U.S. Index Futures Dip Amid Inflation Data Anticipation, Oil and Iron Ore Prices Retreat

February 26 2024 - 5:57AM

IH Market News

On Monday, U.S. index futures fell slightly, signaling investor

tension as they await new inflation data this week, closely

monitored by the Federal Reserve, and keep an eye on the wave of

significant earnings reports approaching, including

Salesforce (NYSE:CRM), restaurants, and major

retailers.

At 05:22 AM, Dow Jones futures (DOWI:DJI) fell 55 points, or

0.15%. S&P 500 futures dropped by 0.08%, and Nasdaq-100 futures

retreated by 0.03%. The yield on 10-year Treasury bonds was at

4.244%.

In the commodities market, West Texas Intermediate crude oil for

April fell 0.48%, to $76.12 a barrel. Brent crude for April dropped

0.53%, near $81.19 a barrel. Iron ore traded on the Dalian exchange

fell 3.21%, to $121.56 per metric ton. Iron ore in China also

closed lower, impacted by increased stocks in the largest consumer

and by a slowdown in construction activity caused by adverse

weather conditions, which intensified uncertainties about

demand.

Asian markets showed a mix of results, with Japan’s Nikkei 225

index reaching new highs, while China saw the end of a streak of

gains. The Nikkei rose 0.4%, marking a record above the 1989

historical peak. In contrast, China’s CSI 300 index fell 1.04%.

Measures in South Korea to improve corporate governance had little

effect on the Kospi, which fell 0.8%. Investors remain attentive to

upcoming economic data, while Hong Kong’s Hang Seng index recorded

a drop of -0.5%. Australia’s ASX 200 rose 0.1%.

European markets started the week on a negative trend,

reflecting investor caution as they await new inflation data. The

Stoxx 600 registered a slight decline, after reaching a record the

previous week. The performance of sectors varied, with a notable

drop in the mining sector, while the retail sector recorded a

modest increase. The anticipation around the U.S. personal

consumption expenditures price index, a key inflation indicator,

adds a layer of anticipation to the market.

U.S. stocks followed Thursday’s rise but had a modest

performance on Friday, with the Dow and S&P 500 hitting

records. The movement reflected optimism about

Nvidia (NASDAQ:NVDA), but the euphoria cooled,

keeping the market cautious. Gold rose, while semiconductors and

airlines fell, anticipating significant economic reports next

week.

For Monday’s quarterly earnings front, companies scheduled to

present financial reports before the market opens include

Li Auto (NASDAQ:LI), Domino’s

Pizza (NYSE:DPZ), Krystal (NASDAQ:KRYS),

Freshpet (NASDAQ:FRPT), Elanco Animal

Health (NYSE:ELAN), BioCryst

Pharmaceuticals (NASDAQ:BCRX), among others.

After the market closes, investors await the results from

Unity (NYSE:U), Zoom Video

Communications (NASDAQ:ZM), Workday

(NASDAQ:WDAY), Hims & Hers (NYSE:HIMS),

iRobot (NASDAQ:IRBT), Oneok

(NYSE:OKE), CarGurus (NASDAQ:CARG),

Heico (NYSE:HEI), TransMedics

(NASDAQ:TMDX), and more.

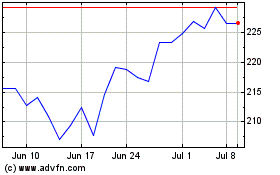

Workday (NASDAQ:WDAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Workday (NASDAQ:WDAY)

Historical Stock Chart

From Apr 2023 to Apr 2024