UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 1)

| QSAM

Biosciences, Inc. |

| (Name

of Issuer) |

| Common

Stock |

| (Title

of Class of Securities) |

| Joseph

Teltser |

| 595

E. Colorado Blvd., Suite 530 |

| Pasadena

CA 91101 |

| (626)

365-1597 |

| (Name,

Address and Telephone Number of Person |

| Authorized

to Receive Notices and Communications) |

| December

31, 2023 |

| (Date

of Event which Requires Filing of this Statement) |

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| (1)

Names of reporting persons |

Charles

Thomas Paschall |

| (2)

Check the appropriate box if a member of a group (see instructions) |

(a)

☒

(b)

☐ |

| (3)

SEC use only |

|

| (4)

Source of Funds |

OO |

| (5)

Disclosure of Legal Proceedings |

|

| (6)

Citizenship or Place of Organization |

USA |

Number

of shares beneficially owned by each reporting

person with

(7)

Sole voting power |

285,667

shares |

| (8)

Shared voting power |

0 |

| (9)

Sole dispositive power |

285,667

shares |

| (10)

Shared dispositive power |

0 |

| (11)

Aggregate amount beneficially owned by each reporting person |

285,667

shares (1) (2) |

| (12)

check if the aggregate amount in Row (11) excludes certain shares (see instructions) |

|

| (13)

Percent of class represented by amount in Row (11) |

6.43%

fully diluted (3) |

| (14)

Type of reporting person (see instructions) |

IN |

(1)

Beneficial ownership of common stock of the Issuer is being reported herein solely because Mr. Paschall is the sole managing member of

Checkmate Strategic Capital 2, LLC, which beneficially owns 220,448 shares of common stock of the Issuer, and Checkmate Strategic Capital

2, LLC is a member (with voting and dispositive control) of Checkmate Strategic Capital Holdings, LLC, which beneficially owns 65,219

shares of common stock of the Issuer. As such, Mr. Paschall may be deemed to beneficially own 285,667 shares of common stock of the Issuer.

Neither the filing of this Schedule 13D nor any of its contents shall be deemed to constitute an admission by any reporting person that

it is the beneficial owner of any of the securities referred to herein for purposes of Section 13(d) of the Securities Exchange Act of

1934, as amended, except to the extent of his pecuniary interest therein, and such beneficial ownership is expressly disclaimed.

(2)

Includes 69,332 shares of common stock acquired by Checkmate Strategic Capital 2, LLC and 65,219 shares of common stock acquired by Checkmate

Strategic Capital Holdings, LLC pursuant to exchange of Series B Convertible Preferred Stock of the Issuer for common stock at

an exchange price of $3.00 per share on February 6, 2024, in accordance with an exchange agreement dated October 17,

2023 (the “Exchange Agreement”).

(3)

Based on 4,445,469 shares of common stock of the Issuer issued and outstanding as of February 9, 2024.

| (1)

Names of reporting persons |

Checkmate

Strategic Capital 2, LLC |

(2)

Check the appropriate box if a member of a group

(see

instructions) |

(a)

☒

(b)

☐ |

| (3)

SEC use only |

|

| (4)

Source of Funds |

OO |

| (5)

Disclosure of Legal Proceedings |

|

| (6)

Citizenship or Place of Organization |

Delaware |

Number

of shares beneficially owned by each reporting

person with

(7)

Sole voting power |

285,667

shares |

| (8)

Shared voting power |

0

shares |

| (9)

Sole dispositive power |

285,667

shares |

| (10)

Shared dispositive power |

0

shares |

| (11)

Aggregate amount beneficially owned by each reporting person |

285,667

shares (1) (2) |

| (12)

check if the aggregate amount in Row (11) excludes certain shares (see instructions) |

|

| (13)

Percent of class represented by amount in Row (11) |

6.43%

fully diluted (3) |

| (14)

Type of reporting person (see instructions) |

OO |

(1)

Includes 69,332 shares acquired pursuant to exchange of Series B Convertible Preferred Stock for shares of common stock of the Issuer

on February 6, 2024 at an exchange price of $3.00 per share under the Exchange Agreement (defined above).

(2)

Checkmate Strategic Capital 2, LLC is a member of Checkmate Strategic Capital Holdings, LLC, possessing voting and dispositive control.

Checkmate Strategic Capital 2, LLC beneficially owns 220,448 shares of common stock of the Issuer. Checkmate Strategic Capital Holdings,

LLC beneficially owns 65,219 shares of common stock of the Issuer. Therefore, Checkmate Strategic Capital 2, LLC may be deemed to beneficially

own 285,667 shares of common stock of the Issuer. Neither the filing of this Schedule 13D nor any of its contents shall be deemed to

constitute an admission by any reporting person that it is the beneficial owner of securities held by Checkmate Strategic Capital Holdings,

LLC for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, except to the extent of its pecuniary interest

therein, and such beneficial ownership is expressly disclaimed.

(3)

Based on 4,445,469 shares of common stock of the Issuer issued and outstanding as of February 9, 2024.

| (1)

Names of reporting persons |

Checkmate

Capital Group, LLC |

(2)

Check the appropriate box if a member of a group

(see

instructions) |

(a)

☒

(b)

☐ |

| (3)

SEC use only |

|

| (4)

Source of Funds |

OO |

| (5)

Disclosure of Legal Proceedings |

|

| (6)

Citizenship or Place of Organization |

Delaware |

Number

of shares beneficially owned by each reporting

person with

(7)

Sole voting power |

27,624

shares |

| (8)

Shared voting power |

0 |

| (9)

Sole dispositive power |

27,624

shares |

| (10)

Shared dispositive power |

0 |

| (11)

Aggregate amount beneficially owned by each reporting person |

27,624

shares (1) (2) |

| (12)

check if the aggregate amount in Row (11) excludes certain shares (see instructions) |

|

| (13)

Percent of class represented by amount in Row (11) |

0.62

% fully diluted (3) |

| (14)

Type of reporting person (see instructions) |

OO |

(1)

Investment decisions of Checkmate Capital Group, LLC are made by a board of seven managers, each of whom votes in the proportion

to their membership percentages. Under the so-called “rule of three,” if voting and dispositive decisions regarding an entity’s

securities are made by three or more individuals, and a voting or dispositive decision requires the approval of a majority of those individuals,

then none of the individuals is deemed a beneficial owner of the entity’s securities. This is the situation with regard to the

board of managers of Checkmate Capital Group, LLC.

(2)

Includes 8,571 shares of common stock of Issuer acquired on December 19, 2023 pursuant to the cashless exercise of warrants

issued to Checkmate Capital Group LLC, on January 15, 2023. See below for more details.

(3)

Based on 4,445,469 shares of common stock of the Issuer issued and outstanding as of February 9, 2024.

| (1)

Names of reporting persons |

Checkmate

Strategic Capital Holdings, LLC |

(2)

Check the appropriate box if a member of a group

(see

instructions) |

(a)

☒

(b)

☐ |

| (3)

SEC use only |

|

| (4)

Source of Funds |

OO |

| (5)

Disclosure of Legal Proceedings |

|

| (6)

Citizenship or Place of Organization |

Delaware |

Number

of shares beneficially owned by each reporting

person with

(7)

Sole voting power |

65,219

shares |

| (8)

Shared voting power |

0 |

| (9)

Sole dispositive power |

65,219

shares |

| (10)

Shared dispositive power |

0 |

| (11)

Aggregate amount beneficially owned by each reporting person |

65,219

shares (1) |

| (12)

check if the aggregate amount in Row (11) excludes certain shares (see instructions) |

|

| (13)

Percent of class represented by amount in Row (11) |

1.47

% fully diluted (2) |

| (14)

Type of reporting person (see instructions) |

OO |

(1)

Includes 65,219 shares acquired pursuant to exchange of Series B Convertible Preferred Stock for shares of common stock of the Issuer

on February 6, 2024, at an exchange price of $3.00 per share pursuant to the Exchange Agreement (defined above).

(2)

Based on 4,445,469 shares of common stock of the Issuer issued and outstanding as of February 9, 2024.

Item

1. Security and Issuer.

Common

Stock of QSAM Biosciences Inc. (the “Issuer”)

9442

Capital of Texas Hwy N, Plaza 1, Suite 500Austin, TX 78759

Item

2. Identity and Background.

| (a) |

Charles

Thomas Paschall |

|

Checkmate

Strategic Capital 2, LLC

Checkmate

Capital Group, LLC

Checkmate

Strategic Capital Holdings, LLC |

| |

|

|

|

| (b) |

595

E. Colorado Blvd., Suite 530, Pasadena CA 91101 |

|

595

E. Colorado Blvd., Suite 530, Pasadena CA 91101 |

| |

|

|

|

| (c) |

CEO

of Checkmate Capital Group, LLC |

|

Investing

in securities of companies in designated sectors, providing commercial consulting services. |

| |

|

|

|

| (d) |

None |

|

None |

| |

|

|

|

| (e) |

No |

|

No |

| |

|

|

|

| (f) |

USA |

|

Delaware,

USA |

Item

3. Source or Amount of Funds or Other Consideration.

Each

of these entities acquired common stock of the Issuer

in the following manner:

Checkmate

Capital Group LLC: (1) On December 31, 2020, in connection with consulting services performed by Checkmate Capital Group, LLC

for the benefit of the Issuer, certain officers and directors of the Issuer assigned a total of $50,000 worth of performance bonuses

granted to such individuals by the Issuer, to Checkmate Capital Group, LLC (“assigned bonus”), and Checkmate Capital

Group, LLC immediately agreed to convert the assigned bonus into 5,682 shares of common stock of the Issuer at a conversion price of

$8.80 per share; (2) on December 31, 2020, Checkmate Capital Group, LLC converted an assigned promissory note in the amount of

$117,659 inclusive of accrued interest into 13,370 shares of common stock at $8.80 per share; and (3) on January 15, 2023, pursuant

to a warrant agreement, the Issuer issued 50,000 warrants to Checkmate Capital Group, LLC for general consulting services at an

exercise price of $6.00. On December 19, 2023, Checkmate Capital Group, LLC exercised the warrants at a mutually agreed reduced

exercise price of $5.25 per share on a cashless basis in accordance with the formula set forth in the warrant agreement for cashless

exercises, into 8,571 shares of common stock of the Issuer.

Checkmate

Strategic Capital 2, LLC: (1) On December 31, 2020,

Checkmate Strategic Capital 2, LLC converted previously held promissory notes in the aggregate amount of $1,329,812 inclusive of accrued

interest into a total of 151,116 shares of common stock of the Issuer; and (2) converted an additional promissory note in the

amount of $155,954 inclusive of accrued interest into 156 shares of Series B Convertible Preferred Stock, which were exchanged

for 69,332 shares of common stock of the Issuer on February 6, 2024 pursuant to the Exchange Agreement (defined above).

Checkmate

Strategic Capital Holdings, LLC: Checkmate Strategic

Capital Holdings, LLC received funds from other investors, including investment by Checkmate Strategic Capital 2, LLC, for purchase of

150 shares of Series B Convertible Preferred Stock for $150,000 in connection with a private placement offering on January

15, 2021, which were subsequently exchanged, including all accrued dividends, for 65,219 shares of common stock of the Issuer

on February 6, 2024 pursuant to the Exchange Agreement (defined above).

Item

4. Purpose of Transaction.

Investment.

Other than as described in this Schedule 13D, the Reporting Person does not have any present plans or proposals that relate to or would

result in:

| (a) |

the

acquisition by any person of additional securities of the issuer, or the disposition of securities of the Issuer; |

| |

|

| (b) |

an

extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries;

|

| |

|

| (c) |

a

sale or transfer of a material amount of assets of the issuer or any of its subsidiaries; |

| |

|

| (d) |

any

change in the present board of directors or management of the Issuer; |

| |

|

| (e) |

any

material change in the present capitalization or dividend policy of the Issuer; |

| |

|

| (f) |

any

other material change in the Issuer’s business or corporate structure; |

| |

|

| (g) |

changes

in the Issuer’s charter, by-laws or instruments corresponding thereto or other actions which may impede the acquisition of

control of the Issuer by any person; |

| |

|

| (h) |

causing

a class of securities of the Issuer to be de-listed from a national securities exchange or to cease to be authorized to be quoted

in an inter-dealer quotation system of a registered national securities association; |

| |

|

| (i) |

a

class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Securities

Exchange Act; or |

| |

|

| (j) |

any

action similar to any of those enumerated above. |

Item

5. Interest in Securities of the Issuer.

(a)

| Reporting Person | |

Total Beneficial Ownership (including right to acquire within 60 days) | | |

Percent, fully diluted | |

| Charles Thomas Paschall | |

| - | | |

| - | |

| Checkmate Strategic Capital 2, LLC | |

| 220,448 | | |

| 4.96 | % |

| Checkmate Capital Group, LLC | |

| 27,624 | | |

| 0.62 | % |

| Checkmate Strategic Capital Holdings, LLC | |

| 65,219 | | |

| 1.47 | % |

| Group Total | |

| 313,291 | | |

| 7.05 | % |

(b)

| Reporting Person | |

Sole voting & dispositive power | | |

Shared voting & dispositive power | |

| Charles Thomas Paschall | |

| 285,667 | | |

| 0 | |

| Checkmate Strategic Capital 2, LLC | |

| 285,667 | | |

| 0 | |

| Checkmate Capital Group, LLC | |

| 27,624 | | |

| 0 | |

| Checkmate Strategic Capital Holdings, LLC | |

| 65,219 | | |

| 0 | |

| (c) |

On

January 15, 2023, pursuant to a warrant agreement, the Issuer issued 50,000 warrants to Checkmate Capital Group, LLC in

exchange for general consulting services exercisable at an exercise price of $6.00 per share. Checkmate Capital Group,

LLC exercised the warrants on December 19, 2023 on a cashless basis at a mutually agreed reduced exercise price of $5.25, in accordance with the formula set forth in the warrant agreement for

cashless exercises, and acquired 8,571 shares of common stock of the Issuer. On February

6, 2024, in connection with and prior to the signing of a Plan of Merger between the Issuer and Telix Pharmaceuticals Limited dated

February 7, 2024, and in accordance with the Exchange Agreement (defined above), all of the Series B Convertible Preferred

Stock owned by the applicable Reporting Persons were exchanged for an aggregate of 134,551 shares of common stock of the

Issuer. |

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Charles

Thomas Paschall is the sole member of Checkmate Strategic Capital 2, LLC.

Each

of Checkmate Strategic Capital 2, LLC and Checkmate Capital Group, LLC is a member of Checkmate Strategic Capital Holdings, LLC. Checkmate

Capital Group, LLC manages the assets of Checkmate Strategic Capital Holdings, LLC and has a carried interest in the profits of Checkmate

Strategic Capital Holdings, LLC.

Charles

Thomas Paschall indirectly holds a non-controlling membership interest in Checkmate Capital Group, LLC.

Item

7. Material to Be Filed as Exhibits.

Joint Filing Agreement.

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| |

/s/

Charles Thomas Paschall |

| |

Charles

Thomas Paschall |

| |

February

20, 2024 |

| |

Checkmate

Strategic Capital 2, LLC |

| |

By: |

Charles

Thomas Paschall |

| |

|

|

| |

By: |

/s/

Charles Thomas Paschall |

| |

|

Managing

Member |

| |

|

February

20, 2024 |

| |

|

|

| |

Checkmate

Capital Group, LLC |

| |

By: |

Charles

Thomas Paschall |

| |

|

|

| |

By: |

/s/

Charles Thomas Paschall |

| |

|

Chief

Executive Officer |

| |

|

February

20, 2024 |

| |

|

|

| |

Checkmate

Strategic Capital Holdings, LLC |

| |

By: |

Charles

Thomas Paschall |

| |

|

|

| |

By: |

/s/

Charles Thomas Paschall |

| |

|

Chief

Executive Officer |

| |

|

February

20, 2024 |

Exhibit 1

Joint

Filing Agreement Pursuant to Rule 13d-1

This

Joint Filing Agreement is made pursuant to Rule 13d-1(k)(1) under the Securities and Exchange Act of 1934, as amended (the “Act”)

by and between the parties listed below, each referred to herein as a “Joint Filer.” The Joint Filers agree that a statement

of beneficial ownership as required by Sections 13(g) or 13(d) of the Act and the Rules promulgated thereunder may be filed on each of

their behalf on Schedule 13G or 13D, as appropriate, and that said joint filing may thereafter be amended by further joint filings. The

Joint Filers further agree that this Joint Filing Agreement be included as an Exhibit to such joint filings. The Joint Filers state that

they each satisfy the requirements for making a joint filing under Rule 13d-1 and hereby, being duly authorized, have executed this Joint

Filing Agreement as of the date listed under each Joint Filer’s signature below.

| |

/s/

Charles Thomas Paschall |

| |

Charles Thomas Paschall |

| |

February 20, 2024 |

| |

Checkmate Strategic

Capital 2, LLC |

| |

By: |

Charles Thomas Paschall |

| |

|

|

| |

By: |

/s/

Charles Thomas Paschall |

| |

|

Managing Member |

| |

|

February 20, 2024 |

| |

|

|

| |

Checkmate Capital

Group, LLC |

| |

By: |

Charles

Thomas Paschall |

| |

|

|

| |

By: |

/s/

Charles Thomas Paschall |

| |

|

Chief Executive Officer |

| |

|

February 20, 2024 |

| |

|

|

| |

Checkmate Strategic

Capital Holdings, LLC |

| |

By: |

Charles

Thomas Paschall |

| |

|

|

| |

By: |

/s/

Charles Thomas Paschall |

| |

|

Chief Executive Officer |

| |

|

February 20, 2024 |

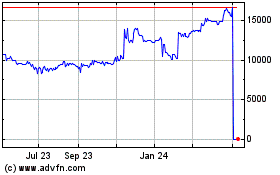

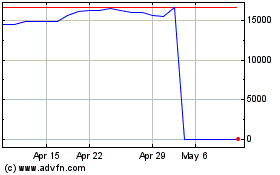

Common Stock (QB) (USOTC:QSAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Common Stock (QB) (USOTC:QSAM)

Historical Stock Chart

From Apr 2023 to Apr 2024