0001645113false00016451132024-02-012024-03-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

February 22, 2024

Date of Report (date of earliest event reported)

NovoCure Limited

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Jersey | 001-37565 | 98-1057807 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

No. 4 The Forum, Grenville Street | St. Helier | Jersey | JE2 4UF |

(Address of Principal Executive Offices) | (Zip Code) |

+44 (0) 15 3475 6700

Registrant's telephone number, including area code

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Ordinary Shares, no par value | NVCR | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.02 Results of Operations and Financial Condition.

On February 22, 2024, the Company issued a press release announcing certain financial results for the fiscal year and quarter ended December 31, 2023. A copy of the press release is attached as Exhibit 99.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

NovoCure Limited

(Registrant)

Date: February 22, 2024

By: /s/ Ashley Cordova

Name: Ashley Cordova

Title: Chief Financial Officer

Novocure Reports Fourth Quarter and Full Year 2023 Financial Results and Provides Company Update

Full year 2023 net revenues of $509 million and fourth quarter net revenues of $134 million

PMA application for TTFields in NSCLC accepted for review by U.S. Food and Drug Administration

Enrollment completed in phase 3 TRIDENT trial studying the use of TTFields therapy and concomitant radiation for the treatment of newly diagnosed GBM

ROOT, Switzerland – Novocure (NASDAQ: NVCR) today reported financial results for the quarter and full year ended December 31, 2023. Novocure is a global oncology company working to extend survival in some of the most aggressive forms of cancer by developing and commercializing its innovative therapy, Tumor Treating Fields (TTFields).

“In 2023, we reached many milestones in our commercial, clinical and product development programs,” said Asaf Danziger, Novocure’s Chief Executive Officer. “Our launch in France is off to a strong start and globally we finished the year with 9% year-over-year growth in active patients.

“Our LUNAR phase 3 clinical trial in non-small cell lung cancer met its primary endpoint and we submitted marketing applications to the regulatory bodies in our key markets,” continued Mr. Danziger. “We also completed enrollment of three additional phase 3 trials – METIS, PANOVA-3, and most recently, TRIDENT. Finally, we successfully introduced our next generation arrays in several European markets and we have filed for regulatory approval to launch in the U.S. I am incredibly proud of our colleagues’ achievements in 2023 and look forward to an exciting 2024.”

“2024 will be a pivotal year for Novocure,” said William Doyle, Novocure’s Executive Chairman. “We are laser-focused on achieving three core objectives – growing our GBM business, launching TTFields therapy in non-small cell lung cancer, and delivering the promise of our clinical trial and product development pipelines. Achieving our goals should position Novocure for sustained success for years to come.”

Financial updates for the full year and fourth quarter ended December 31, 2023:

•Total net revenues for the year were $509.3 million, a decrease of 5% year-over-year. This decrease resulted primarily from $48 million in reduced collections from denied or appealed claims in the U.S., which were largely exhausted in 2022. We expect future net revenue to more closely reflect core drivers of net revenue: number of active patients on therapy, duration of therapy, and net realized price per month.

•Total net revenues for the quarter were $133.8 million, an increase of 4% year-over-year.

•The United States, Germany and Japan contributed $91.3 million, $14.7 million, and $7.6 million in quarterly net revenues, respectively, with our other active markets contributing $15.9 million.

•Revenue in Greater China from Novocure’s partnership with Zai Lab totaled $4.4 million.

•Gross margin for the quarter was 76%.Gross margin was impacted by increased investments in patient support capacity and the rollout of our next generation arrays. In time, we expect these impacts to be offset by increased active patient counts as well as improved efficiencies and scale within our supply chain as we optimize manufacturing for our new arrays.

•Research, development and clinical studies expenses for the quarter were $54.3 million, a decrease of 1% from the same period in 2022. Clinical trial expenses can fluctuate quarter-to-quarter dependent upon the number of clinical trials actively underway, amount of clinical research organization services delivered and clinical materials procured.

•Sales and marketing expenses for the quarter were $59.2 million, an increase of 19% from the same period in 2022. This primarily reflects increased costs associated with geographic expansion and pre-launch activities intended to increase awareness of TTFields therapy in anticipation of our launch in non-small cell lung cancer (NSCLC).

•General and administrative expenses for the quarter were $39.4 million, an increase of 4% from the same period in 2022.

•Net loss for the quarter was $47.1 million with loss per share of $0.45.

•Adjusted EBITDA* for the quarter was $(31.6) million.

•Cash, cash equivalents and short-term investments were $910.6 million as of December 31, 2023.

Operational updates for the fourth quarter ended December 31, 2023:

•1,564 prescriptions were received in the quarter, an increase of 14% year-over-year. Prescriptions from the United States, Germany and Japan contributed 960, 217 and 105 prescriptions, respectively, with the remaining 282 prescriptions received in our other active markets.

•As of December 31, 2023, there were 3,755 active patients on therapy, an increase of 9% year-over-year. Active patients from the United States, Germany and Japan contributed 2,162, 525 and 375 active patients, respectively, with the remaining 693 active patients contributed by our other active markets.

Quarterly updates and achievements:

•In December, Novocure submitted a Premarket Approval (PMA) application to the U.S. Food and Drug Administration (FDA) seeking approval for the use of TTFields therapy together with standard therapies for the treatment of NSCLC, following progression on or after platinum-based therapy. In January, the FDA accepted the application for filing and it is now under substantive review as of December 15, 2023. Novocure also has active regulatory submissions under review in the European Union and Japan.

•In December 2023, Novocure submitted a PMA supplement to the FDA for Optune Gio® next generation arrays for newly diagnosed glioblastoma.

•In January, Novocure completed enrollment in the phase 3 TRIDENT clinical trial evaluating the efficacy of initiating Optune Gio use concurrent with radiation therapy and temozolomide for the treatment of adult patients with newly diagnosed GBM. Patients will be followed for a minimum of 24 months with data anticipated in 2026.

•In January, Novocure announced the appointment of Dr. Nicolas Leupin to the role of Chief Medical Officer. Dr. Leupin joins Novocure with an established track record of leadership and innovation in the biopharmaceutical sector, built upon extensive experience as a practicing medical oncologist and educator.

Anticipated clinical milestones:

•Top-line data from the phase 3 METIS clinical trial in brain metastases (late Q1 2024)

•Top-line data from the phase 3 PANOVA-3 clinical trial in locally advanced pancreatic cancer (Q4 2024)

•Data from the phase 3 TRIDENT clinical trial in newly diagnosed glioblastoma (2026)

Conference call details

Novocure will host a conference call and webcast to discuss fourth quarter and full year 2023 financial results at 8:00 a.m. EST today, Thursday, February 22, 2024. To access the conference call by phone, use the following conference call registration link,and dial-in details will be provided. To access the webcast, use the following webcast registration link.

The webcast and earnings slides presented during the webcast and the corporate presentation can be accessed live from the Investor Relations page of Novocure’s website, www.novocure.com/investor-relations, and will be available for at least 14 days following the call. Novocure has used, and intends to continue to use, its investor relations website, as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

About Novocure

Novocure is a global oncology company working to extend survival in some of the most aggressive forms of cancer through the development and commercialization of its innovative therapy, Tumor Treating Fields. Novocure’s commercialized products are approved in certain countries for the treatment of adult patients with glioblastoma, malignant pleural mesothelioma and pleural mesothelioma. Novocure has ongoing or completed clinical studies investigating Tumor Treating Fields in brain metastases, gastric cancer, glioblastoma, liver cancer, non-small cell lung cancer, pancreatic cancer and ovarian cancer.

Headquartered in Root, Switzerland and with a growing global footprint, Novocure has regional operating centers in Portsmouth, New Hampshire and Tokyo, as well as a research center in Haifa, Israel. For additional information about the company, please visit Novocure.com and follow @Novocure on LinkedIn and Twitter.

*Non-GAAP Financial Measurements

We measure our performance based upon a non-U.S. GAAP measurement of earnings before interest, taxes, depreciation, amortization and shared-based compensation ("Adjusted EBITDA"). We believe Adjusted EBITDA is useful to investors in evaluating our operating performance because it helps investors compare the results of our operations from period to period by removing the impact of earnings attributable to our capital structure, tax rate and material non-cash items, specifically share-based compensation.

Forward-Looking Statements

In addition to historical facts or statements of current condition, this press release may contain forward-looking statements. Forward-looking statements provide Novocure’s current expectations or forecasts of future events. These may include statements regarding anticipated scientific progress on its research programs, clinical study progress, development of potential products, interpretation of clinical results, prospects for regulatory approval, manufacturing development and capabilities, market prospects for its products, coverage, collections from third-party payers and other statements regarding matters that are not historical facts. You may identify some of these forward-looking statements by the use of words in the statements such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe” or other words and terms of similar meaning. Novocure’s performance and financial results could differ materially from those reflected in these forward-looking statements due to general financial, economic, environmental, regulatory and political conditions and other more specific risks and uncertainties facing Novocure such as those set forth in its Annual Report on Form 10-K filed on February 22, 2024, and subsequent flings with the U.S. Securities and Exchange Commission. Given these risks and uncertainties, any or all of these forward-looking statements may prove to be incorrect. Therefore, you should not rely on any such factors or forward-looking statements. Furthermore, Novocure does not intend to update publicly any forward-looking statement, except as required by law. Any forward-looking statements herein speak only as of the date hereof. The Private Securities Litigation Reform Act of 1995 permits this discussion.

Consolidated Statements of Operations

USD in thousands (except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve months ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net revenues | $ | 133,784 | | | $ | 128,429 | | | $ | 509,338 | | | $ | 537,840 | |

| Cost of revenues | 32,556 | | | 28,888 | | | 128,280 | | | 114,867 | |

| Gross profit | 101,228 | | | 99,541 | | | 381,058 | | | 422,973 | |

| | | | | | | |

| Operating costs and expenses: | | | | | | | |

| Research, development and clinical studies | 54,308 | | | 54,820 | | | 223,062 | | | 206,085 | |

| Sales and marketing | 59,188 | | | 49,629 | | | 226,809 | | | 173,658 | |

| General and administrative | 39,448 | | | 38,070 | | | 164,057 | | | 132,753 | |

| Total operating costs and expenses | 152,944 | | | 142,519 | | | 613,928 | | | 512,496 | |

| | | | | | | |

| Operating income (loss) | (51,716) | | | (42,978) | | | (232,870) | | | (89,523) | |

| Financial (expenses) income, net | 13,182 | | | 10,420 | | | 41,130 | | | 7,677 | |

| | | | | | | |

| Income (loss) before income tax | (38,534) | | | (32,558) | | | (191,740) | | | (81,846) | |

| Income tax | 8,545 | | | 4,745 | | | 15,303 | | | 10,688 | |

| Net income (loss) | $ | (47,079) | | | $ | (37,303) | | | $ | (207,043) | | | $ | (92,534) | |

| | | | | | | |

| Basic and diluted net income (loss) per ordinary share | $ | (0.45) | | | $ | (0.36) | | | $ | (1.95) | | | $ | (0.88) | |

| Weighted average number of ordinary shares used in computing basic and diluted net income (loss) per share | 106,983,693 | | | 105,026,945 | | | 106,391,178 | | | 104,660,476 | |

Consolidated Balance Sheets

USD in thousands (except share data)

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 240,821 | | | $ | 115,326 | |

| Short-term investments | 669,795 | | | 854,099 | |

| Restricted cash | 1,743 | | | 508 | |

| Trade receivables, net | 61,221 | | | 86,261 | |

| Receivables and prepaid expenses | 22,677 | | | 25,959 | |

| Inventories | 38,152 | | | 29,376 | |

| Total current assets | 1,034,409 | | | 1,111,529 | |

| Long-term assets: | | | |

| Property and equipment, net | 51,479 | | | 32,678 | |

| Field equipment, net | 11,384 | | | 12,684 | |

| Right-of-use assets | 34,835 | | | 23,596 | |

| Other long-term assets | 14,022 | | | 11,161 | |

| Total long-term assets | 111,720 | | | 80,119 | |

| Total assets | $ | 1,146,129 | | | $ | 1,191,648 | |

Consolidated Balance Sheets

USD in thousands (except share data)

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| Liabilities and shareholders’ equity | | | |

| Current liabilities: | | | |

| Trade payables | $ | 94,391 | | | $ | 85,197 | |

| Other payables, lease liabilities and accrued expenses | 84,724 | | | 73,580 | |

| Total current liabilities | 179,115 | | | 158,777 | |

| Long-term liabilities: | | | |

| Long-term debt, net | 568,822 | | | 565,509 | |

| Deferred revenues | — | | | 2,878 | |

| Employee benefit liabilities | 8,258 | | | 4,404 | |

| Long term leases | 27,420 | | | 18,762 | |

| Other long-term liabilities | 18 | | | 148 | |

| Total long-term liabilities | 604,518 | | | 591,701 | |

| Total liabilities | 783,633 | | | 750,478 | |

| Commitments and contingencies | | | |

| Shareholders’ equity: | | | |

| Share capital - | | | |

| Ordinary shares - No par value, Unlimited shares authorized; Issued and outstanding: 107,075,754 shares and 105,049,411 shares at December 31, 2023 and December 31, 2022 respectively; | — | | | — | |

| Additional paid-in capital | 1,353,468 | | | 1,222,063 | |

| Accumulated other comprehensive loss | (5,469) | | | (2,433) | |

| Accumulated deficit | (985,503) | | | (778,460) | |

| Total shareholders’ equity | 362,496 | | | 441,170 | |

| Total liabilities and shareholders’ equity | $ | 1,146,129 | | | $ | 1,191,648 | |

Non-U.S. GAAP financial measures reconciliation

USD in thousands

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, |

| 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Net income (loss) | $ | (47,079) | | | $ | (37,303) | | | 26 | % | | $ | (207,043) | | | $ | (92,534) | | | 124 | % |

| Add: Income tax | 8,545 | | | 4,745 | | | 80 | % | | $ | 15,303 | | | $ | 10,688 | | | 43 | % |

| Add: Financial expenses (income), net | (13,182) | | | (10,420) | | | 27 | % | | $ | (41,130) | | | $ | (7,677) | | | 436 | % |

| Add: Depreciation and amortization | 2,723 | | | 2,700 | | | 1 | % | | $ | 10,969 | | | $ | 10,624 | | | 3 | % |

| EBITDA | $ | (48,993) | | | $ | (40,278) | | | 22 | % | | $ | (221,901) | | | $ | (78,899) | | | 181 | % |

| Add: Share-based compensation | 17,438 | | | 29,782 | | | (41) | % | | $ | 115,608 | | | $ | 106,955 | | | 8 | % |

| Adjusted EBITDA | $ | (31,555) | | | $ | (10,496) | | | 201 | % | | $ | (106,293) | | | $ | 28,056 | | | (479) | % |

Investors & Media:

Ingrid Goldberg

610-723-7427

investorinfo@novocure.com

media@novocure.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

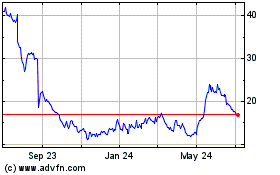

NovoCure (NASDAQ:NVCR)

Historical Stock Chart

From Mar 2024 to Apr 2024

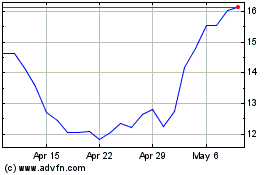

NovoCure (NASDAQ:NVCR)

Historical Stock Chart

From Apr 2023 to Apr 2024