false000092222400009222242024-02-162024-02-160000922224us-gaap:CommonStockMember2024-02-162024-02-160000922224ppl:A2007SeriesADue2067Member2024-02-162024-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 16, 2024

| | | | | | | | | | | | | | | | | |

Commission File Number | Registrant; State of Incorporation; Address and Telephone Number | IRS Employer Identification No. |

| | | | | | |

| 1-11459 | PPL Corporation | 23-2758192 |

| (Exact name of Registrant as specified in its charter) | |

| Pennsylvania | |

| Two North Ninth Street | |

| Allentown, | PA | 18101-1179 | |

| (610) | 774-5151 | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol: | Name of each exchange on which registered |

Common Stock of PPL Corporation | PPL | New York Stock Exchange |

| | |

Junior Subordinated Notes of PPL Capital Funding, Inc. | | |

2007 Series A due 2067 | PPL/67 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition

On February 16, 2024, PPL Corporation ("PPL") issued a press release announcing its financial results for the year ended December 31, 2023, and other business matters. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Section 7 - Regulation FD

Item 7.01 Regulation FD Disclosure

On February 16, 2024, at 11:00 a.m. (Eastern Time), members of PPL's senior management will hold a teleconference and webcast with financial analysts to discuss PPL's financial results for the year ended December 31, 2023, and other business matters. The event will be available live, in audio format, together with the slides to be used during the teleconference, on PPL's Internet website: www.pplweb.investorroom.com/events. The webcast will be available for replay on PPL's website for 90 days.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

| | | | | | | | | | | | | | | | | |

| (d) | | Exhibits | |

| | | | |

| | | | Press Release, dated February 16, 2024, announcing PPL's financial results for the year ended December 31, 2023, and other business matters. |

| | | 104 - | Cover Page Interactive Data File (the Cover Page Interactive Data File is embedded within the Inline XBRL document). |

| | | | | |

As provided in General Instruction B.2 of Form 8-K, the information contained in Items 2.02 and 7.01 of this Form 8-K shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall any such information be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| PPL CORPORATION |

| | | |

| By: | /s/ Marlene C. Beers | |

| | Marlene C. Beers

Vice President and Controller | |

Dated: February 16, 2024

| | | | | | | | |

| news release | |

| www.pplnewsroom.com | |

| |

| | | | | |

| Contacts: | For news media: Ryan Hill, 610-774-4033

For financial analysts: Andy Ludwig, 610-774-3389 |

PPL Corporation reports 2023 earnings results, exceeds midpoint of forecast

and extends growth targets through 2027

•Announces 2023 reported earnings (GAAP) of $1.00 per share.

•Exceeds 2023 earnings from ongoing operations forecast midpoint, achieving $1.60 per share.

•Extends 6% to 8% annual EPS and dividend growth targets through at least 2027.

•Increases capital plan to more than $14 billion through 2027, raising rate base growth to 6.3%.

•Updated plan maintains strong credit metrics without the need for equity issuances.

•Announces 7.3% increase in quarterly common stock dividend.

ALLENTOWN, Pa. (Feb. 16, 2024) – PPL Corporation (NYSE: PPL) today announced 2023 reported earnings (GAAP) of $740 million, or $1.00 per share, compared with 2022 reported earnings of $756 million, or $1.02 per share.

Adjusting for special items, 2023 earnings from ongoing operations (non-GAAP) were $1.18 billion, or $1.60 per share, compared with $1.04 billion, or $1.41 per share, a year ago.

PPL’s fourth-quarter 2023 reported earnings were $113 million, or $0.15 per share, compared with fourth-quarter 2022 reported earnings of $190 million, or $0.26 per share.

Adjusting for special items, fourth-quarter 2023 earnings from ongoing operations were $299 million, or $0.40 per share, compared with fourth-quarter 2022 earnings from ongoing operations of $209 million, or $0.28 per share.

“Despite mild weather, heightened storm activity and challenging macroeconomic factors, we delivered on all of our commitments to shareowners in 2023, provided exceptional reliability for our 3.5 million customers and took significant steps to advance a safe, reliable, affordable and cleaner energy mix,ˮ said PPL President and Chief Executive Officer Vincent Sorgi. “In addition, we exceeded our target of $50-$60 million in operation and maintenance (O&M) efficiencies, achieving about $75 million in savings from the company’s 2021 baseline.

“Looking ahead, we remain laser-focused on creating the utilities of the future to advance the clean energy transition reliably, affordably and sustainably for our customers. And throughout PPL, we’re driven to create long-term value for both our customers and shareowners.ˮ

2023 Highlights

In 2023, PPL exceeded the midpoint of its ongoing earnings forecast, delivered 8% ongoing earnings per share (EPS) growth from pro forma 2022 EPS of $1.48 per share (reflecting a full year of earnings contributions from Rhode Island Energy), and offset more than $0.10 per share in mild weather and storm impacts.

At the same time, the company executed $2.4 billion in planned infrastructure investments to improve service to customers, better enable the grid to withstand severe weather, and support increased renewable energy and electrification.

In addition, the company’s Kentucky and Rhode Island subsidiaries achieved constructive outcomes in key regulatory proceedings. This included approval in Kentucky to retire and replace 600 megawatts (MW) of aging coal generation and more than 50 MWs of aging peaking units by 2027 with an affordable, reliable and cleaner energy mix. In addition, it included approval in Rhode Island to deploy advanced metering infrastructure across Rhode Island Energy’s service territory.

2024 Earnings Guidance and Outlook

In conjunction with today’s earnings announcement, PPL today announced a 2024 earnings forecast range of $1.63 to $1.75 per share. The midpoint, $1.69 per share, represents a 7% increase over the midpoint of the company’s 2023 ongoing earnings per share target, in line with its targeted growth rate.

In addition, PPL announced a 7.3% increase in its quarterly common stock dividend, raising the dividend from $0.24 per share to $0.2575 per share. The increased dividend will be payable April 1, 2024, to shareowners of record as of March 8, 2024, and reflects PPL’s commitment to dividend growth in line with earnings per share growth targets.

PPL also extended its competitive 6% to 8% annual EPS and dividend growth targets through at least 2027 based off the midpoint of its 2024 earnings forecast range.

The company increased planned infrastructure investments to $14.3 billion from 2024 to 2027 compared to the prior plan of $11.9 billion from 2023 to 2026. These investments are expected to result in 6.3% average annual rate base growth through 2027, up from 5.6% over the prior plan period.

The company also said it remains on track to deliver its targeted annual operation and maintenance savings of at least $175 million by 2026, with $120-$130 million of annual savings planned by the end of 2024 from the company’s 2021 baseline. These expected savings will be driven largely by transmission and distribution operations as PPL continues to deploy scalable technologies and data science across its utility portfolio.

Lastly, PPL said it expects to maintain a balance sheet that is among the best in the U.S. utility sector. PPL continues to project a Funds from Operations (FFO)/Cash Flow from Operations (CFO) to debt ratio of 16% to 18% throughout the updated business planning period without the need for equity issuances through at least 2027.

Fourth-Quarter and Year-to-Date Earnings Details

As discussed in this news release, reported earnings are calculated in accordance with U.S. Generally Accepted Accounting Principles (GAAP). “Earnings from ongoing operationsˮ is a non-GAAP financial measure that is adjusted for special items. See the tables at the end of this news release for a reconciliation of reported earnings to earnings from ongoing operations, including an itemization of special items.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions, except for per share amounts) | 4th Quarter | | Year |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Reported earnings | $ | 113 | | | $ | 190 | | | (41) | % | | $ | 740 | | | $ | 756 | | | (2) | % |

| Reported earnings per share | $ | 0.15 | | | $ | 0.26 | | | (42) | % | | $ | 1.00 | | | $ | 1.02 | | | (2) | % |

| | | | | | | | | | | |

| 4th Quarter | | Year |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Earnings from ongoing operations | $ | 299 | | | $ | 209 | | | 43 | % | | $ | 1,183 | | | $ | 1,041 | | | 14 | % |

| Earnings from ongoing operations per share | $ | 0.40 | | | $ | 0.28 | | | 43 | % | | $ | 1.60 | | | $ | 1.41 | | | 13 | % |

Fourth-Quarter and Year-to-Date Earnings by Segment(1)

| | | | | | | | | | | | | | | | | | | | | | | |

| 4th Quarter | | Year |

| Per share | 2023 | | 2022 | | 2023 | | 2022 |

| Reported earnings | | | | | | | |

| | | | | | | |

| Kentucky Regulated | $ | 0.16 | | | $ | 0.11 | | | $ | 0.75 | | | $ | 0.75 | |

| Pennsylvania Regulated | 0.18 | | | 0.16 | | | 0.70 | | | 0.71 | |

| Rhode Island Regulated | 0.04 | | | 0.01 | | | 0.13 | | | (0.06) | |

| Corporate and Other | (0.23) | | | (0.08) | | | (0.58) | | | (0.44) | |

| Discontinued Operations | — | | | 0.06 | | | — | | | 0.06 | |

| Total | $ | 0.15 | | | $ | 0.26 | | | $ | 1.00 | | | $ | 1.02 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 4th Quarter | | Year |

| 2023 | | 2022 | | 2023 | | 2022 |

| Special items (expense) benefit | | | | | | | |

| | | | | | | |

| Kentucky Regulated | $ | (0.01) | | | $ | — | | | $ | (0.02) | | | $ | (0.01) | |

| Pennsylvania Regulated | (0.02) | | | — | | | (0.04) | | | 0.01 | |

| Rhode Island Regulated | (0.01) | | | (0.02) | | | (0.07) | | | (0.14) | |

| Corporate and Other | (0.21) | | | (0.06) | | | (0.47) | | | (0.31) | |

| Discontinued Operations | — | | | 0.06 | | | — | | | 0.06 | |

| Total | $ | (0.25) | | | $ | (0.02) | | | $ | (0.60) | | | $ | (0.39) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 4th Quarter | | Year |

| 2023 | | 2022 | | 2023 | | 2022 |

| Earnings from ongoing operations | | | | | | | |

| | | | | | | |

| Kentucky Regulated | $ | 0.17 | | | $ | 0.11 | | | $ | 0.77 | | | $ | 0.76 | |

| Pennsylvania Regulated | 0.20 | | | 0.16 | | | 0.74 | | | 0.70 | |

| Rhode Island Regulated | 0.05 | | | 0.03 | | | 0.20 | | | 0.08 | |

| Corporate and Other | (0.02) | | | (0.02) | | | (0.11) | | | (0.13) | |

| | | | | | | |

| Total | $ | 0.40 | | | $ | 0.28 | | | $ | 1.60 | | | $ | 1.41 | |

(1) Kentucky holding company costs for intercompany financing activity are now presented in Corporate and Other beginning on Jan. 1, 2023. Prior

periods have been adjusted to reflect this change.

Key Factors Impacting Earnings

In addition to the segment drivers outlined below, PPL’s reported earnings in 2023 included net special-item after-tax charges of $443 million, or $0.60 per share, primarily attributable to integration and related expenses associated with the acquisition of Rhode Island Energy, as well as the Talen litigation settlement. Reported earnings in 2022 included net special-item after-tax charges of $285 million or $0.39 per share, primarily attributable to integration and related expenses associated with the acquisition of Rhode Island Energy.

PPL’s reported earnings for the fourth quarter of 2023 included special-item after-tax charges of $186 million, or $0.25 per share, primarily attributable to the Talen litigation settlement, as well as integration and related expenses associated with the acquisition of Rhode Island Energy. Reported earnings for the fourth quarter of 2022 included special-item after-tax charges of $19 million, or $0.02 per

share, primarily attributable to integration and related expenses associated with the acquisition of Rhode Island Energy, partially offset by taxes related to discontinued operations of the U.K. utility business.

Kentucky Regulated Segment

PPL’s Kentucky Regulated segment primarily consists of the regulated electricity and natural gas operations of Louisville Gas and Electric Company and the regulated electricity operations of Kentucky Utilities Company.

Reported earnings in 2023 were even compared with a year ago. Earnings from ongoing operations in 2023 increased by $0.01 per share compared with a year ago. Factors driving earnings results primarily included lower operation and maintenance expense, partially offset by lower sales volumes largely due to mild weather and higher interest expense.

Reported earnings in the fourth quarter of 2023 increased by $0.05 per share compared with a year ago. Earnings from ongoing operations in the fourth quarter of 2023 increased by $0.06 per share compared with a year ago. Factors driving earnings results primarily included lower operation and maintenance expense, partially offset by lower sales volumes largely due to mild weather.

Pennsylvania Regulated Segment

PPL’s Pennsylvania Regulated segment consists of the regulated electricity delivery operations of PPL Electric Utilities.

Reported earnings in 2023 decreased by $0.01 per share compared with a year ago. Earnings from ongoing operations increased by $0.04 per share compared to a year ago. Factors driving earnings results primarily included higher transmission revenue, distribution regulatory rider recovery and lower operation and maintenance expense, partially offset by lower sales volumes and higher interest expense.

Reported earnings in the fourth quarter of 2023 increased by $0.02 per share compared with a year ago. Earnings from ongoing operations in the fourth quarter of 2023 increased by $0.04 per share compared with a year ago. Factors driving earnings results primarily included lower operation and maintenance expense and higher transmission revenue, partially offset by lower sales volumes and higher interest expense.

Rhode Island Regulated Segment

PPL’s Rhode Island Regulated segment consists of the regulated electricity and natural gas operations of Rhode Island Energy, which was acquired on May 25, 2022.

Reported earnings in 2023 increased by $0.19 per share compared with a year ago. Earnings from ongoing operations increased by $0.12 per share compared to a year ago, primarily reflecting PPL’s ownership of Rhode Island Energy for a full year in 2023.

Reported earnings in the fourth quarter of 2023 increased by $0.03 per share compared with a year ago. Earnings from ongoing operations in the fourth quarter of 2023 increased by $0.02 per share compared with a year ago. Factors driving earnings results primarily included higher revenues from capital investments, partially offset by higher interest expense.

Corporate and Other

PPL’s Corporate and Other category primarily includes financing costs incurred at the corporate level that have not been allocated or assigned to the segments, certain non-recoverable costs resulting from commitments made to the Rhode Island Division of Public Utilities and Carriers and the Rhode Island Attorney General’s Office in conjunction with the acquisition of Rhode Island Energy, and certain other unallocated costs.

Reported earnings in 2023 decreased by $0.14 per share compared with a year ago, primarily attributable to certain special items discussed above. Adjusting for special items, earnings from ongoing operations in 2023 increased by $0.02 per share compared with a year ago. Factors driving earnings results

primarily included lower income taxes, lower operation and maintenance expense and other factors, partially offset by higher interest expense.

Reported earnings in the fourth quarter of 2023 decreased by $0.15 per share compared with a year ago. Earnings from ongoing operations in the fourth-quarter of 2023 were even compared with a year ago. Factors driving earnings results primarily included lower income taxes offset by higher operation and maintenance expense.

2024 Earnings Forecast

PPL today announced a 2024 earnings forecast range of $1.63 to $1.75 per share, with a midpoint of $1.69 per share.

Earnings from ongoing operations is a non-GAAP measure that could differ from reported earnings due to special items that are, in management’s view, non-recurring or otherwise not reflective of the company’s ongoing operations. PPL management is not able to forecast if any of these factors will occur or whether any amounts will be reported for future periods. Therefore, PPL is not able to provide an equivalent GAAP measure for earnings guidance.

About PPL

PPL Corporation (NYSE: PPL), headquartered in Allentown, Pennsylvania, is a leading U.S. energy company focused on providing electricity and natural gas safely, reliably and affordably to 3.5 million customers in the U.S. PPL’s high-performing, award-winning utilities are addressing energy challenges head-on by building smarter, more resilient and more dynamic power grids and advancing sustainable energy solutions. For more information, visit www.pplweb.com.

# # #

(Note: All references to earnings per share in the text and tables of this news release are stated in terms of diluted earnings per share unless otherwise noted.)

Conference Call and Webcast

PPL invites interested parties to listen to a live Internet webcast of management’s teleconference with financial analysts about fourth-quarter and full-year 2023 financial results at 11 a.m. Eastern time on Friday, Feb. 16. The call will be webcast live, in audio format, together with slides of the presentation. Interested individuals can access the webcast link at www.pplweb.com/investors under Events and Presentations or access the live conference call via telephone at 1-844-512-2926. International participants should call 1-412-317-6300. Participants will need to enter the following “Elite Entry” number in order to join the conference: 2705921. For those who are unable to listen to the live webcast, a replay with slides will be accessible at www.pplweb.com/investors for 90 days after the call.

# # #

Management utilizes “Earnings from Ongoing Operations” or “Ongoing Earnings” as a non-GAAP financial measure that should not be considered as an alternative to reported earnings, or net income, an indicator of operating performance determined in accordance with GAAP. PPL believes that Earnings from Ongoing Operations is useful and meaningful to investors because it provides management’s view of PPL’s earnings performance as another criterion in making investment decisions. In addition, PPL’s management uses Earnings from Ongoing Operations in measuring achievement of certain corporate performance goals, including targets for certain executive incentive compensation. Other companies may use different measures to present financial performance.

Earnings from Ongoing Operations is adjusted for the impact of special items. Special items are presented in the financial tables on an after-tax basis with the related income taxes on special items separately disclosed. Income taxes on special items, when applicable, are calculated based on the statutory tax rate of the entity where the activity is recorded. Special items may include items such as:

•Gains and losses on sales of assets not in the ordinary course of business.

•Impairment charges.

•Significant workforce reduction and other restructuring effects.

•Acquisition and divestiture-related adjustments.

•Significant losses on early extinguishment of debt.

•Other charges or credits that are, in management’s view, non-recurring or otherwise not reflective of the company’s ongoing operations.

Statements contained in this news release, including statements with respect to future earnings, cash flows, dividends, financing, regulation and corporate strategy, are “forward-looking statements” within the meaning of the federal securities laws. Although PPL Corporation believes that the expectations and assumptions reflected in these forward-looking statements are reasonable, these statements are subject to a number of risks and uncertainties, and actual results may differ materially from the results discussed in the statements. The following are among the important factors that could cause actual results to differ materially from the forward-looking statements: asset or business acquisitions and dispositions; the novel coronavirus pandemic or other pandemic health events or other catastrophic events and their effect on financial markets, economic conditions and our businesses; market demand for energy in our service territories; weather conditions affecting customer energy usage and operating costs; the effect of any business or industry restructuring; the profitability and liquidity of PPL Corporation and its subsidiaries; new accounting requirements or new interpretations or applications of existing requirements; operating performance of our facilities; the length of scheduled and unscheduled outages at our generating plants; environmental conditions and requirements and the related costs of compliance; system conditions and operating costs; development of new projects, markets and technologies; performance of new ventures; any impact of severe weather on our business; receipt of necessary government permits, approvals, rate relief and regulatory cost recovery; capital market conditions and decisions regarding capital structure; the impact of state, federal or foreign investigations applicable to PPL Corporation and its subsidiaries; the outcome of litigation against PPL Corporation and its subsidiaries; stock price performance; the market prices of equity securities and the impact on pension income and resultant cash funding requirements for defined benefit pension plans; the securities and credit ratings of PPL Corporation and its subsidiaries; political, regulatory or economic conditions in jurisdictions where PPL Corporation or its subsidiaries conduct business, including any potential effects of threatened or actual cyberattack, terrorism, or war or other hostilities; new state, federal or foreign legislation, including new tax legislation; and the commitments and liabilities of PPL Corporation and its subsidiaries. Any such forward-looking statements should be considered in light of such important factors and in conjunction with factors and other matters discussed in PPL Corporation’s Form 10-K and other reports on file with the Securities and Exchange Commission.

Note to Editors: Visit our media website at www.pplnewsroom.com for additional news and background about PPL Corporation.

| | | | | | | | | | | |

| PPL CORPORATION AND SUBSIDIARIES |

CONDENSED CONSOLIDATED FINANCIAL INFORMATION(1) |

| | | |

| Condensed Consolidated Balance Sheets (Unaudited) |

| (Millions of Dollars) |

| | | |

| December 31, | | December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Cash and cash equivalents | $ | 331 | | | $ | 356 | |

| Accounts receivable | 1,221 | | | 1,046 | |

| Unbilled revenues | 428 | | | 552 | |

| Fuel, materials and supplies | 505 | | | 443 | |

| Regulatory assets | 293 | | | 258 | |

| Other current assets | 154 | | | 169 | |

| | | |

| Property, Plant and Equipment | | | |

| Regulated utility plant | 38,608 | | | 36,961 | |

| Less: Accumulated depreciation - regulated utility plant | 9,156 | | | 8,352 | |

| Regulated utility plant, net | 29,452 | | | 28,609 | |

| Non-regulated property, plant and equipment | 72 | | | 92 | |

| Less: Accumulated depreciation - non-regulated property, plant and equipment | 23 | | | 46 | |

| Non-regulated property, plant and equipment, net | 49 | | | 46 | |

| Construction work in progress | 1,917 | | | 1,583 | |

| Property, Plant and Equipment, net | 31,418 | | | 30,238 | |

| Noncurrent regulatory assets | 1,874 | | | 1,819 | |

| Goodwill and other intangibles | 2,553 | | | 2,561 | |

| | | |

| | | |

| Other noncurrent assets | 459 | | | 395 | |

| Total Assets | $ | 39,236 | | | $ | 37,837 | |

| | | |

| Liabilities and Equity | | | |

| Short-term debt | $ | 992 | | | $ | 985 | |

| Long-term debt due within one year | 1 | | | 354 | |

| Accounts payable | 1,104 | | | 1,201 | |

| Other current liabilities | 1,243 | | | 1,249 | |

| | | |

| Long-term debt | 14,611 | | | 12,889 | |

| Deferred income taxes and investment tax credits | 3,219 | | | 3,124 | |

| Accrued pension obligations | 275 | | | 206 | |

| Asset retirement obligations | 133 | | | 138 | |

| Noncurrent regulatory liabilities | 3,340 | | | 3,412 | |

| Other deferred credits and noncurrent liabilities | 385 | | | 361 | |

| Common stock and additional paid-in capital | 12,334 | | | 12,325 | |

| Treasury stock | (948) | | | (967) | |

| Earnings reinvested | 2,710 | | | 2,681 | |

| Accumulated other comprehensive loss | (163) | | | (124) | |

| Noncontrolling interests | — | | | 3 | |

| Total Liabilities and Equity | $ | 39,236 | | | $ | 37,837 | |

(1)The Financial Statements in this news release have been condensed and summarized for purposes of this presentation. Please refer to PPL Corporation's periodic filings with the Securities and Exchange Commission for full financial statements, including note disclosure.

| | | | | | | | | | | | | | | | | | | | | | | |

| PPL CORPORATION AND SUBSIDIARIES |

| | | | | | | |

| Condensed Consolidated Statements of Income (Unaudited) |

| (Millions of Dollars, except share data) |

| | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Operating Revenues | $ | 2,031 | | | $ | 2,290 | | | $ | 8,312 | | | $ | 7,902 | |

| | | | | | | |

| Operating Expenses | | | | | | | |

| Operation | | | | | | | |

| Fuel | 166 | | | 223 | | | 733 | | | 931 | |

| Energy purchases | 411 | | | 593 | | | 1,841 | | | 1,686 | |

| Other operation and maintenance | 657 | | | 727 | | | 2,462 | | | 2,398 | |

| Depreciation | 314 | | | 309 | | | 1,254 | | | 1,181 | |

| Taxes, other than income | 93 | | | 102 | | | 392 | | | 332 | |

| Total Operating Expenses | 1,641 | | | 1,954 | | | 6,682 | | | 6,528 | |

| | | | | | | |

| Operating Income | 390 | | | 336 | | | 1,630 | | | 1,374 | |

| | | | | | | |

| Other Income (Expense) - net | (91) | | | 18 | | | (40) | | | 54 | |

| | | | | | | |

| Interest Expense | 172 | | | 152 | | | 666 | | | 513 | |

| | | | | | | |

| Income from Continuing Operations Before Income Taxes | 127 | | | 202 | | | 924 | | | 915 | |

| | | | | | | |

| Income Taxes | 14 | | | 54 | | | 184 | | | 201 | |

| | | | | | | |

| Income from Continuing Operations After Income Taxes | 113 | | | 148 | | | 740 | | | 714 |

| | | | | | | |

| Income (Loss) from Discontinued Operations (net of income taxes) | — | | | 42 | | | — | | | 42 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net Income (Loss) | $ | 113 | | | $ | 190 | | | $ | 740 | | | $ | 756 | |

| | | | | | | |

| Earnings Per Share of Common Stock: | | | | | | | |

| Basic | | | | | | | |

| Income from Continuing Operations After Income Taxes | $ | 0.15 | | | $ | 0.20 | | | $ | 1.00 | | | $ | 0.97 | |

| Income (Loss) from Discontinued Operations (net of income taxes) | — | | | 0.06 | | | — | | | 0.06 | |

| Net Income (Loss) Available to PPL Common Shareowners | $ | 0.15 | | | $ | 0.26 | | | $ | 1.00 | | | $ | 1.03 | |

| | | | | | | |

| Diluted | | | | | | | |

| Income from Continuing Operations After Income Taxes | $ | 0.15 | | | $ | 0.20 | | | $ | 1.00 | | | $ | 0.96 | |

| Income (Loss) from Discontinued Operations (net of income taxes) | — | | | 0.06 | | | — | | | 0.06 | |

| Net Income (Loss) Available to PPL Common Shareowners | $ | 0.15 | | | $ | 0.26 | | | $ | 1.00 | | | $ | 1.02 | |

| | | | | | | |

| | | | | | | |

| Weighted-Average Shares of Common Stock Outstanding (in thousands) | | | | | | | |

| Basic | 737,128 | | | 736,369 | | | 737,036 | | | 736,027 | |

| Diluted | 738,600 | | | 737,570 | | | 738,166 | | | 736,902 | |

| | | | | | | | | | | | | | | | | |

| PPL CORPORATION AND SUBSIDIARIES |

| Condensed Consolidated Statements of Cash Flows (Unaudited) |

| (Millions of Dollars) |

| | | | | |

| 2023 | | 2022 | | 2021 |

| Cash Flows from Operating Activities | | | | | |

| Net income (loss) | $ | 740 | | | $ | 756 | | | $ | (1,480) | |

| Loss (income) from discontinued operations (net of income taxes) | — | | | (42) | | | 1,498 | |

| Income from continuing operations (net of income taxes) | 740 | | 714 | | 18 |

| Adjustments to reconcile net income to net cash provided by operating activities | | | | | |

| Depreciation | 1,254 | | | 1,181 | | | 1,082 | |

| Amortization | 81 | | | 52 | | | 39 | |

| Defined benefit plans - expense (income) | (73) | | | (16) | | | 10 | |

| Deferred income taxes and investment tax credits | 322 | | | 179 | | | 87 | |

| | | | | |

| Loss on sale of Safari Holdings | — | | | 60 | | | — | |

| | | | | |

| Impairment of solar panels | — | | | — | | | 37 | |

| Loss on extinguishment of debt | — | | | — | | | 395 | |

| Other | 4 | | | 51 | | | 10 | |

| Change in current assets and current liabilities | | | | | |

| Accounts receivable | (170) | | | (176) | | | (14) | |

| Accounts payable | (72) | | | 358 | | | 24 | |

| Unbilled revenues | 128 | | | (197) | | | (5) | |

| Fuel, materials and supplies | (60) | | | (90) | | | (21) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Taxes payable | 6 | | | (80) | | | 27 | |

| | | | | |

| | | | | |

| Regulatory assets and liabilities, net | (37) | | | (119) | | | 52 | |

| Accrued interest | 27 | | | 1 | | | (32) | |

| Other | 39 | | | (89) | | | (9) | |

| Other operating activities | | | | | |

| Defined benefit plans - funding | (13) | | | (12) | | | (53) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Other | (418) | | | (87) | | | (103) | |

| Net cash provided by operating activities - continuing operations | 1,758 | | | 1,730 | | | 1,544 | |

| Net cash provided by operating activities - discontinued operations | — | | | — | | | 726 | |

| Net cash provided by operating activities | 1,758 | | | 1,730 | | | 2,270 | |

| Cash Flows from Investing Activities | | | | | |

| Expenditures for property, plant and equipment | (2,390) | | | (2,155) | | | (1,973) | |

| | | | | |

| | | | | |

| | | | | |

| Proceeds from sale of Safari Holdings, net of cash divested | — | | | 146 | | | — | |

| Proceeds from sale of U.K. utility business, net of cash divested | — | | | — | | | 10,560 | |

| Acquisition of Narragansett Electric, net of cash acquired | — | | | (3,660) | | | — | |

| Other investing activities | 7 | | | 15 | | | (23) | |

| Net cash provided by (used in) investing activities - continuing operations | (2,383) | | | (5,654) | | | 8,564 | |

| Net cash provided by (used in) investing activities - discontinued operations | — | | | — | | | (607) | |

| Net cash provided by (used in) investing activities | (2,383) | | | (5,654) | | | 7,957 | |

| Cash Flows from Financing Activities | | | | | |

| Issuance of long-term debt | 3,252 | | | 850 | | | 650 | |

| Retirement of long-term debt | (1,854) | | | (264) | | | (4,606) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Payment of common stock dividends | (704) | | | (787) | | | (1,279) | |

| Purchase of treasury stock | — | | | — | | | (1,003) | |

| | | | | |

| | | | | |

| Retirement of term loan | — | | | — | | | (300) | |

| Retirement of commercial paper | — | | | — | | | (73) | |

| Net increase (decrease) in short-term debt | 7 | | | 916 | | | (726) | |

| Other financing activities | (51) | | | (6) | | | (7) | |

| Net cash provided by (used in) financing activities - continuing operations | 650 | | | 709 | | | (7,344) | |

| Net cash provided by (used in) financing activities - discontinued operations | — | | | — | | | (411) | |

| Contributions from discontinued operations | — | | | — | | | 365 | |

| Net cash provided by (used in) financing activities | 650 | | | 709 | | | (7,390) | |

| Effect of Exchange Rates on Cash, Cash Equivalents and Restricted Cash included in Discontinued Operations | — | | | — | | | 8 | |

| Net (Increase) Decrease in Cash, Cash Equivalents and Restricted Cash included in Discontinued Operations | — | | | — | | | 284 | |

| Net Increase (Decrease) in Cash, Cash Equivalents and Restricted Cash | 25 | | | (3,215) | | | 3,129 | |

| Cash, Cash Equivalents and Restricted Cash at Beginning of Period | 357 | | | 3,572 | | | 443 | |

| Cash, Cash Equivalents and Restricted Cash at End of Period | $ | 382 | | | $ | 357 | | | $ | 3,572 | |

| | | | | |

Supplemental Disclosures of Cash Flow Information | | | | | |

| Cash paid during the period for: | | | | | |

| Interest - net of amount capitalized | $ | 604 | | | $ | 462 | | | $ | 191 | |

| Income taxes - net | $ | 281 | | | $ | 163 | | | $ | 284 | |

| Significant non-cash transactions: | | | | | |

| Accrued expenditures for property, plant and equipment at December 31, | $ | 220 | | | $ | 269 | | | $ | 245 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Operating - Electricity Sales (Unaudited)(1) |

| | | | | | | | | | | |

| Three Months Ended December 31, | | | | Twelve Months Ended December 31, | | |

| | | | | Percent | | | | | | Percent |

| (GWh) | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| | | | | | | | | | | |

| PA Regulated Segment | | | | | | | | | | | |

Retail Delivered(2) | 8,810 | | | 9,195 | | | (4.2) | % | | 35,704 | | | 37,593 | | | (5.0) | % |

| | | | | | | | | | | |

| KY Regulated Segment | | | | | | | | | | | |

| Retail Delivered | 6,739 | | | 6,926 | | | (2.7) | % | | 28,278 | | | 29,812 | | | (5.1) | % |

Wholesale(3) | 149 | | | 397 | | | (62.5) | % | | 531 | | | 1,080 | | | (50.8) | % |

| Total | 6,888 | | | 7,323 | | | (5.9) | % | | 28,809 | | | 30,892 | | | (6.7) | % |

| | | | | | | | | | | |

| Total | 15,698 | | | 16,518 | | | (5.0) | % | | 64,513 | | | 68,485 | | | (5.8) | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) Excludes the Rhode Island Regulated segment electricity sales as revenues are decoupled from volumes delivered.

(2) Sales volumes for the three months ended December 31, 2022, are adjusted to account for a correction to a customer account.

(3) Represents FERC-regulated municipal and unregulated off-system sales.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Segment Reported Earnings to Earnings from Ongoing Operations |

| (After-Tax) |

| (Unaudited) |

| |

| 4th Quarter 2023 | (millions of dollars) |

| KY | | PA | | RI | | Corp. | | | | |

| Reg. | | Reg. | | Reg. | | & Other | | | | Total |

Reported Earnings(1) | $ | 120 | | | $ | 135 | | | $ | 26 | | | $ | (168) | | | | | $ | 113 | |

| Less: Special Items (expense) benefit: | | | | | | | | | | | |

| | | | | | | | | | | |

Talen litigation costs, net of tax of $24(2) | — | | | — | | | — | | | (93) | | | | | (93) | |

Strategic corporate initiatives, net of tax of $0, $1(3) | — | | | (1) | | | — | | | (3) | | | | | (4) | |

Acquisition integration, net of tax of $2, $16(4) | — | | | — | | | (10) | | | (59) | | | | | (69) | |

| PA tax rate change | — | | | (1) | | | — | | | — | | | | | (1) | |

Sale of Safari Holdings, net of tax of ($1)(5) | — | | | — | | | — | | | (1) | | | | | (1) | |

PPL Electric billing issue, net of tax of $4(6) | — | | | (9) | | | — | | | — | | | | | (9) | |

FERC transmission credit refund, net of tax of $0(7) | (1) | | | — | | | — | | | — | | | | | (1) | |

Unbilled revenue estimate adjustment, net of tax of $2(8) | (5) | | | — | | | — | | | — | | | | | (5) | |

Other non-recurring charges, net of tax of $1(9) | — | | | (3) | | | — | | | — | | | | | (3) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Total Special Items | (6) | | | (14) | | | (10) | | | (156) | | | | | (186) | |

| Earnings from Ongoing Operations | $ | 126 | | | $ | 149 | | | $ | 36 | | | $ | (12) | | | | | $ | 299 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (per share - diluted) |

| KY | | PA | | RI | | Corp. | | | | |

| Reg. | | Reg. | | Reg. | | & Other | | | | Total |

Reported Earnings(1) | $ | 0.16 | | | $ | 0.18 | | | $ | 0.04 | | | $ | (0.23) | | | | | $ | 0.15 | |

| Less: Special Items (expense) benefit: | | | | | | | | | | | |

| | | | | | | | | | | |

Talen litigation costs(2) | — | | | — | | | — | | | (0.13) | | | | | (0.13) | |

| | | | | | | | | | | |

Acquisition integration(4) | — | | | — | | | (0.01) | | | (0.08) | | | | | (0.09) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

PPL Electric billing issue(6) | — | | | (0.02) | | | — | | | — | | | | | (0.02) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Unbilled revenue estimate adjustment(8) | (0.01) | | | — | | | — | | | — | | | | | (0.01) | |

| | | | | | | | | | | |

| Total Special Items | (0.01) | | | (0.02) | | | (0.01) | | | (0.21) | | | | | (0.25) | |

| Earnings from Ongoing Operations | $ | 0.17 | | | $ | 0.20 | | | $ | 0.05 | | | $ | (0.02) | | | | | $ | 0.40 | |

(1) Reported Earnings represents Net Income.

(2) Represents a settlement agreement with Talen Montana, LLC and affiliated entities and other litigation costs.

(3) Represents costs primarily related to PPL's centralization efforts and other strategic efforts.

(4) Primarily integration and related costs associated with the acquisition of Rhode Island Energy.

(5) Primarily final closing and other related adjustments for the sale of Safari Holdings, LLC.

(6) Certain expenses related to billing issues.

(7) Prior period impact related to a FERC refund order.

(8) Prior period impact of a methodology change in determining unbilled revenues.

(9) Certain expenses associated with a litigation settlement.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Segment Reported Earnings to Earnings from Ongoing Operations |

| (After-Tax) |

| (Unaudited) |

| | | | | | | | | | | |

| Year-to-Date December 31, 2023 | (millions of dollars) |

| KY | | PA | | RI | | Corp. | | | | |

| Reg. | | Reg. | | Reg. | | & Other | | | | Total |

Reported Earnings(1) | $ | 552 | | | $ | 519 | | | $ | 96 | | | $ | (427) | | | | | $ | 740 | |

| Less: Special Items (expense) benefit: | | | | | | | | | | | |

Talen litigation costs, net of tax of $26(2) | — | | | — | | | — | | | (99) | | | | | (99) | |

Strategic corporate initiatives, net of tax of $0, $1, $3(3) | (1) | | | (2) | | | — | | | (10) | | | | | (13) | |

Acquisition integration, net of tax of $14, $58(4) | — | | | — | | | (56) | | | (218) | | | | | (274) | |

| | | | | | | | | | | |

Sale of Safari Holdings, net of tax of $0(5) | — | | | — | | | — | | | (4) | | | | | (4) | |

PPL Electric billing issue, net of tax of $10(6) | — | | | (24) | | | — | | | — | | | | | (24) | |

FERC transmission credit refund, net of tax of $2(7) | (6) | | | — | | | — | | | — | | | | | (6) | |

Unbilled revenue estimate adjustment, net of tax of $2(8) | (5) | | | — | | | — | | | — | | | | | (5) | |

Other non-recurring charges, net of tax of $1, $0(9) | — | | | (3) | | | — | | | (15) | | | | | (18) | |

| | | | | | | | | | | |

| Total Special Items | (12) | | | (29) | | | (56) | | | (346) | | | | | (443) | |

| Earnings from Ongoing Operations | $ | 564 | | | $ | 548 | | | $ | 152 | | | $ | (81) | | | | | $ | 1,183 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (per share - diluted) |

| KY | | PA | | RI | | Corp. | | | | |

| Reg. | | Reg. | | Reg. | | & Other | | | | Total |

Reported Earnings(1) | $ | 0.75 | | | $ | 0.70 | | | $ | 0.13 | | | $ | (0.58) | | | | | $ | 1.00 | |

| Less: Special Items (expense) benefit: | | | | | | | | | | | |

| | | | | | | | | | | |

Talen litigation costs(2) | — | | | — | | | — | | | (0.13) | | | | | (0.13) | |

Strategic corporate initiatives(3) | — | | | — | | | — | | | (0.01) | | | | | (0.01) | |

Acquisition integration(4) | — | | | — | | | (0.07) | | | (0.30) | | | | | (0.37) | |

| | | | | | | | | | | |

Sale of Safari Holdings(5) | — | | | — | | | — | | | (0.01) | | | | | (0.01) | |

PPL Electric billing issue(6) | — | | | (0.04) | | | — | | | — | | | | | (0.04) | |

FERC transmission credit refund(7) | (0.01) | | | — | | | — | | | — | | | | | (0.01) | |

Unbilled revenue estimate adjustment(8) | (0.01) | | | — | | | — | | | — | | | | | (0.01) | |

Other non-recurring charges(9) | — | | | — | | | — | | | (0.02) | | | | | (0.02) | |

| | | | | | | | | | | |

| Total Special Items | (0.02) | | | (0.04) | | | (0.07) | | | (0.47) | | | | | (0.60) | |

| Earnings from Ongoing Operations | $ | 0.77 | | | $ | 0.74 | | | $ | 0.20 | | | $ | (0.11) | | | | | $ | 1.60 | |

(1) Reported Earnings represents Net Income.

(2) Represents a settlement agreement with Talen Montana, LLC and affiliated entities and other litigation costs.

(3) Represents costs primarily related to PPL's centralization efforts and other strategic efforts.

(4) Primarily integration and related costs associated with the acquisition of Rhode Island Energy.

(5) Primarily final closing and other related adjustments for the sale of Safari Holdings, LLC.

(6) Certain expenses related to billing issues.

(7) Prior period impact related to a FERC refund order.

(8) Prior period impact of a methodology change in determining unbilled revenues.

(9) PA Reg. includes certain expenses associated with a litigation settlement. Corp. & Other primarily includes certain expenses related to

distributed energy investments.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Segment Reported Earnings to Earnings from Ongoing Operations |

| (After-Tax) |

| (Unaudited) |

| | | | | | | | | | | | | |

| 4th Quarter 2022 | (millions of dollars) |

| KY | | PA | | | | RI | | Corp. | | Disc. | | |

| Reg. | | Reg. | | | | Reg. | | & Other | | Ops.(2) | | Total |

Reported Earnings(1) | $ | 84 | | | $ | 115 | | | | | $ | 11 | | | $ | (62) | | | $ | 42 | | | $ | 190 | |

| Less: Special Items (expense) benefit: | | | | | | | | | | | | | |

| Income (loss) from Discontinued Operations | — | | | — | | | | | — | | | — | | | 42 | | | 42 | |

Talen litigation costs, net of tax of $1(3) | — | | | — | | | | | — | | | (4) | | | — | | | (4) | |

| | | | | | | | | | | | | |

Acquisition integration, net of tax of $4, $11(4) | — | | | — | | | | | (17) | | | (44) | | | — | | | (61) | |

PA tax rate change(5) | — | | | — | | | | | — | | | 1 | | | — | | | 1 | |

Sale of Safari Holdings, net of tax of ($3)(6) | — | | | — | | | | | — | | | 3 | | | — | | | 3 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Special Items | — | | | — | | | | | (17) | | | (44) | | | 42 | | | (19) | |

| Earnings from Ongoing Operations | $ | 84 | | | $ | 115 | | | | | $ | 28 | | | $ | (18) | | | $ | — | | | $ | 209 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (per share - diluted) |

| KY | | PA | | | | RI | | Corp. | | Disc. | | |

| Reg. | | Reg. | | | | Reg. | | & Other | | Ops.(2) | | Total |

Reported Earnings(1) | $ | 0.11 | | | $ | 0.16 | | | | | $ | 0.01 | | | $ | (0.08) | | | $ | 0.06 | | | $ | 0.26 | |

| Less: Special Items (expense) benefit: | | | | | | | | | | | | | |

| Income (loss) from Discontinued Operations | — | | | — | | | | | — | | | — | | | 0.06 | | | 0.06 | |

Talen litigation costs(3) | — | | | — | | | | | — | | | (0.01) | | | — | | | (0.01) | |

| | | | | | | | | | | | | |

Acquisition integration(4) | — | | | — | | | | | (0.02) | | | (0.06) | | | — | | | (0.08) | |

| | | | | | | | | | | | | |

Sale of Safari Holdings(6) | — | | | — | | | | | — | | | 0.01 | | | — | | | 0.01 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Special Items | — | | | — | | | | | (0.02) | | | (0.06) | | | 0.06 | | | (0.02) | |

| Earnings from Ongoing Operations | $ | 0.11 | | | $ | 0.16 | | | | | $ | 0.03 | | | $ | (0.02) | | | $ | — | | | $ | 0.28 | |

(1) Reported Earnings represents Net Income.

(2) Tax benefit due to the provision to final 2021 tax return adjustments, primarily related to the discontinued U.K. utility business.

(3) Represents costs related to litigation with Talen Montana, LLC and affiliated entities.

(4) Primarily includes integration and related costs associated with the acquisition of Rhode Island Energy.

(5) Impact of Pennsylvania state tax reform.

(6) Primarily includes the estimated loss on the sale of Safari Holdings, LLC at December 31, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Segment Reported Earnings to Earnings from Ongoing Operations |

| (After-Tax) |

| (Unaudited) |

| | | | | | | | | | | | | |

| Year-to-Date December 31, 2022 | (millions of dollars) |

| KY | | PA | | | | RI | | Corp. | | Disc. | | |

| Reg. | | Reg. | | | | Reg. | | & Other | | Ops.(2) | | Total |

Reported Earnings(1) | $ | 549 | | | $ | 525 | | | | | $ | (44) | | | $ | (316) | | | $ | 42 | | | $ | 756 | |

| Less: Special Items (expense) benefit: | | | | | | | | | | | | | |

| Income (loss) from Discontinued Operations | — | | | — | | | | | — | | | — | | | 42 | | | 42 | |

Talen litigation costs, net of tax of $0(3) | — | | | — | | | | | — | | | 1 | | | — | | | 1 | |

Strategic corporate initiatives, net of tax of $3, $4(4) | (8) | | | — | | | | | — | | | (15) | | | — | | | (23) | |

Acquisition integration, net of tax of $28, $39(5) | — | | | — | | | | | (109) | | | (148) | | | — | | | (257) | |

PA tax rate change(6) | — | | | 9 | | | | | — | | | (4) | | | — | | | 5 | |

Sale of Safari Holdings, net of tax of $16(7) | — | | | — | | | | | — | | | (53) | | | — | | | (53) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Special Items | (8) | | | 9 | | | | | (109) | | | (219) | | | 42 | | | (285) | |

| Earnings from Ongoing Operations | $ | 557 | | | $ | 516 | | | | | $ | 65 | | | $ | (97) | | | $ | — | | | $ | 1,041 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (per share - diluted) |

| KY | | PA | | | | RI | | Corp. | | Disc. | | |

| Reg. | | Reg. | | | | Reg. | | & Other | | Ops.(2) | | Total |

Reported Earnings(1) | $ | 0.75 | | | $ | 0.71 | | | | | $ | (0.06) | | | $ | (0.44) | | | $ | 0.06 | | | $ | 1.02 | |

| Less: Special Items (expense) benefit: | | | | | | | | | | | | | |

| Income (loss) from Discontinued Operations | — | | | — | | | | | — | | | — | | | 0.06 | | | 0.06 | |

| | | | | | | | | | | | | |

Strategic corporate initiatives(4) | (0.01) | | | — | | | | | — | | | (0.02) | | | — | | | (0.03) | |

Acquisition integration(5) | — | | | — | | | | | (0.14) | | | (0.20) | | | — | | | (0.34) | |

PA tax rate change(6) | — | | | 0.01 | | | | | — | | | (0.01) | | | — | | | — | |

Sale of Safari Holdings(7) | — | | | — | | | | | — | | | (0.08) | | | — | | | (0.08) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Special Items | (0.01) | | | 0.01 | | | | | (0.14) | | | (0.31) | | | 0.06 | | | (0.39) | |

| Earnings from Ongoing Operations | $ | 0.76 | | | $ | 0.70 | | | | | $ | 0.08 | | | $ | (0.13) | | | $ | — | | | $ | 1.41 | |

(1) Reported Earnings represents Net Income.

(2) Tax benefit due to the provision to final 2021 tax return adjustments, primarily related to the discontinued U.K. utility business.

(3) Represents costs and insurance reimbursements received related to litigation with Talen Montana, LLC and affiliated entities.

(4) Represents costs primarily related to the acquisition of Rhode Island Energy and PPL’s corporate centralization efforts.

(5) Primarily includes integration and related costs associated with the acquisition of Rhode Island Energy, along with costs for certain

commitments made during the acquisition process.

(6) Impact of Pennsylvania state tax reform.

(7) Primarily includes the estimated loss on the sale of Safari Holdings, LLC at December 31, 2022.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ppl_A2007SeriesADue2067Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

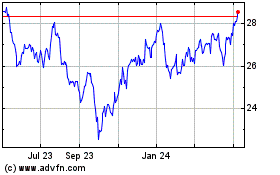

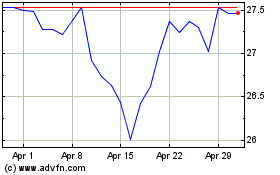

PPL (NYSE:PPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PPL (NYSE:PPL)

Historical Stock Chart

From Apr 2023 to Apr 2024