false000106223100010622312024-02-162024-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 16, 2024

AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation) | | | | | |

| 1-14303 | 38-3161171 |

| |

| (Commission File Number) | (IRS Employer Identification No.) |

| |

One Dauch Drive, Detroit,Michigan | 48211-1198 |

| |

| (Address of Principal Executive Offices) | (Zip Code) |

| | | | | |

| (313) | 758-2000 |

| (Registrant's Telephone Number, Including Area Code) |

|

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | AXL | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 2 - FINANCIAL INFORMATION

Item 2.02 Results of Operations and Financial Condition

On February 16, 2024, American Axle & Manufacturing Holdings, Inc., (the “Company” or “AAM”) issued a press release regarding AAM's financial results for the fourth quarter and full year 2023. AAM also provided its full year 2024 financial outlook and 2024-2026 new business backlog. A copy of this press release is furnished as Exhibit 99.1.

SECTION 7 - REGULATION FD

Item 7.01 Regulation FD Disclosure

See Item 2.02 Result of Operations and Financial Condition.

SECTION 9 - FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits

| | | | | | | | | | | |

| Exhibit No. | | Description | |

| | | |

| | Press release dated | February 16, 2024 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized. | | | | | | | | | | | | | | | | | |

| | | | | |

| | AMERICAN AXLE & MANUFACTURING HOLDINGS, INC. | |

| Date: | February 16, 2024 | By: | /s/ Christopher J. May | |

| | | Christopher J. May | |

| | | Executive Vice President & Chief Financial Officer | |

EXHIBIT 99.1

AAM Reports Fourth Quarter and Full Year 2023 Financial Results

AAM Delivers Sequential Margin Improvement

DETROIT, February 16, 2024 -- American Axle & Manufacturing Holdings, Inc. (AAM), (NYSE: AXL) today reported its financial results for the fourth quarter and full year 2023.

Fourth Quarter 2023 Results

•Sales of $1.46 billion

•Net loss of $(19.1) million, or (1.3)% of sales

•Adjusted EBITDA of $169.5 million, or 11.6% of sales

•Diluted loss per share of $(0.16); Adjusted loss per share of $(0.09)

•Net cash provided by operating activities of $52.9 million; Adjusted free cash flow of $4.5 million

Full Year 2023 Results

•Sales of $6.08 billion

•Net loss of $(33.6) million, or (0.6)% of sales

•Adjusted EBITDA of $693.3 million, or 11.4% of sales

•Diluted loss per share of $(0.29); Adjusted loss per share of $(0.09)

•Net cash provided by operating activities of $396.1 million; Adjusted free cash flow of $219.0 million

“AAM’s fourth quarter performance was on track with our improvement objectives, ending a challenging 2023 on a better trajectory,” said AAM’s Chairman and Chief Executive Officer, David C. Dauch. “As we look ahead, AAM will leverage its strong core business while selectively building a product portfolio to drive the future pivot to electrification.”

AAM's sales in the fourth quarter of 2023 were $1.46 billion as compared to $1.39 billion in the fourth quarter of 2022. Sales for the fourth quarter of 2023 were favorably impacted by volume and mix partially offset by the UAW work stoppage. AAM's sales for full year 2023 were $6.08 billion as compared to $5.80 billion for full year 2022. Sales for the full year were favorably impacted by volume and mix and the Tekfor acquisition.

AAM's net loss in the fourth quarter of 2023 was $(19.1) million, or $(0.16) per share, as compared to net income of $13.9 million, or $0.11 per share in the fourth quarter of 2022. AAM's net loss for full year 2023 was $(33.6) million, or $(0.29) per share, as compared to net income of $64.3 million, or $0.53 per share, for full year 2022. AAM's Adjusted loss per share in the fourth quarter of 2023 was $(0.09) as compared to Adjusted loss per share of $(0.07) in the fourth quarter of 2022. AAM's Adjusted loss per share for full year 2023 was $(0.09) as compared to Adjusted earnings per share of $0.60 for full year 2022.

In the fourth quarter of 2023, AAM's Adjusted EBITDA was $169.5 million, or 11.6% of sales, as compared to $157.7 million, or 11.3% of sales, in the fourth quarter of 2022. For full year 2023, AAM's Adjusted EBITDA was $693.3 million, or 11.4% of sales, as compared to $747.3 million, or 12.9% of sales, in 2022.

AAM's net cash provided by operating activities for the fourth quarter of 2023 was $52.9 million as compared to $148.5 million for the fourth quarter of 2022. AAM's net cash provided by operating activities for full year 2023 was $396.1 million as compared to $448.9 million for full year 2022.

AAM's Adjusted free cash flow for the fourth quarter of 2023 was $4.5 million as compared to $99.0 million for the fourth quarter of 2022. AAM's Adjusted free cash flow for full year 2023 was $219.0 million as compared to $313.0 million for full year 2022.

AAM's 2024 Financial Outlook

AAM's full year 2024 financial targets are as follows:

•AAM is targeting sales in the range of $6.05 - $6.35 billion.

•AAM is targeting Adjusted EBITDA in the range of $685 - $750 million.

•AAM is targeting Adjusted free cash flow in the range of $200 - $240 million; this target assumes capital spending of approximately 4.0% - 4.5% of sales.

These targets are based on the following assumptions for 2024:

•North American light vehicle production of approximately 15.8 million units.

•AAM's production estimates of key programs that we support.

•Current customer launch schedules and operating environment.

AAM's 2024-2026 New Business Backlog

AAM’s gross new and incremental business backlog launching from 2024 - 2026 is estimated at approximately $600 million in future annual sales. AAM expects the launch cadence of the three-year backlog to be approximately $300 million in 2024, $175 million in 2025 and $125 million in 2026. Electrification mix approximates 50% of AAM's new business backlog versus 40% in the prior backlog (2023-2025). The backlog takes into account recent OEM powertrain trends and timing estimates.

Fourth Quarter 2023 Conference Call Information

A conference call to review AAM's fourth quarter results is scheduled today at 10:00 a.m. ET. Interested participants may listen to the live conference call by logging onto AAM's investor web site at http://investor.aam.com or calling (877) 883-0383 from the United States or (412) 902-6506 from outside the United States with access code 133151. A replay will be available one hour after the call is complete until February 23, 2024 by dialing (877) 344-7529 from the United States or (412) 317-0088 from outside the United States. When prompted, callers should enter replay access code 2703442.

Non-GAAP Financial Information

In addition to the results reported in accordance with accounting principles generally accepted in the United States of America (GAAP) included within this press release, AAM has provided certain information, which includes non-GAAP financial measures such as Adjusted EBITDA, Adjusted earnings (loss) per share and Adjusted free cash flow. Such information is reconciled to its most directly comparable GAAP measure in accordance with Securities and Exchange Commission rules and is included in the attached supplemental data.

Certain of the forward-looking financial measures included in this earnings release are provided on a non-GAAP basis. A reconciliation of non-GAAP forward-looking financial measures to the most directly comparable forward-looking financial measures calculated and presented in accordance with GAAP has been provided. The amounts in these reconciliations are based on our current estimates and actual results may differ materially from these forward-looking estimates for many reasons, including potential event driven transactional and other non-core operating items and their related effects in any future period, the magnitude of which may be significant.

Management believes that these non-GAAP financial measures are useful to management, investors, and banking institutions in their analysis of AAM's business and operating performance. Management also uses this information for operational planning and decision-making purposes.

Non-GAAP financial measures are not and should not be considered a substitute for any GAAP measure. Additionally, non-GAAP financial measures as presented by AAM may not be comparable to similarly titled measures reported by other companies.

Definition of Non-GAAP Financial Measures

AAM defines Adjusted earnings (loss) per share to be diluted earnings (loss) per share excluding the impact of restructuring and acquisition-related costs, debt refinancing and redemption costs, loss on sale of business, pension curtailment and settlement charges, unrealized gains or losses on equity securities and non-recurring items, including the tax effect thereon.

AAM defines EBITDA to be earnings before interest expense, income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA excluding the impact of restructuring and acquisition-related costs, debt refinancing and redemption costs, loss on sale of business, pension curtailment and settlement charges, unrealized gains or losses on equity securities and non-recurring items.

AAM defines free cash flow to be net cash provided by operating activities less capital expenditures net of proceeds from the sale of property, plant and equipment. Adjusted free cash flow is defined as free cash flow excluding the impact of cash payments for restructuring and acquisition-related costs, and cash payments related to the Malvern fire, including payments for capital expenditures, net of recoveries.

Company Description

As a leading global Tier 1 Automotive and Mobility Supplier, AAM (NYSE: AXL) designs, engineers and manufactures Driveline and Metal Forming technologies to support electric, hybrid and internal combustion vehicles. Headquartered in Detroit with over 80 facilities in 18 countries, AAM is bringing the future faster for a safer and more sustainable tomorrow. To learn more, visit aam.com.

Forward-Looking Statements

In this earnings release, we make statements concerning our expectations, beliefs, plans, objectives, goals, strategies, and future events or performance. Such statements are “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 and relate to trends and events that may affect our future financial position and operating results. The terms such as “will,” “may,” “could,” “would,” “plan,” “believe,” “expect,” “anticipate,” “intend,” “project,” "target," and similar words or expressions, as well as statements in future tense, are intended to identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief as of that time with respect to future events and are subject to risks and may differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to: global economic conditions, including the impact of inflation, recession or recessionary concerns, or slower growth in the markets in which we operate; reduced purchases of our products by General Motors Company (GM), Stellantis N.V. (Stellantis), Ford Motor Company (Ford) or other customers; our ability to respond to changes in technology, increased competition or pricing pressures; our ability to develop and produce new products that reflect market demand; lower-than-anticipated market acceptance of new or existing products; our ability to attract new customers and programs for new products; reduced demand for our customers' products (particularly light trucks and sport utility vehicles (SUVs) produced by GM, Stellantis and Ford); risks inherent in our global operations (including tariffs and the potential consequences thereof to us, our suppliers, and our customers and their suppliers, adverse changes in trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), compliance with customs and trade regulations, immigration policies, political stability or geopolitical conflicts, taxes and other law changes, potential disruptions of production and supply, and currency rate fluctuations); supply shortages and the availability of natural gas or other fuel and utility sources in certain regions, labor shortages, including increased labor costs, or price increases in raw material and/or freight, utilities or other operating supplies for us or our customers as a result of pandemic or epidemic illness such as COVID-19, geopolitical conflicts, natural disasters or otherwise; a significant disruption in operations at one or more of our key manufacturing facilities; risks inherent in transitioning our business from internal combustion engine vehicle products to electric vehicle products; negative or unexpected tax consequences, including those resulting from tax litigation; risks related to a failure of our information technology systems and networks, including cloud-based applications, and risks associated with current and emerging technology threats and damage from computer viruses, unauthorized access, cyber attacks and other similar disruptions; our suppliers', our customers' and their suppliers' ability to maintain satisfactory labor relations and avoid or minimize work stoppages; cost or availability of financing for working capital, capital expenditures, research and development (R&D) or other general corporate purposes including acquisitions, as well as our ability to comply with financial covenants; our customers' and suppliers' availability of financing for working capital, capital expenditures, R&D or other general corporate purposes; an impairment of our goodwill, other intangible assets, or long-lived assets if our business or market conditions indicate that the carrying values of those assets exceed their fair values; liabilities arising from warranty claims, product recall or field actions, product liability and legal proceedings to which we are or may become a party, or the impact of product recall or field actions on our customers; our ability or our customers' and suppliers' ability to successfully launch new product programs on a timely basis; risks of environmental issues, including impacts of climate-related events, that could result in unforeseen issues or costs at our facilities, or risks of noncompliance with environmental laws and regulations, including reputational damage; our ability to maintain satisfactory labor relations and avoid work stoppages; our ability to consummate and successfully integrate acquisitions and joint ventures; our ability to achieve the level of cost reductions required to sustain global cost competitiveness or our ability to recover certain cost increases from our customers; our ability to realize the expected revenues from our new and incremental business backlog; price volatility in, or reduced availability of, fuel; our ability to protect our intellectual property and successfully defend against assertions made against us; adverse changes in laws, government regulations or market conditions affecting our products or our customers' products; our ability or our customers' and suppliers' ability to comply with regulatory requirements and the potential costs of such compliance; changes in liabilities arising from pension and other postretirement benefit obligations; our ability to attract and retain qualified personnel in key positions and functions; and other unanticipated events and conditions that may hinder our ability to compete. It is not possible to foresee or identify all such factors and we make no commitment to update any forward-looking statement or to disclose any facts, events or circumstances after the date hereof that may affect the accuracy of any forward-looking statement.

# # #

For more information:

Investor Contact

David H. Lim

Head of Investor Relations

(313) 758-2006

david.lim@aam.com

Media Contact

Christopher M. Son

Vice President, Marketing & Communications

(313) 758-4814

chris.son@aam.com

Or visit the AAM website at www.aam.com.

AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (in millions, except per share data) |

| | | | | | | |

| Net sales | $ | 1,463.0 | | | $ | 1,392.7 | | | $ | 6,079.5 | | | $ | 5,802.4 | |

| | | | | | | |

| Cost of goods sold | 1,308.1 | | | 1,225.5 | | | 5,455.2 | | | 5,097.5 | |

| | | | | | | |

| Gross profit | 154.9 | | | 167.2 | | | 624.3 | | | 704.9 | |

| | | | | | | |

| Selling, general and administrative expenses | 95.7 | | | 88.5 | | | 366.9 | | | 345.1 | |

| | | | | | | |

| Amortization of intangible assets | 21.4 | | | 21.3 | | | 85.6 | | | 85.7 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Restructuring and acquisition-related costs | 9.0 | | | 3.8 | | | 25.2 | | | 30.2 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income | 28.8 | | | 53.6 | | | 146.6 | | | 243.9 | |

| | | | | | | |

| Interest expense | (50.2) | | | (42.3) | | | (201.7) | | | (174.5) | |

| | | | | | | |

| Interest income | 7.3 | | | 5.4 | | | 26.2 | | | 17.0 | |

| | | | | | | | |

| Other income (expense): | | | | | | | |

| Debt refinancing and redemption costs | (1.0) | | | (0.4) | | | (1.3) | | | (6.4) | |

| Gain on bargain purchase of business | — | | | 0.6 | | | — | | | 13.6 | |

| Pension curtailment and settlement charges | (1.3) | | | — | | | (1.3) | | | — | |

| Unrealized gain (loss) on equity securities | 0.1 | | | (1.5) | | | (1.1) | | | (25.5) | |

| Other income (expense), net | 3.0 | | | 2.6 | | | 8.1 | | | (1.8) | |

| | | | | | | | |

| Income (loss) before income taxes | (13.3) | | | 18.0 | | | (24.5) | | | 66.3 | |

| | | | | | | |

| Income tax expense | 5.8 | | | 4.1 | | | 9.1 | | | 2.0 | |

| | | | | | | |

| Net income (loss) | $ | (19.1) | | | $ | 13.9 | | | $ | (33.6) | | | $ | 64.3 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted earnings (loss) per share | $ | (0.16) | | | $ | 0.11 | | | $ | (0.29) | | | $ | 0.53 | |

AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| | (in millions) |

| ASSETS | | | |

| Current assets | |

| Cash and cash equivalents | $ | 519.9 | | | $ | 511.5 | |

| Accounts receivable, net | 818.5 | | | 820.2 | |

| Inventories, net | 482.9 | | | 463.9 | |

| Prepaid expenses and other | 185.3 | | | 197.8 | |

| Total current assets | 2,006.6 | | | 1,993.4 | |

| | | |

| Property, plant and equipment, net | 1,760.9 | | | 1,903.0 | |

| Deferred income taxes | 169.4 | | | 119.0 | |

| Goodwill | 182.1 | | | 181.6 | |

| Other intangible assets, net | 532.8 | | | 616.2 | |

| GM postretirement cost sharing asset | 111.9 | | | 127.6 | |

| Operating lease right-of-use asset | 115.6 | | | 107.2 | |

| Other assets and deferred charges | 477.0 | | | 421.4 | |

| Total assets | $ | 5,356.3 | | | $ | 5,469.4 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities | | | |

| Current portion of long-term debt | $ | 17.0 | | | $ | 75.9 | |

| Accounts payable | 773.9 | | | 734.0 | |

| Accrued compensation and benefits | 200.1 | | | 186.6 | |

| Deferred revenue | 16.6 | | | 28.1 | |

| Current portion of operating lease liabilities | 21.9 | | | 21.1 | |

| Accrued expenses and other | 172.1 | | | 153.6 | |

| Total current liabilities | 1,201.6 | | | 1,199.3 | |

| | | | |

| Long-term debt, net | 2,751.9 | | | 2,845.1 | |

| Deferred revenue | 70.4 | | | 73.4 | |

| Deferred income taxes | 16.5 | | | 10.7 | |

| Long-term portion of operating lease liabilities | 95.5 | | | 87.2 | |

| Postretirement benefits and other long-term liabilities | 615.5 | | | 626.4 | |

| Total liabilities | 4,751.4 | | | 4,842.1 | |

| | | |

| | | |

| | | |

| Total stockholders' equity | 604.9 | | | 627.3 | |

| Total liabilities and stockholders' equity | $ | 5,356.3 | | | $ | 5,469.4 | |

AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | Three Months Ended | | Twelve Months Ended |

| | | December 31, | | December 31, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| | | (in millions) |

| Operating activities | | | | | | | | |

| Net income (loss) | | $ | (19.1) | | | $ | 13.9 | | | $ | (33.6) | | | $ | 64.3 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities | | | | | | | | |

| Depreciation and amortization | | 121.4 | | | 125.0 | | | 487.2 | | | 492.1 | |

| | | | | | | | |

| Other | | (49.4) | | | 9.6 | | | (57.5) | | | (107.5) | |

| Net cash provided by operating activities | | 52.9 | | | 148.5 | | | 396.1 | | | 448.9 | |

| | | | | | | | |

| Investing activities | | | | | | | | |

| Purchases of property, plant and equipment | | (56.0) | | | (53.5) | | | (194.6) | | | (171.4) | |

| Proceeds from sale of property, plant and equipment | | 0.1 | | | 0.4 | | | 0.9 | | | 4.7 | |

| Acquisition of business, net of cash acquired | | (0.6) | | | (0.6) | | | (2.5) | | | (88.9) | |

| | | | | | | | |

| Other | | (1.3) | | | 8.1 | | | 11.7 | | | 12.6 | |

| Net cash used in investing activities | | (57.8) | | | (45.6) | | | (184.5) | | | (243.0) | |

| | | | | | | | |

| Financing activities | | | | | | | | |

| Net debt activity | | (94.3) | | | (65.6) | | | (177.2) | | | (216.8) | |

| Other | | (3.0) | | | (3.8) | | | (28.3) | | | (0.4) | |

| Net cash used in financing activities | | (97.3) | | | (69.4) | | | (205.5) | | | (217.2) | |

| | | | | | | | |

| Effect of exchange rate changes on cash | | 6.5 | | | 5.7 | | | 2.3 | | | (7.4) | |

| | | | | | | | |

| Net increase (decrease) in cash and cash equivalents | | (95.7) | | | 39.2 | | | 8.4 | | | (18.7) | |

| | | | | | | | |

| Cash and cash equivalents at beginning of period | | 615.6 | | | 472.3 | | | 511.5 | | | 530.2 | |

| | | | | | | | |

| Cash and cash equivalents at end of period | | $ | 519.9 | | | $ | 511.5 | | | $ | 519.9 | | | $ | 511.5 | |

AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.

SUPPLEMENTAL DATA

(Unaudited)

The supplemental data presented below is a reconciliation of certain financial measures which is intended

to facilitate analysis of American Axle & Manufacturing Holdings, Inc. business and operating performance.

Earnings before interest expense, income taxes and depreciation and amortization (EBITDA) and Adjusted EBITDA(a) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | (in millions) |

| | | | | | | |

| Net income (loss) | $ | (19.1) | | | $ | 13.9 | | | $ | (33.6) | | | $ | 64.3 | |

| Interest expense | 50.2 | | | 42.3 | | | 201.7 | | | 174.5 | |

| Income tax expense | 5.8 | | | 4.1 | | | 9.1 | | | 2.0 | |

| Depreciation and amortization | 121.4 | | | 125.0 | | | 487.2 | | | 492.1 | |

| EBITDA | 158.3 | | | 185.3 | | | 664.4 | | | 732.9 | |

| Restructuring and acquisition-related costs | 9.0 | | | 3.8 | | | 25.2 | | | 30.2 | |

| Debt refinancing and redemption costs | 1.0 | | | 0.4 | | | 1.3 | | | 6.4 | |

| | | | | | | |

| | | | | | | |

| Unrealized loss (gain) on equity securities | (0.1) | | | 1.5 | | | 1.1 | | | 25.5 | |

Pension curtailment and settlement charges | 1.3 | | | — | | | 1.3 | | | — | |

| Non-recurring items: | | | | | | | |

| Malvern fire insurance recoveries, net of charges | — | | | (32.7) | | | — | | | (39.1) | |

| Acquisition-related fair value inventory adjustment | — | | | — | | | — | | | 5.0 | |

| Gain on bargain purchase of business | — | | | (0.6) | | | — | | | (13.6) | |

| | | | | | | |

| Adjusted EBITDA | $ | 169.5 | | | $ | 157.7 | | | $ | 693.3 | | | $ | 747.3 | |

Adjusted earnings (loss) per share(b) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Diluted earnings (loss) per share | $ | (0.16) | | | $ | 0.11 | | | $ | (0.29) | | | $ | 0.53 | |

| Restructuring and acquisition-related costs | 0.07 | | | 0.03 | | | 0.22 | | | 0.25 | |

| Debt refinancing and redemption costs | 0.01 | | | — | | | 0.01 | | | 0.05 | |

| | | | | | | |

| | | | | | | |

| Unrealized loss on equity securities | — | | | 0.01 | | | 0.01 | | | 0.21 | |

Pension curtailment and settlement charges | 0.01 | | | — | | | 0.01 | | | — | |

| | | | | | | |

| Non-recurring items: | | | | | | | |

| Malvern fire insurance recoveries, net of charges | — | | | (0.26) | | | — | | | (0.32) | |

| Acquisition-related fair value inventory adjustment | — | | | — | | | — | | | 0.04 | |

| Gain on bargain purchase of business | — | | | (0.01) | | | — | | | (0.11) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Tax effect of adjustments | (0.02) | | | 0.05 | | | (0.05) | | | (0.05) | |

| | | | | | | |

| Adjusted earnings (loss) per share | $ | (0.09) | | | $ | (0.07) | | | $ | (0.09) | | | $ | 0.60 | |

Adjusted earnings (loss) per share are based on weighted average diluted shares outstanding of 117.1 million and 114.6 million for the three months ended December 31, 2023 and 2022 respectively, and 116.6 million and 120.4 million for the twelve months ended December 31, 2023 and 2022, respectively.

AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.

SUPPLEMENTAL DATA

(Unaudited)

The supplemental data presented below is a reconciliation of certain financial measures which is intended

to facilitate analysis of American Axle & Manufacturing Holdings, Inc. business and operating performance.

Free cash flow and Adjusted free cash flow(c)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (in millions) |

| Net cash provided by operating activities | $ | 52.9 | | | $ | 148.5 | | | $ | 396.1 | | | $ | 448.9 | |

| Capital expenditures net of proceeds from the sale of property, plant and equipment | (55.9) | | | (53.1) | | | (193.7) | | | (166.7) | |

| Free cash flow | (3.0) | | | $ | 95.4 | | | 202.4 | | | 282.2 | |

| Cash payments for restructuring and acquisition-related costs | 7.5 | | | 6.6 | | | 23.6 | | | 27.8 | |

| Cash payments (insurance proceeds) related to Malvern fire, net | — | | | (3.0) | | | (7.0) | | | 3.0 | |

| Adjusted free cash flow | $ | 4.5 | | | $ | 99.0 | | | $ | 219.0 | | | $ | 313.0 | |

Segment Financial Information

On June 1, 2022, our acquisition of Tekfor became effective and we began consolidating the results of Tekfor on that date, which are reported in our Metal Forming segment. In the first quarter of 2023, we moved a plant location that was previously reported under our Driveline segment to our Metal Forming segment in order to better align our product and process technologies. The amounts in the tables below for the three and twelve months ended December 31, 2022 have been recast to reflect this reorganization.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| | December 31, | | December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| (in millions) |

| Segment Sales | | | | | | | |

| Driveline | $ | 1,015.2 | | | $ | 950.2 | | | $ | 4,176.7 | | | $ | 4,063.5 | |

| Metal Forming | 576.2 | | | 563.8 | | | 2,454.3 | | | 2,280.7 | |

| Total Sales | 1,591.4 | | | 1,514.0 | | | 6,631.0 | | | 6,344.2 | |

| Intersegment Sales | (128.4) | | | (121.3) | | | (551.5) | | | (541.8) | |

| Net External Sales | $ | 1,463.0 | | | $ | 1,392.7 | | | $ | 6,079.5 | | | $ | 5,802.4 | |

| | | | | | | |

Segment Adjusted EBITDA(a) | | | | | | | |

| Driveline | $ | 140.1 | | | $ | 118.7 | | | $ | 543.6 | | | $ | 510.9 | |

| Metal Forming | 29.4 | | | 39.0 | | | 149.7 | | | 236.4 | |

| Total Segment Adjusted EBITDA | $ | 169.5 | | | $ | 157.7 | | | $ | 693.3 | | | $ | 747.3 | |

Full Year 2024 Financial Outlook

| | | | | | | | | | | |

| Adjusted EBITDA |

| Low End | | High End |

| | (in millions) |

| Net income (loss) | $ | (10) | | | $ | 40 | |

| Interest expense | 195 | | | 195 | |

| Income tax expense | — | | | 15 | |

| Depreciation and amortization | 480 | | | 480 | |

| Full year 2024 targeted EBITDA | 665 | | | 730 | |

| Restructuring and acquisition-related costs | 20 | | | 20 | |

| Full year 2024 targeted Adjusted EBITDA | $ | 685 | | | $ | 750 | |

| | | | | | | | | | | |

| Adjusted Free Cash Flow |

| Low End | | High End |

| (in millions) |

| Net cash provided by operating activities | $ | 445 | | | $ | 485 | |

| Capital expenditures net of proceeds from the sale of property, plant and equipment | (265) | | | (265) | |

| Full year 2024 targeted Free Cash Flow | 180 | | | 220 | |

| Cash payments for restructuring and acquisition-related costs | 20 | | | 20 | |

| Full year 2024 targeted Adjusted Free Cash Flow | $ | 200 | | | $ | 240 | |

___________

(a)We define EBITDA to be earnings before interest expense, income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA excluding the impact of restructuring and acquisition-related costs, debt refinancing and redemption costs, loss on sale of a business, pension curtailment and settlement charges, unrealized gains or losses on equity securities and non-recurring items. We believe that EBITDA and Adjusted EBITDA are meaningful measures of performance as they are commonly utilized by management and investors to analyze operating performance and entity valuation. Our management, the investment community and the banking institutions routinely use EBITDA and Adjusted EBITDA, together with other measures, to measure our operating performance relative to other Tier 1 automotive suppliers. We also use Segment Adjusted EBITDA as the measure of earnings to assess the performance of each segment and determine the resources to be allocated to the segments. EBITDA and Adjusted EBITDA are also key metrics used in our calculation of incentive compensation. EBITDA and Adjusted EBITDA should not be construed as income from operations, net income or cash flow from operating activities as determined under GAAP. Other companies may calculate EBITDA and Adjusted EBITDA differently.

(b)We define Adjusted earnings (loss) per share to be diluted earnings (loss) per share excluding the impact of restructuring and acquisition-related costs, debt refinancing and redemption costs, loss on sale of a business, pension curtailment and settlement charges, unrealized gains or losses on equity securities and non-recurring items, including the tax effect thereon. We believe Adjusted earnings (loss) per share is a meaningful measure as it is commonly utilized by management and investors in assessing ongoing financial performance that provides improved comparability between periods through the exclusion of certain items that management believes are not indicative of core operating performance and which may obscure underlying business results and trends. Other companies may calculate Adjusted earnings (loss) per share differently.

(c) We define free cash flow to be net cash provided by operating activities less capital expenditures net of proceeds from the sale of property, plant and equipment. Adjusted free cash flow is defined as free cash flow excluding the impact of cash payments for restructuring and acquisition-related costs and cash payments related to the Malvern fire, including payments for capital expenditures, net of recoveries. We believe free cash flow and Adjusted free cash flow are meaningful measures as they are commonly utilized by management and investors to assess our ability to generate cash flow from business operations to repay debt and return capital to our stockholders. Free cash flow and Adjusted free cash flow are also key metrics used in our calculation of incentive compensation. Other companies may calculate free cash flow and Adjusted free cash flow differently.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

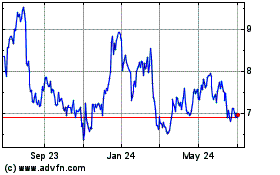

American Axle and Manufa... (NYSE:AXL)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Axle and Manufa... (NYSE:AXL)

Historical Stock Chart

From Apr 2023 to Apr 2024