false

0000884887

0000884887

2024-02-22

2024-02-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

To Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 22, 2024

ROYAL CARIBBEAN CRUISES LTD.

|

| (Exact Name of Registrant as Specified in Charter) |

| |

Republic of Liberia

|

| (State or Other Jurisdiction of Incorporation) |

| 1-11884 |

|

98-0081645 |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

1050

Caribbean Way, Miami,

Florida |

|

33132 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: 305-539-6000

Not

Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

RCL |

|

New York Stock Exchange |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

On

February 22, 2024, Royal Caribbean Cruises Ltd. (the “Company”) issued a press release announcing that it has

priced its upsized private offering of $1.25 billion aggregate principal amount of 6.25% senior unsecured notes due 2032 (the

“Notes”). The Notes are expected to be issued on or around March 7, 2024, subject to customary closing

conditions.

The Company intends to use

the proceeds from the sale of the Notes, together with cash on hand and/or borrowings under the Company’s revolving credit facilities,

to redeem all of the outstanding 11.625% Senior Notes due 2027 (including to pay fees and expenses in connection with such redemption).

The

Notes are being offered only to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the

Securities Act, as amended (the “Securities Act”), and outside the United States, only to certain non-U.S. investors pursuant

to Regulation S under the Securities Act. The Notes will not be registered under the Securities Act or any state securities laws and may

not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities

Act and applicable state laws.

A

copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

This Current Report on Form 8–K shall

not constitute an offer to sell or a solicitation of an offer to buy the Notes or any other securities, and shall not constitute an offer,

solicitation or sale in any jurisdiction in which such an offer, solicitation or sale would be unlawful. This Current Report on Form 8-K

shall not constitute a notice of redemption with respect to the 11.625% Senior Notes due 2027.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

Exhibit 99.1 – Press release, dated February 22, 2024.

Exhibit 104 - Cover

Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

ROYAL CARIBBEAN CRUISES LTD. |

| |

|

|

| Date: |

February 22, 2024 |

By: |

/s/ Naftali Holtz |

| |

|

Name: |

Naftali Holtz |

| |

|

|

Chief Financial Officer |

Exhibit 99.1

Royal Caribbean Group announces upsizing and pricing of $1.25 billion

offering of senior unsecured notes to refinance its senior notes due 2027

MIAMI, Feb. 22, 2024 /PRNewswire/ -- Royal Caribbean

Cruises Ltd. (NYSE: RCL) (the "Company") today announced that it has priced its private offering of $1.25 billion aggregate

principal amount of 6.25% senior unsecured notes due 2032 (the "Notes"). The aggregate principal amount of Notes to be issued

was increased to $1.25 billion. The Notes will mature on March 15, 2032. The Notes are expected to be issued on or around March 7,

2024, subject to customary closing conditions.

The Company intends to use the proceeds from the sale

of the Notes, together with cash on hand and/or borrowings under the Company's revolving credit facilities, to redeem all of the outstanding

11.625% Senior Notes due 2027 (including to pay fees and expenses in connection with such redemption).

The Notes are being offered only to persons reasonably

believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the "Securities

Act"), and outside the United States, only to certain non-U.S. investors pursuant to Regulation S. The Notes will not be registered

under the Securities Act or any state securities laws and may not be offered or sold in the United States absent registration or an applicable

exemption from the registration requirements of the Securities Act and applicable state laws.

This press release shall not constitute an offer to

sell or a solicitation of an offer to buy the Notes or any other securities and shall not constitute an offer, solicitation or sale in

any jurisdiction in which such offer, solicitation or sale would be unlawful. This press release shall not constitute a notice of redemption

with respect to the 11.625% Senior Notes due 2027. This press release is being issued pursuant to and in accordance with Rule 135c

under the Securities Act.

Special Note Regarding Forward-Looking Statements

Certain statements in this press release relating to,

among other things, the offering and sale of the Notes constitute forward-looking statements under the Private Securities Litigation Reform

Act of 1995. These statements include, but are not limited, to: statements regarding the expected timing for the closing of the offering

and the intended use of proceeds. Words such as "anticipate," "believe," "could," "driving," "estimate,"

"expect," "goal," "intend," "may," "plan," "project," "seek," "should,"

"will," "would," "considering," and similar expressions are intended to help identify forward-looking statements.

Forward-looking statements reflect management's current expectations, are based on judgments, are inherently uncertain and are subject

to risks, uncertainties and other factors, which could cause the Company's actual results, performance or achievements to differ materially

from the future results, performance or achievements expressed or implied in those forward-looking statements. Examples of these risks,

uncertainties and other factors include, but are not limited to, the following: the impact of contagious illnesses on economic conditions

and the travel industry in general and the financial position and operating results of the Company in particular, such as governmental

and self-imposed travel restrictions and guest cancellations; the Company's ability to obtain sufficient financing, capital or revenues

to satisfy liquidity needs, capital expenditures, debt repayments and other financing needs; the impact of the economic and geopolitical

environment on key aspects of the Company's business, such as the demand for cruises, passenger spending, and operating costs; incidents

or adverse publicity concerning the Company's ships, port facilities, land destinations and/or passengers or the cruise vacation industry

in general; concerns over safety, health and security of guests and crew; further impairments of the Company's goodwill, long-lived assets,

equity investments and notes receivable; an inability to source crew or provisions and supplies from certain places; an increase in concern

about the risk of illness on the Company's ships or when traveling to or from the Company's ships, all of which reduces demand; unavailability

of ports of call; growing anti-tourism sentiments and environmental concerns; changes in U.S. foreign travel policy; the uncertainties

of conducting business internationally and expanding into new markets and new ventures; the Company's ability to recruit, develop and

retain high quality personnel; changes in operating and financing costs; the Company's indebtedness, any additional indebtedness the Company

may incur and restrictions in the agreements governing the Company's indebtedness that limit its flexibility in operating its business;

the impact of foreign currency exchange rates, the impact of higher interest rate and food and fuel prices; vacation industry competition

and changes in industry capacity and overcapacity; the risks and costs related to cyber security attacks, data breaches, protecting the

Company's systems and maintaining integrity and security of its business information, as well as personal data of the Company's guests,

employees and others; the impact of new or changing legislation and regulations (including environmental regulations) or governmental

orders on the Company's business; pending or threatened litigation, investigations and enforcement actions; the effects of weather, natural

disasters and seasonality on the Company's business; the impact of issues at shipyards, including ship delivery delays, ship cancellations

or ship construction cost increases; shipyard unavailability; the unavailability or cost of air service; and uncertainties of a foreign

legal system as the Company is not incorporated in the United States.

Forward-looking statements should not be relied upon

as predictions of actual results. Undue reliance should not be placed on the forward-looking statements in this release, which are based

on information available to the Company on the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

About Royal Caribbean Group

Royal Caribbean Group (NYSE: RCL) is one of the leading

cruise companies in the world with a global fleet of 65 ships traveling to approximately 1,000 destinations around the world. Royal Caribbean

Group is the owner and operator of three award winning cruise brands: Royal Caribbean International, Celebrity Cruises, and Silversea

Cruises and it is also a 50% owner of a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. Together, the brands have an

additional 8 ships on order as of December 31, 2023.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

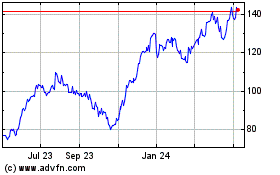

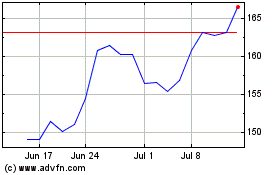

Royal Caribbean (NYSE:RCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Caribbean (NYSE:RCL)

Historical Stock Chart

From Apr 2023 to Apr 2024