UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the

month of February 2024

Commission

File Number 001-35297

Fortuna

Silver Mines Inc.

(Translation

of registrant’s name into English)

200 Burrard

Street, Suite 650, Vancouver, British Columbia, Canada V6C 3L6

(Address

of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

FORM 20-F

¨ FORM 40-F

x

Indicate by check mark if

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1): ¨

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Fortuna Silver Mines Inc. |

| |

(Registrant) |

| |

|

| Date: February 16, 2024 |

By: |

/s/ “Jorge Ganoza Durant” |

| |

|

Jorge Ganoza Durant |

| |

|

President and CEO |

Exhibits:

Exhibit 99.1

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report

Effective

Date: December 31, 2023

| Prepared by |

|

Eric Chapman |

| |

|

Senior Vice President of Technical Services - Fortuna Silver Mines Inc. |

| |

|

|

| |

|

Paul Weedon |

| |

|

Senior Vice President of Exploration - Fortuna Silver Mines Inc. |

| |

|

|

| |

|

Raul Espinoza |

| |

|

Director of Technical Services - Fortuna Silver Mines Inc. |

| |

|

|

| |

|

Mathieu Veillette |

| |

|

Director, Geotechnical, Tailings and Water - Fortuna Silver Mines Inc. |

| |

|

|

| |

|

Patricia Gonzalez |

| |

|

Director of Operations – Compania Minera Cuzcatlan S.A. de C.V. |

Suite 650, 200 Burrard

Street, Vancouver, BC, V6C 3L6 Tel: (604) 484 4085, Fax: (604) 484 4029

|

|

Fortuna Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical Report |

| Contents |

| |

| 1 Summary |

14 |

| 1.1 |

Introduction |

14 |

| 1.2 |

Property description, location and access |

14 |

| 1.3 |

Mineral tenure, surface rights and royalties |

14 |

| 1.4 |

History |

15 |

| 1.5 |

Geology and mineralization |

15 |

| 1.6 |

Exploration, drilling and sampling |

16 |

| 1.7 |

Data verification |

18 |

| 1.8 |

Mineral processing and metallurgical testing |

18 |

| 1.9 |

Mineral Resources |

19 |

| 1.10 |

Mineral Reserves |

20 |

| 1.11 |

Mining methods |

22 |

| 1.12 |

Processing and recovery methods |

22 |

| 1.13 |

Project infrastructure |

23 |

| 1.14 |

Market studies and contracts |

23 |

| 1.15 |

Environmental studies and permitting |

24 |

| 1.16 |

Sustaining capital and operating costs |

24 |

| 1.17 |

Economic analysis |

26 |

| 1.18 |

Conclusions |

26 |

| 1.19 |

Risks, and opportunities |

26 |

| 1.20 |

Recommendations |

27 |

| |

1.20.1 Exploration |

27 |

| |

1.20.2 Technical and operational studies |

27 |

| |

|

|

| 2 Introduction |

29 |

| 2.1 |

Report purpose |

29 |

| 2.2 |

Qualified Persons |

29 |

| 2.3 |

Scope of personal inspection |

29 |

| 2.4 |

Effective dates |

30 |

| 2.5 |

Previous technical reports |

30 |

| 2.6 |

Information sources and references |

31 |

| 2.7 |

Acronyms |

31 |

| |

|

|

| 3 Reliance on Other Experts |

33 |

| |

|

| 4 Property Description and Location |

34 |

| 4.1 |

Mineral tenure |

34 |

| |

4.1.1 Mining claims and concessions |

34 |

| 4.2 |

Surface rights |

38 |

| December 31, 2023 | Page 2 of 213 |

| | |

|

|

Fortuna Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical Report |

| 4.3 |

Royalties |

39 |

| 4.4 |

Environmental aspects, permits and social considerations |

40 |

| |

4.4.1 Mine closure |

40 |

| 4.5 |

Comment on Section 4 |

40 |

| |

|

|

| 5 Accessibility, Climate, Local Resources, Infrastructure and Physiography |

41 |

| 5.1 |

Access |

41 |

| 5.2 |

Climate |

41 |

| 5.3 |

Topography, elevation and vegetation |

41 |

| 5.4 |

Infrastructure |

41 |

| 5.5 |

Sufficiency of surface rights |

41 |

| 5.6 |

Comment on Section 5 |

42 |

| |

|

|

| 6 History |

43 |

| 6.1 |

Ownership history |

43 |

| 6.2 |

Exploration history |

43 |

| 6.3 |

Production history |

44 |

| |

6.3.1 Compania Minera Arcata |

44 |

| |

6.3.2 Bateas |

44 |

| |

|

|

| 7 Geological Setting and Mineralization |

46 |

| 7.1 |

Regional geology |

46 |

| 7.2 |

Local geology |

47 |

| |

7.2.1 Yura Group |

48 |

| |

7.2.2 Tacaza Group |

49 |

| |

7.2.3 Tertiary volcanic deposits |

49 |

| |

7.2.4 Recent clastic deposits |

49 |

| |

7.2.5 Intrusive igneous rocks |

49 |

| 7.3 |

Project geology |

49 |

| |

7.3.1 Structural setting |

51 |

| |

7.3.2 Alteration |

51 |

| |

7.3.3 Mineralization |

51 |

| |

7.3.4 Silver veins |

52 |

| |

7.3.5 Polymetallic veins |

54 |

| |

7.3.6 Oxidation |

57 |

| 7.4 |

Geologic sections |

57 |

| 7.5 |

Comment on Section 7 |

57 |

| |

|

|

| 8 Deposit Types |

58 |

| 8.1 |

Mineral deposit type |

58 |

| 8.2 |

Comment on Section 8 |

59 |

| December 31, 2023 | Page 3 of 213 |

| | |

|

|

Fortuna Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical Report |

| 9 Exploration |

60 |

| 9.1 |

Exploration conducted by Compania Minera Arcata |

60 |

| 9.2 |

Exploration conducted by Bateas |

60 |

| |

9.2.1 Geophysics |

60 |

| |

9.2.2 Surface channel sampling |

60 |

| |

9.2.3 Geological mapping of major structures |

62 |

| |

9.2.4 Geological mapping of exploration targets |

63 |

| 9.3 |

Exploration potential |

67 |

| 9.4 |

Comment on Section 9 |

68 |

| |

|

|

| 10 Drilling |

69 |

| 10.1 |

Drilling conducted by Compania Minera Arcata |

69 |

| 10.2 |

Drilling conducted by Bateas |

69 |

| |

10.2.1 Drilling by vein |

72 |

| |

10.2.2 Drilling since the Mineral Resource database cut-off date |

78 |

| 10.3 |

Diamond drilling methods |

79 |

| 10.4 |

Geological and geotechnical logging procedures |

79 |

| 10.5 |

Drill core recovery |

80 |

| 10.6 |

Extent of drilling |

81 |

| 10.7 |

Drill hole collar surveys |

81 |

| 10.8 |

Downhole surveys |

81 |

| 10.9 |

Drill Sections |

81 |

| 10.10 |

Sample length versus true thickness |

87 |

| 10.11 |

Example drill intercepts |

87 |

| 10.12 |

Comment on Section 10 |

88 |

| |

|

|

| 11 Sample Preparation, Analyses, and Security |

89 |

| 11.1 |

Sample preparation prior to dispatch of samples |

89 |

| |

11.1.1 Channel chip sampling |

89 |

| |

11.1.2 Core sampling |

90 |

| |

11.1.3 Bulk density determination |

90 |

| 11.2 |

Dispatch of samples, sample preparation, assaying and analytical procedures |

90 |

| |

11.2.1 Sample dispatch |

90 |

| |

11.2.2 Sample preparation |

91 |

| |

11.2.3 Assaying of silver, lead, copper and zinc |

91 |

| |

11.2.4 Assaying of gold |

92 |

| 11.3 |

Laboratory accreditation |

92 |

| 11.4 |

Sample security and chain of custody |

92 |

| 11.5 |

Quality control measures |

93 |

| |

11.5.1 Certified reference material |

93 |

| |

11.5.2 Blanks |

94 |

| December 31, 2023 | Page 4 of 213 |

| | |

|

|

Fortuna Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical Report |

| |

11.5.3 Duplicates |

95 |

| |

11.5.4 Quality control measures employed by CMA |

96 |

| 11.6 |

Comment on Section 11 |

97 |

| |

|

|

| 12 Data Verification |

98 |

| 12.1 |

Introduction |

98 |

| |

12.1.1 Compania Minera Arcata |

98 |

| |

12.1.2 Bateas |

98 |

| 12.2 |

Database |

98 |

| 12.3 |

Collars and downhole surveys |

99 |

| 12.4 |

Geologic logs and assays |

99 |

| 12.5 |

Geotechnical and hydrology |

100 |

| 12.6 |

Metallurgical recoveries |

100 |

| 12.7 |

Mineral Resource Estimation |

100 |

| 12.8 |

Mineral Reserve estimation |

101 |

| 12.9 |

Mine reconciliation |

102 |

| 12.10 |

Comment on Section 12 |

102 |

| |

|

|

| 13 Mineral Processing and Metallurgical Testing |

104 |

| 13.1 |

Metallurgical tests |

104 |

| 13.2 |

Deleterious elements |

107 |

| 13.3 |

Comments on Section 13 |

107 |

| |

|

|

| 14 Mineral Resource Estimates |

108 |

| 14.1 |

Introduction |

108 |

| 14.2 |

Disclosure |

108 |

| |

14.2.1 Known issues that materially affect Mineral Resources |

108 |

| 14.3 |

Assumptions, methods and parameters |

109 |

| 14.4 |

Supplied data, data transformations and data validation |

110 |

| |

14.4.1 Data transformations |

110 |

| |

14.4.2 Software |

110 |

| |

14.4.3 Data preparation |

110 |

| |

14.4.4 Data validation |

111 |

| 14.5 |

Geological interpretation and domaining |

111 |

| 14.6 |

Exploratory data analysis |

112 |

| |

14.6.1 Compositing of assay intervals |

112 |

| |

14.6.2 Statistical analysis of composites |

113 |

| |

14.6.3 Sub-domaining |

116 |

| |

14.6.4 Extreme value treatment |

116 |

| |

14.6.5 Boundary conditions |

117 |

| |

14.6.6 Data declustering |

118 |

| December 31, 2023 | Page 5 of 213 |

| | |

|

|

Fortuna Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical Report |

| |

14.6.7 Sample type comparison |

118 |

| 14.7 |

Variogram analysis |

118 |

| |

14.7.1 Continuity analysis |

118 |

| |

14.7.2 Variogram modeling |

119 |

| 14.8 |

Modeling and estimation |

120 |

| |

14.8.1 Block size selection |

120 |

| |

14.8.2 Block model parameters |

121 |

| |

14.8.3 Sample search parameters |

122 |

| |

14.8.4 Grade interpolation |

123 |

| 14.9 |

Bulk density |

124 |

| 14.10 |

Model validation |

126 |

| |

14.10.1 Cross validation |

126 |

| |

14.10.2 Global estimation validation |

127 |

| |

14.10.3 Local estimation validation |

129 |

| |

14.10.4 Mineral Resource reconciliation |

129 |

| |

14.10.5 Mineral Resource depletion |

130 |

| 14.11 |

Mineral Resource classification |

130 |

| |

14.11.1 Geological continuity |

130 |

| |

14.11.2 Data density and orientation |

131 |

| |

14.11.3 Data accuracy and precision |

131 |

| |

14.11.4 Spatial grade continuity |

131 |

| |

14.11.5 Estimation quality |

132 |

| |

14.11.6 Classification |

132 |

| 14.12 |

Mineral Resource reporting |

133 |

| |

14.12.1 Reasonable prospects for eventual economic extraction |

133 |

| |

14.12.2 Mineral Resource statement |

134 |

| |

14.12.3 Mineral Resources by key geologic attributes |

135 |

| |

14.12.4 Comparison to previous estimate |

138 |

| 14.13 |

Comment on Section 14 |

138 |

| |

|

|

| 15 Mineral Reserve Estimates |

139 |

| 15.1 |

Mineral Resource handover |

139 |

| 15.2 |

Mineral Reserve methodology |

139 |

| 15.3 |

Key Mining Parameters |

140 |

| |

15.3.1 Mining Recovery |

140 |

| |

15.3.2 Dilution |

140 |

| |

15.3.3 Metal prices, metallurgical recovery and NSR values |

142 |

| 15.4 |

Cut-off grade determination |

143 |

| 15.5 |

Mineral Reserves |

143 |

| 15.6 |

Comments on Section 15 |

145 |

| December 31, 2023 | Page 6 of 213 |

| | |

|

|

Fortuna Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical Report |

| 16 Mining Methods |

146 |

| 16.1 |

Overview |

146 |

| 16.2 |

Hydrogeology |

146 |

| 16.3 |

Mine geotechnical |

147 |

| 16.4 |

Mining methods |

147 |

| |

16.4.1 Mechanized cut-and-fill |

147 |

| |

16.4.2 Semi-mechanized cut-and-fill |

148 |

| |

16.4.3 Conventional cut-and-fill |

148 |

| |

16.4.4 Sublevel Longhole Stoping (SLS) |

148 |

| 16.5 |

Mine production schedule |

149 |

| |

16.5.1 Stope design |

150 |

| 16.6 |

Underground mine model |

150 |

| |

16.6.1 Mine layout |

150 |

| |

16.6.2 Lateral development |

150 |

| |

16.6.3 Raising requirements |

151 |

| 16.7 |

Development schedule |

151 |

| 16.8 |

Equipment, manpower, services, and infrastructure |

152 |

| |

16.8.1 Contractor development |

152 |

| |

16.8.2 Mining equipment |

152 |

| |

16.8.3 Mine manpower |

152 |

| |

16.8.4 Production drilling |

152 |

| |

16.8.5 Ore and waste handling |

153 |

| |

16.8.6 Mine ventilation |

153 |

| |

16.8.7 Backfill |

154 |

| |

16.8.8 Mine dewatering system |

154 |

| |

16.8.9 Maintenance facilities |

154 |

| |

16.8.10 Electrical power distribution |

155 |

| |

16.8.11 Other services |

155 |

| 16.9 |

Comments on Section 16 |

156 |

| |

|

|

| 17 Recovery Methods |

157 |

| 17.1 |

Processing plant design |

157 |

| 17.1.1 |

Crushing and milling circuits |

157 |

| 17.2 |

Metallurgical treatment |

159 |

| 17.2.1 |

Lead-silver flotation circuit |

159 |

| 17.2.2 |

Zinc flotation circuit |

159 |

| 17.2.3 |

Concentrates thickening and filtration |

160 |

| 17.2.4 |

Tailings disposal |

160 |

| 17.3 |

Requirements for energy, water, and process materials |

160 |

| 17.4 |

Comment on Section 17 |

161 |

| December 31, 2023 | Page 7 of 213 |

| | |

|

|

Fortuna Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical Report |

| 18 Project Infrastructure |

162 |

| 18.1 |

Overview |

162 |

| 18.2 |

Roads |

162 |

| 18.3 |

Tailing storage facilities |

163 |

| 18.4 |

Mine waste stockpiles |

163 |

| 18.5 |

Ore stockpiles |

163 |

| 18.6 |

Concentrate production and transportation |

163 |

| 18.7 |

Power generation |

164 |

| 18.8 |

Communications systems |

164 |

| 18.9 |

Water supply |

164 |

| 18.10 |

Comments on Section 18 |

164 |

| |

|

|

| 19 Market Studies and Contracts |

165 |

| 19.1 |

Market studies |

165 |

| 19.2 |

Commodity price projections |

165 |

| 19.3 |

Contracts |

166 |

| |

19.3.1 Lead concentrate |

166 |

| |

19.3.2 Zinc concentrate |

166 |

| |

19.3.3 Operations |

166 |

| 19.4 |

Comments on Section 19 |

166 |

| |

|

|

| 20 Environmental Studies, Permitting and Social or Community Impact |

167 |

| 20.1 |

Regulation and permitting |

167 |

| |

20.1.1 Environmental legislation |

168 |

| |

20.1.2 Environmental obligations |

171 |

| 20.2 |

Environmental baseline |

171 |

| |

20.2.1 Location and access routes |

171 |

| |

20.2.2 Climatology |

172 |

| |

20.2.3 Air quality |

172 |

| |

20.2.4 Water quality |

172 |

| |

20.2.5 Hydrology |

173 |

| |

20.2.6 Soil science |

173 |

| |

20.2.7 Fauna and flora |

174 |

| |

20.2.8 Ecosystem characterization |

174 |

| |

20.2.9 Identification of protected areas |

175 |

| |

20.2.10 Archaeology |

175 |

| |

20.2.11 Environmental risks |

175 |

| |

20.2.12 Environmental management plan |

179 |

| |

20.2.13 Operation and management |

181 |

| 20.3 |

Community relations |

182 |

| |

20.3.1 Social management approach |

183 |

| December 31, 2023 | Page 8 of 213 |

| | |

|

|

Fortuna Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical Report |

| |

20.3.2 Framework convention management committee |

184 |

| |

20.3.3 Social investment |

185 |

| 20.4 |

Mine closure |

185 |

| |

20.4.1 Legal requirements |

185 |

| |

20.4.2 Closure objectives |

189 |

| |

20.4.3 Closure criteria |

189 |

| |

20.4.4 Stakeholder identification |

190 |

| |

20.4.5 Post-closure maintenance and monitoring |

190 |

| |

20.4.6 Post-closure maintenance activities |

191 |

| |

20.4.7 Closure costs |

191 |

| 20.5 |

Comment on Section 20 |

192 |

| |

|

|

| 21 Capital and Operating Costs |

193 |

| 21.1 |

Sustaining capital costs |

193 |

| |

21.1.1 Mine development |

193 |

| |

21.1.2 Equipment and infrastructure |

194 |

| |

21.1.3 Mine closure and rehabilitation |

194 |

| 21.2 |

Operating costs |

194 |

| 21.3 |

Comment on Section 21 |

194 |

| |

|

|

| 22 Economic Analysis |

195 |

| 22.1 |

Economic analysis |

195 |

| 22.2 |

Comments on Section 22 |

195 |

| |

|

|

| 23 Adjacent Properties |

196 |

| |

|

|

| 24 Other Relevant Data and Information |

197 |

| |

|

|

| 25 Interpretation and Conclusions |

198 |

| 25.1 |

Mineral tenure, surface rights, water rights, royalties and agreements |

198 |

| 25.2 |

Geology and mineralization |

198 |

| 25.3 |

Exploration, drilling and analytical data collection in support of Mineral Resource estimation |

198 |

| |

25.3.1 Data verification |

199 |

| 25.4 |

Metallurgical testwork |

200 |

| 25.5 |

Mineral Resource estimation |

200 |

| 25.6 |

Mineral Reserve estimation |

201 |

| 25.7 |

Mine plan |

202 |

| 25.8 |

Recovery |

202 |

| 25.9 |

Infrastructure |

202 |

| 25.10 |

Markets and contracts |

203 |

| 25.11 |

Environmental, permitting and social considerations |

203 |

| December 31, 2023 | Page 9 of 213 |

| | |

|

|

Fortuna Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical Report |

| 25.12 |

Capital and operating costs |

204 |

| 25.13 |

Economic analysis |

204 |

| 25.14 |

Risks and opportunities |

204 |

| |

|

|

| 26 Recommendations |

206 |

| 26.1 |

Overview |

206 |

| 26.2 |

Exploration |

206 |

| 26.3 |

Technical and operational |

206 |

| |

|

|

| 27 References |

207 |

| |

|

| Certificates |

209 |

| December 31, 2023 | Page 10 of 213 |

| | |

|

|

Fortuna Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical Report |

| Tables |

|

| Table 1.1 Mineral Resources as of December 31, 2023 |

20 |

| Table 1.2 Mineral Reserves as of December 31, 2023 |

21 |

| Table 1.3 Summary of projected major capital costs for the LOM |

25 |

| Table 1.4 Life-of-mine operating costs |

26 |

| Table 2.1 Acronyms |

31 |

| Table 4.1 Mining concessions owned by Bateas |

35 |

| Table 4.2 Surface rights for operations held by Bateas at Caylloma |

38 |

| Table 6.1 Exploration by drill hole and channels conducted by CMA |

43 |

| Table 6.2 Production figures during CMA management of Caylloma |

44 |

| Table 6.3 Production figures during Bateas management of Caylloma (2006-2023) |

44 |

| Table 10.1 Exploration drilling conducted by CMA |

69 |

| Table 10.2 Exploration drilling conducted by Bateas |

69 |

| Table 10.3 Drill intervals encountered post data cut-off date |

79 |

| Table 10.4 Example of representative drill results at the Caylloma Mine |

87 |

| Table 11.1 Terminology employed by Fortuna for duplicates |

95 |

| Table 14.1 Drill holes and channels available for geologic interpretation |

110 |

| Table 14.2 Metal prices used to define mineralized envelopes |

112 |

| Table 14.3 Composite length by vein |

112 |

| Table 14.4 Univariate statistics of undeclustered composites by vein |

114 |

| Table 14.5 Topcut thresholds by vein |

117 |

| Table 14.6 Variogram model parameters |

119 |

| Table 14.7 Caylloma block model parameters by vein |

121 |

| Table 14.8 Estimation method by vein |

123 |

| Table 14.9 Density statistics by vein |

125 |

| Table 14.10 Density assigned in the 2023 block models |

125 |

| Table 14.11 Cross validation results by vein |

126 |

| Table 14.12 Global validation statistics of Measured Resources at a zero cut-off grade (COG) |

127 |

| Table 14.13 Global validation statistics of Indicated Resources at a zero COG |

128 |

| Table 14.14 Global validation statistics of Inferred Resources at a zero COG |

128 |

| Table 14.15 Depletion codes stored in the resource block model |

130 |

| Table 14.16 Parameters used in NSR estimation |

133 |

| Table 14.17 Mineral Resources exclusive of Mineral Reserves |

134 |

| Table 14.18 Mineral Resources inclusive of Mineral Reserves |

135 |

| Table 14.19 Mineral Resources inclusive of Mineral Reserves (Oxide) |

136 |

| December 31, 2023 | Page 11 of 213 |

| | |

|

|

Fortuna Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical Report |

| Table 14.20 Mineral Resources inclusive of Mineral Reserves (Sulfide) |

137 |

| Table 15.1 Average dilution factors for wide and narrow veins |

142 |

| Table 15.2 Metal prices |

142 |

| Table 15.3 Metallurgical recoveries |

142 |

| Table 15.4 NSR values |

143 |

| Table 15.5 Operating costs by mining method |

143 |

| Table 15.6 Mineral Reserves |

144 |

| Table 16.1 Classification of rock mass |

147 |

| Table 16.2 Caylloma life-of-mine production schedule |

149 |

| Table 16.3 Caylloma life-of-mine production schedule |

149 |

| Table 16.4 Summary of lateral development requirements for LOM |

150 |

| Table 16.5 Summary of vertical development requirements for LOM |

151 |

| Table 16.6 LOM development schedule |

151 |

| Table 16.7 Planned mining equipment |

152 |

| Table 19.1 Long-term concensus commodity price projections |

165 |

| Table 20.1 Environmental factors |

175 |

| Table 20.2 Mine closure budget |

192 |

| Table 21.1 Summary of projected major capital costs for the LOM |

193 |

| Table 21.2 Life-of-mine operating costs |

194 |

| December 31, 2023 | Page 12 of 213 |

| | |

|

|

Fortuna Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical Report |

| Figures |

|

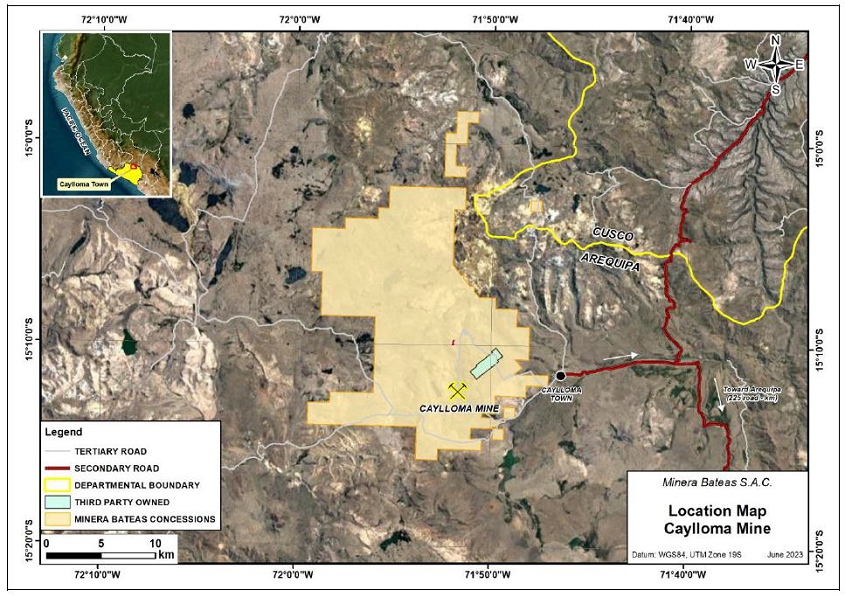

| Figure 4.1 Map showing the location of the Caylloma Mine |

34 |

| Figure 4.2 Location of mining concessions at the Caylloma Mine |

37 |

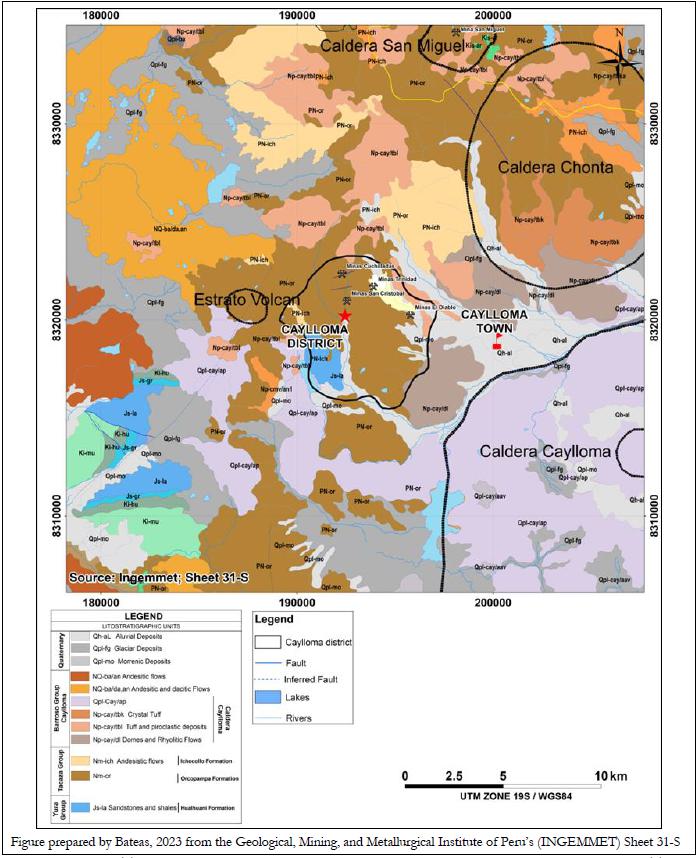

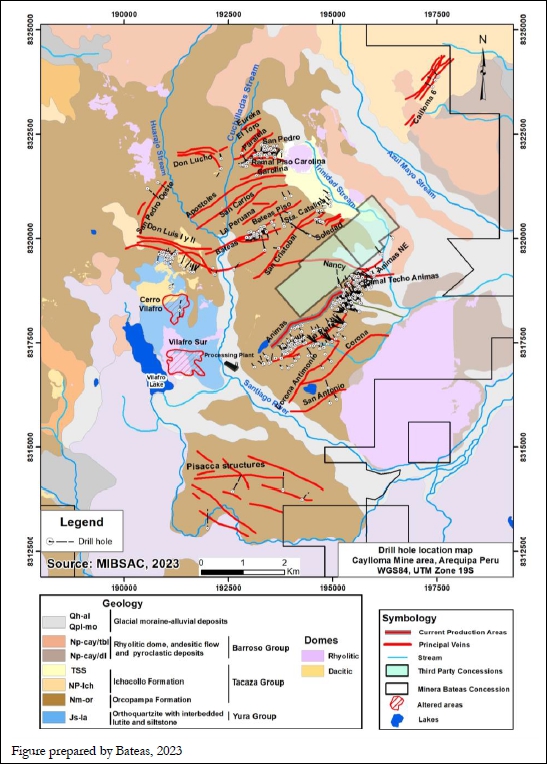

| Figure 7.1 Location map of the Caylloma District |

46 |

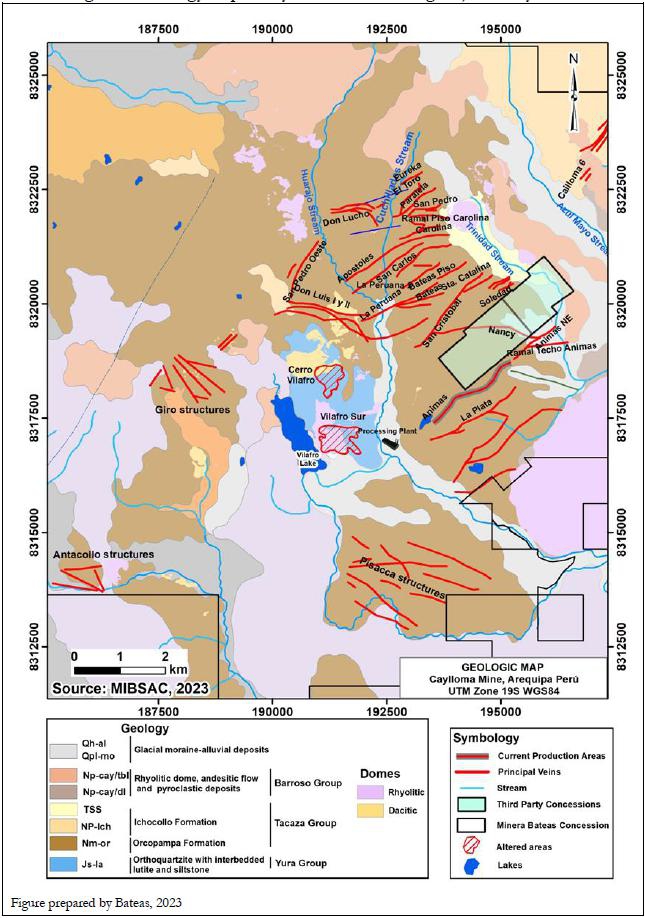

| Figure 7.2 Local geologic map of Caylloma District |

47 |

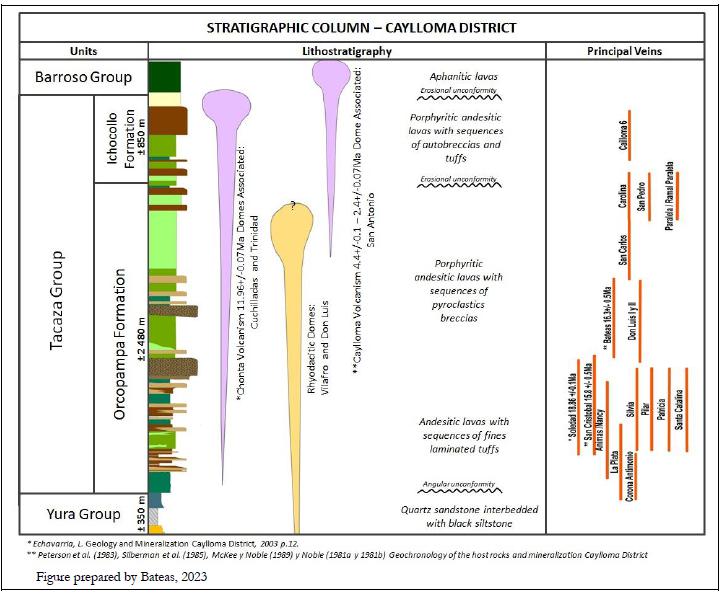

| Figure 7.3 Stratigraphic column of Caylloma District |

48 |

| Figure 7.4 Geology map of Caylloma Mine showing major vein systems |

50 |

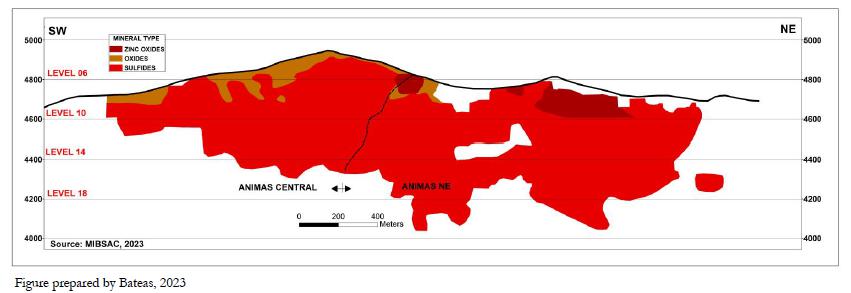

| Figure 7.5 Long section of Animas vein showing sulfide/oxide/zinc oxide zones |

57 |

| Figure 8.1 Idealized section displaying the classification of epithermal and base metal deposits sourced |

58 |

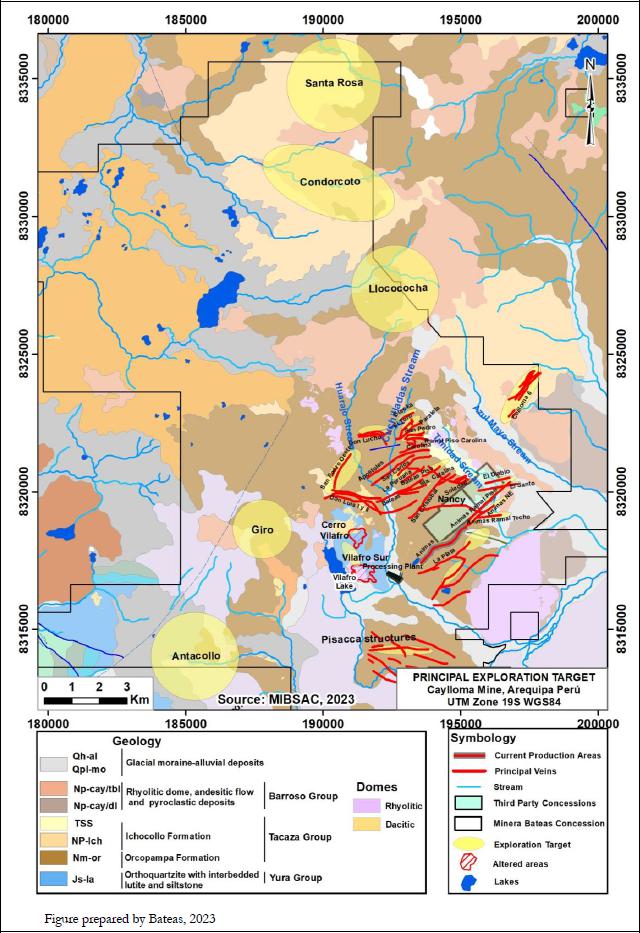

| Figure 9.1 Plan map showing principal exploration targets |

61 |

| Figure 9.2 Plan map showing surface geology and geochemistry of Cerro Vilafro |

64 |

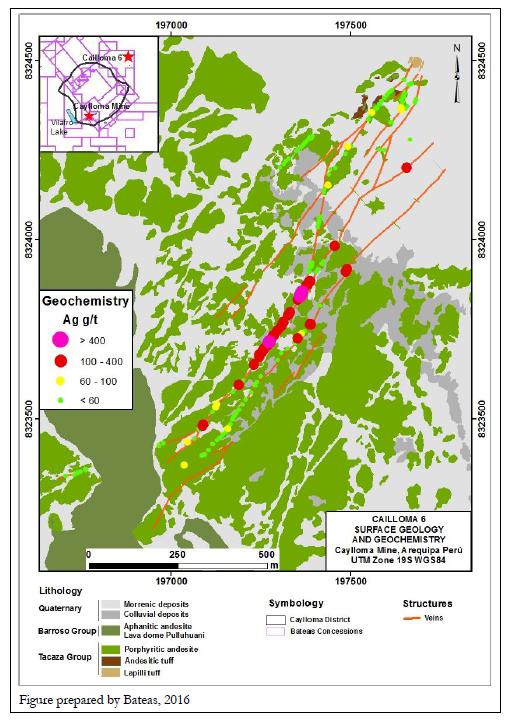

| Figure 9.3 Plan map showing surface geology and geochemistry of Cailloma 6 |

66 |

| Figure 9.4 Plan map showing the location of exploration targets |

67 |

| Figure 10.1 Map showing surface drill hole collar locations |

72 |

| Figure 10.2 Graph of core recovery of Animas/Animas NE vein |

80 |

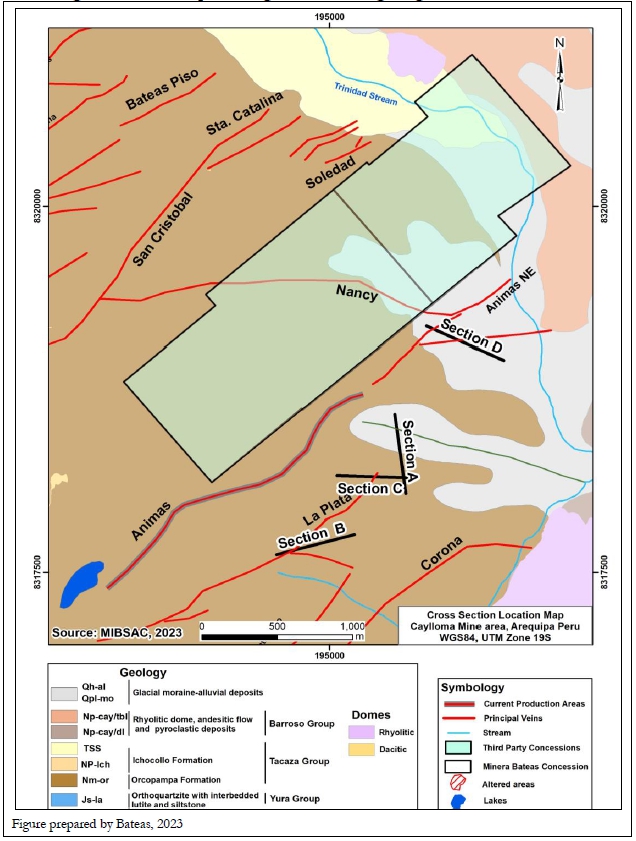

| Figure 10.3 Plan map showing orientation of geologic sections |

82 |

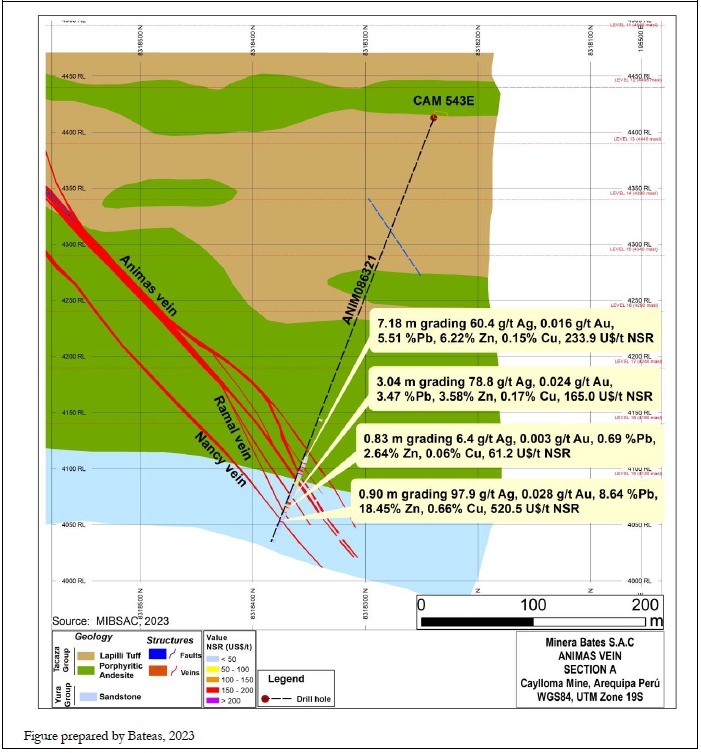

| Figure 10.4 Geologic interpretation of Animas & Nancy vein (Section A) |

83 |

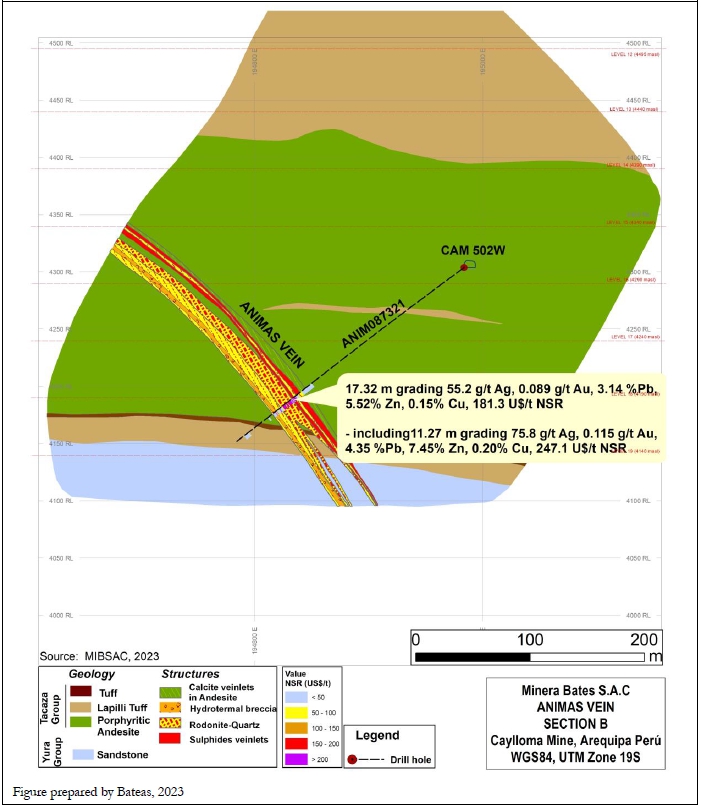

| Figure 10.5 Geologic interpretation of Animas vein (Section B) |

84 |

| Figure 10.6 Geologic interpretation of Animas vein (Section C) |

85 |

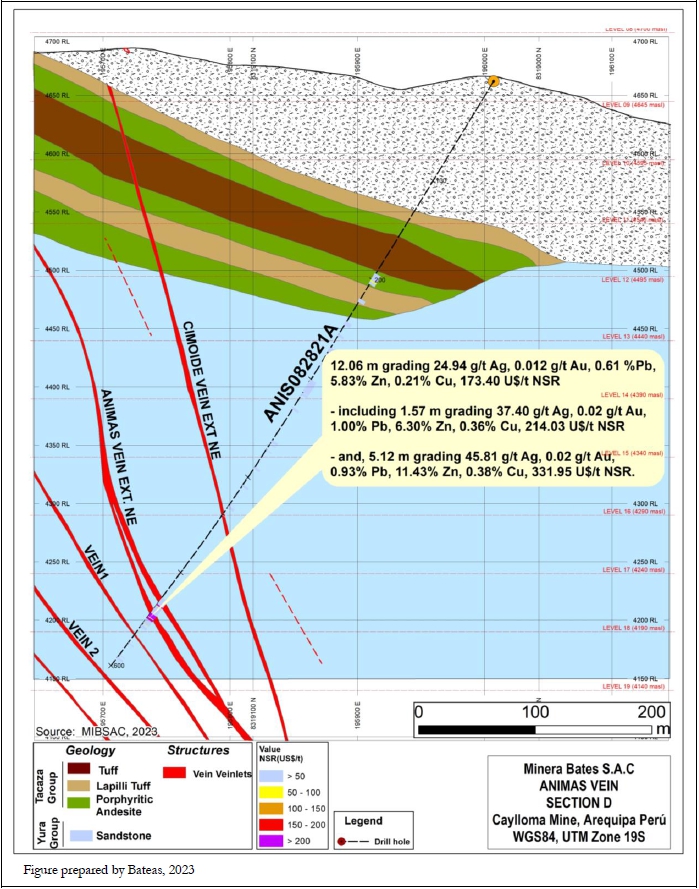

| Figure 10.7 Geologic interpretation of Animas NE vein (Section D) |

86 |

| Figure 14.1 Slice validation plot of the Animas NE vein |

129 |

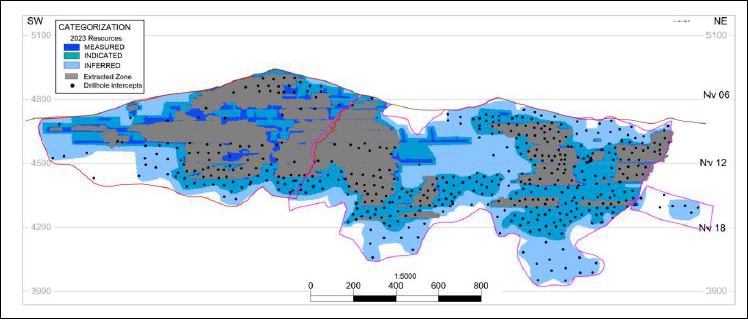

| Figure 14.2 Longitudinal section showing Mineral Resource classification for the Animas vein |

133 |

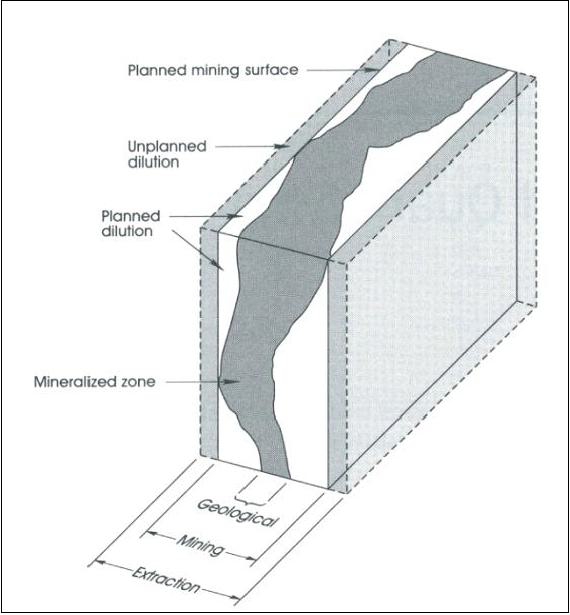

| Figure 15.1 Conceptual diagram of operational dilution |

141 |

| Figure 15.2 Longitudinal section showing Proven and Probable Reserves, Mineral Resources exclusive of reserves and stope design for the Animas vein |

145 |

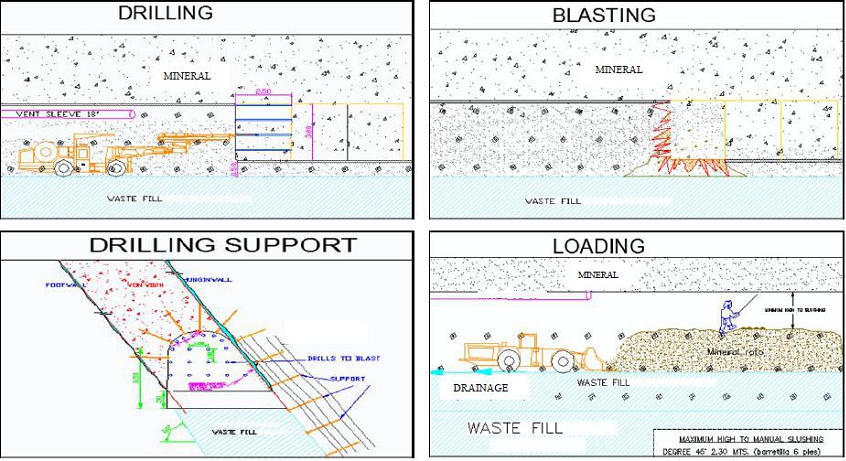

| Figure 16.1 Schematic showing mechanized mining sequence |

148 |

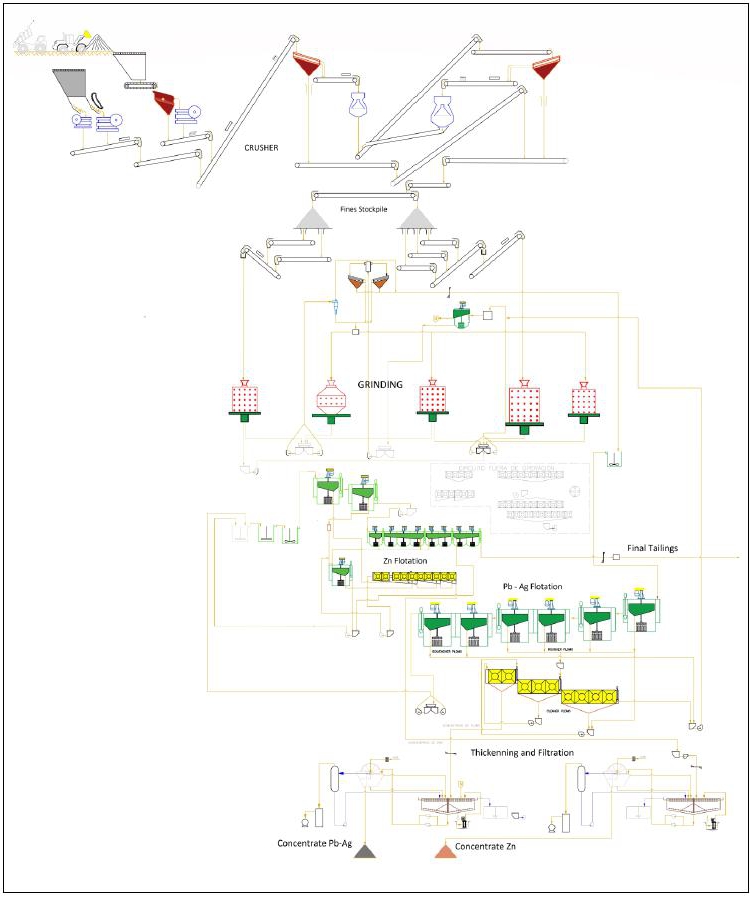

| Figure 17.1 Crushing and milling circuits at the Caylloma processing plant |

158 |

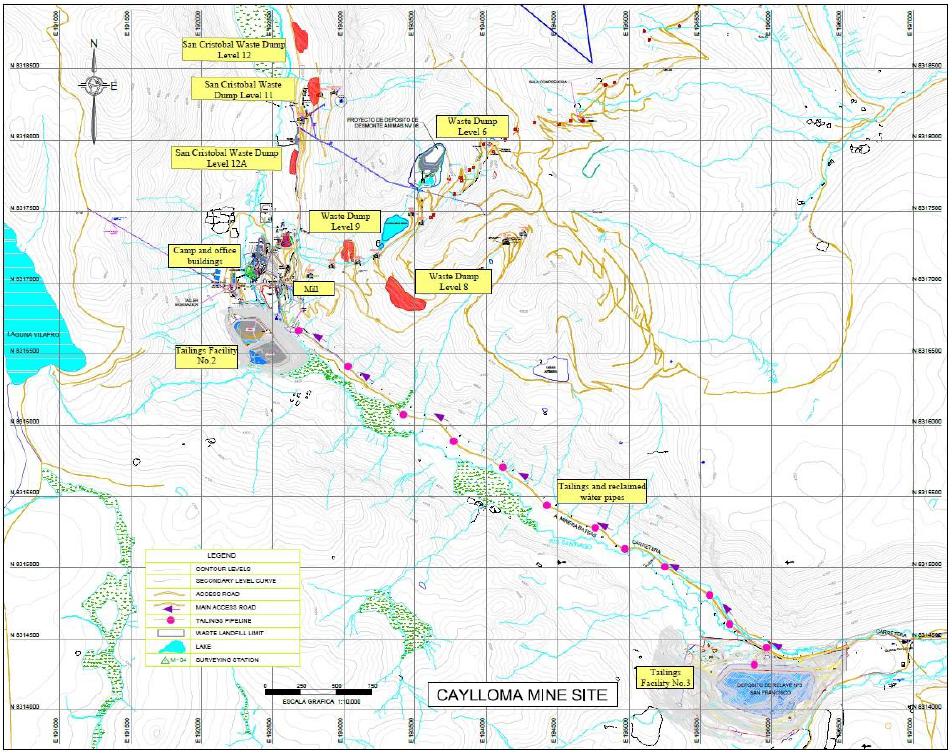

| Figure 18.1 Plan view of mine infrastructure |

162 |

| December 31, 2023 | Page 13 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

Fortuna

Silver Mines Inc. (Fortuna) has compiled a Technical Report (the Report) on the Caylloma Mine (the Caylloma Project or Project) located

in the Caylloma District, Peru.

The Caylloma

Mine ownership is 100 % held by Fortuna.

The mineral

rights of the Caylloma Mine are held by Compania Minera Bateas S.A.C. (Bateas). Bateas is a Peruvian subsidiary that is 100 % indirectly

owned by Fortuna and is responsible for running the underground silver-lead-zinc mine.

The Report

discloses updated Mineral Resource and Mineral Reserve estimates for the Project.

Costs

are in US dollars (US$) unless otherwise indicated.

| 1.2 | Property

description, location and access |

The Caylloma

Mine is located in the Puna region of Peru at an altitude of between 4,300 and 5,000 meters above sea level (masl). Surface topography

is generally steep with vegetation being primarily comprised of grasses and small shrubs common at high altitudes. The mine facilities

are located at approximately 4,400 masl.

Access

to the Caylloma Mine is by a combination of sealed and gravel road. The mine is located 225 road kilometers from Arequipa, a city of

approximately a million people that includes an international airport and requires a trip of approximately five hours by vehicle. Access

is available to all concessions via a network of unsealed roads.

The Caylloma

Mine is an operating underground mine located in the Caylloma Mining District, 14 km northwest of the town of Caylloma at the UTM grid

location of 8192263E, 8321387N, (WGS84, UTM Zone 19S).

| 1.3 | Mineral

tenure, surface rights and royalties |

The Caylloma

Project consists of mineral rights for 74 mining concessions for a total surface area of 35,622 hectares (ha) and one beneficiation concession

comprising 91.12 ha. Tenure is held in the name of Bateas with all mining concessions having an expiry date beyond the expected

mine life.

Bateas

has signed 22 surface right or easement contracts covering a total of 8,311 ha with landowners to cover the surface area needed for the

operation and tailings facilities.

The Caylloma

Mine is not subject to any back-in rights, liens, payments or encumbrances.

There

are royalties attached to the mineral concessions, however, the only royalties that affect the Mineral Reserves and have been considered

in the economic analysis are:

| · | A

2 % royalty on silver production to Nueva Granada Gold Ltd. (formerly Lemuria Royalties Corp.). |

| · | A

1 % royalty or an effective rate based on operating profit (whichever is greater) to the

Peruvian Government has been taken into account in predicting cash flows. |

| | | |

| | · | A Special Tax on Mining based on the quarterly operating profit of

the mining concession holder. |

| December 31, 2023 | Page 14 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

The earliest

documented mining activity in the Caylloma District dates back to that of Spanish miners in 1620. English miners carried out activities

in the late 1800s and early 1900s. Numerous companies have been involved in mining the district of Caylloma but limited records are available

to detail these activities.

The Caylloma

Mine was acquired by Compania Minera Arcata S.A. (CMA), a wholly owned subsidiary of Hochschild Mining plc in 1981. Fortuna acquired

the mine from CMA in 2005.

CMA focused

exploration on identifying high-grade silver vein structures. Exploration was concentrated in the northern portion of the district and

focused on veins including Bateas, El Toro, Paralela, San Pedro, San Cristobal, San Carlos, Don Luis, La Plata, and Apostles.

Production

prior to 2005 came primarily from the San Cristobal vein, as well as from the Bateas, Santa Catalina and the northern silver veins (including

Paralela, San Pedro, and San Carlos) with production focused on silver ores and no payable credits for base metals. While under CMA management

production parameters fluctuated during the late 1990s, as reserves were depleted. Owing to low metal prices, funds were not available

to develop the Mineral Resources at depth or extend along the strike of the veins. Ultimately this resulted in production being halted

in 2002.

Production

under Bateas management focused on the development of polymetallic veins producing lead and zinc concentrates with silver and gold credits.

Total production since October 2006 through December 31, 2023, is estimated at 23.4 Moz of silver, 36 koz of gold, 193 kt of

lead, and 272 kt of zinc.

| 1.5 | Geology

and mineralization |

The mine

is within the historical mining district of Caylloma, northwest of the Caylloma caldera complex and southwest of the Chonta caldera complex.

Host rocks at the Caylloma Mine are volcanic in nature, belonging to the Tacaza Group. Mineralization is in the form of low to intermediate

sulfidation epithermal vein systems.

Epithermal

veins at the Caylloma Mine are characterized by minerals such as pyrite, sphalerite, galena, chalcopyrite, marcasite, native gold, stibnite,

argentopyrite, and silver-bearing sulfosalts (tetrahedrite, polybasite, pyrargyrite, stephanite, stromeyerite, jalpite, miargyrite and

bournonite). These are accompanied by gangue minerals, such as quartz, rhodonite, rhodochrosite, johannsenite (manganese-pyroxene) and

calcite.

There

are two different types of mineralization at Caylloma; the first is comprised of silver-rich veins with low concentrations of base metals

and includes the Bateas, Bateas Piso, Bateas Techo, La Plata, Cimoide La Plata, San Cristobal, Pilar, Patricia, San Pedro, San Carlos,

Paralela, Ramal Piso Carolina, and Don Luis II veins. The second type of vein is polymetallic in nature with elevated lead, zinc, copper,

silver and gold grades and includes the Animas, Animas NE, Comoide ASNE, Ramal Techo ASNE, Rosita, Nancy Santa Catalina, Silvia and Soledad

veins.

Underground

operations are presently focused on mining the Animas, Animas NE, Nancy and associated splay veins.

| December 31, 2023 | Page 15 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

| 1.6 | Exploration,

drilling and sampling |

CMA implemented

a series of exploration programs to complement their mining activities prior to the closure of the operation in 2002. There is no reliable

information available to detail the exploration conducted by CMA at the Caylloma Mine. Bateas were able to recover and validate information

on 47 diamond drill holes totaling 8,177.67 m drilled by CMA between 1981 and 2003 at the Caylloma Mine.

Since

Fortuna took ownership of the property in 2005, the principal exploration conducted at the deposit has been surface and underground drilling,

to explore the numerous vein structures identified through surface mapping or geophysical surveys conducted by Bateas, or for infill

purposes to increase the confidence level of the Mineral Resource estimates.

As of

June 30, 2023, Bateas had completed 1,658 drill holes on the Caylloma Project totaling 283,593.30 m since the company took ownership

in 2005 and represents all data compiled as of the data cut-off date used for Mineral Resource estimation. All holes are diamond drill

holes and include 565 from the surface totaling 160,521.80 m, and 1,093 from underground totaling 123,071.50 m. It is important to note

that not all the holes presented encountered mineralization and only drill holes in areas where reasonable geological continuity of mineralized

structures could be established were used in defining and ultimately estimating Mineral Resources.

Bateas

has used a number of different drilling contractors to carry out exploration and definition drilling since it took ownership of the mine

in 2005. Both HQ (63.5 mm) and NQ (47.6 mm) diameter core were obtained, depending on the depth of the hole. Ground conditions are generally

good with core recovery averaging 94 % and higher in mineralized zones.

Proposed

surface and underground drill hole collar coordinates, azimuths and inclinations were designed based on the known orientation of the

veins and the planned depth of vein intersection using geological plan maps and sections as a guide. For surface holes, the location

of the collar is located in the field using differential global positioning system (GPS) instruments. The drill pad is then prepared

at this marked location. Upon completion of the drill hole, a survey of the collar is performed using Total Station equipment, with results

reported in the collar coordinates using reference Datum WGS84, UTM Zone 19S. For underground drill holes, once the drill station has

been established, the location of the collar is located using Total Station instruments based on previously surveyed control points.

The geologist

in charge of drilling is responsible for orienting the azimuth and inclination of the hole at the collar using a compass clinometer.

Downhole surveys are completed by the drilling contractor using survey equipment such as a Flexit or Reflex tool at approximately 50

m intervals for all surface drill holes and for underground drill holes greater than 100 m in length. Bateas assesses the downhole survey

measurements as a component of data validation.

Drill

holes are typically drilled on sections spaced 40 to 60 m apart along the strike of the vein with surface drilling focusing on exploring

the extents of the Animas, Animas NE, Bateas and Nancy veins and underground drilling used for a mix of exploration and resource definition.

The extent of drilling varies for each vein with those having the greatest coverage having drill holes extending over 3 km of the vein’s

strike length (Animas/Animas NE), to exploration prospects having only a few drill holes extending over just 50 m (Antimonio).

| December 31, 2023 | Page 16 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

The relationship

between the sample intercept lengths and the true width of the mineralization varies in relation to the intersect angle between the steeply

dipping zone of mineralized veins and the inclined nature of the diamond core holes. Calculated estimated true widths (ETWs) are always

reported together with actual sample lengths by taking into account the angle of intersection between drill hole and the mineralized

structure.

In 2018,

all logging became digital, being incorporated daily into the Maxwell Datashed database system. Data were recorded initially with Excel

templates, and later with the Maxwell LogChief application using essentially the same structure. Both input methods used picklists and

data validation rules to ensure consistency between loggers. Separate pages were designed to capture, lithology, alteration,

veins, sulfide-oxide zones, minerals, structure (contacts, fractures, veins, and faults with attitudes to core axis), magnetic susceptibility,

and special data (samples collected for geochemistry, thin section examinations, the core library, density, etc.). Intensity of

alteration phases was recorded using a numeric 1 to 4 scale (weak, moderate, strong, very strong); abundance of veins and most other

minerals were estimated in volume percent.

Geotechnical

logging is conducted prior to cutting of the core and involves the collection of drill core recovery and rock-quality designation (RQD)

data. Information is recorded in the field using the Maxwell LogChief application.

The sampling

methodology, preparation, and analyses differ depending on whether it is drill core or a channel sample. All samples are collected by

geological staff of Bateas with sample preparation and analysis being conducted either at the onsite Bateas Laboratory or transported

to the ALS Global preparation facility in Arequipa prior to being sent on for analysis at their laboratory in Lima.

The Bateas

Laboratory operated by Bateas is not independent and does not hold an internationally recognized accreditation.

ALS Global

is an independent, privately-owned analytical laboratory group. The preparation laboratory in Arequipa and the analytical laboratory

in Lima are supported by a Quality Management System (QMS) framework which is designed to highlight data inconsistencies sufficiently

early in the process to enable corrective action to be taken in time to meet reporting deadlines. The QMS framework follows the most

appropriate ISO Standard for the service at hand i.e. ISO 9001:2015 for survey/inspection activity and ISO 17025:2005 UKAS ref 4028 for

laboratory analysis.

Channel

samples are collected from the faces of underground workings. The entire process is carried out under the geology department’s

supervision. Sampling is carried out at 2 m intervals within the drifts of all veins and 3 m intervals in stopes (except for

Bateas and Soledad, where due to the thickness of the vein, sampling is carried out every 2 m in stopes). The channel lengths and orientations

are identified using paint in the underground working and by painting the channel number on the footwall. The channel is between 20 cm

to 30 cm wide and approximately 2 cm deep, with each individual sample being no longer than 1.5 m.

Drill

core is laid out for sampling and logging at the core logging facility at the camp. Sample intervals are marked on the core and depths

recorded on the appropriate box. A geologist is responsible for determining and marking the drill core intervals to be sampled, selecting

them based on geological and structural logging. The sample length must not exceed 1.2 m or be less than 30 cm.

| December 31, 2023 | Page 17 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

The elements

of silver, copper, lead and zinc are assayed using either; atomic absorption (AA); inductively coupled plasma atomic emission spectroscopy

(ICP-AES); or for high lead and zinc grades volumetric/titration techniques (VOL); or for high silver grades gravimetric techniques (GRAV)

depending on the laboratory and assay value. Assay results and certificates are reported electronically by e-mail.

Bulk

density samples have been primarily sourced from drill core with a limited number being sampled from underground workings. Bulk density

measurements are performed at the ALS Global Laboratory in Lima using the OA-GRA09A methodology.

Sample

collection and transportation of drill core and channel samples is the responsibility of Brownfields exploration and the Bateas mine

geology departments and must follow strict security and chain of custody requirements established by Fortuna. Samples are retained in

accordance with the Fortuna corporate sample retention policy.

Implementation

of a quality assurance/quality control (QAQC) program is current industry best practice and involves establishing appropriate procedures

and the routine insertion of certified reference material (CRMs), blanks, and duplicates to monitor the sampling, sample preparation

and analytical process. Fortuna implemented a full QAQC program to monitor the sampling, sample preparation and analytical process for

all drilling campaigns in accordance with its companywide procedures. The program involved the routine insertion of CRMs, blanks, and

duplicates. Evaluation of the QAQC data indicates that the data are sufficiently accurate and precise to support Mineral Resource estimation.

Data

verification programs performed by the QPs on the data collected by Bateas are adequate to support Mineral Resource and Mineral Reserve

estimation.

| 1.8 | Mineral

processing and metallurgical testing |

It is

the opinion of the QP that the Caylloma Mine has an extensive body of metallurgical investigation comprising several phases of testwork

as well as an extensive history of treating ore at the operation since 2006. In the opinion of the QP, the Caylloma metallurgical samples

tested and the ore that is presently treated in the plant is representative of the material included in the life-of-mine (LOM) in respect

to grade and metallurgical response.

Metallurgical

recovery values forecast in the LOM for sulfide material averages 82 % for silver, 22 % for gold, 89 % for lead, and 89 % for zinc with

the exception of gold rich veins (> 1 g/t Au) where testwork has demonstrated that minor adjustments in the processing plant can achieve

metallurgical recovery rates of 85 % for silver, 55 % for gold, 87 % for lead and 89 % for zinc.

Until

2012, ore identified as containing high zinc oxide content was classified as not amenable for flotation. Laboratory and plant tests conducted

since 2013 include metallurgical testing of material from the different levels of the Animas vein. The main conclusion was that zinc

oxide contents greater than 0.20 % within the ore were related to lower metallurgical recoveries. In order to include this type of material

without affecting the metallurgical recoveries blending has to be performed to limit the oxide material content to no more than 11 %

of the plant feed. This has been considered in the LOM plan.

| December 31, 2023 | Page 18 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

Beyond

the blending consideration for oxide material, as described above, there are no additional deleterious elements that require special

treatment in the plant as of the effective date of this Report.

The 2023

Mineral Resource update has relied on channel and drill hole sample information obtained by Bateas since 2005. Mineralized domains identifying

potentially economically extractable material were modeled for each vein and used to code drill holes and channel samples for geostatistical

analysis, block modeling and grade interpolation by ordinary kriging or inverse distance weighting.

Resource

confidence classification considers a number of aspects affecting confidence in the resource estimation including; geological continuity

and complexity; data density and orientation; data accuracy and precision; and grade continuity. Mineral Resources are categorized as

Measured, Indicated or Inferred. The criteria used for classification includes the number of samples, spatial distribution, distance

to block centroid, kriging efficiency (KE) and slope of regression (ZZ).

Mineral

Resources are reported based on underground mining within mineable stope shapes based on actual operational costs and mining equipment

sizes using net smelter return (NSR) values in the block model calculated based on the projected long-term metal prices, commercial terms,

and actual metallurgical recoveries experienced in the plant.

Veins

classified as wide, being on average greater than two meters, are amenable to extraction by semi-mechanized mining methods with a mine

to mill cost reported as US$ 89.78/t. Taking into account a 15% upside in metal prices for the evaluation of long-term resources

a US$ 75/t NSR cut-off value is applied to the wide veins including Animas, Animas NE, Ramal Techo ASNE, Cimoide ASNE, Nancy, Rosita,

and San Cristobal.

Veins

classified as narrow, being on average less than 2 m, are amenable to extraction by conventional mining methods with a mine to mill cost

estimated as US$ 170/t. Taking into account a 15% upside in metal prices for the evaluation of long term resources a US$135 /t

NSR cut-off value is applied to the narrow veins including Bateas, Bateas Piso, Bateas Techo, La Plata, Cimoide La Plata, Soledad, Santa

Catalina, Silvia, Ramal Piso Carolina, Paralela, San Carlos, San Pedro, Patricia, Pilar, and Don Luis II.

By the

application of a NSR value taking into consideration the average metallurgical recovery and long-term metal prices for each metal, and

the determination of a reasonable cut-off value using actual operating costs, as well as the exclusion of Mineral Resources identified

as being isolated or economically unviable using a floating stope optimizer, the Mineral Resources have ‘reasonable prospects for

eventual economic extraction’.

Mineral

Resources exclusive of Mineral Reserves for the Caylloma Mine are reported as of December 31, 2023, and detailed in Table 1.1.

| December 31, 2023 | Page 19 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

Table

1.1 Mineral Resources as of December 31, 2023

| Category |

Tonnes

(000) |

Ag

(g/t) |

Au

(g/t) |

Pb

(%) |

Zn

(%) |

Contained

Metal |

| Ag

(koz) |

Au

(koz) |

Pb

(kt) |

Zn

(kt) |

| Measured |

524 |

98 |

0.30 |

2.09 |

3.16 |

1,646 |

5 |

11 |

17 |

| Indicated |

1,262 |

82 |

0.21 |

1.47 |

2.54 |

3,338 |

9 |

19 |

32 |

| Measured

+ Indicated |

1,786 |

87 |

0.24 |

1.65 |

2.72 |

4,983 |

14 |

29 |

49 |

| Inferred |

4,505 |

99 |

0.43 |

2.43 |

3.70 |

14,382 |

63 |

110 |

167 |

Notes

on Mineral Resources

| · | Mineral

Resources are reported in situ, as defined by the 2014 CIM Definition Standards for Mineral

Resources and Mineral Reserves. |

| · | Mineral

Resources as reported exclusive of Mineral Reserves. Mineral Resources that are not Mineral

Reserves do not have demonstrated economic viability. |

| · | Mineral

Resources are reported as of December 31, 2023. |

| · | Mr. Eric

Chapman P.Geo., a Fortuna employee, is the Qualified Person for the estimate. |

| · | Point

metal values (taking into account metal price, concentrate recovery, smelter cost, metallurgical

recovery) used for NSR evaluation are US$ 0.49/g for silver, US$ 15.40/% for lead, and US$

15.58/% for zinc with the exception of gold rich veins that used US$ 0.51/g for silver,

US$ 24.69/g for gold, US$ 14.88/% for lead, and US$ 15.48/% for zinc, based on metal prices

of US$ 21/oz for silver, US$ 1,600/oz for gold, US$ 2,000/t for lead and US $2,600/t

for zinc, and metallurgical recovery values of 82 % for silver, 22 % for gold, 89 %

for lead, and 89 % for zinc, with the exception of gold rich veins that used 85 % for silver,

55 % for gold, 87 % for lead, and 89 % for zinc. |

| · | Mineral

Resources for veins classified as wide (Anima, Animas NE, Cimoide ASNE, Nancy, Rosita, and

San Cristobal) are reported above an NSR cut-off value of US$ 75/t. Mineral Resources for

veins classified as narrow (all other veins) are reported above an NSR cut-off value of US$

135/t based on actual and projected mining costs and a 15% upside in metal prices. |

| · | Mineral

Resource tonnes are rounded to the nearest thousand. |

| · | Totals

may not add due to rounding. |

Factors

that may affect the Mineral Resource estimates include metal price and exchange rate assumptions; changes to the assumptions used to

generate the cut-off grade; changes in local interpretations of mineralization geometry and continuity of mineralized zones; changes

to geological and mineralization shape and geological and grade continuity assumptions; variations in density and domain assignments;

geometallurgical assumptions; changes to geotechnical, mining, dilution, and metallurgical recovery assumptions; change to the input

and design parameter assumptions that pertain to the conceptual stope designs constraining the estimates; and assumptions as to the continued

ability to access the site, retain mineral and surface rights titles, maintain environment and other regulatory permits, and maintain

the social license to operate.

Mineral

Reserves were converted from Measured and Indicated Mineral Resources. Inferred Mineral Resources were set to waste.

Mineral

Reserves assume overhand cut and fill or sublevel stoping mining methods.

The overall

mining recovery is approximately 94 % which takes into account the presence of pillars in wide veins and crown pillars for each main

level of the mine.

Two sources

of dilution were considered, operational dilution and mucking dilution. Operational dilution for cut and fill (mechanized – breasting)

averages 17 % if a zero

| December 31, 2023 | Page 20 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

grade

for the waste material is applied and this represents 91 % of the total reserves estimated. Other mining methods applied in less tonnage

are cut and fill (mechanized – enhanced) averages 21 %, cut and fill (semi-mechanized) average 22 % and conventional cut and fill

averages 34 %. For Sublevel longhole stoping, the calculation of the mining width estimated is 0.8 m (0.6 m for hangingwall and 0.2 m

for footwall) with a minimum mining width of 0.8, then minimum stope shape dimension of 1.6m.

Metal

prices used for Mineral Reserve estimation were determined as of June 2023 by the corporate financial department of Fortuna based

on market consensus.

Metallurgical

recoveries were based on metallurgical test work and operational results at the plant from July 2022 to June 2023.

Net smelter

return (NSR) values were dependent on various parameters including metal prices, metallurgical recovery, price deductions, refining charges

and penalties.

A breakeven

cut-off grade was determined based on all variable and fixed costs applicable to the operation. These include exploitation and treatment

costs, general expenses and administrative and commercialization costs (including concentrate transportation). The breakeven cut-off

grade was determined to be US$ 89.78/t for mechanized (breasting); US$ 79.70/t for mechanized (enhanced); US$ 88.81/t for sub-level stoping

(SLS); US$ 93.27/t for semi-mechanized; and US$ 170/t conventional.

Mechanized

(breasting) cut and fill mining will be used for 91 % of the total Mineral Reserves, with the other methods representing the remainder.

Mineral

Reserves as of December 31, 2023, are reported in Table 1.2.

Table

1.2 Mineral Reserves as of December 31, 2023

| Category |

Tonnes

(000) |

Ag

(g/t) |

Au

(g/t) |

Pb

(%) |

Zn

(%) |

Contained

Metal |

| Ag

(koz) |

Au

(koz) |

Pb

(kt) |

Zn

(kt) |

| Proven |

20 |

261 |

0.94 |

2.23 |

2.62 |

165 |

0.6 |

0.4 |

0.5 |

| Probable |

2,269 |

81 |

0.13 |

2.79 |

4.06 |

5,924 |

9.3 |

63.2 |

92.0 |

| Proven

+Probable |

2,288 |

83 |

0.13 |

2.78 |

4.04 |

6,089 |

9.9 |

63.6 |

92.5 |

Notes

on Mineral Reserves

| · | Mineral

Reserves are reported at the point of delivery to the process plant using the 2014 CIM Definition

Standards. |

| · | Mineral

Reserves are reported as of December 31, 2023. |

| · | Raul

Espinoza, FAusIMM (CP), a Fortuna employee, is the Qualified Person for the estimate. |

| · | Mineral

Reserves are reported based on underground mining within optimized stope designs using an

NSR breakeven cut-off for extraction including; mechanized (breasting) at US$ 89.78/t;

mechanized (enhanced) at US$ 79.70/t; sub-level stoping (SLS) at US$88.81/t; semi-mechanized

at US$ 93.27/t; and conventional at US$ 170/t. |

| · | Metal

prices used in the NSR evaluation are US$ 21/oz for silver, US$ 1,600/oz for gold,

US$ 2,000/t for lead, and US$ 2,600/t for zinc. |

| · | Metallurgical

recovery rates used for NSR values are 82% for Ag, 22% for Au, 89% for Pb and 89% for Zn

except for gold rich veins (>1 g/t Au) that use 85% for Ag, 55% for Au, 87% for Pb and

89% for Zn and include the Soledad, Cimoide La Plata, La Plata, Pilar, San Pedro, and Ramal

Piso Carolina veins. |

| · | Mining,

processing and administrative costs used to determine NSR cut-off values were estimated based

on second half of 2022 and first half of 2023 actual operating costs. |

| · | Mining

recovery is estimated to average 94 % with mining dilution ranging from 10 % to 34 % depending

on the mining methodology. |

| December 31, 2023 | Page 21 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

| · | Tonnes

are rounded to the nearest thousand. |

| · | Totals

may not add due to rounding. |

The mining

method employed at the Caylloma Mine is primarily cut-and-fill, which is commonly used in the mining of steeply dipping orebodies in

stable rock masses. Cut-and-fill is a bottom-up mining method that consists of removing ore in horizontal slices, starting from a bottom

undercut and advancing upwards. The operation bases its mining plan on a mix of mechanized, semi-mechanized, and conventional extraction

methods based on vein width and rock quality.

Geotechnical

recommendations used in mine design are based on a combination of rock mass rating and geotechnical strength index data.

Water

inflows are currently managed using three pumping stations installed at different levels of the mine. Main pumping station at level 17

is under construction and expected to be completed in January 2024 with testing and commissioning in February 2024.

The mining

production period extends from 2024 to 2028, almost 5 years. At full production the planned mining rate is 1,500 tpd (543,000 tonnes

per annum). Planned LOM production is 2.3 Mt at an average silver grade of 83 g/t, gold grade of 0.14 g/t, lead grade of 2.79 %,

and zinc grade of 4.03 %.

Access

to the Caylloma underground mine is from surface through a main ramp. The Caylloma Mine has been designed with a separation of 100 m

between levels primarily to limit blast vibration but also to assist with hanging wall and footwall stability.

Transportation

of ore and waste is done via trucks with a 15 m3 of capacity through the main and secondary ramps.

The ventilation

requirements for the Animas underground mine to produce 1,500 tpd is 345,100 cfm based on the utilization of the planned mining equipment.

Air intake is through the RB 509 N and the main access ramp for levels 7 (NE), 8, 9 and 12 which represents an estimated 356,855 cfm.

Ventilation is controlled by three principal fans, two operating at 120,000 cfm and one at 100,000 cfm.

The mine

uses two kinds of backfill; waste rock backfill generated during underground mining and hydraulic backfill.

The mobile

equipment fleet is based on the current mining operations, which are known to achieve the production targets set out in the LOM.

Mine

infrastructure and supporting facilities are sufficient for the remaining LOM.

| 1.12 | Processing and recovery

methods |

The process

design is based on metallurgical testwork completed on samples from the deposit. The design and equipment are conventional.

The process

plant design is split into four principal stages including: crushing; milling; flotation; and thickening, filtering and shipping. The

plant has a 1,500 tpd throughput rate.

Energy

requirements at the operation are provided by a state power line of 15 kV. The maximum power demand for the plant is 2300 kW.

| December 31, 2023 | Page 22 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

The processing

plant water consumption is 2.45 m3/t to process one tonne of ore. Approximately 74 % (1.82 m3/t) is recovered from

the tailings facility and pumped back to the plant to be re-used in the process along with 26 % (0.63 m3/t) fresh water collected

from the mine and pumped to Level 9 to send it to the plant.

The plant

uses conventional reagents, including a frother, collectors, flocculant and a depressor.

| 1.13 | Project infrastructure |

All mine

and process infrastructure and supporting facilities are in place at the operation with only an increase in tailings storage facility

in 2026 and designation of underground waste disposal area required to meet the needs of the mine plan and production rate beyond 2025.

The Caylloma

Mine has infrastructure consisting primarily of the concentration plant, electrical power station, water storage facilities, tailings

facilities, stockpiles, and workshop facilities, all connected by unsealed roads. Additional structures located at the mine include offices,

dining hall, laboratory, core logging and core storage warehouses. The mine site infrastructure has a footprint of 91.12 ha associated

with the Huayllacho beneficiation concession.

All process

buildings, offices, and camp facilities for operating the mine have been constructed.

The current

tailings storage facility (TSF N° 3) is located approximately 4 km to the south of the concentration plant. The tailings facility

has a current incremental capacity of 921,000 m3, sufficient to handle tailings until the end of 2026 based on current production

levels, with an expansion required for completion in 2026 to provide sufficient capacity for the LOM.

The mine

currently has a single surface waste stockpile used for storing waste material that could not be effectively disposed of underground.

There is sufficient remaining capacity for LOM requirements based on the currently defined underground waste disposal areas that are

sufficient to the end of 2025 and the identification of an additional waste storage area on Level 8 of the Animas vein.

The mine

currently has one ore stockpile which is used for blending or plant feed if underground mining is temporarily stopped.

The maximum

power demand for the operation is 7800 kW provided mainly through the national power grid and three diesel generators on site to cover

the shortfall and provide backup.

Water

demand at the Caylloma Mine is 60 l/s, including 10 l/s for the camp. Approximately 70 % of the processing plant total water consumption

is recovered from tailings facility N° 3 with the other 30 % from fresh water provided by the Santiago River.

| 1.14 | Market studies

and contracts |

Since

the operation commenced production in October 2006, a corporate decision was made to sell the concentrate on the open market. In

order to get the best commercial terms for the concentrates, it is Fortuna’s policy to sign contracts for periods no longer than

one year. All commercial terms entered between the buyer and Bateas are regarded confidential, but are considered to be within standard

industry norms.

| December 31, 2023 | Page 23 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

Fortuna

established the metal pricing for Mineral Resources and Mineral Reserves using a consensus approach based on long-term analyst and bank

forecasts prepared in May 2023. A long-term price estimate of US$ 21/oz for silver and US$ 1,600/oz for gold has been applied, based

on the mean consensus prices from 2024 to 2026 of US$ 24.00/oz of silver and US$ 1,788/oz for gold weighted at 40 % and the 10-year historical

average of US$ 19.1/oz for silver and US$ 1,452/oz for gold weighted at 60 %.

Bateas

has used a Peruvian sol exchange rate of 3.6 soles to the US dollar for financial analysis purposes, which conforms with general industry-consensus.

Bateas

has eight major contracts for services relating to operations at the mine regarding: mining activities, ground support, raise boring,

drilling, transportation, electrical installations, plant and mine maintenance, explosives and civil works. The costs of such contracts

are accounted for in the capital and operating expenditures depending on work performed. Contracts are negotiated and renewed as needed.

Contract terms are typical of similar contracts in Peru that Fortuna is familiar with.

The QP

has reviewed the information provided by Fortuna on marketing, contracts, metal price projections and exchange rate forecasts and notes

that the information provided support for the assumptions used in this Report and are consistent with the source documents, and that

the information is consistent with what is publicly available within industry norms.

| 1.15 | Environmental

studies and permitting |

The mining

operation has been developed under strict compliance of norms and permits required by public institutions associated with the mining

sector. Furthermore, all work follows quality and safety international norms as set out in ISO 14001 and OHSAS 18000.

In addition

to these norms and permits obtained from the environmental department, the operation also ensures that all environmental activities are

regularly monitored and recorded as part of the quality control measures that are presented to the Ministry of Energy and Mining (MEM)

and other legal regulatory organizations.

Of particular

importance is monitoring of the quality of river water in the area. This activity involves monitoring the Santiago River, being the main

river that passes through the property, employing people from the local communities to verify the results.

Bateas

has a very strong commitment to the development of neighboring communities of the Caylloma Mine. In this respect, Bateas is committed

to sustainable projects, direct support and partnerships that build company engagement in local communities while respecting local values,

customs and traditions. The company aims to develop projects or programs based on respect for ethno-cultural diversity, open communication

and effective interaction with local stakeholders that improve education, health and infrastructure.

Mine

closure is included in the environmental program. For 2024 a total of US$ 471,000 has been budgeted for the ongoing closure plan

and environmental liabilities. The closure plan is performed to ensure compliance with the programs and plans submitted to the MEM. Budgeted

mine closure costs for the LOM total US$ 16.1 million.

| 1.16 | Sustaining capital

and operating costs |

Capital

and operating cost estimates are based on established cost experience gained from current operations, projected budget data and quotes

from manufacturers and suppliers.

| December 31, 2023 | Page 24 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

The capital

and operating cost provisions for the LOM plan that supports Mineral Reserves have been reviewed. The basis for the estimates is appropriate

for the known mineralization, mining and production schedules, marketing plans, and equipment replacement and maintenance requirements.

The QP

considers the capital and operating costs estimated for the Caylloma Mine as reasonable based on industry-standard practices and actual

costs observed for 2023.

All remaining

capital costs are considered to be sustaining capital costs.

Capital

costs include all investments in ongoing mine development, infill drilling, mine equipment overhaul and components, infrastructure necessary

to sustain the continuity of the operation. The capital costs are split into three areas: mine development; equipment and infrastructure;

and mine closure and site rehabilitation.

Mine

development includes the main development and infrastructure of the mine through the generation of ramps, ventilation raises, and extraction

levels. Infill delineation drilling is included under mine development costs as this activity has the objective of increasing the confidence

in currently defined Mineral Resources, and Brownfields exploration drilling is included regarding planned activities for the coming

year.

Equipment

and infrastructure costs are attributed to mine infrastructure in the Animas NE vein and energy capacity expansion for the plant and

other minor equipment acquisition and spare parts.

Mine

closure costs are attributed to site rehabilitation costs required to remediate the area where the mine is located and to meet mine closure

requirements.

The capital

cost estimate is summarized in Table 1.3

Table

1.3 Summary of projected major capital costs for the LOM

| Capital

Cost Item (MUS$) |

2024 |

2025 |

2026 |

2027 |

2028 |

| Development

|

3.61 |

5.89 |

2.52 |

2.87 |

0.00 |

| Brownfields |

0.24 |

0.00 |

0.00 |

0.00 |

0.00 |

| Infill

drilling |

0.74 |

0.50 |

0.50 |

0.50 |

0.50 |

| Mine

Development & Brownfields |

4.59 |

6.39 |

3.02 |

3.37 |

0.50 |

| |

| Mine |

6.07 |

0.98 |

1.32 |

4.08 |

0.00 |

| Plant |

0.36 |

0.13 |

0.09 |

0.03 |

0.00 |

| Tailings

dam |

0.44 |

3.61 |

5.41 |

0.31 |

0.00 |

| Maintenance

and Energy |

6.18 |

1.68 |

0.23 |

0.00 |

0.00 |

| General

services |

1.07 |

2.89 |

0.15 |

0.23 |

0.00 |

| Equipment

and Infrastructure |

14.11 |

9.29 |

7.20 |

4.64 |

0.00 |

| |

| Mine

Closure & Site Rehabilitation |

0.47 |

0.07 |

2.10 |

1.90 |

11.52 |

| |

| Total

Capital Expenditure* |

19.17 |

15.75 |

12.32 |

9.91 |

12.02 |

| *Numbers

may not add due to rounding |

Long-term

projected operating costs are based on the LOM mining and processing requirements, as well as historical information regarding performance,

operational and administrative support demands.

| December 31, 2023 | Page 25 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

Operating

costs include site costs and operating expenses to maintain the operation. These operating costs are analyzed on a functional basis and

the cost structure is not similar to the operating costs reported by the financial statements published by Fortuna.

Site

costs relate to activities performed on the property including mine, plant, general services, and administrative service costs. Other

operating expenses include costs associated with concentrate transportation and community support activities.

Projected

operating costs for the LOM are detailed in Table 1.4.

Table

1.4 Life-of-mine operating costs

| Area |

Units |

2024 |

2025 |

2026 |

2027 |

2028 |

| Mine |

US$/t |

45.3 |

44.1 |

42.4 |

41.9 |

43.2 |

| Plant |

US$/t |

15.7 |

12.2 |

12.2 |

12.2 |

12.2 |

| General

Services |

US$/t |

16.4 |

16.4 |

16.4 |

16.4 |

16.4 |

| Administrative

Services |

US$/t |

12.0 |

12.1 |

12.1 |

12.1 |

12.0 |

| Management

Fee |

US$/t |

1.7 |

1.8 |

1.8 |

1.8 |

1.7 |

| Distribution |

US$/t |

7.4 |

7.1 |

7.3 |

7.1 |

7.2 |

| Community

Support Activities |

US$/t |

1.2 |

1.2 |

1.2 |

1.2 |

1.2 |

| Total |

US$/t |

99.8 |

94.8 |

93.3 |

92.6 |

93.9 |

Fortuna

is using the provision for producing issuers, whereby producing issuers may exclude the information required under Item 22 for technical

reports on properties currently in production and where no material expansion in production is planned.

Mineral

Reserve declaration is supported by a positive cashflow for the period set out in the LOM based on the assumptions detailed in this Report.

An economic

analysis was performed in support of the estimation of Mineral Reserves. This indicated a positive cash flow using the assumptions and

parameters detailed in this Report.

| 1.19 | Risks, and opportunities |

Opportunities

include:

| · | Reduction

in overall pumping costs through improvements to the mine dewatering system resulting in

reduced power consumption and maintenance requirements. |

| · | Potential

to expand the ore processing capacity at the plant. The conceptual study indicates a possible

business case to increase production to 2,200 tpd and requires further studies to confirm

its feasibility. |

| · | Potential

to expand current resources through exploration of the Animas NE vein with mineralization

remaining open to the northeast and at depth. |

Risks

include:

| · | An

expansion of the current tailings storage facility TSF N° 3 will be required for stage

(3C) to cover the current production levels up to LOM requirements. A |

| December 31, 2023 | Page 26 of 213 |

| | |

|

Fortuna

Silver Mines Inc.: Caylloma Mine, Caylloma District, Peru

Technical

Report |

permit

will be required for the expansion, and although there is no guarantee this will be granted, Bateas is confident that if the

application is submitted in a timely manner, the permit should be granted based on previous permit applications.

| · | Bateas

management occasionally receives requests from local authorities and/or civil organizations

regarding unrealistic social expectations. Bateas are mitigating the risk of conflict regarding

these demands by working with local authorities, landowners, and communities to address expectation

levels and to take requests into account in preparing its annual community relations work

program and budget. |

| · | TSF

N° 2 provides a small capacity (two months) as a contingency plan for tailings storage.