Media Release Reviewed Results For the year ended 31 December 2023 Key featuresStatement by Mike Fraser, CEO Gold Fields is a business with quality operations that are run by talented and dedicated people, who care deeply about the work they do and are committed to delivering value for all of our stakeholders. I joined Gold Fields on 1 January 2024 and since then, I have had the opportunity to visit most of our operations and meet with our teams from across the globe. I am pleased to report that for the year ended 31 December 2023, Gold Fields delivered on its original cost guidance despite operational challenges and persistent inflationary headwinds facing the industry. Group attributable production for the year, excluding Asanko, was 2.244m gold-equivalent ounces (Moz) was 99.7% of the guided range of 2.250Moz – 2.300Moz while Group all-in sustaining costs (AISC) at US$1,295/oz were better than the guided range of between US$1,300/oz and US$1,340/oz, as weaker exchange rates provided some reprieve to the inflationary pressures. Group all-in costs (AIC) were US$1,512/oz, also within the guided range of US$1,480/oz – US$1,520/oz. Our safety performance, however, has not been at the level we strive for as we have not eliminated serious injuries and fatalities in our business. It is with profound sadness that we have had to report the loss of three of our colleagues who were fatally injured at our operations in the past 12 months. It is a painful reminder to all of us at Gold Fields, that the safety and wellbeing of our colleagues must remain the absolute priority for all of us. We extend heartfelt condolences to the families, friends and colleagues of those who lost their lives at our operations. The favourable Australian Dollar and South African Rand exchange rates as well as the strong gold price received of US$1,942/oz during 2023 (2022: US$1,785/oz) provided notable tailwinds for our financial performance. In the year under review, we reported steady normalised earnings at US$900m (2022: US$860m) and generated free cash flow from operations of US$1,002m (2022: US$855m). This enabled us to declare total dividend of R7.45/share for 2023, compared with the total R7.45/share paid in 2022. This is equal to 40.1% of our normalised earnings, in line with our policy of paying 30 – 45% of normalised earnings in dividends. We are mindful that the gold price and exchange rate tailwinds will not persist, and that the favourable pricing cycle for the industry could turn. We are therefore committed to continue building a resilient business that delivers competitive returns to shareholders and sustainable value for stakeholders through the price cycles. This means being disciplined about how we allocate capital (and manage the trade-off between short term returns and investing in our business for the long term), reducing costs in a sustainable manner (through a review of our organisational structure, innovation and modernisation), replacing Mineral Reserves and pursuing accretive growth opportunities to maximise the value and quality of our portfolio. We will do this while delivering on our 2030 Environmental, Social and Governance (ESG) targets which are focused on safety and health, diversity, stakeholder value creation, tailings management, decarbonisation, responsible water stewardship. • 2 fatalities reported. • Gold Fields ranked number 1 in Sunday Times top 100 Companies. • Final dividend of 420 cents per share declared. • Cost guidance met and production volumes at 99.7% of guidance. • Salares Norte project delayed. • Scope 3 emissions reduction target announced for 2030. • Disposal of Asanko and Rusoro holdings. US$367m adjusted free cash flow* US$1,002m adjusted free cash flow from operations US$900m normalised earnings** 2.304m ounces of attributable production US$1,295 per ounce of all-in sustaining cost US$1,512 per ounce of all-in cost • Cash flow from operating activities less net capital expenditure, environmental payments, lease payments and redemption of Asanko preference shares. ** Profit excluding gains and losses on foreign exchange, financial instruments and non-recurring items after taxation and non-controlling interest effect JOHANNESBURG, 22 February 2024: Gold Fields Limited (NYSE & JSE: GFI) announced profit attributable to owners of the parent for the year ended 31 December 2023 of US$703.3m (US$0.79 per share). This compared to profit of US$711.0m (US$0.80per share) for the year ended 31 December 2022. A final dividend number 99 of 420 SA cents per share (gross) is payable on 18 March 2024, giving a total dividend for the year ended 31 December 2023 of 745 SA cents per share (gross).

A key overlay to our strategy is the disciplined allocation of capital. As a priority, we invest in our existing operations to ensure safe and reliable production, while maintaining an investment grade credit rating. Next to be funded will be shareholder returns in the form of a base dividend which is linked to normalised earnings. Thereafter growth opportunities (including improvements to operations, organic growth, acquisitions, and extensions of life) will compete with additional shareholder returns in the form of special dividends and share buy-backs for the use of excess cash. We have set the following key priorities for the business to achieve this year: • Ensuring the physical and psychological safety of our people • Safe delivery against our production and cost targets • Delivery of the Salares Norte ramp up • Continuing progress towards meeting our 2030 ESG targets • Continuing to improve the value and quality of our portfolio Several critical leadership changes took place at Gold Fields during 2023, with more executive appointments to follow this year, we have announced the retirement of two EVPs and our CFO Paul Schmidt. The searches to fill these positions are well advanced with appointments expected in the first half of 2024. The relatively high turnover in our leadership is due to the resignations of long-serving executives for personal reasons or age-related retirements. It is worth noting that our mines’ operational performances remained strong throughout this period of change, which reflects the capability that exists deep in the organisation. I will now provide details of our 2023 performance and 2024 focus areas under each of our three strategic pillars. Pillar 1: Maximising the potential from our current assets through people and innovation Ensuring the health and safety of our people The safety and health of our people remains our first and most important value and we are committed to ensuring that everyone goes home safe and healthy every day. Nothing matters more. We are deeply saddened by the fatal incidents that occurred at our operations. In 2023 two fatalities occurred at our Tarkwa mine in Ghana both involving contractors working on site. Furthermore, we recorded a fatal incident during the reconstruction of the T&A Stadium in Tarkwa, a project funded by the Gold Fields Ghana Foundation. After year-end, on 2 January 2024, a trackless mechanical supervisor at South Deep in South Africa was fatally injured underground in a trackless equipment related incident. We extend our heartfelt condolences to the families, loved ones and colleagues of those who lost their lives at our operations. Despite concerted efforts over many years, we have not yet been able to eliminate serious injuries and fatalities from our business. We continue to work towards this and have initiated an independent review, to be carried out in H1 2024, of the safety culture, processes, systems, and practices across the Group, the findings of which will allow us to identify gaps, high- risk areas and opportunities to ensure the safety of our people. This is crucial in accelerating our safety journey and establishing a standard safety approach across the organisation. Our commitment to the health and safety of our people extends to psychological health, which is key to building safer, more inclusive, and respectful workplaces. As previously reported, Gold Fields conducted an independent review of the lived experiences of our people in the workplace during 2022 and reported the findings of this review by Elizabeth Broderick and Company in August 2023. We are implementing all the recommendations of this review, the progress of which is being monitored closely by management and the Board. We will continue to engage and report transparently in this regard and will conduct a follow up independent review in 2026. The findings of the EB&Co’s report and the planned safety review form an integral part of our transformational culture journey, which started in early 2022. This journey, the Gold Fields Way, has safety and respectful workplace as two of its priority themes, and has the overall safety and wellbeing of our people as its irrevocable foundation. Maximising our current assets to deliver quality ounces Gold Fields is well positioned in terms of our jurisdictional footprint, asset quality (AIC and life) and profitability per ounce produced. Our production base is set to increase by 20% over the next 24 months as Salares Norte ramps up and South Deep builds up to 380koz per annum. Importantly, this incremental production comes with very competitive all-in costs and will improve the overall quality of the portfolio and enhance the cash generation of the business. Our production base is underpinned by the Australian assets which are expected to continue producing approximately 1Moz per annum for at least the next decade. Over time, this portfolio of assets has had a strong track record of replacing the Mineral Reserves depleted through production. We continue to showcase the potential of these assets and believe that further growth in reserves, particularly at the Invincible mine at St Ives and the Wallaby deposit at Granny Smith will further increase the valuation of this part of the business. Over the next 10 years, however, we expect to be mining deeper and are innovating to deliver on life extension opportunities. In Ghana, Tarkwa as the largest mine in our portfolio, can continue delivering approximately 480koz per annum for at least the next 10 years on a standalone basis. The Tarkwa/Iduapriem joint venture, currently in progress and awaiting the approval of the Government of Ghana, will further leverage operating efficiencies to unlock higher gold grades and enable an extension of life to at least 18 years. The combined mine (on 100% basis) will deliver estimated annual production of approximately 900koz over the first five years and approximately 600koz per annum for the remaining life of the operation. Under Pillar 3 below, we provide an update on the progress of the joint venture. South Deep, which is on a better footing following the mine resetting, is building up to 380koz per annum which the mine is expected to reach on a steady state monthly run rate in the latter part of 2026. With its substantial resource and long life, this mine presents a unique opportunity for longevity of producing quality ounces. We are managing he future of the Damang and Cerro Corona mines (which are non-core) in a manner that will deliver value for Gold Fields and is responsible towards the various stakeholders. We are considering alternatives to best achieve this and will continue to keep the market appraised in this regard. The recent sale of our 45% effective interest in the Asanko mine in Ghana to our JV partner Galiano Gold, for a total consideration of US$170m plus a 1% net smelter royalty on future production from the Nkran deposit as well as the disposal of our 24.35% interest in TSX-listed Rusoro Mining for US$62m, is part of our strategy to streamline our portfolio. The disposals of non-core assets raises additional funds, allowing us to invest capital and resources in strategically aligned, value-adding opportunities. Asset optimisation Our asset optimisation programme is gaining traction with each of our operations having identified initiatives over the next two years to improve operational efficiencies and performance, improve ore movement and metal recoveries, use energy efficiently and optimise the use of renewables. Benefits from these initiatives are expected from 2024 onwards. As our asset optimisation programme matures, we will be identifying breakthrough and transformative improvements to the way we mine through modernisation and the deployment of appropriate technologies. These will be important for the long-term sustainability of our operations as persistent inflation erodes margins and valuations and the landscape of mining evolves. 2 Gold Fields Reviewed Results for the year ended 31 December 2023

Pillar 2: Build on our leading commitment to ESG Gold Fields has embedded ESG into its operations and set itself 2030 targets for its six priority commitments: • safety wellbeing and environment; • gender diversity; • stakeholder value creation; • decarbonisation; • tailings management; and • water stewardship. The 2023 performance against these priorities is depicted in the table below. Year ended ESG priority areas 2030 Target 2023 2022 Safety, wellbeing and environment Fatalities1 0 2 1 Serious injuries 0 6 5 Level 3–5 env. incidents 0 0 0 Gender diversity Women representation 30% 25% 23% Stakeholder value creation Total value creation benefiting host communities 30% 31% 27% Legacy programmes benefiting host communities 6 1 under implementation 0 Decarbonisation Net emissions reduction (%) (30)% (4)% +1% Absolute emissions reduction (%) (50)% (12)% (18)% Tailings management Global Industry Standard on Tailings Management (GISTM) 2025: Full GISTM conformance Priority TSF reports completed On track Reduce active upstream raised TSFs from 5 to 3 3 5 5 Water Stewardship Recycling/reuse of water (%) 80% 74% 75% Freshwater withdrawal (GL) 7.8 8.8 8.5 1 Refers to fatalities reported at the operations. During 2023 noticeable progress was made in a number of areas: • The number of women among our employees reached 25% at the end of the year compared with 23% a year earlier, with over 50% of these women working in core mining roles. • The Group’s value distribution to national economies was US$3.8bn for 2023. Of this value distribution, US$1bn, 31% of the total, was delivered to host communities through employment, procurement and social investments. Environmentally, Gold Fields made significant strides in its decarbonisation journey. Scope 1 and 2 CO₂ emissions during 2023 declined by 5% below 2022 levels, a significant reduction made possible by our investments in renewable electricity projects over the past four years. Renewable energy accounted for 17% (2022: 13%) of electricity consumption at Group level during 2023, with renewables providing 100% of electricity consumed by our Cerro Corona mine in Peru, 50% at the Agnew mine in Australia and 15% of South Deep’s electricity consumption. We are making meaningful progress towards our target to reduce emissions by 30% by 2030 (from our 2016 baseline). At end 2023 we were 4% below the base. In February 2024, our Board approved construction of the renewables microgrid project at our St Ives mine in Australia budgeted at approximately A$296m (US$195m). The microgrid, the largest in the Group’s portfolio, will comprise 42MW of wind and 35MW of solar and will provide 73% of the mine’s energy requirements, once operational towards the end of 2025. It will reduce St Ives’ Scope 1 and 2 emissions by an estimated 50% in 2030 against the mines 2016 baseline. A critical element in our decarbonisation journey is including emissions reductions in our supply chain, the so-called scope 3 emissions. In November 2023, Gold Fields announced its 2030 target of reducing scope 3 emissions by a net 10% from a 2022 base. The baseline study that defined the target in line with the ICMM’s new scope 3 methodology, determined that Gold Fields’ total 2022 scope 3 emissions amounted to 980kt CO2e, 36% of its total 2022 emissions of 2,696kt CO2e. The 36% level is an increase from the 25% reported previously. Gold Fields announced a five-year US$1.2bn revolving credit facility (RCF) in May 2023, aligned to the Company’s strategy and 3 of its 2030 ESG targets. In October 2023, a second sustainability-linked loan, backed by a syndicate of 10 Australian and international banks, was announced, with the same indicators. The Australian facility was one of the first sustainability- linked loan transactions in the local mining industry and the first for a gold mining company in the country. Pillar 3: Grow the value and quality of our portfolio of assets It is important to stress that growth in our portfolio is driven by quality and value and not necessarily production volumes. This means focusing growth on cash flow per ounce and not simply volumes and life-of-mine. We are fortunate to have a pipeline of quality growth projects in our portfolio at various stages of execution which we discuss below. In addition, we fully expect further consolidation in the gold sector over the coming years. We want to be positioned to be opportunistic in this consolidation and are exploring value accretive acquisitions, bolt-on opportunities and strategic joint ventures to replace reserves and grow the value and quality our current portfolio of assets. At the same time, we will review assets within our portfolio which do not meet the required cash flow returns and show limited potential in expanding reserves. Salares Norte Project The Salares Norte Project presents significant growth and value uplift for our portfolio. After having experienced several delays owing to the impacts of the Covid-19 pandemic, adverse weather conditions, supply chain constraints and construction labour scarcity, mechanical construction of the project is now 99.4% complete with pre-commissioning, commissioning and handover of the project to the operations team currently underway. Mining continued as planned throughout the course of 2023, with a cumulative 87.2Mt of waste moved by the end of the year and 2.3Mt containing 520koz gold equivalent on stockpile. As announced on 28 December 2023, labour availability and an underestimation of the interdependence of pre-commissioning and commissioning activities have recently delayed the delivery of first gold from the project and its subsequent ramp-up. Since the beginning of the year, we have seen progress on labour availability on site and resolved critical commissioning delays. First filtered (dry stack) tailings were delivered in February 2024, a key milestone in the pre-commissioning process. The project plan has been updated and has been reviewed by independent experts, who have confirmed that they are in agreement with the project plan for the delivery of first gold by April 2024. The second phase of the review, which is to confirm the ramp up schedule, is underway and is expected to be completed shortly. For 2024, we expect gold equivalent production of 250koz at AIC of US$1,790/eq oz – US$1,850/eq oz. Production volumes for 2025 are expected to be 580koz. 3

Average gold equivalent production for the first five years of the mine life (2025 – 2029) is expected to be 485koz per annum at an AIC of US$790/eq oz (in 2024 money). Gold equivalent ounces produced over the life of mine (2025 – 2033) is expected to be 360koz at an AIC of US$820/eq oz (in 2024 money). During 2023 US$438m was spent on the project, comprising US$395m in capital expenditure, US$29m in exploration expenditure, US$2m release of working capital and US$13m in other cost. The total project capital cost has been revised to US$1,180m – US$1,200m (from US$1,040m previously), mainly due to higher contractor costs, owing to increased contractor rates, additional contractors on site and the four month delay in the delivery of first gold and ramp up. We will continue to invest in exploration within the area of the project to add to the life-of-mine production pipeline. Over 15,000m of exploration drilling occurred in 2023 compared to 18,836m in 2022. In late January, we received the last required permit to recommence with the capture and relocation of chinchillas from future mining areas at Salares Norte. We will start the programme, carried out and supervised by independent environmental experts, in late February. Tarkwa/Iduapriem joint venture We continue to engage with the Government of Ghana for the necessary approvals to support the implementation of the Tarkwa/ Iduapriem joint venture which has the potential to create the largest gold mine in Africa, supported by a substantial mineral endowment. It will bring value not only for the two companies but also to the government in the form of tax and royalty payments and distributions for its life-of-mine, spanning almost two decades. Critically, the proposed JV will bring economic opportunities in the form of jobs, procurement and infrastructure investment in local communities for a longer period of time than were the mines to continue operating separately. We remain positive and committed to the successful conclusion of the joint venture and are working closely with AngloGold Ashanti on the integration plan for the combined mine. Windfall Project The Windfall Project in Québec, Canada, a 50:50 JV with Canada’s Osisko Mining, is a unique growth opportunity for Gold Fields to partner with Osisko mining in developing a world-class orebody in a sought after, Tier 1 mining jurisdiction. The project’s environmental impact assessment was submitted to the regulator in December 2023 with a decision expected by late 2024/early 2025. Once the Environmental Impact Assessment (EIA) is approved, construction of the mine will commence, and Gold Fields will settle the balance of the acquisition price of C$300m. Windfall has a production target of approximately 300koz of gold annually over its current 10-year life-of-mine. It currently employs around 370 people of which 230 are contractors. The project has been allocated hydro- electricity via a 95km long power line, owned and operated by the Cree First Nation of Waswanapi on whose traditional land the project is located. As part of the partnership with Osisko Mining, Gold Fields has also acquired a 50% interest in Osisko’s highly prospective Urban Barry and Quévillon district exploration tenements, which total approximately 2,400km2. These will be co-explored and co-developed with Osisko, with Gold Fields funding the first C$75m in regional exploration for the first seven years of the partnership, after which time exploration spend will be shared on a 50:50 basis. Results for 2023 Normalised earnings for the year were 5% higher YoY at US$900m or US$1.01 per share (2022: US$860m or US$0.97 per share) while headline earnings for 2023 were 21% lower YoY to US$837m or US$0.94 per share (2022: US$1,061bn or US$1.19 per share). The 2022 headline earnings included the once off net proceeds for the Yamana break fee of US$202m (US$0.23 per share). Basic earnings for 2023 decreased by 1% YoY to US$703m or US$0.79 per share (2022: US$711m or US$0.80 per share) and included after-tax impairments of assets and investments of US$157m (2022: US$380m). The average US Dollar/Rand exchange rate weakened by 13% to R18.45 in 2023 from R16.37 in 2022. The average Australian Dollar/US Dollar exchange rate weakened by 4% to US$0.66 from US$0.69. In line with our dividend policy of paying out 30% to 45% of normalised earnings as dividends, we declared a final dividend of 420 SA cents per share. This takes the total dividend declared for the year to 745 SA cents per share (2022: 745 SA cents per share). The 2022 dividend included 185 SA cents per share, relating to the after-tax break fee received from the terminated Yamana bid. Gold Fields generated cash flow from operating activities less net capital expenditure, environmental payments, lease payments and redemption of Asanko preference shares of US$367m in 2023 (2022: US$431m). During 2023, there was a US$320m increase in the net debt, ending the year at US$1,024m, with a net debt to adjusted EBITDA ratio of 0.42. This compares with a net debt balance of US$704m, with a net debt to adjusted EBITDA ratio of 0.29x at the end of December 2022. Excluding lease liabilities, the core net debt was US$588m at the end of 2023. Regional overviews Australia Gold Fields’ Australian operations delivered another year of strong operational performance in 2023, once again surpassing the 1Moz annual production level. Gold production was in line with 2022 at 1,062koz. All-in cost increased by 14% to A$1,886/oz (US$1,253/oz) in 2023 from A$1,659/ oz (US$1,150/oz) in 2022 driven by mining-related inflation. The Australia region generated adjusted free cash flow of US$486m in 2023, 13% higher than the US$431m generated in 2022. The Gruyere mine was impacted in 2023 by the failure to achieve planned capital and waste material movements. The tight labour market in Western Australia impacted the ability to attract and retain skilled mining operators, maintenance workers and supervisors at Gruyere, particularly to support the planned increased production profile. There has been a collaborative intervention by the contractor management, Gold Fields executives, and our joint venture partner Gold Road on the way forward to deliver an accelerated business plan in 2024. South Africa South Deep had a tough start to the year, with two fall of ground incidents impacting production in Q1 2023. This was compounded by a shortage of key skills, particularly operators and artisans for the long-hole stoping drill rigs. These challenges led to a decrease in guidance for South Deep with the release of our H1 2022 results, with new guidance set at 10,000kg (321koz) set for 2023. Gold production decreased 2% to 10,021kg (322koz) in 2023 from 10,200kg (328koz) in 2022. Total all-in cost increased by 12% to R800,097/kg (US$1,349/oz) in 2023 from R713,624/kg (US$1,356/oz) in the 2022, mainly due to higher cost of sales before amortisation and depreciation and lower gold sold, partially offset by lower capital expenditure. South Deep in early February also concluded a two-year extension to its current 3-year wage agreement with organised labour. This agreement seeks to balance the interest of the Company and employees and brings much needed certainty and stability to the operation until 2026. Encouragingly, adjusted free cash flow increased by 78% to R3.8bn (US$204m) in 2022 from R2.1bn (US$129m) in 2022. This is the fifth consecutive year of positive free cash flow from the mine. Ghana Total production (excluding Asanko) decreased by 8% to 704koz in 2023 from 762koz in 2022 driven by decreased production at Damang due to the completion of the Huni and Lima Kwesi Gap pits and increased processing of lower grade stockpiles. All-in costs increased by 15% to US$1,377/oz in 2023 from US$1,198/oz in 2022, which included a US$34m NRV write down of stockpiles at Damang. The region produced adjusted free cash flow (excluding Asanko) of US$238m in 2023, 8% higher than the US$219m generated in 2022. In December 2023, we announced the sale of our 45% effective interest in the Asanko gold mine to our joint venture partner Galiano Gold, as discussed earlier. The transaction was structured in such a way that Gold Fields received an upfront amount of US$85m (settled in cash and Galiano shares) with the remaining amount staggered over three future payments. In addition, we will receive a 1% net smelter royalty on future production from the Nkran deposit once certain conditions have been met. We expect the transaction to close in the first half of 2024. 4 Gold Fields Reviewed Results for the year ended 31 December 2023

Peru Equivalent gold production at Cerro Corona decreased by 8% to 239koz in 2023 from 261oz in 2022, due to lower grades and tonnes processed and a lower copper/gold price conversion factor. Total all-in costs per equivalent ounce increased by 15% to US$1,146 per equivalent ounce from US$998 per equivalent ounce in 2022. Cerro Corona generated adjusted free cash flow of US$75m in 2023, largely unchanged from the US$76m generated in 2022. Reserve and resources update Group attributable Gold Measured and Indicated Exclusive Mineral Resource decreased 2.4% to 30.3Moz at 31 December 2023 from 31.1 Moz at 31 December 2022 while attributable Inferred Exclusive Mineral Resource decreased 8.4% to 10.2Moz (31 December 2022: 11.1Moz). Group attributable proved and probable gold mineral reserves decreased 3.1% to 44.6Moz at 31 December 2023 (31 December 2022: 46.1Moz). The decrease in both resources and reserves net of depletion is primarily due to depletion and cost inflation. There has been some impact to reserve replacement due to changes in the reporting calendar to better align business planning and reserves. Significant reduction in the mineral resources at Cerro Corona is due to planned sterilisation once in-pit tailings starts in 2026. Gold Fields provided a metal price deck and exchange rate guidance to the operations for resource and reserve modelling in May 2023. An amendment to the guidance was made in October 2023 due to the devaluation of the A$ (US$ to A$ at 0.65). The change has been applied to the financials across all of the Australian operations but has not been applied to all aspects of the reserve process. Given the late timing of this change, the Australian operations have not yet updated their physicals and optimisations with the new forex rate. The mineral resources and mineral reserves supplement will be published with the Integrated Annual Report at the end of March 2024. Mineral Reserves Attributable Proved and Probable Reserves 2022 Attributable Proved and Probable Reserves 2023 YoY % change Gold Mineral Reserves Proved and Probable (Moz) 46.1 44.6 (3.1)% Copper Mineral Reserves Proved and Probable (Mlbs) 398.4 336.0 (15.7)% Silver Mineral Reserves Proved and Probable (Moz) 42.2 41.9 (0.1)% Mineral Resources Attributable Resource 2022 Attributable Resource 2023 YoY % change Gold Mineral Resource Measured and Indicated (Moz) 31.1 30.3 (2.4)% Gold Mineral Resource Inferred (Moz) 11.2 10.2 (8.4)% Copper Mineral Resource Measured and Indicated (Mlbs) 299.6 — (100.0)% Copper Mineral Resource Inferred (Mlbs) 1.1 — (100.0)% Silver Mineral Resource Measured and Indicated (Moz) 2.5 2.2 (12.3)% Silver Mineral Resource Inferred (Moz) 0.5 0 (83.8)% The Company’s Mineral Resources and Mineral Reserves are estimated and prepared in accordance with SAMREC and SEC regulations under the supervision and review of the group competent persons, Julian Verbeek and Jason Sander, who are members of Gold Fields’ Corporate Technical Services team. They both consent to the disclosure of these statements in the form they are presented. Outlook and 2024 guidance 2024 remains another significant capital expenditure year for Gold Fields, given the remaining project capital at Salares Norte, the renewables microgrid at St Ives as well as the elevated level of sustaining capex across the portfolio, to maintain the production base of the Group. Based on the impending sale of our 45% effective interest in Asanko in 2024, no guidance will be provided for the equity-accounted investee. Consequently, Group guidance excludes our share of the Asanko joint venture. For 2024, attributable gold equivalent production (excluding Asanko) is expected to be between 2.33Moz and 2.43Moz (2023 comparable 2.24Moz). AISC is expected to be between US$1,410/oz and US$1,460/oz, and AIC is expected to be US$1,600/oz to US$1,650/oz. Included in sustaining capital expenditure is A$200m (US$132m) for a St Ives renewable power project. Excluding this renewable microgrid project which accounts for approximately US$60/oz, the ranges for AISC will be US$1,350/oz – US$1,400/oz and AIC will be US$1,540/oz to US$1,590/oz. The exchange rates used for our 2024 guidance are: R/US$18.70, US$/A$0.66 and C$/US$0.75. The metal price assumptions for the calculation of royalties and copper and silver by-products are: gold price US$2,050/oz (A$3,100/oz, R1,200,000/kg); copper price US$8,500/t and silver price US$23/oz. The increase in AIC is due to higher sustaining capital expenditure mainly at Gruyere, St Ives and South Deep and higher cost of sales before amortisation and depreciation as a result of inflationary increases as well as gold inventory movements mainly at St Ives, Damang and Tarkwa, partially offset by higher production. Total capex for the Group for the year is expected to be US$1.130bn – US$1.190bn. Sustaining capital is expected to be US$860m – US$890m. The increase in sustaining capital from US$692m in 2023 is driven largely by: • A$200m (US$132m) to be spent in 2024 on the renewable microgrid project; • increased development and infrastructure capital at St Ives; • increased capital waste stripping at Gruyere; and • mine infrastructure upgrades and fleet replacement at South Deep. Non-sustaining capex is expected to be US$270m – US$300m, with the largest component of this being the Salares Norte project capital of US$148m and Windfall Project capital of US$56m with the balance relating to various growth projects in the Australia region. The above is subject to safety performance which limits the impact of safety-related stoppages and the forward-looking statement on page 70. Mike Fraser Chief Executive Officer 22 February 2024 5

Key statistics United States Dollar Quarter Year ended Figures in millions unless otherwise stated December 2023 September 2023 December 2022 December 2023 December 2022 Gold produced* oz (000) 608 542 601 2,304 2,399 – Continuing operations oz (000) 594 526 586 2,244 2,322 – Discontinued operations oz (000) 14 16 15 60 77 Tonnes milled/treated 000 10,653 10,933 10,638 43,052 42,199 – Continuing operations 000 9,984 10,225 9,955 40,315 39,576 – Discontinued operations 000 669 708 683 2,737 2,623 Revenue (excluding Asanko) US$/oz 1,987 1,924 1,736 1,942 1,785 Cost of sales before gold inventory change and amortisation and depreciation (excluding Asanko) US$/tonne 54 48 50 51 49 AISC# US$/oz 1,372 1,381 1,063 1,295 1,105 – Continuing operations US$/oz 1,356 1,380 1,058 1,289 1,097 – Discontinued operations US$/oz 2,060 1,427 1,217 1,516 1,346 Total AIC# US$/oz 1,632 1,622 1,298 1,512 1,320 – Continuing operations US$/oz 1,618 1,622 1,300 1,507 1,317 – Discontinued operations US$/oz 2,248 1,632 1,227 1,672 1,435 Net debt US$m 1,024 1,141 704 1,024 704 Net debt (excluding lease liabilities) US$m 588 749 310 588 310 Net debt to adjusted EBITDA ratio 0.42 0.48 0.29 0.42 0.29 Adjusted free cash flow US$m 367 431 Profit/(loss) attributable to owners of the parent US$m 703.3 711.0 – Continuing operations US$m 722.2 698.0 – Discontinued operations US$m (18.9) 13.0 Profit/(loss) per share attributable to owners of the parent US c.p.s. 79 80 – Continuing operations US c.p.s. 81 79 – Discontinued operations US c.p.s. (2) 1 Headline earnings attributable to owners of the parent US$m 837.3 1,061.0 – Continuing operations US$m 809.3 1,048.0 – Discontinued operations US$m 28.0 13.0 Headline earnings per share attributable to owners of the parent US c.p.s. 94 119 – Continuing operations US c.p.s. 91 118 – Discontinued operations US c.p.s. 3 1 Normalised profit attributable to owners of the parent US$m 899.9 860.1 – Continuing operations US$m 871.9 847.1 – Discontinued operations US$m 28.0 13.0 Normalised profit per share attributable to owners of the parent US c.p.s. 101 97 – Continuing operations US c.p.s. 98 96 – Discontinued operations US c.p.s. 3 1 * Gold produced in this table is attributable and includes Gold Fields’ share of 45% in Asanko. # Refer to page 51. At 31 December 2023, all operations are wholly owned except for Tarkwa and Damang in Ghana (90.0%), South Deep in South Africa (96.43%), Cerro Corona in Peru (99.5%), Gruyere JV (50%) and Asanko JV (45% equity share). Gold produced and sold throughout this report includes copper gold equivalents of approximately 5% of Group production. AISC and total AIC in the key statistics table include all Gold Fields operations, projects and offices. Figures may not add as they are rounded independently. 6 Gold Fields Reviewed Results for the year ended 31 December 2023

All-in cost reconciliation United States Dollar Quarter Year ended Figures in millions unless otherwise stated December 2023 September 2023 December 2022 December 2023 December 2022 AIC for mining operations (pages 51–52) US$/oz 1,321 1,389 1,119 1,277 1,164 Salares Norte US$/oz 243 173 169 192 143 Total AIC for mining operations including Salares Norte US$/oz 1,564 1,562 1,288 1,469 1,307 Windfall US$/oz 36 48 — 21 — Corporate and other US$/oz 32 12 10 22 13 Total AIC US$/oz 1,632 1,622 1,298 1,512 1,320 Currencies and metal prices United States Dollar Quarter Year ended Figures in millions unless otherwise stated December 2023 September 2023 December 2022 December 2023 December 2022 US$1-ZAR 18.73 18.65 17.61 18.45 16.37 A$-US$ 0.65 0.65 0.66 0.66 0.69 Gold price (US$/oz) 1,987 1,924 1,736 1,942 1,785 Copper price (US$/tonne) 8,169 8,356 8,006 8,483 8,816 STOCK DATA FOR THE YEAR ENDED DECEMBER 2023 Number of shares in issue NYSE – (GFI) – at 31 December 2023 893,540,813 Range – Year US$9.05 – US$17.40 – average for the year 893,318,864 Average Volume – Year 5,073,079 shares/day Free float 100 per cent JSE Limited – (GFI) ADR ratio 1:1 Range – Year ZAR163.82 – ZAR323.13 Bloomberg/Reuters GFISJ/GFLJ.J Average volume – Year 3,135,791 shares/day Pro forma financial information This media release contains certain non-IFRS financial measures in respect of the Group’s financial performance, the statement of financial position and cash flows presented in order to provide users with relevant information and measures used by the Group to assess performance. Non-IFRS financial measures are financial measures other than those defined or specified under all relevant accounting standards. To the extent that these measures are not extracted from the segment disclosure included in the reviewed condensed consolidated financial statements of Gold Fields Limited for the year ended 31 December 2023, these measures constitute pro forma financial information in terms of the JSE Limited Listings Requirements and are the responsibility of the Group’s Board of Directors. They are presented for illustrative purposes only and due to their nature, may not fairly present Gold Fields’ financial position, changes in equity, results of operations or cash flows. In addition, these measures may not be comparable to similarly titled measures used by other companies. The key non-IFRS measures used include normalised profit attributable to the owners of the parent, normalised profit per share attributable to the owners of the parent, net debt (including and excluding lease liabilities), adjusted EBITDA, sustaining capital expenditure, non-sustaining capital expenditure, adjusted free cash flow, adjusted free cash flow from operations, all-in sustaining and total all-in costs. The applicable criteria on the basis of which this information has been prepared is set out in the notes accompanying the media release. This pro forma financial information has been reported on by the Group’s auditors, being PricewaterhouseCoopers Inc. Their unqualified auditor’s report thereon is on page 67 of this report. 7

Results for the Group Year ended 31 December 2023 compared with year ended 31 December 2022 Health and safety The safety of our people is our number one value and it is therefore with deep sadness that we had to report two operational fatalities (2022: 1) and six serious injuries (2023: 5) during 2023. A fatal incident involving a contractor at our Tarkwa mine was reported in our H1 results. Tragically, a contractor dump truck operator was fatally injured on 30 August 2023 while working at the Underlap waste rock dump, also at Tarkwa, during night shift operations. Additionally, there was a non-operational fatal incident at the T&A Stadium in Tarkwa during H1 2023. We extend our heartfelt sympathies and condolences to the families, friends and colleagues of the deceased. The annual Total Recordable Injury Frequency Rate (TRIFR) for the Group was 2.01, continuing the reduction achieved in recent years. Despite concerted effort over many years, we have been unable to eliminate fatalities and serious injuries from our business. We have initiated an independent review, to be carried out in H1 2024, of safety culture, processes, systems and practices across the Group. Year ended Safety 2023 2022 2021 Fatalities 2 1 1 Serious injuries1 6 5 9 TRIFR2 2.01 2.04 2.16 1 A Serious Injury is a work-related injury that incurs 14 days or more of work lost and results in a range of injuries detailed at goldfields.com/safety.php 2 TRIFR = (Fatalities + Lost Time Injuries3 + Restricted Work Injuries4 + Medically Treated Injuries5) x 1,000,000/ number of hours worked. 3 A Lost Time Injury (LTI) is a work-related injury resulting in the employee or contractor being unable to attend work for a period of one or more days after the day of the injury. The employee or contractor is unable to perform any functions. 4 A Restricted Work Injury (RWI) is a work-related injury sustained by an employee or contractor which results in the employee or contractor being unable to perform one or more of their routine functions for a full working day from the day after the injury occurred. The employee or contractor can still perform some of his duties. 5 A Medically Treated Injury (MTI) is a work-related injury sustained by an employee or contractor which does not incapacitate that employee and who, after having received medical treatment, is deemed fit to immediately resume their normal duties on the next calendar day, immediately following the treatment/re-treatment. Environmental No serious (level 3–5) environmental incidents were reported for 2023, continuing the trend of preceding years. We last incurred a serious environmental incident in 2018. In 2021, the Group announced two water-related targets for 2030. Performance remains on track to meet these targets: • 2023 water recycled/reused was 74% (2022: 75%). Targets: 2023: 75%; 2030: 80%. • Freshwater use was reduced by 39% (2022: 41%) from the 2018 baseline. Targets: 2023: 31%; 2030: 45%. Ongoing water savings initiatives at Tarkwa contributed to the good performance but performance against both metrics declined slightly in 2023 compared to 2022 in part because South Deep’s underground filtration plant did not treat water at full capacity and illegal miners vandalised its potable water pipeline. Group energy spend was US$405m (19% of operating costs) and US$163/oz for 2023 compared to US$424m (21% of operating costs) and US$165/oz in 2022, reflecting lower fuel prices and increased renewable energy consumption in 2023. Group energy use was unchanged at 14.1 petajoules (PJ). Energy savings of 1.3 PJ were achieved (9% of 2023 energy use), compared to 1.1 PJ (8% of energy consumption) in 2022. Scope 1 and 2 CO₂ emissions were 1.6 Mt in 2023, 5% below 2022. This is 4% below the 2016 baseline used for our 2030 emissions reduction target, announced in 2021. Scope 1 and 2 CO₂ emissions intensity improved to 656 kgCO₂e/oz from 668 kgCO₂e/oz in 2022. The main reason for the reduction in carbon emissions was the higher use of renewable electricity at a number of our operations. Renewables accounted for 17% (2022: 13%) of electricity consumption at Group level during 2023, with renewables providing over 50% of electricity consumed by our Agnew mine in Australia and 15% of South Deep’s electricity consumption. The hydro-electricity supply to our Cerro Corona mine in Peru was again certified 100% renewable. Wind trials and an Environmental Impact Assessment continue at South Deep. The go-ahead by the Board to build the US$195m renewables microgrid at St Ives will provide further impetus in our drive to reduce our scope 1 and 2 emissions. In November 2023, we announced a 2030 target to reduce scope 3 carbon emissions by a net 10% from a 2022 baseline. The baseline study that defined the target determined that Gold Fields’ total 2022 scope 3 emissions amounted to 980kt CO2e, 36% of its total 2022 emissions of 2,696kt CO2e. The 36% level is an increase from the 25% reported previously. The Salares Norte chinchilla rescue and relocation plan was approved by the regulator in June 2023. Implementation of the plan, which has a term of 36 months and includes 34 actions, is currently underway. In line with our 2020 commitment, we published the GISTM reports for our high-priority dams at the Tarkwa and Cerro Corona mines on 4 August 2023. While Gold Fields has successfully addressed all elements related to material dam safety and the environment, we also identified areas for further improvement, particularly in community engagement and consultation and addressing human rights risks with respect to emergency response and preparedness. These areas for improvement will be closed out by 2025. Year ended Environmental 2023 2022 2021 Environmental incidents − level 3–5 — — — Fresh water withdrawal (GL)1 8.78 8.51 9.44 Water recycled/reused (% of total) 73.9 75.4 75.0 Energy consumption (PJ)2 14.1 14.1 13.9 Energy intensity (GJ/oz) 5.7 5.5 5.7 CO2 emissions (kt)3 1.6 1.7 1.7 CO2 emissions intensity (kg CO2/t mined) 656 668 697 Renewables as % of total electricity 17.2 13.5 4.3 1 Relates to operations only. 2 Petajoules (1 PJ=1,000,000MJ). 3 CO2 emissions comprise scope 1 and 2 emissions4. 4 Scope 1 emissions arise directly from sources managed by the Company. Scope 2 are indirect emissions generated in the production of electricity used by the Company 8 Gold Fields Reviewed Results for the year ended 31 December 2023

Social Gold Fields continues to focus on maximising in-country and host community economic impact. The Group’s value distribution to national economies was US$3.8bn for 2023 compared to US$3.9bn in 2022. Gold Fields’ procurement from in-country suppliers was US$2.5bn for 2023 (97% of total procurement) compared to US$2.4bn in 2022 (97% of total). Gold Fields aims to sustain the value delivered to host communities through employment, procurement and social investments. The Group host community workforce was 8,834 people – 51% of the total workforce (excluding projects and corporate offices) for 2023 compared to 9,473, 52% of the total workforce, in 2022. Group host community procurement spend was US$852m (33% of total spend), compared to US$747m (31% of total) in 2022. Spending on socio-economic development (SED) projects in our host communities totalled US$17m in 2023 compared to US$21m in the previous year. In total, value creation to host communities amounted to US$998m in 2023, 31% of total value creation (2022: US$913m; 27%). Our 2030 target is 30% of total value creation. The Group has an approved pipeline of legacy programmes that will positively impact host communities beyond the life-of-mine. Implementation of the first programme started in Q4 2023, with the second programme commencing in 2024. Our total workforce at 31 December 2023 was 21,526 (including projects and corporate offices), comprising 6,297 employees and 15,229 contractors, compared to a total workforce of 23,084 at year-end 2022. Women comprised 25% of Gold Fields’ employees at the end of December 2023, compared to 23% at the end of 2022. Just over 54% of our female employees work in core mining activities. Training spend for our employees totalled US$8.8m in 2023, compared to US$8.9m in 2022. Year ended Social 2023 2022 2021 Host community procurement (% of total) 33 31 31 Host community workforce (% of total) 51 52 54 Socio-economic development spending (US$m) 17 21 16 Women in workforce (% of total) 25 23 22 Training spend (US$/employee) 1,400 1,411 1,397 9

Revenue Attributable equivalent gold production, (including Asanko) decreased by 4% from 2,399Moz in 2022 to 2,304Moz in 2023. Attributable equivalent gold production at Asanko decreased by 21% from 76,700oz in 2022 to 60,300oz in 2023. Revenue from Asanko is not included in Group revenue as Asanko results are equity accounted. Gold production at our Australian operations increased marginally from 1,061,100oz in 2022 to 1,061,500oz in 2023. At Gruyere, gold production (100% basis) increased by 2% from 314,600oz in 2022 to 322,000oz in 2023 due to increased ore processed. The Group’s share of gold production at Gruyere increased by 2% from 157,300oz in 2022 to 161,000oz in 2023. Gold sold increased by 3% from 156,400oz in 2022 to 161,400oz in 2023. At Granny Smith, gold production decreased by 1% from 287,900oz in 2022 to 283,900oz in 2023 due to a 12% decrease in yield on lower grades mined, partially offset by increased ore tonnes processed. Gold sold decreased by 1% from 287,400oz to 284,400oz. At St Ives, gold production decreased by 1% from 376,700oz in 2022 to 371,800oz in 2023. Gold sold decreased by 1% from 373,200oz to 368,700oz. At Agnew, gold production increased by 2% from 239,200oz in 2022 to 244,900oz in 2023 due to a 12% increase in ore tonnes processed, partially offset by a 9% decrease in yield. Gold sold increased by 1% from 238,700oz to 242,000oz. At our South Africa region, managed production decreased by 2% from 10,200kg (327,900oz) in 2022 to 10,021kg (322,200oz) in 2023. Attributable production at South Deep decreased by 2% from 9,836kg (316,200oz) in 2022 to 9,663kg (310,700oz) in 2023. The decrease was due to lower underground reef yield as a result of lower than planned mine call factor and plant recovery factor. Included in the 2023 gold production, is a gold inventory draw down of 568kg (18,300oz). Gold sold decreased by 2% from 10,200kg (327,900oz) to 10,000kg (321,500oz). Managed gold production at our West African operations (excluding Asanko), decreased by 8% from 761,600oz in 2022 to 703,600oz in 2023 mainly due to decreased production at Damang with the completion of mining at the Huni and Lima Kwesi Gap (LKG) pits and the subsequent increase in processing of low-grade stockpiles. Attributable gold production at the West African operations (excluding Asanko), decreased by 8% from 685,400oz in 2022 to 633,300oz in 2023. At Damang, managed gold produced decreased by 34% from 230,000oz in 2022 to 152,600oz in 2023 due to lower yield resulting from lower grade of ore processed. Gold sold decreased by 33% from 228,900oz to 152,600oz. Managed gold produced at Tarkwa increased by 4% from 531,600oz in 2022 to 551,100oz in 2023 due to higher tonnes processed and improved yield. Gold sold increased by 4% from 529,100oz to 548,100oz. Gold production at Asanko decreased by 21% from 76,700oz (45% basis) in 2022 to 60,300oz (45% basis) in 2023 mainly due to lower yield. Gold sold decreased by 20% from 75,500oz (45% basis) to 60,400oz (45% basis). Total managed gold equivalent production in Peru decreased by 8% from 260,500oz in 2022 to 239,200oz in 2023 mainly due to lower tonnes processed combined with lower grade gold processed and lower copper recoveries. Attributable equivalent gold production at Cerro Corona in Peru, decreased by 8% from 259,200oz in 2022 to 238,000oz in 2023. Gold equivalent ounces sold decreased by 8% from 260,100oz to 238,200oz. The average US Dollar gold price achieved by the Group (excluding Asanko) increased by 9% from US$1,785/eq oz in 2022 to US$1,942/eq oz in 2023. The average Australian Dollar gold price increased by 13% from A$2,592/oz to A$2,937/oz. The average Rand gold price increased by 22% from R943,581/kg to R1,149,066/kg. The average US Dollar gold price for the Ghanaian operations (excluding Asanko) increased by 8% from US$1,806/oz in 2022 to US$1,949/oz in 2023. The average equivalent US Dollar gold price, net of treatment and refining charges, for Cerro Corona increased by 13% from US$1,671/eq oz in 2022 to US$1,895/eq oz in 2023. The average Australian/US Dollar exchange rate weakened by 4% from A$1.00 = US$0.69 to A$1.00 = US$0.66. The average US Dollar/Rand exchange rate weakened by 13% from R16.37 in 2022 to R18.45 in 2023. Gold equivalent ounces sold (excluding Asanko) decreased by 3% from 2.40Moz in 2022 to 2.32Moz in 2023. Revenue increased by 5% from US$4,287m in 2022 to US$4,501m in 2023 due to the higher gold price received, partially offset by the lower gold sold. Cost of sales before amortisation and depreciation Cost of sales before amortisation and depreciation increased by 11% from US$1,763m in 2022 to US$1,952m in 2023 mainly due to inflationary increases affecting all the regions and a US$77m lower gold inventory credit to cost in 2023 compared to 2022, partially offset by the weakening of the Australian Dollar and the South African Rand. Included in the gold inventory movement mentioned above, is a US$34m net realisable value adjustment of stockpiles at Damang. Excluding the net realisable value write down the increase in cost of sales before amortisation and depreciation was 9% from US$1,763m in 2022 to US$1,918m in 2023. Effective mining inflation for 2023 was as follows: Inflation as at December 2023 Australia 4.4% South Africa 6.9% Ghana (US-based) 7.3% Chile (US-based) 5.3% Peru (US-based) 0.6% Group weighted 5.3% At our Australia region, cost of sales before amortisation and depreciation increased by 19% from A$1,091m (US$756m) in 2022 to A$1,298m (US$862) in 2023 mainly due to inflationary pressures on commodity inputs and employee and contractor costs. At Gruyere, cost of sales before amortisation and depreciation (on a 50% basis) increased by 21% to A$175m (US$116m) in 2023 from A$145m (US$101m) in 2022, due to a gold inventory charge to cost and contractor rate increases, partially offset by lower operating cost as a result of lower ore and operational waste mined in 2023. The gold inventory charge to cost (on a 50% basis) of A$12m (US$8m) in 2023 compared to a gold inventory credit to cost of A$22m (US$15m) in 2022 with a buildup of stockpiles in 2022 compared to a draw down in 2023 as mining focused on stripping stages 4 and 5 of the Gruyere pit. At Granny Smith, cost of sales before amortisation and depreciation increased by 15% to A$338m (US$224m) in 2023 from A$293m (US$203m) in 2022. due to increased ore production, as well as inflationary pressures on commodity inputs and employee and contractor costs, including contractor rate increases. At St Ives, cost of sales before amortisation and depreciation increased by 27% to A$491m (US$326m) in 2023 from A$387m (US$268m) in 2022 mainly due to a 16% increase in total ore tonnes mined combined with inflationary pressures on commodity inputs and employee and contractor costs which resulted in higher production costs. Underground mining cost was impacted by above inflation contractor rate increases and open pit mining cost impacted by economies of scale on reduced total volumes mined. Gold inventory charge to cost of A$5m (US$4m) in 2023 compared to a gold inventory credit to cost of A$9m (US$6m) in 2022. A credit was generated in 2022 with a buildup of ore in the second half of 2022 from the Neptune pit at higher cost. The charge in 2023 mainly relates to the draw down of Neptune’s stockpiled ore. The oxide ore from Neptune must be blended with fresh ore in the mill and is therefore stockpiled before processing. At Agnew, cost of sales before amortisation and depreciation increased by 11% to A$294m (US$195m) in 2023 from A$266m (US$184m) in 2022. The increase was due to a 20% increase in ore tonnes mined and 12% increase in ore tonnes processed combined with inflationary pressures on commodity inputs and employee and contractor costs. Gold inventory credit to cost of A$8m (US$5m) in 2023 compared to a gold inventory charge to cost of A$2m (US$1m) in 2022 due to a gold inventory buildup in 2023 compared to a gold inventory draw down in 2022. 10 Gold Fields Reviewed Results for the year ended 31 December 2023

At South Deep, cost of sales before amortisation and depreciation increased by 18% from R5,138m (US$314m) in 2022 to R6,069m (US$329m) in 2023 mainly due to the 9% increase in underground tonnes mined as well as inflationary increases and higher employee and contractor costs. South Deep had a gold-in-process charge to cost of R254m (US$14m) in 2023 compared to a R175m (US$11m) credit to cost in 2022 due to a 568kg (18,300oz) gold inventory draw down in 2023 compared to a gold inventory buildup of 309kg (9,900oz) in 2022. At our West Africa region, (excluding Asanko), cost of sales before amortisation and depreciation increased by 19% from US$524m in 2022 to US$625m in 2023 mainly due to the impact of inflationary cost pressures, higher mining volumes at Tarkwa and a net realisable value adjustment of US$34m relating to stockpiles at Damang. At Damang, cost of sales before amortisation and depreciation increased by 47% to US$223m in 2023 from US$152m in 2022. Operational waste tonnes mined decreased by 17% (1Mt) and ore tonnes mined decreased by 39% (2Mt) as mining at the Huni and LKG pits were completed during 2023. Damang had a gold-in-process charge to cost of US$45m in 2023, comprising of a US$11m gold inventory draw down as a result of depleting from stockpiles and the US$34m NRV adjustment of stockpiles. This compared to a US$41m credit to cost in 2022 while adding ore to the stockpiles. At Tarkwa, cost of sales before amortisation and depreciation increased by 8% to US$402m in 2023 from US$371m in 2022. Ore tonnes mined increased by 25% from 14.1Mt in 2022 to 17.5Mt in 2023 and operational waste tonnes mined increased by 16% from 30.2Mt in 2022 to 34.9Mt in 2023. Tarkwa had a gold-in-process credit to cost of US$53m in 2023 compared to a US$36m credit to cost in 2022 due to a buildup of stockpiles in 2023. At our South America region, at Cerro Corona, cost of sales before amortisation and depreciation increased by 3% from US$175m in 2022 to US$181m in 2023. The cost of sales before gold inventory change and amortisation and depreciation increased by 1% to US$227m in 2023 from US$225m in 2022. The gold inventory credit to cost decreased to US$46m in 2023 from US$50m in 2022 due to a lower buildup of low- grade stockpiles. Amortisation and depreciation Amortisation and depreciation for the Group decreased by 6% from US$844m in 2022 to US$795m in 2023 mainly due to the depreciation of the Australian Dollar and South African Rand. Investment income Investment income increased by 92% from US$13m in 2022 to US$25m in 2023 due to higher interest received as a result of higher average cash and cash equivalents during 2023. Finance expense Finance expense for the Group decreased by 14% from US$73m in 2022 to US$63m in 2023 mainly due to higher interest capitalised in 2023. Interest expense on borrowings of US$82m, lease interest of US$23m, rehabilitation interest of US$22m and silicosis liability unwinding of US$1m, partially offset by interest capitalised of US$65m in 2023 compared to interest expense on borrowings of US$75m, lease interest of US$23m, rehabilitation interest of US$12m and silicosis liability unwinding of US$1m partially offset by interest capitalised of US$38m in 2022. The increase in interest capitalised relates to higher cumulative spend on Salares Norte. Share of results of equity-accounted investees after taxation The share of results of equity-accounted investees after taxation increased from a loss of US$3m in 2022 to US$33m in 2023. The loss of US$33m in 2023 comprised a share of losses of US$28m of Windfall, a share of losses of US$3m of Lunnon Metals Limited and expenditure of US$2m incurred at FSE. The loss of US$3m in 2022 comprised share of losses of Lunnon of US$2m and expenditure of US$1m on FSE. On 21 December 2023, Gold Fields announced the divestment of its 45% shareholding in Asanko Gold to the joint venture partner Galiano Gold. The share of results of equity investee of Asanko Gold have been presented as a discontinued operation in the consolidated financial statements and the comparative income statement have been presented as if Asanko Gold had been discontinued from the start of the comparative years. (Loss)/gain on foreign exchange The loss on foreign exchange of US$6m in 2023 compared to a gain on foreign exchange of US$7m in 2022 and related to the conversion of offshore cash holdings into their functional currencies. Gain on financial instruments The gain on financial instruments of US$24m in 2022 compared to nil in 2023. December 2023 December 2022 Ghana oil hedge — 14 Australia oil hedge — 8 Salares Norte foreign currency hedge — 2 Gain on financial instruments — 24 Unrealised gain and prior year marked-to- market reversals on derivative contracts — 2 Realised gain on derivative contracts — 22 Gain on financial instruments — 24 Share-based payments Share-based payments for the Group increased by 29% from US$7m in 2022 to US$9m in 2023 mainly due to higher forecast vesting percentages and higher value allocations in 2023 of share-based payments. Long-term incentive plan The long-term incentive plan increased by 93% from US$29m in 2022 to US$56m in 2023 mainly due to the improved vesting percentages on the absolute and relative Gold Fields share price performance. Other costs, net Other costs for the Group increased by 88% from US$24m in 2022 to US$45m in 2023 mainly due to higher community spend at Cerro Corona and facility fees on the renegotiated RCF. Exploration expense Exploration expense decreased by 6% from US$81m in 2022 to US$76m in 2023 mainly due to lower spend in Chile and Ghana as well as the weakening of the Australian Dollar. The US$76m spend in 2023 included US$29m spend at Salares Norte and US$47m related to exploration spend at the other operations. US$81m spend in 2022 included US$32m spend at Salares Norte and US$49m related to exploration spend at the other operations. Non-recurring items Non-recurring expenses decreased by 33% from US$245m in 2022 to US$165m in 2023. Non-recurring expenses of US$165m in 2023 mainly includes: • Impairment of US$156m of the Cerro Corona cash-generating unit (CGU). The after-tax impairment is US$110m. The impairment calculation is based on the fair value less cost of disposal (FVLCOD) calculated using a combination of the market (resource value) and income approach using level 3 of the fair value hierarchy (2023 life-of-mine plan) with the following assumptions: – Gold price – US$ per ounce – 2024 – US$1,910 – 2025 – US$1,875 – 2026 – US$1,800 – 2027 – US$1,760 – Long term – US$1,720 – Copper price – US$ per tonne – 2024 – US$8,500 – 2025 – US$8,700 – 2026 – US$8,900 – 2027 – US$8,600 – Long term – US$8,400 – Life-of-mine of seven years – Discount rate of 7.7% 11

• The impairment is mainly due to the increased costs and capital expenditure as a result of a change in the life-of-mine plan to accommodate the unloading of the east wall and continued cost pressures, as well as the derecognition of the resource as a result of the life-of-mine sterilising the resource through the deposition of in-pit tailings from 2026 onwards. The carrying value after impairment for the Cerro Corona CGU is US$419m. The information underlying the impairment calculation may be subject to further adjustments in the future. • Expected credit loss against a contractor loan of US$33m at Tarkwa and Damang; • Restructuring costs at Damang, Tarkwa and St Ives of US$8m; and • Rehabilitation year-end adjustments of US$4m. These were partially offset by: • Profit on disposal of assets of US$32m mainly related to a US$32m gain on disposal of the Kambalda tenements at St Ives in exchange for shares in Mineral Resources Limited; and • Adjustment of the silicosis provision of US$4m. Non-recurring expenses of US$245m in 2022 mainly include: • Impairment of US$325m of the Tarkwa CGU. The after tax impairment is US$220m. The impairment calculation is based on the FVLCOD calculated using a combination of the market (resource value) and income approach using level 3 of the fair value hierarchy (2022 life-of- mine plan) with the following assumptions: – Gold price – US$ per ounce – 2023 – US$1,740 – 2024 – US$1,730 – 2025 – US$1,700 – 2026 – US$1,650 – Long term – US$1,620 – Resource price of US$71 per ounce – Resource ounces of 3.3 million ounces – Life-of-mine of 13 years – Discount rate of 15.9% • The impairment is mainly due to an increase in the discount rate from 8.3% to 15.9% as a result of increases in the Ghana country risk premium and the risk-free rate as well as inflationary cost pressures experienced in 2022. The carrying value after impairment for the Tarkwa CGU is US$812m. The information underlying the impairment calculation may be subject to further adjustments in the future. • Impairment of US$63m of the Cerro Corona CGU. The after-tax impairment is US$44m. The impairment calculation is based on the FVLCOD calculated using a combination of the market (resource value) and income approach using level 3 of the fair value hierarchy (2022 life- of-mine plan) with the following assumptions: – Gold price – US$ per ounce – 2023 – US$1,740 – 2024 – US$1,730 – 2025 – US$1,700 – 2026 – US$1,650 – Long-term – US$1,620 – Copper price – US$ per tonne – 2023 – US$7,700 – 2024 – US$8,150 – 2025 – US$8,150 – 2026 – US$8,150 – Long term – US$7,7000 – Resource price of $30 per ounce – Resource ounces of 1.0 million ounces – Life-of-mine of eight years – Discount rate of 8.1% • The impairment is mainly due to an increase in the discount rate from 4.8% to 8.1% as a result of increases in the risk free rate as well as inflationary cost pressures experienced in 2022. The carrying value after impairment for the Cerro Corona CGU is US$477m. The information underlying the impairment calculation may be subject to further adjustments in the future. • US$114m related to impairment of FSE. Management has actively been engaged in the process of disposing of FSE in 2022. The disposal process proved unsuccessful and no offers were received. Management’s assessment is that it is unlikely the investment could be sold for any value and wrote off the investment by US$114m to a carrying value of nil; • US$18m related to an expected credit loss against a contractor loan at Tarkwa and Damang; • US$11m related to restructuring costs in Ghana; and • US$3m related to impairment of redundant assets at various operations. These were partially offset by: • US$267m income related to the Yamana break fee, net of costs. As a result of Yamana entering into an arrangement agreement with Pan American Silver Corp and Agnico Eagle Mines Limited, Gold Fields terminated the agreement in respect of the proposed acquisition of Yamana. In accordance, within the terms of the arrangement agreement, Yamana was required to pay Gold Fields a termination fee of US$300m. The fee has been partially offset by transaction costs of US$33m; • US$10m income related to profit on disposal of assets; • US$2m income arising on adjustment of silicosis provision; and • US$10m income arising on rehabilitation provision year-end adjustments. Royalties Government royalties for the Group increased by 5% from US$110m in 2022 to US$116m in 2023 in line with the higher revenue. Mining and income taxation The taxation charge for the Group increased by 5% from US$442m in 2022 to US$465m in 2023 in line with the increase in profit before royalties and taxation of 5% from US$1,261m in 2022 to US$1,327m in 2023. Normal taxation decreased by 4% from US$475m in 2022 to US$458m in 2023. The deferred tax credit of US$33m in 2022 compared to a charge of US$7m in 2023. Profit from continuing operations Profit for the year from continuing operations increased by 5% from US$709m in 2022 to US$745m in 2023. (Loss)/profit from discontinued operation Profit for the year from discontinued operation of US$13m in 2022 compared to a loss of US$19m in 2023. The loss of US$19m in 2023 comprises an impairment of the equity investment in Asanko of US$47m partially offset by share of profits realised during the year of US$28m. Profit for the year Profit for the year increased by 1% from US$722m in 2022 to US$726m in 2023. Profit for the year of US$726m in 2023 comprises profit for the year attributable to owners of the parent of US$703m and profit for the year attributable to non-controlling interest of US$23m. Profit for the year of US$722m in 2022 comprises profit for the year attributable to owners of the parent of US$711m and profit for the year attributable to non-controlling interest of US$11m. Profit for the year from continuing operations attributable to owners of the parent increased by 3% from US$698m or US$0.79 per share in 2022 to US$722m or US$0.81 per share in 2023. Profit for the year from discontinued operation attributable to owners of the parent of US$13m or US$0.01 per share in 2022 compared to a loss of US$19m or US$0.02 per share in 2023. Headline earnings for the year from continuing operations attributable to owners of the parent decreased by 23% from US$1,048m or US$1.18 per share in 2022 to US$809m or US$0.91 per share in 2023. Headline earnings from discontinued operation attributable to owners of the parent increased by 115% from US$13m or US$0.01 per share in 2022 to US$28m or US$0.03 per share in 2023. Normalised profit for the year from continuing operations attributable to owners of the parent increased by 3% from US$847m or US$0.96 per share in 2022 to US$872m or US$0.98 per share in 2023. Normalised profit from discontinued operation attributable to owners of the parent increased by 115% from US$13m or US$0.01 per share in 2022 to US$28m or US$0.03 per share in 2023. 12 Gold Fields Reviewed Results for the year ended 31 December 2023

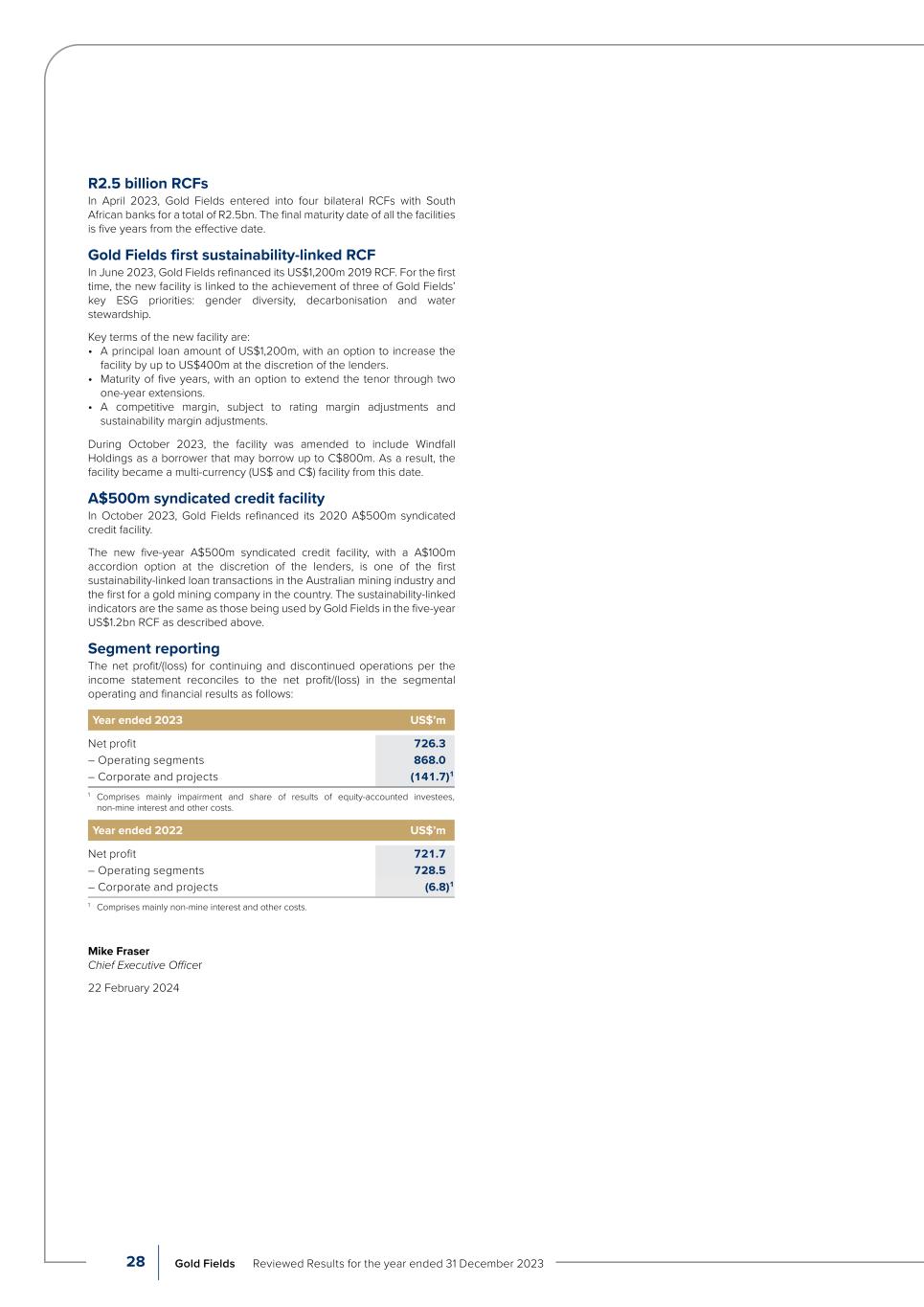

Normalised profit Normalised profit reconciliation for the Group is calculated as follows: US$’m December 2023 December 2022 Profit for the year attributable to owners of the parent – continuing operations 722.2 698.0 Profit for the year attributable to owners of the parent – discontinued operations (18.9) 13.0 Profit for the year attributable to owners of the parent (continuing and discontinued) 703.3 711.0 Non-recurring items 165.2 245.1 Tax effect of non-recurring items* (38.9) (57.5) Non-controlling interest effect of non-recurring items* (4.2) (24.1) Loss/(gain) on foreign exchange 5.6 (6.7) Tax effect on foreign exchange* (2.9) 2.8 Non-controlling interest effect on foreign exchange* (0.9) 0.5 Gain on financial instruments — (24.0) Tax effect on financial instruments* — 7.5 Non-controlling interest effect on financial instruments* — 0.9 Damang NRV adjustment to stockpiles2 33.8 — Non-controlling interest effect on NRV adjustment* (3.3) — Impairment of Asanko equity investee 46.9 South Deep deferred tax change1 — 4.6 Gold Fields exchange rate adjustment* (4.7) — Normalised profit for the year attributable to owners of the parent – continuing operations 871.9 847.1 Normalised profit for the year attributable to owners of the parent – discontinued operations 28.0 13.0 Normalised profit attributable to owners of the parent (continuing and discontinued) 899.9 860.1 Normalised profit is considered an important measure by Gold Fields of the profit realised by the Group in the ordinary course of operations. In addition, it forms the basis of the dividend pay-out policy. Normalised profit is defined as profit excluding gains and losses on foreign exchange, financial instruments and non-recurring items after taxation and non-controlling interest effect. 1 During June 2022, the South African Revenue Services published the draft 2022 Rates & Monetary Bill, inclusive of an amendment to the gold tax formula from Y = 34 – 170/X to Y = 33 – 165/X in respect of year assessments ending on or after 31 March 2023. This resulted in the effective mining tax rate used for deferred tax purposes for Gold Fields Operations Limited ("GFO") and GFI Joint Venture Holdings (Proprietary) Limited ("GFIJVH"), owners of the South Deep mine, decreasing from 29% at 31 December 2021 to 28% at 31 December 2022, amounting to a charge of R76.2m (US$4.6m) through profit or loss. 2 No tax effect on Damang NRV adjustment. * Based on information underlying the reviewed condensed consolidated financial statements of Gold Fields Limited for the years ended 31 December 2023 and 31 December 2022. Cash flow Cash flow from operating activities Cash inflow from operating activities decreased by 8% from US$1,714m in 2022 to US$1,575m in 2023. The decrease was mainly due to higher cash from profit before royalties and taxation in 2022 largely due to the Yamana break fee received and lower royalties and taxation payment, partially offset by a higher investment in working capital. The investment in working capital increased by 49% from US$134m in 2022 to US$199m in 2023 due to a buildup of stockpiles at Cerro Corona, Salares Norte and Tarkwa. The royalties and taxation paid decreased by 26% from US$724m in 2022 to US$535m in 2023. The higher taxation payment in 2022 included withholding tax of US$75m tax on the Yamana break fee, US$65m tax paid to the South African Revenue Service on the Yamana break fee as well as US$23m additional tax payment to the Ghana Revenue Authority related to transfer pricing. Dividends paid Dividends paid increased by 14% from US$335m in 2022 to US$382m in 2023. The dividend paid of US$382m in 2023 comprised dividends paid to owners of the parent of US$369m related to the 2022 final and 2023 interim dividends and dividend paid to non-controlling interest holders of US$14m. The dividend paid of US$335m in 2022 comprised dividends paid to owners of the parent of US$304m related to the 2021 final and 2022 interim dividends and dividends paid to non-controlling interest holders of US$30m. Cash flow from investing activities Cash outflow from investing activities increased by 28% from US$1,072m in 2022 to US$1,370m in 2023. Capital expenditure Capital expenditure decreased by 1% from US$1,069m in 2022 to US$1,055m in 2023. The capital expenditure of US$1,055m in 2023 comprised of sustaining capital expenditure of US$692m and non-sustaining capital expenditure of US$363m. The capital expenditure of US$1,069m in 2022 comprised of sustaining capital expenditure of US$657m and non-sustaining capital expenditure of US$412m. Sustaining capital expenditure, (excluding Asanko), increased by 5% from US$657m in 2022 to US$692m in 2023 mainly due to an increase at Gruyere. Sustaining capital expenditure of US$692m in 2023 comprised US$226m at the Australian operations, US$93m at South Deep, US$221m at the Ghana region, US$149m at the South America region and US$3m at Corporate. Sustaining capital expenditure of US$657m in 2022 comprised US$236m at the Australian operations, US$98m at South Deep, US$279m at the Ghana region, US$42m at the South America region and US$2m at Corporate. Non-sustaining capital expenditure (excluding Asanko), decreased by 12% from US$412m in 2022 to US$363m in 2023. Non-sustaining expenditure of US$363m for 2023 comprised US$280m at Salares Norte, US$70m at the Australian operations and US$13m at Cerro Corona. Non-sustaining expenditure of US$412m for 2022 comprised US$286m at Salares Norte, US$81m at the Australian operations, US$15m at Cerro Corona, US$20m at South Deep and US$10m at Damang. At the Australia region, capital expenditure decreased by 3% from A$457m (US$317m) in 2022 to A$445m (US$296m) in 2023. At Gruyere, capital expenditure (50% basis) increased by 63% from A$48m (US$33m) in 2022 to A$78m (US$52m) in 2023 reflecting pre-stripping of stages 4 and 5 of the Gruyere pit. At Granny Smith, capital expenditure decreased by 19% from A$141m (US$98m) in 2022 to A$115m (US$76m) in 2023 mainly due to lower development and the completion of the second decline in 2022. At St Ives, capital expenditure increased by 1% from A$146m (US$101m) to A$147m (US$97m) due to increased development at Invincible Deeps mine in 2023, partially offset by reduced pre-strip activities at Neptune stage 7 pit which was completed in 2022. At Agnew, capital expenditure decreased by 14% from A$123m (US$85m) to A$106m (US$70m) mainly due to expenditure incurred on the mill crushing circuit replacement project and a 100-room expansion of the accommodation village in 2022. At the South Africa region at South Deep, capital expenditure decreased by 12% from R1,943m (US$119m) in 2022 to R1,717m (US$93m) in 2023 mainly due to lower spending on the solar plant in 2023 and the completion of phase 2 of the Doornpoort TSF in 2022. At the West Africa region, (excluding Asanko), capital expenditure decreased by 24% from US$289m in 2022 to US$221m in 2023. Capital expenditure at Damang decreased by 92% from US$60m to US$5m due to no capital waste tonnes mined in 2023. At Tarkwa, capital expenditure decreased by 6% from US$229m to US$216m mainly due to a 13% reduction in capital waste tonnes mined. Capital expenditure at Asanko (on a 100% basis) increased by 224% from US$17m in 2022 to US$55m in 2023 due to expenditure on TSF stage 7 construction, Abore pre-stripping and water treatment plant. The Asanko capital expenditure is not included in the Group capital expenditure as Asanko is equity accounted. 13