UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☒ Soliciting Material under §240.14a-12

Nikola Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

[Transcript from prerecorded portion of earnings call on February 22, 2024, including transcript from video presentation]

Good morning, and welcome to Nikola Corporation's Fourth Quarter and Full Year 2023 earnings and business update call. Currently, all participants are in a listen-only mode. We begin today's call with a short video presentation followed by management's prepared remarks. A brief question and answer session will follow the prepared remarks. If anyone should require operator assistance during the conference, please press *0 on your telephone keypad. As a reminder, this conference is being recorded. It is my pleasure to introduce Dhillon Sandhu, Head of Investor Relations.

Dhillon Sandhu, Investor Relations

Thank you, operator, and good morning, everyone. Welcome to Nikola Corporation's Fourth Quarter and Full Year 2023 earnings and business update call. Joining me today are Steve Girsky, President and CEO, and Brian DeHoog, Corporate Controller.

A press release detailing our financial and business results was distributed earlier this morning. This release can be found on the investor relations section of our website, along with presentation slides accompanying today’s call.

Today’s discussion includes references to non-GAAP measures. These measures are reconciled to the most comparable US GAAP measures and can be found at the end of the Q4 earnings press release we issued today.

Today’s discussion also includes forward-looking statements about our future results, expectations and plans. Actual results may differ materially from those stated, and some factors that could cause actual results to differ are also explained at the end of today’s earnings press release, on page 2 of our earnings call deck, and also in our filings with the SEC. Forward-looking statements speak only as of the date on which they are made. You are cautioned not to put undue reliance on forward-looking statements.

After the video presentation, Steve and Brian will provide their prepared remarks, followed by analyst Q&A, then we will conclude with questions from our stockholders. Please begin the video presentation. Thank you.

Speaker 1:

We are here at Los Angeles at the auto show.

Speaker 2:

LA and California in general are ground zero for our strategy to decarbonize long haul transportation. It's great to be part of a show where we showcase a convergence of technology and mobility.

Speaker 3:

Are, uh, super excited. Nikola is out here in Stockton, California launching one of the very, uh, first hydrogen fuel cell class eight commercial trucks to, uh, an early adopter coyote container.

Speaker 4:

It's so smooth. The, the ride is so comfortable. They are leader in the industry.

Speaker 5:

Well ahead of anybody else in terms of actually bringing the technology. That's why I chose Nikola.

Speaker 6:

Whoa, this thing has a better turning radius than my F-150.

Speaker 2:

We are here in Las Vegas, Nevada at the Consumer Electronics Show.

Speaker 7:

The hydrogen economy is here right now and we're the leader in this area.

[Legend below appears at end of video]

Forward-Looking Statements

This communication contains certain forward-looking statements within the meaning of federal securities laws with respect to Nikola Corporation (the “Company”). Forward-looking statements are predictions, projections, and other statements about future events based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. These statements include, but are not limited to: the Company’s future financial outlook and future business performance, business plan, focus, strategy and milestones, including Q4 2023 and fiscal year 2023 results, and guidance for Q1 2024 and fiscal year 2024; expected timing of completion of production, delivery, and other milestones; expected benefits of changes to the management team; expected orders and deliveries of the Company’s trucks and the timing thereof; the Company’s belief that it has first-mover advantage; expectations regarding the Company’s hydrogen supply and plans to secure adequate hydrogen supply; expected scope, costs and timing related to the battery-electric truck recall, including the nature of the repairs, the Company's expectation that the trucks will be lighter, improving payload capacity, and other attributes, and timing of truck deliveries and sales; expectations regarding cost of trucks; expected features of the hydrogen fuel cell electric truck; expansion plans and strategy for the hydrogen highway; expected benefits of modular stations; expectations relating to component supply; expectations regarding cash use and capital needs; potential benefits of planned and actual collaborations with strategic partners; Trevor Milton’s intentions related to nominating directors, and the Company’s plans to respond; the Company’s beliefs regarding the qualifications of its directors and benefits to the Company’s stockholders; the Company’s plans to pursue its arbitration award against Mr. Milton; and government incentives and expectations regarding customer demand related to such incentives. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: design and manufacturing changes and delays, including global shortages in parts and materials and other supply challenges; general economic, financial, legal, regulatory, political and business conditions and changes in domestic and foreign markets; the outcome of legal, regulatory and judicial proceedings to which the Company is, or may become a party; demand for and customer acceptance of the Company’s trucks and hydrogen fueling solutions; the results of customer pilot testing; risks associated with development and testing of fuel-cell power modules and hydrogen storage systems; risks related to the recall, including higher than expected costs, the discovery of additional problems, delays retrofitting the trucks and delivering such trucks to customers, supply chain and other issues that may create additional delays, order cancellations as a result of the recall, litigation, complaints and/or product liability claims, and reputational harm; the effects of competition on the Company’s future business; the Company’s ability to raise capital; the execution and terms of definitive agreements with strategic partners and customers; the failure to convert LOIs or MOUs into binding orders; the cancellation of orders; the Company’s ability to achieve cost reductions and decrease its cash usage; the grant, receipt and continued availability of federal and state incentives; the completion of the 2023 audit and any related adjustments to financial results; and the factors, risks and uncertainties described in the “Risk Factors” section of the Company’s quarterly report on Form 10-Q for the quarter ended September 30, 2023 filed with the SEC, in addition to the Company’s subsequent filings with the Securities and Exchange Commission (“SEC”). These filings identify and address other important risks and uncertainties that could cause actual events to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as required by law, the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Additional Information and Where to Find It

Nikola intends to file with the SEC a proxy statement on Schedule 14A, containing a form of WHITE proxy card, with respect to its solicitation of proxies for Nikola’s 2024 Annual Meeting of Stockholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY NIKOLA AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by Nikola free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Nikola are also available free of charge in the investor relations section of Nikola’s website at nikolamotor.com.

Participants

Nikola, its directors and executive officers and other members of management and employees will be participants in the solicitation of proxies with respect to a solicitation by Nikola. Information about Nikola’s executive officers and directors is available in Nikola’s definitive proxy statement for its 2023 Annual Meeting, which was filed with the SEC on April 25, 2023, and its Current Reports on Form 8-K filed with the SEC on April 28, 2023, August 4, 2023, August 18, 2023, September 1, 2023, September 19, 2023, September 21, 2023, November 17, 2023, December 15, 2023, February 2, 2024, February 16, 2024 and February 21, 2024. To the extent holdings by the directors and executive officers of Nikola securities reported in the proxy statement for Nikola’s 2023 Annual Meeting have changed, such changes have been or will be reflected in Forms 3, 4 or 5 filed with the SEC. These documents are or will be available free of charge at the SEC’s website at www.sec.gov and in the investor relations section of Nikola’s website at nikolamotor.com.

[Call continues following conclusion of video]

Steve Girsky, President and Chief Executive Officer

Thanks Dhillon, and good morning, everyone. Welcome to our Fourth Quarter and Full Year 2023 earnings and business update call. What a time it is for Nikola, as our mission of decarbonizing the trucking industry is crystallizing.

Previously, we’ve shared a lot about what our plans are and what we are working towards – today it’s all about execution.

Our production hydrogen fuel cell electric trucks are in fleet operations hauling freight. The list of fleets operating the trucks is strong, and includes Biagi Bros, a long-standing partner, IMC Logistics, the largest marine drayage company in the United States, 4Gen Duncan and Sons, and independent fleet operator and frequent social media poster Coyote Container.

As we said in January, during the fourth quarter, we built 42 hydrogen fuel cell electric trucks, reserving 7 for testing and customer demos, and wholesaled the remaining 35. We ended Q4 with no finished goods inventory, selling every truck available for ship to commerce, and notably, every truck we sold to dealers had a designated end user behind it. Nothing was sold as dealer stock inventory. We could have sold more trucks if not for supplier part constraints.

Additionally, we continue to accumulate HVIP vouchers in California. For vouchers issued in 2023 and through January 2024, in California, there were 360 voucher requests for hydrogen fuel cell tractor trucks, of which 355 were for Nikola. That’s a 99% share of the requested vouchers, a testament to our leading position in the market and first mover advantage. Another interesting fact about the vouchers, there are more HVIP voucher requests for our hydrogen fuel cell electric truck than all other OEMs combined on battery-electric truck and fuel cell in that same period.

We have a clear market plan – focusing on regions with strong tailwinds like California and Canada for our hydrogen fuel cell electric trucks and HYLA infrastructure solutions.

Our battery-electric trucks are being retrofit with new battery packs, driver enhancements, and software updates. We remain on track to get the first trucks back in end user hands by the end of Q1 and believe all trucks will be returned to end user fleets by late Q2 or early Q3. Once these end user trucks have been returned, we will begin selling through our existing battery-electric inventory for revenue again. The revised truck, which we nicknamed the BEV “2.0,” is currently undergoing validation testing in Coolidge, and initial results have been exceptional.

Our HYLA hydrogen infrastructure business is on solid footing with a strong leadership team. We recently announced the opening of our first modular fueling station in Ontario, Southern California. Customers are fueling at our Ontario station daily, and later in the call we will share our additional expansion plans for the hydrogen highway.

In 2023, we continued to improve our liquidity position and decreased our spend, more than doubling our unrestricted cash position to $464.7 million and cutting cash use by approximately 35%. Our unrestricted cash position is the highest it’s been at, at a quarter end since Q4 2021.

We continue to improve our liquidity position and remain financially disciplined. Furthermore, we have effectively completed all footprint related Capex in Coolidge, which is expected to bring our cash use down further in 2024.

We continue to attract top tier talent and have a world class management team in place for the long haul – experienced leaders such as Ole Hoefelmann, President of Energy, Mary Chan, Chief Operating Officer, and are in discussions with a potential new Chief Financial Officer whose experience includes roles as CFO of other publicly listed companies and relevant operational experience. They understand the urgency with which we need to keep moving and break new ground. This is the team to bring us forward.

We have a Board of Directors with deep expertise in trucking, manufacturing, and energy. In December, we added Jonathan Pertchik, former CEO of TravelCenters of America and just last week, Carla Tully joined. Carla has a successful track record leading and scaling energy organizations across Fortune 150, private equity, startup, and government entities for over two decades. If you look at the makeup of our Board, it’s a group who are highly experienced entrepreneurial thinkers and operators of global companies.

Q4 was about getting out on the field, proving we could bring this groundbreaking technology to the market, and deploying the building blocks to begin developing the hydrogen highway. This coming year is about scaling our business, growing revenues, and optimizing costs.

Now, onto our business updates, and a discussion about what’s to come in 2024.

Beginning with the hydrogen fuel cell electric truck. As I stated earlier in the call, during Q4 we built 42 production FCEVs, delivering 35 of the trucks and reserving 7 for captured fleet testing and customer demos. These trucks are operating in California and Canada hauling commercial freight. There have been several posts online from fleets and Nikola fans spotting the trucks in operation. So here are a few anecdotes.

•Coyote Container successfully drove their truck from the Port of Oakland to the Port of Long Beach, then to HYLA Ontario to refuel, and back to the Port of Oakland. There is probably no other zero-emissions truck that could handle the 866-mile journey hauling freight with one refuel.

•AMTA’s truck drove 519 kilometers roundtrip from Edmonton to Calgary and back, with the tank about 40% full after they completed the journey. That route is Alberta’s busiest transportation corridor, and the journey proves our zero-emissions truck can serve that market. Not to mention all while it was minus 10 degrees Celsius outside. As far as we are aware, no other FCEV trials in Alberta to date have been able to complete this trip until now.

•And our Nikola engineering team is still pushing our trucks to the limit, driving the truck more than 1,000 miles in one day, fully loaded without any problems.

Initial fleet feedback has been overwhelmingly positive, with a smooth ride and power being among the highlights, and our sales team continues to work alongside dealers to facilitate sales.

Last November, we told you we had approximately 96% of the hydrogen fuel cell electric truck HVIP voucher requests in California. At that time there were 135 requested vouchers, of which 130 were for Nikola. As of the end of January 2024, there were 360 vouchers requested in California, of which 355 are for our truck. So, of the additional 225 requested vouchers since the last call, 100% of them have been for our truck. It’s a testament to our first-mover advantage, sales strategy having boots on the ground helping fleets realize their sustainability goals, our leading market position, and the quality of our product.

This is not a science project. Our production hydrogen fuel cell truck is driving on the road today, and we are making our mission to decarbonize heavy duty transportation happen one fleet at a time.

Progress continues on our battery-electric truck remediation. We remain on track to return the first trucks to customer operations by the end of Q1. Our plan is to have all end user trucks back in their respective fleets by the end of Q2. And throughout Q3 and Q4, we will complete upgrades to additional BEVs at our Coolidge, Arizona facility and have the BEV “2.0” available for sale.

We continue to accumulate HVIP vouchers for the BEV, with 95 requested at the end of January, up from 62 on last quarter’s call. The additional voucher requests are in addition to the purchase orders for 47 BEVs from one dealer on the East Coast. Our sales team and dealers are in further discussions with fleets to secure additional purchase orders and are on track to have all trucks in Nikola inventory spoken for prior to resuming production.

As I said earlier, we’re calling the truck BEV “2.0” because not only are we replacing the battery packs and addressing outstanding service campaign fixes, but we’ve made a number of additional

enhancements – some available immediately, and others that, over time, are expected to be updated over-the-air, to augment the truck’s capabilities. The improvements include an updated instrument readout for more vital information viewing; connectivity improvements; a more user-friendly mobile app; a Scheduled Departure feature which ensures maximum charge when drivers begin their route; and a better charging experience. In addition to improved battery packs and new features, the trucks are also expected to be lighter, which is expected to result in higher payload capacity for fleets.

We are committed to the battery-electric product. Nikola is one truck platform, two powertrain options, and we’re developing a network providing zero-emission fueling and charging solutions for Class 8 trucking — that’s all we do.

Moving on to the energy business, HYLA. Earlier this month, we announced the opening of our first modular hydrogen fueling station in Ontario, California, which can fuel up to 40 trucks per day. Customers are utilizing the station on a daily basis to fuel up and keep hauling freight. Additionally, we named FirstElement Fuel as an authorized fueling solutions partner. The collaboration enables Nikola customers to utilize their new multi-use heavy-duty refueling station strategically situated near the Port of Oakland, which will be able to serve up to 200 trucks per day. These locations are ideally located, providing customers with the opportunity to go from Northern to Southern California and back.

The HYLA team is hard at work to secure additional refueling locations and assets. In Southern California, we have a line of sight right now to secure 6 additional HYLA modular refueling sites in 2024. As mentioned, in Northern California, we have FirstElement Fuel in Oakland, with 3 additional sites being planned near the Bay Area and Sacramento. In addition to the planned HYLA stations and FirstElement, we are in discussions with other hydrogen fueling station operators to allow Nikola customers to fuel at their underutilized assets.

The modular station in Ontario is the first step in the development of the HYLA hydrogen highway. Modular stations are intended to support new geographies as hydrogen fuel cell electric truck network density is amassed in the surrounding area and serve as a nimble interim solution while permanent refueling infrastructure is built. Upon completion of the permanent station infrastructure, the modular fueling assets can be redeployed in a new location as we look develop density in existing markets or enter new ones.

We believe the modular strategy will provide us with a flexible solution allowing us to rapidly penetrate new markets and remain capital efficient without the need to commit to permanent infrastructure prior to developing hydrogen fuel cell electric truck demand, ensuring high utilization of refueling assets.

The planned hydrogen highway is well underway, and the top priority of the HYLA team is to ensure customers are up 100% of the time and fuel is not a bottleneck to deliver trucks. We are happy to confirm at this time, our energy team has secured more than enough offtake to support our 2024 truck plan of record.

Passing it to Brian to cover the financial results.

Brian DeHoog, Corporate Controller

Thank you, Steve. Throughout 2023, we continued to strengthen our liquidity position, increasing our unrestricted cash balance, while also cutting our cash use by focusing spend on core business initiatives. Cash used for Capex and operating activities, which excludes loss on supplier deposits, stock-based compensation, depreciation, and impact of working capital averaged $85 million per quarter in the second half of 2023 compared to $130 million in the first half of 2023. That burn rate will continue in the first half of 2024 as we ramp up hydrogen fuel cell electric and HYLA activities but have visibility to reducing to less than $70 million per quarter by year end.

In 2023, we sold 79 battery-electric trucks prior to the recall and 35 hydrogen fuel cell electric trucks in Q4, for total net truck revenue of $30.1 million. Net truck revenue includes the impact of dealer rebates, incentives, and truck returns due to the cancellation of certain dealer agreements. Service and other revenue in 2023 was $5.8 million.

Our gross loss in 2023 was negative $214.1 million. Gross loss is outsized in 2023 due to the battery-electric truck recall, which includes a reserve of $65.8 million for estimated recall costs, and the write down of $45.7 million for BEV battery pack and other BEV inventory components.

Total operating expenses for the year came in at $435.8 million and includes $75.4 million of stock-based compensation and $28.8 million loss on supplier deposits. Excluding loss on supplier deposits, total operating expenses were within our previously provided guidance range and improved substantially versus the full year 2022.

We’d also like to provide a little color on the elevated interest expense for 2023. Net interest expense totaled $76.0 million for the full year, of which $41.2 million is from a one-time non-cash expense related to the conversion of the April 2023 toggle convertible notes during the third quarter.

Net loss from continuing operations for the full year was $864.6 million, and on a non-GAAP basis came in at $631.3 million.

Capex for the full year totaled $120.5 million as we completed the manufacturing footprint and line reconfiguration in Coolidge to bring hydrogen fuel cell electric truck production online. While we expect some hydrogen fuel cell electric truck tooling costs to carry over into 2024, the vast majority of these expenditures are in the rearview mirror.

Moving onto the Q4 2023 results. During the quarter, we delivered 35 hydrogen fuel cell electric trucks for total truck revenue of $12.5 million. Net of dealer rebates and incentives, ASP was $351 thousand due to the fulfillment of a number of lower priced legacy deals, which drove down ASP. We expect ASP to increase throughout 2024 as our sales mix transitions away from legacy deals as they are fulfilled. Net revenue for the quarter was $10.4 million and includes the reversal of some revenue from dealer cancellations and repurchase of their BEV inventory as we continue to strategically refine and position our dealer and service network in geographies with strong tailwinds like California and Canada.

Gross loss in Q4 was approximately $38.2 million, resulting in a negative gross margin of 332%. Gross loss is outsized due to low production volume, high variable and fixed costs, and non-cash accruals. We would like to provide some additional insight into the current unit economics per hydrogen fuel cell electric truck, and show the true cash spend per truck today.

Looking at hydrogen fuel cell electric truck production on a standalone basis, we can separate cost of goods into 3 buckets:

1.Variable cash cost;

2.Fixed cash costs; and

3.Accruals, depreciation, and amortization

Variable cash costs include our bill of materials and variable manufacturing costs in Coolidge such as direct labor, manufacturing supplies, inbound freight, duties, and taxes. On a per unit basis, variable cash costs were approximately $679 thousand per truck. We expect these cash costs to decrease as our bill of materials come down and revert from air freight back to ocean freight as supplier throughput normalizes.

Fixed cash costs primarily include indirect labor and facilities overhead spend. On a per unit basis, fixed cash costs per vehicle were $126 thousand. We expect we will experience the benefits of operating leverage on a fixed cash costs on a per unit basis as we scale production volumes. So, on a cash basis per truck, we are at a negative 129% cash margin.

The third component of cost of goods, accruals and D&A, include items like warranty, net realizable value write downs of inventory, the Iveco S-Way license amortization, and depreciation on the Coolidge manufacturing facility and equipment. On a per unit basis, accruals and D&A were $459 thousand per truck, resulting in a gross margin loss on the trucks of negative 260%. As we continue to increase ASP, lower our bill of materials, and increase production, we expect the items above to substantially decrease on a per unit basis.

Since this is our first quarter reporting hydrogen fuel cell electric truck sales, we wanted to give you some insight as there are many accruals and accounting reserves included in the P&L that are highlighted with lower production volumes. We believe looking at operating leverage is a better measure of Nikola’s performance in this early stage of production. Actual cash spend per truck gives insight into where we have operating leverage and provides a clearer runway to improve cash margin as we achieve higher production and delivery volumes in the second half of the year.

Steve will share where we expect to be on a cash contribution margin basis later in the call when we provide 2024 guidance.

Moving on to our operating expenses. Total operating expenses for Q4 came in at $89.6 million, within the provided guidance range, and includes $10.4 million of losses on supplier deposits and $6.5 million of stock-based compensation. Excluding loss on supplier deposits, operating expenses came in below the low end of expense guidance as we continue to foster financial discipline and reduce cash use. Cash use for Q4 was $129.9 million, below our $140 million target. We anticipate our cash use will continue to decline on average as we continue to see reductions in bill of materials costs and manage our working capital effectively.

Lastly, we ended Q4 with a total unrestricted cash balance of $464.7 million, an improvement of $102 million from Q3, and our highest unrestricted cash balance since Q4 of 2021.

Steve Girsky, President and Chief Executive Officer

Thanks, Brian. Let’s discuss our 2024 outlook. We’re starting the year in a strong position as demand is not a constraint and we believe we can sell every truck we can build. We are experiencing some delays in the ramp up of new components from suppliers on the hydrogen fuel cell electric truck and modular refueling assets. At this time, we are guiding for full year hydrogen fuel cell electric truck deliveries in the range of 300 – 350 trucks. There could be upside to this range if supply constraints on both the truck components and dispensing assets alleviate as we have plenty of production capacity in Coolidge and hydrogen supply. As always, our supply chain team is diligently working with our suppliers, and we will continue to provide you with updates in the coming quarters.

With current demand greater than supply, we can be selective on customer orders and believe we can push price higher. Contrast this with the current light duty EV market where inventory is high, and prices are coming down, we are doing the opposite.

On the battery-electric trucks, we expect to deliver at least 100 in 2024. These deliveries will begin after we have completed the return of the recalled trucks to end users in late Q2 or early Q3 2024. We are encouraged as dealers continue to submit HVIP vouchers, and our sales team is working through the sales pipeline for additional purchase orders. We expect total truck revenue for the full year to be between $150 – $170 million dollars.

This year, we expect hydrogen revenue and associated costs to be minimal as we are just beginning to deliver the first trucks and develop the hydrogen highway. For the full year 2024 guide, we think hydrogen and other revenue will be in the range of $10.0 to $12.0 million.

We expect total gross margin for the full year 2024 to be in the range of negative 100% on the low end of delivery guidance and negative 80% on the high end. On the truck side, lower production volumes will be helpful to the cash burn initially as we will not incur as many costs. However, we do see a line of sight to achieve positive cash contribution margin later in the year. As Brian talked about earlier, there are some non-cash accruals and fixed costs that are elevated right now as we ramp up production volumes and deploy new technology. At this time, we believe if we can continue to increase ASP and reduce bill of material costs, we believe we can be in a position to produce a positive cash contribution margin on every truck as we transition into 2025. At that point, selling more trucks will produce more cash flows to begin covering fixed manufacturing costs and operating expenses.

We expect 2024 operating expenses to be in the range of $280 million to $300 million, including $30 million of stock-based compensation. Our expected Capex for 2024 is $60 to $70 million. Capex will be predominantly spent on HYLA modular refueling infrastructure, supplier tooling, and investments to reduce the hydrogen fuel cell electric truck bill of materials.

For the first quarter of 2024, based on supply availability, we expect to deliver between 30 – 35 hydrogen fuel cell electric trucks, for revenues between $12.0 and $14.0 million. We expect gross margin for Q1 will be approximately negative 245% to negative 205%.

Operating expenses for Q1 are expected to be between $72.5 million – $77.5 million and include $7.9 million of stock-based compensation. Capex in Q1 will be approximately $20 million dollars. We expect operating expenses to decline further throughout the year as we complete the battery-electric truck recall and reduce hydrogen fuel cell electric truck engineering and validation activities as we are now focused on production.

To close the call, I’d like to just talk about the interest in Nikola and our products and services. There has been so much interest from government officials to suppliers, to partners, and fleets. Nowhere was that more evident than at CES 2024, where we were hosted by Bosch and brought three hydrogen fuel cell electric trucks. We gave walkaround tours and rides, and the excitement and reactions from people said it all – they know we’re for real. While other OEMs had their future trucks on the showroom floor, our Class 8 hydrogen fuel cell electric truck was the only one driving attendees up and down Paradise Road. We are building the products, hauling freight, and refueling at our first modular station. We have entered the execution phase of Nikola’s business model and we’re doing what we said we’re going to do.

Finally, I want to thank those fleets who have our trucks in operation and are putting them to work, while also collaborating with us to refine our product with each mile. Your faith in our pioneering product inspires us and we are here to support you in your journey to ensure your success.

Thank you all again for your time, passion, and commitment to Nikola’s future.

This concludes our prepared remarks. Operator, please open the line for analyst questions.

[Analyst Q&A]

Operator

Thank you. I will now hand the call back over to Dhillon for investor questions.

Dhillon Sandhu, Investor Relations

Thank you, operator. We received a series of questions from retail investors through the SAY platform, the majority of which can be summed up into 3 topics.

1.What are our plans for 2024?

2.How does Nikola differentiate itself from competitors? How is Nikola better positioned than other manufacturers who are entering the hydrogen and battery-electric Class 8 market?

3.What happened with the Badger program? Is what we’re seeing on social media true?

Steve, let’s start off with the first question, what can investors look forward to in 2024?

Steve Girsky, President and Chief Executive Officer

Thank you, Dhillon. 2024 is about execution, scaling our business and optimizing revenue and costs. Every day, we are validating our business model by executing on what we said we were going to do. Near-term drivers include higher average sales price, growing our strong sales pipeline, and deploying sufficient modular fuelers to meet the needs of our customers. Since we announced we delivered 35 hydrogen fuel cell electric trucks in Q4, we’ve had heightened interest in our product. In fact, the total number of HVIP vouchers for our hydrogen fuel cell electric truck at the end of January exceeds the total vouchers requested for all BEVs requested since 2023 - and that’s across all manufacturers. We own a dominant share of the available HVIP vouchers for hydrogen fuel cell electric truck vouchers and we intend to keep it that way.

This is not a time for distractions; We remain hyper-focused on the business and ensuring that our customers come first. The stock price will take care of itself as we execute our plans. I’ll say it again, we are in the right place at the right time, with the right products to transform the commercial transportation ecosystem for the better. I couldn’t be more excited to be a part of Nikola as I am now.

Dhillon Sandhu, Investor Relations

Thank you, Steve. Next topic is, how are we better positioned and what differentiates us from the competition?

Steve Girsky, President and Chief Executive Officer

The biggest difference is our hydrogen fuel cell electric truck is available to customers right now. We’ve overcome many challenges to be the first manufacturer to deliver a Class 8 hydrogen fuel cell electric truck to customers in North America. Customers like Biagi, IMC Logistics, 4Gen, and Coyote Containers are hauling freight as we speak. What sets our hydrogen fuel cell electric truck apart is that it has extended range, more features, more capabilities than its peers. Demo and customer experience data show that customers prefer the tighter turning radius, driver assistance features, smoother ride, and the extended range, up to 500 miles.

They appreciate the embedded technology of over-the-air updates, which keeps them out of the service bay and on the road. These software driven over-the-air updates will allow us to add more features over time to make the trucks even better. In short, we are benefitting from being a leader in the market and first-mover advantage. Our clear market plan – focusing on regions with strong tailwinds like California and Canada for our hydrogen fuel cell electric trucks and HYLA infrastructure solutions—will bear out vs. our competitors.

Dhillon Sandhu, Investor Relations

Great. And the third topic is about some of the social media posts regarding the Badger recently. Britton, I will turn this one over to you.

Britton Worthen, Chief Legal Officer

Thank you, Dhillon, and good morning. I have been a member of the Nikola team for eight years – taking part in its growth from just a few people in Utah to a company today with more than 900 employees, a headquarters in Phoenix and manufacturing facility in Coolidge. I am very proud of what this company has accomplished and overcome as we work to decarbonize the heavy-duty trucking industry.

There have been some confusing and potentially misleading videos and comments about Nikola’s Badger program that have been posted in recent days that I would like to address with facts.

The Badger program was initiated by Trevor Milton. After Nikola undertook some research and development, more than six thousand reservations and deposits were taken, and two prototypes were built, eventually being completed in late 2020.

The Badger program was always predicated on an OEM partnership, because passenger vehicle development programs take billions of dollars to engineer, validate, produce, and distribute. It is an extraordinarily complex endeavor and very different from Class 8 trucks. This is why passenger vehicle companies do not typically build heavy-duty trucks, and vice versa.

After Mr. Milton’s departure from the Company in September 2020, Nikola did not pursue the Badger program. On November 30, 2020, we announced that we were returning all order deposits for the Badger, in addition to a press release on that day in which our CEO at the time stated that we were focusing on our core business of Class 8 heavy-duty semi-trucks.

This brings us to the summer of 2023, when an agreement was executed between Nikola, and EMBR, a company majority owned by Dave Sparks and Cole Cannon. Nikola agreed to sell the Badger and powersports related assets, which included certain intellectual property and some physical prototypes.

Mr. Sparks and Mr. Cannon expressed a desire to bring these products to market and brought several EV-related partners to meetings as we discussed a possible sale. Based upon their representations that they planned to bring these products to market, and that they needed working capital to do so, a deal was struck that allowed EMBR to purchase the assets on a note, with no money down, to be paid back to Nikola over time. Nikola retained a 30% interest in EMBR, which lowered the note payable owed back from EMBR, allowed Nikola to retain some value for its shareholders if the assets were ever developed into anything worthwhile, and allowed Nikola to claw back 500,000 shares that were given by Mr. Milton to Mr. Sparks as part of Mr. Milton’s departure from the company.

Mr. Sparks and Mr. Cannon agreed that Mr. Milton would not be involved, directly or indirectly, in any way with the Badger or powersports assets. It was specifically stated that Mr. Milton was to have zero involvement in this effort because the Company felt strongly that he had caused enough reputational, financial, and operational damage to Nikola. Mr. Sparks and Mr. Cannon acknowledged and agreed to this stipulation.

Over the three-and-a-half years since Mr. Milton left the company, we at Nikola have worked to stay above the fray, not comment on his legal proceedings and stay focused on the work at hand, to bring zero-emission Class 8 trucks to market. As you have all heard on this call, we have done just that.

The irony that Mr. Milton is now trying to take control of Nikola, after all that has happened in the past three and a half years, is not lost on us at the Company. We will continue to push back against any efforts he makes to attempt to take control of Nikola, and we believe our directors and management are far and away better for our stockholders than a slate of directors who lack relevant experience to run a clean energy clean tech company.

We continue to pursue all legal avenues against Mr. Milton related to the $165 million dollar arbitration award we won related to his wrongful conduct. We are currently working to have that arbitration award confirmed in Federal Court. Not surprisingly, Mr. Milton has opposed that request for confirmation, but we are waiting on a decision from the Federal Court judge.

Our company has made a commitment to openness and transparency, with government entities, our stockholders, partners and our employees. I am honored to be a part of this organization every day, and like all Nikola team members, remain committed to our mission and eliminating unnecessary distractions.

Thank you for your time this morning and now I turn it back to Dhillon.

Dhillon Sandhu, Investor Relations

Thank you, Britton. I think that sums it up for us. Thank you all for joining.

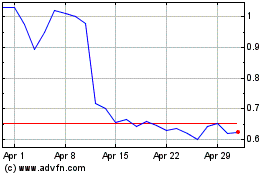

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From Apr 2023 to Apr 2024