0001841925FALSE00018419252024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 22, 2024

INDIE SEMICONDUCTOR, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40481 | | 88-1735159 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

32 Journey Aliso Viejo, California | | 92656 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (949) 608-0854

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on

which registered |

| Class A common stock, par value $0.0001 per share | | INDI | | The Nasdaq Stock Market LLC |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

The information set forth in Exhibit 99.1 of this Current Report is being furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information set forth in Exhibit 99.1 of this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

On February 22, 2024, indie Semiconductor, Inc. (“indie”) issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2023. A copy of the press release is attached as Exhibit 99.1.

A conference call with simultaneous webcast to discuss the financial results for the fourth quarter and year ended December 31, 2023 will be held today, February 22, 2024 at 5:00 p.m. Eastern Time. After the live webcast of the conference call, an audio replay will remain available until March 7, 2024 in the Investor Relations section of indie's website at www.indiesemi.com.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| INDIE SEMICONDUCTOR, INC. |

| | | |

| February 22, 2024 | By: | /s/ Thomas Schiller |

| | Name: | Thomas Schiller |

| | Title: | Chief Financial Officer & EVP of Strategy

(Principal Financial Officer) |

indie Semiconductor Achieves Record Fourth Quarter and 2023 Results

•Posts Q4 Revenue of $70.1M, up 112% Year-over-Year and 16% Sequentially

•Expands Q4 Non-GAAP Gross Margin to 52.7%, up 50 Basis Points Year-over-Year

•Delivers $223.2M in 2023 revenue, up 101% Year-over-Year

•Extends ADAS, User Experience and EV Design Win Pipeline

ALISO VIEJO, Calif. – February 22, 2024 – indie Semiconductor, Inc. (Nasdaq: INDI), an Autotech solutions innovator, today announced fourth quarter and year end results for the period ended December 31, 2023. Fourth quarter revenue was up 112 percent from the same period a year ago and 16 percent sequentially to a record $70.1 million, within the Company’s prior guidance range. Non-GAAP gross margin expanded 50 basis points year-over-year to 52.7 percent, in-line with indie’s guidance for the period. On a GAAP basis, fourth quarter 2023 operating loss was $20.6 million compared to $29.0 million a year ago. Non-GAAP operating loss for the fourth quarter of 2023 was $2.4 million, versus $15.1 million during the same period last year, reflecting higher revenue, improving gross margin and operating expense leverage. Q4 GAAP loss per share was $0.09, while Non-GAAP loss per share was $0.01, consistent with indie’s guidance and consensus estimates.

Full year 2023 revenue was up 101 percent year-over-year to a record $223.2 million with non-GAAP gross margin expanding to 52.5 percent, a 260 basis point improvement over the prior year.

“indie continues to outexecute and outperform our industry peer group,” said Donald McClymont, indie’s co-founder and chief executive officer. “We more than doubled our top line for a third consecutive year in 2023 driven by increasing global demand for indie’s highly innovative semiconductor solutions spanning virtually all leading tier ones and vehicle OEMs. Further, we are at the unique intersection of vehicle safety systems, sensor fusion and Artificial Intelligence (AI) towards realizing our vision of the uncrashable car. While we are not immune from the current automotive end market weakness and the industry-wide inventory correction, we remain well positioned to demonstrate earnings power when the market recovers, to capitalize on the strategic Autotech opportunity, led by these exciting new technologies, and most importantly, to create shareholder value.”

Business Highlights

•Recognized by Morgan Stanley as the fastest growing semiconductor company in the world over the past two years, among 224 global suppliers

•Entered strategic partnership with Ficosa on AI-based automotive camera solutions

•Unveiled breakthrough computer vision processors enabling viewing and sensing capability at the vehicle’s edge

•Captured in-cabin monitoring programs at BMW, Ford, General Motors and Toyota

•Secured smart connectivity wins at one of the world’s leading Electric Vehicle (EV) OEMs

Q1 2024 Outlook

We provide guidance on a non-GAAP basis only because certain information necessary to reconcile such results and guidance to GAAP is difficult to estimate and dependent on future events outside of our control and, therefore, is not available without unreasonable efforts. Please refer to the attached Discussion Regarding the Use of Non-GAAP Financial Measures in this press release for a further discussion of our use of non-GAAP measures.

“For the first quarter of 2024, we expect indie’s revenue to be up 38 percent year-over-year but down 20 percent sequentially, reflecting market seasonality and current industry softness,” said Thomas Schiller, indie’s chief financial officer and executive vice president of strategy. “Looking forward, based on our new product pipeline, we

anticipate Q1 to be a trough quarter with top line recovery in Q2 and a resumption of outsized sequential growth in Q3 and Q4, yielding a profitability baseline in the second half of this year, ahead of our significant Radar and Vision ramps in 2025.”

indie’s Q4 2023 Conference Call

indie Semiconductor will host a conference call with analysts to discuss its fourth quarter and 2023 results and business outlook today at 5:00 p.m. Eastern time. To listen to the conference call via the Internet, please go to the Financials tab on the Investors page of indie’s website. To listen to the conference call via telephone, please call (877)-451-6152 (domestic) or (201)-389-0879 (international), Conference ID: 13743878.

A replay of the conference call will be available beginning at 9:00 p.m. Eastern time on February 22, 2024 until 11:59 p.m. Eastern time on March 7, 2024 under the Financials tab on the Investors page of indie’s website, or by calling (844) 512-2921 (domestic) or (412) 317-6671 (international), Replay Pin Number: 13743878.

About indie

indie is empowering the Autotech revolution with next generation automotive semiconductors and software platforms. We focus on developing innovative, high-performance and energy-efficient technology for ADAS, user experience and electrification applications. Our mixed-signal SoCs enable edge sensors spanning Radar, LiDAR, Ultrasound, and Computer Vision, while our embedded system control, power management and interfacing solutions transform the in-cabin experience and accelerate increasingly automated and electrified vehicles. We are an approved vendor to Tier 1 partners and our solutions can be found in marquee automotive OEMs worldwide. Headquartered in Aliso Viejo, CA, indie has design centers and regional support offices across the United States, Canada, Argentina, Scotland, England, Germany, Hungary, Morocco, Israel, Japan, South Korea, Switzerland and China.

Please visit us at www.indiesemi.com to learn more.

Safe Harbor Statement

This communication contains “forward-looking statements” (including within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended). Such statements can be identified by words such as “will likely result,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “plan,” “project,” “outlook,” “should,” “could,” “may” or words of similar meaning and include, but are not limited to, the preliminary financial results for our fourth quarter and full year 2023 included in this press release; statements regarding our future business and financial performance and prospects, including expectations regarding our guidance for top line recovery and growth, non-GAAP financial metrics such as gross margin, operating income (loss) and EBITDA, expectations regarding the conditions of the automotive end market and industry-wide inventory corrections, our belief regarding the resumption of sequential growth in Q3 and Q4 2023 yielding a profitability baseline in the second half of 2024, and our anticipated program wins and ability to gain design win momentum across ADAS, user experience and vehicle electrification applications and capitalize on the strategic Autotech opportunity to create shareholder value. Such forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results included in such forward-looking statements. The preliminary unaudited financial results for our fourth quarter and year ended December 31, 2023 included in this press release represent the most current information available to management. Our actual results when disclosed in the Form 10-K may differ from these preliminary results due to the completion of our financial audit. In addition to the factors previously disclosed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on March 28, 2023 and in our other public reports filed with the SEC (including those identified under “Risk Factors” therein), the following factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: macroeconomic conditions, including inflation, rising interest rates and volatility in the credit and financial markets; the impacts of the ongoing conflicts in Ukraine and the Middle East, our reliance on contract manufacturing and outsourced supply chain and the availability of semiconductors and manufacturing capacity; competitive products and pricing pressures; our ability to win competitive bid selection processes and achieve additional design wins; the impact of recent acquisitions made and any other acquisitions we may make, including our ability to successfully integrate acquired businesses and risks that the anticipated benefits of any acquisitions may not be fully realized or take longer to realize than expected; our ability to develop, market and gain acceptance for new and enhanced products and expand into new technologies and markets; trade restrictions and trade tensions; and political or economic instability in our target markets. All forward-looking statements in this press release are expressly qualified in their entirety by the foregoing cautionary statements.

Investors are cautioned not to place undue reliance on the forward-looking statements in this press release, which information set forth herein speaks only as of the date hereof. We do not undertake, and we expressly disclaim, any intention or obligation to update any forward-looking statements made in this announcement or in our other public filings, whether as a result of new information, future events or otherwise, except as required by law.

Media Inquiries

media@indiesemi.com

Investor Relations

ir@indiesemi.com

#indieSemi_Earnings

INDIE SEMICONDUCTOR, INC.

PRELIMINARY CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Revenue: | | | | | | | |

| Product revenue | $ | 63,153 | | | $ | 26,494 | | | $ | 195,624 | | | $ | 89,457 | |

| Contract revenue | 6,980 | | | 6,533 | | | 27,545 | | | 21,340 | |

| Total revenue | 70,133 | | | 33,027 | | | 223,169 | | | 110,797 | |

| Operating expenses: | | | | | | | |

| Cost of goods sold | 42,236 | | | 16,151 | | | 133,606 | | | 60,491 | |

| Research and development | 34,162 | | | 33,002 | | | 154,388 | | | 121,197 | |

| Selling, general, and administrative | 14,364 | | | 12,834 | | | 69,656 | | | 48,237 | |

| Total operating expenses | 90,762 | | | 61,987 | | | 357,650 | | | 229,925 | |

| Loss from operations | (20,629) | | | (28,960) | | | (134,481) | | | (119,128) | |

| Other income (expense), net: | | | | | | | |

| Interest income | 1,654 | | | 1,747 | | | 7,801 | | | 2,567 | |

| Interest expense | (2,116) | | | (1,201) | | | (8,650) | | | (1,692) | |

| Gain from change in fair value of warrants | 13,692 | | | 6,474 | | | 7,066 | | | 55,069 | |

| Gain (loss) from change in fair value of contingent considerations and acquisition related holdbacks | (7,193) | | | 5,922 | | | (2,985) | | | 9,468 | |

| | | | | | | |

| Other expense | (912) | | | (110) | | | (1,175) | | | (107) | |

| Total other income, net | 5,125 | | | 12,832 | | | 2,057 | | | 65,305 | |

| Net loss before income taxes | (15,504) | | | (16,128) | | | (132,424) | | | (53,823) | |

| Income tax benefit | 1,820 | | | 370 | | | 4,534 | | | 1,035 | |

| Net loss | (13,684) | | | (15,758) | | | (127,890) | | | (52,788) | |

| Less: Net income (loss) attributable to noncontrolling interest | 426 | | | (3,366) | | | (10,810) | | | (9,388) | |

| Net loss attributable to indie Semiconductor, Inc. | $ | (14,110) | | | $ | (12,392) | | | $ | (117,080) | | | $ | (43,400) | |

| | | | | | | |

| Net loss attributable to common shares — basic | $ | (14,110) | | | $ | (12,392) | | | $ | (117,080) | | | $ | (43,400) | |

| Net loss attributable to common shares — diluted | $ | (14,110) | | | $ | (12,392) | | | $ | (117,080) | | | $ | (43,400) | |

| | | | | | | |

| Net loss per share attributable to common shares — basic | $ | (0.09) | | | $ | (0.10) | | | $ | (0.81) | | | $ | (0.37) | |

| Net loss per share attributable to common shares — diluted | $ | (0.09) | | | $ | (0.10) | | | $ | (0.81) | | | $ | (0.37) | |

| | | | | | | |

| Weighted average common shares outstanding — basic | 159,996,055 | | 125,762,839 | | 145,188,867 | | 118,660,785 |

| Weighted average common shares outstanding — diluted | 159,996,055 | | 125,762,839 | | 145,188,867 | | 118,660,785 |

INDIE SEMICONDUCTOR, INC.

PRELIMINARY CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

(Unaudited)

| | | | | | | | | | | |

| December 31, 2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 151,678 | | | $ | 321,629 | |

| Restricted cash | — | | | 250 | |

| Accounts receivable, net | 63,602 | | | 26,441 | |

| Inventory, net | 33,141 | | | 13,256 | |

| Prepaid expenses and other current assets | 23,399 | | | 12,290 | |

| Total current assets | 271,820 | | | 373,866 | |

| Property and equipment, net | 26,966 | | | 15,829 | |

| Intangible assets, net | 208,134 | | | 63,117 | |

| Goodwill | 294,310 | | | 136,463 | |

| Operating lease right-of-use assets | 13,790 | | | 12,055 | |

| Other assets and deposits | 3,070 | | | 2,021 | |

| Total assets | $ | 818,090 | | | $ | 603,351 | |

| | | |

| Liabilities and stockholders' equity | | | |

| Accounts payable | $ | 18,405 | | | $ | 14,186 | |

| Accrued payroll liabilities | 6,621 | | | 11,541 | |

| Accrued expenses and other current liabilities | 21,410 | | | 10,659 | |

| Contingent considerations | 83,903 | | | 2,500 | |

| Intangible asset contract liability | 4,429 | | | 9,377 | |

| Current debt obligations | 4,106 | | | 15,700 | |

| Total current liabilities | 138,874 | | | 63,963 | |

| Long-term debt, net of current portion | 156,735 | | | 155,699 | |

| Warrant liability | — | | | 45,398 | |

| | | |

| Intangible asset contract liability, net of current portion | — | | | 4,177 | |

| Deferred tax liabilities, non-current | 12,910 | | | 7,823 | |

| Operating lease liability, non-current | 10,850 | | | 10,115 | |

| Other long-term liabilities | 21,695 | | | 1,844 | |

| Total liabilities | $ | 341,064 | | | $ | 289,019 | |

| Commitments and contingencies | | | |

| Stockholders' equity | | | |

| Preferred stock | $ | — | | | $ | — | |

| Class A common stock | 16 | | | 13 | |

| Class V common stock | 2 | | | 2 | |

| Additional paid-in capital | 812,164 | | | 568,564 | |

| Accumulated deficit | (360,896) | | | (243,816) | |

| Accumulated other comprehensive loss | (6,170) | | | (11,951) | |

| indie's stockholders' equity | 445,116 | | | 312,812 | |

| Noncontrolling interest | 31,910 | | | 1,520 | |

| Total stockholders' equity | 477,026 | | | 314,332 | |

| Total liabilities and stockholders' equity | $ | 818,090 | | | $ | 603,351 | |

INDIE SEMICONDUCTOR, INC.

RECONCILIATION OF PRELIMINARY NON-GAAP MEASURES TO GAAP

(Unaudited)

GAAP refers to financial information presented in accordance with U.S. Generally Accepted Accounting Principles. This press release includes non-GAAP financial measures, as defined in Regulation G promulgated by the Securities and Exchange Commission. We believe that our presentation of non-GAAP financial measures provides useful supplementary information to investors. The presentation of non-GAAP financial measures is not meant to be considered in isolation from or as a substitute for results prepared in accordance with GAAP.

The reconciliations of our preliminary GAAP to non-GAAP measures are as follows (in thousands, except share and per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Computation of non-GAAP gross margin: | | | | | | | |

| GAAP revenue | $ | 70,133 | | $ | 33,027 | | $ | 223,169 | | $ | 110,797 |

| GAAP cost of goods sold | 42,236 | | 16,151 | | 133,606 | | 60,491 |

| Acquisition-related expenses | (5,983) | | (270) | | (11,967) | | | (1,130) |

| Amortization of intangible assets | (1,580) | | (20) | | (12,509) | | | (3,717) |

| Inventory cost realignments | (1,413) | | — | | (2,778) | | | — |

| Share-based compensation | (111) | | (67) | | (360) | | (148) |

| Non-GAAP gross profit | $ | 36,984 | | $ | 17,233 | | $ | 117,177 | | $ | 55,301 |

| Non-GAAP gross margin | 52.7 | % | | 52.2 | % | | 52.5 | % | | 49.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Computation of non-GAAP operating loss: | | | | | | | |

| GAAP loss from operations | $ | (20,629) | | | $ | (28,960) | | | $ | (134,481) | | | $ | (119,128) | |

| Acquisition-related expenses | 8,538 | | | 2,494 | | | 19,417 | | | 6,848 | |

| Amortization of intangible assets | 1,892 | | | 1,252 | | | 19,624 | | | 6,952 | |

| Inventory cost realignments | 1,413 | | | — | | | 2,778 | | | — | |

| Share-based compensation | 6,371 | | | 10,145 | | | 44,082 | | | 40,990 | |

| Non-GAAP operating loss | $ | (2,415) | | | $ | (15,069) | | | $ | (48,580) | | | $ | (64,338) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Computation of non-GAAP net loss: | | | | | | | |

| Net loss | $ | (13,684) | | | $ | (15,758) | | | $ | (127,890) | | | $ | (52,788) | |

| Acquisition-related expenses | 8,538 | | | 2,494 | | | 19,417 | | | 6,848 | |

| Amortization of intangible assets | 1,892 | | | 1,252 | | | 19,624 | | | 6,952 | |

| Inventory cost realignments | 1,413 | | | — | | | 2,778 | | | — | |

| Share-based compensation | 6,371 | | | 10,145 | | | 44,082 | | | 40,990 | |

| Gain from change in fair value of warrants | (13,692) | | | (6,474) | | | (7,066) | | | (55,069) | |

| (Gain) loss from change in fair value of contingent considerations and acquisition-related holdbacks | 7,193 | | | (5,922) | | | 2,985 | | | (9,468) | |

| | | | | | | |

| Other expense | 912 | | | — | | | 1,175 | | | — | |

| Non-cash interest expense | 274 | | | 191 | | | 995 | | | 417 | |

| Income taxes benefits | (1,820) | | | (370) | | | (4,534) | | | (1,035) | |

| Non-GAAP net loss | $ | (2,603) | | | $ | (14,442) | | | $ | (48,434) | | | $ | (63,153) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Computation of Non-GAAP EBITDA: | | | | | | | |

| Net loss | $ | (13,684) | | | $ | (15,758) | | | $ | (127,890) | | | $ | (52,788) | |

| Interest income | (1,654) | | | (1,747) | | | (7,801) | | | (2,567) | |

| Interest expense | 2,116 | | | 1,201 | | | 8,650 | | | 1,692 | |

| Gain from change in fair value of warrants | (13,692) | | | (6,474) | | | (7,066) | | | (55,069) | |

| (Gain) loss from change in fair value of contingent considerations and acquisition-related holdbacks | 7,193 | | | (5,922) | | | 2,985 | | | (9,468) | |

| Other expenses | 912 | | | — | | | 1,175 | | | — | |

| Income taxes benefits | (1,820) | | | (370) | | | (4,534) | | | (1,035) | |

| Depreciation and amortization | 3,344 | | | 2,052 | | | 24,192 | | | 9,082 | |

| Stock-based compensation | 6,371 | | | 10,145 | | | 44,082 | | | 40,990 | |

| Inventory cost realignments | 1,413 | | | — | | | 2,778 | | | — | |

| Acquisition-related expenses | 8,538 | | | 2,494 | | | 19,417 | | | 6,848 | |

| Non-GAAP EBITDA | $ | (963) | | | $ | (14,379) | | | $ | (44,012) | | | $ | (62,315) | |

| | | | | |

| Three Months Ended December 31, 2023 |

| Computation of non-GAAP share count: | |

| Weighted Average Class A common stock - Basic | 159,996,055 | |

| Weighted Average Class V common stock - Basic | 18,929,115 | |

| Escrow Shares | 1,725,000 | |

| TeraXion Unexercised Options | 924,680 | |

| |

| |

| Non-GAAP share count | 181,574,850 | |

| |

| Non-GAAP net loss attributable to indie Semiconductor, Inc. | $ | (2,603) | |

| Non-GAAP net loss per share | $ | (0.01) | |

Discussion Regarding the Use of Non-GAAP Financial Measures

Our earnings release contains some or all of the following financial measures that have not been calculated in accordance with United States Generally Accepted Accounting Principles (“GAAP”): (i) non-GAAP gross profit and gross margin, (ii) non-GAAP operating loss, (iii) non-GAAP net loss, (iv) non-GAAP EBITDA, (v) non-GAAP share count and (v) non-GAAP net loss per share. As set forth in the tables above, we derive such non-GAAP financial measures by excluding certain expenses and other items from the respective GAAP financial measure that is most directly comparable to each non-GAAP financial measure. Management may use these non-GAAP financial measures to, amongst other things, evaluate operating performance and compare it against past periods or against peer companies, make operating decisions, forecast for future periods and to determine payments under compensation programs. These non-GAAP financial measures provide management with additional means to understand and evaluate the operating results and trends in our ongoing business by eliminating certain expenses and other items that management believes might otherwise make comparisons of our ongoing business with prior periods and competitors more difficult, obscure trends in ongoing operations or improve management’s ability to forecast future periods.

We provide investors with non-GAAP gross profit and gross margin, non-GAAP operating loss, non-GAAP net loss and non-GAAP net loss per share because we believe it is important for investors to be able to closely monitor and understand changes in our ability to generate income from ongoing business operations. We believe these non-GAAP financial measures give investors an additional method to evaluate historical operating performance and identify trends, an additional means of evaluating period-over-period operating performance and a method to facilitate certain comparisons of our operating results to those of our peer companies. We further believe these non-GAAP financial measures allow investors to assess the overall financial performance of our ongoing operations by eliminating the impact of (i) acquisition-related expenses (including acquisition-related professional fees and legal expenses, deemed compensation expense and expenses recognized in relation to changes in contingent consideration obligations), (ii) amortization of acquisition-related intangibles and certain license rights, (iii) inventory cost realignments, (iv) gains or losses recognized in relation to changes in the fair value of warrants, contingent considerations issued by indie, acquisition-related holdbacks and unrealized gains or losses from currency hedging contracts, (v) non-cash interest expenses related to the amortization of debt discounts and issuance costs, (vi) share-based compensation, and (vii) income tax benefit (expenses). We believe that disclosing these non-GAAP financial measures contributes to enhanced financial reporting transparency and provides investors with added clarity about complex financial performance measures.

We do not report a GAAP measure of gross profit or gross margin because certain costs related to contract revenues are expensed as incurred and included in research and development expenses, and not in cost of sales, as it is not practicable for us to bifurcate these expenses. We derive and reconcile non-GAAP gross profit from the most relevant GAAP financial measures by subtracting GAAP cost of sales, adjusted for acquisition-related expenses and share-based compensation, from GAAP revenue. We calculate non-GAAP operating loss by excluding from GAAP operating loss, any (i) acquisition-related expenses (including acquisition-related professional fees and legal expenses, deemed compensation expense and expenses recognized in relation to changes in contingent consideration obligations), (ii) amortization of acquisition-related intangibles and certain license rights, (iii) inventory cost realignments and (iv) share-based compensation. We calculate non-GAAP net loss by excluding from GAAP net income (loss), any (i) acquisition-related expenses (including acquisition-related professional fees and legal expenses, deemed compensation expense and expenses recognized in relation to changes in contingent consideration obligations), (ii) amortization of acquisition-related intangibles and certain license rights, (iii) inventory cost realignments, (iv) gains or losses recognized in relation to changes in the fair value of warrants, contingent considerations issued by indie, acquisition-related holdbacks and unrealized gains or losses from currency hedging contracts, (v) non-cash interest expenses related to the amortization of debt discounts and issuance costs, (vi) share-based compensation, and (vii) income tax benefit (expenses). We calculate non-GAAP share count by adding to GAAP weighted average common share outstanding (i) weighted average Class A common stock, (ii) weighted average Class V common stock, (iii) Escrow Shares and (iv) vested but unexercised options issued as part of the TeraXion acquisition. Non-GAAP net loss per share is calculated by non-GAAP loss divided by non-GAAP share count.

We exclude the items identified above from the respective non-GAAP financial measure referenced above for the reasons set forth with respect to each such excluded item below:

Acquisition-related expenses - including such items as, when applicable, fair value charges incurred upon the sale of acquired inventory, accounting impact to the cost of goods sold due to one-time inventory costing realignment with a specific supplier and acquisition-related professional fees and legal expenses because they are not considered by management in making operating decisions and we believe that such expenses do not have a direct correlation to our future business operations and thereby including such charges do not necessarily reflect the performance of our ongoing operations for the period in which such charges or reversals are incurred.

Amortization expenses - related to the amortization expense for acquired intangible assets and certain license rights.

Depreciation expenses - related to the depreciation expenses for all property and equipment on hand.

Inventory cost realignments - related to the supplier allocation premiums introduced during COVID that is currently incorporated in our inventory cost but have since been eliminated going forward. The impact of this premium is deemed non-recurring and therefore not considered by management in its evaluation of the ongoing performance of the business.

Share-based compensation - related to the non-cash compensation expense associated with equity awards granted to our employees (including those granted in lieu of cash compensation) and employer tax related to employee stock transactions. These expenses are not considered by management in making operating decisions and such expenses do not have a direct correlation to our future business operations.

Gain (loss) from change in fair values - because these adjustments (1) are not considered by management in making operating decisions, (2) are not directly controlled by management, (3) do not necessarily reflect the performance of our ongoing operations for the period in which such charges are recognized and (4) cannot make comparisons between peer company performance less reliable.

Non-cash interest expense - related to the amortization of debt discounts and issuance costs because (1) these expenses are not considered by management in making decision with respect to financing decisions, and (2) these generally reflect non-cash costs.

Income tax benefit (expense) - related to the estimated income tax benefit (expense) that does not result in a current period tax refunds (payments).

The non-GAAP financial measures presented should not be considered in isolation and are not an alternative for the respective GAAP financial measure that is most directly comparable to each such non-GAAP financial measure. Investors are cautioned against placing undue reliance on these non-GAAP financial measures and are urged to review and consider carefully the adjustments made by management to the most directly comparable GAAP financial measures to arrive at these non-GAAP financial measures. Non-GAAP financial measures may have limited value as analytical tools because they may exclude certain expenses that some investors consider important in evaluating our operating performance or ongoing business performance. Further, non-GAAP financial measures are likely to have limited value for purposes of drawing comparisons between companies as a result of different companies potentially calculating similarly titled non-GAAP financial measures in different ways because non-GAAP measures are not based on any comprehensive set of accounting rules or principles.

Beginning in Q4 2023, management added non-GAAP EBITDA, which removes non-recurring, irregular and one-time items that may distort EBITDA, to the current non-GAAP financial measures. We will calculate non-GAAP EBITDA by excluding from GAAP net income (loss), any (i) acquisition-related expenses (including acquisition-related professional fees and legal expenses, deemed compensation expense and expenses recognized in relation to changes in contingent consideration obligations), (ii) amortization of acquisition-related intangibles and certain license rights, (iii) depreciation of property, plant and equipment, (iv) inventory cost realignments, (v) gains or losses recognized in relation to changes in the fair value of warrants, contingent considerations issued by indie, acquisition-related holdbacks and unrealized gains or losses from currency hedging contracts, (vi) non-cash interest expenses related to the amortization of debt discounts and issuance costs, (vii) share-based compensation, and (viii) income tax benefit (expenses).

To the extent our disclosures contain forward-looking estimates of non-GAAP financial measures, such as our forward-looking outlook for non-GAAP EBITDA, these measures are provided to investors on a prospective basis for the same reasons (set forth above) we provide them to investors on a historical basis. We are generally unable to provide a reconciliation of our forward-looking non-GAAP measures because certain information needed to make a reasonable forward-looking estimate of such non-GAAP measures are difficult to predict and estimate and is often dependent on future events that may be uncertain or outside of our control and, therefore, is not available without unreasonable efforts. Such events may include unanticipated changes in our GAAP effective tax rate, unanticipated one-time charges related to asset impairments (fixed assets, inventory, intangibles, or goodwill), unanticipated acquisition-related expenses, unanticipated settlements, gains, losses and impairments and other unanticipated items not reflective of ongoing operations. Our forward-looking estimates of both GAAP and non-GAAP measures of our financial performance may differ materially from our actual results and should not be relied upon as statements of fact.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

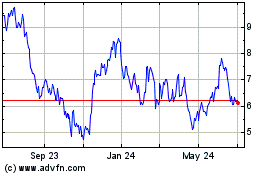

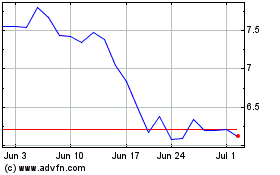

indie Semiconductor (NASDAQ:INDI)

Historical Stock Chart

From Mar 2024 to Apr 2024

indie Semiconductor (NASDAQ:INDI)

Historical Stock Chart

From Apr 2023 to Apr 2024