbook or non-compete and non-disclosure agreement of the company employee works for or any agreement with the company employee works for to have any relevant punishment records, however, if an employee has relevant punishment records, the Company may determine the proportions of the vesting shares based on the severity of the case, and has fulfilled both the personal performance indicators and operational goals set by the Company, the proportions of the vesting shares to be granted for such employee on the vesting date each year is as follows:

a. On the job for 2 years after granting: 33%

b. On the job for 3 years after granting: 33%

c. On the job for 4 years after granting: 34%

(2) Personal performance indicator(s): A performance rating of A or higher for the most recent fiscal year prior to the end of each vesting period.

(3) The operational goals of the Company use the earnings per share (EPS), total shareholder return (Total Shareholder Return, TSR) and ESG Target as performance indicators. Listed below are the performance targets and weighting for the indicators. Targets are set for each indicator. Indicators that have achieved the target value, the number of vested shares in the year is calculated according to the corresponding weighting, otherwise, the corresponding weighting is 0%. The performance period refers to the fiscal year of the most recent annual financial statement audited by a certified public accountant before the vesting date. Performance indicators are based on the consolidated financial statements audited by a certified public accountant corresponding to the period required by the indicators.

|

|

|

Indicator |

Weighting |

Target |

Earnings Per Share (EPS) |

30% |

Higher than the Company’s average of the previous three years (Note 1) |

Total Shareholder Return (TSR) (Note 2) |

30% |

UMC TSR comparing to TWSESCI Index TSR: ˙If greater than or equal to TWSESCI Index TSR: 100% vested ˙If less than TWSESCI Index TSR: 0% vested |

ESG |

40% |

Fulfill both the below goals will be 100% vested; otherwise, will be 0%. ˙Greenhouse gas (GHG) emissions (Note 3) |

|

|

|

|

|

On the job for 2 years after granting: Reduce 14% and above in year 2025; On the job for 3 years after granting: Reduce 16% and above in year 2026; On the job for 4 years after granting: Reduce 18% and above in year 2027. ˙Female directors reach or more than 1/3 and above of the board. (Note 4) |

Note 1. Comparing the performance period with the average of the preceding three years. The average of the previous three years is calculated based on taking the EPS of each year with infinite digits and then calculating the average by rounding off to four decimal places.

Note 2. The TSR is calculated by the share prices of the Company (Ticker: 2303 TT) and the Taiwan Semiconductor Index (Ticker: TWSESCI Index) using the initial share price (i.e., the average share price of previous 30 transaction days from and including the first day of the performance period), the ending share price (i.e., the average share price of previous 30 transactions days from and including the last day of the performance period), plus the dividend (if any). Stock price and dividend information is based on the Taiwan Stock Exchange and Bloomberg Financial Database.

Note 3. Taking year 2020 as the base year, the scope of GHG emissions includes direct emissions (Scope 1) and indirect emissions from purchased electricity (Scope 2) defined by GHG Protocol, and the reduction performance will be calculated based on full capacity scenario.

Note 4. Based on the list of board members on each vesting date.

5. Measures to be taken when employees fail to meet the vesting conditions or in the event of inheritance:

Where an employee has failed to fulfill the vesting conditions, the shares granted to him/her will be recalled and canceled by the Company without compensation. Any other matters will be subject to the regulations established by the Company to govern the issuance of the shares.

6. Other issuance criteria: None

7. Qualification criteria for employees:

(1) To protect the interest of shareholders, the Company will manage the awards program with care. An eligible employee shall be any full-time employee of UMC group who remains on the job on the vesting date. Such employee shall reach a certain level of performance and fulfill at least one of the following conditions:

a. The employee is strongly related to the future strategic development of the Company;

b. The employee is a core technical talent.

(2) The number of grantable restricted stock award shares will be determined based on seniority, job level, position, job performance, overall contribution, special achievement, or other conditions required as the basis for management. The number of shares granted shall be approved by the Chairman and submitted to the Board of Directors for resolution. Any employee who are directors or executives shall be subject to the approval of the Remuneration Committee. Employee who are not directors or executives shall be subject to the approval of the Audit Committee.

(3) Any person who holds 10% and more of the outstanding common shares of the Company is not eligible for a grant. Any member of the Remuneration Committee or any member of the Board of Directors who is not an employee is not eligible for a grant.

(4) The number or ratio of restricted stock award shares granted to any employee shall be subject to the Offering and Issuance Regulations.

8. The necessary reason of the current issuance of RSA:

The Company, in order to attract and retain key talents for the achievement of its medium- and long-term objectives, intends to encourage employees to spare no efforts in reaching its operational goals, with the aim of creating more benefits for the Company and its shareholders and ensuring the alignment of the interest of UMC Group employees with that of its shareholders.

9. Calculated expense amount:

The Company shall measure the fair value of the shares on the grant date and recognize the related expenses by year during the vesting period. Under the circumstance where all the vesting conditions have been fulfilled, the total estimated calculated expense amount is NT$2,943,491 thousand. The estimated calculated expense amounts for 2024 to 2028 respectively are NT$89,454 thousand, NT$1,056,124 thousand, NT$1,015,586 thousand, NT$550,094 thousand, and NT$232,233 thousand.

10. Dilution of the Company's earnings per share (EPS):

Calculated on the basis of the current number of the Company’s outstanding common shares and restricted stock awards not exceeding the amount issued this time, the dilution of Company’s EPS is estimated in the amount of NT$0.01, NT$0.07, NT$0.07, NT$0.04, and NT$0.03 for 2024 to 2028, respectively.

11. Other matters affecting shareholder's equity: No significant impact

12. Restrictions before employees meet the vesting conditions once the RSA are received or subscribed for:

Before any employee who has been granted restricted stock award shares fulfills the vesting conditions, except for the case of inheritance, the restricted stock award shares may not be sold, pledged, transferred, gifted to others, created any encumbrance, or otherwise disposed of.

13. Other important terms and conditions (including stock trust custody, etc.):

The restricted stock award shares issued by the Company shall be placed under custodial trust.

14. Any other matters that need to be specified:

(1) Where the conditions set for this issue of restricted stock award shares require revision or amendment due to instructions from the competent authority, amendment of the applicable laws and regulations or conditions in the financial market, it is proposed that a Shareholders’ Meeting will authorizes the Board of Directors or any person authorized by the Board to deal with the matter at full discretion.

(2) This issue of restricted stock award shares, its related limitations and the important matters agreed to, or any matter not provided for, shall be subject to the applicable laws and regulations and the regulations established by the Company to govern the issuance.

Exhibit 99.6

The announcement of UMC Board of Directors’ Resolution to convene the 2024 Annual General Meeting

1. Date of the board of directors' resolution: 2024/02/27

2. Shareholders meeting date: 2024/05/30

3. Shareholders meeting location: No. 16, Creation Rd. 1, Hsinchu Science Park (UMC’s Fab8S Conference Hall)

4. Shareholders’ meeting will be held by means of (physical shareholders’ meeting/ hybrid shareholders’ meeting / virtual-only shareholders’ meeting): physical shareholders’ meeting

5. Cause for convening the meeting (1) Reported matters:

1. 2023 business report

2. Audit Committee's report of the 2023 audited financial reports

3. 2023 distributable compensation for employees and directors

4. The issuance of the corporate bonds

6. Cause for convening the meeting (2) Acknowledged matters:

1. The Company’s 2023 business report and financial statements

2. The Company’s 2023 earnings distribution

7. Cause for convening the meeting (3) Matters for Discussion:

1. To release the newly elected directors and its designated representatives from non-competition restrictions

2. To amend the Company's Articles of Incorporation

3. To propose the issuance of Restricted Stock Awards

8. Cause for convening the meeting (4) Election matters:

To elect the Company’s 16th term of Directors

9. Cause for convening the meeting (5) Other Proposals: None

10. Cause for convening the meeting (6) Extemporary Motions: None

11. Book closure starting date: 2024/04/01

12. Book closure ending date: 2024/05/30

13. Any other matters that need to be specified: None

Exhibit 99.7

The board meeting approved capital budget execution

1. Date of the resolution of the board of directors or shareholders meeting: 2024/02/27

2. Content of the investment plan: capital budget execution

3. Projected monetary amount of the investment: NTD 1,915 million

4. Projected date of the investment: by capital budget plan

5. Source of capital funds: working capital

6. Specific purpose: capacity deployment

7. Any other matters that need to be specified: none

Exhibit 99.8

To announce related materials on capital injection to UMC CAPITAL CORP.

1. Name and nature of the underlying assets (if preferred shares, the terms and conditions of issuance shall also be indicated, e.g., dividend yield, etc.):

UMC CAPITAL CORP. common shares

2. Date of occurrence of the event: 2024/02/27

3. Amount, unit price, and total monetary amount of the transaction:

Trading volume: Not exceeding 22,000,000 shares;

Unit price: USD 1(approximately NTD 31.49);

Total amount: Not exceeding USD 22,000,000 (approximately NTD 692,780,000)

4. Trading counterparty and its relationship with the Company (if the trading counterparty is a natural person and furthermore is not a related party of the Company, the name of the trading counterparty is not required to be disclosed):

UMC CAPITAL CORP.; the Company’s subsidiary

5. Where the trading counterparty is a related party, announcement shall also be made of the reason for choosing the related party as trading counterparty and the identity of the previous owner, its relationship with the Company and the trading counterparty, and the previous date and monetary amount of transfer:

Participate in subsidiary capital increase; N/A

6. Where an owner of the underlying assets within the past five years has been a related party of the Company, the announcement shall also include the date and price of acquisition and disposal by the related party, and its relationship with the Company at the time of the transaction: N/A

7. Matters related to the current disposal of creditors' rights (including types of collaterals of the disposed creditor’s rights; if creditor’s rights over a related party, announcement shall be made of the name of the related party and the book amount of the creditor’s rights, currently being disposed of, over such related party): N/A

8. Profit or loss from the disposal (not applicable in cases of acquisition of securities) (those with deferral should provide a table explaining recognition): N/A

9. Terms of delivery or payment (including payment period and monetary amount), restrictive covenants in the contract, and other important terms and conditions:

Terms of delivery or payment: based on the capital call schedule of UMC CAPITAL CORP.;

Restrictive covenants in the contract: None

Other important terms and conditions: None

10. The manner of deciding on this transaction (such as invitation to tender, price comparison, or price negotiation), the reference basis for the decision on price, and the decision-making unit:

The decision making manner: new share issuance;

Reference for the decision on price: price of issuance;

The decision-making department: Board of Directors

11. Net worth per share of the Company's underlying securities acquired or disposed of: USD 2.14 (approximately NTD 67.39)

12. Cumulative no. of shares held (including the current transaction), their monetary amount, shareholding percentage, and status of any restriction of rights (e.g., pledges), as of the present moment:

Cumulative volume: Not exceeding 93,662,977 shares;

Monetary amount: Not exceeding NTD 5,476,944,650;

Percentage of holdings: 100 %;

Status of any restriction of rights: None

13. Current ratio of securities investment (including the current trade, as listed in article 3 of Regulations Governing the Acquisition and Disposal of Assets by Public Companies) to the total assets and equity attributable to owners of the parent as shown in the most recent financial statement and working capital as shown in the most recent financial statement as of the present:

Ratio of total assets: 31.99%;

Ratio of shareholder’s equity: 46.45%;

The operational capital as shown in the most recent financial statement: NTD 63,084,968,000.

14. Broker and broker’s fee: No

15. Concrete purpose or use of the acquisition or disposal: Long term investment

16. Any dissenting opinions of directors to the present transaction: None

17. Whether the counterparty of the current transaction is a related party: Yes

18. Date of the board of directors’ resolution: 2024/02/27

19. Date of ratification by supervisors or approval by the Audit Committee: 2024/02/27

20. Whether the CPA issued an unreasonable opinion regarding the current transaction: NA

21. Name of the CPA firm: NA

22. Name of the CPA: NA

23. Practice certificate number of the CPA: NA

24. Whether the transaction involved in change of business model: No

25. Details on change of business model: NA

26. Details on transactions with the counterparty for the past year and the expected coming year: NA

27. Source of funds: NA

28. Any other matters that need to be specified: None

Exhibit 99.9

UMC’s donation to UMC Science and Culture Foundation

1. Date of occurrence of the event: 2024/02/27

2. Reason for the donation: For the promotion of culture education

3. Total amount of the donation: NT$15,250,000

4. Counterparty to the donation: UMC Science and Culture Foundation

5. Relationship with the Company:

A non-profit organization of which the funds donated from the enterprise exceeds one third of the non-profit organization's total funds

6. Name and resume of independent director(s) that expressed an objection or qualified opinion: None

7. Objection or qualified opinion by the aforementioned independent director(s): None

8. Any other matters that need to be specified: None

Exhibit 99.10

Represent subsidiary UMC Capital Corporation to announce the board of directors approves the investment in 7V AI Capital LLC

1. Name and nature of the underlying assets (if preferred shares, the terms and conditions of issuance shall also be indicated, e.g., dividend yield, etc.):

7V AI Capital LLC

2. Date of occurrence of the event: 2024/02/27

3. Amount, unit price, and total monetary amount of the transaction:

Unit Price: N/A (due to the nature of Limited liability company)

Total monetary amount: No more than USD20,000,000

4. Trading counterparty and its relationship with the Company (if the trading counterparty is a natural person and furthermore is not a related party of the Company, the name of the trading counterparty is not required to be disclosed): N/A

5. Where the trading counterparty is a related party, announcement shall also be made of the reason for choosing the related party as trading counterparty and the identity of the previous owner, its relationship with the Company and the trading counterparty, and the previous date and monetary amount of transfer: N/A

6. Where an owner of the underlying assets within the past five years has been a related party of the Company, the announcement shall also include the date and price of acquisition and disposal by the related party, and its relationship with the Company at the time of the transaction: N/A

7. Matters related to the current disposal of creditors' rights (including types of collaterals of the disposed creditor’s rights; if creditor’s rights over a related party, announcement shall be made of the name of the related party and the book amount of the creditor’s rights, currently being disposed of, over such related party): N/A

8. Profit or loss from the disposal (not applicable in cases of acquisition of securities) (those with deferral should provide a table explaining recognition): N/A

9. Terms of delivery or payment (including payment period and monetary amount), restrictive covenants in the contract, and other important terms and conditions:

According to subscription agreement

10. The manner of deciding on this transaction (such as invitation to tender, price comparison, or price negotiation), the reference basis for the decision on price, and the decision-making unit:

According to subscription agreement

UMC Capital Corporation’s Board of Directors.

11. Net worth per share of the Company's underlying securities acquired or disposed of: N/A

12. Cumulative no. of shares held (including the current transaction), their monetary amount, shareholding percentage, and status of any restriction of rights (e.g., pledges), as of the present moment:

Cumulative volume: N/A;

Monetary amount: no more than USD20,000,000

Percentage of holdings: N/A

Status of any restriction of rights: None

13. Current ratio of securities investment (including the current trade, as listed in article 3 of Regulations Governing the Acquisition and Disposal of Assets by Public Companies) to the total assets and equity attributable to owners of the parent as shown in the most recent financial statement and working capital as shown in the most recent financial statement as of the present:

Ratio of total assets: 0.99%

Ratio of shareholder’s equity of the parent company: 1.44%

The operating capital on the latest financial statements as of the date of occurrence: NTD63,084,968,000

14. Broker and broker’s fee: None

15. Concrete purpose or use of the acquisition or disposal: Long term investment

16. Any dissenting opinions of directors to the present transaction: No

17. Whether the counterparty of the current transaction is a related party: No

18. Date of the board of directors’ resolution: 2024/02/27

19. Date of ratification by supervisors or approval by the Audit Committee: NA

20. Whether the CPA issued an unreasonable opinion regarding the current transaction: No

21. Name of the CPA firm: N/A

22. Name of the CPA: N/A

23. Practice certificate number of the CPA: N/A

24. Whether the transaction involved in change of business model: No

25. Details on change of business model: N/A

26. Details on transactions with the counterparty for the past year and the expected coming year: None

27. Source of funds: Disposable funds of the company

28. Any other matters that need to be specified: No need to obtain CPA to issue a price reasonableness opinion on the transaction price because initial public offering

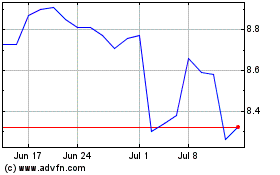

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

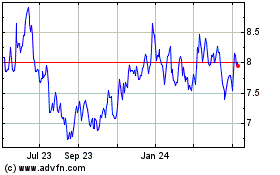

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Apr 2023 to Apr 2024